DyDo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DyDo Bundle

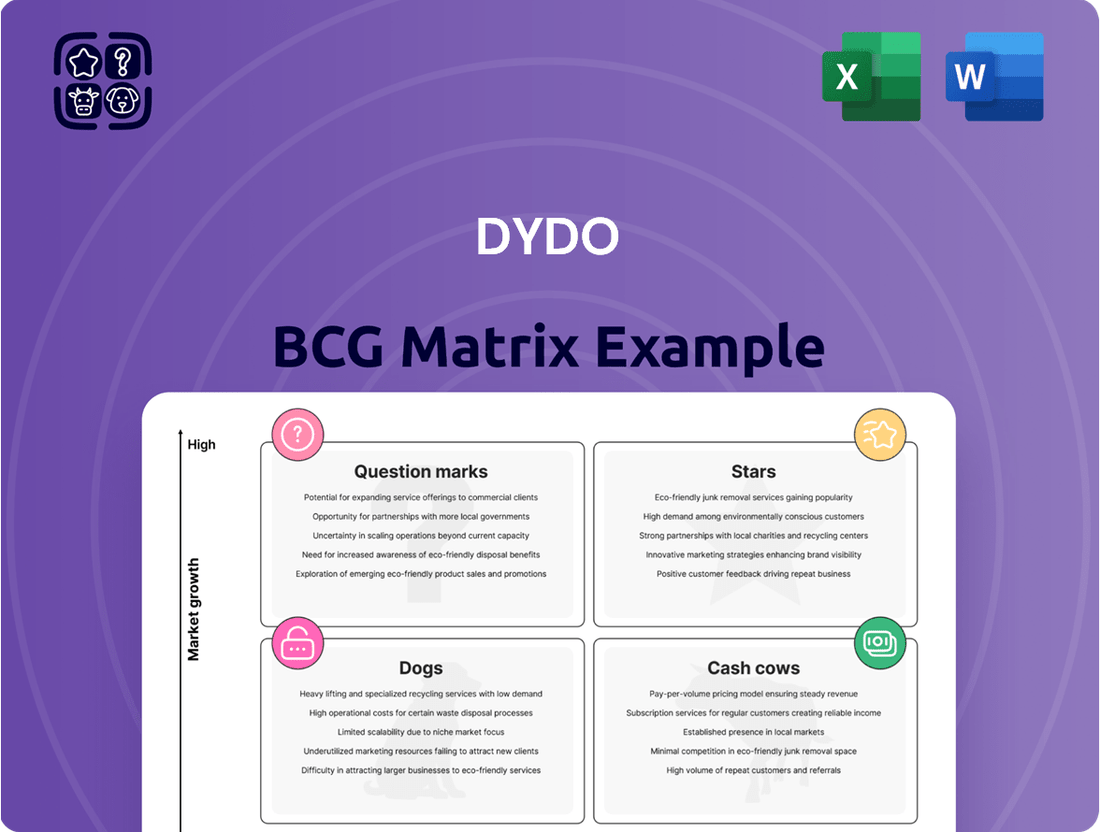

The DyDo BCG Matrix categorizes its diverse product portfolio into Stars, Cash Cows, Dogs, and Question Marks, offering a crucial snapshot of market performance and potential. Understanding these placements is key to unlocking strategic growth and optimizing resource allocation.

Gain a clear view of where DyDo's products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

DyDo's Turkish beverage business is a shining star in its portfolio, demonstrating impressive performance. For the fiscal year 2024, this segment was a major driver of the company's financial success. It contributed to an substantial 11.2% surge in net sales and a remarkable 28.3% jump in operating profit.

DyDo's Pharmaceutical-Related Business, specifically its pouch products, has seen remarkable performance, achieving record net sales. This surge in demand indicates a robust and growing market for these items.

The company's pouch line is operating at its absolute maximum capacity, a clear signal of high demand and a strong market position for DyDo in this sector. This full utilization underscores the success and potential of this business segment.

To truly leverage this growth trajectory, DyDo is strategically investing in its pharmaceutical pouch operations. This includes significant efforts like reorganizing the production system to ensure it can meet and exceed future demand, solidifying its foothold in this high-demand area.

