DXC Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DXC Technology Bundle

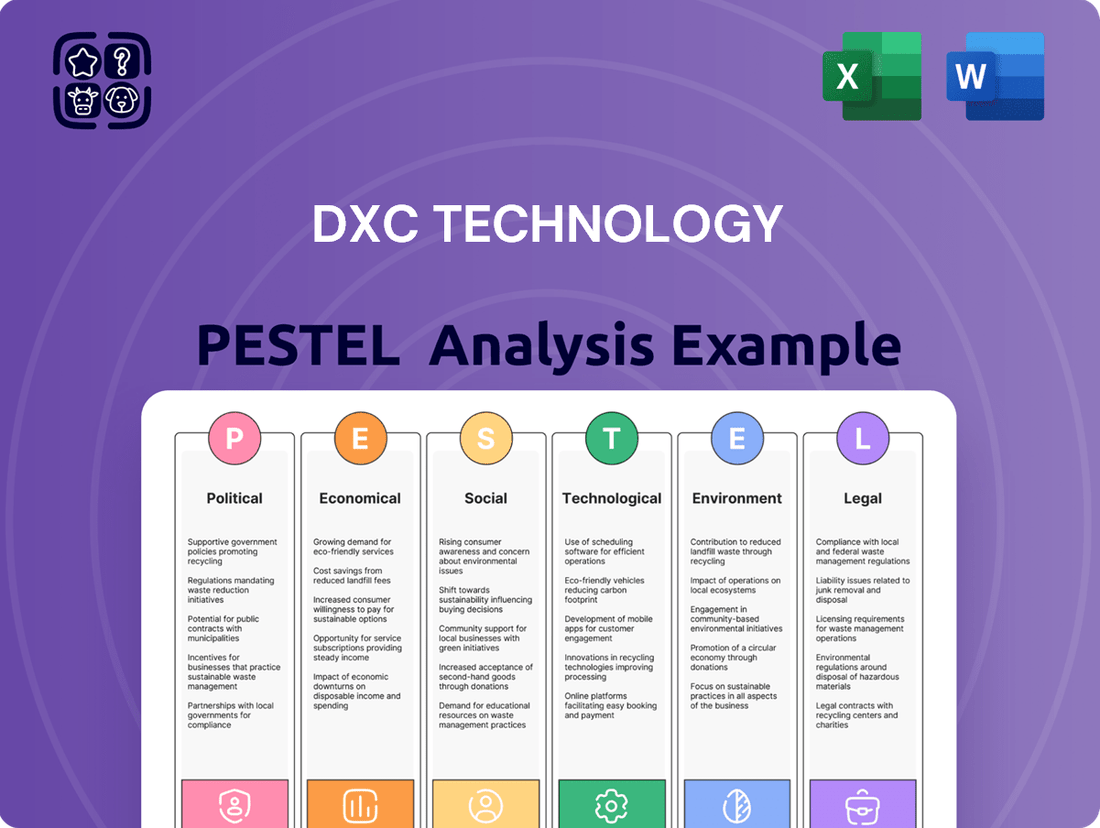

Navigate the complex external forces shaping DXC Technology's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the IT services giant. Equip yourself with the strategic intelligence needed to anticipate market changes and secure your competitive advantage. Download the full PESTLE analysis now for actionable insights.

Political factors

Government IT spending, a critical driver for companies like DXC Technology, saw continued focus in 2024 as nations prioritized digital transformation and enhanced cybersecurity measures. For instance, the U.S. federal government allocated billions towards modernizing its IT infrastructure, with agencies like the Department of Defense and the Department of Homeland Security being major consumers of advanced IT services. This spending directly translates into contract opportunities for IT service providers.

Changes in public sector procurement policies and contract awards can significantly sway DXC Technology's revenue. In 2024, many governments continued to emphasize cloud migration and data analytics, potentially shifting contract values and strategic partnerships. A shift towards outcome-based contracting, rather than traditional time-and-materials, also became more prevalent, requiring providers to adapt their service delivery models.

Political stability and a government's commitment to technology modernization are paramount for predictable revenue. In 2024, geopolitical events and evolving national security concerns underscored the importance of robust and secure government IT systems. Nations that maintained stable political environments and actively supported technology upgrades offered more reliable long-term contract prospects for companies like DXC.

Global geopolitical tensions and ongoing trade disputes, such as those impacting semiconductor supply chains, directly affect DXC Technology's ability to procure essential hardware and manage its international operations. Protectionist policies can erect barriers to market access in key regions, potentially increasing operational costs and complicating DXC's global service delivery model.

The increasing trend of data localization requirements and restrictions on cross-border data flows present a significant hurdle for DXC, a company reliant on seamless global data management for its IT services. Navigating these diverse regulatory landscapes necessitates flexible operational strategies and robust compliance frameworks to mitigate risks and ensure continued service provision.

