DXP Enterprises SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DXP Enterprises Bundle

DXP Enterprises possesses significant strengths in its diverse product offerings and established customer relationships. However, potential weaknesses in supply chain management and integration of acquisitions could pose challenges. Understanding these internal dynamics is crucial for navigating the competitive landscape.

Opportunities lie in expanding into new markets and leveraging technological advancements within the industrial distribution sector. Conversely, threats from economic downturns and intensified competition demand careful strategic planning.

Want the full story behind DXP Enterprises' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DXP Enterprises boasts an extensive product and service portfolio, encompassing a wide array of MRO products, equipment, and integrated solutions. This includes critical components like rotating equipment, bearings, power transmission systems, pumps, hoses, fluid power, and instrumentation.

This broad offering allows DXP to serve a diverse customer base across numerous industries, from manufacturing to energy. For instance, their comprehensive pump and fluid power solutions are vital for many industrial processes, showcasing the breadth of their market reach.

The company's ability to provide such a wide spectrum of essential industrial supplies and services creates a significant competitive advantage. It positions DXP as a one-stop shop for many of their clients' operational needs, fostering customer loyalty and simplifying procurement processes.

In the fiscal year 2023, DXP Enterprises reported net sales of $1.35 billion, a testament to the demand for their diverse product and service catalog and their ability to effectively serve a broad market. This substantial revenue underscores the strength derived from their comprehensive MRO solutions.

DXP Enterprises boasts a formidable distribution network, with a significant presence across the United States, Canada, Mexico, and even Dubai. This extensive geographic reach, encompassing over 250 locations as of early 2024, allows for efficient product delivery and service provision to a broad customer base.

Their dedication to exceptional customer service and the provision of customized solutions has cultivated strong relationships, fostering high levels of customer satisfaction and loyalty. This focus on client needs translates directly into recurring business, a testament to their effective service model.

DXP Enterprises excels by offering integrated supply solutions and deep technical expertise, helping clients streamline their procurement processes. This focus on value-added services allows customers to reduce costs and boost overall productivity and efficiency.

This service-driven strategy, especially evident in their high-value offerings like Innovative Pumping Solutions, directly contributes to improved profit margins. It also serves as a key differentiator, setting DXP apart from competitors who might focus solely on product sales.

For instance, DXP's commitment to integrated solutions played a role in their reported net sales increasing by 14% to $1.4 billion for the nine months ending September 30, 2024, compared to the same period in 2023. This growth underscores the market's positive reception to their value-added approach.

Diversified End Markets and Resilience

DXP Enterprises benefits significantly from its diversified end markets, serving critical sectors such as oil & gas, chemical, food & beverage, municipal, and general manufacturing. This broad customer base provides a strong foundation for stable revenue streams.

This diversification acts as a crucial buffer, enhancing DXP's resilience against downturns in any single industry. For instance, while the energy sector might experience volatility, demand from food & beverage or municipal clients can help offset these fluctuations.

As of the first quarter of 2024, DXP reported that its largest segment, Service Centers, which includes distribution and rental services across these varied industries, continued to show robust performance, contributing to overall balanced sales growth.

The company's ability to cater to such a wide spectrum of industries demonstrates a strategic advantage in navigating economic cycles, ensuring more predictable financial outcomes and supporting sustained growth.

- Broad Industry Reach: Serves oil & gas, chemical, food & beverage, municipal, and general manufacturing sectors.

- Economic Resilience: Diversification mitigates risks associated with sector-specific downturns.

- Balanced Growth: Provides stability and predictability in revenue streams.

- Strategic Advantage: Enhances ability to navigate economic uncertainties effectively.

Proven Acquisition Strategy for Growth

DXP Enterprises has a well-established track record of utilizing strategic acquisitions to fuel its expansion. This approach has consistently broadened the company's product portfolio, extended its geographical footprint, and enhanced its service capabilities, all of which are crucial drivers of revenue growth.

The impact of this strategy is clearly visible in recent financial performance. For fiscal year 2024, acquisitions alone contributed an impressive $98.5 million to the company's sales figures. This demonstrates the tangible financial benefits derived from successfully integrating new businesses.

Looking ahead, DXP Enterprises remains committed to this growth engine. The company has explicitly stated its intention to continue pursuing strategic acquisitions throughout 2025, signaling a sustained focus on inorganic growth as a key element of its corporate strategy.

