Dufry Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dufry Bundle

Unlock the core components of Dufry's global retail strategy with our Business Model Canvas. Discover how they leverage key partnerships and customer relationships to deliver unique value propositions in diverse travel environments. This snapshot reveals their operational efficiency and revenue streams.

Dive deeper into Dufry’s proven success with the complete Business Model Canvas. This comprehensive document breaks down their customer segments, cost structure, and revenue streams, offering actionable insights for your own strategic planning. Get the full picture today!

Partnerships

Dufry's core operations are built upon securing and maintaining long-term concession agreements with airport and port authorities, along with landlords of railway stations and prominent tourist districts. These crucial partnerships provide Dufry with exclusive rights to operate retail outlets in high-traffic travel environments, forming the bedrock of its business model.

The profitability and market standing of Dufry are significantly influenced by the specific terms of these concession agreements, including their duration and the associated rental structures. For instance, in 2024, Dufry continued to focus on renewing and extending these vital contracts to ensure sustained access to key locations.

Dufry's success hinges on its extensive network of global and local brand collaborations, crucial for curating a compelling product selection across diverse categories such as beauty, confectionery, and apparel. These vital relationships grant Dufry access to sought-after and unique items, enabling the company to cater effectively to its international clientele.

In 2024, Dufry continued to strengthen these ties, recognizing that strong supplier management directly impacts inventory efficiency and product availability, ensuring a seamless shopping experience for travelers. For instance, their strategic alliances allow them to secure exclusive travel retail offerings, a key differentiator in a competitive market.

Dufry’s reliance on logistics and distribution partners is paramount for its global operations, ensuring goods reach its diverse retail outlets efficiently. In 2024, Dufry continued to leverage these relationships to navigate the complexities of international supply chains, a critical factor for a travel retailer with a presence in over 60 countries.

These partnerships are key to maintaining optimal stock levels and mitigating disruptions, especially considering the volatile nature of global logistics. For instance, a robust distribution network allows Dufry to respond effectively to fluctuating travel demand, a trend observed throughout 2024 as passenger numbers continued to rebound.

Technology & Payment Solution Providers

Dufry's strategic alliances with technology and payment solution providers are fundamental to its operational excellence and customer engagement. These partnerships ensure seamless shopping experiences and efficient back-end processes.

Collaborations with technology firms are crucial for Dufry's integrated retail operations. This includes advanced point-of-sale (POS) systems that speed up transactions and robust inventory management software to optimize stock levels across its global network. Furthermore, Dufry leverages partnerships for its e-commerce and digital platforms, enhancing the omnichannel customer journey. For instance, in 2023, Dufry continued to invest in digital transformation, with a focus on improving in-store technology and online offerings to cater to evolving traveler preferences.

Critical to Dufry's business are its partnerships with payment solution providers. These alliances enable the company to offer secure, swift, and convenient payment options to a diverse international clientele. Supporting a wide array of currencies and payment methods, including contactless and mobile payments, is paramount for travelers. Dufry's commitment to integrating diverse payment technologies was evident as it processed millions of transactions globally in 2023, highlighting the importance of these partnerships for revenue realization and customer satisfaction.

- Technology Partnerships: Dufry works with providers for POS, inventory management, and e-commerce solutions to streamline operations and enhance customer experience.

- Payment Solution Integration: Collaborations with payment providers facilitate secure, multi-currency, and multi-method transactions for international travelers.

- Digital Transformation Focus: Dufry's ongoing investment in technology aims to improve both in-store and online retail capabilities, reflecting industry trends in 2023.

Tourism Boards & Airlines

Dufry cultivates strategic alliances with tourism boards and airlines to boost traveler traffic and brand exposure. These collaborations often feature joint marketing campaigns, loyalty program tie-ins, and convenient pre-order options, directly expanding sales channels and deepening customer engagement within the travel sector.

For instance, in 2024, Dufry's extensive network of travel retail outlets, including those in airports and popular tourist destinations, benefits significantly from these partnerships. Airlines, in particular, serve as a direct conduit, with co-branded promotions or exclusive offers for their passengers driving footfall to Dufry stores.

- Strategic Alliances: Partnerships with national and regional tourism organizations amplify Dufry's reach to international visitors.

- Airline Integration: Collaborations with airlines can include in-flight magazine advertising, co-branded loyalty programs, and airport retail promotions targeting specific flight routes.

- Customer Engagement: Joint marketing efforts and integrated services like pre-ordering for collection at departure or arrival points enhance the overall travel experience and drive sales.

Dufry's key partnerships are vital for its operational success and market positioning. These include concession agreements with airport and port authorities, ensuring access to high-traffic retail locations. In 2024, Dufry continued to focus on renewing these agreements, underscoring their importance for sustained business operations.

Strong relationships with global and local brands are essential for curating a diverse product offering. These collaborations, crucial for securing unique items, were actively managed by Dufry in 2024 to maintain competitive inventory. Furthermore, Dufry relies heavily on logistics and distribution partners to manage its extensive global supply chain, a critical function for a retailer operating in over 60 countries.

| Partnership Type | Description | 2024 Focus/Impact |

|---|---|---|

| Concession Agreements | Securing retail space in airports, ports, and stations. | Renewal and extension of key contracts for market access. |

| Brand Collaborations | Accessing diverse product assortments (beauty, fashion, etc.). | Strengthening supplier relationships for inventory efficiency and exclusive offerings. |

| Logistics & Distribution | Ensuring efficient global supply chain management. | Navigating international complexities and maintaining optimal stock levels. |

What is included in the product

A detailed blueprint of Dufry's operations, outlining its strategy for serving diverse traveler segments through various retail formats and distribution channels.

This model emphasizes Dufry's core value proposition of providing a convenient and appealing shopping experience for travelers, supported by strong supplier relationships and efficient operational infrastructure.