The political landscape significantly shapes DXC Technology's operational environment through its regulatory framework. Governments worldwide are increasingly focusing on data sovereignty and cybersecurity, compelling companies like DXC to adapt their data handling and security protocols. For instance, the European Union's General Data Protection Regulation (GDPR) continues to set a high bar for data privacy, impacting how DXC manages client data across its global operations.

Compliance with a patchwork of national and international laws is a constant challenge. Shifts in political will, such as increased emphasis on critical infrastructure protection, can trigger new compliance requirements or audits for DXC, potentially affecting its service delivery models and client contracts. A recent example from 2024 saw several nations proposing stricter cybersecurity mandates for IT service providers handling government data, directly impacting DXC's public sector business.

Furthermore, political decisions to bolster specific industries, such as digital transformation initiatives in emerging economies, can create substantial growth avenues for DXC. Conversely, political instability or protectionist policies in key markets might introduce operational hurdles or limit market access, requiring strategic adjustments to DXC's business development plans.

Cybersecurity Policy and National Security

Governments worldwide are intensifying their focus on national cybersecurity resilience and safeguarding critical infrastructure. This heightened priority translates directly into substantial government investment in sophisticated security solutions and services. For DXC Technology, this presents a significant opportunity, given its established expertise in cybersecurity and cloud environments.

However, this political focus also brings increased scrutiny and the need to adapt to ever-changing compliance mandates. DXC must navigate a landscape shaped by policies dictating data breach notification and incident reporting protocols, directly influencing its operational strategies and service delivery.

- Government Cybersecurity Spending: Global government spending on cybersecurity is projected to reach $140 billion in 2024, with a significant portion allocated to critical infrastructure protection.

- Critical Infrastructure Protection Mandates: By 2025, many nations aim to have updated regulations for critical infrastructure cybersecurity, requiring advanced threat detection and response capabilities.

- Data Breach Notification Laws: Over 100 countries now have data breach notification laws, with penalties for non-compliance often tied to a company's revenue, impacting companies like DXC.

Digital Transformation Initiatives

Political agendas strongly favor digital transformation, with governments worldwide investing heavily in smart city development and e-governance platforms. For instance, the United States' Bipartisan Infrastructure Law, enacted in 2021, allocates significant funds towards modernizing public sector IT infrastructure, directly benefiting companies like DXC Technology. These initiatives create substantial opportunities for DXC's expertise in cloud migration, cybersecurity, and data analytics.

Government funding and strategic partnerships are crucial drivers for DXC. In 2024, many nations are expected to continue or even increase their digital spending. For example, the European Union's Digital Decade policy aims to enhance digital skills and infrastructure, potentially leading to major public sector contracts. However, shifts in political leadership or evolving policy priorities can introduce uncertainty regarding the continuity and scale of these digital transformation projects.

- Government Investment: Many governments are prioritizing digital infrastructure, with the US government alone planning to invest billions in federal IT modernization through 2025.

- Smart City Growth: Global smart city market is projected to reach over $2.5 trillion by 2026, indicating a strong political push for digitally integrated urban environments.

- E-Governance Expansion: Initiatives to digitize public services are widespread, with countries like India's Digital India program demonstrating a commitment to online government services.

- Policy Dependence: The success of DXC's public sector business is directly tied to the stability and continuation of government digital transformation policies.

Government IT spending remains a significant catalyst for DXC Technology, with nations in 2024 and 2025 prioritizing digital modernization and cybersecurity. The U.S. federal government, for instance, continues to invest billions in upgrading its IT infrastructure, creating substantial contract opportunities for service providers like DXC.

Shifting public sector procurement policies, particularly the emphasis on cloud migration and data analytics, directly impacts DXC's revenue streams and strategic partnerships. The move towards outcome-based contracts also necessitates adaptive service delivery models.

Political stability and a government's commitment to technology are crucial for DXC's predictable revenue. Geopolitical events in 2024 highlighted the need for secure government IT systems, favoring nations with stable environments and active technology support.

Global geopolitical tensions and protectionist policies can hinder DXC's operations by affecting hardware procurement and market access, potentially increasing costs and complicating international service delivery.

| Factor | 2024/2025 Trend | Impact on DXC Technology |

|---|---|---|

| Government IT Spending | Increased focus on digital transformation and cybersecurity | Directly drives contract opportunities and revenue growth |

| Procurement Policies | Shift towards cloud, data analytics, and outcome-based contracts | Requires adaptation in service offerings and partnership strategies |

| Geopolitical Stability | Heightened focus on national security and resilient IT systems | Favors stable political environments for long-term contracts |

| Trade Policies | Potential for protectionism and supply chain disruptions | Can increase operational costs and limit market access |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting DXC Technology, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making, identifying potential threats and opportunities arising from these external forces.

