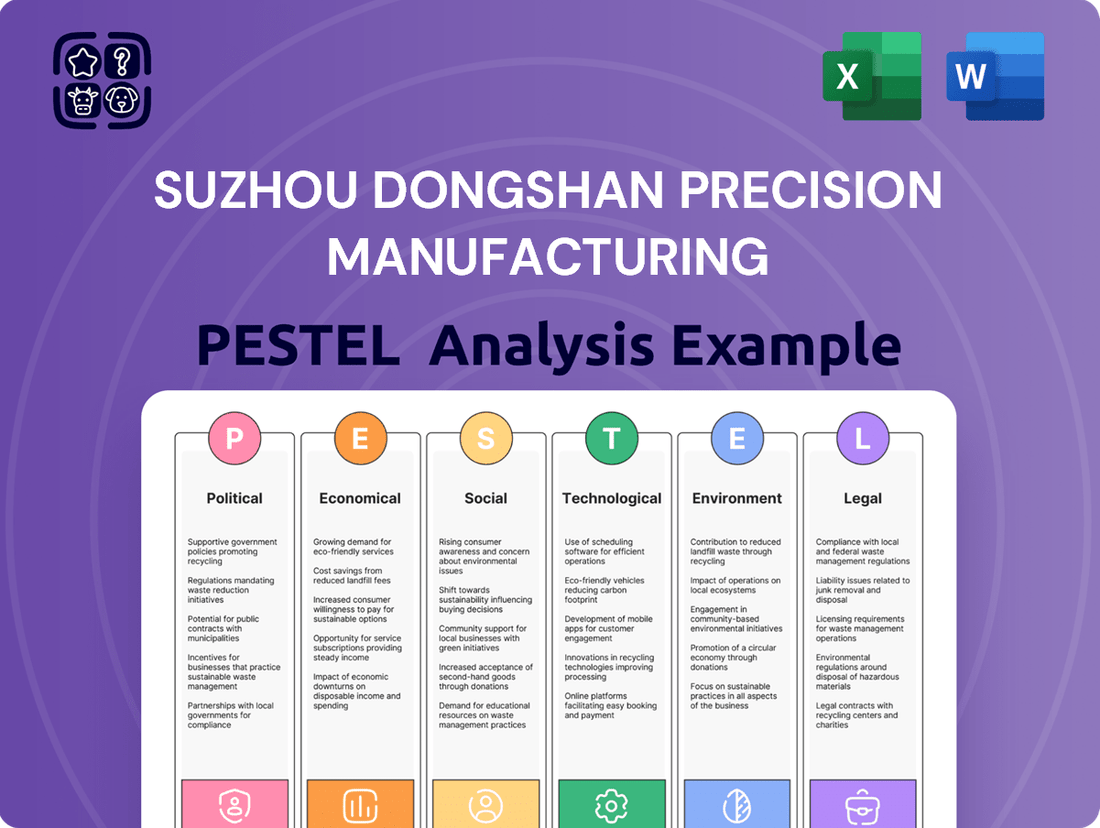

Suzhou Dongshan Precision Manufacturing PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suzhou Dongshan Precision Manufacturing Bundle

Navigate the complex external forces shaping Suzhou Dongshan Precision Manufacturing with our expert PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for the company. Don't get left behind; download the full analysis now to gain actionable intelligence and refine your market strategy.

Political factors

The Chinese government's commitment to advancing its manufacturing capabilities, notably through the Made in China 2025 initiative, directly benefits companies like Suzhou Dongshan Precision Manufacturing. This strategic push aims to elevate the nation's industrial prowess and technological sophistication. For instance, government projections indicate substantial investment flowing into advanced manufacturing sectors through 2025, creating a supportive ecosystem for growth.

Global trade relations, especially with key markets like the United States and the European Union, are crucial for Suzhou Dongshan's export performance. For instance, in 2023, the electronics sector, a major area for precision manufacturing, continued to navigate complex trade agreements and evolving geopolitical landscapes.

Trade tensions and tariffs, such as those imposed on Chinese goods by the U.S., directly influence companies like Suzhou Dongshan. These measures can alter market access and increase operational costs for electronics manufacturers, impacting their competitiveness in international markets.

China's commitment to enhancing intellectual property (IP) protection is a significant political factor for precision manufacturers like Suzhou Dongshan Precision. Recent initiatives in 2024 and 2025 have bolstered administrative enforcement powers and streamlined application processes, offering more robust safeguards for proprietary designs and advanced manufacturing technologies.

Geopolitical Stability and Supply Chain Resilience

China's political landscape generally provides a stable operating environment for manufacturers like Suzhou Dongshan. However, broader global geopolitical shifts, such as trade tensions and regional conflicts, can introduce volatility. These external factors can ripple through international markets, potentially affecting demand for electronic components and precision manufacturing services.

