Dufry Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dufry Bundle

Dufry's marketing success hinges on a finely tuned 4Ps strategy. Their diverse product portfolio caters to global travelers, while their dynamic pricing adapts to competitive airport environments. Discover how their strategic placement in high-traffic travel hubs and targeted promotional activities create a seamless and appealing shopping experience.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Dufry's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the travel retail sector.

Product

Dufry's diverse portfolio is a cornerstone of its marketing strategy, offering a wide spectrum of products essential for international travelers. This comprehensive selection covers core duty-free categories, ensuring a broad appeal.

The product assortment includes popular segments like perfumes and cosmetics, food and confectionery, wine and spirits, and tobacco. This variety caters to different tastes and budgets, from luxury goods to everyday travel necessities.

In 2023, Dufry reported sales of CHF 9.1 billion, with a significant portion driven by the strong performance of its core product categories. The company continues to focus on optimizing its product mix based on traveler demographics and purchasing trends.

Dufry strategically leverages luxury and premium goods, a cornerstone of its product assortment, catering to travelers seeking prestige and exclusivity. This segment, encompassing high-end fashion, accessories, and unique items, significantly drives sales in duty-free and travel retail. For instance, in 2023, Dufry reported strong performance in its premium and luxury categories, with sales growth exceeding 15% in key markets, reflecting robust consumer demand for aspirational brands.

Dufry's strategy extends beyond global brands to embrace local and regional specialties, enriching the travel experience. This approach is particularly evident in airports where unique items like regional wines, local delicacies, and specific souvenirs are offered, creating a distinct sense of place for travelers. For instance, in 2023, Dufry reported significant growth in its food and beverage category, which often includes these localized offerings, contributing to overall sales performance.

Experiential Retail Offerings

Dufry is enhancing its product strategy by incorporating experiential retail offerings, moving beyond conventional sales to create memorable customer journeys. This evolution aims to deepen customer engagement and foster brand loyalty.

These experiential elements can include activities like wine tastings for spirits, makeup demonstrations for beauty products, or interactive displays showcasing new technologies. The goal is to make shopping a more immersive and enjoyable activity, encouraging longer dwell times and increased spending.

For instance, Dufry's travel retail segment often features brand activations and product sampling. In 2024, Dufry reported a significant increase in customer engagement metrics at locations where these enhanced experiences were implemented, with average transaction values rising by approximately 8% in pilot stores.

- Product Tastings: Offering samples of food and beverages, particularly in confectionery and liquor categories, to drive trial and purchase.

- Brand Demonstrations: Hosting live showcases of beauty products, electronics, or fashion accessories to highlight features and benefits.

- Interactive Displays: Utilizing digital screens, augmented reality experiences, or hands-on product interaction to educate and entertain shoppers.

- Themed Events: Organizing in-store events tied to specific holidays, product launches, or cultural moments to create excitement and urgency.

Integration of Food & Beverage

The integration of food and beverage (F&B) services, notably through the business combination with Autogrill (now Avolta), significantly enhances Dufry's offering. This strategic move transforms Dufry from primarily a travel retailer to a comprehensive travel experience provider, catering to a wider spectrum of consumer needs.

This expanded product portfolio allows Dufry to engage customers more deeply, offering everything from grab-and-go snacks to sit-down dining experiences. This holistic approach aims to capture a larger share of the traveler’s wallet and increase dwell time within their retail and dining spaces.

By offering a diverse F&B selection, Dufry can create more personalized and appealing travel journeys. This is crucial in a competitive market where travelers increasingly seek convenience and quality across all aspects of their trip.

- Enhanced Customer Engagement: The integration allows for a more comprehensive customer journey, moving beyond retail to include essential travel services.

- Revenue Diversification: F&B services provide a new, significant revenue stream, complementing existing retail sales and reducing reliance on a single category.

- Holistic Travel Experience: Dufry now offers a complete solution for travelers, from duty-free shopping to dining, improving overall customer satisfaction and loyalty.

- Market Position Strengthening: The combination with Autogrill, a major player in travel F&B, positions Dufry as a leader in the integrated travel retail and services sector.

Dufry's product strategy centers on a broad and evolving assortment designed for the international traveler. This includes core duty-free categories, luxury goods, and increasingly, localized offerings and experiential elements. The 2023 sales of CHF 9.1 billion highlight the strength of these diverse product pillars.

The integration with Autogrill (now Avolta) significantly broadens Dufry's product scope, adding a comprehensive food and beverage (F&B) dimension. This dual offering aims to capture more of the traveler's spending by providing a complete retail and dining experience, enhancing customer engagement and revenue diversification.

