Suzhou Dongshan Precision Manufacturing Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suzhou Dongshan Precision Manufacturing Bundle

Suzhou Dongshan Precision Manufacturing navigates a landscape shaped by intense rivalry and the constant threat of new entrants, impacting pricing power and innovation. Understanding these dynamics is crucial for any strategic player in this sector.

The complete report reveals the real forces shaping Suzhou Dongshan Precision Manufacturing’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of essential precision metals and electronic components are subject to significant raw material cost volatility. For instance, prices for key inputs like nickel and chromium are projected to see an increase of 3-5% in 2025. This instability directly impacts Suzhou Dongshan Precision Manufacturing's cost of goods sold.

Such price fluctuations can put considerable pressure on the company's profit margins. If Suzhou Dongshan Precision Manufacturing cannot effectively pass these increased input costs onto its customers, its profitability could be negatively affected, highlighting a key challenge in managing its supply chain costs.

Suzhou Dongshan Precision Manufacturing's dependence on highly specialized components for its telecommunications, consumer electronics, and automotive sectors significantly influences supplier power. When the availability of these critical, niche parts is limited, the few suppliers who can provide them gain considerable leverage.

This limited supplier base means Dongshan Precision has fewer viable alternatives if a supplier decides to increase prices or alter terms. For instance, in 2024, the global shortage of advanced semiconductor components, crucial for many of Dongshan Precision's products, demonstrated this dynamic, leading to extended lead times and increased input costs for manufacturers across these industries.

Suppliers leading in technological innovation, like those developing cutting-edge semiconductor packaging or sustainable material solutions, naturally gain leverage. Suzhou Dongshan Precision Manufacturing might find itself needing to align with these advancements, potentially through strategic partnerships or direct investment, to avoid being beholden to suppliers controlling critical, next-generation technologies.

Supply Chain Disruptions

Global supply chain disruptions, a persistent challenge throughout 2023 and into early 2024, significantly bolster the bargaining power of suppliers. These disruptions, stemming from geopolitical tensions and logistical bottlenecks, have led to increased lead times and reduced availability of critical raw materials and components for manufacturers like Suzhou Dongshan Precision Manufacturing.

The impact of these disruptions is evident in rising input costs. For instance, the average price of key electronic components, such as semiconductors, saw an upward trend in late 2023 due to high demand and limited production capacity. This situation forces companies to accept less favorable terms or face production delays.

- Increased Lead Times: Many suppliers now quote lead times extending to 6-12 months for certain specialized components, compared to the pre-disruption 3-6 months.

- Higher Input Costs: The cost of essential raw materials like copper and aluminum, crucial for precision manufacturing, experienced a notable surge of 10-15% in the past year.

- Limited Supplier Options: In sectors experiencing acute shortages, the number of viable suppliers for critical inputs has dwindled, concentrating power in the hands of the few remaining providers.

Supplier Concentration and Scale

In specialized areas of precision manufacturing, a few dominant suppliers can wield considerable influence over pricing and contract conditions. Suzhou Dongshan Precision Manufacturing, even with its substantial operational size, may find itself negotiating with these concentrated markets, potentially facing price increases or less favorable terms.

For instance, the semiconductor industry, a critical supplier for advanced manufacturing, has seen significant supplier concentration. In 2024, the top ten semiconductor foundries accounted for over 90% of global foundry revenue, illustrating the power held by a limited number of large players.

- Supplier Dominance: In niche sectors like high-purity chemicals or specialized machinery, a handful of global manufacturers might supply the vast majority of essential components.

- Pricing Leverage: This concentration allows dominant suppliers to dictate prices, as alternative sourcing options for Dongshan Precision may be scarce or prohibitively expensive.

- Impact on Margins: Increased input costs from powerful suppliers can directly squeeze Suzhou Dongshan Precision Manufacturing's profit margins, affecting its overall financial performance.

The bargaining power of suppliers for Suzhou Dongshan Precision Manufacturing is significant due to the specialized nature of their inputs and global supply chain dynamics. For example, critical electronic components saw price increases of 8-12% in late 2023, impacting manufacturers like Dongshan.