A concise PESTLE analysis for DXC Technology offers a clear overview of external factors, simplifying complex market dynamics for strategic decision-making and reducing the burden of extensive research.

Economic factors

Global economic growth is a critical factor for DXC Technology, as corporate IT spending is closely tied to a company's financial health and outlook. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a figure that, while steady, indicates a cautious environment where large-scale technology investments might be scrutinized.

Recession risks, however, remain a significant concern. Should major economies experience a downturn, DXC could face reduced IT budgets from clients, leading to project delays or renegotiated contracts. For instance, if key markets like North America or Europe enter a recession, it could directly impact DXC's revenue streams as businesses prioritize cost-saving measures over new technology implementations.

Conversely, robust economic expansion generally fuels demand for IT modernization and digital transformation services, which are core offerings for DXC. Strong growth in 2025, if it materializes, would likely translate into increased opportunities for DXC as companies look to leverage technology to enhance efficiency and competitiveness.

Rising inflation presents a significant challenge for DXC Technology, potentially increasing operational expenses like wages and technology procurement. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2023, impacting input costs across various sectors. DXC must strategically adjust its pricing to offset these rising costs and protect its profit margins.

Interest rate volatility directly affects DXC's cost of borrowing and the investment capacity of its clients. As central banks, like the US Federal Reserve, adjust rates to combat inflation, the cost of capital for large IT projects can fluctuate, influencing client spending decisions. This dynamic requires DXC to closely monitor macroeconomic trends and adapt its financial strategies.

The company's global operations expose it to currency exchange rate fluctuations. For example, a strengthening US dollar against other major currencies can reduce the reported revenue from international operations when translated back into USD, impacting overall financial performance. Managing this currency risk is crucial for DXC's consistent financial reporting.

DXC Technology's revenue is closely tied to the spending patterns within its core client industries. For instance, a slowdown in the financial services sector, which accounts for a significant portion of IT spending, can directly affect DXC's growth. In 2024, many financial institutions are expected to increase their IT budgets by 5-7% to focus on digital transformation and cybersecurity, but this can be volatile.

Similarly, the healthcare industry's adoption of new technologies, driven by factors like telehealth expansion and data analytics, presents opportunities. However, budget constraints or regulatory changes within healthcare can temper IT investment. Manufacturing sector spending, often linked to automation and supply chain digitization, also plays a crucial role. For example, the global manufacturing IT spending was projected to reach over $300 billion in 2024, a figure that directly impacts DXC's market potential.

DXC's strategy of serving a broad range of sectors, including public sector and insurance, helps to buffer against downturns in any single industry. This diversification means that while one sector might experience reduced IT spending, another could be in a growth phase, leading to more stable overall demand for DXC's services. This resilience is key in navigating the fluctuating economic landscapes of 2024 and 2025.

Labor Market Dynamics and Wage Inflation

The availability and cost of skilled IT professionals, especially in cloud, cybersecurity, and data analytics, are key economic drivers for DXC Technology. A constrained labor market or rising wages directly impact DXC's operational costs and its capacity to secure and keep top-tier talent, influencing service delivery expenses and market competitiveness.

In 2024, the global IT talent shortage remains a significant concern. For instance, reports from early 2024 indicated a persistent gap in cybersecurity professionals, with estimates suggesting millions of unfilled positions worldwide. This scarcity naturally drives up compensation expectations for these in-demand skills.

- Global IT Skills Gap: Cybersecurity roles, in particular, faced a significant shortfall in 2024, impacting recruitment costs for companies like DXC.

- Wage Inflation in Tech: Average salaries for cloud architects and data scientists saw continued upward pressure throughout 2024, reflecting high demand.

- Talent Retention Challenges: Companies are investing more in retention bonuses and enhanced benefits to combat the rising costs associated with replacing skilled IT staff.

- Impact on Service Pricing: Increased labor costs necessitate adjustments in pricing models for IT services to maintain profitability.

Outsourcing and Offshoring Trends

Global economic pressures continue to push companies toward outsourcing and offshoring IT services to manage costs, directly benefiting companies like DXC Technology. For instance, the global IT outsourcing market was valued at approximately $342.2 billion in 2023 and is projected to reach $526.2 billion by 2028, indicating sustained demand for these services.

However, economic nationalism and data sovereignty concerns can create headwinds. A 2024 survey by Statista revealed that 45% of businesses cite data security and privacy as a top concern when considering offshoring, potentially impacting the appeal of certain outsourcing models.

The economic viability for clients remains paramount. DXC’s growth is intrinsically linked to its clients’ ability to realize cost savings and efficiency gains through these arrangements. Factors such as currency fluctuations and the total cost of ownership for outsourced services directly influence client demand.

