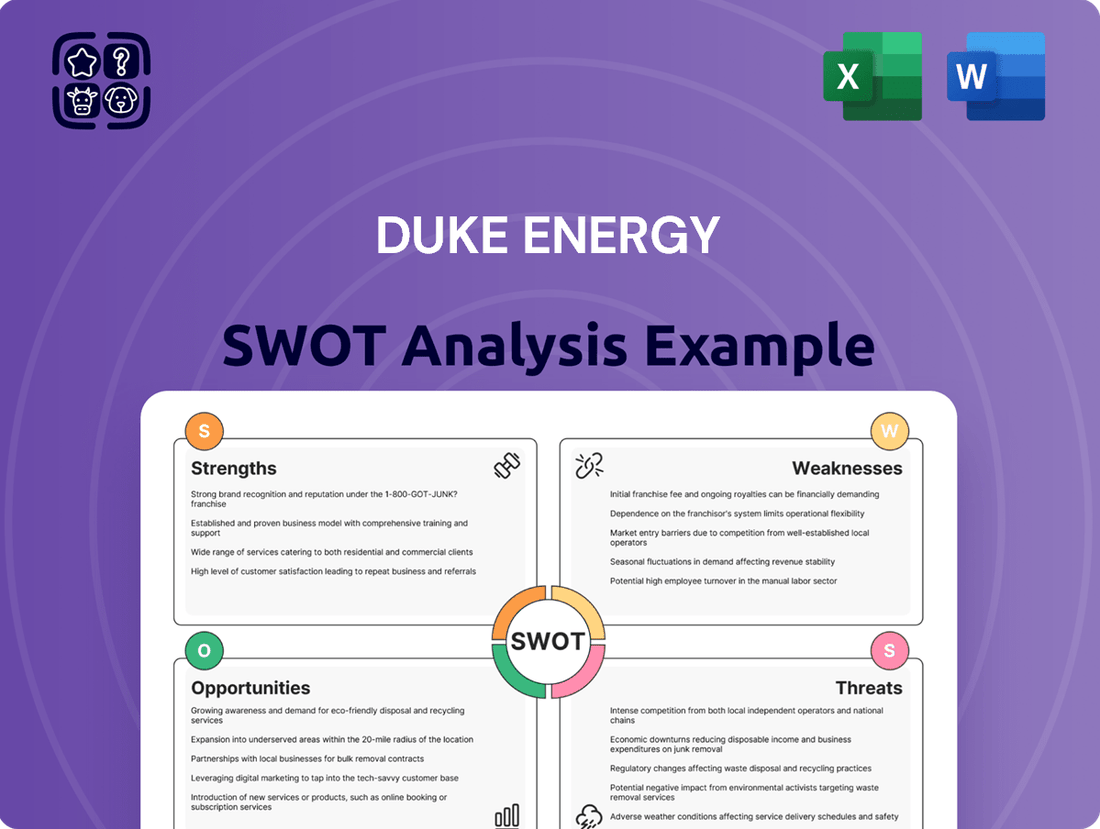

Duke Energy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Duke Energy Bundle

Duke Energy navigates a complex energy landscape, balancing strong regulated utility operations with the evolving demands of renewable energy and infrastructure modernization. While its established market presence offers stability, the company faces pressure from increasing competition and the significant capital investments required for its transition.

Want the full story behind Duke Energy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Duke Energy's strength lies in its diversified energy portfolio, encompassing natural gas, nuclear, and an increasing share of renewables. This broad mix provides significant resilience against volatile energy markets and evolving regulatory landscapes.

The company serves a vast customer base, with around 8.6 million electric and 1.6 million natural gas customers spread across the Southeast and Midwest. This extensive reach translates into predictable revenue streams and substantial economies of scale, bolstering financial stability.

Duke Energy exhibits strong financial performance, evidenced by consistent growth in operating revenues and robust adjusted earnings per share. In the first quarter of 2025, the company posted a net income of $1.40 billion, marking a significant 22% increase compared to the same period in 2024.

This financial health is further underscored by Duke Energy's reaffirmation of its 2025 adjusted earnings per share guidance. Such financial stability, coupled with ready access to capital markets, positions the company to make substantial investments in its infrastructure and pursue ambitious growth strategies.

Looking ahead, Duke Energy has outlined an impressive $83 billion capital plan extending through 2029, demonstrating its capacity and commitment to significant future investments.