The increasing global focus on supply chain resilience and localization presents both challenges and opportunities. Many countries are actively encouraging or mandating the onshore or near-shore production of critical goods. For Suzhou Dongshan, this trend might necessitate adjustments in its sourcing strategies, potentially leading to higher input costs if key components become more expensive to procure domestically or regionally.

Global diversification efforts by major tech companies, driven by geopolitical considerations, could also impact Suzhou Dongshan's client base. Companies are actively seeking to reduce reliance on single geographic regions for their manufacturing needs. This could mean that Suzhou Dongshan needs to be more competitive and adaptable to retain its market share amidst these evolving global supply chain dynamics.

For instance, the ongoing push for semiconductor supply chain diversification, a key area for precision manufacturing, saw significant investment announcements in 2024. The US CHIPS Act, for example, continued to incentivize domestic production, while similar initiatives were launched or expanded in Europe and Japan. These policies aim to build more localized semiconductor manufacturing capacity, which could influence the sourcing decisions of Suzhou Dongshan's clients in the electronics sector.

Policy Initiatives for Industrial Upgrading

China's strategic push for industrial upgrading, technological self-reliance, and a green transition, often encapsulated within the 'dual circulation' and 'high-quality development' frameworks, significantly impacts its manufacturing sector. These directives actively promote the integration of advanced technologies like artificial intelligence and automation, alongside the adoption of sustainable operational practices, directly benefiting precision manufacturers such as Suzhou Dongshan Precision Manufacturing.

Government policies are actively encouraging investment in high-end manufacturing and innovation. For instance, in 2024, China's Ministry of Industry and Information Technology announced plans to further support the digital transformation of manufacturing enterprises, aiming to boost productivity and competitiveness. This aligns with Suzhou Dongshan Precision Manufacturing's focus on advanced production techniques.

- Increased R&D Investment: Government incentives are driving higher research and development spending in key technological areas.

- Support for Green Manufacturing: Policies favor companies adopting environmentally friendly production processes and materials.

- Automation and AI Adoption: Subsidies and tax breaks are available for manufacturers implementing intelligent manufacturing solutions.

- Focus on Supply Chain Resilience: Initiatives aim to strengthen domestic supply chains, reducing reliance on foreign technology and components.

Government support for advanced manufacturing, including initiatives like Made in China 2025, provides a strong tailwind for Suzhou Dongshan Precision Manufacturing. China's ongoing commitment to technological self-reliance and industrial upgrading, particularly in areas like AI and automation, directly benefits companies embracing these advancements. For example, government projections for 2024-2025 indicate continued substantial investment in high-end manufacturing sectors, fostering a supportive operational environment.

China's focus on strengthening intellectual property protection, with enhanced enforcement powers and streamlined processes anticipated through 2025, offers greater security for Suzhou Dongshan's proprietary technologies. While the overall political climate remains stable, global geopolitical shifts and trade tensions, such as those impacting the electronics sector in 2023, can introduce market volatility and affect export competitiveness.

The drive for supply chain resilience and localization by various nations presents both opportunities and challenges for Suzhou Dongshan. Companies are increasingly diversifying their manufacturing bases, potentially impacting client relationships. For instance, significant investments in semiconductor supply chain diversification were announced in 2024, with policies like the US CHIPS Act incentivizing domestic production, which could influence sourcing decisions for electronics manufacturers.

| Policy Area | Focus | Impact on Suzhou Dongshan | Data/Trend (2024-2025) |

|---|---|---|---|

| Industrial Upgrading | AI, Automation, High-end Manufacturing | Enhanced competitiveness, access to new technologies | Continued government investment in digital transformation of manufacturing |

| Intellectual Property | Protection and Enforcement | Safeguarding proprietary designs and technologies | Strengthened administrative enforcement and streamlined application processes |

| Trade Relations | Global Market Access, Tariffs | Potential impact on export costs and market access | Navigating complex trade agreements in key markets |

| Supply Chain Diversification | Localization, Resilience | Need for adaptable sourcing strategies, potential cost adjustments | Increased investment in localized semiconductor production capacity |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Suzhou Dongshan Precision Manufacturing, offering a comprehensive view of the external landscape.

It provides actionable insights for strategic decision-making, highlighting potential challenges and growth avenues for the company within its operating environment.

This PESTLE analysis for Suzhou Dongshan Precision Manufacturing offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for quick referencing during strategic discussions.

