DXC Technology SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DXC Technology Bundle

DXC Technology's strategic position is shaped by its strong market presence and technological expertise, but also faces challenges from intense competition and evolving industry demands. Understanding these dynamics is crucial for any stakeholder looking to navigate the IT services landscape.

Want the full story behind DXC Technology's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DXC Technology boasts a significant global presence, operating in over 70 countries and serving thousands of clients, including major corporations and public sector entities. This extensive reach is a core strength, allowing them to tap into diverse markets and client bases worldwide.

The company offers a comprehensive suite of IT services, covering everything from modernizing IT infrastructure and optimizing data to ensuring robust security and scalability across various cloud environments. This broad portfolio enables DXC to act as a one-stop shop for complex IT needs, a significant advantage in the competitive landscape.

DXC Technology's consistent placement as a Leader in the Gartner Magic Quadrant for Outsourced Digital Workplace Services in both 2024 and 2025 highlights its robust vision and execution capabilities. This industry recognition directly translates to enhanced market credibility and a stronger reputation, positioning DXC as a preferred partner for businesses seeking dependable digital workplace solutions.

DXC Technology boasts over 40 years of dedicated experience in the insurance sector, a testament to its deep vertical expertise. This extensive history has led to supporting 21 of the top 25 global insurers and managing over a billion policies, showcasing a significant market presence and trust.

This specialized knowledge allows DXC to craft highly tailored solutions, like the AI-powered DXC Assure Illustrations launched in 2024. Such innovations are designed to deliver substantial value and demonstrate a clear competitive edge in a demanding industry.

The company's profound understanding of the insurance vertical translates into a stable and loyal client base, reinforcing its position as a trusted partner for complex technological needs within this critical financial services segment.

Improved Book-to-Bill Ratio and Strategic Focus

DXC Technology's book-to-bill ratio has seen a notable improvement, reaching 1.22x in the fourth quarter of fiscal year 2025 and a full-year figure of 1.03x for fiscal year 2025. This indicates that the company is securing new business at a faster pace than it is recognizing revenue, a healthy sign for future growth.

This positive booking trend, combined with a clear strategic emphasis on achieving sustained profitable revenue growth, signals a potential shift in DXC's financial trajectory. The company is actively investing in its core operations and market positioning to foster this turnaround.

- Improved Book-to-Bill Ratio: Achieved 1.22x in Q4 FY25 and 1.03x for FY25.

- Focus on Profitable Growth: Strategic priority to drive sustained revenue expansion.

- Investment in Capabilities: Rebuilding operational strengths and market presence.

- Positive Revenue Outlook: Bookings exceeding revenue suggest a potential turnaround.

Strong Cash Flow Generation and Balance Sheet Strengthening

DXC Technology has demonstrated robust financial health, highlighted by its strong cash flow generation. For the full fiscal year 2025, the company reported $687 million in free cash flow, surpassing earlier forecasts. This financial performance is a key strength, indicating efficient operations and effective management of resources.

The company is actively focused on improving its balance sheet. DXC Technology plans to continue its debt reduction efforts in fiscal year 2026. Furthermore, the company intends to return capital to shareholders through share repurchases, signaling confidence in its financial stability and future prospects.

- Strong Free Cash Flow: Generated $687 million in free cash flow for FY25.

- Debt Reduction: Committed to further reducing outstanding debt in FY26.

- Shareholder Returns: Plans to execute share repurchases in FY26.

- Financial Flexibility: These actions enhance the company's financial flexibility and strengthen its balance sheet.

DXC Technology's extensive global footprint, operating in over 70 countries, provides a significant advantage in accessing diverse markets and a broad client base. This international presence is complemented by a comprehensive suite of IT services, positioning DXC as a versatile provider capable of addressing complex, end-to-end digital transformation needs. The company's leadership in the Gartner Magic Quadrant for Outsourced Digital Workplace Services in 2024 and 2025 underscores its strong market standing and execution capabilities.

The company's deep specialization in the insurance sector, evidenced by its work with 21 of the top 25 global insurers and managing over a billion policies, fosters client loyalty and provides a stable revenue stream. Innovations like the AI-powered DXC Assure Illustrations, launched in 2024, highlight their ability to deliver tailored, value-added solutions within this vertical.

