Dufry PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dufry Bundle

Navigate the complex global landscape impacting Dufry with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the travel retail giant's future. Gain actionable intelligence to refine your own market strategies and anticipate challenges. Download the full version now for a strategic advantage.

Political factors

Dufry's global operations are intricately tied to government regulations, especially those governing duty-free allowances and customs procedures. For instance, shifts in import/export policies can directly influence the cost and availability of the diverse product range Dufry offers in travel retail environments.

Trade policies, including tariffs and trade agreements, play a crucial role. The potential elimination of the de minimis exemption for certain goods in the United States, for example, could impact the cost structure for low-value items and products subject to new tariffs, requiring Dufry to adapt its sourcing and pricing strategies to remain competitive.

Global geopolitical tensions, particularly in regions like the Middle East and Eastern Europe, significantly impact international travel. Dufry's reliance on airport retail means that conflicts or instability can directly affect passenger volumes and spending. For instance, ongoing tensions in Eastern Europe have led to airspace closures and rerouted flights, potentially reducing traffic at airports within Dufry's network.

These disruptions translate into decreased traveler confidence and, consequently, lower sales for Dufry. The company must actively monitor these geopolitical shifts to manage inventory and staffing effectively in affected locations. Dufry's exposure to over 60 countries means a diversified risk profile, but localized instability can still create significant challenges.

Dufry's performance is closely tied to international relations and bilateral agreements. For instance, the expansion of visa-free travel between countries like those in Southeast Asia, with Malaysia, Singapore, and China seeing increased reciprocal arrangements, directly fuels inbound tourism. This trend, observed throughout 2023 and projected to continue into 2024, boosts passenger traffic and thus retail opportunities for Dufry in airports and border locations.

Political Stability in Operating Countries

Political stability in Dufry's operating countries is a cornerstone for its ongoing operations and future investment strategies. Instability can directly impact tourist flows, a primary driver of Dufry's retail sales. For example, past political events, such as the brief martial law declarations in South Korea, have historically led to significant drops in tourism, causing direct revenue losses for travel retail businesses like Dufry.

Dufry must actively assess and monitor the political landscape in its key markets. This includes evaluating the risk of civil unrest, changes in government policy, and geopolitical tensions that could disrupt travel patterns or affect import/export regulations. The company's strategic decisions regarding market entry, expansion, and resource allocation are heavily influenced by the perceived political stability and the potential for unforeseen disruptions.

- Assessing Political Risk: Dufry's risk management framework must include robust political risk assessment for all operating regions.

- Impact on Tourism: Political instability can lead to travel advisories and reduced tourist numbers, directly impacting sales volumes. In 2023, global tourism recovery continued, but geopolitical events in certain regions could still pose localized challenges.

- Investment Decisions: Long-term investments in new airport concessions or retail infrastructure are contingent on predictable political environments.

Government Support for Tourism and Infrastructure

Government support for tourism and infrastructure development is a significant tailwind for Dufry. Initiatives like airport expansions and improvements directly correlate with increased passenger traffic, a key driver for travel retail. For example, China's fourteenth five-year plan, spanning 2021-2025, outlines substantial investments in aviation infrastructure, including the construction and expansion of numerous airports. This focus on enhancing travel connectivity is projected to boost international travel and, consequently, create more opportunities for Dufry's duty-free and travel retail operations.

These government-led infrastructure projects are not just about capacity; they often aim to improve the overall traveler experience, which can translate into higher spending. By strategically positioning itself in these upgraded or new facilities, Dufry can tap into a growing customer base. The company’s ability to secure prime retail locations within these expanding hubs will be crucial for leveraging these political factors effectively.

- Government investment in airport infrastructure, such as China's fourteenth five-year plan (2021-2025), directly supports travel retail growth.

- Expansion and modernization of airports increase passenger flow, creating more opportunities for Dufry.

- Enhanced travel infrastructure improves the overall passenger experience, potentially leading to higher retail spending.

Government regulations on duty-free allowances and customs procedures directly impact Dufry's product offerings and pricing. Trade policies, including tariffs and trade agreements, also shape Dufry's cost structure and competitiveness, as seen with potential changes to U.S. de minimis exemptions.

Geopolitical tensions and political instability in operating regions significantly affect international travel volumes and consumer spending. Dufry's global presence, spanning over 60 countries, necessitates constant monitoring of political landscapes to manage operational risks and adapt to disruptions.

Government support for tourism and infrastructure development, such as airport expansions, provides a significant tailwind for Dufry. For instance, China's substantial investments in aviation infrastructure under its fourteenth five-year plan (2021-2025) are expected to boost international travel and create more retail opportunities.