Duke Energy benefits from a constructive regulatory landscape, which has historically allowed for significant investments in its rate base. This supportive environment is crucial for funding long-term projects.

In 2024 alone, Duke Energy secured approvals for approximately $45 billion in rate-based investments. These approvals are vital for advancing the company's strategic goals in areas like grid modernization and the transition to cleaner energy sources.

The company's ability to achieve favorable outcomes in rate cases across its operating jurisdictions minimizes near-term regulatory uncertainty and provides a stable foundation for its infrastructure upgrade initiatives.

Commitment to Clean Energy Transition and Decarbonization Goals

Duke Energy is making significant strides in its commitment to a cleaner energy future. The company has set aggressive goals, aiming to cut carbon emissions by at least 50% by 2030 and reach net-zero by 2050. This forward-thinking approach positions them favorably in a market increasingly focused on sustainability.

Their strategy involves substantial capital allocation towards renewable energy sources and advanced technologies. These investments are crucial for meeting their decarbonization targets and adapting to evolving regulatory landscapes and customer preferences.

- Aggressive Decarbonization Targets: Aiming for at least 50% carbon emission reduction by 2030 and net-zero by 2050.

- Significant Investment in Renewables: Allocating capital to solar, wind, and battery storage projects.

- Future-Ready Infrastructure: Planning for new natural gas generation with hydrogen capabilities to ensure reliability during the transition.

- Focus on Advanced Technologies: Exploring and investing in advanced nuclear technologies as part of the clean energy mix.

Operational Excellence and Grid Modernization

Duke Energy's commitment to operational excellence and grid modernization is a significant strength. The company consistently invests in advanced technologies to improve reliability and efficiency. For instance, in 2024, their smart, self-healing grid technology was instrumental in preventing more than 2.3 million customer outages.

These strategic investments in grid modernization pay dividends by enhancing operational efficiency and reducing costs. Furthermore, they are crucial for effectively integrating growing renewable energy sources into the existing infrastructure.

- Operational Excellence: Duke Energy prioritizes safe and efficient operations across its network.

- Grid Modernization: Significant investments are channeled into smart grid technologies and infrastructure upgrades.

- Reliability Improvements: In 2024, smart grid technology prevented over 2.3 million customer outages.

- Renewable Integration: Modernized grids better support the incorporation of renewable energy assets.

Duke Energy's diversified energy portfolio, including natural gas, nuclear, and growing renewables, provides resilience. Its vast customer base, serving approximately 8.6 million electric and 1.6 million natural gas customers, ensures predictable revenue and economies of scale.

Financially, Duke Energy demonstrated strong performance in Q1 2025 with $1.40 billion in net income, a 22% increase year-over-year, and reaffirmed its 2025 adjusted EPS guidance. This financial health supports its ambitious $83 billion capital plan through 2029.

The company benefits from a supportive regulatory environment, securing approximately $45 billion in rate-based investment approvals in 2024. This allows for crucial infrastructure upgrades and cleaner energy transitions.

Duke Energy's commitment to decarbonization is a key strength, targeting at least 50% carbon emission reduction by 2030 and net-zero by 2050, with significant capital allocated to renewables and advanced technologies.

Operational excellence is evident, with smart grid technology preventing over 2.3 million customer outages in 2024, enhancing reliability and efficiency for renewable integration.

| Metric | Value | Period |

|---|---|---|

| Net Income | $1.40 billion | Q1 2025 |

| Customer Base (Electric) | ~8.6 million | 2024 |

| Customer Base (Gas) | ~1.6 million | 2024 |

| Capital Plan | $83 billion | Through 2029 |

| Rate-Based Investments Approved | ~$45 billion | 2024 |

| Carbon Emission Reduction Target | 50% by 2030 | 2030 |

| Customer Outages Prevented (Smart Grid) | >2.3 million | 2024 |

What is included in the product

Analyzes Duke Energy’s competitive position through key internal and external factors, highlighting its strengths in regulated markets and opportunities in renewable energy while acknowledging weaknesses in aging infrastructure and threats from regulatory changes.

Offers a clear, actionable framework to identify and address Duke Energy's key challenges and opportunities.

