DXC Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DXC Technology Bundle

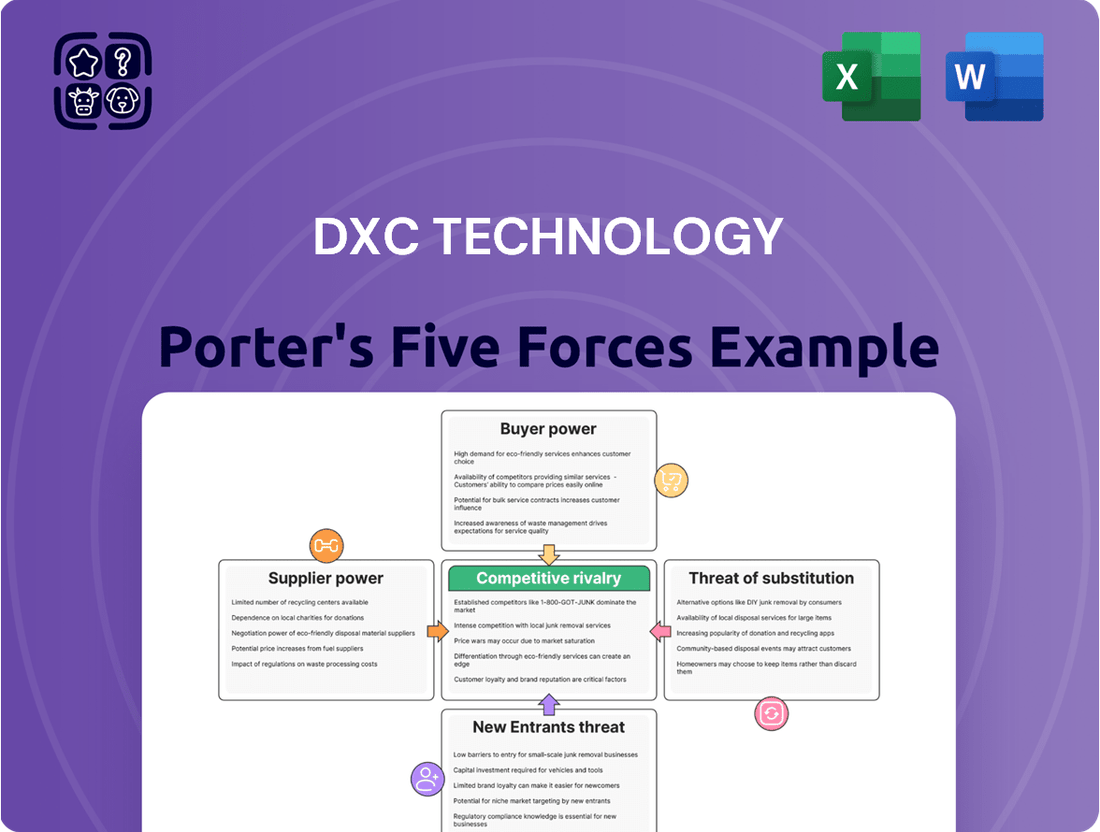

DXC Technology operates in a dynamic IT services landscape, facing moderate rivalry from established players and emerging disruptors. The bargaining power of buyers, particularly large enterprises, is significant due to the commoditization of many IT functions. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping DXC Technology’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DXC Technology's reliance on a concentrated supplier base for hardware, software, and specialized services can significantly impact its bargaining power. When a few dominant vendors control critical components or expertise, they gain leverage to dictate terms and pricing. This is especially true for proprietary technologies or niche services that DXC cannot easily substitute, potentially increasing operational costs.

The effort and expense DXC Technology incurs when changing IT service providers can be significant. This includes the costs associated with re-integrating new systems, retraining staff on different platforms, and the potential for disruptions to ongoing client services, which can damage DXC's reputation and revenue streams.

These substantial switching costs effectively bolster the bargaining power of DXC's existing suppliers. Because the process of finding and onboarding a new provider is so resource-intensive, DXC is less likely to switch even if a supplier presents less favorable terms or pricing, giving that supplier leverage.

