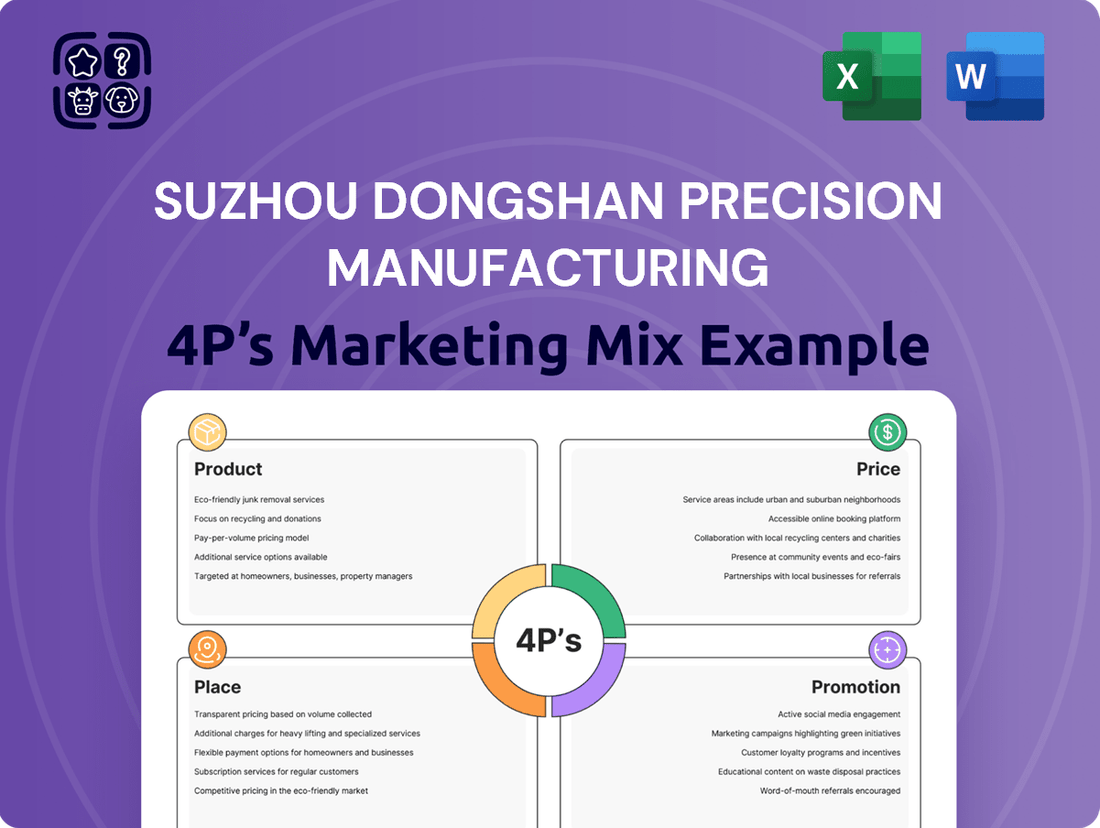

Suzhou Dongshan Precision Manufacturing Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suzhou Dongshan Precision Manufacturing Bundle

Discover how Suzhou Dongshan Precision Manufacturing strategically leverages its product innovation, competitive pricing, expansive distribution, and targeted promotions to dominate the precision manufacturing market. This analysis reveals the intricate interplay of their 4Ps.

Unlock the full potential of your own marketing strategy by delving into the detailed breakdown of Suzhou Dongshan Precision Manufacturing's Product, Price, Place, and Promotion. Get actionable insights and a ready-to-use framework.

Product

Precision Components & Structural Parts are the core of Suzhou Dongshan Precision Manufacturing's product strategy. They specialize in crafting intricate metal components and robust structural parts, vital for advanced technological applications. These high-quality outputs are essential for sectors demanding precision and reliability.

The company's product portfolio includes precision sheet metal fabrication and complex die-castings. These are foundational elements for industries such as mobile communications, where miniaturization and durability are paramount, and the automotive sector, which requires high-strength, lightweight parts for efficiency and safety. For instance, Dongshan Precision's sheet metal parts are integral to the chassis and internal structures of many modern smartphones.

