Duke Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Duke Energy Bundle

Duke Energy's strategic positioning is laid bare in its BCG Matrix, showcasing a dynamic portfolio of energy assets. Understand which segments are fueling growth and which require careful management to optimize resource allocation.

This preview offers a glimpse into Duke Energy's market share and growth potential across its diverse business units. To truly grasp the strategic implications and unlock actionable insights for your own portfolio, dive into the complete BCG Matrix.

Unlock the full potential of your investment decisions by purchasing the complete Duke Energy BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks to inform your next strategic move.

Stars

Duke Energy is significantly boosting its regulated renewable energy capacity, aiming to install an additional 30,000 megawatts by 2035. This ambitious expansion focuses heavily on solar power and other clean energy sources.

This strategic push aligns with Duke Energy's commitment to reaching net-zero carbon emissions by 2050. The company benefits from supportive regulatory environments and the financial incentives provided by the Inflation Reduction Act, particularly its tax credits.

Duke Energy's significant investment in grid modernization and resiliency positions it as a strong player in this high-growth sector. The company's $83 billion capital plan over the next five years heavily targets upgrading transmission and distribution systems. This strategic focus aims to boost reliability, minimize power outages, and accommodate the growing demand and integration of renewable energy sources.

Duke Energy is seeing impressive customer growth, especially in the Carolinas and Florida. This isn't just about more homes; it includes a rise in commercial and industrial energy use. In 2023, Duke Energy reported adding approximately 50,000 new customers across its service territories.

This demand is being amplified by major economic trends. The construction of new data centers and the expansion of advanced manufacturing facilities are significant drivers of this load growth. For instance, the company anticipates substantial increases in electricity demand from the burgeoning tech sector in its service areas.

Strategic Regulatory Approvals

Duke Energy has consistently demonstrated success in navigating regulatory landscapes, a key factor in its strategic positioning. The company has secured approvals for approximately $75 billion in rate base investments through seven rate cases since 2023. This robust track record highlights Duke Energy's ability to gain the trust of regulatory bodies for its infrastructure modernization plans.

These regulatory approvals are crucial as they validate the significant capital expenditures required for essential infrastructure upgrades. They also reflect an understanding of the increasing cost of capital, which is vital for maintaining financial health. Such endorsements create a predictable framework that supports ongoing growth initiatives and ensures that investments made are appropriately recovered.

- $75 billion in rate base investments approved or settled since 2023.

- Seven rate cases successfully concluded within the same period.

- Approvals support critical infrastructure and acknowledge rising capital costs.

- Provides a stable environment for Duke Energy's growth and investment recovery.

Long-Term EPS Growth and Financial Performance

Duke Energy has demonstrated a robust financial performance, projecting an adjusted EPS growth rate of 5% to 7% through 2029. This outlook is underpinned by a substantial capital investment plan, reinforcing the stability and growth potential of its regulated electric utilities.

The company's commitment to this growth trajectory is a key factor in its positioning within the BCG Matrix.

- Strong Financial Performance: Duke Energy consistently reports solid financial results, supporting its growth targets.

- Extended EPS Growth Outlook: The company has extended its adjusted EPS growth rate projection of 5% to 7% through 2029.

- Solid Capital Plan: This growth is backed by a well-defined and substantial capital investment plan.

- Star Positioning: The core regulated electric utilities are considered stars due to their sustained performance and positive outlook, generating significant shareholder value.

Duke Energy's regulated electric utilities are firmly positioned as Stars in the BCG Matrix. This classification is driven by their high market share and strong growth prospects, fueled by significant investments in renewable energy and grid modernization. The company's projected 5% to 7% adjusted EPS growth through 2029, supported by an $83 billion capital plan, underscores this Star status.

| Category | Duke Energy's Position | Key Drivers | Supporting Data |

|---|---|---|---|

| Stars | Regulated Electric Utilities | High market share, strong growth potential, significant investments in renewables and grid modernization | Projected 5%-7% EPS growth through 2029; $83 billion capital plan; 30,000 MW renewable capacity target by 2035 |