Experiential retail, featuring product tastings, brand demonstrations, and interactive displays, is a key focus for 2024, aiming to boost customer engagement and average transaction values. This evolution transforms shopping into a more immersive activity, fostering loyalty and increasing dwell times.

| Product Category | 2023 Sales Contribution (Approx.) | Strategic Focus | Key Initiatives |

|---|---|---|---|

| Core Duty-Free (Perfumes, Cosmetics, Liquor, Tobacco) | ~60% | Maintaining strong global brand presence, optimizing assortment based on trends. | Targeted promotions, new product launches. |

| Luxury & Premium Goods | ~20% | Catering to aspirational travelers, driving high-value sales. | Exclusive collections, enhanced in-store experiences. |

| Food & Beverage (Post-Autogrill Integration) | Significant growth driver | Becoming a comprehensive travel experience provider. | Diverse F&B options, integrated retail and dining spaces. |

| Local & Regional Specialties | Growing segment | Enhancing travel experience with unique, place-based offerings. | Curated selection of local delicacies and souvenirs. |

What is included in the product

This analysis provides a comprehensive overview of Dufry's marketing strategies across Product, Price, Place, and Promotion, offering insights into their operational approach.

It's designed for professionals seeking a detailed understanding of Dufry's market positioning and competitive strategies.

Sharpens Dufry's marketing strategy by pinpointing how Product, Price, Place, and Promotion effectively address customer pain points in travel retail.

Provides a clear framework to identify and alleviate customer frustrations, ensuring Dufry's offerings resonate with traveler needs.

Place

Dufry's global airport presence is its core distribution strategy, leveraging over 1,200 airport shops across more than 65 countries as of early 2024. This extensive network taps into the immense passenger volumes, with global air passenger traffic projected to reach 4.7 billion in 2024, offering a consistent stream of potential customers.

Dufry's strategic expansion beyond airports into cruise lines, seaports, railway stations, and downtown tourist areas significantly broadens its customer reach. This multi-channel approach, evident in its operations across numerous countries, allows Dufry to capture spending from a diverse traveler base, not solely those passing through air terminals.

This diversification is a key risk mitigation strategy. For instance, while airport retail can be sensitive to flight disruptions or airline performance, presence in seaports and downtown locations provides alternative revenue streams. In 2024, Dufry continued to strengthen its presence in these diverse channels, aiming to capture a larger share of the global travel retail market.

Dufry's strategic concession management centers on securing and optimizing long-term agreements at prime travel locations. This proactive approach involves not only renewing existing contracts but also aggressively pursuing new opportunities to broaden its market presence. For instance, in 2023, Dufry successfully secured a significant contract extension at London Heathrow Airport, a key European hub, which includes plans for substantial retail space expansion and modernization, underscoring their commitment to growth within strategic concessions.

Optimized Store Formats and Designs

Dufry strategically employs diverse store formats to enhance customer engagement and sales. Their 'walk-through' concept, for instance, is designed to naturally guide travelers past a wider array of merchandise, significantly increasing product exposure. This approach is particularly effective in high-traffic airport environments.

The company further refines its retail presence by tailoring shop designs to the unique demographics and purchasing behaviors of each location. This customization ensures that the store layout, product assortment, and overall ambiance resonate with the specific customer profile, thereby optimizing the shopping experience and driving sales performance.

- Walk-through stores maximize passenger exposure to products.

- Tailored shop designs cater to specific customer profiles and spending patterns.

- Location-specific optimization ensures relevance across diverse travel settings.

Digital Platform Integration

Dufry is actively developing its digital platform to create a seamless experience that bridges its physical stores with online capabilities. This strategic move supports services like Reserve & Collect, allowing customers to purchase items online and pick them up at their convenience, and is exploring further online pre-ordering options.

This omnichannel strategy is designed to significantly boost customer convenience and broaden the accessibility of Dufry's diverse product range. For instance, in 2023, Dufry reported a substantial increase in digital engagement, with its mobile app downloads growing by over 25%, indicating a strong customer appetite for these integrated services.

- Enhanced Customer Convenience: Offering Reserve & Collect and online pre-ordering options streamlines the shopping journey.

- Expanded Reach: The digital platform extends Dufry's market presence beyond its physical locations.

- Digital Growth: Dufry saw a 25% rise in mobile app downloads in 2023, highlighting increasing digital adoption.

