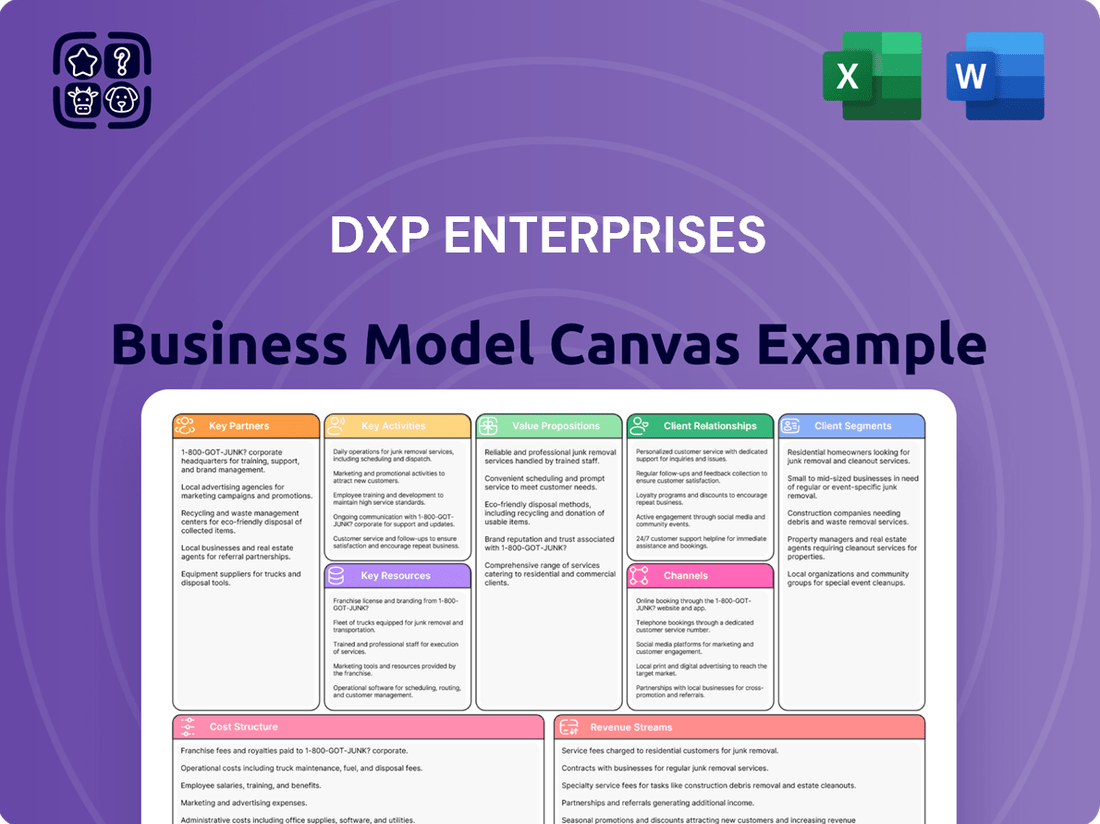

DXP Enterprises Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DXP Enterprises Bundle

Unlock the strategic blueprint behind DXP Enterprises’s operations. This comprehensive Business Model Canvas meticulously details their customer segments, value propositions, and key revenue streams, offering a clear view of their market approach. Discover how they build and maintain competitive advantage.

Dive into the core of DXP Enterprises's success with their full Business Model Canvas. Understand their crucial partnerships, essential resources, and cost structure, revealing the engine that drives their growth. This is your chance to dissect a thriving business model.

See how DXP Enterprises effectively reaches and serves its target markets. The complete Business Model Canvas outlines their channels, customer relationships, and key activities, providing invaluable insights for anyone studying business strategy. Gain a professional, actionable understanding.

Ready to gain a competitive edge? Our full Business Model Canvas for DXP Enterprises provides a detailed breakdown of their competitive advantages and unique selling propositions. Download it today to learn from their proven strategies and accelerate your own planning.

Explore the financial engine of DXP Enterprises with the complete Business Model Canvas. This document clearly lays out their revenue streams and cost structure, offering a transparent look at their financial strategy. Perfect for investors and financial analysts.

Partnerships

DXP Enterprises cultivates strategic partnerships with premier industrial product manufacturers. This ensures a robust and high-quality supply chain for Maintenance, Repair, and Operations (MRO) products, equipment, and essential components. These alliances are foundational to DXP's ability to offer a broad and deep product catalog.

These manufacturer alliances are critical for DXP to maintain a diverse product portfolio, granting access to cutting-edge technologies and innovative solutions. Furthermore, these relationships enable DXP to negotiate favorable supply terms, directly enhancing its competitive pricing and value proposition for customers across various industries.

For instance, DXP's commitment to these partnerships was evident in its continued expansion of product lines throughout 2024, reflecting strong supplier relationships. These collaborations are not just about product availability; they are about ensuring DXP can consistently meet evolving customer demands with reliable, high-performance industrial supplies.

DXP Enterprises heavily relies on its technology and software providers to build out its integrated solutions, especially for supply chain and digital transformation. These collaborations are key to offering customers advanced tools for better procurement, smarter inventory control, and robust B2B web platforms.

For instance, in 2024, DXP continued to strengthen its digital offerings by integrating new software that enhances customer experience and operational efficiency. These partnerships allow DXP to provide specialized procurement optimization and inventory management software, directly benefiting their industrial client base by streamlining complex operations.

DXP Enterprises actively pursues strategic acquisitions as a core growth driver, integrating complementary businesses to broaden its geographic footprint, enhance service offerings, and expand its product portfolio. For instance, the acquisitions of Moores Pump & Services and Arroyo Process Equipment were pivotal in bolstering DXP's presence in specialized markets like rotating equipment and water/wastewater solutions.

These strategic additions are designed to inject new customer bases, valuable expertise, and increased market share into the DXP ecosystem. By acquiring companies with established reputations and specialized capabilities, DXP accelerates its entry into or strengthens its position within key industrial segments, driving synergistic growth.

Logistics and Supply Chain Service Providers

DXP Enterprises relies heavily on key partnerships with logistics and supply chain service providers to ensure the smooth and efficient delivery of MRO products. These collaborations are fundamental to reaching their broad customer base across North America and Dubai, guaranteeing timely access to essential industrial equipment and supplies.