Suppliers offering highly specialized or unique software, platforms like cloud infrastructure, or niche skilled labor, such as cybersecurity experts, wield significant bargaining power. DXC Technology's capacity to deliver differentiated services is often contingent on its ability to effectively utilize these advanced technologies from its suppliers, underscoring their critical role.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly amplify their bargaining power against DXC Technology. If a critical supplier, particularly one providing specialized IT components or platforms, were to begin offering similar IT services directly to DXC's existing client base, it would create a direct competitive challenge. This scenario would allow the supplier to capture a larger share of the value chain, potentially eroding DXC's market position and profitability.

While broad IT services are complex to replicate, the possibility exists for specialized software or cloud infrastructure providers to expand their offerings into the service delivery domain. For instance, a major cloud platform provider could develop its own managed services, directly competing with DXC's offerings to businesses leveraging that specific cloud environment. This shift could put DXC in a position where its suppliers are also its direct competitors.

- Increased Competition: Suppliers moving into direct service delivery could fragment DXC's customer base.

- Margin Pressure: Direct competition from suppliers may force DXC to lower prices to retain clients.

- Dependency Risk: DXC's reliance on specific suppliers becomes riskier if those suppliers can bypass DXC.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for DXC Technology. When numerous alternative suppliers offer similar components or services, or when substitute technologies are readily accessible, DXC's leverage increases. This allows DXC to negotiate more favorable terms by playing suppliers against each other.

For instance, in the IT services sector, DXC relies on various inputs like cloud infrastructure, software licenses, and specialized talent. If there are many cloud providers offering comparable services, or if open-source alternatives exist for proprietary software, DXC’s dependence on any single supplier diminishes. This is crucial for managing costs and ensuring supply chain resilience.

- Reduced Supplier Dependence: A broad base of potential suppliers for critical IT components and services dilutes the power of any individual supplier.

- Cost Negotiation Leverage: The presence of readily available substitutes enables DXC to negotiate pricing more effectively, potentially lowering procurement costs. For example, the competitive landscape among major cloud providers like AWS, Azure, and Google Cloud allows DXC to secure advantageous pricing for its infrastructure needs.

- Technological Flexibility: Access to substitute technologies, such as different programming languages or development platforms, provides DXC with greater flexibility in choosing solutions that best meet project requirements and cost objectives.

DXC Technology faces moderate bargaining power from its suppliers, largely due to the specialized nature of many IT components and services it requires. While DXC is a large buyer, the complexity and integration of certain software, cloud platforms, and niche technical expertise can limit its ability to switch providers easily, as highlighted by significant switching costs. For example, reliance on specific enterprise software vendors or specialized cybersecurity talent can give those suppliers leverage.

| Supplier Type | Impact on DXC's Bargaining Power | Key Factors |

|---|---|---|

| Cloud Infrastructure Providers (e.g., AWS, Azure, Google Cloud) | Moderate to High | High switching costs, proprietary platforms, specialized services |

| Enterprise Software Vendors (e.g., Microsoft, SAP) | High | Proprietary technology, deep integration, significant retraining costs |

| Specialized IT Talent/Consulting Firms | Moderate to High | Scarcity of niche skills, project-specific expertise, high onboarding costs |

| Hardware Manufacturers | Low to Moderate | Commoditization, multiple sourcing options, lower switching costs |

What is included in the product

This analysis unpacks the competitive forces impacting DXC Technology, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the IT services industry.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing DXC Technology's competitive landscape and identifying key areas for intervention.

Customers Bargaining Power

DXC Technology's customer base includes major global corporations and public sector entities, giving these clients considerable leverage. Their substantial business volume allows them to negotiate for tailored solutions and aggressive pricing. For instance, in fiscal year 2023, DXC reported that its top 10 clients accounted for approximately 20% of its total revenue, highlighting the concentrated nature of its customer relationships and their inherent bargaining power.