The Dufry Business Model Canvas offers a clear, visual representation of their operations, simplifying complex strategies for easier understanding and identification of potential friction points.

It acts as a pain point reliever by providing a structured, one-page overview that facilitates targeted problem-solving and strategic adjustments within Dufry's travel retail ecosystem.

Activities

Dufry's primary focus is the day-to-day running of its vast retail presence, encompassing duty-free and duty-paid shops in airports, cruise ships, and other travel hubs. This involves a constant effort to boost sales, manage teams effectively, and adhere to all relevant local rules. In 2023, Dufry reported a turnover of CHF 9,499.1 million, showcasing the scale of its retail operations.

Key to success is ensuring smooth operations, which means everything from inventory management to customer interaction runs efficiently. The company emphasizes maximizing sales per square meter, a critical metric for profitability in the competitive travel retail sector. Dufry's strategic focus on operational excellence directly impacts its financial performance and market position.

Dufry's key activity revolves around a complex global supply chain and inventory management system. This encompasses accurate demand forecasting, sourcing from a vast network of over 7,000 suppliers, efficient warehousing, and timely distribution to its numerous retail outlets across the globe.

In 2024, Dufry continued to refine its inventory strategies to balance product availability with capital efficiency. By leveraging advanced analytics, the company aims to reduce instances of both stockouts, which can lead to lost sales, and overstocking, which ties up valuable working capital. This meticulous approach ensures that the right products are in the right place at the right time, a crucial element for a travel retail business with diverse product categories and high customer footfall.

Dufry's core activities revolve around securing and diligently managing concession agreements. This means constantly engaging in competitive bidding for prime locations within airports and ports worldwide, and then negotiating favorable terms with authorities.

In 2024, Dufry continued to expand its global presence through strategic concession wins. The company actively pursued renewals and new contracts, reinforcing its position in key travel retail markets.

Successful management of these concessions is paramount for Dufry's sustained growth and ability to maintain market leadership. This includes optimizing store layouts, product assortment, and operational efficiency to maximize revenue from each location.

Marketing & Customer Engagement

Dufry's marketing and customer engagement efforts are central to attracting and retaining travelers. They deploy a range of strategies, from in-store promotions and targeted digital marketing to robust loyalty programs. For instance, in 2023, Dufry continued to invest in its digital platforms and personalized offers, aiming to boost customer lifetime value.

These initiatives are designed to increase foot traffic within their retail locations and improve sales conversion rates. By understanding traveler preferences, Dufry aims to create a compelling shopping experience that encourages repeat business. This focus is crucial in the dynamic travel retail sector, where competition is intense.

- In-store Promotions: Seasonal sales, limited-time offers, and brand collaborations to drive immediate purchases.

- Digital Marketing: Targeted online advertising, social media engagement, and email campaigns reaching travelers before, during, and after their journeys.

- Loyalty Programs: Schemes like Dufry's RED loyalty program offer exclusive benefits and rewards to frequent shoppers, fostering long-term relationships.

- Personalized Communications: Utilizing customer data to deliver tailored product recommendations and promotions, enhancing the individual shopping experience.

Product Sourcing & Category Management

Dufry's core operations revolve around continuously sourcing new and exclusive products while effectively managing its extensive range of categories. This dynamic process involves staying ahead of market trends, forging strong relationships with brands through negotiation, and meticulously curating product assortments to cater to the diverse tastes of travelers worldwide.

This strategic approach to product sourcing and category management is fundamental to Dufry's ability to deliver its unique value proposition. By offering a compelling and relevant selection of goods, Dufry aims to enhance the travel shopping experience and drive customer loyalty.

- Product Sourcing: Dufry actively seeks out new and exclusive products, often through direct negotiations with brands, to differentiate its offerings.

- Category Management: The company manages a broad spectrum of product categories, including fashion, beauty, food and beverage, and electronics, tailoring assortments to specific airport locations and traveler demographics.

- Market Trend Identification: Dufry invests in market research and analysis to identify emerging consumer preferences and product trends relevant to the travel retail sector.

- Assortment Optimization: Based on sales data and customer feedback, Dufry continuously optimizes its product mix to maximize sales and customer satisfaction.

Dufry's key activities are centered on the meticulous management of its retail operations across diverse travel environments, including airports and cruise terminals. This involves optimizing sales performance, ensuring efficient inventory turnover, and cultivating strong relationships with suppliers and brand partners. In 2023, Dufry's turnover reached CHF 9,499.1 million, underscoring the scale of its operational execution.

A significant activity is the continuous pursuit and management of concession agreements, which are vital for securing prime retail locations. Dufry actively engages in bidding processes and negotiates favorable terms to maintain and expand its global footprint. In 2024, the company focused on strategic wins and renewals, reinforcing its market presence.

Furthermore, Dufry dedicates considerable effort to marketing and customer engagement, employing strategies like in-store promotions, digital advertising, and loyalty programs to enhance the traveler shopping experience and drive repeat business. For instance, the RED loyalty program continued to foster customer relationships in 2023.

