DXP Enterprises PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DXP Enterprises Bundle

Navigate the complex external forces shaping DXP Enterprises's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors critical for strategic planning. Understand how shifting regulations or emerging technologies could impact their market position and identify potential growth avenues. Gain a competitive advantage by leveraging these expert insights. Download the full PESTLE analysis now to unlock actionable intelligence for your business.

Political factors

Government infrastructure spending is a significant tailwind for DXP Enterprises. Increased investment in projects like roads, bridges, and utilities directly boosts demand for the industrial supplies and equipment DXP distributes. These initiatives are expected to create a robust market for maintenance, repair, and operations (MRO) products, leading to more sales and service opportunities. The outlook for 2025 remains positive, largely due to these ongoing infrastructure initiatives.

Changes in international trade agreements, tariffs, and import/export regulations directly impact DXP Enterprises' supply chain costs and product availability. For instance, the ongoing trade tensions between major economies could lead to unpredictable tariff increases on industrial components, potentially raising DXP's procurement expenses. In 2024, global trade disputes continued to create volatility, impacting companies like DXP that rely on international sourcing and distribution networks.

Tariffs on essential raw materials or finished goods can escalate operational expenses, forcing DXP to adjust its pricing strategies. This, in turn, affects the cost for their customers, potentially influencing demand for DXP's industrial parts and services. For example, a 7.5% tariff implemented in late 2023 on certain manufactured goods from a key supplier region added to DXP's cost of goods sold for affected product lines.

Geopolitical forces and evolving foreign trade relations present both complexities and opportunities for industrial distributors like DXP. Shifts in alliances or the imposition of sanctions can disrupt established trade flows, necessitating swift adaptation in sourcing and market access strategies. Navigating these dynamic international landscapes is crucial for maintaining competitive pricing and ensuring consistent product delivery in the 2024-2025 period.

Government initiatives promoting domestic manufacturing and reshoring are a significant tailwind for DXP Enterprises. These policies directly boost demand for Maintenance, Repair, and Operations (MRO) products and services in the U.S. and Canada, DXP's core markets. For instance, the Inflation Reduction Act of 2022, with its emphasis on domestic production, is expected to channel billions into American manufacturing, creating a more substantial local industrial ecosystem that relies on DXP's offerings. This trend strengthens DXP's position by aligning its business with national economic strategies.

Looking ahead, potential shifts in industrial policy following the 2024 U.S. elections warrant close observation. Changes in government priorities could reshape supply chain dynamics and influence the pace of reshoring, directly impacting demand for MRO solutions. The Biden administration's focus on strengthening domestic supply chains, evident in initiatives like the CHIPS and Science Act which aims to onshore semiconductor manufacturing, signals a broader governmental commitment that could benefit companies like DXP. Therefore, DXP must remain agile to adapt to evolving political landscapes and their downstream effects on industrial demand.

Political Stability and Geopolitical Tensions

Political instability in regions critical for manufacturing and logistics can significantly disrupt supply chains, directly impacting the availability and cost of maintenance, repair, and operations (MRO) supplies. For DXP Enterprises, this translates to potential volatility in raw material prices and a broader dampening of industrial confidence, which can slow investment in MRO. For instance, ongoing conflicts in Eastern Europe in early 2024 led to significant fluctuations in energy prices, a key input for many industrial goods.

Geopolitical tensions, including trade disputes and regional conflicts, can force shifts in established trade routes and create product shortages. These disruptions directly affect DXP's operational efficiency, complicating the sourcing of components and the timely distribution of finished products to its customers. The Red Sea shipping disruptions beginning in late 2023, for example, rerouted numerous vessels, increasing transit times and costs for many businesses, including those relying on global MRO supply chains.

- Supply Chain Volatility: Political instability can lead to unpredictable price swings for raw materials vital to MRO, as seen with energy price volatility in 2024.

- Geopolitical Risk: Tensions can alter trade routes and create shortages, impacting DXP's ability to source and deliver goods, evidenced by the Red Sea shipping disruptions in late 2023.

- Investment Climate: Broader geopolitical uncertainty can reduce overall industrial confidence, potentially slowing down investment in MRO services and products.

Regulatory Environment for Industrial Operations

The regulatory environment significantly impacts industrial operations, influencing demand for Maintenance, Repair, and Operations (MRO) products. Stricter regulations around workplace safety and environmental compliance, for instance, drive the need for specialized MRO solutions that ensure adherence. DXP Enterprises' success hinges on its capacity to offer compliant products and swiftly adapt to evolving legal frameworks, thereby solidifying its market standing and fostering strong customer ties.

Proactive adaptation to regulatory shifts is paramount for companies. This involves enhancing supplier collaboration and developing robust contingency plans. Leveraging data analytics and sophisticated supply chain management software allows businesses to anticipate and navigate these changes effectively. For example, the Occupational Safety and Health Administration (OSHA) continues to update its guidelines, with significant revisions to permissible exposure limits for certain chemicals being a key focus in 2024 and expected to continue through 2025, directly impacting the types of safety equipment and materials industrial clients require.

- Regulatory Stringency: Increased enforcement of environmental and safety standards in industrial sectors necessitates compliant MRO products.

- DXP's Role: Providing solutions that meet these evolving regulations is critical for DXP's market relevance and customer loyalty.

- Proactive Strategies: Companies are advised to engage suppliers early and utilize advanced supply chain technology to manage regulatory changes.