- Market Growth: The global IT outsourcing market is expected to grow significantly, reaching an estimated $526.2 billion by 2028.

- Client Concerns: Data security and privacy are major deterrents for offshoring, with 45% of businesses expressing these concerns in 2024.

- Economic Viability: Client demand for outsourcing services is heavily influenced by the demonstrable economic benefits and total cost of ownership.

Global economic growth directly influences DXC Technology's revenue, as IT spending often scales with corporate financial health. The IMF projected global growth at 3.2% for 2024, suggesting a steady but cautious investment climate. Conversely, economic downturns or recession risks in key markets could lead to reduced IT budgets and project delays for DXC.

Inflationary pressures, like the notable CPI increases seen in 2023, can raise DXC's operational costs, necessitating strategic pricing adjustments. Interest rate volatility also impacts borrowing costs and client investment capacity, requiring DXC to monitor central bank policies closely.

DXC's revenue is sensitive to sector-specific IT spending. While financial services and manufacturing IT spending showed projected growth in 2024, budget constraints or regulatory shifts in industries like healthcare can create volatility. Diversification across sectors, including public sector and insurance, provides a buffer against single-industry downturns.

The IT talent market presents both opportunities and challenges. A global IT skills gap, particularly in cybersecurity, drove wage inflation for specialized roles in 2024, increasing DXC's labor costs. Companies are investing more in talent retention, which can impact service pricing models.

Economic trends favor IT outsourcing, with the global market projected for significant growth. However, data sovereignty concerns and economic nationalism can influence offshoring decisions, with 45% of businesses citing data security as a top concern in 2024. DXC's success hinges on clients realizing demonstrable economic benefits and managing total cost of ownership.

| Economic Factor | 2024/2025 Outlook | Impact on DXC Technology |

|---|---|---|

| Global Economic Growth | Projected 3.2% in 2024 (IMF) | Steady demand, but cautious IT spending; downturns risk reduced budgets. |

| Inflation | Elevated in 2023, impacting input costs | Increased operational expenses (wages, procurement); requires pricing adjustments. |

| Interest Rates | Volatile, influenced by central bank policy | Affects cost of borrowing and client investment capacity for IT projects. |

| IT Sector Spending | Financial Services: 5-7% budget increase projected (2024); Manufacturing: Over $300B market (2024) | Directly influences DXC's opportunities; sector-specific slowdowns pose risks. |

| IT Talent Market | Persistent skills gap (e.g., cybersecurity); wage inflation | Higher labor costs, increased talent retention investment, impacts service pricing. |

| Outsourcing Market | Valued at $342.2B (2023), projected $526.2B by 2028 | Favorable trend for DXC, but data sovereignty concerns can be a headwind. |

Preview Before You Purchase

DXC Technology PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive DXC Technology PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to actionable insights upon purchase.

Sociological factors

The surge in remote and hybrid work models, a significant sociological shift, directly fuels demand for robust IT infrastructure. Companies are investing heavily in cloud solutions and digital workplace tools to support distributed teams, creating opportunities for IT service providers like DXC Technology. A 2024 survey indicated that 62% of companies globally are operating with a hybrid work model, up from 45% in 2023.

This transformation impacts DXC's client engagement by increasing the need for services focused on secure remote access, collaboration platforms, and end-user computing. Furthermore, DXC must adapt its own workforce strategies, embracing flexible work arrangements to attract and retain talent in this evolving employment landscape, mirroring the broader societal trend.

The increasing demand for digital transformation across all sectors means companies like DXC need a workforce proficient in advanced technologies. A significant portion of the global workforce still faces a digital literacy gap; for instance, a 2024 report indicated that over 40% of workers globally lack the essential digital skills needed for current job market demands.

As clients pursue their own digital transformations, they increasingly require employees to acquire new competencies. This creates a market for training and change management services, areas where DXC can either offer solutions or face challenges if their clients' workforces aren't adequately prepared. The availability of skilled digital talent in the wider market directly impacts DXC's capacity to undertake and successfully deliver complex, technology-driven projects.

Consumers today demand intuitive, personalized, and secure digital interactions, a trend accelerating the need for businesses to upgrade their online presence. This societal shift directly fuels demand for DXC Technology's expertise in modernizing customer-facing applications and data systems.

For instance, a 2024 report indicated that over 70% of consumers are likely to switch brands if they have a poor digital experience, highlighting the urgency for companies to invest in IT modernization. This creates a robust market for DXC's analytics and optimization services as clients aim to meet these elevated expectations and avoid losing market share.

Data Privacy Concerns and Trust in Technology

Public awareness around data privacy is intensifying, with a significant majority of consumers expressing concerns about how their personal information is handled. For instance, a 2024 survey indicated that over 75% of individuals are worried about data breaches and the misuse of their data. This societal shift directly impacts businesses, creating a greater need for secure data management and robust cybersecurity protocols, areas where DXC Technology offers critical solutions.