This leverage is amplified when there are few suppliers for essential, high-tech materials, as seen with advanced semiconductor packaging where a limited number of firms control key technologies. In 2024, the global shortage of certain advanced chipsets meant lead times extended to over nine months, directly affecting production schedules and costs for companies reliant on them.

The concentration of suppliers in niche markets, such as high-purity metals, grants them considerable pricing power. In 2025, projected increases of 3-5% for nickel and chromium underscore this reality, forcing manufacturers to absorb higher costs or risk production disruptions.

Global supply chain disruptions, a persistent issue through 2023 and into early 2024, have further empowered suppliers by reducing availability and increasing lead times for crucial components, often by 50% or more for specialized items.

| Input Category | Supplier Power Factor | Impact on Dongshan Precision (2023-2025) | Example Data Point |

|---|---|---|---|

| Advanced Semiconductors | Limited Supplier Base, High Technological Dependence | Extended Lead Times, Increased Input Costs | Lead times > 9 months (2024) |

| Specialized Metals (Nickel, Chromium) | Raw Material Price Volatility | Pressure on COGS, Potential Margin Squeeze | Projected 3-5% price increase (2025) |

| High-Purity Chemicals | Supplier Concentration, Niche Market | Pricing Leverage, Limited Sourcing Options | Dominant suppliers dictate terms |

| Electronic Components (General) | High Demand, Limited Production Capacity | Upward Price Trends, Reduced Availability | 8-12% price increase (late 2023) |

What is included in the product

This analysis reveals the competitive intensity faced by Suzhou Dongshan Precision Manufacturing, detailing the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes and industry rivalry.

Instantly assess competitive pressures across the industry, allowing Suzhou Dongshan Precision Manufacturing to proactively address threats and capitalize on opportunities.

Gain a clear, actionable understanding of supplier and buyer power, enabling strategic negotiations and cost-saving initiatives.

Customers Bargaining Power

Suzhou Dongshan Precision Manufacturing's reliance on a few major clients presents a significant bargaining chip for these customers. Their annual reports often signal that a substantial portion of the company's income stems from these key accounts, granting them considerable power. This concentration means these large buyers can exert substantial influence over pricing and contract terms, potentially squeezing Dongshan Precision's profit margins.

Customers in key sectors such as telecommunications, consumer electronics, and automotive frequently place substantial orders for precision metal components, structural parts, and Electronic Manufacturing Services (EMS). For instance, in 2023, the global automotive sector alone saw production of over 80 million vehicles, many of which rely heavily on precision-engineered components from suppliers like Dongshan Precision.

These high-volume commitments grant these customers considerable bargaining power. They can effectively leverage their purchasing scale to negotiate more favorable pricing structures and insist on tailored solutions that precisely meet their complex manufacturing needs, directly impacting supplier margins.

The Electronics Manufacturing Services (EMS) landscape is quite crowded, featuring major global players such as Foxconn, Flex, and Jabil. This intense competition means customers have a wide array of choices when selecting an EMS partner.

This abundance of alternative EMS providers significantly amplifies the bargaining power of customers. If a customer finds current pricing, quality standards, or service levels unsatisfactory, they can readily shift their business to a competitor, putting pressure on existing providers like Suzhou Dongshan Precision Manufacturing to remain competitive.

Customer's Cost Sensitivity

In mature markets like consumer electronics and automotive, customers are keenly aware of costs and actively seek ways to reduce their supply chain expenses. This intense focus on price can put significant pressure on Suzhou Dongshan Precision Manufacturing.

For instance, in 2024, the average profit margin for contract manufacturers in the consumer electronics sector hovered around 3-5%, reflecting the intense price competition driven by customer demands.

- High Cost Sensitivity: Customers in established consumer electronics and automotive sectors prioritize cost optimization, directly impacting pricing strategies.

- Price Pressure: This sensitivity forces manufacturers like Suzhou Dongshan to consider price reductions or more accommodating terms to secure and maintain contracts.

- Competitive Landscape: The industry's nature means that even small price advantages can sway large orders, making cost control a critical factor for success.

Backward Integration Potential

Large original equipment manufacturers (OEMs) possess the financial clout and technical expertise to potentially bring component production in-house. This capability directly enhances their bargaining power against suppliers like Suzhou Dongshan Precision Manufacturing.