- Data-Driven Compliance: Utilizing data analytics helps anticipate and respond to new regulations, ensuring operational continuity and safety.

Government infrastructure spending is a significant tailwind for DXP Enterprises, with continued investment in roads, bridges, and utilities expected to boost demand for industrial supplies through 2025. Changes in international trade agreements and tariffs directly impact DXP's supply chain costs and product availability, as seen with ongoing trade disputes in 2024. Government initiatives promoting domestic manufacturing also benefit DXP by strengthening local industrial ecosystems. Political instability in key manufacturing regions can disrupt supply chains, leading to price volatility for essential MRO components.

Regulatory environments significantly affect industrial operations; stricter safety and environmental compliance mandates drive demand for specialized MRO solutions. Proactive adaptation to these evolving legal frameworks, supported by data analytics and supply chain technology, is crucial for companies like DXP to maintain market relevance. For instance, OSHA's continued updates to permissible exposure limits in 2024 and 2025 directly influence the types of safety equipment industrial clients require.

| Factor | Impact on DXP Enterprises | 2024-2025 Relevance |

|---|---|---|

| Infrastructure Spending | Increased demand for MRO products and services. | Continued government investment expected to sustain demand. |

| Trade Policies & Tariffs | Supply chain cost volatility and product availability issues. | Global trade disputes create ongoing market uncertainty. |

| Domestic Manufacturing Initiatives | Growth in local industrial ecosystems requiring DXP's offerings. | Policies like the Inflation Reduction Act support domestic production. |

| Political Instability | Disruptions to supply chains, price volatility for raw materials. | Regional conflicts impact energy prices and industrial confidence. |

| Regulatory Compliance | Demand for specialized, compliant MRO solutions. | Evolving safety and environmental standards require adaptation. |

What is included in the product

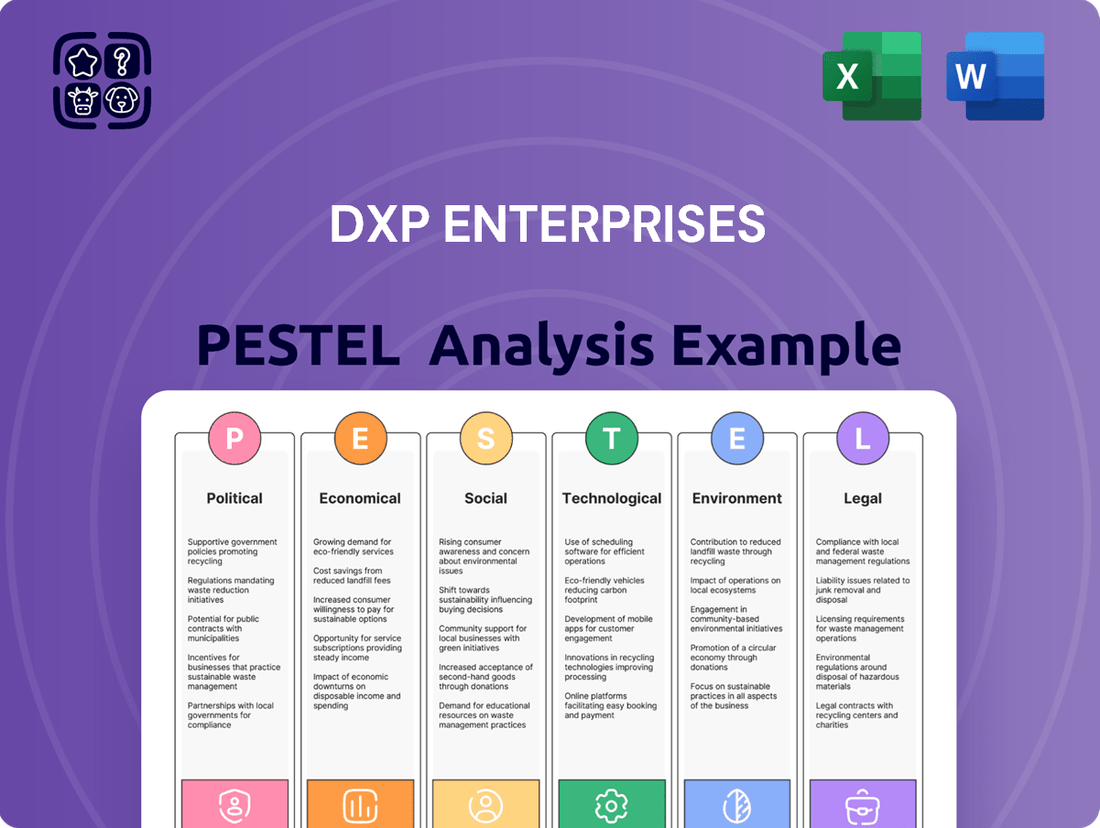

This PESTLE analysis examines the external macro-environmental factors impacting DXP Enterprises across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting key trends and their implications for the company's operations and market position.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, allowing stakeholders to quickly grasp DXP Enterprises' external environment and strategic implications.

Helps support discussions on external risk and market positioning during planning sessions by offering a structured overview of the political, economic, social, technological, environmental, and legal factors impacting DXP Enterprises.

Economic factors

Economic growth is a key driver for DXP Enterprises. When the economy is expanding, businesses tend to increase their production and operational output. This heightened activity directly translates into a greater demand for maintenance, repair, and operating (MRO) supplies, which are DXP's core offerings. For instance, a robust economy often means higher capacity utilization across various industries, necessitating more frequent and extensive maintenance to keep operations running smoothly.