The company also prioritizes product sourcing and category management, curating a diverse range of goods to meet traveler demands. This includes identifying market trends and optimizing product assortments across categories like beauty, fashion, and food and beverage.

| Key Activity | Description | 2023/2024 Relevance |

| Retail Operations Management | Day-to-day running of shops, sales optimization, team management. | Turnover of CHF 9,499.1 million in 2023 highlights operational scale. |

| Concession Agreement Management | Securing and managing retail locations in travel hubs. | Strategic wins and renewals in 2024 to expand global presence. |

| Marketing & Customer Engagement | Promotions, digital marketing, loyalty programs. | Continued investment in digital platforms and personalized offers in 2023. |

| Product Sourcing & Category Management | Curating diverse product assortments and managing supplier relationships. | Focus on market trends and assortment optimization to enhance traveler experience. |

Preview Before You Purchase

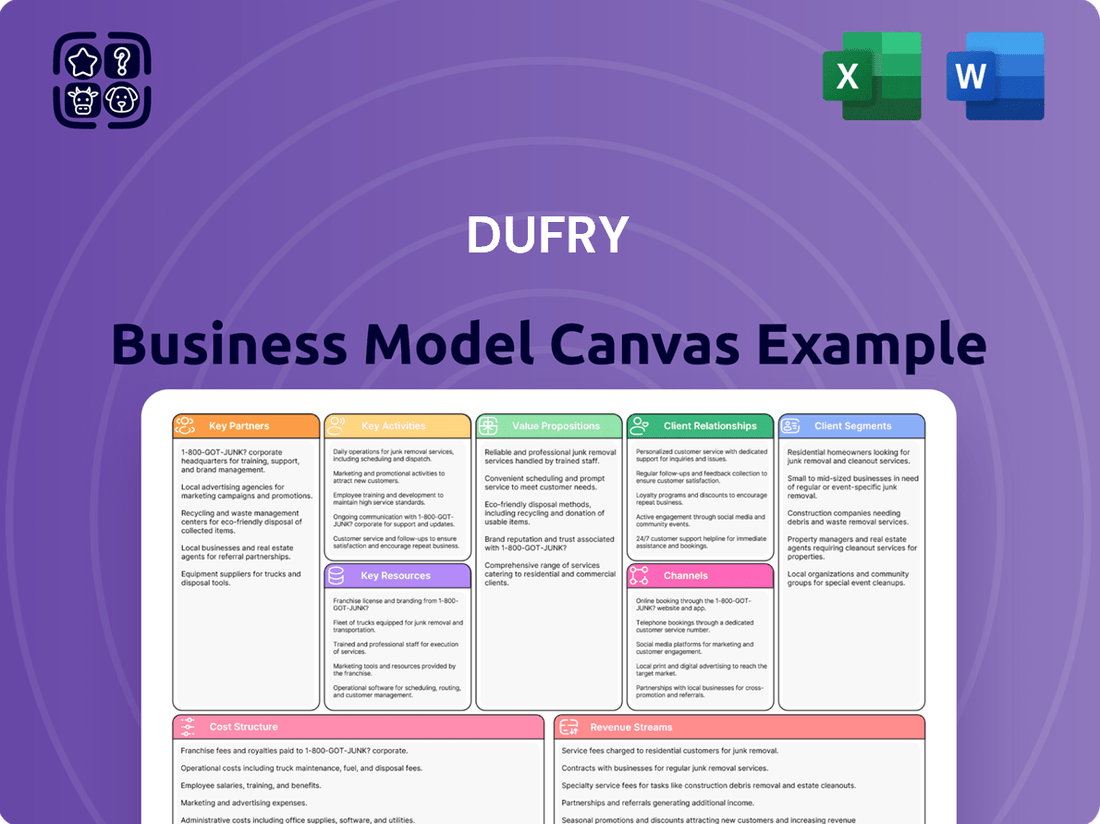

Business Model Canvas

The Dufry Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unaltered structure and content that will be delivered to you, ensuring full transparency and no surprises. Once your order is processed, you will gain immediate access to this same comprehensive Business Model Canvas, ready for your strategic analysis and implementation.

Resources

Dufry's core physical assets are its vast network of retail stores. These are strategically positioned in high-traffic travel hubs like airports, cruise terminals, seaports, and train stations worldwide, as well as in key downtown tourist zones.

This extensive infrastructure is crucial for direct customer engagement and showcasing their product offerings. For instance, in 2023, Dufry operated over 2,300 stores across more than 65 countries, highlighting the sheer scale of its physical retail presence.

Dufry's global brand portfolio represents a significant key resource, encompassing a vast and diverse inventory. This includes popular items in perfumes, cosmetics, food, wine, tobacco, fashion, and accessories, sourced from leading international brands.

This extensive product offering, managed through sophisticated inventory systems, enables Dufry to meet varied customer demands effectively. For instance, in 2023, Dufry reported a robust sales performance, highlighting the appeal of its curated brand selection to travelers worldwide.

Dufry's global workforce, numbering over 31,000 employees as of 2023, is a cornerstone of its business model. This human capital includes dedicated retail staff who are the face of the brand, category managers with deep product knowledge, and supply chain experts ensuring efficient operations.

The retail expertise of Dufry's employees is vital for understanding and catering to the diverse needs of international travelers. Their ability to provide exceptional customer service directly impacts sales and customer loyalty, a critical factor in the competitive travel retail market.

In 2023, Dufry continued its investment in employee development, recognizing that skilled personnel are essential for managing its extensive network of over 2,300 shops across more than 60 countries. This focus on human capital ensures the company can adapt to evolving market demands and maintain its operational excellence.

Concession Agreements & Licenses

Dufry's business model hinges on securing long-term concession agreements and operational licenses. These are not physical assets, but they are incredibly valuable because they give Dufry the exclusive right to operate in prime locations like airports and train stations.

These agreements are the bedrock of Dufry's market access and its ability to maintain a competitive edge. Without them, operating in these high-traffic areas would be impossible.

- Exclusive Operating Rights: Concession agreements grant Dufry the sole permission to sell goods at specific transport hubs, eliminating direct competition within those locations.

- Long-Term Stability: Many of these contracts extend for 10 years or more, providing a stable revenue base and allowing for significant capital investment.

- Strategic Locations: Dufry focuses on securing concessions in airports and other travel points with high passenger volumes, ensuring consistent customer flow.

- Regulatory Compliance: Licenses ensure Dufry adheres to all legal and operational standards required by transport authorities and landlords.