For instance, a major electronics OEM could leverage its significant capital reserves, potentially in the billions of dollars, to invest in the necessary machinery and research for producing certain critical components. This threat of backward integration means OEMs can demand lower prices or more favorable terms from their current suppliers, knowing they have an alternative.

- OEMs' Financial Strength: Major OEMs often report annual revenues exceeding tens of billions of dollars, providing substantial resources for backward integration projects.

- Technical Capability: These companies typically employ large engineering teams capable of developing and managing in-house production processes.

- Reduced Supplier Dependence: The potential to produce components internally reduces OEM reliance on external suppliers, increasing their leverage in negotiations.

The bargaining power of customers for Suzhou Dongshan Precision Manufacturing is substantial, driven by high volume purchases and the availability of numerous alternative suppliers in the competitive EMS market. Customers' cost sensitivity, particularly in sectors like consumer electronics and automotive, forces suppliers to offer competitive pricing, as evidenced by the tight profit margins in the industry. Furthermore, the potential for large OEMs to vertically integrate their operations adds another layer of leverage, enabling them to negotiate more favorable terms.

| Factor | Impact on Dongshan Precision | Customer Leverage | Supporting Data (2023-2024) |

| Customer Concentration | High reliance on few major clients | Significant influence over pricing and terms | Key clients represent a substantial portion of revenue (specific percentage often undisclosed but implied in annual reports) |

| Alternative Suppliers | Crowded EMS market | Ease of switching providers | Major competitors include Foxconn, Flex, Jabil, offering diverse options |

| Cost Sensitivity | Pressure on pricing | Demand for lower prices and cost optimization | Average profit margins for contract manufacturers in consumer electronics around 3-5% in 2024 |

| Potential for Backward Integration | Threat of losing business | Ability to bring production in-house | Major OEMs possess billions in capital and extensive engineering resources for potential in-house manufacturing |