Industrial activity levels are closely tied to economic health. As industrial sectors ramp up production, the need for MRO products and services escalates. DXP's business benefits significantly from this increased industrial output, as more machinery operating means more wear and tear, and thus a higher demand for replacement parts, lubricants, and maintenance services.

The global industrial distribution market is projected for growth, with North America holding a significant position. In 2024, North America is expected to lead this market, indicating a strong environment for companies like DXP that are heavily invested in the region. This trend suggests a favorable backdrop for DXP's sales and expansion efforts in the near term.

Fluctuations in interest rates directly impact DXP Enterprises' borrowing costs and the ability of its customers to finance purchases. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as seen in late 2023 and into 2024, DXP's cost of capital for new equipment or facility upgrades will be influenced.

Higher interest rates can lead to a slowdown in capital expenditure across various industries, potentially affecting demand for DXP's larger, more expensive equipment sales. Businesses might postpone significant investments if financing becomes prohibitively expensive, impacting DXP's revenue streams from these segments.

The Federal Reserve's outlook on interest rates plays a crucial role in the availability and cost of capital for mergers and acquisitions. Stable or declining rates can encourage M&A activity, providing DXP with opportunities for strategic growth, while persistent high rates may dampen such transactions.

Rising inflation directly affects DXP Enterprises' cost of goods sold, influencing the prices of the products they source and increasing operational expenses such as transportation and labor. For example, the US Producer Price Index (PPI) for intermediate materials saw a notable increase throughout 2023 and into early 2024, indicating sustained cost pressures for manufacturers.

To counteract margin compression, DXP must skillfully navigate its pricing strategies and maintain strong relationships with its suppliers. This proactive approach is crucial as manufacturers themselves continue to grapple with elevated input costs, reflected in persistently high producer price indices for raw materials.

Supply Chain Disruptions and Costs

Ongoing global supply chain challenges, including material shortages and shipping delays, continue to impact industries like MRO. These disruptions directly affect DXP Enterprises by potentially limiting inventory, extending lead times for customers, and squeezing profit margins due to increased logistics costs. For instance, a 2024 report indicated that over 60% of MRO businesses cited material shortages as a primary operational concern.

DXP's strategic imperative lies in cultivating and maintaining a resilient, diversified supply chain. This is absolutely crucial for ensuring consistent product availability, a key differentiator for customer satisfaction. The ability to navigate these persistent supply chain headwinds will be a significant factor in DXP's operational efficiency and financial performance through 2025.

- Global MRO sector facing persistent material shortages as a top operational challenge in 2024.

- Increased logistics costs are directly impacting profitability for companies like DXP.

- Maintaining robust inventory levels is becoming more difficult due to extended lead times.

- Supply chain diversification is a critical strategy for mitigating risks and ensuring product availability.

Customer Industry Performance

The economic health of the diverse sectors DXP Enterprises serves is a critical driver of demand for its MRO (Maintenance, Repair, and Operations) products. Industries like oil & gas, chemical processing, food & beverage, general manufacturing, and municipal water treatment each have unique economic cycles that influence their purchasing power and need for DXP's offerings.

DXP's Q1 2025 financial report underscores this dynamic, revealing significant growth in its Innovative Pumping Solutions segment, which saw a 13% increase in sales, and its Service Centers, which experienced a 9% uplift. This performance indicates that while some sectors might face headwinds, DXP's diversified customer base allows it to capitalize on strengths in other areas, demonstrating resilience.

For instance, a slowdown in capital expenditure within the oil and gas sector could be mitigated by increased activity in the food and beverage industry, driven by consumer demand. DXP's ability to adapt and serve these varying needs is key to its consistent performance.

- Oil & Gas: Demand for MRO products is tied to drilling activity and refinery utilization rates.

- Chemical: Stable demand is often seen due to the essential nature of chemical products, though raw material costs can fluctuate.

- Food & Beverage: Generally resilient, with demand driven by consumer spending and the need for operational efficiency.

- General Manufacturing: Performance is linked to broader economic output and industrial production indices.

Economic growth directly fuels demand for DXP's MRO supplies. As industries expand, they require more maintenance and repair, boosting DXP's sales. For example, in 2024, strong industrial output increased the need for operational supplies.

Interest rate shifts influence DXP's capital costs and customer financing. Higher rates, like the Federal Reserve's 5.25%-5.50% target range in 2024, can slow customer investment, impacting sales of larger equipment.

Inflation increases DXP's cost of goods sold and operational expenses. Persistent producer price index increases for raw materials in 2023-2024 necessitated careful pricing strategies by DXP to protect margins.

Supply chain disruptions, including material shortages noted by over 60% of MRO businesses in 2024, impact DXP's inventory and lead times, making supply chain diversification a critical strategy through 2025.

| Economic Factor | Impact on DXP Enterprises | 2024/2025 Data Point |

|---|---|---|

| Economic Growth | Increased demand for MRO supplies | North America leading global industrial distribution market in 2024 |

| Interest Rates | Higher borrowing costs, potentially reduced customer capital expenditure | Federal Reserve target range 5.25%-5.50% (late 2023-2024) |

| Inflation | Increased cost of goods sold and operational expenses | Rising US Producer Price Index for intermediate materials (2023-early 2024) |

| Supply Chain Disruptions | Inventory challenges, extended lead times, increased logistics costs | Over 60% of MRO businesses cited material shortages as a top concern in 2024 |

Full Version Awaits

DXP Enterprises PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for DXP Enterprises delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping DXP Enterprises' strategic landscape. This is your complete, ready-to-deploy strategic tool.