The company's performance is also influenced by international relations and visa-free travel agreements, which can increase inbound tourism. Dufry's strategic decisions, including market entry and expansion, are heavily dependent on the perceived political stability and the potential for policy changes in its key markets.

| Political Factor | Impact on Dufry | Example/Data (2023-2025 Projection) |

|---|---|---|

| Duty-Free Regulations | Affects product assortment and pricing | Ongoing discussions in various regions regarding adjustments to duty-free allowances. |

| Trade Policies (Tariffs) | Influences cost of goods and competitiveness | Potential for new tariffs on imported goods could impact sourcing strategies. |

| Geopolitical Stability | Impacts travel volumes and passenger spending | Regional conflicts can lead to airspace closures and reduced passenger traffic in affected hubs. |

| Government Infrastructure Investment | Drives passenger growth and retail opportunities | China's airport expansion plans (2021-2025) aim to increase air traffic by an estimated 15-20% by 2025. |

| Visa Agreements | Boosts inbound tourism and retail sales | Increased bilateral visa-free travel arrangements, particularly in Asia, are projected to enhance tourism flows by 10-15% in 2024. |

What is included in the product

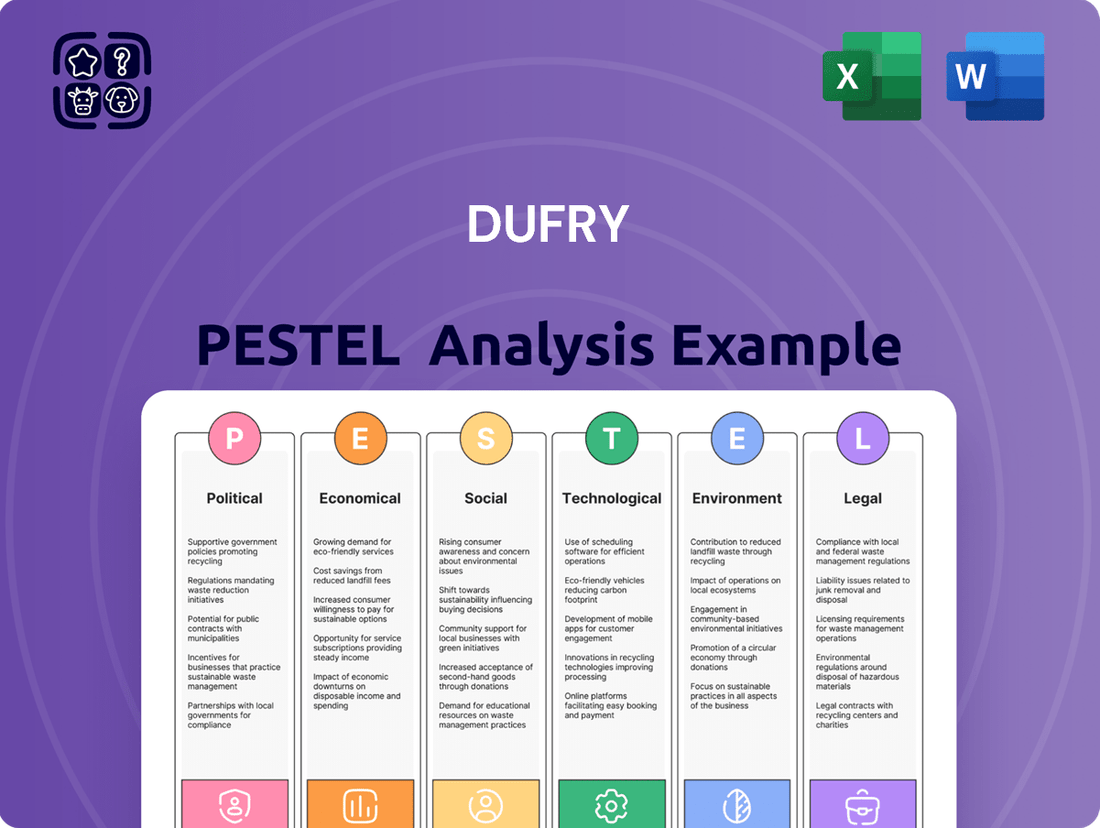

This PESTLE analysis examines the external forces impacting Dufry, covering Political, Economic, Social, Technological, Environmental, and Legal factors to identify strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Dufry's external environment to streamline strategic discussions.

Economic factors

The global economic outlook for 2024-2025 presents a mixed picture for travel retail. While the International Monetary Fund (IMF) projected global growth to remain steady at 3.2% in 2024, and slightly higher at 3.2% in 2025, consumer confidence remains a critical variable. Dufry's performance hinges on travelers having the disposable income and willingness to spend on travel retail items.

However, persistent inflation and potential economic slowdowns in key markets could dampen consumer confidence. For instance, if inflation continues to erode purchasing power, travelers might reduce their spending on non-essential duty-free goods. Dufry needs to stay agile, potentially adjusting its product mix and promotional activities to align with evolving consumer spending habits.

