Dufry Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dufry Bundle

Dufry navigates a competitive retail landscape shaped by powerful buyer bargaining, intense rivalry, and the ever-present threat of new entrants. Understanding these forces is crucial for any stakeholder looking to grasp Dufry's market position.

The complete report reveals the real forces shaping Dufry’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dufry collaborates with a wide range of global brands spanning categories like perfumes, cosmetics, food, and fashion. The sheer volume of suppliers, particularly for everyday items, typically dilutes their individual leverage.

However, for highly sought-after luxury brands, suppliers can wield significant bargaining power. This is due to the strong desirability of these brands and the limited availability of comparable alternatives, allowing them to negotiate more favorable terms.

When suppliers offer highly unique or exclusive products, like limited-edition luxury items or specialized travel retail assortments, their bargaining power can be amplified. For instance, a brand that exclusively partners with Dufry for certain travel-exclusive fragrances or accessories would hold significant leverage, as Dufry’s customers specifically seek these items.

However, Dufry’s extensive network and broad product range often provide a counterbalance. By curating a diverse selection of brands and product categories, Dufry can offer customers alternatives, thereby reducing reliance on any single unique supplier and mitigating their individual bargaining strength.

For standard product categories, Dufry likely faces low switching costs. This means they can readily change suppliers without significant financial penalties or operational disruptions, thereby increasing their bargaining power. For instance, if Dufry sources generic confectionery, finding an alternative supplier is usually straightforward and inexpensive.

However, the situation shifts dramatically when dealing with exclusive or high-demand luxury brands. Switching away from a supplier of a sought-after luxury watch brand, for example, could incur substantial costs for Dufry, not just in terms of potential contract termination fees but also the significant risk of losing valuable sales volume and the associated brand prestige. In 2024, the travel retail market continued to see strong demand for premium and luxury goods, making supplier relationships with these brands even more critical.

Threat of Forward Integration by Suppliers

The threat of forward integration by Dufry's suppliers is generally low. Most suppliers, such as cosmetic brands or food manufacturers, operate with distinct business models focused on production, not direct retail operations in the travel sector. Their core competencies lie elsewhere, making a significant move into travel retail unlikely to disrupt Dufry's established global footprint.

For a supplier to effectively forward integrate into travel retail, they would need to replicate Dufry's complex infrastructure, including securing prime retail locations in airports and managing diverse product assortments and logistics. This requires substantial capital investment and specialized expertise that most suppliers lack. For instance, a major beverage company might struggle to gain the necessary airport concessions and manage the broad range of duty-free goods that Dufry offers.

While some suppliers might engage in limited direct-to-consumer sales or pop-up shops, this is not the same as establishing a comprehensive travel retail presence. Dufry's scale and experience in navigating the unique demands of travel retail, including regulatory compliance and consumer behavior in transit environments, create a significant barrier to entry for suppliers. In 2024, Dufry continued to solidify its position through strategic acquisitions and partnerships, further strengthening its competitive advantage against potential supplier encroachment.

- Low Likelihood of Supplier Forward Integration: Dufry's diverse supplier base, including cosmetics, fashion, and food, typically focuses on manufacturing and brand building, not the complex operational demands of travel retail.

- High Barriers to Entry for Suppliers: Replicating Dufry's extensive global network of airport retail locations, logistics, and diverse product offerings requires significant capital and specialized expertise that most suppliers do not possess.

- Dufry's Strategic Advantages: Dufry's established expertise in airport concessions, regulatory navigation, and understanding of traveler purchasing habits creates a substantial competitive moat, making it difficult for suppliers to effectively compete through forward integration.

Importance of Dufry to Suppliers

Dufry, now operating as Avolta, is the leading global travel retailer. This scale means many suppliers, especially those in travel retail and duty-free goods, rely heavily on Dufry as a primary sales channel. For instance, in 2023, Dufry reported net sales of CHF 10.1 billion, underscoring the significant volume of business it drives for its brand partners.

This substantial market presence grants Dufry considerable bargaining power. Suppliers often find it challenging to find comparable distribution reach and volume elsewhere, making them more amenable to Dufry's terms. The company's extensive network of stores across numerous airports and other travel locations worldwide solidifies its position as a critical partner for brand growth and market penetration.