DXC Technology's customers often face low switching costs, a key factor in their bargaining power. While the initial IT service migration can seem daunting, the perceived difficulty of moving to a competitor is often manageable, particularly if customers are unhappy with current service levels or discover more cutting-edge alternatives. This perception is amplified by the increasing modularity of IT services, especially within cloud and hybrid infrastructures, which inherently lowers the barriers to entry for new providers.

Customer price sensitivity is a significant factor in the IT services industry, particularly for standardized offerings. DXC Technology faces pressure as clients actively seek cost reductions, making it crucial for the company to offer competitive pricing without sacrificing profitability. For instance, in 2023, the global IT services market saw continued demand for cost-effective solutions, with many clients scrutinizing vendor contracts for potential savings.

Customer Information and Transparency

Customers in the IT services sector, including those interacting with DXC Technology, are far more informed today than in the past. This heightened awareness stems from readily available industry benchmarks, detailed service comparisons, and extensive online reviews. For instance, many clients now leverage independent IT consulting firms to vet potential vendors and pricing structures before engaging. This access to information significantly strengthens their position when negotiating contracts, allowing them to demand better terms and service levels.

The digital age has fostered unprecedented transparency in pricing and performance metrics within the IT services market. Buyers can easily access data on competitor pricing, service level agreements, and customer satisfaction scores. This makes it harder for companies like DXC to maintain pricing power if their offerings are not competitive or clearly superior. A 2024 report indicated that over 70% of enterprise IT procurement decisions are influenced by publicly available performance data and peer reviews, directly impacting bargaining leverage.

- Increased Information Access: Clients can readily compare pricing, service features, and vendor track records online.

- Industry Benchmarking: Clients utilize industry standards and benchmarks to evaluate DXC's service offerings and pricing.

- Negotiation Power: Greater transparency empowers customers to negotiate more favorable terms and conditions.

- Vendor Comparison: Easy comparison with competitors allows customers to demand competitive pricing and superior service from DXC.

Threat of Backward Integration by Customers

Large enterprises, DXC Technology's core clientele, possess the potential to bring IT functions in-house. This is especially true for tasks that aren't absolutely critical or require very specific, niche expertise. For instance, a major financial institution might decide to build its own cybersecurity monitoring tools rather than relying on a third party like DXC for that specific service.

This capability for backward integration directly enhances customer bargaining power. When clients can realistically consider developing their own IT solutions, they gain significant leverage during contract negotiations with DXC. They can demand better pricing or more favorable terms, knowing they have an alternative to outsourcing.

Consider the trend in 2024 where many companies are re-evaluating their IT spend and looking for cost efficiencies. A report from Gartner in late 2023 indicated that a significant percentage of large enterprises were exploring options to insource certain managed services, driven by a desire for greater control and potential cost savings. This directly impacts DXC's ability to dictate terms.

- Customer Insourcing Potential: Large enterprise clients can develop or bring IT capabilities in-house, particularly for non-core or specialized functions.

- Negotiating Leverage: The threat of backward integration empowers customers by giving them an alternative to relying solely on external providers like DXC.

- Market Trends (2024): Increased focus on IT cost optimization and control in 2024 fuels the consideration of insourcing among large enterprises.

DXC Technology's customers, particularly large enterprises, wield significant bargaining power due to their substantial business volume and the increasing ease of switching providers. This leverage is amplified by readily available industry benchmarks and pricing transparency, allowing clients to demand competitive terms. For instance, DXC's top 10 clients represented about 20% of its revenue in FY23, underscoring their influence.

| Factor | Impact on DXC | Supporting Data (FY23/2024 Trends) |

| Customer Concentration | High leverage for major clients | Top 10 clients accounted for ~20% of revenue. |

| Switching Costs | Low to moderate, enabling easier provider changes | Modularity of IT services, especially cloud, reduces migration barriers. |

| Information Availability | Empowers customers to negotiate better terms | Over 70% of IT procurement decisions in 2024 influenced by public data/reviews. |

| Potential for Backward Integration | Customers can insource IT functions, reducing reliance | Enterprises in 2024 re-evaluating IT spend, exploring insourcing for control/savings. |

Full Version Awaits

DXC Technology Porter's Five Forces Analysis

You're previewing the final version of DXC Technology's Porter's Five Forces Analysis—precisely the same comprehensive document that will be available to you instantly after buying. This detailed report examines the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry within the IT services industry. Understanding these forces is crucial for DXC Technology to strategize effectively and maintain its competitive edge.