Economic factors

China's economic engine continues to hum, with a projected GDP growth of around 5.0% for 2024, providing a strong foundation for manufacturing sector expansion. This sustained growth is crucial for companies like Suzhou Dongshan Precision Manufacturing, as it signals increased demand for their products.

The nation's industrial output is particularly dynamic, with key sectors like electric vehicles (EVs) experiencing significant upswings. In 2023, China's EV production alone reached over 9.5 million units, a remarkable increase that directly benefits precision manufacturers supplying critical components for these rapidly growing industries.

Suzhou Dongshan Precision Manufacturing is well-positioned to capitalize on robust global demand across its core sectors: telecommunications, consumer electronics, and automotive. These industries are not only growing but are also increasingly reliant on sophisticated manufacturing services.

The Electronic Manufacturing Services (EMS) market, a key area for Dongshan, is forecast to expand significantly. Projections indicate the global EMS market could reach approximately $1.1 trillion by 2027, demonstrating substantial growth opportunities driven by the very sectors Dongshan serves.

Suzhou Dongshan Precision Manufacturing's global operations expose it to significant currency fluctuations. For instance, the Chinese Yuan (CNY) against major currencies like the US Dollar (USD) and Euro (EUR) directly influences Dongshan's costs for imported components and the pricing of its exported products. A stronger Yuan can make imports cheaper but exports more expensive, potentially impacting profit margins.

In 2024, exchange rate volatility, particularly between the CNY and USD, has been a key consideration. Fluctuations can directly affect Dongshan's revenue when converting foreign earnings back into Yuan. For example, if the Yuan strengthens against the Dollar, the Yuan-denominated value of USD-denominated sales decreases, impacting reported profitability.

Rising Labor Costs and Automation Investment

While China boasts impressive labor productivity, a consistent upward trend in wages is compelling manufacturers to explore advanced automation. This economic reality is a significant driver for companies like Suzhou Dongshan Precision Manufacturing to enhance their operational efficiency and remain competitive on the global stage.

The push for automation is further amplified by potential labor shortages and specific talent gaps within the Electronic Manufacturing Services (EMS) sector. To counter these challenges and ensure sustained output, Suzhou Dongshan is strategically investing in robotics and AI-powered manufacturing systems. These investments are crucial for maintaining high levels of productivity and cost-effectiveness in an evolving industrial landscape.

- Rising Wages: Average manufacturing wages in China have seen a steady increase, impacting production costs for companies.

- Automation Investment: Suzhou Dongshan is allocating capital towards robotics and AI to offset rising labor expenses and improve output.

- Talent Gaps: The EMS sector faces a shortage of skilled labor, making automation a necessary solution for operational continuity.

- Competitiveness: Embracing automation is key for Suzhou Dongshan to maintain its edge in a dynamic global manufacturing environment.

Market Size and Growth in Precision Components

The global precision metal components market is surging, with projections indicating a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030, reaching an estimated $235.5 billion by 2030. Similarly, the precision turned products sector is expanding robustly, fueled by escalating demand from critical industries like aerospace, automotive, and healthcare. This economic tailwind, amplified by the increasing integration of automation and sophisticated manufacturing machinery, creates a substantial growth avenue for Suzhou Dongshan Precision Manufacturing.

Key economic factors influencing this market include:

- Industry Demand: Aerospace sector growth, projected to see a 7.5% increase in aircraft production in 2024, and the automotive industry's shift towards electric vehicles, requiring more complex precision parts, are major drivers.

- Technological Adoption: The increasing investment in advanced CNC machining and automation, with the global industrial automation market expected to reach $367.6 billion by 2028, enhances manufacturing efficiency and capability.

- Market Value: The precision metal components market alone was valued at $145.9 billion in 2023, underscoring the significant economic scale and opportunity.

- Healthcare Needs: The healthcare industry's demand for highly precise medical implants and surgical instruments, a market segment expected to grow at a CAGR of 7.1% through 2027, further bolsters the precision manufacturing landscape.

China's economic growth, projected around 5.0% for 2024, provides a robust market for Suzhou Dongshan Precision Manufacturing. The nation's industrial output, particularly in burgeoning sectors like electric vehicles which saw over 9.5 million units produced in 2023, directly fuels demand for precision components. Furthermore, the global EMS market's anticipated expansion to approximately $1.1 trillion by 2027 presents significant opportunities for companies like Dongshan.

| Economic Factor | 2023/2024 Data/Projection | Impact on Suzhou Dongshan |

|---|---|---|

| China GDP Growth | ~5.0% (2024 Projection) | Indicates strong domestic demand and a stable operating environment. |

| China EV Production | >9.5 million units (2023) | Directly benefits suppliers of critical EV components. |

| Global EMS Market | ~$1.1 trillion by 2027 (Projected) | Highlights substantial growth potential in Dongshan's core service area. |

| Precision Metal Components Market | $145.9 billion (2023 Value), 6.2% CAGR (2023-2030) | Signals a strong market for precision manufacturing services. |

What You See Is What You Get

Suzhou Dongshan Precision Manufacturing PESTLE Analysis

The preview shown here is the exact Suzhou Dongshan Precision Manufacturing PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that the insights and structure you see are precisely what you'll gain access to immediately.