DXC Technology's financial performance shows positive momentum, with a book-to-bill ratio of 1.22x in Q4 FY25 and 1.03x for the full FY25, indicating strong new business acquisition. The company generated $687 million in free cash flow in FY25 and plans further debt reduction and share repurchases in FY26, demonstrating a commitment to improving its financial health and shareholder returns.

| Metric | FY25 (Actual) | FY25 (Q4) | FY26 (Planned) |

| Book-to-Bill Ratio | 1.03x | 1.22x | N/A |

| Free Cash Flow | $687 million | N/A | N/A |

| Debt Reduction Focus | Ongoing | N/A | Priority |

| Shareholder Returns | N/A | N/A | Planned (Share Repurchases) |

What is included in the product

Delivers a strategic overview of DXC Technology’s internal and external business factors, identifying its core capabilities and market challenges.

Offers a clear, actionable framework to address DXC Technology's competitive challenges and leverage its market opportunities.

Weaknesses

DXC Technology has faced a persistent revenue decline, with its total revenue dropping 5.8% to $12.9 billion in fiscal year 2025. This marks a continuation of a trend observed since the company's inception in 2017, highlighting a significant challenge in reversing this long-term downward trajectory. Despite recent positive signals in bookings, the company has a history of consistently lowering its revenue forecasts, underscoring the difficulty in achieving sustainable top-line growth.

DXC Technology is currently engaged in another substantial restructuring initiative. This effort is designed to simplify its operations and reduce capacity in its older business segments.

While these changes are intended to improve efficiency, they come with significant financial implications. The company has projected approximately $250 million in costs associated with these restructuring efforts for fiscal year 2025, which could also affect its free cash flow in the short term.

This recurring need for restructuring points to persistent operational inefficiencies and difficulties in adapting to evolving market demands.

DXC Technology's share price has faced considerable headwinds, with investors expressing dissatisfaction stemming from persistent restructuring efforts and a struggle to deliver consistent organic revenue growth. The company's stock performance has been notably weak, and there's a reported low tolerance among investors for further significant restructuring that could negatively impact near-term free cash flow generation. This environment makes it increasingly difficult for DXC to attract new capital and retain its current shareholder base.

Challenges in Global Infrastructure Services Segment

The Global Infrastructure Services (GIS) segment presents a notable weakness for DXC Technology, experiencing a steeper revenue decline than Global Business Services (GBS). For the full fiscal year 2025, GIS recorded an 8.2% organic revenue decline. This ongoing contraction in a key segment continues to weigh on the company's overall financial performance.

Despite some positive movement in GIS bookings, the persistent revenue shrinkage highlights a critical area requiring substantial attention. The segment's performance suggests that the ongoing transformation and modernization efforts may not yet be yielding the desired results to counteract the revenue headwinds.

- Significant Revenue Decline: GIS saw an 8.2% organic revenue decline in FY25, outpacing GBS.

- Bookings vs. Revenue Gap: While bookings are improving, revenue contraction persists.

- Need for Deeper Transformation: The segment's performance indicates a need for more impactful modernization strategies.

Profitability and Margin Pressures

DXC Technology has grappled with profitability pressures, evidenced by a recent pre-tax profit margin of -2.9%. While adjusted EBIT margins have shown some expansion, diluted earnings per share have experienced notable declines in certain quarters year-over-year.

These figures indicate that despite ongoing cost-reduction efforts, DXC needs to refine its strategic approach to achieve more robust profitability.

- Profitability Challenges: Persistent issues with achieving consistent profitability.

- Margin Compression: Negative pre-tax profit margins in recent reporting periods.

- EPS Decline: Significant drops in diluted earnings per share compared to previous years.

- Strategic Imperative: Need for sharpened strategies to boost overall financial performance.

DXC Technology's persistent revenue decline, a trend continuing into fiscal year 2025 with a 5.8% drop to $12.9 billion, highlights a core weakness. This ongoing contraction, particularly in the Global Infrastructure Services (GIS) segment which saw an 8.2% organic revenue decline in FY25, indicates challenges in reversing top-line performance. The company’s recurring need for substantial restructuring, costing around $250 million in FY25, points to underlying operational inefficiencies and an inability to adapt swiftly to market shifts.

