DXC Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DXC Technology Bundle

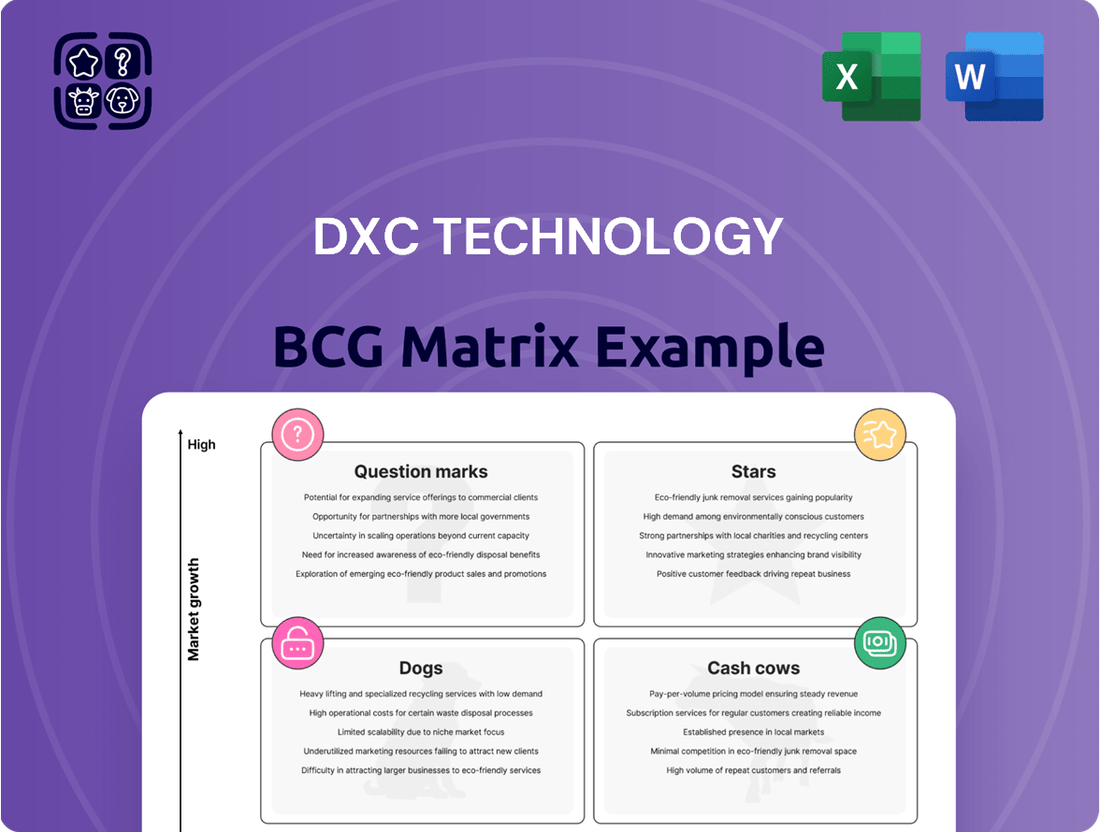

Curious about DXC Technology's strategic positioning? Our BCG Matrix analysis offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the complete picture; purchase the full report for actionable insights and a clear roadmap for optimizing their market presence.

Stars

DXC Technology is making substantial investments in AI and Generative AI, aiming to differentiate itself in the IT services landscape by offering AI-infused solutions. The company's strategic focus on these advanced technologies positions it to capitalize on the rapidly expanding global AI IT services market, which is expected to see considerable growth in the coming years.

DXC's AI Impact solution is specifically designed to deliver tangible benefits through practical AI applications, enhancing operational efficiency and driving improved business outcomes for clients across diverse industries. This proactive approach underscores DXC's commitment to leveraging AI for real-world impact and value creation.

DXC Technology's strategic partnership with Amazon Web Services (AWS) is a prime example of a 'Star' in the BCG Matrix, signifying high market growth and a strong competitive position. This collaboration is designed to accelerate cloud adoption and digital transformation for a substantial customer base, numbering close to 1,000 clients.