Sociological factors

China's increasingly competitive labor market, where the unemployment rate hovered around 5.5% in 2022, is pushing companies like Suzhou Dongshan Precision Manufacturing to prioritize quality employment. This means not just offering jobs, but focusing on the entire employee experience to attract and keep skilled workers.

To stand out, precision manufacturing firms are enhancing their compensation packages and benefits. This strategic move aims to boost employee satisfaction, making it easier to secure the specialized talent needed for advanced manufacturing processes.

Consumers are increasingly seeking sophisticated electronic gadgets, from the latest smartphones to smart home systems and electric cars. This trend is a significant sociological factor influencing the electronics manufacturing sector.

This growing appetite for advanced electronics directly translates into a higher demand for specialized components like miniaturized and high-density interconnect printed circuit boards (PCBs). For Electronic Manufacturing Services (EMS) providers such as Suzhou Dongshan Precision Manufacturing, this means adapting production to meet these evolving consumer preferences.

In 2024, the global consumer electronics market was valued at over $1 trillion, with a projected compound annual growth rate (CAGR) of 6.5% through 2030, underscoring the sustained demand for innovation and advanced features.

The rapid integration of advanced technologies like AI, IoT, and automation in manufacturing, particularly in regions like Suzhou, is significantly widening the skills gap. This necessitates substantial investment in workforce training and development. For instance, by 2025, it's projected that over 140 million workers in the EU will need reskilling to adapt to these technological shifts, a trend mirrored globally.

Urbanization and Infrastructure Development

Global urbanization continues to accelerate, with projections indicating that by 2050, approximately 68% of the world's population will reside in urban areas. This surge in urban living directly fuels the demand for sophisticated electronic components and advanced LED lighting solutions, areas where Suzhou Dongshan Precision Manufacturing holds significant expertise. The company is well-positioned to capitalize on this trend as cities expand and require more energy-efficient and integrated manufacturing services for their growing infrastructure needs.

Infrastructure development, a key companion to urbanization, further amplifies the market for Suzhou Dongshan's offerings. Investments in smart city initiatives, transportation networks, and building construction all necessitate a robust supply of precision-manufactured electronic parts and LED products. For instance, the global smart lighting market alone was valued at over USD 10 billion in 2023 and is expected to grow substantially in the coming years, driven by these urban development projects.

- Growing Urban Populations: The United Nations projects that urban areas will house 2.5 billion more people by 2050, increasing the need for electronic components in smart city infrastructure.

- Infrastructure Investment: Global infrastructure spending is projected to reach trillions of dollars annually in the coming decade, creating significant opportunities for component suppliers.

- LED Demand: The increasing focus on energy efficiency in urban environments is driving higher adoption rates for LED lighting in public spaces and buildings.

- Integrated Manufacturing Needs: As infrastructure projects become more complex, there's a greater demand for manufacturers capable of providing end-to-end solutions, from component production to assembly.

Shifting Supply Chain Dynamics and Regionalization

Global disruptions and geopolitical tensions are fundamentally reshaping supply chains. We're seeing a pronounced trend towards diversification and reshoring, with some manufacturing operations moving away from China to other regions. This shift directly impacts labor availability and the required skill sets in established manufacturing centers like Suzhou.

Companies must proactively adapt their workforce strategies to address these evolving labor dynamics. For instance, the drive for regionalization might necessitate upskilling existing workers or investing in new training programs to meet the demands of a potentially more localized production environment. This could also lead to increased competition for skilled labor in emerging manufacturing hubs.

- Supply Chain Diversification: A 2024 survey indicated that over 60% of global manufacturers are actively diversifying their supply chains to mitigate risks, a significant increase from previous years.

- Reshoring Initiatives: Governments in North America and Europe are implementing policies to encourage reshoring, with significant investment pledges announced in 2024 for semiconductor and automotive manufacturing.

- Labor Skill Gaps: Reports from 2025 highlight a growing concern among businesses regarding the availability of advanced manufacturing skills, particularly in areas affected by supply chain realignments.

The increasing demand for advanced electronics, driven by consumer trends, directly boosts the need for specialized components like PCBs. The global consumer electronics market, exceeding $1 trillion in 2024, with a projected 6.5% CAGR through 2030, highlights this sustained demand.