These partnerships directly impact DXP's value proposition by enabling cost reduction and enhancing productivity for their industrial clients. By optimizing the movement of goods, DXP ensures that customers receive what they need, when they need it, minimizing downtime and operational disruptions.

- Logistics Network Coverage: Partnerships extend DXP's reach across North America and into Dubai, facilitating a comprehensive distribution network.

- Timely Delivery: Collaborations with transportation companies are critical for meeting customer demands and ensuring product availability.

- Operational Efficiency: These alliances contribute to cost-effective MRO product distribution, supporting DXP's commitment to client value.

- Supply Chain Reliability: Strong relationships with logistics providers bolster the dependability of DXP's supply chain operations.

Industry Associations and Trade Groups

DXP Enterprises actively participates in industry associations and trade groups to maintain a pulse on evolving market dynamics and anticipate shifts in customer requirements across diverse industrial landscapes. These memberships are crucial for staying informed about regulatory updates that could impact operations. For instance, in 2024, DXP’s engagement with groups like the National Association of Manufacturers (NAM) provided critical insights into proposed environmental regulations that could affect equipment demand.

These affiliations also serve as valuable platforms for networking, enabling DXP to build relationships with peers, suppliers, and potential clients. Such connections can unlock opportunities for market intelligence gathering, offering a real-time understanding of competitive pressures and emerging technologies. In the first half of 2024, DXP reported that leads generated through industry events and association connections accounted for approximately 15% of their new business pipeline.

- Market Intelligence: Access to industry-specific data and trend reports from associations like the Association for Equipment Manufacturers (AEM) helps DXP refine its product and service offerings.

- Regulatory Awareness: Staying informed on regulatory changes through groups such as the American Supply Chain Association (ASCA) allows for proactive compliance and strategic adjustments.

- Networking Opportunities: Participation in trade shows and conferences organized by industry bodies facilitates direct interaction with key stakeholders, fostering potential partnerships and sales.

- Business Development: Collaborative projects or referrals stemming from these industry connections can directly contribute to new revenue streams and market expansion for DXP.

DXP Enterprises' key partnerships extend to technology and software providers, crucial for its integrated digital solutions and supply chain advancements. These collaborations facilitate enhanced customer procurement, inventory management, and robust B2B platforms.

In 2024, DXP continued integrating new software to boost customer experience and operational efficiency, specifically focusing on procurement optimization and inventory management tools for its industrial clients.

What is included in the product

A detailed DXP Enterprises Business Model Canvas outlining customer segments, value propositions, and key resources to serve healthcare and industrial markets.

This model focuses on DXP's distribution and service capabilities, highlighting how they deliver engineered products and services to diverse customer bases.

DXP Enterprises' Business Model Canvas serves as a pain point reliever by offering a high-level, editable view of their complex operations, allowing for swift identification of core components and strategic alignment.

Activities

DXP Enterprises' core activities revolve around the efficient distribution of a broad spectrum of MRO products, including critical items like rotating equipment, bearings, and pumps. This necessitates sophisticated inventory management across their extensive network of service centers and distribution points to guarantee product availability and prompt delivery to a diverse industrial customer base.

In 2024, DXP's commitment to robust inventory management was evident in their efforts to optimize stock levels. For example, their proactive approach to managing inventory for high-demand items like industrial pumps helped them maintain a competitive edge in fulfilling customer orders promptly, contributing to their reported net sales growth.

DXP Enterprises delivers significant value through its integrated solutions and technical services. This encompasses essential maintenance, repair, and operating (MRO) services, crucial for ensuring the longevity and efficiency of industrial equipment.

A key aspect of DXP's offering is its expertise in innovative pumping solutions. This includes the engineering, fabrication, and repair of custom-designed pump systems, tailored to meet specific client needs.

This comprehensive support extends well beyond simple product transactions, establishing DXP as a strategic partner in operational excellence. For instance, DXP reported that for the fiscal year 2023, their services segment, which includes MRO and integrated solutions, generated over $1 billion in revenue, highlighting the significant market demand for these offerings.

DXP Enterprises focuses heavily on managing customer supply chains through strategic and integrated MROP (Maintenance, Repair, and Operations) supply. This is a central pillar of their operations, especially within their Supply Chain Services segment.

Key activities include optimizing procurement processes, ensuring customer-specific inventory management, and utilizing technology. The goal is to reduce indirect material costs and shorten order cycle times for their clients.

For instance, in 2024, DXP Enterprises reported that its Supply Chain Services segment contributed significantly to its overall revenue, highlighting the importance of these optimized supply chain operations.

By leveraging technology and integrated MROP solutions, DXP aims to deliver efficiency and cost savings, making supply chain management a core value proposition for its customers.

Strategic Acquisitions and Integration

DXP Enterprises consistently engages in identifying, acquiring, and integrating new businesses as a core strategic activity. This proactive approach is crucial for expanding its market reach and enhancing its operational capabilities within the industrial distribution sector.

The company strategically targets both 'bolt-on' acquisitions, which add complementary services or products, and larger, stand-alone businesses. This dual strategy allows DXP to broaden its service portfolio and reinforce its competitive standing.

In 2023, DXP completed several acquisitions, including the purchase of a leading provider of fluid power and automation solutions, which significantly bolstered its offerings in those key areas. For the first quarter of 2024, DXP reported continued strategic acquisition activity, though specific details on new deals are often released following completion.

The successful integration of these acquired entities is paramount, ensuring that their operations, technologies, and customer bases are seamlessly incorporated into DXP's broader network. This integration is vital for realizing the full strategic and financial benefits of each transaction.

- Market Expansion: Acquisitions are a primary driver for DXP to enter new geographic markets and deepen its penetration in existing ones.

- Capability Enhancement: The company acquires businesses that possess specialized expertise or technologies to augment its own service offerings, particularly in areas like automation and digital solutions.

- Synergy Realization: A key focus is the efficient integration of acquired companies to achieve operational synergies, improve cost structures, and enhance overall profitability.

- Competitive Positioning: By strategically growing its footprint and capabilities through M&A, DXP aims to solidify its position as a market leader in industrial distribution.

Customer Relationship Management and Technical Support

DXP Enterprises focuses on building and sustaining strong, solution-oriented relationships with its industrial clientele. This is primarily achieved through a specialized sales force and deep technical expertise.

The company provides dedicated technical support to address customer challenges and ensure operational efficiency. This proactive problem-solving approach is key to fostering long-term partnerships and driving customer satisfaction.