- Proven Acquisition Strategy: DXP's history shows successful acquisitions expanding product offerings, geographic reach, and service capabilities, directly contributing to revenue growth.

- Fiscal 2024 Impact: Acquisitions generated $98.5 million in sales during fiscal 2024, underscoring their significant contribution to the company's top line.

- Future Growth Plans: The company plans to continue its acquisition strategy in 2025, indicating ongoing investment in inorganic growth opportunities.

DXP's extensive product and service portfolio, covering MRO products, equipment, and integrated solutions like pumps and bearings, makes it a one-stop shop for many industrial clients.

This breadth of offerings, serving diverse sectors from manufacturing to energy, is a significant competitive advantage, fostering customer loyalty and simplifying procurement.

For the nine months ending September 30, 2024, DXP's net sales increased by 14% to $1.4 billion, reflecting the market's positive reception to their comprehensive solutions.

What is included in the product

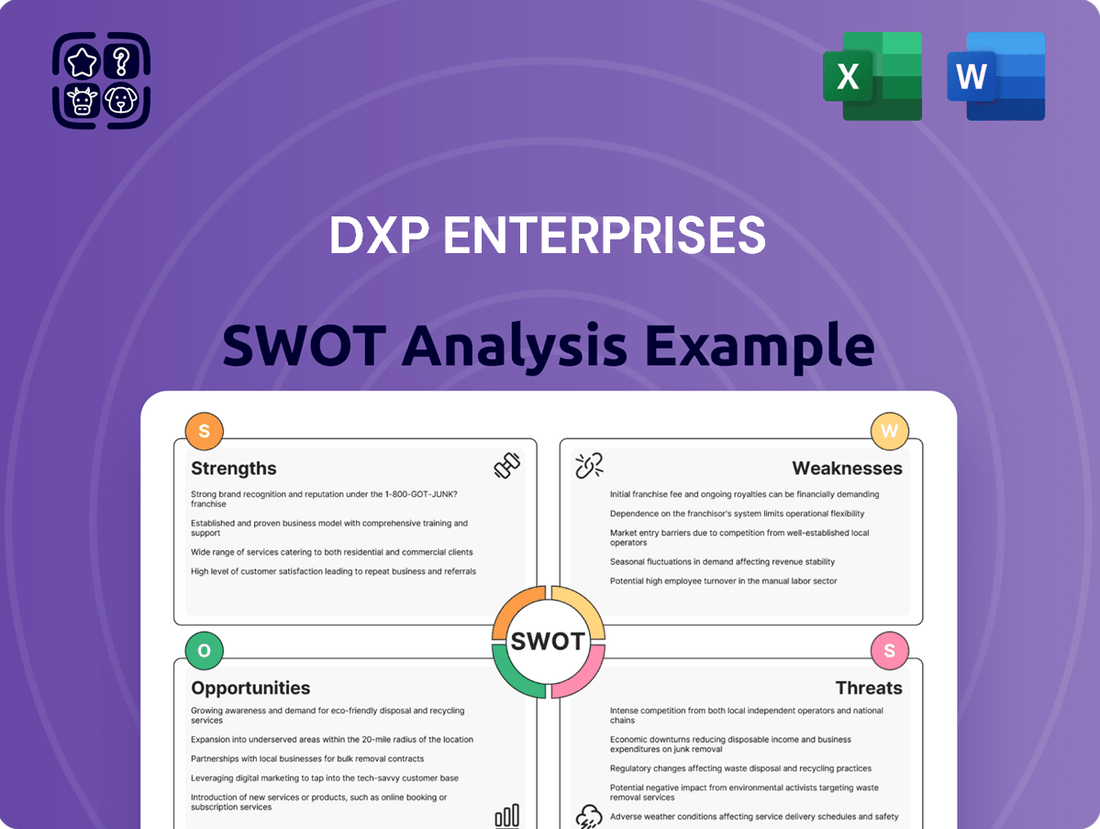

Delivers a strategic overview of DXP Enterprises’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of DXP Enterprises' market position and competitive landscape, simplifying strategic decision-making.

Weaknesses

DXP Enterprises' reliance on industrial sectors makes it vulnerable to the ebb and flow of economic cycles. When industrial manufacturing activity slows, as indicated by a dip in the ISM Manufacturing PMI, DXP can see a direct impact on the demand for its distribution and services.

For example, a significant contraction in industrial production, like the 1.3 point drop in the ISM Manufacturing PMI to 49.1 in April 2024, signals a weakening economy that could translate to reduced sales for DXP's extensive product lines.