Sociological factors

The industrial sector's demographic shifts present a significant challenge for DXP Enterprises, particularly concerning the availability of skilled labor. An aging workforce, coupled with a declining interest in traditional trades, means fewer experienced technicians are entering the field. This scarcity directly impacts DXP's capacity to staff its technical service operations and, by extension, affects its customers' ability to maintain and upgrade their industrial equipment.

By 2025, the manufacturing industry is projected to grapple with a pronounced talent deficit, especially for roles demanding advanced technological proficiency. This makes it harder for companies like DXP to find individuals capable of servicing modern, automated machinery. To counteract this, DXP may need to substantially increase its investment in comprehensive training and development programs, upskilling existing employees or cultivating new talent from less traditional pools. Furthermore, exploring and integrating advanced technologies, such as remote diagnostics and augmented reality support, can help bridge these labor gaps and maintain operational efficiency for both DXP and its clientele.

Customer expectations are rapidly evolving, largely due to the influence of e-commerce and advanced digital platforms. This shift means industrial distributors like DXP Enterprises are facing increased pressure to offer faster, more convenient, and highly personalized service. For instance, a significant percentage of B2B buyers now expect a B2C-like online experience, with many stating they would switch suppliers for a better digital interface.

To stay competitive, DXP must adapt its service models to mirror these evolving demands. This includes strengthening its online ordering capabilities and optimizing fulfillment processes for greater efficiency. Meeting these expectations is crucial for fostering customer loyalty in an increasingly competitive market.

Customers today prioritize flexibility, expecting seamless interactions across various channels, from web portals to direct sales. Speed and convenience in product fulfillment are paramount; a survey indicated that over 60% of B2B buyers consider delivery speed a key factor when choosing a supplier, a trend that will likely intensify through 2025.

There's a growing societal and corporate focus on safety and health, particularly in the workplace. This trend directly fuels demand for products and services that enhance safety in industrial settings, areas where DXP Enterprises operates. For instance, in 2024, workplace safety regulations continue to be a priority for many industries, leading to increased spending on personal protective equipment and safety management systems.

DXP Enterprises can leverage this heightened awareness by expanding its offerings of safety equipment and related solutions. By presenting itself as a comprehensive provider, DXP can become a go-to partner for businesses prioritizing industrial safety, a segment that saw significant investment in safety technology in 2024.

DXP's commitment to employee, customer, and community well-being aligns perfectly with these societal expectations. This commitment isn't just about compliance; it's about building trust and demonstrating responsibility, which can translate into stronger customer loyalty and a positive brand image in 2025.

Corporate Social Responsibility (CSR)

The increasing focus on Corporate Social Responsibility (CSR) significantly impacts DXP Enterprises. Customers and stakeholders are more likely to support companies that demonstrate a commitment to ethical practices and community involvement. For instance, a 2024 survey indicated that 68% of consumers consider a company's social and environmental impact when making purchasing decisions. This trend means DXP's dedication to responsible operations can directly influence its market share and partnership opportunities.

DXP's proactive approach to CSR can serve as a powerful differentiator. By emphasizing ethical conduct, community engagement, and sustainable business practices, DXP can cultivate a stronger brand reputation. This, in turn, helps attract clients who prioritize working with socially conscious organizations. In 2025, DXP continued its efforts to integrate ESG principles, aiming to reduce its carbon footprint by 15% by 2027, a target that resonates with environmentally aware partners.

DXP Enterprises is actively working towards a sustainable future, setting ambitious Environmental, Social, and Governance (ESG) goals. The company actively engages both internally and externally to define and achieve these objectives. This commitment is not just about compliance but about building long-term value and resilience. For example, DXP's 2024 annual report highlighted a 10% increase in employee volunteer hours dedicated to community projects, demonstrating tangible social impact.

- Growing Customer Demand for CSR: A significant portion of consumers now factor a company's social and environmental responsibility into their buying choices, influencing DXP's market position.

- Enhanced Brand Reputation: DXP's commitment to ethical practices and community support directly bolsters its brand image, attracting ethically-minded clients and partners.

- Attracting Socially Conscious Clients: Companies that align with DXP's CSR values are more likely to engage in partnerships, expanding DXP's business network.

- ESG Goal Setting and Progress: DXP's dedication to setting and pursuing ESG goals, such as its 2027 carbon reduction target, demonstrates a forward-thinking and responsible business strategy.

Education and Training Needs

The fast-paced changes in industrial technology mean DXP and its clients' employees must constantly learn. DXP can provide valuable training on new products, how to maintain them, and digital tools, which builds stronger customer ties and helps develop industry skills. This focus aligns with key hiring trends for 2025 in manufacturing, where upskilling and workforce training are paramount. For example, a 2024 Deloitte survey found that 70% of manufacturing executives see a significant skills gap in their workforce, highlighting the critical need for such programs.

Offering these educational services can position DXP as a knowledge partner, not just a supplier. This proactive approach to skill development can significantly enhance customer loyalty and differentiate DXP in a competitive market. By investing in training, DXP addresses the industry-wide challenge of staying current with evolving technologies, such as advancements in automation and data analytics, which are projected to see substantial growth in adoption through 2025.