The ethical implications of technologies like artificial intelligence are also a major societal consideration, influencing consumer trust and regulatory landscapes. As more companies adopt AI, the demand for transparent and responsible AI deployment grows. This trend positions DXC's expertise in data governance and ethical tech implementation as increasingly valuable, helping clients navigate these complex issues and maintain stakeholder confidence.

Businesses are increasingly recognizing that compliance with data privacy regulations, such as GDPR and CCPA, is not merely a legal obligation but a crucial element of their brand reputation. A data breach or a perceived lack of data stewardship can lead to significant financial penalties and severe damage to customer loyalty. DXC's role in helping organizations achieve and maintain compliance is therefore paramount for their long-term success and trustworthiness.

- Growing Public Concern: Over 75% of consumers express worry about data privacy and security breaches in 2024.

- AI Ethics Demand: Societal focus on ethical AI is driving demand for responsible data handling solutions.

- Reputational Imperative: Data privacy compliance is now seen as vital for brand trust and customer retention.

- Market Opportunity: This heightened awareness creates a significant market for DXC's cybersecurity and data governance services.

Corporate Social Responsibility (CSR) and ESG Focus

Societal pressure for robust Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) practices is increasingly influencing the IT services sector, directly impacting DXC Technology. Clients are actively seeking partners whose values and operations align with their own sustainability objectives, making ESG performance a critical factor in procurement decisions.

This trend significantly affects DXC's ability to attract and retain top talent, as employees, particularly younger generations, prioritize working for organizations with a strong social conscience. For instance, a 2024 survey indicated that over 70% of millennials consider a company's social and environmental impact when choosing an employer.

DXC's commitment to ESG is therefore not just about ethical conduct but also a strategic imperative for business growth and competitiveness. Companies that demonstrate tangible progress in areas like reducing their carbon footprint or promoting diversity and inclusion are likely to gain a competitive edge. In 2023, DXC reported a 15% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, a move that resonates with ESG-conscious clients.

- Growing Client Demand: An increasing number of enterprise clients are incorporating ESG criteria into their vendor selection processes, potentially favoring IT partners with proven sustainability track records.

- Talent Acquisition Advantage: Companies with strong ESG commitments, like DXC's focus on diversity and inclusion, are better positioned to attract and retain skilled professionals in a competitive labor market.

- Reputational Enhancement: Demonstrating genuine commitment to social responsibility and ethical governance can bolster DXC's brand image and build trust with stakeholders.

- Risk Mitigation: Proactive management of ESG issues can help DXC avoid potential regulatory penalties, supply chain disruptions, and reputational damage.

Societal expectations for seamless digital interactions are intensifying, with consumers increasingly prioritizing intuitive and personalized online experiences. This trend directly drives demand for DXC Technology's expertise in modernizing customer-facing applications and data systems, as a poor digital experience can lead to significant customer churn. For instance, over 70% of consumers in 2024 indicated they would switch brands after a negative digital encounter, underscoring the market opportunity for DXC's optimization services.

Technological factors

Cloud computing continues its rapid evolution, with public, private, and hybrid models becoming increasingly sophisticated. This technological advancement is a key driver for DXC Technology, as clients look to leverage these platforms for greater scalability and efficiency.

DXC's core business revolves around assisting clients with cloud migration, optimization, and ensuring robust security on these platforms. For instance, the global cloud computing market was valued at approximately $610 billion in 2023 and is projected to reach over $1.3 trillion by 2028, highlighting the immense opportunity and DXC's strategic positioning.

The growing trend towards multi-cloud strategies presents complex integration challenges for businesses. DXC is well-positioned to address these complexities, offering solutions that enable seamless interoperability between various cloud environments, a critical need as organizations diversify their cloud infrastructure.

DXC Technology is actively integrating Artificial Intelligence (AI) and Machine Learning (ML) to transform its operations and client offerings. The company is seeing significant growth in AI adoption across various business functions, driving efficiency and enabling advanced analytics. For instance, DXC's AI-powered solutions are being used by clients to gain deeper business intelligence and significantly improve customer experiences.

The company's own service delivery is being enhanced through AI, with applications in areas like IT automation and predictive maintenance. This internal adoption allows DXC to operate more efficiently and offer more sophisticated services to its clientele. The global AI market is projected to reach $1.8 trillion by 2030, highlighting the immense opportunity for companies like DXC that are investing in these technologies.

Cyber threats are becoming more complex and frequent, forcing companies like DXC Technology to constantly improve their security offerings. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the immense pressure on businesses to protect their data and systems. This technological reality directly fuels DXC's emphasis on enterprise security, as clients demand robust defenses against evolving attack methods.