| Metric | FY25 (Actual/Projected) | Trend |

|---|---|---|

| Total Revenue | $12.9 billion | -5.8% decline |

| GIS Organic Revenue | N/A | -8.2% decline |

| Restructuring Costs | $250 million | Significant expense |

| Pre-tax Profit Margin | -2.9% | Negative profitability |

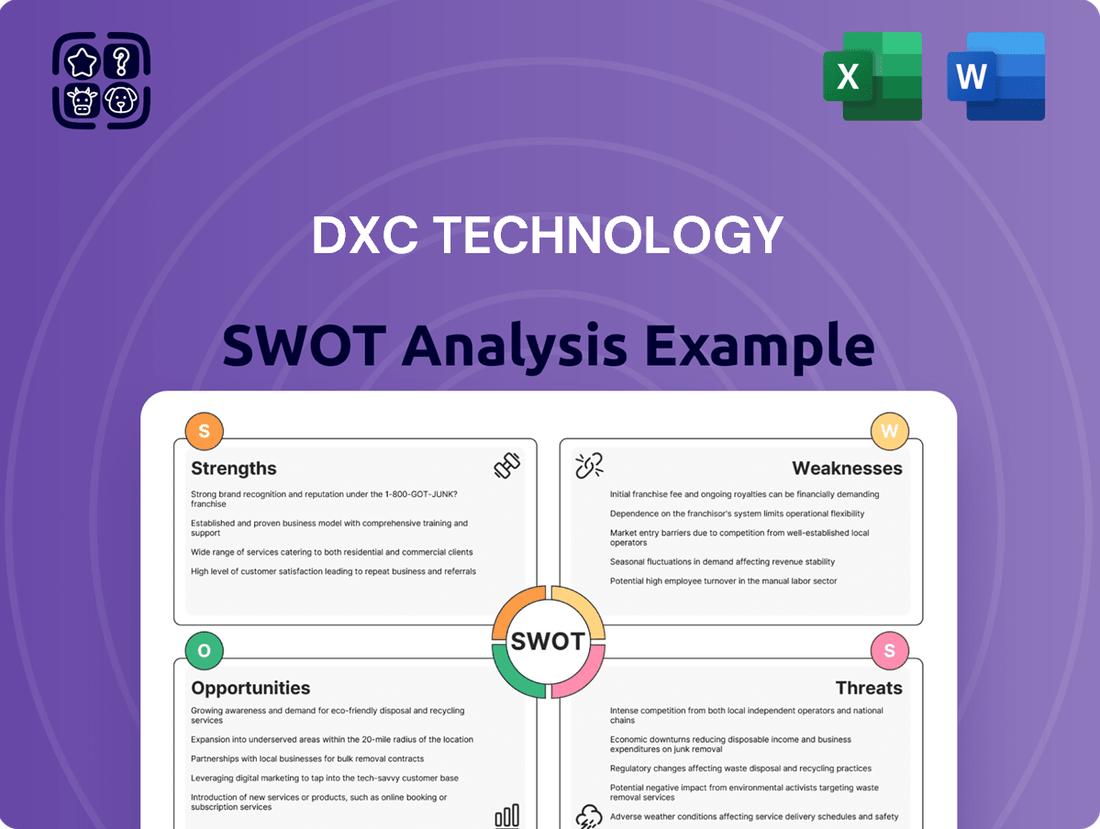

Preview the Actual Deliverable

DXC Technology SWOT Analysis

This is the actual DXC Technology SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It covers key internal strengths and weaknesses, alongside external opportunities and threats impacting DXC's market position and future growth.

The preview below is taken directly from the full DXC Technology SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of the company's strategic landscape.

Opportunities

The global market for digital transformation services is experiencing robust growth, projected to reach approximately $2.5 trillion by 2025, according to recent industry analyses. This surge is driven by businesses seeking to enhance efficiency, customer experience, and competitive advantage through technology adoption.

DXC Technology is strategically positioned to benefit from this trend, given its expertise in modernizing IT infrastructure and optimizing data across multi-cloud environments. Their focus on cloud migration, data analytics, and cybersecurity directly addresses the core needs of enterprises undergoing digital evolution.

The increasing reliance on cloud computing, with global cloud spending expected to exceed $1.5 trillion in 2025, underscores the significant opportunity for DXC. Their ability to manage complex IT landscapes and deliver scalable cloud solutions aligns perfectly with this expanding market demand.

