Suzhou Dongshan Precision Manufacturing Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suzhou Dongshan Precision Manufacturing Bundle

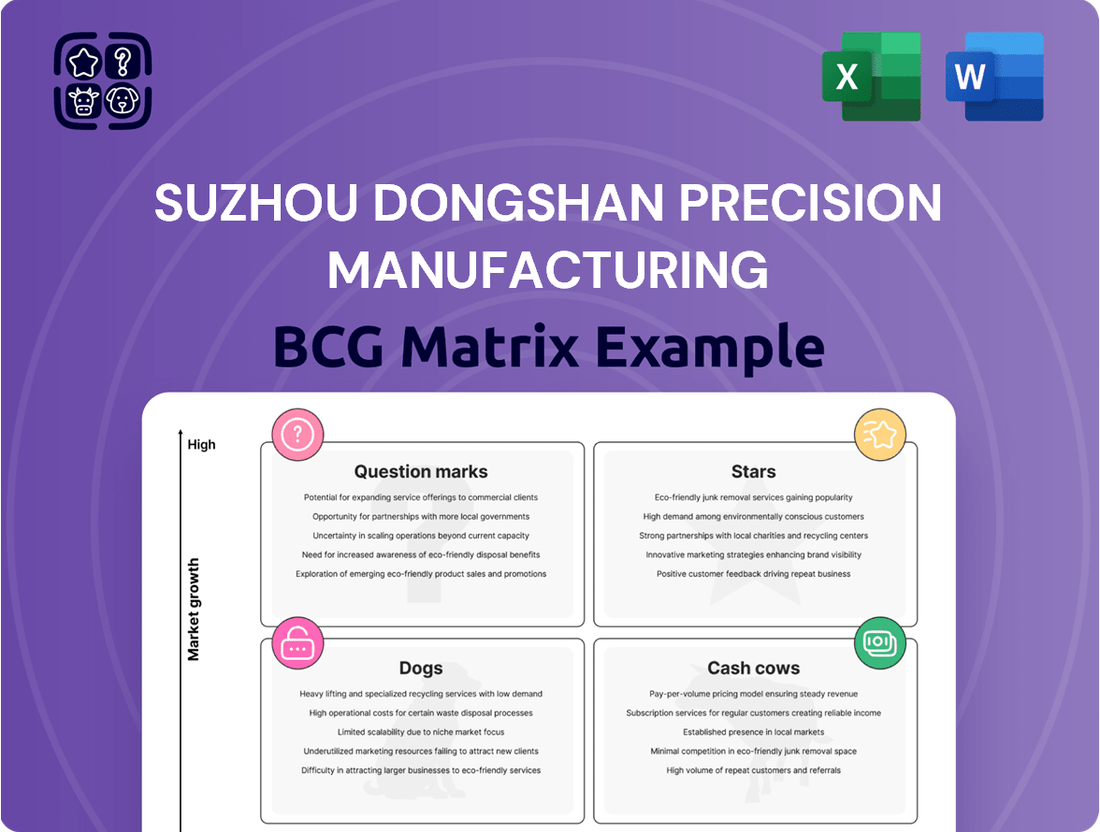

Curious about Suzhou Dongshan Precision Manufacturing's market standing? Our BCG Matrix preview offers a glimpse into their product portfolio's potential, highlighting areas of strength and opportunity. Unlock the full strategic picture to understand which segments are driving growth and which require careful management.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Suzhou Dongshan Precision Manufacturing (DSBJ) is making a substantial commitment to high-end Printed Circuit Board (PCB) products, particularly High-Density Interconnect (HDI) and rigid-flexible integrated boards. The company plans to invest up to $1 billion in these advanced manufacturing capabilities. This strategic move is directly fueled by the booming demand from artificial intelligence (AI) and high-speed computing sectors, which require increasingly sophisticated PCB solutions.