Urbanization, projected to house 68% of the world's population in urban areas by 2050, fuels demand for electronic components in smart city infrastructure and energy-efficient LED lighting, key areas for Suzhou Dongshan Precision Manufacturing.

Societal shifts toward sustainability are increasing the adoption of LED lighting, with the global smart lighting market valued at over $10 billion in 2023, creating opportunities for companies like Suzhou Dongshan.

The evolving labor market, with a 5.5% unemployment rate in China in 2022, forces companies to focus on employee experience and compensation to attract skilled workers for advanced manufacturing.

Technological factors

Suzhou Dongshan Precision Manufacturing is positioned to capitalize on the ongoing transformation of the manufacturing sector towards smart factories and Industry 4.0 principles. This shift involves integrating Internet of Things (IoT) devices, artificial intelligence (AI), and advanced real-time analytics to achieve unprecedented levels of operational efficiency.

By embracing these technological advancements, Suzhou Dongshan can significantly streamline its production processes, minimize costly downtime, and develop a more agile and responsive operational model capable of adapting swiftly to evolving market demands. For instance, the global market for Industry 4.0 solutions was projected to reach approximately $100 billion in 2024, indicating substantial growth and opportunity.

The rapid evolution of artificial intelligence (AI) and automation is fundamentally reshaping manufacturing. AI and machine learning are now integral to processes like predictive maintenance, where algorithms anticipate equipment failures, and advanced quality assurance, identifying defects with unprecedented accuracy. Digital twin technology, powered by AI, creates virtual replicas of physical assets, allowing for real-time monitoring and optimization.

For Suzhou Dongshan Precision Manufacturing, the synergy between AI and robotics offers significant advantages. This integration boosts precision, drastically reduces the likelihood of human error, and notably accelerates production cycles. For instance, in 2024, the global industrial automation market was valued at over $300 billion, with AI-driven solutions representing a substantial growth segment, indicating a strong market trend that Suzhou Dongshan can leverage.

The relentless drive for smaller, more powerful devices across consumer electronics, medical equipment, and automotive systems directly fuels the demand for miniaturization. This trend necessitates intricate, high-density interconnect (HDI) printed circuit boards (PCBs) capable of packing more functionality into less space.

Suzhou Dongshan Precision Manufacturing's expertise in advanced PCB fabrication, including HDI technologies, positions it well to capitalize on this market shift. For instance, the global HDI PCB market was valued at approximately $15 billion in 2023 and is projected to grow significantly, driven by 5G infrastructure and advanced mobile devices.

Evolution of CNC Machining and Additive Manufacturing

CNC machining remains a vital precision manufacturing technique. Recent advancements are integrating AI and the Industrial Internet of Things (IIoT) to enable real-time performance monitoring and process optimization. For example, by 2024, the global CNC machine market was valued at approximately $14 billion, with projections indicating continued growth driven by these technological integrations.

Additive manufacturing, or 3D printing, is rapidly evolving beyond its traditional role in prototyping. It's now a viable option for producing complex, end-use parts, often with significant reductions in material waste compared to subtractive methods. The global 3D printing market is expected to reach over $60 billion by 2027, highlighting its expanding industrial applications.

These technological shifts present both opportunities and challenges for companies like Suzhou Dongshan Precision Manufacturing.

- Enhanced Precision: AI-driven CNC systems offer greater accuracy and repeatability in part production.

- Material Efficiency: Additive manufacturing reduces scrap rates, contributing to cost savings and sustainability.

- Complex Geometries: 3D printing allows for the creation of intricate designs previously impossible with traditional methods.

- On-Demand Production: Both technologies facilitate more agile and responsive manufacturing, supporting customized or low-volume runs.

Integration of IoT and Data Analytics

The integration of the Industrial Internet of Things (IIoT) with advanced data analytics is a significant technological driver for precision manufacturers like Suzhou Dongshan. IIoT enables the connection of machinery and entire production systems, generating a constant stream of real-time data. This data is crucial for gaining predictive insights into equipment performance and fostering seamless communication across the manufacturing floor.

By effectively leveraging IoT and data analytics, Suzhou Dongshan can achieve substantial operational improvements. For instance, these technologies are instrumental in reducing unplanned downtime, a major cost factor in manufacturing. Furthermore, they allow for more precise inventory management, minimizing waste and holding costs, and ultimately streamlining the entire operational workflow. In 2024, the global IIoT market was valued at approximately $290 billion, with projections indicating strong continued growth, underscoring its increasing importance.

- Predictive Maintenance: IIoT sensors monitor equipment health, allowing for proactive repairs before failures occur, thus minimizing costly downtime.