Preview Before You Purchase

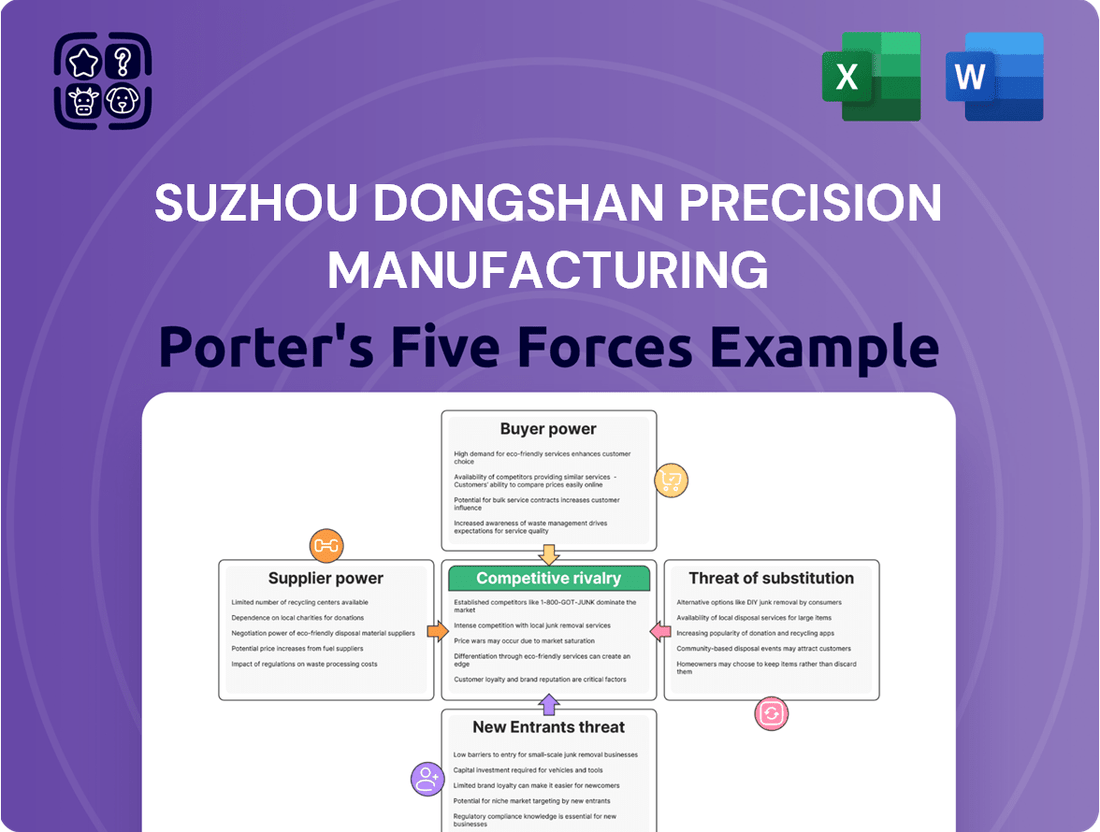

Suzhou Dongshan Precision Manufacturing Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Suzhou Dongshan Precision Manufacturing's competitive landscape through a comprehensive Porter's Five Forces analysis, examining supplier power, buyer power, threat of new entrants, threat of substitutes, and industry rivalry.

Rivalry Among Competitors

Suzhou Dongshan Precision Manufacturing navigates a competitive landscape across its core business segments: precision metal components, precision structural components, and LED devices, alongside its Electronic Manufacturing Services (EMS). The EMS sector, in particular, is experiencing robust growth, projected to reach approximately $700 billion globally by 2025, but this expansion is met with a highly fragmented market structure. This fragmentation means a multitude of suppliers, from large conglomerates to smaller, specialized firms, all vying for market share, intensifying the rivalry.

Suzhou Dongshan Precision Manufacturing operates in sectors like consumer electronics and telecommunications, where technological progress is incredibly swift. This means companies are always iterating on products and developing new features. For instance, the push towards MiniLED displays and more sophisticated printed circuit board (PCB) designs demands constant R&D from Dongshan Precision to keep pace.

Competitors are heavily investing in research and development to stay ahead. In 2023, the global R&D spending in the semiconductor industry, a key area for Dongshan Precision, saw significant increases, with major players dedicating substantial portions of their revenue to innovation. This intense R&D activity forces Dongshan Precision to continuously innovate its own manufacturing processes and product offerings to maintain its competitive edge and meet evolving market demands.

Suzhou Dongshan Precision Manufacturing faces considerable competitive rivalry due to the mature nature of several of its product segments and a crowded marketplace. This environment intensifies price competition, directly impacting profit margins.

For instance, the LED sector, a key area for many precision manufacturers, saw significant price erosion in 2023. Companies like Dongshan Precision must navigate this landscape by focusing on efficiency and value-added services to maintain profitability amidst aggressive pricing strategies from rivals.

Global and Regional Competition

Suzhou Dongshan Precision Manufacturing navigates a competitive arena populated by both international powerhouses and formidable regional contenders. This is particularly evident in the Asia Pacific region, a critical nexus for global manufacturing operations.

The intensity of this rivalry necessitates a dual strategic approach: maintaining a strong global presence while simultaneously tailoring operations and market penetration to specific local conditions. For instance, in 2023, the precision manufacturing sector saw significant investment and expansion from companies across China, South Korea, and Taiwan, directly impacting market share dynamics for players like Dongshan Precision.

- Global Giants: Large multinational corporations with extensive R&D budgets and established supply chains exert considerable pressure.

- Regional Specialists: Asian manufacturers, often benefiting from lower operational costs and government support, present intense competition within key markets.

- Market Saturation: Certain segments within precision manufacturing are experiencing high levels of competition, driving down prices and margins.

Differentiation through Comprehensive Solutions

Competitive rivalry in the precision manufacturing sector is intensifying, with companies increasingly vying to offer complete, integrated solutions rather than just individual components. This shift means that success hinges on providing a seamless, end-to-end service portfolio.

Suzhou Dongshan Precision Manufacturing distinguishes itself by offering both Electronic Manufacturing Services (EMS) and comprehensive integrated solutions. This approach directly counters competitors who may specialize in narrower product niches, providing a significant advantage.