Functional beverages are indeed shining bright for DyDo, fitting perfectly into the Stars category of the BCG Matrix. The Japanese market for these health-focused drinks is booming, with consumers actively seeking products that offer more than just hydration. DyDo's strategic move into dietary supplements and nutritionals, exemplified by launches like the GABA-infused 'Supervised by HADABISEI' and 'Wanochikara' addressing nutrient gaps, directly taps into this powerful trend.

New Drug 'Firdapse® Tablet 10mg'

DyDo Pharma, Inc.'s Firdapse® Tablet 10mg, approved in September 2024 for Lambert-Eaton Myasthenic Syndrome and launched in January 2025, is positioned as a Star in the DyDo BCG Matrix. This designation reflects its status as a new, high-growth product in a niche, yet potentially lucrative, orphan drug market.

- Product: Firdapse® Tablet 10mg

- Indication: Lambert-Eaton Myasthenic Syndrome

- Approval & Launch: September 2024 & January 2025

- Market Position: Star (High Growth, High Share Potential)

Strategic International Acquisitions (e.g., Polish subsidiary)

DyDo's acquisition of Wosana S.A., a Polish beverage company, in February 2024 was a significant move. This acquisition played a role in the company's improved performance for the fiscal year 2024. It highlights DyDo's focus on expanding its global reach into promising new markets.

This strategic international expansion into emerging markets, like Poland, allows DyDo to quickly build a substantial market presence. Such moves are key for driving future growth and solidifying its position in the beverage industry.

- Acquisition Date: February 2024

- Acquired Entity: Wosana S.A. (Polish beverage company)

- Impact: Contributed to improved performance in FY2024

- Strategic Rationale: Expansion into new, high-growth international markets

DyDo's Turkish beverage operations and its functional beverage segment in Japan are clear Stars. The company's pharmaceutical pouch products and the newly launched Firdapse® Tablet 10mg also fit this category, representing high-growth areas with strong market potential. These segments are driving significant revenue and profit increases for DyDo.

| Business Segment | BCG Category | Key Performance Indicators (FY2024) | Strategic Focus |

|---|---|---|---|

| Turkish Beverage Business | Star | Net Sales: +11.2% Operating Profit: +28.3% |

Continued growth and market penetration |

| Functional Beverages (Japan) | Star | High consumer demand for health-focused products | Product innovation and market expansion |

| Pharmaceutical Pouch Products | Star | Record net sales, operating at maximum capacity | Production system reorganization, capacity expansion |

| Firdapse® Tablet 10mg | Star | New orphan drug in a niche, high-growth market | Market launch and patient access initiatives |

What is included in the product

The DyDo BCG Matrix categorizes products by market share and growth, guiding strategic decisions.

Quickly identify underperforming products for strategic divestment.

Cash Cows

DyDo's extensive vending machine network, a traditional cash cow, generated significant, stable revenue, largely from canned coffee sales. In 2024, despite a shrinking market due to rising operational costs and labor scarcity, DyDo continued to leverage this network by investing in smart operations and AI to boost efficiency and maintain its cash-generating power.

Canned coffee has long been a cornerstone of DyDo's business, acting as a reliable generator of profits and a steady source of cash flow, largely thanks to its extensive vending machine network. This segment has consistently provided stable revenue streams.

While sales per vending machine saw a dip following strategic price adjustments made in anticipation of competitor moves, canned coffee remains a vital product for DyDo. It continues to be a significant contributor to the company's overall revenue generation.

DyDo is actively refining its pricing strategy for canned coffee products. The aim is to stimulate sales volume and strengthen its market position, demonstrating a commitment to adapting to evolving market dynamics and consumer preferences.

DyDo's established domestic beverage brands, such as its popular tea and juice lines, are quintessential Cash Cows. These products have a strong foothold in convenience stores and vending machines, indicating a mature market where DyDo enjoys a stable market share.

While not experiencing rapid expansion, these beverages reliably generate significant cash flow. This is largely due to their loyal customer base and deeply entrenched distribution networks, making them a consistent revenue generator for the company.