Digital Platforms & IT Systems

Dufry's modern digital platforms, including its e-commerce sites and pre-order systems, are crucial. These platforms, supported by robust IT for inventory and sales, are essential for efficient operations and customer engagement in today's retail environment. For example, in 2023, Dufry continued to invest in its digital capabilities, aiming to enhance the customer journey across its various touchpoints.

These technologies are not just about online sales; they underpin the entire operational backbone. Think of the systems managing stock levels across numerous airport locations or tracking products through the supply chain. This digital infrastructure is key to Dufry's ability to manage a complex global retail operation effectively.

The loyalty program infrastructure is another vital digital resource. It allows Dufry to build and maintain relationships with its frequent travelers, offering personalized experiences and rewards. This data-driven approach helps in understanding customer preferences and tailoring offers, which is increasingly important for success in the travel retail sector.

Key digital and IT resources include:

- E-commerce websites and mobile applications for online sales and customer interaction.

- Pre-order systems enabling customers to purchase items before their travel.

- Loyalty program infrastructure to manage customer relationships and rewards.

- Inventory management systems ensuring product availability and efficient stock rotation.

- Sales and point-of-sale (POS) systems for seamless transaction processing.

- Supply chain management IT for tracking and optimizing product flow.

Dufry's key resources are its extensive retail store network in high-traffic travel locations, a diverse global brand portfolio, and a skilled workforce of over 31,000 employees as of 2023. Crucially, long-term concession agreements provide exclusive access to prime retail spaces, while advanced digital platforms and loyalty programs enhance customer engagement and operational efficiency.

| Key Resource | Description | 2023 Data/Impact |

|---|---|---|

| Retail Network | Stores in airports, cruise terminals, seaports, train stations, and downtown tourist zones. | Over 2,300 stores across more than 65 countries. |

| Brand Portfolio | Wide range of products including perfumes, cosmetics, food, wine, tobacco, fashion, and accessories. | Contributed to robust sales performance. |

| Human Capital | Retail staff, category managers, supply chain experts. | Over 31,000 employees globally; continued investment in employee development. |

| Concession Agreements | Exclusive operating rights in prime travel locations. | Foundation for market access and competitive edge. |

| Digital Platforms | E-commerce, pre-order systems, loyalty programs, IT infrastructure. | Continued investment to enhance customer journey and operational efficiency. |

Value Propositions

Dufry’s value proposition centers on providing travelers with remarkably convenient access to a diverse range of products right within airports, train stations, and ports. This strategic placement means customers can shop seamlessly as part of their travel plans, bypassing the need for separate shopping trips before or after their journey.

This integrated approach significantly saves travelers valuable time and effort. For instance, in 2023, Dufry operated in over 65 countries, serving approximately 2.1 billion passengers, highlighting the sheer scale of its convenient access to travelers worldwide.

Travelers enjoy Dufry's wide and thoughtfully assembled range of products, spanning luxury items, regional flavors, and daily necessities. This broad selection caters to a multitude of traveler tastes, positioning Dufry as a convenient destination for all their travel retail requirements.

In 2024, Dufry's commitment to a diverse product portfolio translated into significant customer engagement. For instance, during peak travel seasons, categories like premium spirits and confectionery consistently saw high sales volumes, reflecting traveler demand for both indulgent treats and sought-after gifts.

Dufry's primary value proposition centers on offering travelers duty-free or competitively priced goods, a significant draw for international passengers. This price advantage is particularly noticeable on popular items like spirits, tobacco, and luxury fragrances, translating into tangible savings for consumers.

In 2023, Dufry reported a substantial portion of its sales derived from these price-advantaged categories, reflecting the strong customer appeal. For instance, the travel retail sector generally sees a significant uplift in sales for premium goods when offered at reduced tax rates, a core element of Dufry's strategy.

Enhanced Shopping Experience

Dufry elevates the travel retail journey by curating an enjoyable and premium shopping environment. This includes thoughtfully designed stores and well-trained staff ready to assist travelers.

The company often features exclusive product launches and special promotions, making each visit a potential discovery. This approach transforms shopping into an integral part of the travel experience, adding to overall enjoyment.

- Store Design: Dufry invests in visually appealing and functional store layouts.

- Staff Expertise: Employees are trained to offer personalized service and product knowledge.

- Exclusive Offers: Access to unique products and promotions enhances customer value.

- Travel Integration: Shopping is positioned as a complementary element to the travel experience.

Exclusive & Premium Offerings

Dufry's strategy hinges on providing exclusive and premium offerings, a key value proposition for its discerning traveler clientele. This includes access to limited edition items and high-end brands not easily found elsewhere, creating a unique shopping experience.

This exclusivity directly appeals to travelers seeking distinctive purchases or luxury items, setting Dufry apart from standard retail environments. For instance, in 2024, Dufry continued to expand its portfolio of exclusive collaborations and premium brand partnerships across its global network of travel retail outlets.

- Exclusive Product Access: Offering items unavailable in local markets.

- Premium Brand Partnerships: Showcasing luxury and sought-after labels.

- Limited Editions: Creating urgency and desirability with special releases.

- Enhanced Perceived Value: Differentiating through unique and high-quality merchandise.

Dufry offers travelers unparalleled convenience by providing access to a wide array of products directly within their travel hubs, saving them time and effort. This strategic positioning, exemplified by its 2023 operations in over 65 countries serving approximately 2.1 billion passengers, ensures shopping is an integrated part of the journey.

The company’s value proposition is further enhanced by its diverse product selection, catering to varied traveler needs and preferences. In 2024, high sales in categories like premium spirits and confectionery during peak travel times underscored this broad appeal.