What is included in the product

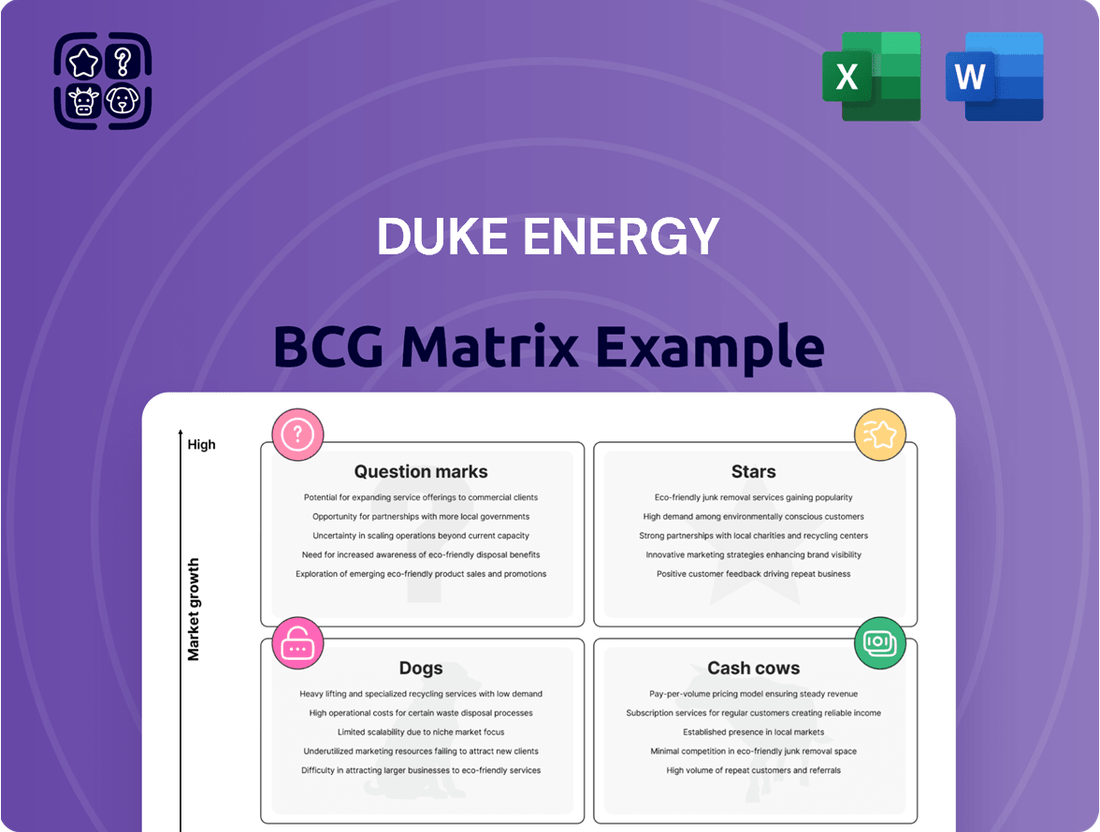

This Duke Energy BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

It provides actionable insights into which segments to invest in, maintain, or divest to optimize the company's portfolio.

A clear Duke Energy BCG Matrix overview visually categorizes business units, alleviating the pain of strategic uncertainty.

Cash Cows

Duke Energy's regulated electric utility operations in the Southeast and Midwest are true cash cows. These segments, representing a substantial portion of the company's business, benefit from established market positions and consistent demand, leading to predictable revenue. In 2024, these regulated operations are expected to continue generating robust and stable cash flows, underpinning Duke Energy's overall financial health.

Duke Energy's natural gas distribution business, notably through Piedmont Natural Gas, is a classic Cash Cow. It holds a substantial market share in its established service territories, providing a reliable stream of income.

This mature segment offers stable cash flow, though its growth potential is more modest compared to Duke's emerging energy ventures. For instance, in 2023, Duke Energy reported that its Gas Utilities and Storage segment generated operating income of $1.5 billion, underscoring its consistent profitability.