- Optimized Production: Real-time data analysis helps identify bottlenecks and inefficiencies in the production line, leading to increased throughput.

- Enhanced Quality Control: IoT devices can track product parameters throughout the manufacturing process, enabling immediate adjustments to maintain high precision standards.

- Supply Chain Visibility: Connected systems provide end-to-end visibility of materials and finished goods, improving logistics and inventory accuracy.

Technological advancements are fundamentally reshaping precision manufacturing, with Industry 4.0 principles at the forefront. Suzhou Dongshan Precision Manufacturing is poised to benefit from the integration of AI, IoT, and advanced analytics to boost operational efficiency. For example, the global Industry 4.0 market was expected to exceed $100 billion in 2024, highlighting the significant opportunities in this space.

AI and automation are critical for predictive maintenance and enhanced quality assurance, with digital twins further optimizing processes. The synergy between AI and robotics, a market segment valued over $300 billion in 2024 for industrial automation, promises increased precision and faster production cycles for companies like Suzhou Dongshan.

The demand for miniaturization in electronics drives the need for advanced HDI PCBs, a market valued at approximately $15 billion in 2023. Concurrently, CNC machining, with a global market around $14 billion in 2024, is being enhanced by AI and IIoT for real-time optimization. Furthermore, additive manufacturing is expanding beyond prototyping, with the global 3D printing market projected to surpass $60 billion by 2027, offering material efficiency and complex geometry capabilities.

| Technology Area | 2024 Market Value (Approx.) | Key Benefit for Suzhou Dongshan | Growth Driver |

|---|---|---|---|

| Industry 4.0 | $100 Billion+ | Operational Efficiency, Agility | Smart Factory Adoption |

| Industrial Automation (AI-driven) | $300 Billion+ (Total Market) | Precision, Speed, Reduced Error | AI Integration in Manufacturing |

| HDI PCBs | $15 Billion (2023) | Enabling Miniaturization, High Density | 5G, Advanced Mobile Devices |

| CNC Machining (AI/IIoT Enhanced) | $14 Billion (Total Market) | Real-time Optimization, Accuracy | Technological Integration |

| Additive Manufacturing (3D Printing) | $60 Billion+ (Projected by 2027) | Material Efficiency, Complex Geometries | End-Use Part Production |

Legal factors

China's commitment to strengthening intellectual property (IP) laws, evidenced by increased enforcement and streamlined application processes for patents and trademarks, directly benefits Suzhou Dongshan Precision Manufacturing. This robust IP protection is crucial for the company to safeguard its innovative designs and advanced manufacturing techniques in the highly competitive global landscape.

In 2023, China's Supreme People's Court reported a significant rise in IP case filings and judgments, reflecting the government's proactive stance on IP enforcement. This legal environment is vital for Suzhou Dongshan as it allows them to protect their technological edge and secure their market position against potential infringements.

Suzhou Dongshan Precision Manufacturing, like all manufacturers in China, operates within a dynamic regulatory landscape concerning environmental protection. Recent years have seen a significant tightening of these rules, with the government prioritizing sustainability and pollution reduction. For instance, in 2024, China continued its push for greener manufacturing, with stricter enforcement of air and water quality standards impacting industrial zones where Dongshan operates.

Compliance with these evolving environmental regulations is crucial for Suzhou Dongshan's operational continuity and reputation. This includes adhering to updated guidelines on emissions control, wastewater treatment, and solid waste disposal. Failure to meet these standards can result in substantial fines, production halts, and damage to the company's brand image. The company's investment in advanced pollution control technologies and sustainable material sourcing directly addresses these legal requirements.

Strict product safety and quality standards are paramount, especially in sectors like automotive and consumer electronics, demanding thorough testing and compliance with global benchmarks. Suzhou Dongshan's commitment to precision manufacturing and robust quality control directly addresses these legal mandates.

Adherence to these stringent regulations is not just a legal obligation but a critical factor in maintaining market reputation and customer trust. For instance, in 2024, recalls in the automotive sector due to safety defects cost manufacturers billions globally, highlighting the financial implications of non-compliance.

Trade Regulations and Tariffs

Suzhou Dongshan Precision Manufacturing's global reach means international trade regulations and tariffs are paramount. Changes in trade agreements, such as those impacting China's trade with the US or EU, directly influence the cost of raw materials and the competitiveness of its finished goods. For instance, the ongoing adjustments in global trade policies could lead to increased import duties on essential components, impacting Dongshan's cost structure.

Navigating these legal frameworks is crucial for maintaining market access and competitive pricing. Compliance with import/export regulations in various operating regions ensures smooth supply chain operations. A significant tariff hike on a key component could necessitate price adjustments, potentially affecting sales volumes.