Weaknesses

Duke Energy's significant reliance on fossil fuels, particularly natural gas and coal, remains a key weakness. As of the first quarter of 2024, approximately 40% of its electricity generation still comes from these sources, exposing the company to the inherent price volatility of these commodities.

This continued dependence also means Duke Energy faces ongoing scrutiny and potential regulatory challenges related to environmental compliance and carbon emissions. For instance, the company has committed to significant emissions reductions, but the pace of transitioning away from these legacy assets is a point of concern for investors and environmental advocates alike, potentially impacting future capital expenditures and operational flexibility.

Duke Energy grapples with significant operating expenses, a key weakness that can erode profitability. These costs are heavily influenced by the price of fuel for electricity generation and the expense of purchased power, both susceptible to market volatility.

For instance, in the first quarter of 2024, Duke Energy reported higher fuel and purchased power costs compared to the same period in 2023. This increase directly impacts the company's bottom line, making efficient cost management a critical operational focus.

As a heavily regulated utility, Duke Energy faces significant regulatory risks. The company must navigate evolving environmental mandates, like the Coal Combustion Residuals (CCR) Rule, which require substantial compliance investments. For instance, in 2023, Duke Energy reported capital expenditures related to environmental compliance, though specific figures for CCR rule compliance are integrated within broader environmental capital plans.

While Duke Energy has historically demonstrated success in recovering these substantial investments through rate adjustments, there's no absolute guarantee that all future compliance costs will be fully recouped. This uncertainty presents a potential financial vulnerability, as unforeseen regulatory changes or challenges in rate case approvals could impact the company's profitability and cash flow.

Potential for Delays and Cost Overruns in Large Capital Projects

Duke Energy's significant capital expenditure plans, vital for upgrading infrastructure and expanding renewable energy capacity, also present inherent execution risks. These large-scale projects, such as the planned investments in grid modernization and cleaner energy generation, are susceptible to delays and cost escalations. For instance, in 2023, Duke Energy reported capital expenditures of $14.4 billion, with a substantial portion allocated to these complex initiatives. Unforeseen issues, regulatory hurdles, or supply chain disruptions can easily push timelines and budgets, potentially impacting the company's projected financial performance and its strategic growth objectives.

The potential for these execution challenges to materialize is a notable weakness. For example, the company has previously encountered delays and cost adjustments on major transmission projects, highlighting the complexities involved. These overruns can strain financial resources, potentially diverting funds from other growth opportunities or impacting dividend payout capacity. The sheer scale of Duke Energy's 2024-2028 capital plan, projected to be around $15 billion to $16 billion, amplifies the risk of encountering such issues, which could negatively affect shareholder returns and the company's overall growth trajectory.

- Execution Risk: Large capital projects, critical for Duke Energy's modernization and clean energy transition, are prone to delays and cost overruns.

- Financial Impact: Project overruns can strain financial resources, potentially impacting profitability and investment capacity.

- Strategic Setbacks: Delays can hinder the company's ability to meet its renewable energy targets and modernize its grid effectively.

- Past Precedents: Historical challenges with large infrastructure projects underscore the ongoing risk of similar issues.

Vulnerability to Extreme Weather Events

Duke Energy's extensive infrastructure, particularly its transmission and distribution lines, remains vulnerable to extreme weather events. Hurricanes and severe storms, which have become more frequent and intense, can cause widespread damage, leading to significant operational disruptions and repair costs. For instance, in 2022, the company reported significant storm restoration expenses following events like Hurricane Ian, impacting its financial performance.

While Duke Energy has mechanisms in place for storm cost recovery through regulatory filings, these processes can be lengthy and may not fully offset the immediate financial strain. The increasing frequency and severity of these weather-related events pose an ongoing challenge to maintaining reliable service and managing operational expenditures. The company's reliance on physical infrastructure in regions prone to these natural disasters inherently creates a consistent risk factor.

- Infrastructure Susceptibility: Duke Energy's vast network of power lines and substations is exposed to damage from high winds, flooding, and debris associated with severe weather.

- Financial Impact: Storm restoration efforts can incur substantial costs, affecting earnings even with established recovery mechanisms.

- Regulatory Hurdles: The process for recovering storm-related expenses can be complex and time-consuming, creating short-term financial pressure.

- Increasing Climate Risk: The projected intensification of weather events due to climate change amplifies the long-term vulnerability of Duke Energy's assets.