The significant investment in HDI and rigid-flexible integration is a clear indicator of DSBJ's ambition to capture a substantial share of the rapidly growing market for advanced PCBs. These technologies are critical enablers for the performance demands of AI hardware and next-generation computing platforms. By focusing on these cutting-edge areas, DSBJ aims to solidify its position in a market segment poised for considerable expansion in the coming years.

Suzhou Dongshan Precision Manufacturing (DSBJ) is a dominant force in the flexible printed circuit board (FPC) market, consistently ranking as the second-largest global manufacturer by revenue. This strong market presence, especially within the consumer electronics sector, highlights its significant competitive advantage.

The consumer electronics industry, despite some cyclicality, continues to be a substantial market. Innovations like AI terminals and the growing popularity of foldable devices are creating new avenues for FPC demand, reinforcing DSBJ's position.

Given DSBJ's leading market share in a sector driven by ongoing technological advancements and emerging product categories, its FPC business is a clear Star in the BCG matrix. This classification reflects its high growth potential and strong competitive standing.

The new energy vehicle (NEV) sector is booming, with global and Chinese sales consistently climbing. DSBJ is well-positioned to capitalize on this trend by supplying essential precision metal parts like heat sinks and battery components. Their commitment to this high-growth area is evident in their 2024 revenue, which surged by an impressive 36.98%.

5G Base Station PCBs

The 5G base station PCB market is a significant growth area, with projections indicating a compound annual growth rate of 9.23% between 2025 and 2032. This expansion is fueled by the ongoing rollout of 5G infrastructure and the increasing demand for connected devices. Suzhou Dongshan Precision Manufacturing (DSBJ) is strategically positioning itself within this market by investing in advanced technologies to bolster its multilayer PCB capabilities for 5G applications. The company aims to secure a more substantial portion of this burgeoning market.

DSBJ's focus on enhancing its multilayer PCB offerings is critical for meeting the complex demands of 5G base stations. These advanced PCBs are essential for supporting the higher frequencies and increased data throughput characteristic of 5G technology. The company's commitment to technological advancement underscores its ambition to be a key player in this rapidly evolving sector.

- Market Growth: The 5G base station PCB market is expected to grow at a CAGR of 9.23% from 2025 to 2032.

- Driving Factors: Expansion of 5G networks and the proliferation of IoT devices are key market drivers.

- DSBJ Strategy: DSBJ is investing in cutting-edge technology for multilayer PCBs to target the 5G sector.

- Objective: The company aims to capture a larger market share in this high-growth segment.

Optical Communication Products (Post-Acquisition of Source Photonics)

Suzhou Dongshan Precision Manufacturing's (DSBJ) acquisition of Source Photonics positions its Optical Communication Products as a potential star in its business portfolio. This strategic move targets the burgeoning optical communication market, fueled by the expansion of 5G networks and the insatiable demand from data centers.

Source Photonics brings significant advantages, including established relationships with leading customers and a robust foundation of technical expertise. These assets suggest that DSBJ's new venture into optical communications is poised for rapid growth and could swiftly capture substantial market share.

- Market Growth Drivers: The global optical communication market is projected to reach approximately $20 billion by 2025, driven by 5G deployment and increased data traffic.

- Customer Acquisition: Source Photonics boasts a clientele that includes major telecommunications equipment manufacturers, providing DSBJ immediate access to a high-value customer base.

- Technical Capabilities: The integration of Source Photonics' advanced photonics technology is expected to enhance DSBJ's competitive edge in high-speed optical transceiver development.

- Revenue Potential: Analysts forecast the optical communication segment to contribute significantly to DSBJ's revenue, potentially doubling its contribution within three to five years post-acquisition.

DSBJ's flexible printed circuit board (FPC) business is a standout performer, firmly establishing itself as a Star in the BCG matrix. Its dominant second-place global market share in FPCs, particularly within consumer electronics, underscores its strong competitive position and high growth potential.