- Impact of US-China Tariffs: While specific current tariff rates fluctuate, historical data from 2018-2019 saw significant tariffs imposed on goods traded between the US and China, directly affecting manufacturing costs and global supply chains.

- WTO Compliance: Adherence to World Trade Organization (WTO) guidelines is fundamental for fair trade practices and dispute resolution, which Suzhou Dongshan must uphold.

- Regional Trade Agreements: The terms of agreements like RCEP (Regional Comprehensive Economic Partnership) can offer preferential trade terms for member countries, potentially benefiting Dongshan's regional market access and pricing strategies.

- Export Control Regulations: Compliance with export control laws in countries where Dongshan sources technology or sells products is vital to avoid legal penalties and maintain business continuity.

Labor Laws and Employment Regulations

Labor laws and employment regulations in China significantly shape Suzhou Dongshan Precision Manufacturing's approach to human resources. These regulations cover critical areas such as minimum wage requirements, mandated working hours, overtime pay, and essential employee benefits like social insurance and housing funds. For instance, as of early 2024, China's national minimum wage standards vary by province, with major cities like Shanghai and Beijing setting higher benchmarks, influencing Dongshan's wage structure.

Strict adherence to these evolving labor laws is not just a matter of legal compliance but also crucial for fostering a stable and motivated workforce. Non-compliance can lead to penalties, labor disputes, and damage to the company's reputation, impacting operational continuity. Dongshan must continuously monitor and adapt its HR policies to align with national and local labor protection standards to ensure smooth operations and employee satisfaction.

- Compliance with China's Labor Contract Law: Ensures proper employment agreements and protects employee rights.

- Adherence to Social Insurance Contributions: Mandates employer contributions to pensions, medical, unemployment, and work-related injury insurance.

- Regulation of Working Hours and Overtime: Sets limits on daily and weekly work hours and dictates overtime compensation rates.

- Protection of Employee Rights and Benefits: Encompasses provisions for paid leave, maternity leave, and safe working conditions.

The legal framework surrounding intellectual property (IP) in China is increasingly robust, offering significant protection for companies like Suzhou Dongshan Precision Manufacturing. China's Supreme People's Court reported a 23.4% increase in IP case filings in 2023, underscoring a commitment to enforcement. This legal environment is vital for Dongshan to safeguard its proprietary technologies and innovative designs in a competitive global market.

Environmental regulations in China continue to tighten, with stricter enforcement of air and water quality standards impacting industrial zones in 2024. Suzhou Dongshan must comply with these evolving rules, which cover emissions, wastewater, and waste disposal, to avoid penalties and maintain its operational license.

Product safety and quality standards are critical, especially in sectors like automotive and consumer electronics, requiring adherence to global benchmarks. Suzhou Dongshan's focus on precision manufacturing and rigorous quality control directly addresses these legal mandates, ensuring market acceptance and customer trust.

International trade regulations and tariffs directly influence Suzhou Dongshan's global operations and cost structure. Changes in trade agreements, such as those affecting trade with the US and EU, can impact raw material costs and the competitiveness of its exports, necessitating careful navigation of import/export laws and WTO compliance.

Labor laws in China, covering minimum wage, working hours, and employee benefits, significantly shape HR practices. As of early 2024, provincial minimum wage standards vary, with major cities like Shanghai setting higher benchmarks, requiring Dongshan to adapt its wage structures and ensure compliance with labor contract laws and social insurance contributions.

Environmental factors

Growing environmental awareness and increasing regulatory pressure are compelling manufacturers like Suzhou Dongshan to integrate sustainable practices. This includes focusing on energy efficiency, minimizing waste, and prioritizing material reuse within their operations. For instance, China's commitment to carbon neutrality, aiming for peak emissions before 2030 and neutrality by 2060, directly influences manufacturing standards and incentives for green production.

By actively embracing circular manufacturing principles and adopting greener production processes, Suzhou Dongshan can significantly strengthen its competitive positioning. This strategic shift not only aligns with global sustainability trends but also opens avenues for innovation and potential cost savings through optimized resource utilization.

The availability and cost of essential raw materials, such as specialized metals and electronic components vital for precision manufacturing, are increasingly susceptible to environmental pressures and global resource scarcity. This directly impacts Suzhou Dongshan's operational costs and supply chain stability.

For instance, the global copper market, a key material in electronics, saw price volatility in late 2024 and early 2025 due to supply disruptions linked to climate-related events in major mining regions. Similarly, rare earth elements, crucial for advanced components, face sourcing challenges exacerbated by environmental regulations and geopolitical factors.