Duke Energy's substantial debt load, totaling approximately $77 billion as of the first quarter of 2024, presents a significant weakness. This high level of leverage increases financial risk, especially in a rising interest rate environment, as servicing this debt consumes a considerable portion of operating income.

The company's significant capital expenditure plans, projected between $15 billion and $16 billion for 2024-2028, will likely require additional borrowing, further increasing its debt obligations. This can limit financial flexibility for other strategic initiatives or shareholder returns.

Duke Energy's reliance on regulated markets, while providing stability, also means its growth is tied to the approval of rate increases by various state public utility commissions. Delays or denials in these rate cases can hinder revenue growth and impact profitability. For example, the company's North Carolina rate case decision in early 2024, while approved, involved adjustments that influenced its earnings trajectory.

The inherent lag between incurring costs and receiving regulatory approval for cost recovery can create cash flow timing mismatches. This can put pressure on short-term liquidity, particularly following significant capital investments or unexpected operational events.

Duke Energy's significant capital expenditure plans, vital for upgrading infrastructure and expanding renewable energy capacity, also present inherent execution risks. These large-scale projects, such as the planned investments in grid modernization and cleaner energy generation, are susceptible to delays and cost escalations. For instance, in 2023, Duke Energy reported capital expenditures of $14.4 billion, with a substantial portion allocated to these complex initiatives.

Unforeseen issues, regulatory hurdles, or supply chain disruptions can easily push timelines and budgets, potentially impacting the company's projected financial performance and its strategic growth objectives. The sheer scale of Duke Energy's 2024-2028 capital plan, projected to be around $15 billion to $16 billion, amplifies the risk of encountering such issues.

| Financial Metric | Q1 2024 (Approx.) | Year-End 2023 (Approx.) |

|---|---|---|

| Total Debt | $77 Billion | $75 Billion |

| Capital Expenditures (2023) | $14.4 Billion | $14.4 Billion |

| Projected CapEx (2024-2028) | $15-$16 Billion | $15-$16 Billion |

Same Document Delivered

Duke Energy SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Duke Energy. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

This is the same Duke Energy SWOT analysis document you'll receive upon purchase—no surprises, just professional quality and in-depth insights. Unlock the full, detailed report to gain a complete understanding of their strategic position.

Opportunities

The growing global and domestic demand for cleaner energy sources is a prime opportunity for Duke Energy. This trend directly supports the expansion of their renewable energy portfolio, especially in solar and wind power generation.

Duke Energy is actively pursuing this opportunity, with significant planned investments. Their commitment includes developing numerous new solar facilities and aiming to reach 30,000 megawatts of regulated renewable energy capacity by 2035, a substantial increase that aligns with market demand.

Technological advancements in grid modernization present significant opportunities for Duke Energy. Innovations in areas like advanced metering infrastructure (AMI) and grid automation are key. For instance, Duke Energy's planned investments in grid modernization through 2028 are substantial, aiming to improve reliability and integrate distributed energy resources more effectively. These upgrades enable better management of energy flow, which is crucial for incorporating renewables.

The deployment of smart meters, a core component of grid modernization, allows for real-time data collection and two-way communication. This enhances operational efficiency by enabling faster outage detection and restoration, ultimately improving the customer experience. Duke Energy's ongoing smart meter rollout is a prime example of leveraging these technologies to build a more responsive and resilient energy infrastructure.

Furthermore, advancements in energy storage solutions, particularly battery storage, offer a critical opportunity. Duke Energy is actively investing in and piloting various battery storage projects, such as the Hyde County battery storage facility, to support grid stability and the integration of intermittent renewable sources like solar and wind. These investments are vital for enhancing system resilience and meeting future energy demands.

Duke Energy's service territories are witnessing robust economic development, fueling a substantial rise in energy demand. This growth is largely driven by expansions in key sectors like manufacturing, technology, and the burgeoning data center industry.

This surge in demand translates into a significant opportunity for load growth, allowing Duke Energy to expand its infrastructure and invest in new capacity. For instance, North Carolina, a key state for Duke Energy, saw its GDP grow by an estimated 3.1% in 2023, indicating a healthy economic environment conducive to increased energy consumption.

Strategic Partnerships and Collaborations

Duke Energy's pursuit of strategic partnerships is a key opportunity for growth and innovation. Collaborating with entities like GE Vernova for essential natural gas turbines, for instance, strengthens their operational capabilities and supply chain resilience.