- Continuous Learning Imperative: Industrial tech advancements require ongoing education for DXP staff and customers.

- Value-Added Training: DXP can offer training on new products, maintenance, and digital tools to boost customer relationships.

- Industry Skill Development: Training programs contribute to a more skilled workforce, benefiting the entire sector.

- 2025 Hiring Trends: Upskilling and workforce training are identified as critical hiring factors for the manufacturing sector in 2025.

Societal shifts are profoundly influencing industrial distribution. An aging workforce and declining interest in trades mean fewer skilled technicians are available, impacting DXP's ability to service equipment. By 2025, this talent deficit is expected to intensify, particularly for roles requiring advanced technological skills, necessitating increased investment in training and the adoption of technologies like remote diagnostics.

Customer expectations are increasingly shaped by digital experiences, demanding faster, more personalized service from industrial suppliers like DXP. Over 60% of B2B buyers consider delivery speed crucial, a trend expected to grow through 2025. Furthermore, a strong societal and corporate focus on workplace safety is driving demand for safety-enhancing products, positioning DXP to expand its safety equipment offerings.

Corporate Social Responsibility (CSR) is a major driver, with 68% of consumers in 2024 considering a company's social and environmental impact. DXP's commitment to ethical practices and community engagement, evidenced by a 10% increase in employee volunteer hours in 2024, enhances its brand reputation and attracts socially conscious clients. DXP aims to reduce its carbon footprint by 15% by 2027, aligning with environmental stakeholder priorities.

Technological factors

DXP's industrial customers are increasingly investing in automation and robotics, a trend directly boosting demand for DXP's MRO (Maintenance, Repair, and Operations) components, sensors, and related integration services. This shift towards smart manufacturing means DXP needs to continually update its product lines and bolster its technical know-how to effectively support these sophisticated operational systems.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is further accelerating this automation wave, paving the way for factories that are not only more efficient but also capable of predictive maintenance. For instance, by 2025, the global industrial robotics market is projected to reach approximately $70 billion, a significant increase highlighting the scale of this technological adoption.

The industrial distribution landscape is rapidly transforming with the rise of digitalization and e-commerce, directly influencing how DXP Enterprises engages with its customer base. This trend necessitates significant investment in digital infrastructure, including sophisticated online catalogs and e-procurement systems, to enhance operational efficiency and customer satisfaction.

E-commerce is emerging as the dominant growth avenue within industrial distribution, with artificial intelligence playing a crucial role in improving product discovery for buyers. For instance, by 2024, B2B e-commerce sales are projected to reach over $2 trillion in the US, underscoring the immense potential of these digital channels.

DXP's strategic focus on these digital platforms allows for a more streamlined customer journey and provides valuable data insights. Companies that effectively leverage AI for product recommendations and personalized experiences in their e-commerce offerings are gaining a significant competitive edge.

The integration of the Internet of Things (IoT) and predictive maintenance is revolutionizing industrial operations. These technologies enable real-time monitoring of machinery, allowing for proactive repairs and significantly reducing unexpected downtime. For DXP Enterprises, this presents a substantial opportunity to enhance its service offerings by providing solutions that leverage these advancements, moving beyond simple product distribution.

AI-driven systems are increasingly at the forefront of equipment maintenance. By analyzing vast amounts of data from IoT sensors, these systems can accurately predict potential equipment failures before they occur. This shift towards AI-powered predictive maintenance is expected to become a standard practice across industries, offering DXP a competitive edge.

In 2024, the global IoT market was valued at approximately $1.1 trillion, with a significant portion dedicated to industrial IoT applications like predictive maintenance. DXP Enterprises can capitalize on this trend by offering integrated solutions that help clients optimize their asset management and operational efficiency, thereby creating new revenue streams.

Data Analytics and AI in Supply Chain

DXP Enterprises can significantly boost its operational efficiency by integrating advanced data analytics and artificial intelligence (AI) into its supply chain. These technologies are crucial for optimizing inventory levels, refining logistics, and improving demand forecasting accuracy. For instance, in 2024, companies leveraging AI in their supply chains reported an average of 15% reduction in inventory holding costs.

AI-driven automation is transforming how supply chains function. This includes optimizing warehouse operations through intelligent robotics and enhancing transportation routes for greater fuel efficiency and faster delivery times. A 2025 industry report indicated that AI adoption in logistics could lead to a 10-20% decrease in transportation expenses.

- Enhanced Inventory Management: AI algorithms can predict demand with greater precision, reducing overstocking and stockouts, thereby minimizing carrying costs.

- Optimized Logistics: Real-time data analysis helps in dynamic route planning and load optimization, leading to reduced transit times and fuel consumption.

- Improved Demand Forecasting: Machine learning models can analyze historical sales data, market trends, and even external factors to provide more accurate demand predictions.

- Automated Warehouse Operations: AI-powered robots and systems can streamline picking, packing, and sorting processes, increasing throughput and reducing labor costs.

Additive Manufacturing (3D Printing)

Additive manufacturing, commonly known as 3D printing, presents a significant technological shift that DXP Enterprises must carefully consider. The ability for customers to produce components on-demand could potentially disrupt the traditional demand for Maintenance, Repair, and Operations (MRO) parts, which is a core business for DXP.