Dufry provides significant price advantages, particularly on duty-free or competitively priced goods such as spirits and luxury fragrances, offering tangible savings. This focus on price-advantaged categories was a substantial contributor to Dufry's sales in 2023, aligning with the general trend of increased sales for premium items when offered at reduced tax rates.

Beyond convenience and price, Dufry curates a premium shopping experience through appealing store designs and knowledgeable staff. The inclusion of exclusive product launches and promotions transforms shopping into an enjoyable aspect of travel, further solidifying its value to customers.

Customer Relationships

Dufry's in-store customer relationships are built on highly personalized service. Their multilingual staff are trained to assist travelers, offering tailored product recommendations and navigating duty-free complexities, fostering a positive and informative shopping environment.

Dufry actively cultivates customer loyalty through its comprehensive loyalty programs, designed to encourage repeat purchases and deepen engagement. These initiatives are central to building lasting relationships with travelers.

By offering exclusive benefits such as special discounts, targeted promotions, and a points-based reward system, Dufry incentivizes customers to consistently choose their retail offerings. This strategy not only drives sales but also fosters a sense of appreciation and value among its frequent shoppers.

In 2023, Dufry reported a significant increase in loyalty program members, demonstrating the effectiveness of these strategies in capturing and retaining customers within the travel retail sector. The company's focus on personalized rewards continues to be a key driver of customer retention.

Dufry actively cultivates customer connections through its digital ecosystem. This includes user-friendly websites, intuitive mobile apps, and engaging social media platforms. These digital touchpoints are crucial for fostering loyalty and extending the customer journey beyond the point of sale.

These digital channels are instrumental in offering services like pre-ordering, which enhances convenience for travelers. They also serve as vital conduits for customer support, addressing inquiries and resolving issues efficiently. In 2024, Dufry continued to invest in these digital capabilities to ensure seamless customer interactions.

Furthermore, Dufry leverages its digital presence to deliver personalized content and promotions, making the customer experience more relevant and engaging. This tailored approach aims to strengthen relationships by anticipating and meeting individual customer needs, thereby driving repeat business and increasing customer lifetime value.

Multi-Lingual Staff Assistance

Dufry understands that its customers come from all over the world, so having staff who can speak different languages is key. This helps travelers feel more at ease when they shop, making their experience smoother and more enjoyable. For instance, Dufry's commitment to multilingual support directly addresses the needs of the millions of international passengers passing through airports.

This focus on effective communication in various languages is a significant part of Dufry's strategy to build strong customer relationships. By making travelers feel understood and catered to, Dufry aims to foster loyalty and encourage repeat business. In 2024, with global travel rebounding, this capability becomes even more critical for capturing a diverse customer base.

- Global Reach: Dufry operates in numerous countries, serving a vast international clientele.

- Enhanced Experience: Multilingual staff bridge communication gaps, improving customer satisfaction.

- Reduced Friction: Easy communication leads to a more pleasant and efficient shopping experience.

- Customer Loyalty: Feeling understood and valued encourages travelers to return.

Post-Purchase Support & Returns

Dufry's post-purchase support is designed to foster customer confidence. They offer straightforward policies for returns and exchanges, aiming to resolve any issues promptly. This dedication to customer service after the sale is crucial for building trust.

By effectively managing post-purchase interactions, Dufry not only enhances customer satisfaction but also cultivates a positive brand perception. This approach encourages repeat business and strengthens the long-term relationship with their clientele.

- Customer Satisfaction: Dufry's clear return and exchange policies are key to ensuring customers feel supported after their purchase.

- Brand Trust: A commitment to after-sales assistance builds significant trust and reinforces a positive brand image for Dufry.

- Loyalty Building: This focus on customer care directly contributes to strengthening long-term customer loyalty and encouraging repeat purchases.

- Operational Efficiency: In 2024, Dufry continued to streamline its return processes, aiming for quicker resolution times to enhance the overall customer experience.

Dufry's customer relationships are multifaceted, blending personalized in-store interactions with robust digital engagement and loyalty programs. Their multilingual staff are a cornerstone, ensuring travelers feel understood and valued, a sentiment reinforced by digital platforms offering pre-ordering and efficient support. This comprehensive approach, including post-purchase care, aims to foster lasting loyalty and repeat business.

In 2023, Dufry saw its loyalty program membership grow, highlighting the success of its strategies in retaining customers. The company's investment in digital capabilities in 2024 further underscores its commitment to seamless customer journeys, from initial interaction to after-sales support.

| Aspect | Strategy | Impact |

|---|---|---|

| Personalization | Multilingual staff, tailored recommendations | Enhanced customer satisfaction, reduced friction |

| Loyalty Programs | Points, exclusive benefits, targeted promotions | Increased repeat purchases, deeper engagement |

| Digital Engagement | Apps, websites, social media, pre-ordering | Convenience, efficient support, relevant content |

| Post-Purchase Support | Clear return/exchange policies | Customer confidence, brand trust |

Channels

Dufry’s backbone consists of its vast network of physical retail stores strategically positioned in key travel hubs. These include major international airports, bustling cruise ports, busy railway stations, and prominent downtown tourist districts, ensuring access to a global customer base.

These brick-and-mortar locations are crucial for providing customers with a tangible shopping experience and the ability to purchase goods immediately. In 2024, Dufry continued to leverage these high-visibility sites, which are essential for impulse purchases and brand presence.

Dufry's online pre-order and click & collect platforms significantly enhance customer convenience by enabling purchases before travel. This digital channel allows shoppers to explore a wider product selection and secure items, especially popular ones, ahead of time. In 2024, Dufry continued to invest in these digital capabilities, aiming to capture a larger share of pre-travel spending.

The click & collect service directly addresses the time constraints faced by travelers, offering a seamless pickup experience at airport locations. This strategy is crucial for maximizing sales opportunities, as it extends the customer engagement window beyond store operating hours and reduces the need for impulse buys during busy travel periods. Dufry's focus on these digital touchpoints reflects a broader industry trend towards omnichannel retail solutions.