For instance, in 2024, the demand for integrated supply chain solutions in electronics manufacturing is projected to grow significantly, with market research indicating a compound annual growth rate of over 8% for this segment. Dongshan's focus on these holistic offerings positions it well to capture this expanding market share.

- Integrated Solutions as a Differentiator: Companies are moving beyond single-component supply to offer complete manufacturing ecosystems.

- Dongshan's Competitive Edge: Offering both EMS and integrated solutions provides a distinct advantage over niche competitors.

- Market Trend: The market for comprehensive manufacturing solutions is experiencing robust growth, with projections suggesting continued expansion through 2024 and beyond.

The competitive rivalry for Suzhou Dongshan Precision Manufacturing is fierce, driven by a fragmented market and rapid technological advancements. Companies are heavily investing in R&D, with the semiconductor industry alone seeing substantial spending increases in 2023 to fuel innovation. This forces Dongshan Precision to continually enhance its manufacturing processes and product offerings to remain competitive.

The market is characterized by both global giants with vast R&D budgets and agile regional specialists, particularly in Asia, often benefiting from lower costs and government support. This intense competition, especially in mature segments like LED manufacturing, leads to price erosion, compelling Dongshan Precision to focus on efficiency and value-added services. For example, the precision manufacturing sector in the Asia Pacific saw significant investment and expansion from key players in 2023, directly impacting market share dynamics.

Dongshan Precision differentiates itself by offering integrated solutions and Electronic Manufacturing Services (EMS), a strategy that counters competitors focused on niche products. The demand for comprehensive supply chain solutions in electronics manufacturing is projected for robust growth, with an estimated compound annual growth rate exceeding 8% through 2024. This focus on holistic offerings positions Dongshan Precision to capitalize on this expanding market trend.

| Competitive Factor | Impact on Dongshan Precision | Example/Data Point |

|---|---|---|

| Market Fragmentation | Intensifies competition and price pressure | EMS market projected to reach $700 billion globally by 2025, with numerous suppliers. |

| Rapid Technological Change | Requires continuous R&D investment | Global R&D spending in semiconductors increased significantly in 2023. |

| Global vs. Regional Players | Demands dual strategic approach (global presence, local tailoring) | Significant investment and expansion from Asian manufacturers in 2023 impacted market share. |

| Price Erosion in Mature Segments | Necessitates focus on efficiency and value-added services | LED sector experienced notable price declines in 2023. |

| Shift to Integrated Solutions | Provides a competitive advantage for Dongshan's EMS and integrated offerings | Market for integrated supply chain solutions in electronics manufacturing projected to grow over 8% CAGR through 2024. |

SSubstitutes Threaten

Advances in alternative manufacturing technologies, like additive manufacturing (3D printing), present a potential long-term threat. These evolving methods could offer more cost-effective or design-flexible production routes for precision components, potentially bypassing traditional manufacturing processes. For instance, the global 3D printing market was valued at approximately $15.77 billion in 2023 and is projected to grow significantly, indicating a growing capability for producing complex parts.

The increasing demand for lightweight materials in sectors such as automotive and aerospace presents a significant threat. Industries are exploring alternatives like advanced composites and specialized plastics, which could reduce reliance on traditional precision metals. This trend directly impacts Suzhou Dongshan Precision Manufacturing's core business by potentially diverting demand away from their metal components.

The increasing integration of functionalities into fewer, more complex components poses a significant threat to Suzhou Dongshan Precision Manufacturing. As technologies evolve, there's a growing demand for solutions where multiple functions are consolidated into single, sophisticated modules. This trend could diminish the need for the discrete precision metal and structural components that form a core part of Dongshan Precision's offerings, as their roles might be absorbed by these larger, integrated systems.

Shifting Display Technologies

The display market is constantly evolving, and while Suzhou Dongshan Precision Manufacturing is a key player in LED devices, alternative technologies pose a threat. Emerging display solutions like advanced OLEDs, microLEDs, and even flexible or transparent displays offer different functionalities and aesthetics that could replace traditional LED screens in various consumer electronics and automotive applications. For instance, the global OLED display market was projected to reach over $30 billion in 2024, indicating significant adoption of these alternative technologies.