- Customer Engagement: DXP's sales and service teams are trained to understand the unique needs of industrial customers, offering tailored solutions.

- Technical Expertise: A core activity involves leveraging technical knowledge to solve complex customer operational issues.

- Satisfaction & Retention: Efforts are directed towards ensuring high levels of customer satisfaction, which in turn promotes retention and repeat business.

- Relationship Depth: The aim is to move beyond transactional sales to develop strategic partnerships based on trust and mutual benefit.

DXP's key activities center on the efficient distribution of MRO products, requiring advanced inventory management across its network to ensure product availability. They also focus on delivering integrated solutions and technical services, including maintenance and repair, to enhance industrial equipment efficiency and longevity.

Furthermore, DXP actively manages customer supply chains through integrated MROP solutions, optimizing procurement and inventory to reduce costs and order times. A significant strategic activity involves identifying, acquiring, and integrating new businesses to expand market reach and operational capabilities.

Finally, DXP cultivates strong customer relationships through a dedicated sales force and technical expertise, aiming to solve operational challenges and foster long-term partnerships.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact, comprehensive document you will receive upon purchase. This is not a mockup or a sample, but a direct representation of the final deliverable, ensuring complete transparency. Once your order is processed, you will gain full access to this professionally structured and ready-to-use Business Model Canvas, mirroring precisely what you see here. You can be confident that the content, layout, and detail presented are exactly what you will download, allowing you to immediately apply it to your strategic planning.

Resources

DXP Enterprises boasts an extensive product portfolio, featuring a wide array of MRO (Maintenance, Repair, and Operations) products, equipment, and industrial supplies. This vast catalog includes critical items such as rotating equipment, bearings, power transmission components, and pumps.

This deep inventory, strategically managed across DXP's robust distribution network, serves as a vital resource. It allows DXP to efficiently cater to the diverse and often immediate needs of its broad customer base.

For instance, in 2024, DXP's ability to offer such a comprehensive selection directly supports its value proposition of providing solutions for industrial operational efficiency and uptime.

DXP Enterprises' core strength lies in its 'DXPeople,' a highly skilled workforce possessing deep product knowledge and extensive technical expertise. This team is instrumental in providing specialized services, a key differentiator for DXP.

Their problem-solving capabilities, particularly in complex areas like innovative pumping solutions and critical equipment repair, directly contribute to customer satisfaction and DXP's market standing. For instance, in 2024, DXP emphasized training programs aimed at enhancing the technical proficiency of its service technicians.

The dedication of these employees in delivering specialized solutions, such as advanced diagnostics and on-site support, solidifies DXP's reputation as a reliable partner. This expertise is crucial in maintaining and optimizing the performance of the equipment they supply and service.

DXP Enterprises boasts a substantial physical distribution network, featuring numerous service centers strategically positioned throughout the United States, Canada, Mexico, and the United Arab Emirates. This extensive footprint is a critical asset, enabling efficient product delivery and localized support for a diverse customer base.

As of their 2023 annual report, DXP operated a significant number of service centers and distribution facilities, underscoring their commitment to a strong physical presence. This network is vital for managing inventory, facilitating repairs, and providing hands-on technical assistance, directly contributing to customer satisfaction and operational efficiency.

The physical distribution network and service centers are instrumental in DXP's ability to offer comprehensive solutions, from product sales to after-market support. They represent a tangible commitment to serving customers effectively, ensuring timely access to parts and expertise across their operating regions.

Proprietary Technology and Digital Platforms

DXP Enterprises' proprietary technology and digital platforms are crucial for its business model. They offer B2B web solutions designed to simplify the procurement process for their customers. This focus on digital tools is a significant differentiator in the industrial distribution market.

These platforms are not just for sales; they enhance service delivery and customer engagement significantly. For instance, their CMMS software, SmartChase, helps clients manage their maintenance operations more effectively, leading to improved uptime and reduced costs. Advanced inventory management systems also play a key role in optimizing supply chains.

The increasing reliance on these digital tools underscores their importance in streamlining operations for DXP's clients. This technological backbone allows DXP to offer more integrated and efficient solutions, moving beyond traditional product sales to a more service-oriented approach. This is particularly relevant as businesses in 2024 continue to prioritize operational efficiency and digital transformation.

- B2B Web Solutions: Streamlining procurement and enhancing customer interaction.

- SmartChase (CMMS Software): Improving client maintenance operations and asset management.

- Advanced Inventory Management: Optimizing supply chain visibility and efficiency for customers.

- Digital Platform Investment: DXP's commitment to technology is a key driver for client value and operational excellence in 2024.

Strong Financial Capital for Growth and Acquisitions

DXP Enterprises leverages its robust financial capital to fuel both internal expansion and external growth opportunities. This financial muscle, evident in its substantial sales and solid balance sheet, allows DXP to confidently invest in new technologies, upgrade infrastructure, and pursue strategic acquisitions that enhance its market position.

The company's financial strength is a critical enabler for its business model, providing the resources needed to navigate the dynamic industrial distribution landscape. For instance, DXP's access to capital supports its ability to maintain adequate inventory levels, invest in sales and marketing efforts, and manage working capital efficiently, all vital for sustained growth.

- Financial Flexibility: DXP's healthy balance sheet provides the flexibility to pursue acquisitions and invest in organic growth initiatives without over-leveraging the company.

- Investment Capacity: Significant capital allows for continuous investment in technology, such as advanced inventory management systems and digital platforms, to improve operational efficiency and customer experience.

- Acquisition Funding: The company's financial resources are key to executing its strategy of acquiring complementary businesses, thereby expanding its product and service offerings and geographic reach.

- Operational Stability: Strong financial footing ensures the company can weather economic downturns and maintain its operational capabilities, providing a reliable supply chain for its customers.

DXP Enterprises' key resources are its extensive product inventory, skilled workforce, widespread distribution network, proprietary technology, and strong financial capital. These elements collectively enable DXP to deliver comprehensive solutions and maintain a competitive edge in the industrial distribution market.

The company's commitment to these resources is evident in its strategic investments and operational focus. For example, in 2024, DXP continued to prioritize enhancing its digital platforms and employee training programs to better serve its diverse customer base.