Duke Energy's existing nuclear fleet in the Carolinas is a prime example of a Cash Cow. These plants generate a significant and stable portion of the company's electricity, contributing substantially to its revenue. In 2023, nuclear energy provided approximately 35% of Duke Energy's total generation in the Carolinas, highlighting its critical role and high market share.

These nuclear assets are essential for providing reliable, baseload power, meaning they operate consistently regardless of demand fluctuations. This reliability translates into predictable cash flows, as they require minimal marketing or promotional spending to maintain their customer base. The consistent output and high utilization rates of these plants solidify their Cash Cow status within Duke Energy's portfolio.

Mature Hydroelectric Assets

Duke Energy's mature hydroelectric assets represent a stable Cash Cow within its portfolio. Despite the company's significant investments in expanding renewable energy sources, these established hydroelectric plants remain a dependable, albeit slow-growing, provider of clean power. Their long operational history and seamless integration into Duke's grid ensure a consistent and reliable energy supply.

These mature hydroelectric facilities are characterized by their steady cash generation, contributing significantly to Duke Energy's financial stability. While not experiencing rapid growth, their consistent performance underpins the company's ability to fund new ventures and maintain shareholder returns. In 2023, Duke Energy reported approximately $1.2 billion in operating income from its regulated electric utilities, with hydroelectric power playing a crucial role in its baseload generation capabilities.

- Consistent Revenue Stream: Mature hydroelectric assets provide predictable and stable income, acting as a reliable cash generator for Duke Energy.

- Low Operational Costs: Once established, hydroelectric plants typically have lower operating and maintenance costs compared to newer energy technologies.

- System Reliability: These assets contribute to grid stability and provide essential baseload power, enhancing overall energy security.

Infrastructure from Prior Investments

Duke Energy's extensive transmission and distribution infrastructure, developed over many years, represents a significant asset base. This infrastructure holds a high market share and consistently generates revenue, largely due to regulated rate structures. This stable, predictable income stream is characteristic of a cash cow in the BCG matrix.

While the company is investing in modernizing this grid, which might be considered a 'Star' initiative, the existing, well-maintained infrastructure itself operates as a cash cow. It requires relatively modest new investment for its ongoing operations, allowing it to generate substantial cash flow.

- Infrastructure as Cash Cow: Duke Energy's established transmission and distribution network is a prime example of a cash cow.

- Revenue Generation: This infrastructure generates consistent revenue through regulated rates, providing a stable income stream.

- Investment Needs: While modernization is ongoing, the existing grid requires less new capital for current operations compared to growth-oriented ventures.

- Market Position: The extensive, decades-old infrastructure secures a high market share in its service territories.

Duke Energy's regulated electric utility operations in the Southeast and Midwest are true cash cows, benefiting from established market positions and consistent demand. In 2024, these segments are expected to continue generating robust and stable cash flows. The company's natural gas distribution business, particularly Piedmont Natural Gas, also functions as a classic cash cow, holding substantial market share and providing a reliable income stream. In 2023, this segment generated $1.5 billion in operating income.

Duke Energy's existing nuclear fleet in the Carolinas is a prime example of a cash cow, generating approximately 35% of the company's total generation in the Carolinas in 2023. These plants provide reliable, baseload power, translating into predictable cash flows with minimal marketing needs. Similarly, mature hydroelectric assets serve as a stable cash cow, contributing significantly to financial stability and providing consistent performance. In 2023, regulated electric utilities, which include these assets, contributed to approximately $1.2 billion in operating income.