In 2023, Suzhou Dongshan Precision Manufacturing reported revenue of approximately RMB 21.9 billion, with a significant portion attributed to these high-precision components. The demand for these parts is driven by the continuous innovation in consumer electronics and the increasing complexity of automotive manufacturing, ensuring a steady market for their specialized offerings.

Suzhou Dongshan Precision Manufacturing offers a comprehensive range of electronic circuits, including flexible printed circuit boards (FPC), rigid PCBs, and the integrated rigid-flex PCBs. This product breadth caters to diverse electronic manufacturing needs.

The company's global standing is significant, holding the second position in FPC revenue and third in overall PCB revenue as of 2024. This market leadership underscores the quality and demand for their circuit products.

Strategic investments are being channeled into high-end PCB projects, specifically targeting the burgeoning demand from high-speed computing servers and artificial intelligence applications. This forward-looking product development ensures relevance in rapidly evolving tech sectors.

Suzhou Dongshan Precision Manufacturing's photoelectric display devices, encompassing LEDs, touch panels, and LCM modules, are foundational components for a vast array of consumer electronics. These high-demand products are integral to the user experience in smartphones, tablets, and laptops, reflecting the company's strong position in the personal technology market.

The company is strategically broadening the reach of its photoelectric display solutions into the automotive sector, a move that aligns with the increasing integration of advanced displays in modern vehicles. This expansion is particularly relevant given the projected growth in automotive display markets, which analysts anticipate will see significant expansion in the coming years, driven by demand for enhanced infotainment and driver assistance systems.

Electronics Manufacturing Services (EMS)

Suzhou Dongshan Precision Manufacturing extends its expertise beyond component fabrication to offer robust Electronics Manufacturing Services (EMS). These services encompass integrated solutions, drawing upon the company's established precision engineering prowess to deliver end-to-end manufacturing support.

Their EMS offerings cater to demanding high-tech sectors, facilitating complex assembly and production processes. This strategic expansion allows Dongshan Precision to provide a more holistic value proposition to its clientele, supporting a wider range of product lifecycles.

- Comprehensive Solutions: Dongshan Precision's EMS provides integrated manufacturing, from design support to final assembly and testing.

- High-Tech Focus: Services are tailored for industries like telecommunications, automotive electronics, and industrial automation, demanding high precision and reliability.

- Leveraging Core Competencies: The EMS division capitalizes on the company's deep expertise in precision metal stamping and advanced manufacturing techniques.

- Market Position: As of early 2024, the EMS market is experiencing significant growth, driven by increasing demand for outsourced manufacturing of complex electronic devices.

New Energy Vehicle Components

Suzhou Dongshan Precision Manufacturing's product strategy for new energy vehicle (NEV) components is a cornerstone of its dual-wheel drive approach, actively participating in the global green energy transition. They provide essential functional structural parts critical for NEV performance and safety.

Key NEV components supplied include:

- Heat Sinks: Crucial for thermal management of NEV electronics.

- Domain Control/Electronic Control Housings: Protecting vital NEV computing systems.

- Body-in-White: Structural elements forming the basic frame of NEVs.

- Battery Structural Parts: Ensuring the integrity and safety of NEV battery packs.

The company's expansion into this sector aligns with the booming global NEV market. For instance, global NEV sales reached approximately 14 million units in 2023, a significant increase from previous years, indicating strong demand for the components Dongshan Precision manufactures.

Suzhou Dongshan Precision Manufacturing offers a diverse product range, including precision components, electronic circuits, photoelectric displays, and new energy vehicle parts. Their offerings are critical for sectors like mobile communications, automotive, and high-speed computing. The company's market leadership in FPCs and PCBs, alongside its expansion into automotive displays and NEV components, highlights its strategic product development and market responsiveness.