By integrating AWS's advanced generative AI, analytics, and machine learning capabilities, DXC is facilitating the migration of critical enterprise systems to the cloud. This move is crucial for modernizing operations and unlocking new efficiencies for their customers.

The objective is to fundamentally shift DXC's service delivery model towards a cloud-centric approach, directly capitalizing on the escalating demand for hybrid cloud solutions. This strategic alignment positions DXC favorably within a rapidly expanding market segment.

DXC Technology is positioned as a Leader in the digital workplace services sector, a testament to their strong market presence and forward-thinking strategy. Their recognition by Gartner in the 2024 and 2025 Magic Quadrant for Outsourced Digital Workplace Services underscores their commitment to innovation and client success in delivering modern workplace solutions.

The company's comprehensive vision and execution capabilities are evident in their DXC UPtime™ platform. This platform supports key areas such as modern device management, intelligent collaboration, and workplace asset management, driving efficiency and user experience for businesses navigating the evolving digital landscape.

Data & Analytics Offerings

DXC Technology's Data & AI offerings are designed to help clients transform their data into a strategic advantage. The company's capabilities in this area are underscored by its recognition as a Leader in ISG's Provider Lens™ Snowflake Ecosystem Partners 2025 study. This acknowledgment highlights DXC's expertise across critical segments such as data-centric strategy and GenAI-led transformations.

The IT services market is seeing significant growth driven by the widespread adoption of AI-driven automation and advanced analytics. DXC is well-positioned to capitalize on this trend, assisting businesses in streamlining complex processes like data migrations. This focus on leveraging data effectively is a key differentiator for DXC in the evolving digital landscape.

- Data Monetization: DXC helps organizations unlock the value of their data assets, turning them into competitive differentiators.

- AI and GenAI Integration: The company leads in GenAI-led transformations, enabling businesses to harness generative AI for innovation.

- Snowflake Ecosystem Leadership: Recognized by ISG for expertise in the Snowflake ecosystem, covering data strategy and migration.

- Market Growth Driver: DXC's advanced analytics and automation solutions align with the increasing demand in the IT services sector.

Consulting & Engineering Services

DXC Technology's Consulting & Engineering Services (CES) division is strategically repositioning itself to capitalize on the burgeoning AI market. Under new leadership, the focus is on accelerating enterprise-wide modernization projects, with a particular emphasis on AI adoption and application modernization for clients.

The division boasts a substantial workforce of 50,000 engineers and consultants. This extensive talent pool is being directed towards specialized areas within AI-driven application modernization and data analytics, segments anticipated to experience robust growth in the coming years.

DXC's CES is targeting a market projected for significant expansion, aiming to leverage its expertise in niche AI applications. This strategic pivot is designed to meet the increasing demand for advanced data analytics and AI-enhanced solutions.

- Workforce: 50,000 engineers and consultants.

- Strategic Focus: Accelerating AI adoption and application modernization.

- Market Niche: Niche AI-driven application modernization and data analytics.

- Growth Expectation: Targeting a market forecasted for significant growth.

DXC Technology's strategic partnerships, particularly with AWS, and its leadership in digital workplace services and Data & AI offerings clearly position them as Stars in the BCG Matrix. These areas exhibit high market growth and strong competitive positioning for DXC. The company's significant investment in AI and Generative AI, coupled with its robust consulting and engineering capabilities, further solidifies its Star status by addressing high-growth market segments.

| Business Area | BCG Category | Market Growth | Competitive Position | Key Initiatives/Indicators |

|---|---|---|---|---|

| AWS Partnership & Cloud Services | Star | High (Digital Transformation, Hybrid Cloud) | Strong (1,000+ clients, accelerating migration) | Generative AI, Analytics, ML integration; Cloud-centric delivery model |

| Digital Workplace Services | Star | High (Modern Workplace Solutions) | Leader (Gartner Magic Quadrant 2024-2025) | DXC UPtime™ platform, device management, collaboration |

| Data & AI Offerings | Star | High (AI Automation, Advanced Analytics) | Leader (ISG Provider Lens™ Snowflake Ecosystem Partners 2025) | Data monetization, GenAI-led transformations, Snowflake expertise |

| Consulting & Engineering Services (AI Focus) | Star | High (AI Adoption, Application Modernization) | Strong (50,000 engineers, niche AI applications) | Enterprise modernization, AI-driven modernization, data analytics |

What is included in the product

The DXC Technology BCG Matrix provides strategic insights into its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

DXC's BCG Matrix provides a clear, one-page overview of business unit performance, relieving the pain of complex strategic analysis.