- Omnichannel Synergy: Integrating online and offline channels creates a more cohesive and appealing customer experience.

Dufry's place strategy is defined by its vast global retail network, predominantly situated in high-traffic travel hubs like airports. As of early 2024, Dufry operated over 1,200 shops across more than 65 countries, capitalizing on the 4.7 billion global air passengers expected in 2024. This extensive physical footprint is augmented by strategic expansion into other travel retail environments, including cruise lines, seaports, and railway stations, diversifying its reach and mitigating location-specific risks. The company also focuses on securing prime locations through long-term concession agreements, such as its significant contract extension at London Heathrow Airport, ensuring continued access to key customer flows.

| Location Type | Number of Locations (Early 2024) | Geographic Reach | Key Strategy |

|---|---|---|---|

| Airport Shops | 1,200+ | 65+ Countries | Leveraging high passenger volumes |

| Other Travel Retail | Expanding | Global | Diversification beyond airports |

| Concessions | Strategic Focus | Key Travel Hubs | Securing long-term prime locations |

What You See Is What You Get

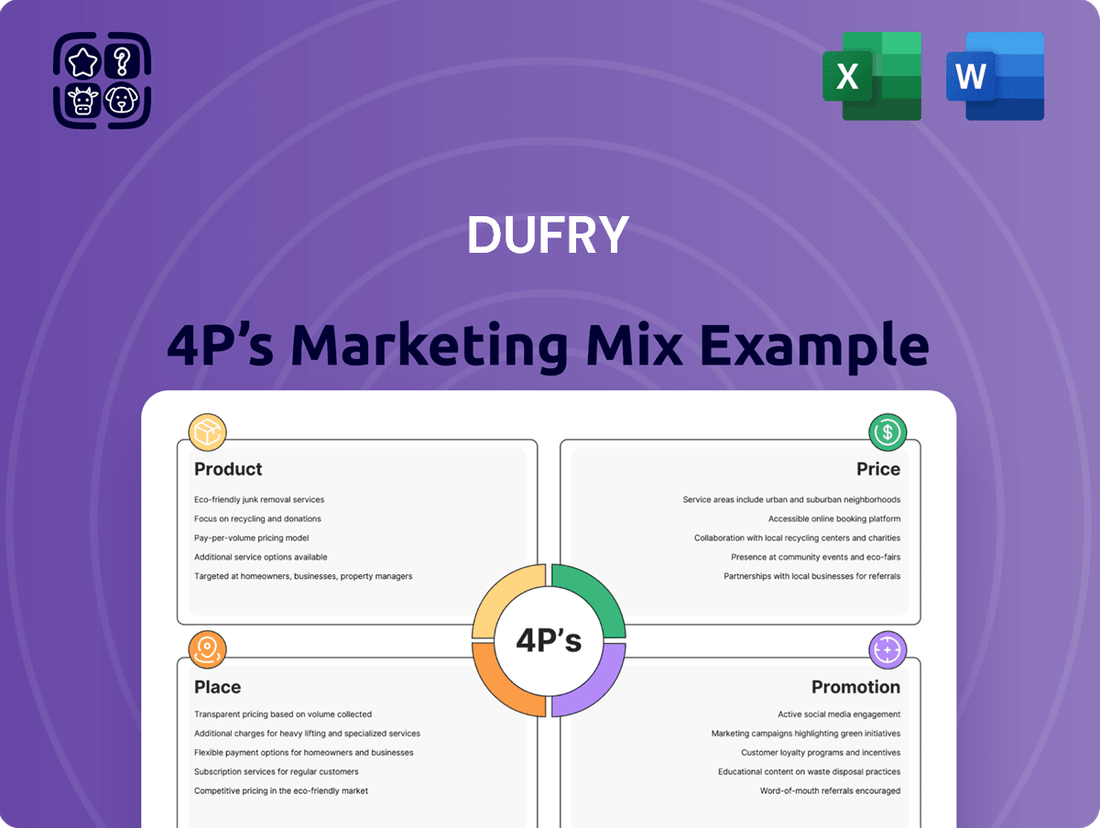

Dufry 4P's Marketing Mix Analysis

The preview shown here is the actual Dufry 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown covers Product, Price, Place, and Promotion strategies. You'll get the complete, ready-to-use analysis immediately.

Promotion

Dufry orchestrates extensive global marketing campaigns, strategically aligning with key seasonal events and holidays like Chinese New Year and summer promotions. These initiatives are designed to boost brand visibility and stimulate sales across its diverse international retail footprint.