For fiscal year 2023, DyDo DRINKO reported net sales of ¥165.8 billion, with their beverage segment forming the core of this revenue. The consistent performance of these mature brands underpins their Cash Cow status, providing the financial stability to invest in other business areas.

Contract Drink Manufacturing

The contract drink manufacturing segment, responsible for OEM production of various beverages including pharmaceuticals and soft drinks, represents a stable pillar within DyDo's operations. This business line, while not experiencing rapid expansion, consistently generates revenue and supports the company's profitability due to its dependable demand from other businesses.

This segment functions as a Cash Cow for DyDo, characterized by its mature market position and consistent cash flow generation. Its established nature means it requires minimal investment for maintenance, allowing DyDo to allocate resources to other growth areas. For instance, in the fiscal year ending March 2024, DyDo's beverage segment, which encompasses contract manufacturing, demonstrated resilience, contributing significantly to the company's overall financial health.

- Steady Revenue: Provides a reliable income stream for DyDo.

- Low Growth, High Profitability: Operates in a mature market with consistent demand, leading to stable profits.

- Cash Generation: Generates more cash than it consumes, funding other business units.

- Minimal Investment: Requires limited capital expenditure due to its established nature.

Fruit Jellies (Tarami Corporation)

Fruit jellies, primarily managed by Tarami Corporation, represent a significant segment within DyDo's food business. This product line is characterized by its mature market status, with domestic sales demonstrating resilience. While international expansion, particularly to China, has experienced a slowdown, the core domestic operations continue to be a reliable source of consistent cash flow. This stability positions fruit jellies as a classic Cash Cow within the DyDo portfolio. For instance, in the fiscal year ending March 2024, Tarami Corporation reported stable revenue streams from its jelly products, underscoring their dependable contribution to the company's overall financial health. The strategy for this segment centers on maintaining its established market share and optimizing operational efficiency to maximize profitability.

The fruit jelly business is a prime example of a mature product with a strong, stable market presence. Despite a noticeable dip in exports to China, Tarami Corporation's domestic performance has been robust, highlighting the enduring appeal of their fruit jellies in Japan. This consistent demand translates into predictable revenue generation, a hallmark of a Cash Cow. In 2023, the Japanese confectionery market, which includes fruit jellies, saw steady consumer spending, with Tarami capturing a significant portion of the jelly segment. The company's focus remains on leveraging this established position to generate consistent profits that can be reinvested in other growth areas of the DyDo Group.

- Product Line: Fruit Jellies (Tarami Corporation)

- Market Position: Mature, stable domestic market share.

- Financial Contribution: Consistent and reliable cash flow generation.

- Strategic Focus: Solidifying the business foundation and maintaining market presence.

DyDo's established domestic beverage brands, such as its popular tea and juice lines, are quintessential Cash Cows. These products have a strong foothold in convenience stores and vending machines, indicating a mature market where DyDo enjoys a stable market share.

While not experiencing rapid expansion, these beverages reliably generate significant cash flow. This is largely due to their loyal customer base and deeply entrenched distribution networks, making them a consistent revenue generator for the company. For fiscal year 2023, DyDo DRINKO reported net sales of ¥165.8 billion, with their beverage segment forming the core of this revenue.

The contract drink manufacturing segment, responsible for OEM production of various beverages including pharmaceuticals and soft drinks, represents a stable pillar within DyDo's operations. This business line, while not experiencing rapid expansion, consistently generates revenue and supports the company's profitability due to its dependable demand from other businesses. For instance, in the fiscal year ending March 2024, DyDo's beverage segment demonstrated resilience, contributing significantly to the company's overall financial health.