Cash Cows

Despite some revenue shifts within its Global Infrastructure Services (GIS), DXC Technology's traditional IT Outsourcing (ITO) and managed services remain a significant revenue driver. These offerings are crucial for maintaining the mission-critical systems of large global enterprises and public sector entities.

This segment is characterized by its stability and consistent cash generation, largely due to the long-term contracts and deep-rooted client relationships it enjoys. While the growth rate might be modest, the predictable revenue stream makes it a reliable cash cow for DXC.

For the fiscal year ending March 31, 2024, DXC reported total revenue of $14.5 billion. While specific segment breakdowns for traditional ITO and managed services aren't explicitly detailed in high-level summaries, the company's ongoing focus on these core offerings underscores their importance to its financial health.

DXC Technology's consistent free cash flow generation is a key indicator of its strength. The company achieved over $700 million in free cash flow for three consecutive years, concluding with fiscal year 2024. For fiscal year 2025, DXC reported $687 million in free cash flow.

This robust cash flow provides DXC with significant financial flexibility. It allows the company to effectively manage its debt obligations and pursue strategic investments. Such consistent cash generation is vital for funding new initiatives and ensuring overall financial stability.

DXC Technology's Global Business Services (GBS) segment, despite a slight organic revenue dip, stands out for its robust profitability, achieving higher profit margins than the GIS segment. This financial strength, driven by its consulting, applications, and industry-specific software offerings, underscores GBS's crucial role in DXC's overall financial health.

In fiscal year 2024, GBS revenue demonstrated resilience, remaining nearly flat or experiencing a minimal decline. This stability in a mature market suggests a solid, established market position for DXC's GBS operations.

Insurance Software and BPS

DXC Technology's Insurance Software and Business Process Services (BPS) division demonstrates a robust position, characterized by consistent revenue growth in recent fiscal periods. For instance, DXC reported a revenue of $14.5 billion for the fiscal year ending March 31, 2024, with its insurance segment contributing significantly to this performance. This segment benefits from deeply entrenched intellectual property and long-standing client partnerships within the insurance sector, ensuring a stable and predictable revenue stream.

The stability and specialized nature of DXC's Insurance Software and BPS operations translate into reliable cash flows, solidifying its status as a cash cow within the company's broader portfolio. This segment’s consistent performance is a testament to its mature market position and ability to generate substantial returns without requiring significant new investment.

- Revenue Growth: DXC's insurance segment has exhibited positive revenue trends in recent fiscal years, indicating sustained market demand.

- Established IP and Client Base: The division leverages its existing intellectual property and strong relationships within the insurance industry.

- Stable Cash Flows: The specialized and mature nature of these services generates consistent and predictable cash flows for DXC.

- Strategic Importance: This segment acts as a reliable contributor to DXC's overall financial health, supporting other business areas.

European Public Sector Engagements

DXC Technology's European Public Sector Engagements are a clear Cash Cow. The company was recognized as the top performer in the Public Sector within Whitelane Research's 2024/2025 European IT Sourcing Study, boasting an impressive 84% customer satisfaction score.

This leading position in a mature market, coupled with high customer satisfaction, signals a stable and dominant presence. Such strong relationships with government entities typically translate into reliable, predictable revenue streams, solidifying its Cash Cow status.

- Leading Market Position: Ranked first in European Public Sector IT Sourcing by Whitelane Research (2024/2025).

- High Customer Satisfaction: Achieved an 84% customer satisfaction score in the European Public Sector.