This sensitivity means that periods of economic recession or even moderate slowdowns can negatively affect DXP's revenue and profitability, as businesses cut back on capital expenditures and operational spending.

The company's performance is therefore closely tied to the broader health of the industrial economy, making it susceptible to macroeconomic shifts beyond its direct control.

DXP Enterprises operates in a crowded industrial distribution market, facing significant competition from established players like Grainger, Fastenal, MSC Industrial, Motion Industries, and Rexel. This crowded landscape directly impacts DXP's ability to maintain pricing power and healthy profit margins.

The sheer number of competitors means DXP must constantly strive for operational efficiency and innovative service offerings to differentiate itself. For instance, in 2023, the industrial distribution sector saw continued consolidation and strategic pricing adjustments as companies vied for market share, a trend likely to persist into 2024 and 2025.

DXP Enterprises faces significant challenges in managing its extensive product portfolio spread across numerous locations, leading to inherent complexities in inventory control. For instance, in Q1 2024, DXP reported inventory levels of $630.3 million, a substantial figure that requires sophisticated systems to optimize. This vast inventory necessitates careful tracking to avoid stockouts or excess carrying costs.

Furthermore, DXP's reliance on a global supply chain exposes it to vulnerabilities. Recent data from 2023 and early 2024 highlights ongoing disruptions, including shipping delays and raw material price volatility, which can hinder DXP's ability to fulfill customer orders promptly. Such inefficiencies can directly impact customer satisfaction and, consequently, the company's overall profitability.

Potential Dependence on Key Customers

DXP Enterprises faces a potential weakness due to its reliance on a few significant customers. This customer concentration can be a double-edged sword; while these relationships drive substantial revenue, they also introduce considerable risk. A downturn in the business of one or two major clients, or a decision by them to reduce their purchasing volume, could disproportionately impact DXP's overall financial performance.

For instance, in their financial reporting, a notable percentage of DXP's sales can often be attributed to a small group of clients. This dependency means that the company's stability is closely tied to the continued success and purchasing habits of these key accounts.

The potential consequences of losing even one major customer are significant, potentially leading to sharp declines in revenue and profitability. This makes proactive customer relationship management and diversification of the customer base a critical strategic imperative for DXP.

- Revenue Concentration: A significant portion of DXP's revenue may be derived from a limited number of large customers.

- Risk of Customer Churn: The loss of a major client could lead to a substantial negative impact on the company's top line.

- Reduced Bargaining Power: Heavy reliance on a few customers might weaken DXP's negotiating position.

- Market Sensitivity: DXP's performance can be highly sensitive to the economic conditions affecting its key customer industries.

Operational Costs and Debt Levels

DXP Enterprises grapples with the persistent challenge of increasing operational costs. These rising expenses, if not offset by efficiency gains or price adjustments, can directly squeeze profit margins. For instance, in the first quarter of 2024, DXP reported an increase in operating expenses. Careful cost management is crucial to maintain profitability in a competitive market.

While DXP Enterprises maintains a generally robust balance sheet, its debt levels require ongoing scrutiny. The company’s interest expenses, directly tied to its debt profile, represent a significant outflow. With planned capital expenditures on the horizon, effectively managing this debt and its associated costs is paramount, especially in a potentially rising interest rate environment.

- Rising operational costs present a continuous challenge to DXP's profitability.

- Managing interest expenses associated with its debt is a key financial consideration.

- Increased capital expenditures necessitate a disciplined approach to debt management.

- The company must balance growth investments with its existing debt obligations.

DXP Enterprises faces a weakness in managing its extensive inventory, which stood at $630.3 million in Q1 2024. This large stock requires sophisticated systems to optimize, balancing the risk of stockouts against the cost of holding excess inventory. Global supply chain disruptions, seen throughout 2023 and early 2024, further complicate timely order fulfillment, potentially impacting customer satisfaction.

Preview the Actual Deliverable

DXP Enterprises SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment. You'll gain access to a comprehensive breakdown of DXP Enterprises' Strengths, Weaknesses, Opportunities, and Threats. This includes detailed insights into their market position, operational efficiencies, potential growth areas, and competitive landscape. Prepare to leverage this professional, structured analysis for strategic decision-making.