- Global Reach: Dufry's operations span over 65 countries, offering suppliers unparalleled access to international travelers.

- Sales Volume: The company's significant net sales, reaching CHF 10.1 billion in 2023, translate into substantial order volumes for its suppliers.

- Brand Dependence: Many niche and global brands within the travel retail sector are significantly dependent on Dufry for a large portion of their sales.

Dufry, now operating as Avolta, holds significant bargaining power over many of its suppliers due to its immense scale and global reach. For many brands, especially those in the travel retail niche, Dufry represents a crucial sales channel. In 2023, Avolta's net sales reached CHF 10.1 billion, illustrating the substantial business volume it generates for its partners.

This reliance on Avolta for significant sales volume often compels suppliers to accept Avolta's terms, as finding comparable distribution and sales volume elsewhere can be difficult. The company's extensive network across over 65 countries provides suppliers with unparalleled access to a global customer base of travelers.

However, suppliers of highly desirable luxury brands or those offering unique, exclusive products can still command considerable leverage. These suppliers benefit from strong customer demand and limited alternatives, enabling them to negotiate more favorable terms with Avolta.

| Factor | Impact on Supplier Bargaining Power | Avolta's Position |

|---|---|---|

| Supplier Concentration | Low for general goods, high for exclusive luxury brands. | Dufry's broad assortment dilutes power of many suppliers. |

| Switching Costs for Avolta | Low for standard products, high for exclusive brands. | Ability to switch suppliers for commodities reduces leverage. |

| Supplier Differentiation | High for unique or luxury offerings. | Avolta's curation of exclusive items can increase supplier dependence. |

| Threat of Forward Integration | Generally low due to operational complexity. | Avolta's established infrastructure is a barrier for suppliers. |

What is included in the product

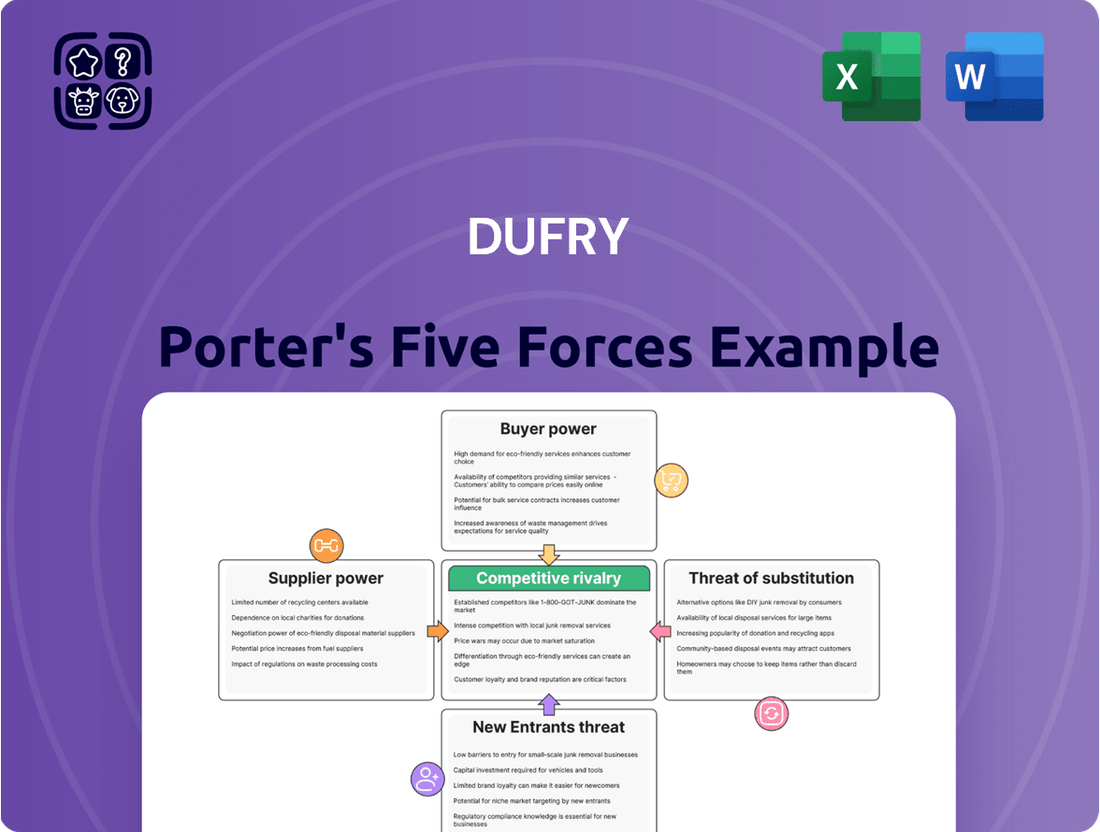

Dufry's Porter's Five Forces Analysis examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the travel retail industry.