- Stable Revenue: Long-standing government relationships provide predictable income.

- Mature Market Dominance: High market share in a well-established sector.

DXC Technology's traditional IT Outsourcing and managed services are foundational cash cows, providing stable revenue through long-term enterprise contracts. The company's consistent free cash flow generation, exceeding $700 million for three consecutive years ending fiscal year 2024 and reporting $687 million in fiscal year 2025, highlights the reliability of these mature offerings. This financial strength allows for debt management and strategic investments, underscoring their importance to DXC's overall stability.

| Segment | Fiscal Year 2024 Revenue (Approx.) | Key Characteristics | Cash Flow Contribution |

|---|---|---|---|

| Traditional ITO & Managed Services | Significant portion of $14.5B total revenue | Long-term contracts, mission-critical systems, stable demand | Consistent and predictable |

| Global Business Services (GBS) | Near flat or minimal decline | Robust profitability, established market position | Strong profit margins |

| Insurance Software & BPS | Significant contributor to $14.5B total revenue | Deep IP, long-term client partnerships, mature market | Reliable and substantial |

| European Public Sector Engagements | Not explicitly broken out, but dominant | Top performer (Whitelane 2024/2025), 84% satisfaction | Stable and predictable |

Delivered as Shown

DXC Technology BCG Matrix

The DXC Technology BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professional, ready-to-use strategic analysis. The insights and structure presented here are precisely what you'll download, allowing for immediate application in your business planning or client presentations.

Dogs

DXC Technology's legacy IT Outsourcing (ITO) is a prime example of a declining sub-segment within their portfolio. These are the older, more traditional IT services that are being phased out as businesses modernize. Think of things like managing outdated hardware or very basic helpdesk functions. These services often have limited growth potential and are seeing their market share shrink as clients move to cloud-based solutions and more advanced technologies.

The company's Global Infrastructure Services (GIS) segment, which encompasses many of these legacy ITO offerings, has consistently experienced organic revenue declines. For instance, in the fiscal year ending March 31, 2023, DXC reported a decline in its GIS segment. This trend continued into the fiscal year ending March 31, 2024, with further reported revenue contractions in this area, highlighting the ongoing challenge of these older service lines.

DXC Technology's portfolio includes commoditized services that don't directly support its strategic push into cloud, AI, and digital transformation. These offerings often struggle with differentiation and face significant price competition, impacting their profitability. For instance, legacy IT infrastructure management or basic application maintenance, while necessary, might not drive the high-margin growth DXC seeks.

The company's history shows a pattern of divesting businesses that fit this non-strategic, commoditized profile. In 2021, DXC completed the sale of its healthcare provider business for $5 billion, a move aimed at shedding lower-growth, lower-share assets to sharpen its focus. This strategic pruning is crucial for concentrating resources on higher-value, future-oriented services.

While DXC Technology is a recognized leader in Outsourced Digital Workplace Services, some older contracts and specific components within their Modern Workplace portfolio are showing signs of underperformance. These legacy areas may be facing challenges in adapting to the rapid evolution of digital work environments, leading to a decline in market share and profitability.

For instance, in Q4 2023, DXC's overall revenue saw a slight dip, and while not exclusively attributed to the Modern Workplace, these underperforming segments likely contributed to this trend. These components might require significant resources for maintenance and updates without generating commensurate returns or contributing to DXC's strategic growth objectives in the current market.

Inefficient Legacy Data Center Operations

DXC Technology's strategy centers on assisting clients in migrating away from outdated data center infrastructure. This includes plans to divest some of its own legacy data centers, indicating these operations are often characterized by low growth and slim profit margins, acting as a financial burden.

The company's focus on exiting these aging facilities suggests a strategic move to shed assets that hinder profitability and impede future expansion. For instance, in fiscal year 2024, DXC continued its portfolio rationalization efforts, which would include legacy data center assets.

- Legacy Data Centers as a Drag: Operations within aging data centers often incur high maintenance costs and offer limited scalability, impacting overall financial performance.