These evolving display technologies can act as substitutes by offering superior performance characteristics or unique design possibilities. For example, OLEDs provide better contrast ratios and faster response times, which might be preferred in high-end smartphones or premium televisions. The increasing market penetration of these alternatives, with the foldable display market alone expected to grow substantially by 2025, directly impacts the demand for conventional LED components that Dongshan Precision manufactures.

- Emerging Display Technologies: Advanced OLED, microLED, and other novel display solutions offer alternatives to traditional LEDs.

- Market Dynamics: The global OLED display market is a significant and growing segment, projected to exceed $30 billion in 2024.

- Substitute Threat: Superior performance or unique design features of alternatives can lead to their adoption over LED devices in various applications.

Software-Defined Hardware

The rise of software-defined hardware presents a significant threat of substitution for traditional hardware manufacturers like Suzhou Dongshan Precision Manufacturing. As vehicles increasingly adopt software-defined architectures, functionalities previously reliant on dedicated hardware components can be consolidated or managed through software updates. This shift could diminish the demand for certain types of specialized hardware, impacting volume and complexity.

For instance, in the automotive sector, the development of software-defined vehicles allows for over-the-air updates to control features like engine performance, infotainment, and driver assistance systems. This trend, gaining momentum in 2024, means that the need for specific, often complex, hardware modules for each function may decrease. Companies that excel in software integration and platform development could offer a more adaptable and potentially cost-effective solution compared to purely hardware-centric approaches.

- Software-Defined Vehicles: The automotive industry is seeing a strong push towards software-defined vehicles, with major players investing billions. For example, Stellantis announced plans to invest over €30 billion through 2026 in electrification and software development.

- Hardware Consolidation: This trend can lead to the consolidation of hardware components, as multiple functions are managed by fewer, more powerful processing units and sophisticated software.

- Reduced Hardware Dependency: As functionalities migrate to software, the direct reliance on specialized, discrete hardware components for those same functions is likely to decline, posing a substitution threat.

The growing adoption of advanced materials like carbon fiber composites in industries such as automotive and aerospace presents a significant threat of substitution. These materials offer superior strength-to-weight ratios compared to traditional metals, potentially reducing the demand for precision metal components that Suzhou Dongshan Precision Manufacturing specializes in.

The global composites market is expanding, with projections indicating continued growth through 2024 and beyond, driven by the need for lighter and more fuel-efficient designs. For instance, the automotive sector alone is increasingly incorporating composites, with some estimates suggesting a significant increase in their usage in vehicle structures by 2025.

This shift towards advanced materials means that customers might opt for solutions that do not rely on the precision metal fabrication services offered by Dongshan Precision, thereby impacting their market share.

| Material Type | Key Advantage | Substitution Threat to Metal Components |

|---|---|---|

| Carbon Fiber Composites | High strength-to-weight ratio, corrosion resistance | Reduced demand for precision metal parts in automotive and aerospace |

| Advanced Plastics/Polymers | Lightweight, design flexibility, cost-effectiveness | Potential replacement for certain metal components in consumer electronics and automotive interiors |

| Additive Manufacturing (3D Printing) | Design complexity, on-demand production, material variety | Alternative for producing intricate or customized components, potentially bypassing traditional manufacturing |

Entrants Threaten

The precision manufacturing and electronics manufacturing services (EMS) sectors demand significant upfront capital. Companies need to invest heavily in state-of-the-art machinery, sophisticated production facilities, and ongoing research and development to stay competitive. For instance, setting up a modern EMS facility can easily run into tens or even hundreds of millions of dollars.

Established players like Suzhou Dongshan Precision Manufacturing leverage considerable economies of scale. Their large-scale operations allow them to spread fixed costs over a greater output, resulting in lower per-unit production costs. This cost advantage makes it exceptionally challenging for new entrants to match their pricing and achieve profitability from the outset.

The intricate design, manufacturing, and sale of precision metal components, structural parts, and LED devices, alongside Electronic Manufacturing Services (EMS), demand a deep well of specialized technical knowledge and protected intellectual property. This inherent complexity acts as a substantial hurdle for any new companies looking to enter the market.