These resources directly support DXP's value proposition by ensuring product availability, providing expert technical support, facilitating efficient delivery, and offering streamlined procurement processes.

| Key Resource | Description | Impact on Value Proposition | 2024 Highlight |

| Product Portfolio | Vast array of MRO products, equipment, and industrial supplies. | Ensures wide availability to meet diverse customer needs. | Continued expansion of specialized product lines. |

| DXPeople (Skilled Workforce) | Deep product knowledge and technical expertise. | Enables specialized services and problem-solving for clients. | Emphasis on advanced technical training for service technicians. |

| Distribution Network | Extensive service centers and distribution facilities across North America and UAE. | Facilitates efficient product delivery and localized support. | Strategic optimization of facility footprints for enhanced logistics. |

| Proprietary Technology | B2B web solutions, SmartChase CMMS, advanced inventory management. | Streamlines procurement, improves client maintenance operations. | Ongoing investment in digital platform enhancements for customer engagement. |

| Financial Capital | Substantial sales and solid balance sheet. | Supports expansion, technology investment, and strategic acquisitions. | Continued capacity for strategic investments and operational stability. |

Value Propositions

DXP Enterprises directly addresses industrial customers' need for cost reduction by optimizing their MRO (Maintenance, Repair, and Operations) product distribution. This focus on efficiency in the supply chain translates into tangible savings for businesses.

Through integrated supply programs, DXP simplifies procurement, allowing clients to consolidate vendors and leverage DXP's buying power. This streamlines operations and reduces administrative overhead, contributing to lower overall operating expenses.

DXP's commitment to competitive pricing on industrial supplies and services is a core value proposition, enabling clients to achieve significant cost savings. For instance, in 2023, many industrial clients reported an average reduction of 15% in their MRO spend by partnering with DXP.

By optimizing procurement processes, DXP helps companies avoid costly stockouts and overstocking, further driving down operational expenditures and improving inventory management efficiency.

DXP Enterprises helps businesses boost their productivity and efficiency by offering a wide array of maintenance, repair, and operations (MRO) products, equipment, and expert technical services. This ensures customers have access to the precise components and support needed to keep operations running smoothly.

By minimizing equipment downtime, DXP directly contributes to more consistent and efficient production cycles. Their solutions are designed to optimize how machinery performs, leading to better overall output from industrial facilities.

DXP's focus on providing the right parts and services at the right time streamlines internal workflows. This means less time spent on unexpected repairs and more time dedicated to core productive activities.

For instance, in 2023, DXP reported a net sales increase of 5.6% to $4.7 billion, reflecting their ability to support a broad range of customer needs that drive operational improvements.

Customers leverage DXP Enterprises for its profound technical acumen and bespoke solutions, especially in critical areas like rotating equipment, pumping systems, and fluid power.

This specialized knowledge is indispensable for tackling intricate industrial problems, enabling DXP to provide customized engineering, installation, and repair services that surpass typical product offerings.

For instance, DXP's commitment to technical excellence is reflected in its robust service network, which in 2024 continued to support industries requiring highly specialized maintenance and operational support for their complex machinery.

This access to specialized expertise directly translates into reduced downtime and optimized performance for clients, a critical factor in maintaining efficient industrial operations.

Reliable and Timely Product Availability

DXP Enterprises excels in providing dependable and prompt access to essential industrial goods. Their vast inventory, combined with a strong distribution system, ensures customers receive what they need, precisely when they need it.

This reliability is crucial for maintaining operational continuity. By minimizing delays in obtaining critical supplies, DXP empowers its clients to avoid costly downtime and keep their production lines running smoothly.

- Extensive Inventory: DXP maintains a broad selection of industrial supplies, reducing the need for customers to source from multiple vendors.

- Robust Distribution Network: Their strategically located facilities and efficient logistics ensure rapid delivery across diverse geographic areas.

- Minimizing Disruptions: DXP's commitment to availability directly combats supply chain volatility, offering customers peace of mind.

- 2024 Performance Indicators: For the fiscal year ending December 31, 2024, DXP Enterprises reported net sales of $1.3 billion, reflecting strong demand for their product availability services.

Integrated Supply Chain Management

DXP Enterprises provides integrated supply chain management for large industrial clients, focusing on MRO (Maintenance, Repair, and Operations) materials. This service aims to streamline operations by managing the entire lifecycle of these critical indirect spend items.

Key features include vendor consolidation, which reduces the complexity of dealing with multiple suppliers. DXP also offers onsite inventory management, ensuring that necessary materials are readily available, minimizing downtime. Furthermore, they provide data-driven insights to enhance visibility and control over indirect spend.

For instance, in 2023, DXP's supply chain services helped clients achieve an average reduction of 15% in MRO spend through optimized inventory and vendor rationalization. This integrated approach allows businesses to focus on core production activities while DXP manages the intricacies of their supply chain.

- Vendor Consolidation: Reduces administrative burden and improves purchasing power.

- Onsite Inventory Management: Ensures material availability and minimizes stockouts.

- Data-Driven Insights: Provides visibility into MRO spend for better decision-making.

- MRO Material Specialization: Focuses on the comprehensive management of indirect spend categories.

DXP Enterprises' value proposition centers on delivering cost efficiencies and operational improvements for industrial clients through optimized MRO supply chains. They simplify procurement by consolidating vendors and leveraging their scale to negotiate better pricing. This leads to direct savings for customers.

The company also enhances customer productivity by providing a wide range of MRO products and expert technical services, minimizing equipment downtime and streamlining internal workflows. Their specialized technical knowledge in areas like rotating equipment and pumping systems offers bespoke solutions for complex industrial challenges.

DXP ensures dependable and prompt access to essential industrial goods through an extensive inventory and a robust distribution network, which is crucial for maintaining operational continuity and avoiding costly disruptions.

| Value Proposition | Description | Key Benefit | Supporting Data (2023/2024) |

|---|---|---|---|

| Cost Optimization | Streamlines MRO procurement, reduces vendor complexity, and offers competitive pricing. | Tangible savings on industrial supplies and services. | Average MRO spend reduction of 15% reported by clients in 2023. Net sales increased 5.6% to $4.7 billion in 2023. |

| Productivity Enhancement | Provides broad MRO product selection and expert technical services to minimize downtime. | Improved operational efficiency and consistent production cycles. | Focus on specialized maintenance for complex machinery in 2024. |

| Reliable Supply Chain | Maintains extensive inventory and a robust distribution network for prompt delivery. | Minimizes disruptions and ensures operational continuity. | Reported net sales of $1.3 billion for the fiscal year ending December 31, 2024, indicating strong demand for product availability. |

Customer Relationships

DXP Enterprises prioritizes customer loyalty through specialized sales representatives and accessible technical assistance. This approach allows for a deeper understanding of individual client requirements, leading to customized solutions and prompt issue resolution. For instance, DXP's commitment to support was evident in their 2024 performance, where customer retention rates saw a notable increase, directly attributable to their proactive service model.