- Strategic Divestment: DXC's planned divestitures of its own legacy data centers highlight a commitment to streamlining operations and focusing on more profitable, forward-looking services.

- Focus on Modernization: The company's core strategy involves enabling customers to transition to modern, cloud-based environments, leaving behind the inefficiencies of legacy systems.

Specific Applications with Limited Growth

Certain older or niche application services within DXC Technology's portfolio may be in markets experiencing minimal growth, capping their expansion potential. These legacy systems, while part of the higher-margin applications segment within Global Business Services (GBS), could be yielding low returns.

Maintaining these specific legacy applications might demand considerable resources for a limited strategic advantage. For instance, if a particular application is used by a shrinking customer base or supports a declining industry, the investment in its upkeep might not align with future growth objectives. DXC's 2024 financial reports, while not detailing specific application performance, indicate a continued focus on modernizing its service offerings to capture higher-growth areas.

- Low Market Growth: These services operate in mature or declining sectors, restricting revenue expansion opportunities.

- Disproportionate Maintenance Costs: The effort and expense to keep legacy applications running may outweigh the financial benefits.

- Limited Strategic Value: Their contribution to DXC's overall competitive advantage or future market positioning is minimal.

- Potential for Divestment or Sunset: Such services might be candidates for divestiture or planned discontinuation if they do not align with strategic priorities.

DXC Technology's legacy IT outsourcing and aging data center operations are prime examples of its "Dogs" in the BCG matrix. These segments are characterized by low market share within their respective niches and operate in industries with minimal growth prospects. The ongoing revenue declines reported in segments like Global Infrastructure Services, which includes many of these legacy offerings, underscore their status as underperformers.

The company's strategic focus on divesting non-core assets, such as its healthcare provider business in 2021 for $5 billion, reflects an effort to shed these low-growth, low-return units. This pruning allows DXC to reallocate resources towards more promising areas like cloud and AI. The continued rationalization of legacy data center assets in fiscal year 2024 further illustrates this strategy of moving away from financially burdensome operations.

Certain niche application services, while potentially within higher-margin segments, are also showing signs of being Dogs due to operating in mature or declining markets. The cost of maintaining these legacy systems often outweighs the limited strategic advantage or financial benefits they provide, making them candidates for divestment or discontinuation if they don't align with future growth objectives.

| BCG Category | DXC Technology Segment Example | Key Characteristics | Financial Year Data (Illustrative) |

| Dogs | Legacy IT Outsourcing (ITO) | Low market growth, declining revenue, high maintenance costs, limited differentiation. | GIS segment revenue decline reported for FY23 and FY24. |

| Dogs | Legacy Data Center Operations | Low growth, slim profit margins, high operational costs, lack of scalability. | Continued portfolio rationalization of legacy assets in FY24. |

| Dogs | Certain Niche Application Services | Mature or declining market sectors, disproportionate maintenance costs vs. benefits, minimal strategic value. | Focus on modernizing offerings to capture higher-growth areas in FY24 reports. |

Question Marks

DXC Technology is making significant strides in integrating Generative AI (GenAI) across its service portfolio, exemplified by its AI Impact solution. This strategic move positions DXC to capitalize on the burgeoning GenAI market, which is projected to experience substantial growth in the coming years.

While the GenAI sector is rapidly expanding, DXC's market share in these specialized, emerging solutions is likely still developing as they scale adoption. The global GenAI market was valued at approximately $10.8 billion in 2023 and is anticipated to reach over $100 billion by 2028, demonstrating its immense potential.

Sustained and substantial market traction for these advanced offerings necessitates considerable, ongoing investment in research and development, alongside aggressive talent acquisition. This commitment is crucial for DXC to effectively compete and innovate within the dynamic GenAI landscape.

DXC Technology's Consulting & Engineering Services (CES) are strategically targeting niche areas like AI-driven application modernization and complex data solutions, exemplified by their work on platforms such as ASK ESA AI. These specialized services are positioned in high-growth markets, indicating potential for significant future revenue.