Dufry's in-flight and on-board sales for cruise lines bring retail directly to passengers during their voyages. This channel leverages the captive audience on ships, offering a convenient shopping experience for a range of products, often duty-free.

In 2024, the cruise industry saw a significant rebound, with passenger numbers projected to reach new heights, creating a substantial customer base for on-board retail. For example, Carnival Corporation reported strong booking trends throughout 2024, indicating robust passenger traffic across its fleet.

Digital Marketing & E-commerce Presence

Dufry leverages digital marketing and a strong e-commerce presence to connect with travelers throughout their journey. This strategy aims to boost both online sales and foot traffic to their physical retail locations.

Key digital initiatives include targeted advertising campaigns, active social media engagement, and showcasing product assortments online. These efforts are designed to capture consumer interest and drive conversions.

- Digital Reach: Dufry's digital marketing efforts are crucial for engaging travelers pre-trip, during transit, and post-purchase.

- E-commerce Integration: The company maintains an e-commerce platform to complement its physical store offerings, facilitating online browsing and purchasing.

- Targeted Promotions: Digital channels enable Dufry to deliver personalized offers and product information, enhancing the customer experience.

- Data-Driven Approach: In 2024, Dufry continued to invest in analytics to refine its digital marketing spend and optimize campaign performance for maximum ROI.

Partnerships with Airlines/Travel Agencies

Dufry's strategic partnerships with airlines and travel agencies are key to expanding its customer reach. By embedding its retail services within travel booking platforms or loyalty schemes, Dufry engages potential shoppers much earlier in their journey. This integration allows for targeted promotions and product showcases, leveraging the trust and established customer base of these travel partners.

These collaborations are crucial for Dufry to tap into the pre-travel planning phase, where consumer intent for travel-related purchases is high. For instance, a traveler booking a flight might see an offer for Dufry's duty-free goods or destination-specific items directly on the airline's website. This proactive approach not only drives sales but also enhances the overall travel experience by offering convenience and value.

- Customer Acquisition: Access to a wider audience of travelers during the booking process.

- Brand Visibility: Enhanced exposure through co-branded promotions and integrated marketing efforts.

- Sales Channel Expansion: Creation of new revenue streams by offering products and services directly within the travel ecosystem.

- Data Insights: Potential to gather valuable customer data through partner collaborations to refine offerings.

Dufry's channels are a multi-faceted approach to reaching travelers. Its core remains its extensive network of physical stores in high-traffic travel locations like airports and cruise ports. Complementing this are robust digital platforms, including e-commerce and click & collect services, which offer convenience and pre-travel purchasing options. Strategic partnerships with airlines and travel agencies further extend Dufry's reach, integrating retail offers into the traveler's journey from the booking stage onwards.

Customer Segments

International air travelers represent Dufry's largest and most crucial customer base. These individuals are navigating airports globally and are primarily interested in the tax-free advantages offered on a wide array of products.

Their shopping habits often focus on premium categories such as luxury goods, fragrances, cosmetics, alcoholic beverages, and tobacco. Convenience and a diverse product assortment are key drivers for this segment as they make purchases during their travel journeys.

In 2024, Dufry continued to see robust recovery in international travel, a trend that directly benefits this segment. For instance, airport passenger traffic has been steadily increasing, with many regions reporting figures nearing or exceeding pre-pandemic levels, underscoring the significant spending potential within this traveler group.

Cruise line passengers are a significant customer segment for Dufry, offering a captive audience with leisure time to engage with retail. These travelers often look for souvenirs, duty-free luxury goods, and everyday essentials, appreciating the convenience of onboard or portside shopping.

In 2024, the global cruise industry saw a robust recovery, with passenger numbers projected to reach over 30 million. This surge in travel directly translates to increased opportunities for Dufry to cater to passengers seeking a premium shopping experience during their voyages.

Dufry serves railway commuters and tourists, offering a convenient retail experience within stations. This segment seeks quick access to snacks, beverages, and travel essentials, with a focus on impulse purchases and easily accessible grab-and-go options. In 2024, the global travel retail market, including rail, continued its recovery, with Dufry leveraging its presence in key transport hubs to capture this demand.

Downtown Tourist Shoppers

Downtown tourist shoppers represent a key segment for Dufry, particularly in major urban centers. These individuals are often on vacation and actively seeking unique local products, luxury goods, and mementos to commemorate their travels. Dufry's downtown locations cater to this desire by offering a curated selection of high-end brands and regional specialties.

The appeal for this demographic is significantly enhanced by the availability of tax-free shopping, a major draw for international visitors. In 2024, global tourism recovery continued to bolster spending in these areas. For instance, cities like Paris and London, which are major tourist hubs, saw significant increases in retail spending by international visitors throughout the year, with downtown duty-free stores being primary beneficiaries.

- Target: Tourists actively exploring urban destinations.

- Purchasing Drivers: Luxury brands, local specialties, souvenirs, and tax-free benefits.

- Market Context: Benefited from continued global tourism recovery in 2024, with strong spending in major European cities.

High-Net-Worth & Luxury Shoppers

High-net-worth and luxury shoppers represent a crucial niche for Dufry, valuing exclusivity and premium offerings. This segment actively seeks out high-end perfumes, designer fashion, and unique accessories, often driving significant revenue per transaction. For instance, in 2024, the luxury travel retail market continued to show resilience, with brands experiencing strong demand from affluent travelers, a trend Dufry is well-positioned to capitalize on through its tailored product assortment and personalized service initiatives.