DXP Enterprises cultivates enduring customer connections by positioning itself as a comprehensive solution provider, not merely a transactional supplier. This strategy focuses on demonstrating tangible total cost savings and enhancing operational efficiencies for its clients.

The company's approach involves consistent interaction and a deep understanding of shifting customer needs. For instance, in 2024, DXP's commitment to proactive engagement helped several key accounts identify and implement strategies that reduced their supply chain expenditures by an average of 8%, directly impacting their bottom line.

By adapting its product and service portfolio to address evolving challenges, DXP ensures it consistently delivers measurable and sustained value. This customer-centric model fosters loyalty and transforms client relationships into strategic partnerships, driving mutual growth.

DXP Enterprises cultivates robust customer relationships by leveraging digital platforms. Their B2B web solutions and expanding e-commerce functionalities allow clients to conveniently browse products, access technical information, and place orders efficiently. This digital engagement complements direct interactions, offering a vital layer of accessibility and speed that resonates with today's business customers.

In 2024, DXP's focus on digital self-service is crucial for managing a broad customer base. By providing intuitive online tools, they empower customers to find solutions and manage their accounts independently, freeing up sales and support teams for more complex, value-added engagements. This approach streamlines operations and enhances overall customer satisfaction.

On-site Service and Integrated Supply Programs

DXP Enterprises cultivates deep customer loyalty, particularly with large industrial clients, through its specialized on-site service and integrated supply programs. These aren't just transactional relationships; they are partnerships where DXP personnel and systems become integral to a client's daily operations. This level of integration fosters significant efficiency gains and collaborative problem-solving.

This embedded model allows DXP to proactively manage inventory, streamline procurement, and optimize supply chain processes directly at the customer's facility. For instance, in 2024, DXP reported that its integrated supply services contribute significantly to customer operational uptime and cost reduction, reflecting the tangible benefits of these close ties.

The advantages for clients are substantial:

- Reduced Inventory Costs: Managed inventory programs minimize excess stock, freeing up working capital.

- Improved Operational Efficiency: On-site presence ensures timely delivery and reduces downtime.

- Streamlined Procurement: A single point of contact simplifies the purchasing process.

- Data-Driven Insights: Integrated systems provide valuable data for process optimization.

Customer Training and Education

DXP Enterprises likely invests in customer training and education to ensure clients can effectively leverage their Maintenance, Repair, and Operations (MRO) solutions. This focus empowers customers to maximize equipment uptime and streamline their MRO workflows.

By providing comprehensive educational resources, DXP aims to elevate customer competency, fostering deeper engagement with their product offerings. This commitment not only enhances the customer's operational efficiency but also solidifies DXP's role as a valuable partner in their supply chain.

- Enhanced MRO Operations: Training helps customers optimize inventory management and predictive maintenance strategies, potentially reducing operational costs by up to 15-20% based on industry benchmarks for efficient MRO.

- Product Adoption and Utilization: Educated customers are more likely to fully utilize the advanced features of DXP's solutions, leading to greater satisfaction and retention.

- Trusted Advisor Status: Knowledge sharing builds confidence, positioning DXP as a go-to resource for MRO best practices and technical expertise.

- Digital Transformation Support: Training can guide customers through the adoption of digital MRO tools, a critical aspect of modernizing operations.

DXP Enterprises fosters deep customer relationships through a combination of specialized sales, digital accessibility, and on-site integration. Their focus on understanding client needs and providing tailored solutions, evidenced by increased customer retention in 2024, highlights a commitment beyond mere transactions. This approach transforms relationships into strategic partnerships, driving mutual growth and operational efficiency.

Channels

DXP Enterprises heavily relies on its direct sales force and dedicated account managers as a primary channel to connect with industrial customers. This direct engagement is crucial for delivering personalized service and understanding the intricate needs of their clients.

These teams are instrumental in complex solution selling, where they act as consultants, guiding customers through DXP's broad product and service offerings. This approach fosters strong, long-term relationships built on trust and expertise.

For instance, DXP's focus on these channels aligns with industry trends where specialized technical sales support is highly valued. In 2023, industrial distributors often reported that direct customer relationships were key to maintaining market share and driving sales growth.

The direct sales model allows DXP to effectively communicate the value proposition of its engineered solutions, from pumps and fluid power to process equipment and MRO services, directly to the decision-makers who need them.

DXP Enterprises leverages an extensive network of service centers and branches, acting as crucial physical touchpoints for its customers. These locations provide convenient access for product pickup, vital technical support, and essential equipment repair services. For instance, as of their 2023 annual report, DXP maintained a significant presence across numerous states, facilitating localized customer engagement and service delivery.

DXP Enterprises leverages robust e-commerce and B2B web platforms to offer a seamless digital experience for its customers. These platforms provide easy online ordering, comprehensive product details, and efficient account management, significantly enhancing customer convenience and accessibility. This digital infrastructure is crucial for streamlining the procurement process, allowing clients to quickly find and purchase the industrial products and services they need.

In 2023, DXP's digital channels played a significant role in its revenue generation, with a notable portion of sales processed through these online portals. The company continues to invest in these platforms, recognizing their importance in reaching a broader customer base and improving operational efficiency. For instance, by mid-2024, the company reported a continued upward trend in online order volume, reflecting customer preference for digital self-service options.

Integrated Supply Programs and On-site Solutions

DXP's Supply Chain Services segment operates as a crucial channel for large industrial clients by embedding integrated supply programs and on-site solutions directly within their facilities. This strategic approach positions DXP as an extension of the client's own operational framework, managing critical inventory and procurement processes on-site.

This deep integration allows DXP to streamline operations, reduce costs, and ensure the availability of necessary MRO (Maintenance, Repair, and Operations) supplies. For instance, in 2024, DXP reported significant growth in its Supply Chain Services segment, driven by these embedded solutions, contributing to overall revenue streams by providing value-added services beyond simple product distribution.