DXP should actively monitor the advancements and adoption rates of additive manufacturing. This trend could necessitate a strategic pivot, potentially leading DXP to explore new avenues such as distributing specialized materials required for 3D printing or even offering 3D printing services directly to its customer base. For instance, the global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to grow significantly, indicating a substantial market shift.

While the rise of 3D printing might alter some traditional MRO part sales, DXP's established strength in complex rotating equipment, integrated solutions, and comprehensive services offers a degree of resilience. The company's expertise in these areas provides a buffer against a complete erosion of demand for its existing offerings.

Furthermore, DXP can leverage this technological evolution to its advantage. Identifying opportunities to supply specialized raw materials crucial for industrial 3D printing, or developing capabilities in rapid prototyping services, could open up entirely new and lucrative revenue streams for the company. The industrial additive manufacturing market alone is expected to reach over $60 billion by 2030.

- Market Disruption: 3D printing enables on-demand production, potentially reducing reliance on traditional MRO part suppliers.

- Strategic Adaptation: DXP could enter the 3D printing supply chain by distributing materials or offering printing services.

- Market Size: The global 3D printing market was valued at $15.1 billion in 2023 and is rapidly expanding.

- New Revenue Streams: Supplying specialized 3D printing materials or offering prototyping services presents growth opportunities.

- Industry Growth: The industrial additive manufacturing sector is projected to exceed $60 billion by 2030, highlighting significant market potential.

The increasing adoption of automation and AI in manufacturing, projected to drive the industrial robotics market to around $70 billion by 2025, directly fuels demand for DXP's components and integration services.

Digitalization and e-commerce are reshaping industrial distribution, with B2B e-commerce sales in the US anticipated to surpass $2 trillion by 2024, necessitating DXP's investment in digital platforms.

IoT and predictive maintenance, supported by a global IoT market valued at approximately $1.1 trillion in 2024 for industrial applications, offer DXP opportunities to enhance service offerings beyond product distribution.

Legal factors

DXP Enterprises operates within a regulatory landscape where product liability and safety standards are paramount for the MRO (Maintenance, Repair, and Operations) products and equipment it distributes. Ensuring compliance with these often-complex regulations is not merely a legal obligation but a cornerstone of operational integrity. Non-compliance can swiftly translate into significant financial repercussions, including hefty fines, costly product recalls, and severe damage to DXP's hard-earned reputation.

The legal framework surrounding product safety, such as the Consumer Product Safety Act (CPSA) in the United States, mandates that products must not pose unreasonable risks of injury. For DXP, this means rigorously vetting suppliers and ensuring the MRO goods they handle meet or exceed established safety benchmarks, like those set by ANSI or ISO standards. A failure to do so could expose DXP to product liability lawsuits, where they could be held responsible for damages caused by defective products, impacting customer trust and potentially leading to extensive litigation costs.

In 2024, regulatory bodies continue to emphasize product safety and traceability, with increased scrutiny on supply chain transparency. Companies like DXP must adopt a proactive stance, constantly monitoring and adapting to evolving safety standards and product liability laws. This proactive approach is essential not only for mitigating legal risks but also for solidifying customer confidence and ensuring the long-term sustainability of its distribution business in a competitive market.

Environmental regulations are becoming stricter, impacting how DXP Enterprises operates and the solutions it offers. This includes rules around waste management, air emissions, and how chemicals are handled. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to focus on reducing greenhouse gas emissions, a trend likely to intensify.

DXP must not only ensure its own facilities meet these evolving standards but also provide customers with products and services that help them achieve their environmental goals. This means offering solutions that support sustainability and compliance for the diverse industries DXP serves.

To stay ahead, companies like DXP need to proactively plan by improving communication with suppliers and developing robust contingency plans. Leveraging data analytics and advanced supply chain software is crucial for anticipating and adapting to regulatory shifts, ensuring operational continuity and competitive advantage.

Changes in labor laws, such as potential adjustments to minimum wage rates and evolving worker safety standards, could directly influence DXP Enterprises' operational expenses and HR strategies in 2024-2025. For instance, if minimum wage increases by a projected 5% nationally by mid-2025, this would necessitate a review of DXP's compensation structure, particularly for entry-level positions in its manufacturing facilities.

Adherence to these labor regulations is not just a legal obligation but a critical component for preventing costly legal battles and ensuring a consistent, motivated workforce, which is especially vital as the manufacturing sector navigates a dynamic workforce landscape in 2025.

Furthermore, shifts in unionization rights or collective bargaining agreements could impact DXP's labor relations and negotiation processes, potentially affecting production schedules and employee benefits.

The manufacturing industry, in particular, is facing a critical juncture in 2025, largely shaped by the evolving expectations and needs of its increasingly diverse and dynamic workforce.

Data Privacy and Cybersecurity Laws

As DXP Enterprises navigates an increasingly digital world, compliance with data privacy and cybersecurity laws is a critical legal factor. Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) dictate how companies must handle personal data, imposing strict requirements for consent, transparency, and data protection. Failure to adhere to these evolving laws can lead to substantial penalties, with GDPR fines potentially reaching up to 4% of annual global turnover or €20 million, whichever is higher. The increasing sophistication of cyber threats necessitates robust cybersecurity measures to prevent data breaches, which can incur not only legal liabilities but also significant financial losses and irreparable reputational damage.