Dufry's strategy to cater to these discerning customers involves a meticulously curated selection of globally recognized luxury brands. This focus on premium merchandise ensures that the company meets the expectations of high-net-worth individuals who are willing to spend more for quality and prestige. The average transaction value from this customer group significantly contributes to Dufry's overall profitability, underscoring the importance of maintaining and enhancing these relationships.

- Targeted Product Assortment: Dufry offers a premium selection of luxury goods, including high-end fragrances, designer apparel, and exclusive accessories, specifically appealing to affluent travelers.

- Personalized Service: Emphasis is placed on providing a high-touch, personalized shopping experience, including dedicated assistance and exclusive previews, to meet the expectations of luxury consumers.

- Revenue Contribution: This segment is vital for driving higher average transaction values, directly impacting Dufry's overall revenue and profitability in key travel retail locations.

- Market Trends: In 2024, the luxury travel segment demonstrated robust growth, with affluent consumers showing a strong propensity for premium purchases, validating Dufry's strategic focus on this demographic.

Dufry's customer base is primarily composed of international air travelers, who seek tax-free purchases of premium goods like fragrances, cosmetics, and alcohol. This segment's spending is directly tied to the recovery of global air travel, which in 2024 showed strong growth, with passenger traffic in many regions exceeding pre-pandemic levels.

Cruise line passengers and railway commuters also form significant customer groups, valuing convenience and impulse purchases during their journeys. The cruise sector's robust recovery in 2024, with passenger numbers projected to surpass 30 million, offers Dufry expanded opportunities.

Furthermore, downtown tourist shoppers, particularly in major cities, are drawn to Dufry for local specialties, luxury items, and the tax-free advantage. This segment's spending power was evident in 2024, with significant increases in retail expenditures by international visitors in hubs like Paris and London.

A key niche is high-net-worth and luxury shoppers, who prioritize exclusivity and are willing to spend more for premium brands and personalized service. The luxury travel retail market's resilience in 2024, marked by strong demand from affluent travelers, confirms Dufry's strategic focus on this high-value demographic.

Cost Structure

Dufry's cost structure is heavily influenced by concession and rent fees, which are payments made to airport authorities, port operators, and other property owners for the privilege of operating retail outlets. These agreements are fundamental to Dufry's business model, granting them prime locations in high-traffic travel hubs.

These fees are not static; they often include a variable component directly linked to Dufry's sales performance. This means that as Dufry generates more revenue, a larger portion of that revenue is paid out as concession fees. For instance, in 2023, Dufry reported that concession fees and other operating expenses represented a significant portion of their overall costs, reflecting the direct correlation between sales and these payments.

Dufry's Cost of Goods Sold (COGS) primarily includes the direct expenses of acquiring a wide array of products for its travel retail operations. This encompasses items like perfumes, cosmetics, food, beverages, tobacco, and fashion accessories. For instance, in 2023, Dufry's gross profit margin was 59.3%, indicating that COGS represented approximately 40.7% of its revenue, highlighting the significant impact of product sourcing on its profitability.

Dufry's personnel and staffing costs represent a substantial portion of its expenses, encompassing salaries, benefits, and training for its extensive global workforce. This includes retail associates, store managers, and essential back-office support staff across its many international operations.

In 2024, Dufry continued to invest in developing a skilled and customer-focused team, recognizing that this is crucial for delivering a positive shopping experience in diverse travel retail environments. These labor costs are fundamental to maintaining operational efficiency and brand standards worldwide.

Logistics & Supply Chain Expenses

Logistics and supply chain expenses are a significant component of Dufry's cost structure, reflecting the complexities of its global operations. These costs encompass warehousing, the movement of goods across vast distances via various transportation modes, and the often substantial customs duties and tariffs incurred when operating in numerous countries. Efficiently distributing products to thousands of retail points worldwide is crucial, and any inefficiencies here directly squeeze profit margins.

In 2024, Dufry's commitment to optimizing its supply chain was evident. For instance, the company continued to invest in technology to enhance inventory management and route optimization, aiming to reduce transportation costs. These efforts are vital as the company navigates fluctuating fuel prices and the ongoing need to ensure timely product availability across its diverse retail network.

- Warehousing and Storage: Costs associated with maintaining facilities for inventory management globally.

- Transportation and Distribution: Expenses for moving goods from suppliers to distribution centers and then to retail outlets, including freight and last-mile delivery.

- Customs Duties and Tariffs: Payments made to governments for importing goods into different countries, a significant factor in international retail.

- Supply Chain Technology: Investments in systems for tracking, inventory control, and network optimization to improve efficiency and reduce costs.

Store Operations & Maintenance

Dufry's store operations and maintenance represent a significant expenditure, covering the upkeep of its extensive global retail network. These costs are essential for providing a premium shopping experience to travelers. In 2024, Dufry continued to invest in maintaining high standards across its locations.

Key expenses include:

- Utilities: Costs associated with electricity, water, and heating for all stores.

- Security: Investment in personnel and systems to ensure store safety and asset protection.

- Store Design & Refurbishment: Expenses for creating and updating store layouts and aesthetics to enhance customer appeal and operational efficiency.

- Maintenance: Regular upkeep of store fixtures, equipment, and facilities to ensure a functional and pleasant environment.

Dufry's cost structure is dominated by concession and rent fees, directly tied to prime retail locations in travel hubs. These fees often include a variable component linked to sales performance, meaning higher revenue translates to higher costs. For instance, concession fees and other operating expenses represented a significant portion of Dufry's total costs in 2023.

The Cost of Goods Sold (COGS) is another major expense, encompassing the direct costs of acquiring a wide variety of products. In 2023, Dufry's gross profit margin of 59.3% indicates that COGS accounted for approximately 40.7% of its revenue, underscoring the importance of efficient product sourcing.