Effortlessly identify and address competitive threats with a visual breakdown of each force, enabling targeted strategic responses.

Customers Bargaining Power

Customer price sensitivity in travel retail is a key factor for Dufry. Travelers, especially those seeking duty-free savings, often compare airport prices with those found downtown or online. For instance, a 2024 report indicated that while 65% of international travelers consider price a primary factor when purchasing travel retail items, the perceived value of convenience and exclusive airport-only products can mitigate this to some degree, particularly for luxury goods or last-minute gifts.

The increasing digitalization of the retail landscape, particularly in travel retail, significantly amplifies the bargaining power of customers. With readily available price comparison tools and extensive product information at their fingertips, consumers can easily identify the best deals and alternative offerings. For instance, in 2024, a significant portion of travelers actively used their smartphones to research prices and read reviews while in Dufry's stores, a trend that has been steadily growing.

Dufry's strategic response to this heightened customer bargaining power centers on its omnichannel initiatives and robust loyalty programs. By integrating online and offline shopping experiences and rewarding repeat customers, Dufry aims to cultivate loyalty and offer value propositions that extend beyond mere price competitiveness. These programs, which saw continued growth in member engagement through 2024, are designed to retain customers by providing exclusive benefits and personalized experiences.

For travelers already within an airport or cruise terminal, the effort to switch between retailers is virtually non-existent. This ease of movement significantly amplifies their bargaining power, allowing them to readily compare prices, product selections, and the overall shopping experience before making a purchase. For instance, in 2024, airport retail saw a significant rebound in passenger traffic, with many airports reporting traffic levels close to or exceeding 2019 figures, creating a competitive environment where customer choice is paramount.

Buyer Concentration

Dufry's customer base is incredibly diverse, made up of millions of individual travelers worldwide. This fragmentation means that no single customer or even a small group of customers can exert significant pressure on Dufry regarding prices or terms. In 2023, global tourist arrivals reached 1.3 billion, underscoring the vastness of Dufry's potential customer pool.

The ongoing expansion of the global middle class, particularly in emerging markets, further contributes to this dispersed customer landscape. For instance, by 2030, it's projected that 60% of the world's middle class will reside in Asia, a demographic shift that will continue to diversify and fragment Dufry's customer base, diminishing individual buyer power.

- Fragmented Customer Base: Millions of individual travelers mean no single buyer holds sway.

- Global Middle Class Growth: Expanding demographics further dilute concentrated buyer power.

- Limited Individual Influence: Travelers typically make individual, low-volume purchases.

- Low Customer Switching Costs: While individual travelers can easily switch between Dufry locations or competitors, the sheer volume of transactions prevents any single customer's decision from impacting Dufry's overall revenue significantly.

Product Differentiation

Dufry actively works to differentiate its offerings beyond standard travel retail. By focusing on creating a unique travel experience, the company aims to reduce the bargaining power of its customers. This strategy involves offering exclusive products, personalized customer service, and innovative retail concepts that set Dufry apart from competitors.

This product differentiation directly impacts customer price sensitivity. When customers perceive value beyond just the product itself, such as a curated selection or a pleasant shopping environment, they are less likely to solely focus on price. For instance, Dufry's investments in digital integration and loyalty programs aim to foster stronger customer relationships.

- Exclusive Brand Partnerships: Dufry collaborates with brands to offer travel-exclusive items, making them unique to the travel retail channel.

- Personalized Services: Initiatives like pre-order services and personalized recommendations cater to individual traveler needs, increasing perceived value.

- Innovative Retail Concepts: Dufry's development of experiential stores, like its Hudson Nonstop shops, provides convenience and a modern shopping experience.