Protecting sensitive customer and operational data is paramount for DXP, as breaches can result in hefty fines and severe damage to its reputation. For instance, the Equifax data breach in 2017, which exposed the personal information of approximately 147 million people, resulted in a settlement of up to $700 million with U.S. regulators. Investing in secure IT infrastructure and stringent data governance protocols is therefore not just a best practice but a legal imperative in the current landscape. This includes implementing encryption, access controls, and regular security audits to safeguard against unauthorized access and cyberattacks, ensuring DXP maintains customer trust and avoids costly legal entanglements.

Key legal considerations for DXP Enterprises regarding data privacy and cybersecurity include:

- Adherence to GDPR and CCPA: Ensuring all data collection, processing, and storage practices align with global and regional privacy regulations.

- Cybersecurity Incident Response: Developing and regularly testing comprehensive plans to effectively manage and report data breaches.

- Data Minimization and Purpose Limitation: Collecting only necessary data and using it only for specified, legitimate purposes.

- Third-Party Data Management: Ensuring vendors and partners also comply with data privacy and security standards.

Acquisition and Antitrust Regulations

DXP Enterprises operates within a complex legal landscape, particularly concerning its growth strategy through acquisitions. Navigating antitrust regulations is paramount to ensure that its expansion efforts do not lead to monopolistic practices, which could result in significant penalties or blocked deals. Successful integration of acquired companies also hinges on strict adherence to these legal frameworks.

The company’s proactive acquisition strategy underscores the importance of these regulations. DXP completed seven acquisitions throughout 2024 and added another in the first quarter of 2025. This aggressive M&A activity directly impacts its market presence and operational capabilities, making regulatory compliance a critical factor for sustained growth.

- Antitrust Compliance: DXP must ensure its acquisitions do not stifle competition or create undue market concentration.

- Regulatory Approvals: Obtaining necessary clearances from governmental bodies is a prerequisite for completing mergers and acquisitions.

- M&A Impact: The legal environment directly influences DXP's ability to leverage acquisitions for market expansion and capability enhancement.

- 2024-2025 Activity: Seven acquisitions in 2024 and one in Q1 2025 highlight the ongoing need for legal diligence in deal-making.

DXP Enterprises’ legal obligations extend to ensuring the safety and compliance of its MRO products, with strict adherence to regulations like the Consumer Product Safety Act. In 2024, ongoing emphasis on product traceability and supply chain transparency means DXP must proactively manage supplier standards to avoid liability lawsuits and reputational damage.

Environmental regulations are increasingly impacting DXP, with a focus on reducing emissions and managing chemicals, as exemplified by the EPA's continued efforts in 2024. The company must offer solutions that help clients meet these evolving sustainability standards.

Labor law changes, such as potential minimum wage adjustments by mid-2025, could increase operational costs for DXP, necessitating strategic HR planning. Adherence to evolving worker safety standards and unionization rights also remains crucial for stable labor relations.

Data privacy and cybersecurity laws, including GDPR and CCPA, impose significant compliance burdens, with fines for violations potentially reaching 4% of global turnover. DXP's investment in secure IT infrastructure and data governance is vital to prevent breaches and maintain customer trust.

Environmental factors

The increasing focus on Environmental, Social, and Governance (ESG) factors is significantly shaping how companies like DXP Enterprises operate and are perceived. Investors, customers, and the broader public are increasingly prioritizing businesses that demonstrate strong ESG commitments. This trend means DXP's business practices and the very products it offers are under greater scrutiny through an environmental lens.

DXP's dedication to sustainability initiatives is a key differentiator. For instance, by actively working to reduce its environmental footprint and promoting energy-efficient products, DXP can not only bolster its brand reputation but also attract a growing segment of environmentally conscious clients. This proactive approach can lead to stronger customer loyalty and open new market opportunities.

DXP Enterprises has publicly committed to fostering a sustainable future. This commitment extends beyond its own operations to encompass the impact on its customers and the planet. As of their latest disclosures, DXP continues to invest in programs aimed at reducing waste and improving the energy efficiency of the solutions they provide, reflecting a strategic alignment with global sustainability goals.

The availability and pricing of critical raw materials, vital for the industrial products DXP Enterprises distributes, are increasingly vulnerable to resource scarcity and geopolitical events. For instance, disruptions in key mining regions or trade disputes can directly affect the cost and supply of metals and other components used in MRO (Maintenance, Repair, and Operations) products.

To navigate these challenges, DXP Enterprises must prioritize building robust and resilient supply chain strategies. This proactive approach is essential for mitigating the inherent risks linked to potential material shortages and the resulting price volatility, ensuring consistent product availability for their customers.

Indeed, material shortages have been identified as a significant disruptor for the MRO sector. Projections for 2025 indicate that this issue will remain a top concern, underscoring the urgent need for companies like DXP to implement advanced inventory management and alternative sourcing solutions.

Climate change poses a significant threat to DXP Enterprises. The increasing frequency and intensity of extreme weather events, such as floods and severe storms, can directly disrupt DXP's intricate supply chains. These disruptions can lead to significant delays in product delivery and increased operational costs, impacting the company's ability to serve its customers efficiently. For instance, the U.S. experienced a record 28 separate billion-dollar weather and climate disasters in 2023, underscoring the growing physical risks.

Beyond supply chain vulnerabilities, extreme weather can also damage DXP's physical infrastructure, including warehouses and distribution centers. This damage can result in costly repairs and downtime, further exacerbating operational challenges. Furthermore, customer operations can be negatively affected by these events, leading to reduced demand or inability to utilize DXP's services.