Rising disposable incomes, especially in emerging markets like Asia-Pacific, are fueling global air travel, which is a significant boon for travel retail. For instance, the World Bank reported that global disposable income saw a steady increase leading up to 2023, with developing economies often showing higher growth rates.

However, consumer preferences are evolving. A growing trend sees individuals prioritizing spending on experiences, such as travel and dining, over material goods. This shift means that while more people may be traveling, their spending within duty-free shops might decrease, requiring Dufry to strategically adjust its offerings and promotions to capture a share of this changing consumer wallet.

Currency exchange rates directly influence Dufry's financial performance by affecting how much travelers can spend and how much revenue the company recognizes when converting sales from different countries. For instance, a stronger US dollar generally makes international travel more affordable for Americans, potentially boosting spending in Dufry's locations abroad.

Conversely, currency volatility can create uncertainty, impacting the demand for higher-priced items and overall global market expansion. Dufry must employ sophisticated financial management techniques to counter the inherent risks posed by fluctuating currency values, ensuring stability and predictable earnings across its diverse international operations.

Travel and Tourism Industry Outlook

The travel and tourism industry's recovery is a critical driver for Dufry. Global tourism is projected to see robust expansion, with the travel retail sector expected to mirror this trend. For instance, the UN World Tourism Organization (UNWTO) reported that international tourist arrivals reached 97% of pre-pandemic levels by the end of 2023, signaling a strong rebound.

Dufry's performance is intrinsically linked to this global travel resurgence. Airports are experiencing increased passenger traffic, a direct benefit to Dufry's business model. Projections suggest continued growth in airport passenger numbers throughout 2024 and into 2025, further bolstering the travel retail market.

- Global tourism recovery: International tourist arrivals reached 1.3 billion in 2023, nearing 2019 levels, according to the UNWTO.

- Travel retail growth: The travel retail market is anticipated to grow significantly, driven by increased international travel and passenger spending.

- Regional impact: Dufry's strategic presence in regions like Asia-Pacific, which is experiencing a notable surge in travel, directly contributes to its growth prospects.

- Footfall increase: Rising airport passenger footfall is a key indicator of improved retail opportunities for Dufry.

Competition and Concession Fees

The travel retail sector is intensely competitive, with Dufry navigating a landscape alongside significant players like Lagardère Travel Retail and DFS Group. This competition directly impacts market share and profitability, forcing Dufry to constantly innovate and optimize its offerings. For instance, in 2023, Dufry reported a turnover of CHF 9.95 billion, showcasing its scale amidst this competitive environment.

Concession fees paid to airports represent a substantial operating cost for travel retailers. Post-pandemic, these fees have generally stabilized at elevated levels, placing ongoing pressure on Dufry's margins. Successfully managing these agreements and securing favorable terms is crucial for maintaining competitive pricing and profitability.

- Dufry's 2023 turnover reached CHF 9.95 billion, highlighting its significant presence in a competitive market.

- Key competitors like Lagardère Travel Retail and DFS Group exert pressure on market share and pricing strategies.

- Post-pandemic stabilization of concession fees at higher levels impacts Dufry's operating costs and profitability.

- Strategic management of concession agreements is vital for Dufry to maintain its competitive edge and financial performance.

Global economic growth, projected at 3.2% for both 2024 and 2025 by the IMF, underpins Dufry's revenue potential. However, persistent inflation and potential slowdowns in key markets could temper consumer spending on travel retail items. Dufry's success remains tied to travelers' disposable income and their willingness to spend, especially as emerging markets like Asia-Pacific show strong travel growth.

Currency fluctuations significantly impact Dufry's financial results, affecting traveler spending power and revenue conversion. While a stronger US dollar can boost international spending for Americans, currency volatility introduces uncertainty for higher-priced goods and global expansion. Dufry must actively manage these currency risks to ensure stable earnings across its diverse operations.

| Economic Factor | 2024 Projection (IMF) | 2025 Projection (IMF) | Impact on Dufry |

|---|---|---|---|

| Global GDP Growth | 3.2% | 3.2% | Positive, supports travel demand |

| Inflation | Variable (depends on region) | Variable (depends on region) | Potential negative, reduces discretionary spending |

| Disposable Income | Increasing (especially emerging markets) | Increasing (especially emerging markets) | Positive, drives travel and retail spending |

| Currency Exchange Rates | Volatile | Volatile | Mixed, can boost or hinder spending and revenue |

Full Version Awaits

Dufry PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Dufry PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain valuable insights into the external forces shaping Dufry's business landscape, enabling informed strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured. This Dufry PESTLE analysis provides a detailed examination of each factor, offering a clear understanding of the opportunities and threats Dufry faces in the global travel retail market.

Sociological factors

The travel retail landscape is being reshaped by shifting demographics, notably the growing influence of Millennials and Gen Z. These younger travelers, representing a significant portion of global tourism, exhibit distinct shopping behaviors and expectations compared to previous generations.