Dufry's bargaining power with customers is generally low due to a highly fragmented customer base and the nature of travel retail. Millions of individual travelers, each making relatively small purchases, mean no single customer can dictate terms. While individual travelers can easily switch between airport retailers, their collective impact is diluted across Dufry's vast operations.

Price sensitivity remains a significant factor, with many travelers actively seeking deals. However, Dufry mitigates this by focusing on exclusive offerings and loyalty programs. By creating unique value propositions, the company aims to reduce reliance on price alone.

The ease with which travelers can compare prices and products, especially with mobile technology, further empowers them. Dufry's strategy involves enhancing the overall shopping experience to foster loyalty and differentiate its services beyond price.

| Factor | Description | Impact on Dufry |

|---|---|---|

| Customer Price Sensitivity | Travelers often compare prices, impacting purchasing decisions. A 2024 survey showed 65% of international travelers prioritize price. | Moderate pressure on pricing and margins. |

| Digitalization & Price Transparency | Easy access to price comparison tools empowers informed choices. Many travelers used smartphones for price research in Dufry stores in 2024. | Increases customer leverage; necessitates competitive pricing. |

| Low Switching Costs (Individual) | Travelers can easily move between retailers within an airport. Airport traffic rebounded significantly in 2024, increasing choice. | Customers can readily switch if unsatisfied. |

| Fragmented Customer Base | Millions of individual, low-volume buyers. Global tourist arrivals reached 1.3 billion in 2023. | No single customer can exert significant influence. |

| Product Differentiation & Loyalty | Exclusive brands, personalized services, and experiential retail reduce price focus. Loyalty programs saw increased engagement in 2024. | Builds customer retention and reduces direct price competition. |

Preview Before You Purchase

Dufry Porter's Five Forces Analysis

This preview showcases the complete Dufry Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape that shapes the company's strategic positioning. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable market intelligence.

Rivalry Among Competitors

The global duty-free and travel retail landscape is intensely competitive, featuring major players such as China Duty Free Group (CDFG), Lagardère Travel Retail, Lotte Duty-Free, DFS Group, and Heinemann. While Dufry, now operating as Avolta, holds the position of the largest entity, it contends with robust competition from these significant global and regional operators.

The travel retail industry is on a strong growth trajectory, with forecasts indicating an annual increase of 7-10% for both 2024 and 2025. This expansion significantly outpaces the projected global GDP growth, creating fertile ground for intensified competition.

As the market expands, existing players and new entrants are likely to vie more aggressively for market share. This heightened rivalry is particularly evident in rapidly developing segments, such as the burgeoning travel retail market in the Asia-Pacific region, where growth rates are exceptionally high.

While many travel retailers offer similar core product categories like beauty, fashion, and confectionery, competitive rivalry is fierce, pushing companies to differentiate. Dufry, for instance, focuses on enhancing the customer experience through personalized service and exclusive brand partnerships. This strategy aims to create a unique shopping environment that goes beyond just product availability.

Competitors are also leveraging digital innovation and unique store concepts to stand out. For example, some have introduced experiential retail spaces or integrated digital tools for seamless shopping journeys. Dufry's own efforts include diversifying its offerings and strengthening its digital presence to cater to evolving consumer preferences in the travel retail sector.

Exit Barriers

Exit barriers in the travel retail sector, particularly for companies like Dufry, are substantial. The high fixed costs tied to securing and operating airport concessions, often involving long-term contracts, mean that exiting the market is not a simple decision. These upfront investments, coupled with the need for specialized infrastructure, lock companies into their positions.

These significant commitments compel businesses to continue competing, even in challenging environments. For example, the capital expenditure required to establish and maintain retail spaces within airports can run into millions of dollars per location.

- High Fixed Costs: Airport concessions demand considerable upfront investment in retail space fit-out, inventory, and staffing.

- Long-Term Contracts: Many airport retail agreements span 10-15 years or more, creating a long-term commitment.

- Specialized Infrastructure: Investments in security, logistics, and specific retail technologies are often non-transferable.

- Brand Reputation: Abruptly exiting a major airport could damage a travel retailer's brand image and future bidding prospects.

Strategic Stakes

The travel retail sector is a crucial marketing and sales avenue for premium and luxury brands, making it strategically vital. This heightened importance significantly raises the stakes for major players like Dufry.