To counter these physical risks, DXP Enterprises must prioritize building robust supply chain resilience. This involves strategies like diversifying suppliers, increasing inventory levels strategically, and developing alternative logistics routes. The acknowledgment of natural disasters as a key risk to supply chain resilience in 2025 highlights the proactive measures needed.

Waste Management and Recycling

Regulations surrounding industrial waste and the growing public demand for recycling directly influence DXP Enterprises' operational strategies and how they handle products at the end of their lifecycle. This pressure necessitates careful consideration of waste reduction and the integration of recycling practices. DXP can leverage these trends by developing new service offerings focused on recycling or by actively promoting products that incorporate a higher percentage of recycled materials.

DXP Enterprises has demonstrated a commitment to sustainability by actively reducing waste and continuing its recycling initiatives across its operations. For instance, in 2023, the company reported a continued focus on improving its environmental footprint, with ongoing efforts to minimize landfill waste and maximize material recovery through established recycling programs. These actions align with broader industry trends and stakeholder expectations for corporate environmental responsibility.

- Regulatory Compliance: DXP must adhere to evolving waste management regulations, which can vary significantly by region and impact disposal costs and operational procedures.

- Circular Economy Opportunities: The company can explore business models centered on product take-back, refurbishment, and recycling, tapping into the growing circular economy.

- Operational Efficiency: Implementing robust waste reduction and recycling programs can lead to cost savings through reduced material purchasing and lower disposal fees.

- Brand Reputation: Demonstrating strong environmental stewardship in waste management enhances DXP's brand image and appeal to environmentally conscious customers and investors.

Energy Efficiency and Renewable Energy Adoption

The increasing global emphasis on energy efficiency and renewable energy adoption significantly influences the industrial sector's equipment selection and operational spending. DXP Enterprises is well-positioned to capitalize on this trend by providing high-efficiency pumps, motors, and other Maintenance, Repair, and Operations (MRO) products that aid customers in lowering their energy usage and facilitating a shift towards cleaner energy sources, thereby supporting overarching environmental objectives. For instance, by the end of 2024, many industrial companies are projected to increase their investments in energy-saving technologies by an average of 15% compared to 2023, driven by regulatory pressures and cost-saving initiatives.

DXP’s strategy includes a commitment to reducing its own energy consumption and actively evaluating projects aimed at energy reduction. This internal focus not only demonstrates corporate responsibility but also provides valuable insights into customer needs. In 2024, DXP reported a 5% year-over-year decrease in energy intensity across its facilities, a testament to its ongoing efforts. Furthermore, the market for energy-efficient industrial equipment is projected to grow at a compound annual growth rate (CAGR) of 7.2% through 2028, reaching an estimated $350 billion globally.

- Market Growth: The global market for energy-efficient industrial equipment is expanding, with projections indicating a CAGR of 7.2% through 2028.

- Customer Demand: Industrial customers are increasingly seeking MRO products that reduce energy consumption and support sustainability goals.

- DXP's Role: DXP can provide solutions like high-efficiency pumps and motors, aligning with customer needs for greener operations.

- Internal Efforts: DXP is actively working to reduce its own energy consumption, as evidenced by a 5% year-over-year decrease in energy intensity in 2024.

Environmental regulations, particularly concerning waste management and recycling, directly shape DXP Enterprises' operational strategies and product lifecycle handling. The company's commitment to waste reduction and recycling initiatives, as evidenced by ongoing efforts in 2023 to minimize landfill waste, aligns with increasing stakeholder expectations for corporate environmental responsibility.

The global push for energy efficiency and renewable energy adoption presents a significant opportunity for DXP Enterprises. By supplying high-efficiency MRO products, DXP assists clients in reducing energy usage and transitioning to cleaner energy sources. The market for these energy-efficient industrial equipment solutions is projected to grow substantially, with a CAGR of 7.2% through 2028.

Climate change impacts DXP Enterprises through increased extreme weather events, which can disrupt supply chains and damage infrastructure. The U.S. saw a record 28 billion-dollar weather disasters in 2023, highlighting these growing physical risks. DXP's focus on supply chain resilience, including supplier diversification and inventory management, is critical for mitigating these challenges.

Material availability and pricing are increasingly vulnerable to resource scarcity and geopolitical events, directly affecting the cost of essential components for MRO products. Projections for 2025 indicate that material shortages will remain a key concern for the MRO sector, necessitating advanced inventory management and alternative sourcing strategies for companies like DXP.

| Environmental Factor | Impact on DXP Enterprises | Key Data/Projections |

|---|---|---|

| Waste Management & Recycling Regulations | Shapes operational strategies, necessitates waste reduction and recycling integration. | Ongoing focus on minimizing landfill waste (2023). |

| Energy Efficiency & Renewables | Opportunity to supply high-efficiency MRO products; supports customer sustainability goals. | Market CAGR of 7.2% for energy-efficient industrial equipment through 2028. |

| Climate Change & Extreme Weather | Disrupts supply chains, damages infrastructure, increases operational costs. | 28 billion-dollar weather disasters in the U.S. (2023). |

| Raw Material Availability & Pricing | Vulnerability to scarcity and geopolitical events impacts component costs. | Material shortages remain a top concern for MRO sector in 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for DXP Enterprises is meticulously constructed using data from reputable financial news outlets, government regulatory bodies, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.