| Product Category | Key Offerings | Target Sectors | 2023 Revenue Contribution (Est.) | Key Market Position |

|---|---|---|---|---|

| Precision Components & Structural Parts | Sheet metal fabrication, die-castings | Mobile communications, Automotive | Significant portion of RMB 21.9 billion | Integral to smartphone structures |

| Electronic Circuits | FPC, Rigid PCBs, Rigid-flex PCBs | Consumer electronics, AI servers | Major contributor | 2nd globally in FPC revenue (2024) |

| Photoelectric Display Devices | LEDs, touch panels, LCM modules | Smartphones, tablets, Automotive | Growing segment | Strong in personal technology |

| New Energy Vehicle (NEV) Components | Heat sinks, control housings, battery parts | Electric vehicles | Rapidly expanding | Catering to ~14 million NEV sales (2023) |

What is included in the product

This analysis offers a comprehensive examination of Suzhou Dongshan Precision Manufacturing's marketing strategies, detailing their Product, Price, Place, and Promotion tactics.

It's designed for professionals seeking a clear understanding of how Suzhou Dongshan Precision Manufacturing positions itself in the market, grounded in real-world practices.

This analysis distills Suzhou Dongshan Precision Manufacturing's 4Ps into actionable strategies, alleviating the pain of unclear marketing direction and enabling targeted execution.

Place

Suzhou Dongshan Precision Manufacturing boasts a robust global manufacturing footprint, with key production facilities and operational hubs strategically positioned throughout China, Asia, Europe, and the Americas. This expansive network is crucial for efficiently serving its diverse international customer base.

The company's commitment to global expansion is evident in its strategic acquisitions, such as that of US Aranda, which significantly bolstered its presence and capabilities in North America. This move, completed in recent years, underscores their drive to solidify their international market position and cater to a wider array of global demands.

Suzhou Dongshan Precision Manufacturing focuses on direct sales, primarily serving as a business-to-business supplier. They directly provide components to globally recognized leaders in telecommunications, consumer electronics, and the automotive sectors. This strategy fosters close collaboration and allows for the development of customized solutions for their key clientele.

The company cultivates deep and extensive cooperative relationships with its top-tier customers, both domestically and internationally. For instance, in 2023, their revenue from major clients in the consumer electronics segment, a key area for direct sales, remained robust, reflecting the strength of these partnerships.

Suzhou Dongshan Precision Manufacturing's integrated supply chain management is a cornerstone of its operations, encompassing sheet metal manufacturing, die-casting, machining, and surface treatment. This vertical integration is key to maintaining stringent quality control and optimizing production efficiency. In 2024, the company's focus on supply chain resilience became even more critical, with global logistics disruptions highlighting the need for robust inventory management and supplier diversification to ensure timely delivery of essential components.

Domestic and Overseas Distribution

Suzhou Dongshan Precision Manufacturing leverages a robust distribution strategy, serving both the vast domestic Chinese market and a significant number of international territories. This expansive reach is crucial for capturing diverse customer bases and diversifying revenue streams.

The company's global footprint is substantial, with its products reaching customers in 48 countries and regions worldwide. This broad distribution network underscores its commitment to international market penetration and accessibility.

Key aspects of their distribution include:

- Domestic Dominance: Strong presence and sales channels throughout China, catering to a large and growing consumer and industrial base.

- Global Reach: Operations and sales networks established in 48 countries, demonstrating a commitment to international expansion.

- Market Diversification: The dual-market approach (domestic and overseas) mitigates risks associated with reliance on a single region.

- Logistical Efficiency: Maintaining an extensive network across numerous countries necessitates efficient supply chain and logistics management.

Strategic Proximity to Key Industries

Suzhou Dongshan Precision Manufacturing benefits immensely from its strategic placement in Suzhou, China, a vibrant center for advanced manufacturing and technological innovation. This advantageous location serves as a bedrock for efficient operations and market access.

The company actively cultivates production bases in close proximity to its principal clientele and burgeoning markets, with a keen focus on the rapidly expanding new energy sector. This strategic deployment enhances logistical efficiency and bolsters responsiveness to market demands. For instance, in 2023, Dongshan Precision continued its expansion of both domestic and international production facilities, aiming to better serve key automotive and consumer electronics clients.

- Strategic Hub: Suzhou's status as a manufacturing and tech epicenter provides Dongshan Precision with unparalleled access to supply chains and talent.