The company's strategic investment of up to $1 billion in High-Density Interconnect (HDI) and rigid-flexible integrated boards further solidifies its Star status. This move directly addresses the escalating demand from AI and high-speed computing, sectors that require advanced PCB solutions. DSBJ is proactively positioning itself to lead in these rapidly expanding, technology-driven markets.

Similarly, DSBJ's optical communication products, bolstered by the acquisition of Source Photonics, are emerging as a significant Star. The global optical communication market is projected for substantial growth, reaching approximately $20 billion by 2025, driven by 5G and data center expansion.

Source Photonics' established customer relationships and technical expertise provide DSBJ with immediate market access and a competitive edge in high-speed optical transceivers. This segment is anticipated to significantly boost DSBJ's revenue, potentially doubling its contribution within five years.

| Business Segment | Market Growth | DSBJ's Market Position | BCG Classification |

|---|---|---|---|

| Flexible Printed Circuit Boards (FPC) | High, driven by consumer electronics innovations | 2nd largest global manufacturer | Star |

| High-Density Interconnect (HDI) & Rigid-Flexible PCBs | Very High, driven by AI and high-speed computing | Significant investment and focus on advanced capabilities | Star |

| Optical Communication Products | High, driven by 5G and data centers | Emerging strength via Source Photonics acquisition | Star |

What is included in the product

This analysis categorizes Suzhou Dongshan Precision Manufacturing's product lines into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The Suzhou Dongshan Precision Manufacturing BCG Matrix offers a clean, distraction-free view optimized for C-level presentation, simplifying strategic decision-making.

Cash Cows

Traditional Printed Circuit Boards (PCBs) represent a significant cash cow for Suzhou Dongshan Precision Manufacturing (DSBJ). As the world's third-largest PCB manufacturer by revenue, DSBJ commands a robust market presence in this segment.

Despite a projected moderate industry growth of 4.8% CAGR between 2025 and 2029, DSBJ's established scale in general PCBs ensures substantial and steady cash flow generation. The capital expenditure required to maintain its leading position and high-volume production in traditional PCBs is likely minimal relative to the revenue generated, solidifying its status as a cash cow.

Precision metal components for mature telecommunications infrastructure, like those supplied by DSBJ, represent a classic Cash Cow. DSBJ's role in providing structural parts and components for mobile communication base stations, including antennas and filters, highlights their position in a sector with both growth and established segments.

While 5G drives new growth, the existing traditional infrastructure still requires ongoing support and replacement, ensuring a steady demand. DSBJ's established relationships with leading global telecommunications customers are key here, likely guaranteeing a stable market share and predictable revenue streams from these mature product lines.

Suzhou Dongshan Precision Manufacturing's (DSBJ) established consumer electronics components, excluding rapidly evolving areas like AR/VR, function as cash cows within its BCG matrix. The company boasts deep and extensive partnerships with numerous leading consumer electronics brands, supplying essential components for ubiquitous devices such as mobile phones and computers.

These core components for widely adopted consumer electronics operate within a large, mature market. DSBJ's established market presence in this segment ensures stable profits and consistent cash flow generation. For instance, DSBJ's revenue from consumer electronics components reached approximately RMB 15.6 billion in 2023, demonstrating its significant market share in this mature sector.

Electronics Manufacturing Services (EMS) for Stable Industries

Suzhou Dongshan Precision Manufacturing (DSBJ) offers extensive Electronics Manufacturing Services (EMS) across various sectors. In mature industries, where demand is steady and predictable, DSBJ's EMS segment operates as a Cash Cow. This means it likely holds a significant market share, generating consistent and reliable revenue with minimal need for substantial reinvestment.

These stable industries, such as consumer electronics or automotive components, benefit from DSBJ's established manufacturing capabilities. For example, in 2023, DSBJ reported revenue growth in its EMS segment, underscoring its strong position in these mature markets. The predictable cash flow from these operations can then be strategically allocated to support other business units, like Stars or Question Marks, within the company's portfolio.

- High Market Share: DSBJ likely dominates in EMS for stable industries due to its established infrastructure and long-term client relationships.