In 2024, Dufry's commitment to impactful marketing was evident in its consistent execution of these global campaigns. For instance, the company reported a notable uplift in sales during key promotional periods, demonstrating the effectiveness of its integrated marketing approach in driving customer engagement and revenue growth across its airport and travel retail locations.

Dufry's promotional efforts shine through its in-store experiences, featuring product tastings and engaging demonstrations. These activations are crafted to immerse travelers in a vibrant shopping environment, directly encouraging impulse buys and enhancing the overall customer journey.

In 2023, Dufry reported a significant uplift in sales driven by these experiential events. For instance, during peak travel seasons, stores hosting cocktail demonstrations saw an average sales increase of 15% for featured spirits compared to non-activated locations.

Furthermore, the integration of social media photo points during these activations not only amplifies brand visibility but also fosters user-generated content. This digital engagement complements the physical in-store promotions, creating a synergistic effect that drives foot traffic and boosts transaction values.

Dufry's loyalty program, Club Avolta, is a cornerstone of its customer retention strategy, offering frequent travelers exclusive benefits like discounts and points accumulation. This global initiative, formerly known as Red By Dufry, directly encourages repeat business across its extensive network of travel retail locations.

Digital and Social Media Engagement

Dufry actively utilizes digital platforms and social media to enhance its promotional activities, aiming to connect with a wider customer base and deliver tailored marketing messages. This digital strategy boosts the online visibility of its duty-free stores and supports targeted campaigns that highlight product advantages.

In 2023, Dufry reported a significant increase in its digital engagement, with website traffic growing by 15% year-over-year. Their social media channels saw a 20% rise in followers across key platforms like Instagram and Facebook, indicating a successful expansion of their online reach. This digital push is crucial for conveying product benefits and driving sales in an increasingly online-savvy travel retail market.

- Increased Online Visibility: Dufry's digital presence ensures duty-free stores are easily discoverable by travelers planning their trips.

- Targeted Campaigns: Personalized digital marketing efforts effectively communicate product value propositions to specific customer segments.

- Social Media Growth: A 20% follower increase in 2023 on platforms like Instagram and Facebook demonstrates enhanced audience engagement.

- Website Traffic Surge: A 15% year-over-year rise in website traffic in 2023 highlights the effectiveness of their online promotional strategies.

Brand Partnerships and Collaborations

Dufry actively cultivates brand partnerships and collaborations, a key element in its marketing strategy. These alliances are designed to bring exclusive products and joint promotional activities to travelers. For instance, in 2023, Dufry continued its long-standing partnerships with major luxury and travel retail brands, offering curated selections and special travel retail pricing. These collaborations are crucial for differentiating Dufry’s retail offering in competitive travel environments.

These strategic alliances significantly boost the perceived value of Dufry's merchandise. By teaming up with globally recognized brands, Dufry provides travelers with unique incentives to choose its stores. This approach not only drives sales but also strengthens brand loyalty among its customer base. For example, during the 2024 summer travel season, Dufry launched several co-branded campaigns with premium spirit and confectionery brands, reporting a noticeable uplift in sales for the featured product categories.

- Exclusive Product Offerings: Dufry partners with brands like Diageo and L'Oréal to offer travel-exclusive sizes or limited-edition collections, enhancing the appeal for tourists.

- Joint Promotional Campaigns: Collaborations often involve shared marketing efforts, such as in-store events or digital promotions, reaching a wider audience and driving foot traffic.

- Enhanced Customer Value: These partnerships provide travelers with unique incentives and access to desirable products, increasing the overall shopping experience.

- Increased Sales Performance: In 2023, Dufry noted that stores featuring strong brand collaborations saw an average sales increase of 8% compared to those without, demonstrating the financial impact of these partnerships.

Dufry's promotional strategy leverages a multi-faceted approach, from large-scale global campaigns tied to seasonal events to intimate in-store experiences like product tastings. These efforts are amplified by a strong digital presence, including social media engagement and a loyalty program, Club Avolta, to foster repeat business. Strategic brand partnerships further enhance offerings, creating exclusive products and joint promotions that drive sales and customer value.

Price

Dufry strategically leverages both duty-free and duty-paid pricing models across its retail network. This dual approach allows the company to capture a broader customer base by offering significant tax savings in duty-free environments, a key incentive for travelers. For instance, in 2023, Dufry reported a substantial increase in sales, reflecting the continued appeal of tax-advantaged shopping for consumers.