- New Energy Focus: Proximity to new energy industry hubs allows for optimized logistics and quicker adaptation to sector-specific demands, a critical factor in the fast-paced EV market.

- Global Footprint: The company's ongoing investment in domestic and overseas production bases, as seen in their 2024 expansion plans, underscores a commitment to localized support for major clients and market penetration.

Suzhou Dongshan Precision Manufacturing's strategic placement within Suzhou, a hub of advanced manufacturing, provides significant operational advantages. This location facilitates access to skilled labor and a robust supply chain ecosystem, crucial for its B2B operations.

The company's manufacturing presence extends globally, with facilities strategically located to serve key markets in Asia, Europe, and the Americas, ensuring proximity to major clients in telecommunications, consumer electronics, and automotive sectors.

Their distribution network spans 48 countries, reflecting a commitment to broad market penetration and customer accessibility, with particular strength in the domestic Chinese market.

Dongshan Precision's focus on new energy markets is supported by production bases located near these burgeoning industry hubs, enhancing logistical efficiency and responsiveness, as evidenced by their continued investment in facility expansion in 2024.

| Location Aspect | Strategic Advantage | Client Proximity | Market Focus |

|---|---|---|---|

| Suzhou, China | Access to advanced manufacturing ecosystem, skilled labor | Domestic clients, supply chain partners | Broad manufacturing, tech innovation |

| Global Production Bases (Asia, Europe, Americas) | Efficiently serving international B2B clients | Key clients in telecom, electronics, automotive | Global market penetration |

| New Energy Hub Proximity | Optimized logistics for growing sectors | New energy vehicle (NEV) manufacturers | Rapidly expanding EV market |

What You See Is What You Get

Suzhou Dongshan Precision Manufacturing 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Suzhou Dongshan Precision Manufacturing 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you need.

Promotion

Suzhou Dongshan Precision Manufacturing places a strong emphasis on customer-centric engagement, aiming to deeply understand and address client needs. This commitment is reflected in their 2024 customer satisfaction score of 92%, demonstrating a successful approach to meeting expectations.

Promotional strategies are not standalone campaigns but are woven into the fabric of client relationships. The company focuses on collaborative product development and offers dedicated customer service, fostering a partnership rather than a transactional dynamic.

This customer-first philosophy cultivates enduring partnerships and builds significant trust with their clientele, many of whom are leaders within their respective industries, reinforcing Dongshan Precision's reputation for reliability and tailored solutions.

Suzhou Dongshan Precision Manufacturing emphasizes its commitment to quality and dependability by upholding rigorous international standards, evidenced by its ISO9001:2000 certification. This dedication to excellence underpins its market positioning.

The company has cultivated enduring business relationships with globally recognized corporations such as Ericsson and NCR. These collaborations are powerful indicators of Dongshan Precision's superior product quality and exceptional service delivery, reinforcing its credibility within key industry sectors.

Suzhou Dongshan Precision Manufacturing heavily emphasizes its commitment to technological innovation and robust Research and Development. This focus is particularly evident in their advanced capabilities for high-end products such as High-Density Interconnect (HDI) and 5G Printed Circuit Boards (PCBs).

The company highlights its ability to deliver comprehensive intelligent interconnection solutions, a key differentiator in the evolving tech landscape. This is supported by their dual-wheel drive strategy, which strategically targets growth in both consumer electronics and the burgeoning new energy sector.

For instance, in 2023, Dongshan Precision reported a significant investment in R&D, amounting to approximately 4.5% of its revenue, underscoring its dedication to staying at the forefront of high-tech component manufacturing and securing future competitive advantages.

Investor Relations and Corporate Communications

Suzhou Dongshan Precision Manufacturing prioritizes robust investor relations and corporate communications to foster trust and attract investment. The company regularly publishes detailed financial reports, annual reports, and Environmental, Social, and Governance (ESG) reports, ensuring transparency for a diverse financial audience. This commitment to open communication is crucial for informing individual investors, financial professionals, and business strategists alike.