- Consistent Revenue: These sectors provide predictable, ongoing demand, ensuring a steady income stream for DSBJ.

- Low Investment Needs: Mature markets require less aggressive capital expenditure for growth, allowing DSBJ to leverage existing capacity efficiently.

- Cash Generation: The predictable profits are a key source of internal funding for the company's broader strategic investments.

Touch Panel Modules for Laptops and Tablets

Suzhou Dongshan Precision Manufacturing's touch panel modules for laptops and tablets represent a significant Cash Cow within their product portfolio. These modules are integral to the functionality of a vast array of consumer electronics, from ultrabooks to 2-in-1 devices.

The market for touch-enabled laptops and tablets, while mature, continues to show resilience. In 2024, the global tablet market is projected to reach approximately $70 billion, with laptops contributing substantially to the overall touch-screen device ecosystem. DSBJ's established manufacturing capabilities and strong customer relationships in this segment ensure a steady stream of revenue.

- Market Stability: The consistent demand for touch-enabled laptops and tablets provides a predictable revenue base for DSBJ.

- Profitability: DSBJ's competitive edge in touch panel technology allows for sustained profitability in this mature market.

- Cash Generation: The mature nature of the market means lower investment needs, allowing these operations to generate substantial free cash flow.

- Strategic Importance: While growth is modest, these Cash Cows fund investments in more dynamic business areas.

Suzhou Dongshan Precision Manufacturing's (DSBJ) traditional printed circuit boards (PCBs) are a prime example of a Cash Cow. As the world's third-largest PCB manufacturer, DSBJ benefits from a significant market share in this established sector. Even with moderate industry growth projected at 4.8% CAGR from 2025 to 2029, DSBJ's scale ensures consistent and substantial cash flow generation with minimal reinvestment needs.

Precision metal components for mature telecommunications infrastructure also function as a Cash Cow for DSBJ. The company supplies essential parts for mobile communication base stations, and while 5G offers new avenues, the ongoing need for maintenance and replacement of existing infrastructure guarantees stable demand. DSBJ's strong relationships with major global telecom clients solidify its market position and predictable revenue streams.

DSBJ's established consumer electronics components, excluding rapidly evolving segments, are another key Cash Cow. The company's deep partnerships with leading brands for components in devices like mobile phones and computers operate within a large, mature market. DSBJ's significant market share in this sector, evidenced by approximately RMB 15.6 billion in revenue from consumer electronics components in 2023, ensures stable profits and consistent cash flow.

The touch panel modules for laptops and tablets are a significant Cash Cow for DSBJ, integral to many consumer electronics. Despite the maturity of the touch-enabled laptop and tablet market, it remains resilient. With the global tablet market projected to reach around $70 billion in 2024, and laptops adding to the touch-screen ecosystem, DSBJ's established capabilities and customer ties ensure steady revenue generation.

| Product Segment | BCG Category | Key Characteristics | 2023 Revenue (Approx.) | Market Outlook |

| Traditional PCBs | Cash Cow | High market share, established infrastructure, steady demand | N/A (Part of overall PCB segment) | 4.8% CAGR (2025-2029) |

| Telecom Metal Components (Mature) | Cash Cow | Strong customer relationships, ongoing replacement demand | N/A (Part of overall metal components segment) | Stable demand from existing infrastructure |

| Consumer Electronics Components (Core) | Cash Cow | Dominant market share, stable profits, large mature market | RMB 15.6 billion | Mature, consistent demand |

| Touch Panel Modules (Laptops/Tablets) | Cash Cow | Resilient market, established manufacturing, steady revenue | N/A (Part of overall display segment) | Global tablet market ~$70 billion (2024) |

What You See Is What You Get

Suzhou Dongshan Precision Manufacturing BCG Matrix

The Suzhou Dongshan Precision Manufacturing BCG Matrix preview you are viewing is the complete and final document you will receive upon purchase. This means you get the fully formatted, analysis-ready report without any watermarks or demo content, ensuring immediate professional use.