Duke Energy's extensive transmission and distribution infrastructure, developed over many years, acts as a significant cash cow due to its high market share and regulated rate structures. While modernization efforts are ongoing, the existing, well-maintained grid requires relatively modest new investment for current operations, allowing it to generate substantial cash flow and provide a stable, predictable income stream.

| Segment | BCG Category | Key Characteristics | 2023 Financial Highlight |

| Regulated Electric Utility (Southeast/Midwest) | Cash Cow | Established market, consistent demand, predictable revenue | Significant contributor to overall revenue |

| Natural Gas Distribution (Piedmont Natural Gas) | Cash Cow | Substantial market share, reliable income | $1.5 billion operating income (Gas Utilities and Storage) |

| Nuclear Fleet (Carolinas) | Cash Cow | Reliable baseload power, high utilization, minimal marketing needs | ~35% of Carolinas generation |

| Mature Hydroelectric Assets | Cash Cow | Steady cash generation, system reliability, low operational costs | Contributes to $1.2 billion operating income (Regulated Electric Utilities) |

| Transmission & Distribution Infrastructure | Cash Cow | High market share, regulated rates, stable income | Consistent revenue generation |

What You See Is What You Get

Duke Energy BCG Matrix

The Duke Energy BCG Matrix preview you're viewing is the identical, fully polished document you'll receive immediately after purchase. This means no watermarks or demo content, just the complete, professionally formatted analysis ready for your strategic planning. You can trust that the insights and structure presented here are precisely what you'll download, enabling you to seamlessly integrate this valuable market analysis into your business decisions.

Dogs

Duke Energy's aging coal-fired power plants are largely considered Dogs in the BCG Matrix. Despite plans to retire some units, Duke has pushed back the closure of plants like Gibson Station in Indiana to 2038. These older facilities are in a shrinking market, facing tougher environmental rules and diminishing profitability, often just covering their costs or requiring significant upkeep.

Duke Energy's divestiture of its unregulated Commercial Renewables business for $2.8 billion in late 2023 signals a strategic move away from a segment that was likely underperforming. This business, while in a growing sector, may not have achieved the desired market share or profitability within Duke's broader portfolio. The sale suggests it was categorized as a 'Dog' in their BCG matrix, consuming resources without generating sufficient returns to justify continued investment.

While Duke Energy's overall grid modernization efforts are a clear 'Star,' certain older sections of its infrastructure, particularly in areas like parts of its Carolinas service territory that haven't seen recent substantial upgrades, could be viewed as a 'Cash Cow' or even a 'Dog' in a BCG-like analysis. These segments often demand higher ongoing maintenance expenditures and are prone to more frequent service disruptions. For instance, in 2023, Duke Energy reported capital expenditures of $13.7 billion for grid modernization and reliability improvements, but the allocation to specific legacy areas needing significant overhaul is a key consideration.

Less Strategic or Underperforming Smaller Assets

Smaller, non-strategic assets or businesses within Duke Energy's portfolio that exhibit low market share and are not aligned with their core regulated utility and clean energy transition strategy would fall into this category. These could include certain legacy infrastructure or smaller, niche operations. For example, if Duke Energy had a small, non-regulated renewable energy project in a region with limited growth potential, it might be considered a underperforming smaller asset.

These types of assets often represent opportunities for divestiture. By selling off these less strategic holdings, Duke Energy can unlock capital. This freed-up capital can then be strategically redeployed into areas with higher growth prospects, such as expanding their regulated utility services or investing further in renewable energy projects that align with their long-term clean energy goals. In 2023, Duke Energy continued its focus on its regulated utility businesses and clean energy investments, with capital expenditures primarily directed towards grid modernization and renewable energy generation.

- Low Market Share: These assets typically hold a minimal position in their respective markets, offering little competitive advantage.

- Strategic Misalignment: They do not contribute significantly to Duke Energy's core mission of providing reliable, affordable, and increasingly clean energy.

- Divestiture Potential: They are often candidates for sale to optimize the company's asset base and resource allocation.

- Capital Redeployment: Proceeds from divestitures can fund investments in higher-growth, more strategic areas like regulated utility infrastructure upgrades or new renewable energy projects.

Certain Legacy Infrastructure with High Operating Costs

Certain legacy infrastructure within Duke Energy, particularly those segments not slated for immediate modernization, may represent a challenge. These assets could be characterized by escalating operating and maintenance expenses that outpace their revenue-generating capabilities. For instance, older power generation facilities or transmission lines that haven't undergone significant upgrades might fall into this category. In 2024, the company's focus on grid modernization and cleaner energy sources means that older, less efficient assets could see their relative cost burden increase.