Fruit jellies, primarily managed by Tarami Corporation, represent a significant segment within DyDo's food business. This product line is characterized by its mature market status, with domestic sales demonstrating resilience. For instance, in the fiscal year ending March 2024, Tarami Corporation reported stable revenue streams from its jelly products, underscoring their dependable contribution to the company's overall financial health.

| Business Segment | Market Status | Cash Flow Generation | Investment Needs | 2023/2024 Data Point |

|---|---|---|---|---|

| Domestic Beverages (Tea, Juice) | Mature, Stable | High, Consistent | Low | Core of ¥165.8 billion net sales (FY2023) |

| Contract Drink Manufacturing | Mature, Stable | High, Consistent | Low | Resilient contribution to overall financial health (FY ending March 2024) |

| Fruit Jellies (Tarami Corp.) | Mature, Stable (Domestic) | High, Consistent | Low | Stable revenue streams reported (FY ending March 2024) |

What You See Is What You Get

DyDo BCG Matrix

The DyDo BCG Matrix report you are currently previewing is the complete and final document you will receive upon purchase. This means the strategic insights, market share data, and growth rate analyses presented here are exactly what you'll have access to, ready for immediate application in your business planning. You can confidently expect a fully formatted, professional report that requires no further editing or revision, ensuring a seamless transition from preview to practical use.

Dogs

DyDo's vending machine segment experienced a concerning trend in FY2024, with sales per machine dropping despite an overall increase in the number of machines. This indicates a potential challenge in a mature market where growth is limited.

The decline in sales per vending machine can be largely attributed to strategic price adjustments made by DyDo that were ahead of competitors. In an environment where consumers are increasingly focused on saving money, these price increases likely deterred some purchases.

This situation places the vending machine business in a difficult position within the BCG matrix. It's a segment that requires ongoing investment to maintain its presence, yet it's not generating proportional returns, suggesting it might be a cash cow that's starting to falter or a dog that needs careful management.

The traditional health drinks market in Japan is indeed facing a shrinking trend. This slowdown directly impacts DyDo's production lines, leading to lower operation rates for their health drinks. This scenario suggests a mature or declining market where DyDo's offerings might be struggling to gain traction or maintain market share.

In 2023, the Japanese functional beverage market, which includes many traditional health drinks, saw a modest growth of around 2% year-on-year, reaching approximately ¥4.5 trillion. However, within this, the segment of older, established health drinks is seeing less dynamism compared to newer, innovative products. DyDo's reliance on these traditional offerings could position them in a low-growth quadrant, potentially becoming a cash trap if investment continues without commensurate returns.

DyDo's food business is facing headwinds with a notable decline in net sales directly linked to a slowdown in exports to China. This situation points towards a challenging market environment for these particular products.

The reduced export performance suggests that the Chinese market for these specific food items may be experiencing low growth or even a contraction. In the context of the BCG matrix, this scenario positions these exports as potential 'dogs'.

This classification implies that DyDo's market share in this segment might be insufficient to capitalize on any remaining growth, leading to a situation where resources are tied up with minimal prospect of significant returns. For instance, if DyDo's food exports to China represented 5% of its total food revenue in 2023 and saw a 10% year-over-year decline in 2024, this would solidify its 'dog' status.

Certain Legacy Beverage Products

Certain legacy beverage products within DyDo's domestic portfolio may be classified as Dogs in the BCG matrix. The Japanese beverage market, particularly for traditional soft drinks, is mature and shows a growing consumer preference for functional and health-oriented beverages. This trend can lead to declining market share for older, less differentiated products.

These legacy products, if not actively managed or repositioned, could be operating with low sales volume and minimal growth. Their contribution to DyDo's overall profitability might be negligible, potentially even operating near break-even. This situation means they consume resources, such as marketing and distribution, without generating substantial returns.

For example, if a particular soda brand launched decades ago has seen its market share erode significantly due to changing consumer tastes and increased competition from healthier alternatives, it would fit the Dog profile. DyDo's 2023 financial reports, while not detailing individual product performance in this manner, indicate a focus on innovation in functional beverages, suggesting a strategic shift away from potentially underperforming legacy items.

- Low Market Share: Legacy products often struggle to maintain relevance in a dynamic market.

- Mature Market Dynamics: Consumer shifts towards health and functionality impact traditional offerings.

- Resource Consumption: These products may tie up capital and operational resources with little profit.

- Potential for Divestment or Revitalization: DyDo may consider phasing out or reinventing these offerings.