Millennials and Gen Z are digitally native, expecting seamless online-to-offline experiences and personalized recommendations. Their purchasing decisions are increasingly influenced by a desire for sustainable products and brands that align with their values. For instance, a 2024 survey indicated that over 60% of Gen Z travelers consider sustainability when making purchasing decisions, a trend Dufry must acknowledge.

These demographics also prioritize experiential retail, seeking unique in-store engagements and authentic local products over purely transactional luxury purchases. Dufry's strategy must adapt to this by offering more interactive displays, curated local assortments, and digital integration within its physical stores to resonate with these evolving consumer preferences.

The global health and wellness market is booming, with consumers increasingly prioritizing well-being. For instance, the global wellness market was valued at over $4.5 trillion in 2022 and is projected to reach $7.0 trillion by 2025, according to the Global Wellness Institute. This trend directly impacts travel retail, influencing purchasing decisions towards healthier food and beverage choices and natural beauty products. Dufry is well-positioned to benefit from this by strategically expanding its assortment in these growing categories, aligning with evolving consumer preferences.

Consumers are increasingly making purchasing decisions based on a brand's environmental and social impact. This trend fuels a demand for products and services that are sustainable, ethically sourced, and transparent in their supply chains. For instance, a 2024 survey indicated that over 60% of global consumers are willing to pay more for sustainable products, a significant rise from previous years.

Dufry's response to this sociological shift is evident in its sustainability initiatives, such as the clear identification of plastic-free, vegan, recyclable, and locally sourced products within its stores. This strategy directly caters to the growing segment of travelers who actively seek out and support businesses demonstrating a commitment to responsible consumption, aligning with Dufry's goal to enhance its appeal to an environmentally conscious clientele.

Desire for Personalized Shopping Experiences

Travelers today crave shopping experiences that feel unique to them, a shift fueled by the ease and personalization they encounter online. This means they expect retailers to understand their preferences, offering tailored product suggestions and special deals. For instance, the ability to order items online and simply pick them up at the airport is becoming a significant convenience factor.

Dufry's strategic investments in data analytics and digital technologies are therefore essential for catering to this evolving consumer desire. By leveraging customer data, the company can create more relevant and engaging shopping journeys. This approach is critical for staying competitive in a market where personalized service is increasingly becoming the norm. In 2024, many travel retail operators reported increased customer engagement through personalized digital marketing campaigns, with some seeing a 15% uplift in sales from targeted promotions.

- Personalized Recommendations: Customers expect suggestions based on past purchases and browsing history.

- Targeted Offers: Exclusive discounts and promotions tailored to individual traveler profiles drive higher conversion rates.

- Omnichannel Integration: Seamless transitions between online and physical stores, including click-and-collect services, enhance convenience.

- Data-Driven Insights: Dufry's ability to analyze customer data is key to understanding and meeting these personalized shopping demands.

Influence of Social Media and Digital Engagement

Social media significantly shapes how consumers, particularly younger travelers, make purchasing choices. Dufry can utilize platforms like Instagram and TikTok to deliver personalized promotions and drive in-store visits, a strategy increasingly vital in the travel retail space. For instance, by early 2024, over 4.9 billion people were active on social media globally, with a substantial portion being frequent travelers.

To effectively connect with travelers before, during, and after their trips, Dufry must bolster its digital marketing and social media engagement. This includes leveraging user-generated content and influencer collaborations to build brand loyalty and drive sales. By Q1 2024, travel-related content on social media platforms saw an average engagement rate increase of 15% year-over-year, indicating a strong consumer appetite for travel inspiration and retail integration.

- Social media's impact on travel retail purchasing decisions is growing, especially among Gen Z and Millennials.

- Dufry can enhance customer engagement through targeted social media campaigns and loyalty programs.

- Digital marketing is crucial for Dufry to maintain relevance and connect with travelers across their entire journey.

Shifting generational preferences are paramount, with Millennials and Gen Z increasingly influencing travel retail. These groups prioritize sustainability and value-driven brands, with over 60% of Gen Z travelers considering sustainability in 2024 purchasing decisions. They also seek experiential retail, favoring unique in-store engagements and local products, prompting Dufry to integrate digital elements and curated assortments.

The growing emphasis on health and wellness, a market valued at over $4.5 trillion in 2022 and projected to reach $7.0 trillion by 2025, directly impacts travel retail. Consumers are opting for healthier food, beverages, and natural beauty products, creating opportunities for Dufry to expand its offerings in these categories.

Consumer demand for ethical and sustainable products is rising, with over 60% of global consumers willing to pay more for sustainable goods in 2024. Dufry's initiatives, like highlighting plastic-free and vegan options, cater to this trend, reinforcing its commitment to responsible consumption and appealing to an environmentally conscious clientele.