Consequently, Dufry and its competitors are compelled to make substantial investments to secure the most desirable airport and other travel hub locations. They also focus on continuously improving their product assortments and customer experiences to maintain a competitive edge.

For instance, in 2024, major airport concession tenders saw intense bidding, with retailers vying for prime spots. Dufry's ongoing efforts to integrate acquisitions, such as the World Duty Free acquisition in 2015 which significantly expanded its European footprint, underscore this strategic imperative. These moves are essential to solidify market position and capture a larger share of the lucrative travel retail spend.

- Strategic Importance: Travel retail serves as a key channel for global brands, particularly in the premium and luxury segments, driving brand visibility and sales.

- High Investment: Retailers like Dufry must invest heavily in securing prime locations and enhancing their offerings to compete effectively in this market.

- Competitive Landscape: The strategic value of travel retail fuels intense competition among major players, leading to significant capital deployment in bids and operational improvements.

The competitive rivalry within the travel retail sector is exceptionally high, driven by a limited number of prime airport concessions and the strategic importance of this channel for global brands. Dufry, now Avolta, faces intense competition from major players like China Duty Free Group and Lagardère Travel Retail, all vying for market share in a growing industry.

The travel retail market is projected to grow at an impressive 7-10% annually in 2024 and 2025, fueling aggressive competition. This expansion encourages existing players and new entrants to compete fiercely for prime locations and customer spend, particularly in high-growth regions like Asia-Pacific.

Companies differentiate through enhanced customer experiences, personalized service, and exclusive brand partnerships, as seen with Dufry's strategies. Digital innovation and unique store concepts are also key differentiators, with competitors investing in experiential retail and seamless digital shopping journeys.

The strategic value of travel retail for premium and luxury brands means retailers like Dufry must invest heavily in securing desirable locations and continuously improving their offerings to maintain a competitive edge. Intense bidding for airport concessions in 2024 highlights this strategic imperative.

| Competitor | Estimated 2023 Revenue (USD Billion) | Key Markets | Competitive Focus |

|---|---|---|---|

| Avolta (Dufry) | ~12.0 | Global (Europe, Americas, Asia) | Customer experience, digital, brand partnerships |

| China Duty Free Group (CDFG) | ~10.0 | China, Hainan | Domestic tourism, luxury brands, integrated retail |

| Lagardère Travel Retail | ~8.0 | Europe, Asia, North America | Diversified portfolio (travel essentials, duty-paid), digital |

| Lotte Duty-Free | ~5.0 | South Korea, Japan, Southeast Asia | K-beauty, luxury, online platforms |

| DFS Group (LVMH) | ~4.0 | Asia-Pacific, North America | Luxury, experiential retail, exclusive products |

SSubstitutes Threaten

Travelers today have a vast array of shopping options beyond traditional airport duty-free stores. They can easily purchase goods online from domestic retailers, directly from brand websites, or through major e-commerce platforms, often with competitive pricing and convenient delivery. For instance, the global e-commerce market was projected to reach over $6.3 trillion in 2024, highlighting the significant competition from these alternative channels.

The traditional price advantage of duty-free shopping is increasingly being challenged. Consumers can readily compare prices online, and many international destinations offer attractive retail prices even without the duty-free exemption. This makes the perceived savings of duty-free less of a compelling differentiator than it once was.

The threat of substitutes for Dufry is significantly influenced by the price-performance trade-off available elsewhere. If the price gap between duty-free offerings and conventional retail channels narrows, or if the convenience of online shopping starts to overshadow the unique travel retail experience, customers might shift their purchasing habits. For instance, in 2024, the global e-commerce market continued its robust growth, with projections indicating it could reach over $6 trillion, presenting a readily accessible alternative for many consumer goods.

Customer propensity to substitute in travel retail is influenced by several key factors. The purpose of travel, whether for leisure or business, significantly shapes purchasing decisions. For instance, business travelers might have less time and be more focused on convenience, while leisure travelers may be more open to browsing and impulse purchases.

The amount of time a traveler has available at the airport also plays a crucial role. Longer layovers or delays can increase the likelihood of exploring retail options and potentially opting for substitutes. Conversely, travelers with tight connections are less likely to engage in extensive browsing, making them less susceptible to substitution.