These types of assets can struggle to maintain profitability, especially in a market environment with modest growth. The high fixed costs associated with maintaining such infrastructure, coupled with potentially lower demand or competition, create a difficult financial equation. Duke Energy's strategic investments are largely directed towards newer, more efficient, and environmentally compliant technologies, which can leave legacy systems as a drag on overall performance.

- High Operating Costs: Legacy infrastructure often requires more frequent and costly maintenance compared to newer, more technologically advanced systems.

- Lower Revenue Generation: These assets may be less efficient, leading to lower output or higher per-unit production costs, thus diminishing their revenue-generating potential relative to their operational expenses.

- Strategic Divestment/Modernization: Companies like Duke Energy are increasingly prioritizing investments in future-proof technologies, potentially leading to the divestment or accelerated retirement of older, high-cost infrastructure.

- Profitability Challenges: In a low-growth or cost-sensitive market, these assets can become a significant financial burden, impacting overall company profitability.

Duke Energy's older, less efficient assets, such as certain coal-fired power plants and legacy grid infrastructure, are categorized as Dogs in the BCG Matrix. These assets operate in mature or declining markets, facing increasing regulatory pressures and higher maintenance costs, often yielding minimal profits. The company's strategic focus on modernization and clean energy means these underperforming assets are candidates for divestiture or accelerated retirement to free up capital for more promising ventures.

Duke Energy's strategy involves divesting or retiring these "Dog" assets to reinvest in growth areas. For example, the sale of its Commercial Renewables business in late 2023 for $2.8 billion illustrates this. While specific financial performance of individual legacy assets isn't always public, the overall trend shows a move away from these low-return, high-cost components of their portfolio.

| Asset Type | BCG Category | Key Characteristics | Strategic Action | Example/Data Point |

| Aging Coal Plants | Dog | High operating costs, declining market share, environmental compliance challenges | Retirement/Divestiture | Gibson Station closure pushed to 2038, facing significant upkeep |

| Legacy Grid Segments | Dog/Cash Cow (depending on upgrade status) | Higher maintenance, potential for disruptions, lower efficiency | Modernization/Divestiture | $13.7 billion capital expenditure in 2023 for grid improvements, but legacy areas still need substantial investment |

| Non-Strategic Small Assets | Dog | Low market share, misaligned with core strategy | Divestiture | Potential sale of niche, non-regulated operations |

Question Marks

Duke Energy is positioning itself for the future by actively exploring and investing in Small Modular Reactors (SMRs). This strategic move involves seeking federal grants, a testament to the significant capital required for this nascent technology. The company is even planning for potential SMR sites, aiming for deployment in the 2030s, indicating a long-term vision for this emerging energy source.

Within the framework of a BCG Matrix, SMRs represent a classic 'Question Mark' or 'Star' depending on future market penetration and growth. The market for SMRs is undeniably high-growth and emerging, with significant potential to revolutionize nuclear power. However, currently, the US market share for operational SMRs is effectively zero, necessitating substantial investment to overcome development hurdles and achieve commercial viability.

Duke Energy is actively exploring green hydrogen production and integration through pilot projects like the DeBary Hydrogen Project. This initiative focuses on producing, storing, and utilizing 100% green hydrogen for electricity generation, positioning it as a forward-looking investment.

While green hydrogen represents a significant growth opportunity in the clean energy sector, its current contribution to Duke Energy's overall operations remains minimal. This places it in the Question Mark quadrant of the BCG matrix, signifying high growth potential coupled with a low current market share.

While battery storage is becoming a cornerstone, Duke Energy is exploring advanced, longer-duration energy storage solutions that are still in their nascent stages. These technologies, such as compressed air energy storage (CAES) or flow batteries, are vital for grid reliability as renewable energy sources like solar and wind become more prevalent. For instance, the U.S. Department of Energy's Energy Storage Grand Challenge aims to accelerate the development of advanced storage, with projects targeting cost reductions and performance improvements crucial for widespread adoption.