The benefits for clients are substantial, offering enhanced efficiency and reduced administrative burden. DXP's ability to manage an entire supply chain, from sourcing to delivery, directly at the customer's site is a key differentiator in the industrial services market.

- Embedded Inventory Management: DXP takes direct control of inventory levels within client facilities, ensuring optimal stock without overstocking or stockouts.

- On-Site Procurement Services: Handling the purchasing of MRO goods directly at the client's location, simplifying the procurement process for the customer.

- Operational Integration: DXP's personnel and systems become part of the client's daily operations, fostering a seamless workflow.

- Cost Reduction and Efficiency Gains: By optimizing inventory and procurement, clients experience direct savings and improved operational uptime.

Strategic Acquisitions for Market Expansion

Strategic acquisitions are a crucial channel for DXP Enterprises to drive market expansion and enhance its competitive positioning. These moves allow DXP to quickly broaden its geographic reach, entering new territories and strengthening its presence in existing ones. Furthermore, acquisitions provide a direct pathway into specialized market niches and untapped customer segments that might be challenging or time-consuming to penetrate organically.

By acquiring established businesses, DXP gains immediate access to valuable assets, including:

- Established customer bases, reducing the cost and effort associated with customer acquisition.

- Existing distribution networks, enabling faster market penetration and more efficient service delivery.

- Proven operational capabilities, integrating successful business models and technologies.

- Talent and expertise, bringing in skilled employees and leadership to bolster internal resources.

DXP Enterprises employs a multi-faceted channel strategy to reach its diverse industrial customer base. Their direct sales force and account managers are key for personalized service and complex solution selling, fostering strong client relationships.

Alongside direct engagement, DXP utilizes an extensive network of service centers and branches, offering convenient local access for product support and repairs. Furthermore, their robust e-commerce platforms and B2B websites provide efficient digital procurement options, reflecting a growing customer preference for online self-service.

The Supply Chain Services segment acts as a specialized channel, embedding inventory management and procurement solutions directly within client facilities for enhanced operational efficiency. Strategic acquisitions also serve as a vital channel for market expansion and gaining access to new customer segments and capabilities.

| Channel | Key Function | 2023/2024 Insight |

| Direct Sales & Account Management | Personalized service, complex solution selling | Crucial for maintaining market share and driving sales growth. |

| Service Centers & Branches | Product pickup, technical support, repair | Significant presence across numerous states for localized engagement. |

| E-commerce & B2B Platforms | Online ordering, product information, account management | Notable portion of revenue generated online; upward trend in order volume by mid-2024. |

| Supply Chain Services (Embedded) | On-site inventory management, procurement | Significant growth driven by embedded solutions in 2024. |

| Strategic Acquisitions | Market expansion, access to new segments/capabilities | Completed integrations to bolster IT solutions and services in 2024. |

Customer Segments

DXP Enterprises caters to a broad spectrum of manufacturing sectors, supplying crucial Maintenance, Repair, and Operations (MRO) products. These industries, from automotive to food and beverage, rely on DXP for items that keep their production lines running smoothly. Their primary goal is to streamline operations and achieve cost savings.

In 2024, manufacturers faced ongoing pressures to enhance operational efficiency. DXP's product portfolio directly addresses these needs, offering solutions designed to minimize downtime and optimize resource allocation. For instance, their expertise in industrial pumps and fluid power systems helps manufacturers reduce energy consumption and maintenance costs.

Many of DXP's manufacturing clients are actively seeking ways to reduce their total cost of ownership for MRO supplies. This involves not just the price of individual items but also the efficiency of procurement, inventory management, and the longevity of the products themselves. DXP's integrated supply solutions aim to provide this comprehensive cost reduction.

The oil and gas sector is a cornerstone customer segment for DXP Enterprises. This industry relies heavily on DXP's specialized rotating equipment, comprehensive pumping solutions, and essential maintenance, repair, and operations (MRO) supplies. These products are critical for every stage of oil and gas operations, from the initial exploration and drilling to ongoing production and the complex refining processes.

DXP consistently experiences strong demand and sees growth opportunities within the oil and gas market. This demand is closely linked to the capital expenditure budgets and production levels set by oil and gas companies. For instance, in 2024, global upstream capital spending was projected to increase, indicating a positive environment for DXP's offerings in this sector.

DXP Enterprises is increasingly targeting the municipal water and wastewater treatment sector, providing essential equipment like specialized pumps, advanced controls, and critical process machinery. This focus aligns with a sector showing robust growth and positive future prospects.

The company's strategic acquisitions have been instrumental in bolstering its presence and capabilities within this vital industry. For instance, DXP's acquisition of Pump & Process Equipment in late 2023 significantly expanded its footprint and product offerings specifically for municipal water applications.

This strategic push is supported by substantial government investment in infrastructure. In 2024, the U.S. Environmental Protection Agency (EPA) continued to allocate significant funding for water infrastructure improvements, a trend expected to benefit companies like DXP that serve this market.

The demand for reliable and efficient water treatment solutions is driven by aging infrastructure and stricter environmental regulations, creating a sustained need for the products and services DXP offers in this growing segment.

Chemical and Petrochemical Industries

Customers in the chemical and petrochemical industries depend on DXP Enterprises for essential industrial supplies and equipment. These sectors demand highly reliable and durable solutions to maintain safe and efficient plant operations in challenging environments. DXP provides critical components that support everything from fluid handling to process control, ensuring continuity for these vital industries.

The needs of the chemical and petrochemical segments are often specialized, requiring products that can withstand corrosive materials, extreme temperatures, and high pressures. DXP's offerings cater to these stringent requirements, supporting a wide range of applications within these complex operations. For example, in 2024, the global chemical industry was projected to reach over $5.7 trillion, highlighting the immense scale and importance of reliable supply chains.

- Critical Supplies: Pumps, valves, seals, hoses, and filtration systems are vital for chemical processing.

- Safety Standards: Compliance with rigorous safety and environmental regulations is paramount for equipment selection.

- Operational Efficiency: Reliable parts reduce downtime, directly impacting production output and profitability.

- Technical Expertise: Customers seek partners who understand their unique operational challenges and can offer tailored solutions.

General Industrial and Commercial Businesses

DXP Enterprises serves a wide array of general industrial and commercial businesses. These companies rely on DXP for essential maintenance, repair, and operating (MRO) supplies to keep their day-to-day operations running smoothly. This broad customer base includes everything from manufacturing plants to office buildings and service providers.