Product category is another critical determinant. For essential items, the ease of substitution is generally high; travelers can easily find similar products elsewhere. However, for luxury goods, unique souvenirs, or gifts, the travel retail experience itself, including the curated selection and the novelty factor, can reduce the propensity to substitute, as these items are often sought for their specific context and perceived value within the travel environment.

Perceived Value of Travel Retail Experience

Dufry strives to differentiate its travel retail offerings by focusing on an enhanced customer experience, blending personalization, innovative technology, and curated local products. This strategy aims to transcend the traditional appeal of duty-free pricing.

If travelers do not perceive this experiential value, the threat of substitutes intensifies. For instance, if the in-store experience feels generic or lacks engaging elements, consumers might opt for alternative purchasing channels that offer convenience or perceived better value, even if not duty-free.

- Experiential Differentiation: Dufry's strategy hinges on creating a memorable shopping journey, moving beyond mere price competition.

- Perception is Key: The success of this differentiation directly impacts the threat of substitutes; a failure to deliver a perceived unique experience weakens Dufry's position.

- Impact on Substitution: If the experiential value is not recognized, travelers may turn to online retailers or local shops outside the airport, eroding Dufry's market share.

Regulatory Changes and Tariffs

Changes in government regulations, such as adjustments to duty-free allowances or the introduction of new import tariffs, can significantly alter the pricing landscape for travel retail. For instance, if a country reduces its duty-free allowance, the price advantage of purchasing goods at airports or on ferries diminishes, making local retail or online purchases a more appealing substitute for consumers. This directly impacts the threat of substitutes by making alternative purchasing channels more cost-effective.

In 2024, the global trade environment continued to be influenced by protectionist policies. The World Trade Organization (WTO) reported a rise in trade-restrictive measures, which can manifest as tariffs or non-tariff barriers. These measures can indirectly increase the cost of goods sold in duty-free environments, thereby strengthening the appeal of substitutes.

- Tariff Impact: Increased tariffs on imported goods can make duty-free items less competitive compared to domestically sourced or online alternatives.

- Allowance Reductions: Lowering duty-free allowances means consumers can bring fewer goods tax-free, reducing the incentive to purchase at travel retail points.

- Regulatory Uncertainty: Shifting regulatory frameworks create uncertainty, potentially leading consumers to favor more predictable purchasing channels.

- Geopolitical Factors: Broader geopolitical tensions can lead to retaliatory tariffs or trade restrictions, further impacting the pricing and availability of goods in travel retail.

The threat of substitutes for Dufry is substantial, with online retailers and local shops presenting compelling alternatives. The sheer convenience and often competitive pricing of e-commerce, which was projected to exceed $6.3 trillion globally in 2024, directly challenge the traditional duty-free model. Travelers can easily compare prices and have goods delivered directly, diminishing the unique selling proposition of airport retail.

Furthermore, the perceived price advantage of duty-free shopping is eroding. As consumers become more price-aware and can easily check prices online, the savings offered at airports may no longer be significant enough to deter them from using alternative channels. This is particularly true for everyday items where the travel retail experience adds less perceived value.

Dufry's strategy to counter this involves enhancing the in-store experience through personalization and curated local products. However, if this experiential value is not effectively communicated or delivered, travelers may default to more convenient or seemingly cost-effective substitutes, especially for product categories with high substitutability.

| Substitute Channel | Key Advantages | Impact on Dufry |

|---|---|---|

| Online Retailers (e.g., Amazon, brand websites) | Convenience, price comparison, wide selection, home delivery | Reduces impulse purchases, erodes price advantage, requires Dufry to offer superior experience |

| Local Retail Stores (in destination country) | Potentially lower prices (even without duty-free), local authenticity, immediate availability | Challenges price competitiveness, offers alternative shopping experience |

| Brand-Specific E-commerce | Direct access to products, brand loyalty programs, often exclusive offers | Bypasses travel retail intermediaries, can offer better value or unique products |

Entrants Threaten

Entering the global travel retail arena, particularly at the scale Dufry operates, demands immense capital. Securing lucrative airport concessions alone can cost hundreds of millions, if not billions, of dollars over the contract duration. For instance, major airport authorities frequently tender long-term contracts requiring significant upfront commitments and ongoing investment in store fit-outs and inventory management.