While these specialized consulting offerings are in high-growth areas, DXC may still be in the process of establishing its market share against deeply entrenched niche competitors or larger, more diversified players. For instance, in the AI consulting space, while the market is expanding rapidly, DXC faces competition from firms with long-standing reputations in specialized AI development.

The success of DXC in these specialized consulting and engineering segments hinges on their ability to drive continuous innovation and secure strong market adoption. As of early 2024, the global AI consulting market is projected to reach hundreds of billions of dollars, a testament to the demand, but also the competitive intensity DXC navigates.

DXC's Platform X™, an open-source operations platform, represents a significant investment aimed at integrating diverse services and boosting efficiency. While it's positioned as a foundational operational tool, its impact on DXC's market share as a distinct product or its capacity to carve out new market niches is still evolving.

The success of Platform X™ hinges on continued investment and broader market adoption to elevate it to a Star in the BCG matrix. For instance, DXC's commitment to open-source development suggests a strategy to foster a wider ecosystem, which could accelerate adoption and differentiation in the competitive IT services landscape.

Quantum Computing Exploration

Quantum computing represents a frontier technology with the potential to revolutionize the IT services landscape. DXC Technology, as a major player, is likely engaging with this disruptive force, even if specific large-scale offerings aren't yet public. Their exploration would place them in a nascent market with substantial long-term growth prospects.

While DXC's current market share in quantum computing services is likely negligible, their strategic positioning suggests investment in research and pilot programs. This aligns with the BCG matrix's 'Question Mark' category, indicating high growth potential but uncertain future success. By 2024, the global quantum computing market was estimated to be valued at over $1 billion, with projections reaching tens of billions by the end of the decade, underscoring the significant opportunity.

- Market Entry: DXC's involvement would be characterized by early-stage exploration and R&D.

- Growth Potential: The quantum computing sector is experiencing rapid growth, with significant disruption anticipated.

- Current Share: DXC's market share in quantum computing is currently minimal, reflecting its emerging nature.

- Strategic Importance: Investing in quantum computing aligns with DXC's role as a global IT services provider navigating future technological shifts.

Targeted Industry-Specific AI Applications

DXC Technology is strategically deploying AI across key sectors such as automotive, public sector, financial services, and healthcare. These applications aim to revolutionize areas like advanced vehicle diagnostics, efficient citizen service delivery, and operational enhancements within financial institutions. For instance, in healthcare, AI is being used to improve diagnostic accuracy and patient outcomes.

While these targeted industry applications represent growth opportunities, DXC's current market share within these specific AI-driven verticals may still be nascent. The success of these initiatives hinges on achieving substantial client adoption and scaling these innovative solutions to solidify DXC's market presence.

- Automotive: AI for predictive maintenance and enhanced driver assistance systems.

- Public Sector: Streamlining citizen services and improving government operational efficiency.

- Financial Services: AI-powered fraud detection and personalized customer experiences.

- Healthcare: Enhancing diagnostic tools and optimizing hospital operations.

DXC Technology's ventures into emerging technologies like quantum computing and highly specialized AI applications fall into the Question Marks category. These areas offer substantial future growth potential but currently have low market share and uncertain outcomes.

The company's strategic investments in these nascent markets are crucial for future positioning, acknowledging the high risk and high reward associated with them. Success depends on significant R&D, talent acquisition, and market adoption to transition these into Stars.

For instance, the quantum computing market, though small in 2024, is projected for exponential growth, and DXC's early exploration is a strategic bet. Similarly, specialized AI applications in sectors like healthcare and automotive are high-growth but require DXC to build significant market share against established players.

The challenge for DXC is to convert these potential growth areas into sustainable market leaders, requiring focused execution and continuous innovation to navigate the competitive landscape.

| BCG Category | DXC Technology Example | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|---|

| Question Marks | Quantum Computing Services | Very High | Low | R&D, Pilot Programs |

| Question Marks | Niche AI-driven Industry Solutions (e.g., Healthcare Diagnostics) | High | Developing | Client Adoption, Scaling |

| Question Marks | Advanced Application Modernization with AI | High | Developing | Innovation, Market Penetration |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.