Engaging in public-private initiatives, such as applying for Department of Energy (DOE) grants for advanced nuclear technologies, positions Duke Energy at the forefront of next-generation energy solutions. This includes efforts focused on developing small modular reactors and exploring the potential of green hydrogen, sectors poised for significant expansion.

- Strategic Alliances: Partnerships with technology providers like GE Vernova enhance access to critical infrastructure components.

- Innovation Funding: Joint applications for DOE grants, potentially worth billions in federal funding for clean energy projects, de-risk R&D investments.

- Emerging Technologies: Collaborations on small modular reactors and green hydrogen tap into rapidly evolving and potentially lucrative markets.

Favorable Regulatory Support for Clean Energy Transition and Cost Recovery

Duke Energy benefits from a supportive regulatory landscape, particularly with the Inflation Reduction Act (IRA). This legislation offers significant tax credits and incentives for clean energy projects, creating a strong opportunity for cost recovery on Duke's substantial investments in renewables and grid modernization. For instance, the IRA's investment tax credits can cover a substantial portion of renewable energy project costs, directly aiding Duke's transition strategy.

Constructive outcomes in rate cases also present a key opportunity, allowing Duke Energy to recover the capital expenditures necessary for its clean energy transition and infrastructure upgrades. This regulatory alignment is crucial for maintaining financial health while pursuing ambitious decarbonization goals. In 2024, Duke Energy's regulated utilities are projected to invest billions in grid modernization and clean energy, with rate cases designed to facilitate this recovery.

This favorable regulatory environment enables Duke Energy to make these critical investments while striving to keep energy costs manageable for its customers. The ability to recover costs through regulated rates provides a degree of certainty, encouraging further deployment of cleaner energy sources and advanced grid technologies.

- IRA Incentives: The Inflation Reduction Act's tax credits, such as the 30% investment tax credit for solar and wind, directly reduce the upfront cost of clean energy projects.

- Constructive Rate Cases: Successful rate case filings allow Duke to include clean energy investments in its rate base, ensuring a return on these capital expenditures.

- Infrastructure Investment: Duke Energy plans to invest approximately $145 billion over the next decade, with a significant portion allocated to clean energy and grid modernization, supported by regulatory frameworks.

- Affordability Focus: Regulatory approvals often include provisions or considerations for customer affordability, balancing transition costs with consumer impact.

Duke Energy is well-positioned to capitalize on the increasing demand for renewable energy sources, with substantial investments planned in solar and wind power. Their strategic focus on grid modernization, including smart meter deployment and advanced infrastructure, promises enhanced reliability and efficient integration of new energy technologies. Furthermore, advancements in energy storage, particularly battery technology, offer a crucial avenue for grid stability and supporting intermittent renewables.

| Opportunity Area | Description | Supporting Data/Fact |

|---|---|---|

| Renewable Energy Growth | Expanding solar and wind capacity to meet rising clean energy demand. | Duke Energy aims for 30,000 MW of regulated renewable energy capacity by 2035. |

| Grid Modernization | Investing in smart grid technologies for improved reliability and integration. | Significant planned investments in grid modernization through 2028. |

| Energy Storage | Deploying battery storage to enhance grid stability and renewable integration. | Investments in projects like the Hyde County battery storage facility. |

| Economic Development | Leveraging growth in key sectors to drive energy demand. | North Carolina's GDP grew by an estimated 3.1% in 2023. |

| Strategic Partnerships | Collaborating with technology providers and for R&D. | Partnerships with GE Vernova for critical infrastructure. |

| Supportive Regulation | Utilizing incentives like the Inflation Reduction Act (IRA) and favorable rate cases. | IRA offers significant tax credits for clean energy projects; planned $145 billion investment over ten years. |

Threats

Duke Energy faces significant competitive pressure across both traditional and emerging energy markets. The utility sector, historically characterized by regulated monopolies, is increasingly seeing competition from independent power producers and distributed generation sources, impacting market share and pricing power.

The push towards renewable energy sources, like solar and wind, has intensified competition as numerous specialized companies enter the market, often with lower cost structures for new installations. For example, by the end of 2023, the US solar capacity alone had surpassed 170 GW, a substantial increase that directly competes with traditional generation assets.