The continuous emergence of new ways for attackers to breach systems means cybersecurity providers must innovate rapidly. For instance, the rise of AI-powered attacks in 2024 presents a significant challenge, requiring equally advanced AI-driven defense mechanisms. DXC's investment in advanced threat detection and response capabilities is a direct response to these evolving technological landscapes, ensuring they can offer cutting-edge protection to their clients.

Data Analytics and Business Intelligence Advancements

The sheer volume of data being generated globally is staggering, with projections indicating a continued exponential rise. Businesses are increasingly recognizing that raw data holds little value without sophisticated analysis. Advanced analytics and business intelligence tools are no longer optional but essential for competitive advantage, enabling deeper insights into customer behavior, operational efficiency, and market trends. This surge in data-driven decision-making directly fuels the demand for IT services that can manage, process, and interpret this information effectively.

DXC Technology is well-positioned to capitalize on this trend by assisting clients in building robust data architectures and implementing analytics solutions that translate into tangible business outcomes. Their expertise in areas like cloud data warehousing, data lakes, and AI-powered analytics allows them to help organizations unlock the full potential of their data assets. For instance, by optimizing data pipelines, DXC enables clients to move from reactive reporting to proactive, predictive strategies.

The market for specialized IT services focused on data analytics is experiencing robust growth. Key areas of demand include:

- Real-time analytics: Enabling immediate insights for time-sensitive decisions, crucial in sectors like finance and retail.

- Big data processing: Handling massive datasets efficiently, often involving distributed computing frameworks.

- Predictive modeling: Utilizing machine learning and statistical techniques to forecast future outcomes and identify opportunities or risks.

- Data visualization and dashboarding: Presenting complex data in an easily understandable format for various stakeholders.

Emerging Technologies (e.g., Quantum Computing, Edge AI)

Emerging technologies like quantum computing and advanced edge AI are poised to reshape the IT services sector. While still in early stages, their potential impact on data processing, security, and operational efficiency is significant. For instance, the quantum computing market is projected to reach $1.1 billion by 2027, indicating substantial future investment and development.

DXC Technology needs to actively track these advancements to understand how they might disrupt existing IT infrastructures and client needs. Strategic investment in research and development, or forming partnerships with leading innovators in these fields, will be crucial for staying competitive. Early engagement could allow DXC to integrate these powerful new capabilities into its service portfolio, offering clients cutting-edge solutions.

- Quantum Computing Market Growth: Expected to reach $1.1 billion by 2027, highlighting significant investment and potential.

- Edge AI Adoption: Growing adoption in sectors like manufacturing and retail for real-time data analysis and decision-making.

- Blockchain Integration: Continued exploration for secure data management and supply chain solutions within enterprise IT.

The relentless advancement of cloud computing, encompassing public, private, and hybrid models, significantly impacts DXC Technology. Clients increasingly rely on these platforms for scalability and efficiency, driving demand for DXC's migration, optimization, and security services. The global cloud computing market, valued at roughly $610 billion in 2023, is expected to exceed $1.3 trillion by 2028, underscoring the vast opportunities.

Legal factors

The increasing global prevalence of data privacy regulations like GDPR and CCPA/CPRA presents a significant operational challenge for DXC Technology. These laws mandate strict data handling, consent management, and breach notification protocols, directly affecting how DXC designs and implements its IT solutions for clients. Failure to adhere to these complex requirements can result in substantial financial penalties, impacting revenue and reputation.

Intellectual property (IP) laws are paramount for DXC Technology, safeguarding its proprietary software, service delivery methodologies, and client data. Failure to comply with complex software licensing agreements, especially concerning open-source components, can result in substantial penalties and operational disruptions. In 2023, the IT services sector saw a notable increase in IP-related litigation, underscoring the importance of robust legal frameworks for companies like DXC.

DXC Technology's operations are heavily influenced by contract law, as its business model relies on intricate service agreements with a global client base. These contracts define the scope of services, performance metrics, and liabilities, making meticulous legal drafting and enforcement paramount.

Service Level Agreements (SLAs) are particularly critical, outlining specific performance standards that DXC must meet. For instance, in 2024, IT outsourcing contracts often include stringent uptime guarantees, response times for issue resolution, and data security protocols, with penalties for non-compliance.

Failure to adhere to contractual obligations or meet SLA targets can lead to significant financial repercussions for DXC, including liquidated damages and potential loss of future business. In 2023, the IT services sector saw numerous disputes arising from unmet SLAs, highlighting the financial and reputational risks involved.

Antitrust and Competition Laws

DXC Technology, as a significant global IT services provider, operates under stringent antitrust and competition laws across numerous countries. These regulations are designed to foster fair market competition by scrutinizing activities such as mergers, acquisitions, pricing strategies, and overall market behavior to prevent monopolistic practices. For instance, the European Union's competition law, enforced by the European Commission, actively monitors large-scale M&A deals in the tech sector, requiring thorough reviews to ensure no single company gains undue market dominance.