Opportunities

DXP Enterprises is well-positioned to capitalize on the accelerating trend of digital transformation and e-commerce growth. By embracing new technologies like automation and advanced data analytics, DXP can significantly enhance its service offerings, streamline operations, and deepen customer engagement.

The company's strategic investment in digital tools, such as predictive maintenance and sophisticated inventory management systems, presents a substantial opportunity to deliver high-value added services to its clients. This focus on digital solutions can differentiate DXP in the marketplace and drive new revenue streams.

The industrial distribution sector, where DXP operates, is increasingly adopting digital platforms for sales and service. For example, in 2024, e-commerce sales within the industrial B2B sector were projected to reach over $2.3 trillion globally, indicating a massive market for digitally enabled solutions.

By expanding its digital footprint and e-commerce capabilities, DXP can reach a wider customer base and offer more convenient purchasing experiences. This digital shift is not just about sales; it's also about improving the entire customer lifecycle, from initial inquiry to post-sale support, through digital channels.

DXP Enterprises consistently seeks strategic acquisitions to broaden its geographical reach, diversify its customer base across various industries, and bolster its product and service offerings. This approach to inorganic growth has been a significant factor in its expansion, as demonstrated by key acquisitions in recent years.

For instance, the acquisitions of Arroyo Process Equipment and Moores Pump & Services in 2023 exemplify DXP's commitment to strengthening its position in specialized markets. These moves are designed to drive future profitability and solidify its market leadership by integrating new capabilities and customer relationships.

The increasing industry push towards automation and smart factory solutions is a significant tailwind for DXP Enterprises. This trend offers a prime opportunity for DXP to leverage its expertise in providing integrated solutions and deep technical knowledge to help clients boost productivity and operational efficiency. For instance, in 2024, the global industrial automation market was projected to reach over $200 billion, with smart factory segments showing particularly strong growth.

Expansion in High-Growth Sectors like Water and Renewable Energy

DXP Enterprises is well-positioned to capitalize on the growing demand for solutions in water and renewable energy. The company's Innovative Pumping Solutions segment has shown robust expansion, particularly within the vital water and wastewater sectors. This focus directly aligns with increasing global investments in water infrastructure and management.

The accelerating shift towards renewable energy sources presents significant opportunities for DXP. By leveraging its established expertise in pumps, fluid handling, and related equipment, DXP can supply critical components and services for renewable energy projects such as solar thermal plants and geothermal systems. This strategic alignment with sustainability trends is a key growth driver.

Consider these specific opportunities:

- Growing Water Infrastructure Investment: Global spending on water and wastewater infrastructure is projected to reach substantial figures, with estimates suggesting trillions of dollars will be invested through the next decade, creating a sustained demand for DXP's pumping solutions.

- Renewable Energy Component Demand: As the renewable energy sector expands, requiring advanced fluid management for technologies like concentrated solar power and advanced battery storage, DXP's specialized product offerings will see increased demand.

- Efficiency and Sustainability Focus: DXP's ability to provide energy-efficient pumping systems aligns with industry-wide pushes for operational cost reduction and environmental sustainability, enhancing its competitive appeal.

Sustainability Initiatives and ESG Focus

The growing emphasis on sustainability presents a significant opportunity for DXP Enterprises. By developing and marketing eco-friendly products and services, DXP can tap into a rapidly expanding market segment of environmentally conscious consumers. This focus can also bolster the company's brand image, positioning it as a responsible corporate citizen.

DXP's commitment to Environmental, Social, and Governance (ESG) principles, such as reducing operational waste and improving energy efficiency, directly addresses shifting market expectations. For instance, in 2023, many industrial equipment providers saw increased demand for energy-efficient machinery, with some reporting up to a 15% rise in sales for these product lines. Aligning with these trends can lead to new revenue streams and enhanced customer loyalty.

- Develop a portfolio of sustainable product offerings.

- Highlight energy-efficient solutions in marketing efforts.

- Publicly report on ESG performance metrics to build trust.

- Explore partnerships with companies focused on circular economy principles.

DXP Enterprises can leverage the increasing demand for industrial automation and smart factory solutions, a market projected to exceed $200 billion globally in 2024. The company is also poised to benefit from substantial investments in water infrastructure, estimated in the trillions over the next decade, strengthening its specialized pumping solutions segment. Furthermore, the expansion of renewable energy projects presents a demand for DXP's fluid handling expertise, aligning with global sustainability goals and potentially driving sales of energy-efficient equipment.