Rivalry Among Competitors

The IT services and consulting landscape is incredibly crowded, featuring a vast array of global giants, highly specialized niche players, and even the internal IT departments of client companies. This sheer volume and diversity of competitors create a fiercely competitive environment for DXC Technology.

DXC finds itself in direct competition with major system integrators, prominent cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, as well as established consulting firms. This multi-faceted competition intensifies the struggle for market share and client contracts.

For instance, in 2023, the global IT services market was valued at over $1.3 trillion, with significant portions captured by these diverse players. This underscores the scale of the competitive challenge DXC navigates daily.

IT services firms like DXC Technology grapple with substantial fixed costs, including massive investments in global infrastructure, cutting-edge technology, and a large, skilled workforce. These overheads necessitate high operational capacity utilization to spread costs effectively.

This environment breeds intense pressure to secure and retain client contracts. Companies often resort to aggressive pricing tactics, sometimes accepting lower margins, to keep their resources engaged and avoid the financial drain of underutilized capacity. For instance, in fiscal year 2024, DXC Technology reported significant operational expenses, underscoring the ongoing need to manage capacity efficiently.

While the IT services industry has dynamic growth areas like artificial intelligence and cloud computing, DXC Technology also operates in more mature or declining segments, particularly traditional IT outsourcing. This creates a challenging environment where intense competition is focused on capturing market share in expanding niches while navigating revenue pressures in legacy services.

Lack of Differentiation in Commoditized Services

For many standardized IT services, standing out from the crowd is tough. This often leads to these services becoming commodities, where the main battleground is price. In 2024, the IT services market continues to see intense competition, with many providers offering similar solutions.

DXC Technology needs to constantly innovate and highlight its unique strengths. Focusing on specialized areas like advanced cybersecurity solutions and sophisticated data architecture optimization is crucial. This helps DXC avoid being seen as just another generic IT provider.

- Commoditization Pressure: The IT services industry, particularly for common offerings like cloud migration and managed IT support, faces significant commoditization. This means that many companies can offer similar services, driving down prices and making differentiation difficult.

- DXC's Differentiation Strategy: DXC is actively working to differentiate itself by emphasizing its expertise in areas like digital transformation, cloud native services, and cybersecurity. For instance, in their fiscal year ending March 31, 2024, DXC reported growth in their Digital Transformation Americas segment, indicating a push towards more specialized offerings.

- Impact on Competition: When services are commoditized, competition intensifies, and price becomes a primary factor. This can squeeze profit margins for all players, including DXC, unless they can successfully demonstrate superior value or specialized capabilities.

Acquisitions and Partnerships for Market Share

The competitive landscape within the IT services sector is heavily influenced by a constant flux of mergers, acquisitions, and strategic alliances. Companies are actively pursuing these avenues to bolster their service portfolios, expand their market reach, and integrate cutting-edge technologies, including generative AI. This dynamic environment means that staying competitive often requires inorganic growth and collaboration.

DXC Technology's strategic partnerships are vital in navigating this competitive terrain. For instance, its collaboration with ServiceNow is designed to enhance its cloud and digital transformation services, directly addressing client needs for integrated solutions. These alliances are not just about expanding offerings but are critical for maintaining and improving DXC's competitive standing in a rapidly evolving market.

- Market Consolidation: The IT services industry continues to see significant M&A activity as firms aim to consolidate market share and acquire new capabilities.

- Technology Integration: Partnerships are key for integrating emerging technologies like generative AI, enabling companies to offer more advanced solutions.