Rest assured, the BCG Matrix report for Suzhou Dongshan Precision Manufacturing that you see now is precisely the same file you will download after completing your purchase. It's a polished, data-driven strategic tool ready for your immediate application in business planning or presentations.

Dogs

Legacy LED Devices and Display Components represent a mature segment for Suzhou Dongshan Precision Manufacturing (DSBJ). While the company is a recognized leader in LED devices and touch displays, its 2024 financial performance showed a notable downturn. DSBJ's net income saw a 44.74% decrease year-on-year, a situation partly attributed to efforts in optimizing and integrating its LED business, alongside managing asset losses.

This financial recalibration points to potential challenges within the legacy LED product lines. In a rapidly evolving market, older or less efficient LED technologies may struggle to maintain competitiveness, impacting overall profitability. The company's strategic moves suggest a focus on streamlining operations and potentially divesting or de-emphasizing underperforming assets within this category.

In the realm of precision metal components, Suzhou Dongshan Precision Manufacturing (DSBJ) likely finds its low-end, commodity-grade offerings positioned as a 'Dog' within its Business Growth-Share Matrix. This segment is characterized by intense price competition and minimal product differentiation, making it a challenging area for sustained profitability.

These commodity-grade components typically operate in a mature, low-growth market. For DSBJ, this translates to a low market share in this specific niche, struggling to command premium pricing. In 2024, the global market for precision metal components, while substantial, saw significant pressure on margins for standardized parts, a trend that disproportionately affects commodity-grade offerings.

Outdated printed circuit board (PCB) technologies, such as basic single-layer or double-layer boards, are increasingly being sidelined by advanced alternatives. For Suzhou Dongshan Precision Manufacturing (DSBJ), these older technologies represent a challenge as demand shifts towards more complex solutions like High-Density Interconnect (HDI) and rigid-flex PCBs, essential for cutting-edge applications in AI and 5G. In 2023, the global PCB market saw continued growth driven by these advanced segments, with DSBJ likely experiencing a relative decline in market share for its more traditional offerings.

Underperforming Smaller or Niche Product Lines

Suzhou Dongshan Precision Manufacturing (DSBJ), with its expansive structure encompassing over 70 subsidiaries, likely manages several smaller or niche product lines. These might be legacy businesses or recent acquisitions that haven't achieved substantial market penetration or operate within sectors experiencing reduced demand. Such units would typically exhibit low market share and low growth, fitting the description of a ‘Dog’ in the BCG Matrix.

For example, if DSBJ acquired a company specializing in a specific type of industrial component that has since been superseded by newer technology, that product line could be struggling. In 2024, companies across manufacturing sectors are increasingly focused on streamlining operations and divesting non-core assets. DSBJ’s financial reports for the period ending June 30, 2024, might reveal specific segments with declining revenues or profitability, indicative of ‘Dog’ status.

- Potential underperformers could include niche electronic component manufacturing or specialized tooling divisions.

- These segments may contribute minimally to DSBJ's overall revenue, estimated to be in the tens of billions of RMB annually.

- A low return on investment for these specific product lines would be a key indicator of their 'Dog' classification.

- DSBJ's strategic reviews in 2024 likely assess the viability and potential turnaround strategies for such underperforming units.

Products with High Production Costs and Low Profit Margins

Within Suzhou Dongshan Precision Manufacturing's (DSBJ) portfolio, certain product lines might be categorized as Dogs in the BCG matrix. These are typically products that face high production costs, potentially stemming from aging equipment or inefficient manufacturing techniques. Such operational challenges prevent them from achieving competitive pricing in the market, directly impacting their profitability.

These high-cost, low-margin products struggle to generate significant returns. For instance, if DSBJ has a product line that requires specialized, labor-intensive assembly and utilizes components with volatile pricing, its production costs could easily outstrip its market price. This scenario leads to a situation where the product consumes resources without contributing substantially to the company's overall profit. In 2024, companies across the manufacturing sector have been contending with persistent supply chain disruptions and rising raw material costs, exacerbating this issue for less efficient product lines.