This dynamic environment challenges Duke Energy's established market position and necessitates continuous investment in grid modernization and competitive pricing strategies to retain customers and secure new projects. The company's ability to adapt its business model to these evolving market conditions is crucial for sustained growth and profitability in the coming years.

Economic uncertainty, including potential recessions, could dampen energy demand across Duke Energy's service territories, impacting revenue streams. For instance, a significant economic slowdown in 2024 could reduce industrial and commercial electricity consumption, a key segment for the company.

Inflationary pressures pose a direct threat to Duke Energy's operational efficiency and capital expenditure plans. Rising costs for fuel, construction materials, and skilled labor, evident in the broader economic climate of late 2023 and projected into 2024, can inflate operating expenses and delay crucial infrastructure upgrades, potentially impacting future earnings and project timelines.

Duke Energy faces growing threats from evolving environmental regulations and the increasing impact of climate change. Stricter emission standards and new energy policies, such as those aimed at reducing carbon output, could necessitate significant capital investments in cleaner technologies, potentially impacting profitability. For instance, the company has committed to reducing carbon emissions by 50% from 2005 levels by 2030, a target that requires substantial ongoing investment in renewables and grid modernization.

The physical risks associated with climate change also present a considerable challenge. Extreme weather events, like hurricanes and severe storms, can damage Duke Energy's infrastructure, leading to costly repairs and service disruptions. In 2022, the company reported approximately $1.3 billion in storm restoration costs, highlighting the financial vulnerability to increasingly volatile weather patterns.

Challenges with Public Perception and Regulatory Delays in Carbon Reduction

Duke Energy faces scrutiny from environmental advocates concerned about the pace of its transition away from fossil fuels, particularly its continued reliance on natural gas. This can foster negative public perception, potentially complicating regulatory approvals and future clean energy initiatives. For instance, the company's North Carolina Carbon Plan has encountered delays, highlighting the challenges in meeting ambitious carbon reduction targets in a timely manner.

These public perception and regulatory hurdles can translate into tangible financial risks. Delays in implementing cleaner energy projects or securing necessary permits can increase operational costs and defer expected revenue streams. As of early 2024, Duke Energy's commitment to reducing greenhouse gas emissions by 50% from 2005 levels by 2030 is under constant review by various stakeholders.

- Public Scrutiny: Environmental groups often criticize Duke Energy’s gradual phase-out of coal and natural gas, impacting brand image.

- Regulatory Hurdles: Delays in approving renewable energy projects or adhering to evolving carbon reduction mandates, such as the North Carolina Carbon Plan, pose significant operational and financial risks.

- Pace of Transition: Critics argue that Duke Energy's pace of adopting renewable energy sources is too slow, potentially leading to missed decarbonization targets and increased regulatory pressure.

Cybersecurity Risks and Technological Obsolescence

Duke Energy, like all utilities, faces escalating cybersecurity threats as its grid becomes more digitized and interconnected. A successful cyberattack could cripple operations, leading to widespread outages and significant financial losses. In 2023, the U.S. energy sector experienced a notable increase in reported cyber incidents, highlighting the persistent danger.

Furthermore, the rapid evolution of energy technology presents a threat of obsolescence. Investments in current infrastructure, such as advanced metering systems or grid modernization projects, could quickly become outdated if more efficient or cost-effective solutions emerge. This necessitates continuous evaluation and adaptation to maintain a competitive edge.

Specific concerns include:

- Vulnerability to ransomware and state-sponsored attacks targeting critical infrastructure.

- The cost of upgrading legacy systems to meet evolving cybersecurity standards.

- The risk of stranded assets if new, disruptive technologies gain rapid market adoption.

Duke Energy faces significant threats from intensifying competition, particularly from distributed generation and independent power producers, as the energy landscape shifts towards renewables. Economic downturns could reduce energy demand, impacting revenue, while inflation raises operational and capital expenditure costs.

Evolving environmental regulations and the physical impacts of climate change, including extreme weather events that damage infrastructure, present substantial financial and operational risks. Public scrutiny over the pace of its transition from fossil fuels can lead to regulatory hurdles and negative perceptions.

Cybersecurity threats are a growing concern, with the potential for crippling attacks on digitized infrastructure, while the rapid pace of technological advancement risks making current investments obsolete.

SWOT Analysis Data Sources

This Duke Energy SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary. These sources ensure a robust and data-driven understanding of the company's strategic position.