- DXC's Strategic Alliances: Collaborations, such as with ServiceNow, are central to DXC's strategy for enhancing its service delivery and competitive differentiation.

- Service Portfolio Expansion: Through acquisitions and partnerships, companies like DXC aim to broaden their service offerings to meet diverse client demands.

The IT services market is intensely competitive, with DXC Technology facing rivals ranging from global giants to specialized niche players. This crowded field, valued at over $1.3 trillion in 2023, forces companies to manage high fixed costs, often leading to aggressive pricing and lower margins to maintain capacity utilization. DXC must constantly innovate and highlight specialized strengths, like digital transformation and cybersecurity, to avoid commoditization and intense price wars seen in 2024.

| Competitor Type | Examples | Competitive Pressure |

| Global System Integrators | Accenture, IBM, Capgemini | High, due to scale and broad service offerings |

| Cloud Service Providers | AWS, Microsoft Azure, Google Cloud | Intense, especially for cloud-native services |

| Specialized IT Consultancies | Boutique firms in AI, cybersecurity | Growing, due to focus on niche expertise |

| Internal IT Departments | Client's own IT teams | Varies, can be a threat for commoditized services |

SSubstitutes Threaten

A significant threat of substitutes for DXC Technology's offerings comes from clients developing or enhancing their own in-house IT departments. Many organizations opt to build out internal capabilities, particularly for critical functions or to exert more direct control over their IT environments and sensitive data.

This trend is fueled by a desire for greater agility and customization, allowing companies to tailor solutions precisely to their unique business needs. For instance, a company might invest in building a robust cybersecurity team internally rather than outsourcing all security functions, aiming to retain direct oversight of their digital defenses.

The rise of cloud-native solutions and SaaS offerings presents a significant threat of substitution for DXC Technology. Businesses can now readily access specialized software and IT functions through subscription models, bypassing the need for extensive custom development or traditional managed IT services. This shift directly impacts DXC's established service lines, particularly those catering to on-premise infrastructure and bespoke solutions.

For instance, the global SaaS market was projected to reach over $270 billion in 2024, demonstrating the massive adoption of these alternative service models. Companies like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud offer a vast array of scalable, on-demand services that can replace components of traditional IT outsourcing, forcing DXC to adapt its value proposition.

Advances in automation and artificial intelligence (AI) present a significant threat of substitution for DXC Technology's IT services. Tools like robotic process automation (RPA) can now perform many routine tasks previously handled by human IT support and operations staff. For instance, a 2024 report indicated that RPA adoption in the IT sector is projected to grow by 30% annually, directly impacting the need for traditional managed services.

This technological shift means that clients can increasingly opt for automated solutions over human-delivered services, especially in areas like helpdesk support, data entry, and basic system monitoring. While DXC actively incorporates AI into its own solutions, the broader availability of these substitute technologies can erode the demand for some of its core, less specialized offerings, potentially impacting revenue streams from these segments.

Freelance and Gig Economy IT Professionals

The threat of substitutes for DXC Technology is significant, particularly from individual freelance and gig economy IT professionals. For specific projects or short-term needs, businesses often find it more agile and cost-effective to hire independent consultants or utilize specialized gig platforms rather than engaging a large, comprehensive service provider.

This trend is fueled by the increasing availability of highly skilled IT talent willing to work on a project basis. For instance, the global freelance platform Upwork reported a substantial increase in IT-related job postings throughout 2024, indicating a growing demand for flexible, on-demand expertise.

- Cost Efficiency: Freelancers often have lower overhead, allowing them to offer competitive rates for discrete tasks, making them an attractive alternative for budget-conscious projects.

- Specialized Skills: The gig economy provides access to niche expertise that might be difficult or expensive to maintain in-house or within a large firm's standard offerings.

- Agility and Speed: For rapidly evolving needs, businesses can quickly onboard freelance talent, bypassing the longer procurement cycles sometimes associated with larger IT service providers.

- Market Growth: The freelance IT sector continues to expand, with many professionals preferring the autonomy and variety of project-based work, increasing the pool of potential substitutes.