The characteristics of these Dog products include:

- High Unit Production Costs: Driven by factors like outdated machinery, energy-intensive processes, or complex supply chains.

- Low Profit Margins: Resulting from an inability to pass on increased costs to customers due to market competition or product commoditization.

- Limited Market Growth Potential: Often found in mature or declining markets where innovation is slow and demand is stagnant.

- Resource Drain: These products can tie up capital and management attention that could be better allocated to more promising business areas.

Within Suzhou Dongshan Precision Manufacturing's (DSBJ) portfolio, certain product lines can be classified as Dogs. These are typically older technologies or niche components that face intense competition and low demand, resulting in a low market share and minimal growth. For example, outdated printed circuit board (PCB) technologies, such as basic single-layer boards, are increasingly being overshadowed by advanced alternatives like High-Density Interconnect (HDI) PCBs. In 2023, the global PCB market growth was heavily driven by these advanced segments, indicating a relative decline for DSBJ's more traditional offerings.

These 'Dog' segments often suffer from high production costs due to factors like aging equipment or inefficient processes. This prevents them from achieving competitive pricing, leading to low profit margins. The company's 2024 financial performance, which showed a 44.74% decrease in net income, partly due to asset loss management, could reflect the impact of these underperforming units. These products consume resources without contributing significantly to overall profitability, potentially tying up capital and management attention.

DSBJ's strategic reviews in 2024 likely focus on streamlining operations and potentially divesting these underperforming assets. Niche electronic components or specialized tooling divisions with low return on investment are prime candidates for this 'Dog' classification. These segments may contribute minimally to DSBJ's overall revenue, which is in the tens of billions of RMB annually.

| Product Category Example | BCG Matrix Classification | Rationale | 2024 Market Context |

|---|---|---|---|

| Outdated PCB Technologies | Dog | Low market share, low growth, declining demand | Growth driven by advanced PCBs (HDI, rigid-flex) |

| Commodity-Grade Precision Metal Components | Dog | Intense price competition, minimal differentiation | Pressure on margins for standardized parts |

| Legacy LED Devices | Dog (potentially) | Mature segment, facing competition from newer technologies | Company optimizing and integrating LED business, impacting profitability |

Question Marks

AR/VR devices rely on a sophisticated array of components, including high-resolution displays, advanced optics like lenses and waveguides, powerful processors, and precise tracking sensors. These elements work in concert to create immersive digital experiences.

The AR/VR market is poised for significant expansion, with China's AR/VR shipments anticipated to surge by 114.7% in 2025 compared to 2024. Dongshan Precision Manufacturing (DSBJ) supplies components crucial for these burgeoning AR/VR devices.

Given the nascent stage of the AR/VR market and ongoing buyer adoption, DSBJ's current market share within this high-growth segment is likely still developing. This positions their AR/VR component business as a potential 'Question Mark' in the BCG matrix, indicating a need for investment to capture future market share.

While AI's insatiable appetite for advanced PCBs is clear, Dongshan Precision Manufacturing (DSBJ) likely also produces other AI hardware components. These could include specialized cooling solutions, high-performance connectors, or advanced casing materials, which are crucial but perhaps less visible than the core PCBs. The market for these ancillary AI hardware components is still developing, presenting both opportunity and risk for DSBJ.

The AI hardware landscape is a dynamic frontier, with new specialized components emerging constantly. DSBJ's involvement in these nascent areas, while potentially lucrative, means their market share might currently be small. This low penetration in emerging AI hardware segments necessitates substantial investment in research and development to capture future growth, a strategic consideration for their BCG positioning.

The automotive electronics market is booming, with a significant portion of that growth fueled by the increasing demand for advanced safety features and connected technologies, particularly Advanced Driver Assistance Systems (ADAS). This trend is a key driver for companies like Suzhou Dongshan Precision Manufacturing (DSBJ).