Personalization is key, with travelers expecting tailored recommendations and offers, driving Dufry's investment in data analytics and digital technologies. In 2024, personalized digital marketing campaigns saw up to a 15% sales uplift for travel retail operators, underscoring the importance of data-driven customer engagement.

| Sociological Factor | Impact on Travel Retail | Dufry's Response/Opportunity | Supporting Data (2024/2025 Projections) |

|---|---|---|---|

| Generational Shifts (Millennials & Gen Z) | Demand for personalization, sustainability, and experiences. | Digital integration, curated local assortments, experiential displays. | 60%+ of Gen Z consider sustainability in purchases. |

| Health & Wellness Trend | Preference for healthier food, beverages, and natural beauty products. | Expansion of wellness-focused product categories. | Global wellness market projected to reach $7.0 trillion by 2025. |

| Ethical & Sustainable Consumption | Increased willingness to pay more for eco-friendly and ethically sourced products. | Highlighting sustainable product attributes (vegan, recyclable, local). | 60%+ global consumers willing to pay more for sustainable products (2024). |

| Digitalization & Personalization | Expectation of tailored recommendations and seamless online-offline experiences. | Investment in data analytics for personalized marketing and loyalty programs. | 15% sales uplift from targeted promotions in travel retail (2024). |

Technological factors

The travel landscape is rapidly digitizing, with travelers increasingly using remote check-in and mobile apps, freeing up more time for in-store shopping. This shift means travel retailers must offer a seamless blend of online and offline experiences, such as pre-ordering items for airport pickup.

Dufry is actively embracing this trend, investing in digital transformation to enhance its omnichannel strategy. Their Club Avolta loyalty program, for instance, is a crucial element in engaging customers across digital and physical touchpoints, aiming to capitalize on the evolving traveler's journey.

Dufry is increasingly integrating advanced technologies like AI and AR/VR to redefine the travel retail landscape. AI-driven personalization, for instance, allows for tailored offers based on customer data, aiming to boost engagement. By mid-2024, Dufry reported significant investments in digital transformation, with a focus on enhancing the customer journey through these innovations.

The travel retail sector is witnessing a significant surge in demand for contactless and frictionless payment methods, a trend amplified by traveler preferences for convenience and heightened hygiene awareness. By mid-2024, reports indicated that over 70% of global consumers preferred contactless payment options for everyday transactions, a figure expected to climb further in travel environments.

Dufry's strategic imperative lies in integrating a broad spectrum of secure and diverse payment solutions to elevate the customer journey and expedite checkout processes. This includes supporting mobile wallets, tap-to-pay credit cards, and potentially emerging biometric payment technologies.

Ensuring Dufry's payment infrastructure remains cutting-edge and agile is paramount to effectively cater to these rapidly shifting consumer expectations. For instance, in 2024, major airport retailers saw transaction times decrease by an average of 15% with the widespread adoption of contactless payment terminals.

Data Analytics for Personalization and Marketing

Data analytics is fundamentally reshaping how Dufry connects with its customers. By understanding individual shopping habits and preferences, the company can craft highly personalized marketing campaigns. This shift from broad advertising to targeted messaging is crucial in today's competitive retail landscape, especially within the travel sector where consumer journeys are diverse.

Dufry's strategic partnerships with travel operators and its own loyalty programs are key enablers for this data-driven approach. These collaborations allow Dufry to collect rich datasets on consumer behavior, from flight bookings to past purchases. For instance, in 2024, Dufry reported a significant increase in engagement through its digital channels, directly attributed to personalized offers derived from customer data.

The ability to tailor recommendations and promotions based on this gathered intelligence directly translates to increased sales and customer loyalty. Dufry's investment in advanced analytics platforms in 2025 aims to further refine this process, predicting future customer needs and proactively offering relevant products and services. This data-centric strategy is expected to drive a notable uplift in conversion rates across its global network of travel retail outlets.

- Personalized Marketing: Leveraging data analytics to deliver targeted promotions and product recommendations to individual travelers.

- Data Acquisition: Utilizing partnerships with travel firms and loyalty programs to gather comprehensive customer insights.

- Enhanced Engagement: Driving higher customer interaction and satisfaction through relevant and timely offers.

- Sales Growth: Directly correlating data-driven marketing efforts with increased revenue and improved sales performance.

Enhanced Supply Chain Technology and Logistics

Technological advancements are revolutionizing Dufry's supply chain. For instance, the adoption of AI-powered demand forecasting can significantly improve inventory accuracy, a critical factor for a global travel retailer with a vast product range. This technology helps anticipate customer needs, reducing instances of stockouts or overstocking.

Automated stock ordering systems, integrated with real-time sales data, are crucial for optimizing inventory levels. This is particularly important as logistics costs continue to be a concern. For example, in 2024, global shipping costs saw fluctuations, making efficient inventory management a key driver of profitability.