Inefficient Vending Machine Operations (Pre-Smart Operations)

Before the widespread adoption of smart technologies, traditional vending machine operations often struggled with significant inefficiencies. Labor shortages, a persistent issue in many service industries, directly impacted the cost and availability of staff needed for restocking and maintenance. This, coupled with rising raw material costs, squeezed profit margins considerably.

These older, less automated models, particularly those not yet upgraded to incorporate AI and data analytics, can be categorized as 'dogs' within a BCG matrix framework. Their profitability is low, and operational expenses remain high, especially in markets where consumer preferences are shifting towards more tech-enabled convenience.

For instance, in 2024, the vending machine industry continued to grapple with these challenges. While specific figures for pre-smart operations are not always isolated, the broader industry faced an average increase in operating costs. Reports from late 2023 indicated that labor costs alone could account for up to 30% of a vending operator's expenses in less automated setups.

- Low Profitability: High operating costs due to manual labor and maintenance, coupled with price sensitivity in some market segments, lead to reduced profit margins.

- High Operational Costs: Reliance on manual restocking, cash handling, and less efficient inventory management drives up expenses.

- Shrinking Market Share: In an era demanding instant, data-driven service, older models may lose out to more advanced, cashless, and personalized vending solutions.

- Vulnerability to External Shocks: Increased susceptibility to fluctuations in labor availability and raw material prices compared to automated systems.

DyDo's legacy beverage products, particularly older soft drink brands, are likely categorized as Dogs. These products operate in a mature Japanese beverage market where consumer preference has shifted significantly towards functional and health-oriented drinks. Their market share has likely eroded due to this trend and increased competition, leading to low sales volume and minimal growth, potentially consuming resources without substantial returns.

The food export business to China also exhibits characteristics of a Dog. A notable decline in net sales, attributed to a slowdown in exports, suggests a challenging market environment with low growth or contraction for these specific items. If DyDo's market share in this segment is insufficient to capitalize on any remaining growth, it becomes a cash trap, tying up resources with limited prospects for significant returns.

Older, less automated vending machines also fall into the Dog category. These machines face low profitability due to high operating costs, including manual labor and maintenance, especially as consumer preferences lean towards tech-enabled convenience. In 2024, the industry continued to see increased operating costs, with labor alone potentially representing up to 30% of expenses for less automated setups.

| Business Segment | BCG Category | Rationale |

|---|---|---|

| Legacy Beverage Products | Dog | Mature market, shifting consumer preferences to health drinks, low market share, minimal growth. |

| Food Exports to China | Dog | Declining net sales, challenging market environment, low growth or contraction, insufficient market share. |

| Traditional Vending Machines (Less Automated) | Dog | Low profitability, high operating costs (labor, maintenance), vulnerability to tech-enabled solutions. |

Question Marks

DyDo's 'ZEPPIN' series experienced a price reduction in August 2024, a move that immediately boosted sales volume. This tactical adjustment signals potential for the product line to capture a larger market share.

Despite the initial sales surge, the long-term viability of this pricing strategy remains a question mark for the 'ZEPPIN' series. Its impact on sustained profitability and market positioning requires ongoing evaluation and possibly further strategic investment to solidify its growth trajectory.

DyDo's newer low-sugar and sugar-free beverages are positioned as Stars in the BCG matrix, reflecting the Japanese market's strong shift towards healthier options. The demand for such products is a significant growth driver, with the health and wellness beverage sector in Japan showing robust expansion. For instance, sales of functional beverages, which often include low-sugar variants, have been steadily increasing, indicating a fertile ground for these innovative offerings.

DyDo's foray into e-commerce for beverages and health foods presents a classic question mark in the BCG matrix. While the Japanese beverage market is increasingly embracing online sales, with e-commerce penetration for food and beverages in Japan reaching approximately 10.5% in 2023, DyDo's established vending machine dominance means its e-commerce market share is likely nascent.

This growing channel demands substantial investment for brand building, logistics, and digital marketing to compete effectively. For instance, major competitors in Japan's beverage e-commerce space saw significant growth in 2023, with online sales contributing to a larger portion of their overall revenue, highlighting the potential but also the competitive landscape DyDo must navigate.