Open-Source Software and Platforms

The rise of robust open-source software and platforms presents a significant threat of substitution for DXC Technology. These alternatives can directly replace proprietary solutions that DXC might offer or manage for its clients. For instance, in 2024, the global open-source software market was valued at approximately $23.5 billion, demonstrating its substantial and growing presence.

Companies increasingly opt for open-source solutions to curb licensing fees and escape vendor lock-in, a trend that directly impacts DXC's service offerings. This cost-saving and flexibility advantage makes open-source a compelling substitute, potentially diverting clients from DXC's traditional, often licensed, IT infrastructure and management services. This shift influences client IT strategy by prioritizing adaptability and reduced operational expenditure.

- Reduced Costs: Open-source software often eliminates significant licensing fees associated with proprietary solutions, directly impacting the total cost of ownership for businesses.

- Increased Flexibility: The adaptable nature of open-source allows for greater customization and integration, reducing dependency on a single vendor's roadmap.

- Community Support: A vast global community actively contributes to the development and maintenance of open-source projects, often providing rapid issue resolution and innovation.

- Avoiding Vendor Lock-in: Businesses can maintain greater control over their IT infrastructure by utilizing open-source, preventing reliance on specific vendors for updates or support.

The threat of substitutes for DXC Technology is substantial, driven by the increasing viability of clients developing in-house IT capabilities or leveraging readily available cloud-native and SaaS solutions. These alternatives offer greater agility, cost control, and customization, directly challenging DXC's traditional managed services. For instance, the global SaaS market's projected growth to over $270 billion in 2024 highlights the widespread adoption of these substitute models.

Furthermore, advances in automation and AI are enabling businesses to replace human-delivered IT support with automated solutions, impacting DXC's less specialized service lines. The gig economy also provides access to specialized freelance talent, offering a more agile and cost-effective alternative for specific projects. The open-source software market, valued at approximately $23.5 billion in 2024, further contributes to this threat by offering cost-efficient and flexible alternatives to proprietary solutions.

| Substitute Category | Key Characteristics | Impact on DXC | 2024 Market Data/Trend |

|---|---|---|---|

| In-house IT Development | Greater control, customization, agility | Reduced demand for outsourcing | Ongoing trend, particularly for core functions |

| Cloud-Native/SaaS | Scalability, on-demand services, subscription models | Threatens traditional managed services | Global SaaS market projected >$270 billion |

| Automation & AI | Routine task automation, efficiency | Erodes demand for basic IT support | RPA adoption in IT projected 30% annual growth |

| Freelance/Gig Economy | Specialized skills, cost-efficiency, speed | Alternative for project-based work | Increased IT job postings on freelance platforms |

| Open-Source Software | Reduced licensing fees, flexibility, no vendor lock-in | Replaces proprietary solutions | Global open-source market valued ~$23.5 billion |

Entrants Threaten

The global IT services and consulting market demands significant upfront capital. New entrants must invest heavily in advanced infrastructure, cutting-edge technology, and crucially, a highly skilled talent pool. For instance, establishing a global delivery network similar to DXC Technology's, which operates in over 70 countries, necessitates billions in investment.

Established players like DXC Technology leverage deeply ingrained client relationships and a robust brand reputation, cultivated over years of consistent service delivery. This history fosters trust, making it difficult for newcomers to quickly gain traction.

New entrants face a significant hurdle in replicating DXC's established credibility and securing the large, complex enterprise contracts that are the bedrock of the IT services industry. Building this level of trust and demonstrating a proven track record typically requires substantial investment and a considerable time horizon.

DXC Technology leverages significant economies of scale, a direct result of its expansive global delivery network and a vast existing client portfolio. This scale allows for substantial cost efficiencies in operations, such as shared infrastructure and centralized support, which are challenging for nascent competitors to replicate. For instance, in 2023, DXC reported revenues of approximately $14.4 billion, underscoring the sheer size of its operational footprint.