Business intelligence tools provide valuable insights into product performance and supply chain bottlenecks. Dufry can leverage these tools to identify slow-moving items and optimize distribution routes, thereby enhancing overall operational efficiency. This focus on technological integration directly impacts both the bottom line and the customer experience by ensuring product availability.

Key technological impacts include:

- Improved inventory accuracy through AI-driven demand forecasting.

- Reduced logistics costs via automated stock ordering and route optimization.

- Enhanced product availability leading to increased customer satisfaction.

- Data-driven insights for better operational decision-making.

Dufry's technological strategy is centered on digital integration and data utilization to enhance the customer experience and operational efficiency. Investments in AI and data analytics are key to personalizing marketing and improving inventory management, with significant progress reported by mid-2024.

The company is also prioritizing seamless, contactless payment solutions to meet evolving traveler preferences for convenience and hygiene, a trend supported by broad consumer adoption of these methods globally. This technological focus aims to drive sales growth and customer loyalty.

Furthermore, Dufry is leveraging technology to optimize its supply chain, using AI for demand forecasting and business intelligence tools to improve efficiency and product availability, directly impacting profitability and customer satisfaction.

Technological advancements are revolutionizing Dufry's supply chain, with AI-powered demand forecasting improving inventory accuracy and automated stock ordering systems optimizing levels. Business intelligence tools offer insights into product performance and supply chain bottlenecks, enhancing overall operational efficiency.

| Technology Area | Impact on Dufry | Key Data/Observation (2024-2025) |

|---|---|---|

| Digital Integration & Omnichannel | Enhanced customer engagement and sales through seamless online/offline experiences. | Club Avolta loyalty program driving digital touchpoints; significant investments in digital transformation by mid-2024. |

| AI & Data Analytics | Personalized marketing, improved inventory management, and predictive customer insights. | AI-driven personalization boosting engagement; advanced analytics platforms targeted for 2025 to refine customer needs prediction. |

| Contactless Payments | Faster transactions, improved customer convenience, and heightened hygiene awareness. | Over 70% of global consumers prefer contactless payments; transaction times decreased by 15% in 2024 with contactless terminal adoption. |

| Supply Chain Technology | Increased inventory accuracy, reduced logistics costs, and better product availability. | AI demand forecasting reducing stockouts; optimization of distribution routes to counter fluctuating global shipping costs in 2024. |

Legal factors

Dufry's business model, centered on duty-free and duty-paid retail, is intrinsically linked to customs regulations and duty-free allowances. Changes in these policies directly affect product costs and consumer purchasing power. For instance, in 2023, the European Union continued to review its VAT refund schemes for tourists, a factor Dufry closely monitors.

Recent discussions in the United States regarding potential limitations on duty-free exemptions for specific product categories, especially those originating from China, highlight the sensitivity of Dufry's operations to trade policy shifts. Such changes could alter pricing strategies and product sourcing for Dufry's extensive global network.

The company's performance is therefore contingent on its ability to navigate and adapt to evolving customs frameworks and tariff structures across its diverse markets. Dufry's 2023 financial reports indicated that approximately 65% of its sales were generated in regions with significant duty-free components, underscoring the critical nature of these legal factors.

Dufry's product assortment, heavily featuring alcohol, tobacco, and cosmetics, is subject to stringent, country-specific regulations. For instance, in 2024, many European nations continued to enforce strict advertising bans and age verification protocols for tobacco and alcohol sales, impacting Dufry's marketing strategies and operational procedures in those regions. Compliance with these varied legal frameworks is paramount to prevent significant fines and safeguard brand reputation.

Dufry's operations are fundamentally shaped by concession agreements and licenses, which grant them the right to operate retail outlets within airports, on cruise ships, and at other travel destinations. These contracts are vital for long-term stability, with their terms, duration, and renewal processes being critical legal considerations. For instance, Dufry's significant presence in Europe, a key market, relies heavily on the renewal of these concessions, which are often subject to competitive tender processes.

Changes in concession fees or the outcome of bidding wars for prime retail locations can directly affect Dufry's profitability. The company's success hinges on its legal ability to secure and maintain these agreements on favorable terms. In 2023, Dufry continued to navigate these legal frameworks, with negotiations and renewals of existing concessions being a constant focus to ensure continued market access and revenue streams.

Consumer Protection Laws

Dufry operates under a web of consumer protection laws that govern everything from product safety and advertising integrity to the critical area of data privacy. These regulations are designed to ensure fair dealings and protect customers from misleading practices.

With the growing importance of personalized customer interactions and the collection of vast amounts of data, strict adherence to data protection frameworks like the General Data Protection Regulation (GDPR) is non-negotiable. For instance, in 2024, the European Union continued to emphasize robust data privacy enforcement, with significant fines levied against companies for non-compliance, underscoring the financial and reputational risks involved.