DXC Technology is strategically prioritizing artificial intelligence to boost operational efficiency, attract capital, and pioneer new client solutions. This focus is evident in initiatives like the recent introduction of AI-driven products such as DXC Assure Illustrations, specifically designed for the life insurance sector, showcasing a tangible commitment to advanced technology integration.

The company sees AI as a powerful avenue to not only refine its current service portfolio but also to unlock novel revenue streams. By optimizing business outcomes for its clientele through AI-powered insights and automation, DXC aims to deliver enhanced value and solidify its market position.

DXC Technology's recent collaborations, like its digital transformation partnership with a major global financial services firm, are a key opportunity. These alliances are designed to expand DXC's reach and generate new revenue. For example, such partnerships are crucial in a market where clients increasingly prefer to consolidate their IT services, a trend that plays directly into DXC's strengths.

The company's full-stack infrastructure and application management capabilities position it advantageously as clients seek fewer, more comprehensive IT partners. This consolidation trend, observed across many industries in 2024 and projected to continue into 2025, can significantly increase the size and volume of contracts DXC secures, enhancing its market standing.

Focus on High-Growth Offerings and Market Segments

DXC Technology is strategically investing in high-growth areas to revitalize its revenue streams. This includes a significant push into consulting and engineering services, alongside expanding its artificial intelligence (AI) capabilities and software platforms.

The company is particularly focusing on segments like Global Business Services (GBS), with its insurance services and software business demonstrating positive organic revenue growth. For instance, in fiscal year 2024, DXC reported that its insurance software and services within GBS were a key driver of growth.

- Targeted Investment: DXC is channeling resources into rebuilding revenue growth, with a specific emphasis on AI and software.

- High-Growth Segments: Consulting, engineering, and insurance software/services are prioritized for expansion.

- Offsetting Legacy Declines: Focusing on these areas aims to counteract slower growth in traditional business lines.

- Future Profitability: This strategic shift is designed to enhance overall profitability by concentrating on more dynamic market opportunities.

Rebuilding Investor Confidence Through Improved Execution

DXC Technology has a significant opportunity to restore investor confidence by demonstrating a commitment to disciplined execution under its new leadership. This focus on operational excellence is crucial for rebuilding trust in the financial community. The company's recent performance, including positive bookings trends and an upward revision of fiscal 2025 financial guidance, indicates a positive trajectory.

Consistent achievement of financial targets and a transparent roadmap for achieving sustainable, profitable growth are key to this rebuilding effort. Such a track record can directly influence investor sentiment and, consequently, the company's share valuation. For instance, DXC's fiscal year 2025 guidance projects revenue growth in the low single digits, a notable shift from previous periods.

- Rebuilding Trust: New leadership and a focus on execution can mend investor relationships.

- Positive Signals: Recent booking strength and raised fiscal 2025 guidance (e.g., revenue growth in low single digits) show progress.

- Path to Growth: Consistent delivery on financial goals and a clear strategy for sustained profitability are vital for share price recovery.

DXC's strategic focus on AI presents a substantial growth avenue, with the global AI market projected to reach $1.5 trillion by 2028, according to recent forecasts. The company's AI-driven solutions, like DXC Assure Illustrations for insurance, directly tap into this expanding sector. Furthermore, DXC's push into consulting and engineering services, areas with strong market demand, aims to offset declines in legacy businesses and enhance overall profitability by concentrating on more dynamic opportunities.

| Opportunity Area | Market Projection/Growth Driver | DXC's Strategic Alignment |

|---|---|---|

| Artificial Intelligence (AI) | Global AI market expected to reach $1.5 trillion by 2028. | Development of AI-driven products (e.g., DXC Assure Illustrations) and integration into service offerings. |

| Consulting & Engineering Services | Increasing demand for specialized IT expertise and digital transformation guidance. | Significant investment and focus on expanding capabilities in these high-growth segments. |

| Digital Transformation | Global digital transformation services market projected at $2.5 trillion by 2025. | Leveraging expertise in cloud migration, data analytics, and cybersecurity to meet enterprise needs. |

Threats

The IT services and consulting landscape is fiercely contested, featuring a multitude of established global giants and nimble, specialized entrants. This intense rivalry directly impacts DXC Technology, creating significant pressure on its pricing strategies, its ability to capture and maintain market share, and its efforts to retain existing clients.