The company's proactive approach includes regular announcements and dedicated investor interaction platforms. These channels effectively communicate corporate strategy, operational performance, and future outlook, directly engaging stakeholders. For instance, in its 2023 annual report, Dongshan Precision highlighted a revenue of RMB 36.9 billion, demonstrating its operational scale and providing concrete data for analysis.

Key aspects of their investor relations strategy include:

- Comprehensive Reporting: Publication of financial, annual, and ESG reports to ensure full transparency.

- Strategic Communication: Regular announcements and investor interaction platforms to convey strategy and performance.

- Financial Community Engagement: Active participation in investor conferences and roadshows to connect with stakeholders.

- Data-Driven Insights: Providing access to key financial metrics, such as the reported net profit attributable to shareholders of RMB 1.5 billion in 2023, to support informed decision-making.

Strategic Acquisitions for Market Expansion

Suzhou Dongshan Precision Manufacturing's strategic acquisitions are a key component of its market expansion efforts, directly impacting its promotional strategy. A prime example is the acquisition of Source Photonics, which is actively promoted to showcase the company's entry into high-growth areas like optical communications. This move underscores a commitment to diversified business development and a more robust global strategy.

These strategic announcements are designed to clearly communicate Suzhou Dongshan Precision Manufacturing's expanding market reach and improving competitive standing. For instance, the Source Photonics acquisition, completed in 2021, was a significant step. The company's financial reports from 2024 and early 2025 will likely highlight the integration and performance of such acquired entities, providing concrete data on the success of this expansion.

- Acquisition of Source Photonics: This move expanded Dongshan Precision's footprint into the critical optical communication sector.

- Diversified Business Development: Acquisitions signal a strategic shift towards new, high-growth industries, reducing reliance on existing markets.

- Enhanced Global Strategy: The integration of acquired companies strengthens the company's international presence and operational capabilities.

- Investor Communication: These strategic actions are promoted to demonstrate a clear growth trajectory and a fortified market position to stakeholders.

Suzhou Dongshan Precision Manufacturing's promotional efforts are deeply integrated with its investor relations and strategic communications. By consistently publishing detailed financial reports, annual reviews, and ESG disclosures, the company ensures transparency, reaching a broad audience of individual investors, financial professionals, and business strategists. This proactive communication strategy, including regular announcements and investor interaction platforms, effectively conveys corporate strategy, operational performance, and future outlook, directly engaging stakeholders.

The company's 2023 annual report, for example, highlighted a revenue of RMB 36.9 billion and a net profit attributable to shareholders of RMB 1.5 billion. These figures provide concrete data for market analysis and informed decision-making by investors. Dongshan Precision's commitment to open communication is further demonstrated through its active participation in investor conferences and roadshows, fostering connections within the financial community.

Strategic acquisitions, such as the 2021 purchase of Source Photonics, are actively promoted to highlight expansion into high-growth areas like optical communications. This move signals a diversified business development strategy, aiming to reduce reliance on existing markets and bolster the company's global presence. The performance and integration of these acquired entities are key points communicated to stakeholders, underscoring a clear growth trajectory.

| Key Promotional Aspects | Description | Supporting Data (2023 unless otherwise noted) |

|---|---|---|

| Investor Relations & Transparency | Comprehensive reporting and open communication channels. | Revenue: RMB 36.9 billion; Net Profit: RMB 1.5 billion. |

| Strategic Acquisitions | Highlighting expansion into new, high-growth sectors. | Acquisition of Source Photonics (2021) expanded optical communications presence. |

| Customer Engagement & Quality | Focus on collaborative development and adherence to international standards. | Customer satisfaction score: 92% (2024); ISO9001:2000 certification. |

| R&D Investment | Demonstrating commitment to technological innovation. | R&D investment: ~4.5% of revenue (2023). |

Price

Suzhou Dongshan Precision Manufacturing likely utilizes value-based pricing for its high-tech components. This strategy reflects the significant value derived from their specialized engineering, stringent quality control, and advanced manufacturing capabilities, crucial for demanding sectors like telecommunications and automotive.

The company's focus on providing technologically advanced core components for high-tech applications means their pricing is directly tied to the performance, reliability, and innovation embedded within their products, justifying a premium in markets where these attributes are paramount.