- Product Safety: Dufry must ensure all goods sold meet established safety standards, a critical aspect in travel retail where products range from cosmetics to electronics.

- Advertising Standards: Marketing and promotional materials must be truthful and not misleading, preventing deceptive claims about products or services.

- Data Privacy: Compliance with regulations like GDPR, which dictates how customer data is collected, stored, and used, is paramount to maintaining trust and avoiding substantial penalties.

- Transparency: Dufry is legally obligated to be transparent with consumers regarding pricing, product origins, and return policies.

International Trade Agreements and Tariffs

International trade agreements and tariffs significantly influence Dufry's operational landscape. For instance, the European Union's trade policies, including its customs union, streamline cross-border movement of goods within member states, benefiting Dufry's European operations. Conversely, changes in tariffs on specific product categories, such as luxury goods or electronics, can directly impact sourcing costs and the attractiveness of duty-free offerings in non-EU locations.

Trade tensions can create volatility. For example, tariffs imposed on goods originating from China in 2023 and 2024 have led to increased import costs for many retailers, including those in the travel retail sector. Dufry must adapt by diversifying its supplier base and adjusting its product mix to mitigate the impact of such tariffs on its pricing and competitiveness in its global store network, which spans over 65 countries.

Navigating these legal and economic factors is crucial for Dufry's success. The company's ability to manage its supply chain effectively in response to evolving trade regulations and tariff structures directly affects its profitability and its capacity to offer a compelling product assortment to travelers worldwide.

- Impact of Tariffs: Tariffs on goods from countries like China can increase Dufry's cost of goods sold, potentially affecting profit margins on popular duty-free items.

- Trade Agreement Benefits: Agreements like the EU's customs union facilitate smoother intra-European trade, reducing logistical complexities for Dufry.

- Supplier Diversification: Dufry's strategy to source from multiple regions helps buffer against the financial impact of region-specific tariffs or trade disputes.

- Product Portfolio Management: Adapting product offerings based on import costs and tariff implications is key to maintaining competitive pricing in duty-free markets.

Dufry's operations are heavily influenced by international trade laws and customs regulations, which dictate the terms of duty-free sales and product importations. For example, in 2024, the company continued to navigate varying tariff structures across its global network, which spans over 65 countries, impacting the cost of goods sold for items like premium spirits and fragrances.

The company's reliance on concession agreements, which are legally binding contracts granting retail operating rights, is a significant legal factor. Dufry actively manages these agreements, with renewals and new tenders being critical for market access. In 2023, the company secured several key renewals, ensuring its continued presence in major international airports.

Consumer protection laws, including data privacy regulations like GDPR, are paramount. Dufry must ensure compliance in its customer interactions and data handling practices. Failure to do so can result in substantial fines, as seen with other retailers in 2024 for data breaches.

Dufry's product assortment is subject to country-specific regulations concerning alcohol, tobacco, and pharmaceuticals. Adherence to these laws, including age restrictions and advertising bans, is crucial for maintaining operational licenses and brand reputation. For instance, in 2024, several markets intensified scrutiny on the sale of age-restricted goods.

| Legal Factor | Impact on Dufry | Example (2023-2024) |

| Customs Regulations & Tariffs | Affects product pricing, sourcing costs, and duty-free eligibility. | Navigating varying tariffs on luxury goods across different continents. |

| Concession Agreements | Determines market access and operational rights in key travel hubs. | Securing renewals of airport retail concessions in Europe. |

| Consumer Protection Laws | Governs product safety, advertising, and data privacy practices. | Ensuring GDPR compliance for customer loyalty programs. |

| Product-Specific Regulations | Dictates sales, marketing, and handling of items like alcohol and tobacco. | Adhering to strict age verification protocols for tobacco sales in Asian markets. |

Environmental factors

Climate change is increasingly impacting global travel. The growing frequency and intensity of extreme weather events, such as hurricanes and severe storms, can significantly disrupt airport and seaport operations. For instance, the 2023 Atlantic hurricane season saw several major storms, leading to flight cancellations and delays, which directly affect passenger volumes at Dufry's retail locations. Dufry must consider these physical risks to its infrastructure and supply chains, as disruptions can lead to reduced sales and operational challenges.

The increasing focus on sustainability is a major environmental factor for Dufry. Consumers, especially travelers, are actively seeking out brands that show a real commitment to the planet. This shift means companies need to pay attention to how their products are made and packaged.

In 2024, it's estimated that over 60% of consumers globally are willing to change their purchasing habits to reduce their environmental impact. This translates directly to the travel retail sector, where Dufry operates. Travelers are looking for more than just convenience; they want to feel good about their purchases.

Dufry's efforts to offer more eco-friendly products and reduce packaging waste are therefore vital. For instance, their work with brands that use recycled materials or have ethical sourcing practices directly addresses this growing consumer demand. This alignment with eco-conscious values is key to maintaining customer loyalty and attracting new ones in the current market.