Beyond concession fees, the capital needed for sophisticated logistics networks, state-of-the-art retail spaces, and robust IT systems presents a formidable hurdle. New players must also contend with the financial muscle of established giants like Dufry, which leverage economies of scale and existing supplier relationships to maintain competitive pricing and operational efficiency. In 2023, Dufry reported revenues of CHF 10.3 billion, illustrating the sheer scale of operations that new entrants would need to match financially.

Securing access to prime distribution channels, particularly at airports and travel hubs, presents a formidable barrier for potential new entrants. Dufry's existing concession agreements are typically long-term, often spanning 10-15 years, and are fiercely contested. For instance, in 2023, the bidding process for concessions at major European hubs saw significant competition, with established players like Dufry leveraging their scale and experience to retain or win these crucial retail locations.

Dufry, recently rebranded as Avolta, enjoys a significant advantage due to its strong brand recognition and established customer loyalty programs, such as Club Avolta. This existing loyalty makes it challenging for new players to attract customers away from Avolta's trusted offerings.

New entrants face the substantial hurdle of needing considerable investment in marketing and the development of truly unique value propositions to even begin competing for customer trust and market share against Avolta's entrenched position.

Economies of Scale

Dufry's vast global presence, operating in over 65 countries, creates significant economies of scale that act as a formidable barrier to entry. Their immense purchasing power allows them to negotiate favorable terms with suppliers for a wide range of products, from luxury goods to everyday essentials. This scale translates directly into lower per-unit costs for inventory, marketing, and operational overhead.

For instance, in 2024, Dufry reported total sales of CHF 10.2 billion. This substantial revenue underscores their ability to leverage volume discounts across their extensive supply chain. New entrants would find it incredibly challenging to match these cost efficiencies without first building a comparable global footprint and sales volume, which requires substantial upfront investment and time.

- Dufry's Global Reach: Operates in over 65 countries, providing a broad base for economies of scale.

- Purchasing Power: Significant volume allows for better negotiation with suppliers, lowering costs.

- Cost Efficiencies: Achieves lower per-unit costs in sourcing, logistics, and operations compared to smaller players.

- 2024 Sales Performance: CHF 10.2 billion in sales highlights the scale of operations and its cost advantages.

Regulatory and Concession Barriers

Regulatory and concession barriers significantly deter new entrants in travel retail. Dufry, like other established players, operates within a framework requiring extensive licensing and permits for each location. For instance, securing a concession at a major international airport involves rigorous bidding processes and often substantial upfront investment, making it difficult for smaller or newer companies to compete effectively. These established relationships and the sheer complexity of compliance act as substantial deterrents.

- High Licensing Costs: Obtaining necessary operating licenses in travel retail can involve significant fees and long waiting periods, creating a financial hurdle for newcomers.

- Concession Agreement Complexity: Airport and travel hub concession agreements are often long-term, highly specific, and require proven operational capabilities, which new entrants typically lack.

- Navigating Bureaucracy: The sheer volume of regulations and the need to comply with varying international standards add layers of complexity that can overwhelm new businesses.

- Established Relationships: Incumbents like Dufry have built strong relationships with airport authorities and suppliers over years, giving them an advantage in securing favorable terms and renewals.

The threat of new entrants into the global travel retail market, where Dufry (now Avolta) operates, is significantly low due to substantial capital requirements and established barriers. Securing lucrative airport concessions alone can cost hundreds of millions, demanding immense upfront investment and ongoing capital for store fit-outs and inventory. For example, major airport tenders often require long-term commitments and significant financial backing, making it difficult for smaller players to enter.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront costs for concessions, store development, and inventory. | Formidable financial hurdle, requiring substantial investment. |

| Distribution Channel Access | Long-term concession agreements with prime airport locations. | Limited access to key retail spaces, as incumbents hold most prime spots. |

| Economies of Scale | Dufry's global presence (65+ countries) and purchasing power. | New entrants struggle to match cost efficiencies in sourcing and operations. |

| Regulatory & Licensing | Complex licensing, permits, and bidding processes for concessions. | Navigating bureaucracy and compliance adds significant complexity and cost. |

Porter's Five Forces Analysis Data Sources

Our Dufry Porter's Five Forces analysis is built upon a robust foundation of data, including Dufry's annual reports, investor presentations, and financial statements. We also incorporate industry-specific market research from firms like Euromonitor and IBISWorld, alongside global economic indicators and travel retail market trend reports.