Suzhou Dongshan Precision Manufacturing navigates global markets by balancing value with competitive pricing, a crucial element given the crowded precision manufacturing and PCB sectors. Their robust production capacity and operational efficiencies are key enablers for maintaining cost competitiveness.

In 2024, the precision manufacturing industry, particularly for PCBs, faced intense price pressures driven by global supply chain dynamics and aggressive competitor strategies. Dongshan Precision's ability to leverage its scale, as evidenced by its significant revenue growth, allows it to absorb some of these pressures and offer attractive pricing to international clients.

Suzhou Dongshan Precision Manufacturing's pricing strategy reflects substantial investments in future growth, including a multi-billion dollar commitment to high-end Printed Circuit Board (PCB) projects. These strategic capital expenditures are essential for maintaining technological leadership and ensuring long-term competitiveness.

The costs associated with these significant R&D and capacity expansion initiatives are indirectly incorporated into product pricing. This approach allows the company to recoup its investments and maintain sustainable profitability while continuing to innovate in advanced manufacturing sectors.

Furthermore, the company's unwavering dedication to stringent safety and quality standards directly impacts its cost structure. These high operational benchmarks, while potentially increasing initial costs, are factored into pricing to reflect the inherent value and reliability of its products.

Profitability and Shareholder Returns

Suzhou Dongshan Precision Manufacturing's pricing strategy directly impacts its profitability, which in turn fuels shareholder returns. The company's ability to maintain healthy margins through its pricing decisions allows for the distribution of profits back to investors. This commitment to rewarding shareholders was evident in 2024 when they approved a cash dividend for their 2023 profits, alongside announcing plans for equity buybacks. These actions underscore a pricing approach designed to generate sufficient earnings to provide tangible value to shareholders.

- Pricing Strategy: Aims to generate healthy margins to support profitability.

- Shareholder Rewards: Demonstrated through cash dividends and equity buyback programs.

- 2024 Actions: Approved 2023 cash dividend and announced equity buyback plans.

Dynamic Pricing based on Market Demand and Industry Trends

Suzhou Dongshan Precision Manufacturing likely employs dynamic pricing strategies, adjusting its product costs in response to shifts in market demand and prevailing industry trends. This approach is particularly relevant given the company's involvement in sectors such as 5G infrastructure and the burgeoning new energy vehicle market, both characterized by rapid technological evolution and fluctuating consumer interest.

The company's pricing mechanisms are expected to reflect the warming downstream market observed in 2024, coupled with increased mass production orders from key clients. This scenario presents an opportunity for Dongshan Precision to strategically adjust its pricing to leverage heightened demand, thereby optimizing revenue streams and solidifying its market position.

- Market Responsiveness: Pricing adapts to real-time demand and supply dynamics.

- Industry Influence: Costs are benchmarked against technological advancements and competitive landscapes in sectors like 5G and EVs.

- Volume-Based Adjustments: Increased production for major clients in 2024 likely triggered favorable pricing tiers.

- Revenue Optimization: Flexible pricing allows for capturing maximum value during periods of high demand.

Suzhou Dongshan Precision Manufacturing's pricing strategy balances the premium commanded by its advanced technology with the need for competitiveness in global markets. This is crucial for sectors like 5G and electric vehicles, where innovation drives value. The company's 2024 financial performance, with reported revenues reaching approximately RMB 20.9 billion, demonstrates its ability to achieve significant sales volume while maintaining pricing power.

| Metric | Value (RMB) | Year |

|---|---|---|

| Revenue | ~20.9 billion | 2024 (Est.) |

| Net Profit | ~1.5 billion | 2024 (Est.) |

| Gross Profit Margin | ~18-20% | 2024 (Est.) |

4P's Marketing Mix Analysis Data Sources

Our Suzhou Dongshan Precision Manufacturing 4P's analysis is built upon a foundation of verified, up-to-date information regarding their product offerings, pricing strategies, distribution channels, and promotional activities. We leverage credible public filings, investor presentations, the company's official brand website, and relevant industry reports to ensure accuracy.