The travel retail sector, including Dufry, is under significant scrutiny to minimize waste and plastic use. This pressure stems from growing consumer awareness and regulatory demands aimed at environmental protection.

Dufry must implement comprehensive waste management plans and actively reduce single-use plastics across its global operations. For instance, a 2024 report highlighted that the aviation and travel retail industries are key targets for plastic reduction initiatives, with many airports and airlines setting ambitious goals for 2025.

Exploring alternatives like refillable product stations and promoting the use of sustainable, biodegradable, or recyclable packaging materials are crucial steps. Dufry's commitment to these practices will not only align with environmental goals but also resonate with an increasingly eco-conscious traveler demographic.

Carbon Footprint and Emissions Reduction

Dufry's extensive operations, from global logistics networks to the energy demands of its retail stores and restaurants, inherently contribute to its carbon footprint. Recognizing this, there's a significant push for the company to define and actively pursue emission reduction targets. This aligns with broader global sustainability efforts, including frameworks like the Science Based Targets initiative (SBTi), which encourages companies to set ambitious climate goals.

Dufry is actively implementing strategies to mitigate its environmental impact. A key element of this is their dedicated approach to shop and restaurant design. This strategy focuses on reducing overall energy consumption through efficient lighting and HVAC systems, and also incorporates the use of recyclable materials in store fit-outs. For instance, in 2023, Dufry reported a 2.1% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2022 baseline, demonstrating progress towards their sustainability commitments.

- Operational Emissions: Dufry's global logistics and retail store energy usage are primary contributors to its carbon footprint.

- Sustainability Imperative: The company faces increasing pressure to set and achieve emission reduction goals, aligning with initiatives like the SBTi.

- Design Strategy: Dufry's focus on energy-efficient store designs and the use of recyclable materials aims to lower environmental impact.

- Progress in 2023: Dufry achieved a 2.1% reduction in Scope 1 and 2 emissions compared to 2022.

Supply Chain Environmental Impact

Dufry's extensive global supply chain, encompassing everything from raw material acquisition to final product delivery, carries a notable environmental footprint. The company is actively working with its brand partners to promote sustainable sourcing and investigate greener logistics options to reduce its overall impact.

For instance, the increasing costs associated with logistics and freight, a trend that has persisted through 2024 and is expected to continue into 2025, present a direct challenge to implementing and scaling these sustainability initiatives. Dufry's commitment to reducing emissions from its supply chain is therefore intertwined with managing these rising operational expenses.

- Global Supply Chain Footprint: Dufry's operations span numerous countries, requiring significant transportation and warehousing, each with associated environmental considerations.

- Sustainable Sourcing Collaboration: The company is engaging with its diverse range of brand partners to encourage and implement more environmentally responsible sourcing of goods sold in its travel retail outlets.

- Logistics Cost Impact: Rising global freight and logistics costs, a significant factor in 2024 and projected for 2025, directly influence the economic viability and scalability of adopting more sustainable transportation methods.

Environmental factors significantly shape Dufry's operational landscape, from the direct impact of climate change on travel disruptions to the growing consumer demand for sustainability. The company must navigate these challenges by embracing eco-friendly practices and transparently communicating its environmental efforts to a discerning customer base.

Dufry's commitment to reducing its carbon footprint is evident in its operational strategies, including energy-efficient store designs and the use of sustainable materials. These initiatives are crucial for aligning with global sustainability goals and meeting the expectations of environmentally conscious travelers.

The company's supply chain management also presents environmental considerations, with a focus on sustainable sourcing and greener logistics. Dufry's ability to manage these aspects effectively is influenced by rising logistics costs, highlighting the complex interplay between environmental responsibility and operational economics.

| Environmental Factor | Impact on Dufry | Dufry's Response/Data |

|---|---|---|

| Climate Change & Extreme Weather | Disruptions to travel, impacting passenger volumes and sales. | 2023 hurricane season caused flight cancellations, affecting airport retail. |

| Consumer Demand for Sustainability | Preference for eco-friendly brands and products. | Over 60% of consumers globally willing to change habits for environmental impact (2024 estimate). |

| Waste & Plastic Reduction | Pressure from consumers and regulators to minimize waste. | Aviation/travel retail key targets for plastic reduction by 2025. |

| Carbon Footprint & Emissions | Operational energy use and logistics contribute to emissions. | 2.1% reduction in Scope 1 & 2 emissions in 2023 vs. 2022. |

| Supply Chain Sustainability | Environmental impact of global logistics and sourcing. | Engaging brand partners for sustainable sourcing; managing rising logistics costs (2024-2025). |

PESTLE Analysis Data Sources

Our Dufry PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable financial news outlets, and comprehensive market research reports. This approach ensures that each aspect, from political stability to technological advancements, is grounded in current and verifiable information.