Consequently, Suzhou Dongshan must prioritize diversifying its sourcing strategies to mitigate risks associated with single-region dependencies and actively explore the integration of more sustainable and recycled materials into its production processes to ensure long-term resilience and cost-effectiveness.

Suzhou Dongshan Precision Manufacturing's operations, particularly in precision engineering, are inherently energy-intensive. The company's reliance on electricity for machinery and climate control directly impacts its operational costs and environmental footprint.

There's a growing global and national emphasis on energy efficiency, pushing manufacturers to adopt more sustainable practices. For instance, China's commitment to carbon neutrality by 2060 incentivizes investments in energy-saving technologies and renewable energy sources, which can significantly lower operating expenses and help meet stringent environmental regulations by 2025.

Waste Management and Pollution Control

Suzhou Dongshan Precision Manufacturing operates within an increasingly stringent environmental regulatory landscape. Effective waste management and pollution control are paramount for continued compliance and operational sustainability. The company must proactively invest in advanced technologies and optimized processes to mitigate industrial waste generation and rigorously control emissions, aligning with evolving national and local environmental standards.

For instance, China's Ministry of Ecology and Environment has been progressively tightening emission standards for various industries. By the end of 2024, many manufacturing sectors are expected to adhere to stricter air pollutant discharge limits, requiring significant upgrades in pollution abatement equipment. This necessitates substantial capital expenditure for companies like Suzhou Dongshan to ensure they meet these benchmarks, potentially impacting operational costs.

- Compliance Costs: Investments in advanced waste treatment and emission control technologies can represent a significant portion of capital expenditure for manufacturers in 2024-2025.

- Operational Efficiency: Streamlining waste reduction processes can lead to more efficient resource utilization and potentially lower raw material costs.

- Reputational Risk: Failure to meet environmental standards can result in fines, production halts, and damage to brand reputation, impacting market access and investor confidence.

- Technological Advancement: The push for better pollution control drives innovation in cleaner manufacturing techniques and materials.

Climate Change and Supply Chain Resilience

Climate change presents significant risks to Suzhou Dongshan Precision Manufacturing's supply chain. Extreme weather events, such as intensified typhoons or prolonged droughts, can directly disrupt logistics and raw material sourcing. For instance, the average global temperature has risen by approximately 1.1 degrees Celsius above pre-industrial levels, a trend expected to accelerate, increasing the frequency and severity of such disruptions.

Developing robust supply chain strategies that proactively address environmental risks is becoming critical for ensuring operational continuity. This involves diversifying suppliers, exploring alternative transportation routes, and investing in more resilient infrastructure. Companies are increasingly recognizing the financial implications; a 2024 report indicated that supply chain disruptions cost businesses an average of $150,000 per hour.

- Increased frequency of extreme weather events impacting logistics and raw material availability.

- Growing importance of supply chain diversification and resilience planning for operational stability.

- Financial impact of disruptions estimated to be substantial, necessitating proactive risk management.

- Need for investment in resilient infrastructure and alternative sourcing strategies.

Environmental regulations are becoming more stringent, pushing Suzhou Dongshan to invest in cleaner production methods and waste management. China's goal of peaking carbon emissions before 2030 and achieving carbon neutrality by 2060 directly influences manufacturing standards and encourages green technology adoption.

Resource scarcity and climate-related supply chain disruptions pose significant risks, impacting raw material costs and availability. For example, copper prices saw volatility in late 2024 and early 2025 due to climate-induced disruptions in mining regions, affecting key components.

Energy efficiency is a growing focus, with China's carbon neutrality targets by 2060 incentivizing investments in energy-saving technologies and renewables to lower operating costs and meet environmental benchmarks by 2025.

The company must also navigate stricter emission standards, requiring capital expenditure for pollution abatement equipment to comply with evolving national and local environmental regulations, with many sectors facing tighter air pollutant limits by the end of 2024.

| Environmental Factor | Impact on Suzhou Dongshan | Key Data/Trend |

|---|---|---|

| Regulatory Compliance | Increased investment in pollution control and waste management technologies. | Stricter emission standards for manufacturing sectors by end of 2024. |

| Climate Change & Supply Chain | Risk of raw material price volatility and supply disruptions. | Copper price volatility in late 2024/early 2025 due to climate events; average global temperature rise of ~1.1°C. |

| Energy Efficiency & Carbon Neutrality | Incentives for adopting energy-saving technologies and renewables. | China's carbon neutrality goal by 2060; focus on energy efficiency by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Suzhou Dongshan Precision Manufacturing is built on data from official Chinese government agencies, including economic and industrial policy updates, alongside reports from reputable market research firms and international organizations tracking global manufacturing trends.