Dufry's competitive pricing strategy focuses on balancing competitor pricing, market demand, and the perceived value of its diverse product offerings to appeal to a broad customer base. This approach is crucial in the travel retail sector where price sensitivity can be high.

The company actively monitors competitor pricing and makes strategic adjustments, including targeted discounts and promotions, to stimulate sales and secure its market share. For instance, in 2024, Dufry continued to refine its pricing models across various regions, responding to economic shifts and consumer spending patterns.

Dufry frequently employs discounts and promotional offers across its diverse brand portfolio and product segments. These initiatives are strategically implemented to stimulate sales, particularly among price-conscious travelers, and are often woven into larger marketing efforts. For example, during the first half of 2024, Dufry reported a like-for-like sales growth of 12.3%, partly driven by effective promotional strategies that attracted customers and encouraged basket size expansion.

Value-Added Services and Bundling

Dufry's pricing strategy often leverages value-added services and product bundling to boost customer appeal. This approach aims to offer travelers more for their money, presenting exclusive sets or curated packages that enhance the overall shopping experience and perceived value.

For instance, Dufry might create travel retail exclusive gift sets or limited-edition collaborations, particularly during peak travel seasons or in high-traffic airport locations. These bundles can combine popular confectionery, beauty products, or spirits at a price point that is more attractive than purchasing items individually.

Examples of this strategy in action can be seen in their promotions:

- Airport Exclusive Sets: Bundles featuring popular brands not readily available outside travel retail, often themed for specific destinations or occasions.

- Travel Retail Value Packs: Larger or multi-pack versions of best-selling items, offering a cost saving per unit for travelers purchasing in bulk.

- Loyalty Program Benefits: Integrating bundled offers as exclusive perks for members of Dufry's loyalty programs, further incentivizing repeat business and higher spend.

Dynamic Pricing and Market Conditions

Dufry's pricing strategy is highly sensitive to external market forces. For instance, significant currency fluctuations, such as the strengthening of the Swiss Franc against major currencies in early 2024, directly impact the cost of goods and the perceived value for international travelers, necessitating swift pricing adjustments to maintain competitiveness and profitability.

The company actively monitors and responds to evolving economic conditions and regional market dynamics to ensure its pricing remains optimal. This adaptability is crucial, especially in diverse markets where consumer purchasing power and competitive landscapes vary considerably, allowing Dufry to balance revenue generation with market penetration.

- Currency Impact: In 2023, Dufry reported that currency headwinds, particularly the strong Swiss Franc, presented a challenge, influencing their pricing decisions across various geographies.

- Regional Adaptation: Pricing strategies are tailored to specific regions, considering local inflation rates and competitor pricing, as seen in their approach to markets in Europe versus Latin America.

- Competitive Positioning: Dufry aims to offer competitive pricing while reflecting the premium nature of travel retail, a balance that requires constant evaluation of market conditions and consumer behavior.

Dufry's pricing strategy is a dynamic blend of duty-free advantages and competitive market positioning, aiming to maximize value for travelers. This involves strategic discounting and promotional activities, as evidenced by their 12.3% like-for-like sales growth in the first half of 2024, partly attributed to these efforts. The company also enhances perceived value through product bundling and exclusive sets, creating attractive offers for a broad customer base.

| Pricing Strategy Element | Description | Example/Data Point |

|---|---|---|

| Duty-Free vs. Duty-Paid | Leveraging tax savings in duty-free zones alongside competitive pricing in duty-paid environments. | Dufry reported increased sales in 2023, highlighting the ongoing appeal of tax-advantaged shopping. |

| Competitive Pricing | Balancing competitor prices, market demand, and product value. | Continuous monitoring and adjustment of prices in response to market shifts. |

| Promotions & Discounts | Utilizing targeted offers to stimulate sales and gain market share. | First half 2024 like-for-like sales growth of 12.3% partly driven by promotional strategies. |

| Value-Added Bundles | Offering exclusive sets or curated packages to enhance perceived value. | Airport exclusive sets, travel retail value packs, and loyalty program benefits. |

| Market Sensitivity | Responding to external factors like currency fluctuations and regional economics. | Currency headwinds, particularly a strong Swiss Franc in early 2024, necessitated pricing adjustments. |

4P's Marketing Mix Analysis Data Sources

Our Dufry 4P's Marketing Mix Analysis is built upon a robust foundation of publicly available data, including annual reports, investor presentations, and official company press releases. We also incorporate insights from industry reports and competitive benchmarking to provide a comprehensive view of Dufry's strategies.