International Expansion into New Regions (beyond Turkey and Poland)

Expanding DyDo's presence into new international territories beyond its established markets in Turkey and Poland positions these ventures as question marks within the BCG matrix. These markets, characterized by low brand recognition and nascent market share for DyDo, demand significant capital infusion and meticulous strategic development to foster growth and potentially transform into future star products or business units.

For instance, entering a market like Vietnam, where the beverage industry is projected to grow significantly but DyDo's presence is minimal, would represent a classic question mark scenario. The company would need to invest heavily in marketing, distribution, and potentially local partnerships to build brand awareness and capture market share.

- Market Entry Costs: Initial investments in new regions can be substantial, covering market research, regulatory compliance, product localization, and establishing distribution networks. For example, entering a market like Brazil in 2024 might require an estimated upfront investment of $10-20 million for initial setup and marketing campaigns.

- Growth Potential vs. Investment: While these markets offer high growth potential, the return on investment is uncertain, necessitating careful evaluation of market dynamics, competitive landscape, and consumer preferences. Analysts project the Southeast Asian beverage market to grow at a CAGR of 6-8% through 2027, presenting an attractive but competitive opportunity.

- Strategic Importance: Successful penetration into these question mark markets can diversify DyDo's revenue streams and create future growth engines, reducing reliance on existing markets. Emerging markets in Africa, for example, are anticipated to see a significant rise in disposable income, offering long-term strategic advantages for early entrants.

- Risk Mitigation: Thorough due diligence and phased market entry strategies are crucial to mitigate risks associated with low brand awareness and intense competition. A pilot launch in a specific city or region within a new country can provide valuable data before a full-scale rollout.

Future Co-Creation Institute Initiatives

DyDo established the DyDo Group Future Co-Creation Institute in March 2025 to spearhead research and development in novel functional materials and advanced manufacturing techniques for its beverage and food products. This strategic move positions these R&D efforts as significant growth opportunities for the company.

These initiatives represent DyDo's investment in future innovation, aiming to unlock new market potential. However, their ultimate commercial viability and potential market penetration remain uncertain, classifying them as question marks within the DyDo BCG Matrix.

Significant capital and sustained effort will be necessary to transform these research endeavors into market-ready products. The institute's focus on functional materials and manufacturing methodologies suggests a long-term vision for product differentiation and operational efficiency.

- Future Co-Creation Institute: Launched March 2025, focusing on R&D for new functional materials and manufacturing.

- Strategic Importance: High-growth prospects, but commercial success and market share are currently unknown.

- BCG Matrix Classification: Positioned as 'question marks' requiring substantial investment and time to mature.

- Investment Focus: Aims to develop innovative beverage and food solutions through cutting-edge research.

DyDo's investment in new international markets, like Vietnam, falls into the question mark category. These ventures require significant capital for marketing and distribution to build brand recognition. For example, the Southeast Asian beverage market is projected to grow at a CAGR of 6-8% through 2027, presenting both opportunity and intense competition for DyDo.

The DyDo Group Future Co-Creation Institute, established in March 2025, represents another question mark. While focused on R&D for novel materials and manufacturing, the commercial success and market penetration of these innovations are yet to be determined, necessitating substantial investment and time.

DyDo's evolving e-commerce presence also presents a question mark. Despite the Japanese food and beverage e-commerce market reaching approximately 10.5% in 2023, DyDo's online sales are likely nascent compared to its vending machine dominance, requiring considerable investment in digital marketing and logistics.

| Category | Current Status | Future Outlook | Key Considerations |

| International Expansion (e.g., Vietnam) | Low brand recognition, nascent market share | High growth potential, but uncertain ROI | Market entry costs ($10-20M estimated for similar markets), competitive landscape, consumer preferences |

| Future Co-Creation Institute | R&D in novel materials and manufacturing | Potential for market-ready products, but commercial viability unknown | Substantial capital investment, long-term development timeline |

| E-commerce Operations | Nascent market share compared to vending | Growing channel, requires significant investment | Brand building, logistics, digital marketing, competitor growth in online sales |

BCG Matrix Data Sources

Our DyDo BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth rates, to accurately position each product.