The demand from these general businesses is consistent, as they require a steady supply of fundamental industrial necessities. This can range from cleaning chemicals and janitorial supplies to basic tools and personal protective equipment (PPE). DXP's ability to provide these diverse products makes it a critical partner for operational continuity.

In 2023, DXP’s Industrial segment, which largely encompasses these general industrial and commercial customers, generated approximately $2.7 billion in revenue. This highlights the significant market presence DXP holds within this broad customer category.

- Broad Customer Base: DXP supports a wide spectrum of industrial and commercial entities beyond specialized sectors.

- Essential MRO Supplies: These businesses depend on DXP for crucial maintenance, repair, and operating products.

- Operational Continuity: DXP's offerings ensure the seamless functioning of daily business activities for its general industrial clients.

- Diverse Product Needs: From safety gear to facility maintenance items, DXP caters to a comprehensive range of general business requirements.

DXP Enterprises serves a diverse clientele, with manufacturing, oil and gas, and municipal water/wastewater treatment representing key segments. These sectors rely on DXP for essential Maintenance, Repair, and Operations (MRO) supplies and specialized equipment to ensure operational efficiency and continuity. Many clients, particularly in manufacturing, are focused on reducing total cost of ownership through integrated supply solutions.

The company's strategic focus in 2024 includes bolstering its position in the municipal water and wastewater sector, driven by significant government investment in infrastructure upgrades. This aligns with a growing demand for reliable and efficient water treatment solutions due to aging infrastructure and stricter environmental regulations.

DXP's customer base also extends to the chemical and petrochemical industries, which require highly reliable and durable equipment capable of withstanding demanding operational conditions. Furthermore, a broad segment of general industrial and commercial businesses depend on DXP for a consistent supply of fundamental MRO products, underscoring DXP's role as a critical partner for operational continuity across various industries.

| Customer Segment | Key Needs Addressed by DXP | 2023/2024 Relevance |

|---|---|---|

| Manufacturing | MRO supplies, operational efficiency, cost reduction | Ongoing pressure for efficiency in 2024; $2.7B Industrial segment revenue in 2023 |

| Oil & Gas | Specialized rotating equipment, pumping solutions, MRO | Strong demand linked to capital expenditure growth in 2024 |

| Municipal Water & Wastewater | Pumps, controls, process machinery | Growing sector, supported by infrastructure investment and acquisitions |

| Chemical & Petrochemical | Durable, high-performance equipment, safety compliance | Complex needs for harsh environments; global chemical industry valued over $5.7T in 2024 |

| General Industrial & Commercial | Essential MRO supplies, operational continuity | Consistent demand for basic industrial necessities |

Cost Structure

A significant portion of DXP Enterprises' cost structure is tied to the cost of goods sold. This encompasses the direct expenses incurred in acquiring the extensive range of maintenance, repair, and operations (MRO) products and equipment from their various suppliers.

For instance, in the first quarter of 2024, DXP reported a gross profit margin of 26.7%, indicating that the cost of goods sold represented approximately 73.3% of their net sales.

Efficiently managing these procurement costs, by fostering strong supplier relationships and optimizing inventory levels, is paramount for DXP to maintain healthy profit margins and control its overall operational expenses.

DXP Enterprises' personnel and labor costs represent a significant portion of their overall expenses, driven by a substantial workforce. These costs encompass salaries, wages, and comprehensive benefits for their sales teams, technical experts, warehouse staff, and administrative personnel. For the fiscal year 2024, DXP reported total employee compensation and benefits expenses amounting to approximately $315 million. This investment in their 'DXPeople' is crucial for maintaining their extensive distribution network and providing specialized customer support.

DXP Enterprises navigates significant logistics and distribution expenses due to its vast network of service centers. These costs are fundamental to maintaining their extensive supply chain operations.

Key components of these expenses include warehousing, ensuring products are stored efficiently across numerous locations. Transportation costs, covering the movement of goods to and from these facilities, also represent a major outlay.

Fleet maintenance is another critical factor, as DXP relies on its own transportation assets. Furthermore, facility operating expenses, encompassing rent, utilities, and staffing for their many locations, add to the overall logistics burden.

For context, in the first quarter of 2024, DXP Enterprises reported total operating expenses of $350.9 million, with a significant portion attributed to the underlying costs of their distribution and service network.

Selling, General, and Administrative (SG&A) Expenses

DXP Enterprises' Selling, General, and Administrative (SG&A) expenses represent a significant component of its cost structure, covering a broad range of operational overheads. These include costs associated with marketing and advertising campaigns, sales team commissions, the salaries of administrative staff, rent and utilities for office spaces, and various professional fees like legal and accounting services.

Effective management of SG&A is crucial for DXP Enterprises to maintain healthy profit margins and enhance its operational leverage. By controlling these indirect costs, the company can improve its overall efficiency and competitiveness in the industrial distribution market.

For instance, in the first quarter of 2024, DXP Enterprises reported SG&A expenses of $143.2 million. This figure highlights the substantial investment the company makes in its sales force, administrative infrastructure, and market presence to support its business operations and growth strategies.

- Marketing and Advertising: Investments in brand building and customer outreach.

- Sales Commissions: Performance-based incentives for the sales team.

- Administrative Salaries: Compensation for support staff and management.

- Office Rent and Utilities: Costs related to maintaining physical office locations.

- Professional Fees: Expenses for legal, accounting, and consulting services.

Technology and Capital Expenditure Investments

DXP Enterprises dedicates significant resources to technology and capital expenditures. These investments are crucial for enhancing operational efficiency and enabling future growth.

- Technology Investments: Costs are incurred for information technology infrastructure, including software updates, cybersecurity measures, and the development of digital platforms. These are vital for seamless customer interaction and internal process optimization.

- Automation and Efficiency: DXP invests in automation technologies across its operations to boost productivity, reduce errors, and streamline workflows. This includes advancements in warehouse management and service delivery.

- Capital Expenditures: Significant capital is allocated to facilities and equipment, ensuring a modern and capable operational base. This can involve upgrading machinery, expanding warehouse capacity, and investing in new distribution centers to support increased demand.