DXC Technology contends with formidable competition from major global IT service providers. For instance, in the first quarter of fiscal year 2025, DXC reported revenue of $3.44 billion, highlighting the scale of operations within this competitive arena. This competitive environment necessitates constant innovation and operational efficiency, which can be particularly demanding as the company navigates its ongoing business transformation initiatives.

Global macroeconomic uncertainties, such as persistent high interest rates and a generally challenging market, pose a significant threat to DXC Technology. These conditions can directly impact client IT spending, leading to the postponement or reduction of new project initiations, which in turn affects DXC's revenue streams.

These external macroeconomic factors are largely outside of DXC's direct control, yet they carry substantial weight in shaping the company's revenue and profitability outlook. For instance, DXC's revenue guidance for fiscal year 2025 still projects a decline, a clear reflection of this uncertain economic backdrop and its anticipated impact.

DXC Technology's continued reliance on its legacy IT outsourcing business presents a significant threat. Despite strategic shifts, a substantial portion of its revenue still originates from traditional infrastructure management, a sector experiencing a secular decline as clients increasingly favor agile, cloud-native solutions.

This dependence leaves DXC vulnerable to market trends that are rapidly moving away from on-premises infrastructure and managed services. For instance, the global IT outsourcing market, while large, is seeing slower growth compared to cloud services, with projections indicating continued shifts towards hyperscalers and specialized cloud providers.

The core challenge for DXC is to accelerate its transformation and migration of clients to modern, cloud-based offerings at a pace that outstrips the natural decline of its legacy revenue streams. Failing to do so risks a continued erosion of market share and profitability in its core, yet shrinking, business segments.

Execution Risks of Ongoing Restructuring

DXC Technology's ongoing restructuring efforts, crucial for its turnaround, face significant execution risks. The success of these multi-year plans hinges on meticulous implementation, with any delays or unforeseen expenses potentially undermining financial recovery and investor sentiment. For instance, the company's recent performance metrics, such as the reported revenue figures for the fiscal year ending March 31, 2024, which saw a decline, highlight the challenges in achieving stability during such transformative periods. The effectiveness of management in navigating these complex changes is paramount.

The company's past experiences with numerous restructurings and leadership transitions underscore the inherent difficulties and potential pitfalls of large-scale organizational overhauls. These historical patterns suggest that the path to transformation is rarely smooth. For example, in fiscal year 2023, DXC reported a net loss, indicating the substantial costs and operational disruptions that can accompany these initiatives. The ability to manage these complexities efficiently is a key determinant of future success.

- Execution Dependency: The turnaround strategy's success is directly tied to the effective execution of restructuring plans.

- Financial and Confidence Impact: Missteps or delays in restructuring can negatively affect financial results and investor confidence.

- Historical Precedent: Past restructurings and leadership changes highlight the complexity and risks of DXC's transformation.

Rapid Technological Advancements and Disruption

The relentless march of technological progress, especially in areas like artificial intelligence, presents a significant challenge for DXC Technology. While the company is actively investing in AI, the sheer speed of development means that failing to integrate these advancements rapidly and effectively could quickly render its offerings outdated. This rapid evolution demands constant vigilance and substantial investment to remain competitive.

Competitors who are quicker to adapt and innovate, particularly in AI integration, could seize market share. For instance, as of early 2024, many IT services firms are significantly boosting their AI-related R&D and talent acquisition, aiming to embed AI across their service portfolios. If DXC cannot match this agility, it risks falling behind.

- AI Integration Pace: Failure to keep pace with AI development and adoption could lead to a loss of competitive edge.

- Market Share Erosion: More agile competitors leveraging new technologies could capture market share.

- Investment Requirements: Staying ahead requires continuous, substantial investment in R&D and technology adoption.

- Talent Acquisition: Attracting and retaining talent skilled in emerging technologies is critical for innovation.

DXC Technology faces intense competition from established players and niche providers, pressuring its pricing and market share. Macroeconomic headwinds, including high interest rates, continue to impact client IT spending, with DXC's fiscal year 2025 revenue guidance reflecting this uncertainty. The company's ongoing reliance on legacy IT outsourcing, a declining market segment, poses a significant threat as clients shift towards cloud-native solutions.

SWOT Analysis Data Sources

This SWOT analysis is built upon a comprehensive review of DXC Technology's financial reports, industry-specific market research, and expert analyses of the IT services landscape to provide a well-rounded perspective.