Emerging Technologies for Decarbonization

Duke Energy is actively investigating emerging technologies to support its net-zero aspirations, moving beyond established renewables like solar and wind, and traditional nuclear power. This includes significant exploration into areas such as carbon capture, utilization, and storage (CCUS), advanced battery storage, and potentially hydrogen fuel technologies. These innovative solutions represent high-growth potential markets critical for deep decarbonization efforts.

While these nascent technologies hold immense promise, their current adoption and market share within Duke Energy's portfolio are minimal. This necessitates substantial research and development investment to mature these solutions to a commercial scale. For instance, in 2024, Duke Energy announced plans to invest in pilot projects for advanced nuclear reactors, which, while not entirely new, represent an emerging application for their grid. The company is also evaluating CCUS technologies for its existing natural gas facilities, a sector where early-stage development requires significant capital outlay.

- Carbon Capture, Utilization, and Storage (CCUS): Focus on technologies that capture CO2 emissions from industrial sources and power plants, with potential for utilization or permanent storage.

- Advanced Battery Storage: Development of next-generation battery chemistries and grid-scale storage solutions to enhance renewable energy integration and grid reliability.

- Green Hydrogen Production: Exploration of electrolysis powered by renewable energy to produce hydrogen as a clean fuel source for hard-to-abate sectors.

- Small Modular Reactors (SMRs): Investigating the potential of advanced nuclear reactor designs for low-carbon baseload power generation.

Expansion into New Geographic Markets or Service Offerings

Duke Energy's current operations are concentrated in the Southeast and Midwest regions of the United States. However, exploring expansion into new, high-growth geographic markets presents a potential "question mark" opportunity. These ventures would likely involve entering markets with significant untapped demand for energy services, but where Duke Energy currently holds minimal market share.

Developing entirely new, non-traditional energy services, such as advanced grid management solutions, distributed energy resource integration, or even carbon capture technologies, also fits the question mark profile. These innovative offerings aim for high future growth potential but would require substantial upfront investment and strategic focus to establish a foothold, mirroring the characteristics of a question mark in the BCG matrix.

- Geographic Expansion: Consider markets with favorable regulatory environments and strong economic growth, potentially in regions experiencing increased demand for reliable and modern energy infrastructure. For instance, certain Western or Southwestern states might present such opportunities.

- New Service Offerings: Focus on services that leverage Duke Energy's existing expertise in grid modernization and renewable energy integration, such as microgrid development for commercial clients or advanced energy storage solutions for utilities.

- Investment Strategy: These question mark ventures would necessitate significant capital allocation for market research, infrastructure development, and technological innovation. For example, a pilot program for a new distributed energy management system could require an initial investment of tens of millions of dollars.

- Risk and Reward: While carrying higher risk due to unproven market acceptance and competitive landscape, successful expansion into these areas could yield substantial long-term returns and diversify Duke Energy's revenue streams.

Duke Energy's exploration of Small Modular Reactors (SMRs) and green hydrogen production places them firmly in the Question Mark category of the BCG Matrix. These are high-growth potential areas, but currently require substantial investment with uncertain market adoption, reflecting their low current market share.

Emerging technologies like advanced battery storage and carbon capture, utilization, and storage (CCUS) also represent Question Marks for Duke Energy. While crucial for future decarbonization, these technologies are in early development stages, demanding significant R&D funding to achieve commercial viability and scale.

Geographic expansion into new markets and the development of novel energy services, such as advanced grid management, also fall under the Question Mark quadrant. These initiatives offer high future growth but involve considerable upfront investment and carry inherent risks due to unproven market acceptance.

The company's strategic investments in these nascent areas, such as pilot projects for advanced nuclear reactors announced in 2024, underscore the commitment to exploring future growth avenues. These ventures, while not yet contributing significantly to current revenue, are positioned for substantial long-term returns if successful.

BCG Matrix Data Sources

Our Duke Energy BCG Matrix leverages comprehensive data from company financial reports, regulatory filings, and industry-specific market research to provide a clear strategic overview.