Furthermore, DXC’s extensive scope of services, encompassing a wide array of solutions across the enterprise technology stack, presents another formidable barrier. This integrated and comprehensive service offering is difficult for newer, more niche entrants to match, as building out such a broad capability set requires considerable time, investment, and expertise. Newcomers often find it more feasible to enter with specialized offerings, making it harder to compete with DXC's all-encompassing approach.

Regulatory and Compliance Hurdles

The IT services industry, particularly for large corporate and government contracts, is burdened by intricate regulatory landscapes and compliance mandates. Think data protection laws and stringent cybersecurity standards. New players must invest heavily to build the necessary infrastructure and obtain certifications, creating a substantial barrier to entry.

For instance, in 2024, companies operating in the public sector often need to adhere to specific government-issued security clearances and data handling protocols, which can take years and millions of dollars to implement effectively. This complexity significantly deters smaller or less established firms from competing for these lucrative, but highly regulated, opportunities.

- Data Privacy Regulations: Compliance with GDPR, CCPA, and similar laws requires robust data governance frameworks.

- Cybersecurity Standards: Meeting requirements like ISO 27001 or NIST frameworks involves significant investment and ongoing audits.

- Industry-Specific Compliance: Sectors like healthcare (HIPAA) or finance have unique, often costly, regulatory demands.

- Government Contract Requirements: Public sector work frequently necessitates specific security clearances and audit trails.

Access to Talent and Niche Skills

The demand for specialized IT talent, particularly in areas like cybersecurity, cloud architecture, and AI, is exceptionally high. For instance, in 2024, the global cybersecurity market alone was projected to reach over $270 billion, indicating a significant need for skilled professionals in that domain. New entrants face considerable hurdles in attracting and retaining these essential skilled professionals. Established firms like DXC Technology often possess extensive, deeply cultivated talent pools and robust recruitment pipelines, giving them a distinct advantage in securing top-tier IT expertise.

This disparity in talent acquisition can directly impact a new entrant's ability to compete effectively. Without access to the necessary specialized skills, emerging companies may struggle to deliver the sophisticated solutions and services that clients expect. Consider the competition for AI engineers; in 2024, the average salary for an AI engineer in the US was reported to be upwards of $150,000, a significant investment that can be difficult for new players to match consistently.

- High Demand for Niche IT Skills: Areas like cybersecurity, cloud, and AI are experiencing intense competition for talent.

- Established Talent Pools: Incumbents like DXC Technology benefit from existing, extensive networks of skilled professionals.

- Recruitment Pipeline Advantage: Larger firms often have more developed and successful strategies for attracting and onboarding new talent.

- Cost of Talent Acquisition: The high salaries and benefits required to attract specialized IT workers present a barrier for new entrants.

The threat of new entrants in the IT services sector, particularly for a company like DXC Technology, is generally considered moderate. Significant capital investment is required for infrastructure and talent, and established players benefit from strong client relationships and brand loyalty. Furthermore, the complexity of regulatory environments and the intense competition for specialized IT talent act as substantial deterrents for newcomers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions needed for global networks, technology, and talent. | High barrier; difficult for smaller firms to match DXC's scale. |

| Brand Loyalty & Client Relationships | Years of service build trust and deep client ties. | Challenging for new entrants to secure large enterprise contracts. |

| Economies of Scale | Vast operational footprint and client base lead to cost efficiencies. | Newcomers struggle to compete on price and service breadth. |

| Regulatory Compliance | Complex data privacy and cybersecurity laws demand significant investment. | Adds cost and time for new entrants to meet standards. |

| Talent Acquisition | High demand for specialized IT skills makes recruitment costly. | Incumbents with established talent pools have a distinct advantage. |

Porter's Five Forces Analysis Data Sources

Our DXC Technology Porter's Five Forces analysis is built upon a robust foundation of data, including DXC's official annual reports, SEC filings, and investor presentations. We also leverage industry-specific market research reports from reputable firms and financial data from platforms like Bloomberg and S&P Capital IQ.