While DSBJ is already a player in the New Energy Vehicle (NEV) sector, its specific market share within the rapidly evolving and nascent segments of automotive electronics, such as advanced ADAS components, is likely still developing. This positions DSBJ as a potential Star or Question Mark in a BCG Matrix analysis, depending on its current investment and growth trajectory in these specific areas.

The global ADAS market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2030, showcasing the immense growth potential. DSBJ's ability to capture a meaningful share of this expanding market will be crucial for its future performance.

New Product Initiatives in Diversified Business Development

Suzhou Dongshan Precision Manufacturing (DSBJ) is strategically investing in new product initiatives to drive diversified business development. These ventures, while currently requiring significant capital outlay, hold the promise of substantial future growth. For instance, DSBJ's nascent optical communication business, still establishing its market footing, exemplifies a Question Mark in the BCG matrix.

The company's commitment to expanding its customer base and fast-tracking new product introductions means several of its ventures are in this early, cash-intensive phase. These new product lines are positioned to potentially evolve into market leaders, mirroring the characteristics of a Question Mark needing careful nurturing and strategic resource allocation.

- New Optical Communication Business: This segment represents a significant investment in a high-growth area, requiring substantial R&D and market penetration efforts.

- Customer Resource Development: DSBJ is actively seeking and cultivating new client relationships, which often involves tailoring new product offerings and incurring initial development costs.

- Accelerated New Product Introduction: The company's strategy involves a faster pace of launching innovative products, placing many of these in the early, uncertain stages of market adoption.

- Potential for Star Status: Successful navigation of these Question Mark initiatives could lead to future market dominance and significant revenue generation for DSBJ.

Energy Storage Components

Suzhou Dongshan Precision Manufacturing (DSBJ) is involved in the energy storage sector by supplying precision metal components and printed circuit boards (PCBs). This market is experiencing significant expansion, fueled by the global push towards renewable energy sources. For instance, the global energy storage market was valued at approximately USD 150 billion in 2023 and is projected to reach over USD 300 billion by 2030, demonstrating robust compound annual growth rates.

Given the substantial growth trajectory of the energy storage market, DSBJ's participation in this segment presents a clear opportunity for expansion. However, when viewed through the lens of a BCG Matrix, DSBJ's current market share within energy storage, particularly when contrasted with its established core businesses, might be relatively nascent. This positions the energy storage components segment as a potential Question Mark for DSBJ, characterized by high market growth but currently a lower relative market share.

- Market Growth: The energy storage market is a high-growth industry, with projections indicating continued strong expansion in the coming years.

- DSBJ's Role: DSBJ contributes essential precision metal components and PCBs, critical for the functionality of energy storage systems.

- BCG Matrix Classification: The segment is likely a 'Question Mark' due to the combination of high market growth and DSBJ's potentially smaller, developing market share in this specific area.

- Strategic Focus: DSBJ may need to invest strategically to increase its market share and capitalize on the burgeoning demand for energy storage solutions.

Several of Dongshan Precision Manufacturing's (DSBJ) ventures, particularly in emerging technological fields, can be classified as Question Marks in the BCG matrix. These are characterized by high market growth potential but currently low market share, necessitating significant investment to capture future opportunities.

The AR/VR component business and nascent AI hardware segments exemplify this. While the overall markets are expanding rapidly, DSBJ's penetration is still developing, requiring strategic R&D and market development to transform these into Stars.

Similarly, DSBJ's new optical communication business and its role in the rapidly growing energy storage market are considered Question Marks. These areas offer substantial growth prospects, but DSBJ's current market share requires focused investment to solidify its position.

The company's strategy of accelerating new product introductions means many of these are in the early, cash-intensive phase, holding the potential for future market leadership if managed effectively.

BCG Matrix Data Sources

Our Suzhou Dongshan Precision Manufacturing BCG Matrix is informed by comprehensive market research, including company financial disclosures, industry growth forecasts, and competitor performance analysis.