Threats

Economic downturns pose a significant threat to DXP Enterprises. A contraction in industrial manufacturing, reflected in indices like the ISM Purchasing Managers' Index, directly reduces demand for the MRO (Maintenance, Repair, and Operations) products and services DXP provides. For instance, if the ISM Manufacturing PMI drops below 50, indicating contraction, DXP could see a substantial decrease in sales volume. This slowdown impacts their revenue streams and overall profitability.

Global supply chain disruptions remain a significant concern for DXP Enterprises. These issues can manifest as material shortages and increased costs for essential raw materials, exacerbated by factors like tariffs on steel and aluminum. For instance, in late 2023 and early 2024, continued inflationary pressures on industrial inputs have impacted companies across sectors, including those relying on manufactured components.

Geopolitical uncertainties further compound these challenges, potentially disrupting DXP's operations. The ability to reliably source and deliver products is directly threatened by these external factors, which can lead to production delays and impact customer fulfillment. The ongoing conflicts and trade tensions observed throughout 2023 and into 2024 highlight the persistent nature of these risks for businesses with complex global supply networks.

The industrial distribution sector DXP operates in is notably fragmented, meaning it contends with a multitude of competitors, ranging from massive corporations to smaller, specialized firms. This constant rivalry inherently pushes down prices as companies vie for market share, directly impacting DXP's ability to maintain healthy profit margins. For instance, in 2023, the industrial distribution market experienced a noticeable uptick in competitive bidding, with some reports indicating average price concessions increasing by 1-2% as companies sought to secure contracts.

Technological Obsolescence and Rapid Innovation

The relentless pace of technological change, especially in industrial automation and digital solutions, presents a significant risk for DXP Enterprises. If the company doesn't consistently update its product portfolio and operational methods, some of its current offerings could become outdated. For instance, the industrial automation market, a key area for DXP, is projected to grow substantially, with estimates suggesting a compound annual growth rate (CAGR) of around 9% from 2024 to 2030, reaching over $300 billion globally. This rapid evolution means DXP must be agile.

The threat of technological obsolescence is amplified by the constant drive for innovation across the industry. Companies that fail to invest in research and development or adopt new technologies risk losing market share to more forward-thinking competitors. DXP's continued success hinges on its ability to anticipate and integrate emerging technologies, ensuring its products and services remain relevant and competitive in a dynamic market. This includes staying ahead of trends in areas like IoT, AI-powered analytics for industrial processes, and advanced robotics, which are increasingly shaping the landscape.

- Rapid Innovation Risk: Failure to adapt to swift technological advancements in industrial automation and digital solutions could render DXP's current products obsolete.

- Market Share Erosion: Competitors embracing new technologies more quickly may capture market share, impacting DXP's revenue streams.

- Investment in R&D: A substantial CAGR of approximately 9% in the industrial automation market underscores the need for continuous R&D investment to keep pace.

- Emerging Technology Integration: DXP must proactively integrate technologies such as IoT, AI, and advanced robotics to maintain its competitive edge.

Regulatory Changes and Compliance Costs

Regulatory changes in areas like environmental standards or industrial safety can increase compliance costs for DXP Enterprises. For instance, stricter emissions regulations, which have been a growing focus globally through 2024 and into 2025, could necessitate significant capital expenditures for updated manufacturing processes or pollution control equipment. These shifts can directly impact operational expenses and may require DXP to re-evaluate its product lines to meet new legal requirements, potentially diverting resources from other strategic initiatives.

The financial burden of adapting to evolving regulations is a key threat. Consider that in 2024, many industrial sectors saw increased scrutiny, leading to higher indirect costs for compliance monitoring and reporting. DXP must be prepared for these potential cost increases, which could affect profitability if not managed effectively.

- Increased operational expenses due to new environmental mandates.

- Potential need for capital investment in compliance technology.

- Impact on product development and market access.

- Higher costs associated with labor law adherence.

The highly competitive industrial distribution landscape presents a significant threat to DXP Enterprises. Intense rivalry, driven by numerous players from large corporations to smaller specialized firms, often leads to price pressures, impacting DXP's ability to maintain robust profit margins. For example, reports from late 2023 indicated that competitive bidding in the sector saw average price concessions rise by 1-2% as companies fought for market share.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of comprehensive data, including DXP Enterprises' official financial filings, detailed market research reports, and expert commentary from industry analysts. These sources provide a robust understanding of the company's internal capabilities and external market dynamics.