Personnel and staffing costs are substantial, covering salaries, benefits, and training for its global workforce, essential for customer service and operations. Logistics and supply chain expenses, including warehousing, transportation, and customs duties, are also significant due to the complexity of its international network. Dufry's investment in supply chain technology in 2024 aimed to mitigate these costs.

| Cost Category | Key Components | Impact on Dufry |

|---|---|---|

| Concession & Rent Fees | Payments for prime retail locations, often with variable sales-linked components. | Directly impacts profitability, especially in high-traffic areas. |

| Cost of Goods Sold (COGS) | Direct costs of acquiring diverse retail products (perfumes, cosmetics, etc.). | A major driver of gross profit; efficient sourcing is critical. |

| Personnel & Staffing | Salaries, benefits, and training for global workforce. | Essential for customer service and operational efficiency. |

| Logistics & Supply Chain | Warehousing, transportation, customs duties, and technology investments. | Crucial for product availability and cost management in a global network. |

Revenue Streams

Dufry's core business revolves around product sales, with travelers being their primary customer base. This encompasses a broad spectrum of goods, from luxury perfumes and cosmetics to everyday items like food and confectionery, as well as popular categories such as wine, spirits, and tobacco. The company also offers fashion and accessories, catering to diverse traveler needs and desires.

In 2023, Dufry reported a significant increase in sales, reaching CHF 9.1 billion, a substantial jump from CHF 5.1 billion in 2022, demonstrating the strong recovery and growth in travel retail. This highlights the direct correlation between travel volume and Dufry's product sales performance.

Dufry's revenue primarily flows from concession-based sales agreements. This means they pay for the right to operate stores in prime travel retail spots like airports and train stations.

The money Dufry makes is directly tied to how much product they sell within these exclusive locations. Higher sales volume and value translate directly into greater revenue for the company.

For example, in 2023, Dufry reported total sales of CHF 9,460.7 million, a significant portion of which is generated through these concession agreements, reflecting the substantial footfall and purchasing power present in travel hubs.

Dufry's digital and e-commerce sales represent a growing revenue stream, reflecting a shift in consumer behavior towards online purchasing. This channel allows customers to browse and buy travel essentials and duty-free items conveniently, often before their trip even begins.

The pre-order service, in particular, has seen significant traction, enabling travelers to secure desired products and pick them up at the airport, streamlining the shopping experience. This digital engagement is crucial for capturing sales from a segment of travelers who value efficiency and planning.

While specific 2024 figures for this segment are still emerging, Dufry has been actively investing in its digital capabilities. In 2023, the company reported a notable increase in digital sales penetration, indicating a positive trend that is expected to continue into 2024 and beyond as they further enhance their online offerings.

Brand Promotional Fees

Dufry capitalizes on brand partnerships by charging promotional fees. These fees are for brands seeking prime visibility within Dufry's extensive retail network, often in high-traffic airport locations. This revenue stream supports marketing initiatives and product launches.

These arrangements can include dedicated shelf space, in-store advertising, or participation in joint marketing campaigns. For example, a luxury cosmetics brand might pay a premium for prominent display during peak travel seasons. Such fees directly contribute to Dufry's profitability beyond the margin on goods sold.

- Promotional Fees: Revenue generated from brands paying for enhanced product placement and marketing within Dufry's retail environments.

- Marketing Contributions: Brands contribute financially to support dedicated promotional campaigns or exclusive launch events held at Dufry locations.

- Strategic Partnerships: Dufry leverages its prime retail locations to offer valuable marketing opportunities to brand partners, creating a symbiotic revenue model.

Loyalty Program Partnerships

Dufry's loyalty program partnerships, while not a core revenue driver, can offer supplementary income. These can include arrangements like co-branded credit cards where a percentage of customer spending or transaction fees is shared. For instance, many travel retailers partner with financial institutions to offer credit cards that reward customers with points or miles, and these partnerships often involve revenue-sharing agreements.

Collaborations with airlines or other travel providers can also create revenue opportunities. When customers redeem loyalty points earned through Dufry's program with these partners, or vice versa, Dufry might receive a commission or a pre-agreed payment. In 2024, the travel retail sector continued to see increased focus on customer retention, making such strategic alliances valuable for both incremental revenue and customer engagement.

- Co-branded Credit Cards: Potential for revenue sharing on transaction fees and customer acquisition.

- Airline/Travel Partner Collaborations: Income generated from points redemption or cross-promotional activities.

- Ancillary Revenue: Minor but consistent income stream that enhances overall customer lifetime value.

Dufry's primary revenue comes from selling a wide variety of products to travelers, including luxury goods, food, beverages, and fashion. This direct sales model is heavily influenced by global travel volumes.

In 2023, Dufry's total sales reached CHF 9,460.7 million, underscoring the significant revenue generated from these product sales within travel retail environments.

Beyond product margins, Dufry also earns revenue through brand partnerships, charging fees for prominent product placement and marketing opportunities within their stores. This provides brands with access to a captive audience of travelers.

Digital and e-commerce sales are an increasingly important revenue stream, with pre-order services allowing customers to purchase items online for airport pickup, enhancing convenience and capturing additional sales. Dufry has been actively investing in these digital channels, expecting continued growth in 2024.

| Revenue Stream | Description | 2023 Data (CHF million) |

|---|---|---|

| Product Sales | Direct sales of diverse product categories to travelers. | 9,460.7 |

| Brand Partnerships (Promotional Fees) | Fees from brands for enhanced visibility and marketing. | N/A (Integrated into overall sales performance) |

| Digital & E-commerce | Revenue from online sales and pre-order services. | N/A (Growing segment, significant investment in 2023 for 2024 growth) |

Business Model Canvas Data Sources

The Dufry Business Model Canvas leverages extensive market research, internal financial reports, and operational data to inform each strategic block. This comprehensive approach ensures accurate representation of customer segments, value propositions, and revenue streams.