Suzhou Dongshan Precision Manufacturing enjoys robust, long-standing relationships with key players across telecommunications, consumer electronics, and automotive sectors. These deeply entrenched client connections create a significant barrier for newcomers.

New entrants would face immense difficulty in replicating the trust and reliability that Dongshan Precision has cultivated over years of consistent performance. Furthermore, establishing competitive supply chains capable of meeting the stringent demands of these major industries presents another substantial hurdle, making it challenging to displace the incumbent.

Regulatory Hurdles and Quality Standards

Industries where Dongshan Precision operates, such as automotive and telecommunications, impose rigorous quality and regulatory standards. New entrants must invest heavily in certifications and compliance to meet these requirements, especially for high-reliability components.

For instance, the automotive sector often demands adherence to standards like IATF 16949, a complex and costly process for new manufacturers. Similarly, telecommunications equipment must comply with various international safety and performance regulations, adding significant upfront investment and time to market.

- Stringent Quality Certifications: Industries like automotive (e.g., IATF 16949) and aerospace require extensive and costly certifications.

- Regulatory Compliance Costs: Meeting telecommunications standards (e.g., FCC, CE) and environmental regulations (e.g., RoHS, REACH) demands significant investment.

- High R&D Investment: Developing components that meet advanced technological and safety specifications necessitates substantial research and development expenditure.

- Capital Intensity: Setting up manufacturing facilities capable of producing precision components often requires multi-million dollar investments in specialized machinery and cleanroom environments.

Talent Acquisition and Retention

The precision manufacturing and electronics manufacturing services (EMS) sectors, crucial for companies like Suzhou Dongshan Precision Manufacturing, are heavily reliant on a highly skilled workforce. This includes specialized engineers, experienced technicians, and quality control personnel.

New companies entering this space would face significant hurdles in attracting and retaining this critical talent. The competition for these skilled individuals is already intense, particularly in regions with a strong manufacturing presence.

- Talent Scarcity: In 2024, the global shortage of skilled manufacturing labor continued to be a significant concern, with reports indicating that up to 2.4 million manufacturing jobs in the US alone could go unfilled by 2028.

- High Training Costs: Developing the necessary expertise for precision manufacturing often requires extensive on-the-job training and specialized certifications, a substantial investment for any new entrant.

- Retention Challenges: Established players often offer competitive compensation, benefits, and career advancement opportunities, making it difficult for newcomers to poach and retain top talent.

The threat of new entrants for Suzhou Dongshan Precision Manufacturing is generally low due to substantial barriers. High capital requirements for advanced machinery and facilities, often in the tens to hundreds of millions of dollars, immediately deter smaller players. Furthermore, the need for deep technical expertise and protected intellectual property in precision and electronics manufacturing services creates a significant knowledge barrier.

Established relationships with major clients in sectors like telecommunications and automotive are difficult for newcomers to replicate, as trust and consistent performance are paramount. Meeting stringent industry quality and regulatory standards, such as IATF 16949 for automotive, demands considerable investment in certifications and compliance, further increasing the entry cost.

The scarcity of skilled labor, with millions of manufacturing jobs potentially unfilled globally in 2024, makes attracting and retaining specialized talent a major challenge for new entrants. High training costs and retention difficulties compound this issue, favoring established companies like Dongshan Precision that already possess experienced workforces.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Setting up precision manufacturing facilities requires millions in specialized machinery and cleanroom environments. | High; significantly limits the number of potential new entrants. |

| Technical Expertise & IP | Intricate design and manufacturing demand specialized knowledge and protected intellectual property. | High; requires substantial investment in R&D and talent acquisition. |

| Customer Relationships | Long-standing, trusted relationships with key industry players are hard to establish. | High; newcomers struggle to displace incumbents with proven track records. |

| Regulatory & Quality Standards | Compliance with standards like IATF 16949 (automotive) is costly and time-consuming. | High; necessitates significant upfront investment and delays market entry. |

| Skilled Labor Availability | Global shortage of skilled manufacturing labor in 2024 makes talent acquisition difficult. | High; increases operational costs and hiring challenges for new firms. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Suzhou Dongshan Precision Manufacturing leverages data from company annual reports, industry-specific market research, and financial databases to assess competitive intensity.