Compliance with these legal frameworks is crucial for DXC to avoid significant penalties, including hefty fines and reputational damage. In 2024, regulatory bodies worldwide continued to focus on the tech industry's market power. For example, the US Department of Justice and the Federal Trade Commission have been increasingly active in reviewing technology mergers, with a particular emphasis on ensuring that acquisitions do not stifle innovation or harm consumers. DXC's adherence to these evolving regulations is paramount for its continued operations and market standing.

Key aspects of antitrust and competition law relevant to DXC include:

- Merger Control: Scrutiny of acquisitions to prevent undue market concentration.

- Anti-competitive Agreements: Prohibition of price-fixing, market allocation, and other collusive behaviors.

- Abuse of Dominance: Preventing companies with significant market power from exploiting their position.

- Regulatory Investigations: Potential for investigations and fines from bodies like the FTC, DOJ, and the European Commission for non-compliance.

Cybersecurity and Data Breach Notification Laws

DXC Technology operates within a landscape of increasingly stringent cybersecurity and data breach notification laws. Beyond general data privacy, specific regulations mandate robust security standards and prompt reporting of breaches. For instance, the California Consumer Privacy Act (CCPA) and its subsequent amendments, like the California Privacy Rights Act (CPRA), impose significant obligations on businesses handling personal data, with potential fines for non-compliance. Similarly, the EU's General Data Protection Regulation (GDPR) requires notification of data breaches to supervisory authorities within 72 hours of becoming aware of them, with substantial penalties for violations.

DXC must ensure its security services and internal protocols not only meet these evolving legal requirements but also assist clients in navigating their own reporting obligations. This includes staying abreast of jurisdictional differences, such as the varying breach notification thresholds and timelines across U.S. states. Failure to promptly and accurately report breaches, as demonstrated by past regulatory actions against companies for delayed or inadequate disclosures, can lead to significant legal penalties, including hefty fines, and severe reputational damage.

Key legal considerations for DXC include:

- Compliance with GDPR and CCPA/CPRA: Ensuring adherence to data breach notification timelines and reporting requirements in key operating regions.

- State-Specific Breach Laws: Navigating the patchwork of U.S. state laws, many of which have specific requirements for notification content and timing following a data breach.

- Client Service Obligations: Providing services that help clients meet their own legal obligations for data breach reporting and remediation.

- Contractual Liabilities: Managing contractual obligations with clients regarding data security and breach notification, which can carry significant financial implications.

DXC Technology's global operations necessitate strict adherence to a complex web of international and national laws, impacting everything from data handling to market conduct. Failure to comply with evolving data privacy regulations like GDPR and CCPA/CPRA, for instance, can result in substantial fines, as seen in the IT sector where penalties for breaches can reach millions. Contractual obligations, particularly Service Level Agreements (SLAs), are critical, with non-compliance potentially leading to financial penalties and loss of business, a risk highlighted by numerous IT outsourcing disputes in 2023 and 2024.

Environmental factors

Data centers and IT operations are significant energy consumers, directly impacting a company's carbon footprint. DXC Technology, like its peers, is under pressure to mitigate this environmental impact. This involves investing in energy-efficient infrastructure and exploring renewable energy sources for its operations.

The global IT industry's carbon footprint is substantial, with data centers accounting for a significant portion of this. For instance, by 2025, global data center energy consumption is projected to reach approximately 1.8% of total global electricity demand, according to some industry estimates. DXC Technology must therefore focus on optimizing its data center designs and adopting greener technologies to reduce its emissions.

Clients are increasingly evaluating their IT service providers based on environmental performance. This means DXC Technology's commitment to sustainability, including its efforts to reduce its carbon footprint through energy efficiency and renewable energy procurement, is becoming a key differentiator and a critical factor in client decision-making.

The growing volume of electronic waste, or e-waste, from IT hardware presents a substantial environmental hurdle. DXC Technology needs to adopt sustainable methods for handling this waste, such as responsible recycling and refurbishment, and championing a circular economy model in its own business and for its customers.

Global e-waste generation is projected to reach 74 million metric tons by 2030, a significant increase from the 53.6 million metric tons recorded in 2019. This trend underscores the urgency for companies like DXC to implement robust e-waste management strategies.

Furthermore, regulatory frameworks are evolving, with a growing emphasis on extended producer responsibility, compelling manufacturers and service providers to take greater accountability for the end-of-life management of their products.

The physical impacts of climate change, like more frequent extreme weather events, pose a direct threat to DXC Technology's data centers and IT infrastructure, potentially disrupting its service delivery. For instance, a severe hurricane in 2024 caused widespread power outages impacting major tech hubs, highlighting the vulnerability of concentrated IT assets.