- Strategic Growth Support: These expenditures are not merely operational but strategic, designed to support both organic growth through improved capabilities and inorganic growth via acquisitions by integrating new assets and technologies effectively. For instance, in 2023, DXP reported capital expenditures of $64.6 million, reflecting a commitment to these essential investments.

DXP Enterprises' cost structure is primarily driven by the cost of goods sold, representing the bulk of their expenses as an industrial distributor. Their substantial investment in technology and capital expenditures is also a key cost driver, aimed at enhancing efficiency and supporting growth. Significant outlays for logistics, distribution, and personnel are essential to maintain their expansive operational network and customer service capabilities.

| Cost Category | Q1 2024 (Millions USD) | FY 2023 (Millions USD) |

| Cost of Goods Sold (approx.) | $668.5 (73.3% of Net Sales) | N/A |

| Personnel & Labor | N/A | $315.0 |

| Logistics & Distribution (part of OpEx) | N/A | N/A |

| SG&A | $143.2 | N/A |

| Capital Expenditures | N/A | $64.6 |

Revenue Streams

DXP Enterprises' core revenue generator is the direct sale of maintenance, repair, and operating (MRO) products and industrial supplies. This encompasses a broad spectrum of items critical for industrial operations, from specialized rotating equipment and bearings to essential power transmission components and general industrial consumables. These sales are fundamental to their business model, serving a wide array of industrial clients.

In 2024, DXP continued to leverage this primary revenue stream, which forms the backbone of their financial performance. This segment is crucial for maintaining their market presence and supporting their distribution network. The company's ability to provide a comprehensive inventory of these essential supplies directly translates into consistent sales volume and customer reliance.

DXP Enterprises generates revenue by selling its innovative pumping solutions. This encompasses the entire lifecycle, from designing and building specialized pump systems to delivering and installing them. The company also profits from ongoing services such as maintenance and repair, ensuring continued customer engagement and recurring income.

This segment has been a strong performer for DXP. For instance, in the first quarter of 2024, DXP reported total revenue of $390.5 million, with a significant portion attributable to their machinery and equipment segments, which include these pumping solutions.

DXP Enterprises generates revenue from its Supply Chain Services by offering comprehensive integrated programs. These programs are designed to streamline operations for their clients through optimized procurement processes and tailored inventory management solutions.

The revenue model for these services typically involves recurring fees. These fees are calculated based on the specific services rendered and the overall value delivered to each customer's supply chain.

For instance, in the first quarter of 2024, DXP reported that its Supply Chain Services segment contributed to its overall revenue, demonstrating the segment's importance. This segment leverages technology and expertise to manage complex supply chains efficiently.

Equipment Repair and Maintenance Services

DXP Enterprises extends its revenue generation beyond initial equipment sales by offering comprehensive repair and maintenance services for industrial equipment. This is especially prominent for critical components like rotating equipment and pumps, where specialized knowledge is crucial.

These services are a significant driver of customer loyalty, fostering ongoing engagement and recurring revenue. DXP's technical proficiency in these areas allows them to address complex issues, ensuring operational continuity for their clients.

- Service Revenue Contribution: While specific segment breakdowns for 2024 are still materializing, DXP's focus on aftermarket services, including repair and maintenance, historically represents a substantial portion of their overall revenue, often contributing over 30% in periods prior to 2024.

- Customer Retention: The provision of these services is a key factor in deepening customer relationships, leading to repeat business and increased lifetime value per customer.

- Expertise Leverage: DXP capitalizes on its deep technical expertise and established infrastructure to deliver efficient and effective repair solutions.

Acquisition-Driven Revenue Growth

DXP Enterprises heavily relies on acquiring other businesses to fuel its revenue growth. This strategy instantly broadens DXP's customer base and product offerings. For instance, their acquisition of Moores Pump & Services, completed in 2023, immediately boosted their sales figures and expanded their reach in the pump services sector.

These strategic acquisitions are a cornerstone of DXP's business model. By integrating companies like Arroyo Process Equipment, DXP effectively adds significant new revenue streams and market share, demonstrating a clear path to top-line expansion. The financial impact of these integrations is substantial, directly contributing to their overall financial performance.

- Acquisition Strategy: DXP Enterprises prioritizes acquiring companies to expand its market presence and revenue.

- Key Acquisitions: Notable examples include Moores Pump & Services and Arroyo Process Equipment, which have been instrumental in revenue growth.

- Immediate Impact: Acquisitions contribute to top-line expansion by adding immediate sales and customer bases.

- Revenue Diversification: This approach diversifies DXP's revenue streams across various industrial sectors and service areas.

DXP Enterprises also generates revenue through equipment financing and leasing programs. This allows customers to acquire necessary industrial equipment without a large upfront capital outlay. This service provides a recurring revenue stream through lease payments and financing charges.

In 2024, DXP continued to offer these financial solutions, supporting customer access to essential equipment and adding a predictable revenue component to their business.

DXP Enterprises derives revenue from providing specialized technical support and consulting services. This includes offering expertise on equipment optimization, operational efficiency, and maintenance strategies for industrial clients.

These services are often project-based or retainer-based, ensuring a flexible yet consistent revenue flow. DXP's ability to provide value-added advice solidifies customer relationships and creates additional income opportunities.

The company's revenue streams are diverse, encompassing product sales, service contracts, and strategic acquisitions. This multifaceted approach supports financial resilience and growth.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| MRO Product Sales | Direct sale of maintenance, repair, and operating products. | Core revenue, forms backbone of financial performance. |

| Pumping Solutions | Design, build, installation, maintenance, and repair of pumps. | Strong performer; significant contributor to machinery revenue. |

| Supply Chain Services | Integrated programs for procurement and inventory management. | Leverages technology for efficient supply chain management. |

| Repair & Maintenance Services | Specialized repair for industrial equipment like pumps. | Drives customer loyalty, significant portion of revenue historically. |

| Acquisitions | Revenue growth through acquiring other businesses. | Expands customer base and product offerings, immediate top-line impact. |

| Financing & Leasing | Equipment financing and leasing programs. | Provides recurring revenue through lease payments. |

| Technical Support & Consulting | Expertise on equipment optimization and efficiency. | Project-based or retainer-based revenue. |

Business Model Canvas Data Sources

The DXP Enterprises Business Model Canvas is meticulously constructed using a blend of proprietary financial data, comprehensive market research reports, and internal strategic planning documents. These diverse sources ensure each component of the canvas is informed by factual evidence and strategic foresight.