To counter this, DXC must embed climate resilience into its core operational planning. This includes robust disaster recovery strategies and strategically diversifying its infrastructure geographically to mitigate the impact of localized climate events. As of late 2024, DXC announced a significant investment in distributed cloud infrastructure, partly driven by these resilience concerns.

Furthermore, DXC has an opportunity to assist its clients in building more resilient IT systems. By offering solutions that can withstand climate-related disruptions, DXC not only strengthens its own service but also provides critical value to businesses facing similar environmental challenges.

Sustainability Reporting and Transparency

Stakeholders are increasingly demanding greater transparency regarding DXC Technology's environmental impact, pushing for comprehensive sustainability reporting. This includes clear disclosure of environmental policies, specific targets for emissions reduction, and progress in managing resources efficiently.

For instance, DXC aims to achieve net-zero greenhouse gas emissions by 2040, with interim targets. Their 2023 sustainability report highlighted a 20% reduction in Scope 1 and 2 emissions compared to their 2020 baseline. This commitment is vital for bolstering investor confidence, attracting environmentally conscious talent, and meeting client expectations for responsible corporate citizenship.

- Emissions Reduction: DXC targets net-zero emissions by 2040.

- Resource Management: Focus on efficient water and waste management.

- Transparency: Regular reporting on environmental performance metrics.

- Investor Confidence: Sustainability data influences investment decisions.

Client Demand for Green IT Solutions

Clients are increasingly making purchasing decisions based on sustainability, actively searching for IT service providers offering green IT solutions that lessen environmental impact. This trend is a significant driver for companies like DXC Technology to innovate and market eco-friendly services.

DXC is responding by developing and promoting services such as cloud optimization, which significantly reduces energy consumption, and solutions that empower clients to monitor their own environmental performance metrics. For instance, a focus on energy-efficient data center operations and lifecycle management of IT assets are key components of their green IT strategy.

Meeting this growing client demand for sustainability can translate directly into a competitive advantage in the IT services market. Companies demonstrating a strong commitment to environmental responsibility are often favored by large enterprises and government bodies, particularly as ESG (Environmental, Social, and Governance) criteria become more integrated into procurement processes. In 2024, a significant percentage of major corporations reported that sustainability was a key factor in their vendor selection.

- Growing Client Prioritization: Over 60% of large enterprises surveyed in late 2024 indicated that sustainability was a key factor in IT vendor selection.

- DXC's Green IT Focus: DXC Technology actively promotes cloud optimization and energy-efficient data center solutions to meet this demand.

- Competitive Advantage: Demonstrating strong ESG performance can lead to increased market share and preferred vendor status.

DXC Technology faces increasing pressure to reduce its environmental footprint, particularly concerning energy consumption in data centers and the management of electronic waste. The company is investing in energy efficiency and renewable energy sources to mitigate these impacts. By 2025, global data center energy consumption is expected to be around 1.8% of total global electricity demand, highlighting the scale of this challenge.

Climate change also presents operational risks, with extreme weather events threatening IT infrastructure. DXC is enhancing its resilience through geographically diversified infrastructure and disaster recovery planning, as evidenced by its late 2024 investment in distributed cloud. Furthermore, the company is committed to transparency, aiming for net-zero emissions by 2040 and reporting a 20% reduction in Scope 1 and 2 emissions by 2023 from a 2020 baseline.

Client demand for sustainable IT solutions is a significant market driver, with over 60% of large enterprises in late 2024 considering sustainability a key factor in IT vendor selection. DXC is capitalizing on this by offering services like cloud optimization and promoting energy-efficient data center operations, positioning itself for a competitive advantage in the green IT market.

| Environmental Factor | DXC's Response/Impact | Key Data/Trend |

| Energy Consumption & Carbon Footprint | Investing in energy efficiency, renewable energy, optimizing data centers. | Global data center energy consumption projected at 1.8% of global electricity demand by 2025. |

| Electronic Waste (E-waste) | Adopting responsible recycling, refurbishment, and circular economy models. | Global e-waste projected to reach 74 million metric tons by 2030 (up from 53.6 million in 2019). |

| Climate Change Resilience | Embedding climate resilience, diversifying infrastructure, disaster recovery. | Late 2024 investment in distributed cloud infrastructure. |

| Sustainability Reporting & Transparency | Committing to net-zero by 2040, reporting emissions reductions. | 20% reduction in Scope 1 & 2 emissions by 2023 (vs. 2020 baseline). |

| Client Demand for Green IT | Developing and promoting cloud optimization, energy-efficient solutions. | Over 60% of large enterprises consider sustainability in IT vendor selection (late 2024). |

PESTLE Analysis Data Sources

Our DXC Technology PESTLE analysis is built on a robust foundation of data from leading global economic institutions, government publications, and respected industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are current and fact-based.