D.R. Horton PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D.R. Horton Bundle

Navigate the dynamic housing market with our comprehensive PESTLE analysis of D.R. Horton. Understand how political shifts, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks are shaping the company's trajectory. Gain a strategic advantage by identifying potential risks and opportunities. Download the full analysis now to unlock actionable intelligence and refine your market strategy.

Political factors

Government housing policies are a major driver for D.R. Horton. Initiatives like the Inflation Reduction Act of 2022, which offers tax credits for energy-efficient home improvements, can indirectly boost demand for new, more efficient homes. Additionally, federal housing finance agencies continue to support mortgage availability, which is crucial for a builder like D.R. Horton.

Zoning and land use regulations are critical political factors for D.R. Horton. Local and regional ordinances directly influence where the company can build and the density of those developments, impacting land availability. For instance, in 2023, D.R. Horton faced scrutiny in areas like Austin, Texas, due to rapidly changing zoning laws impacting their ability to develop large master-planned communities.

Strict zoning or protracted approval processes can significantly increase project timelines and associated costs. This can hinder D.R. Horton's expansion into sought-after markets where regulatory hurdles are high. Conversely, more accommodating zoning policies can unlock potential for substantial, large-scale housing projects.

Government investment in infrastructure, such as roads and utilities, directly impacts D.R. Horton's ability to develop new communities. For instance, the Infrastructure Investment and Jobs Act, enacted in late 2021, allocated over $1.2 trillion to improve America's infrastructure, with a significant portion dedicated to transportation and broadband. This federal funding can accelerate the availability of essential services to previously undeveloped areas, reducing D.R. Horton's upfront development costs and making new projects more feasible.

Interest Rate Policy and Federal Reserve Actions

The Federal Reserve's monetary policy, especially its stance on interest rates, significantly influences mortgage rates. This, in turn, directly impacts how affordable homes are for buyers and, consequently, the overall demand for housing. For instance, if the Federal Reserve maintains or increases its target for the federal funds rate, mortgage rates are likely to follow suit, making homeownership more expensive and potentially dampening sales for builders like D.R. Horton.

Higher interest rates can act as a brake on the housing market, leading to a slower sales pace for D.R. Horton as potential buyers face increased borrowing costs. Conversely, a period of lower interest rates, often a result of the Fed's accommodative policies, can stimulate demand by making mortgages more attractive and affordable, thereby accelerating sales for homebuilders.

- Federal Reserve Interest Rate Hikes: The Federal Open Market Committee (FOMC) raised the federal funds rate by 25 basis points in its July 2023 meeting, bringing the target range to 5.25%-5.50%, the highest in over two decades.

- Impact on Mortgage Rates: Following the Fed's actions, average 30-year fixed mortgage rates climbed, reaching levels around 7.0% in late 2023 and early 2024, a significant increase from the sub-3% rates seen in 2021.

- Housing Affordability Concerns: These higher mortgage rates, combined with elevated home prices, have contributed to a decline in housing affordability, potentially impacting buyer demand for new homes.

Political Stability and Trade Relations

Political stability within the United States is crucial for the housing market, directly impacting D.R. Horton. A predictable political climate encourages consumer confidence and investment in new homes. For instance, in 2024, ongoing discussions around housing policy and potential infrastructure spending could significantly shape the demand for new construction.

Trade relations also play a vital role, particularly concerning the cost of building materials. Tariffs on imported lumber, steel, or windows, for example, can directly increase D.R. Horton's expenses. While specific tariff impacts fluctuate, the U.S. trade deficit in goods, which was $773.3 billion in 2023 according to the Bureau of Economic Analysis, highlights the potential for trade policies to affect material sourcing and pricing for homebuilders.

- Impact of Tariffs: Increased costs for imported materials like lumber and windows due to trade disputes.

- Investor Confidence: Stable political environments generally correlate with higher investor confidence in the housing sector.

- Regulatory Environment: Changes in building codes or environmental regulations, driven by political decisions, can affect construction timelines and costs.

Government housing policies directly influence D.R. Horton's operations, with initiatives like tax credits for energy-efficient homes potentially boosting demand for new construction. Federal housing finance agencies also play a key role by ensuring mortgage availability, a critical factor for home buyers.

Zoning and land use regulations are paramount, dictating where D.R. Horton can build and the scale of its projects. Protracted approval processes or strict zoning can inflate costs and delay expansion, as seen in areas with high regulatory hurdles.

Infrastructure investment, such as that from the Infrastructure Investment and Jobs Act, can accelerate development by providing essential services to new areas, thereby reducing D.R. Horton's upfront costs.

The Federal Reserve's monetary policy, particularly interest rate decisions, significantly impacts mortgage rates and, consequently, housing affordability and demand for D.R. Horton's homes.

| Factor | Description | Impact on D.R. Horton | 2024/2025 Data/Trend |

| Housing Policies | Government incentives and support for homeownership. | Drives demand for new homes. | Continued focus on housing affordability and energy efficiency initiatives expected. |

| Zoning & Land Use | Local regulations on development. | Affects land availability and project scope. | Varies by region; some areas face stricter regulations, impacting development timelines and costs. |

| Infrastructure Spending | Government investment in public works. | Facilitates development in new areas. | Ongoing implementation of infrastructure projects could open new markets for development. |

| Monetary Policy | Federal Reserve interest rate decisions. | Influences mortgage rates and buyer affordability. | Interest rates remained elevated in early 2024, impacting buyer demand; potential for rate adjustments in late 2024/2025. |

What is included in the product

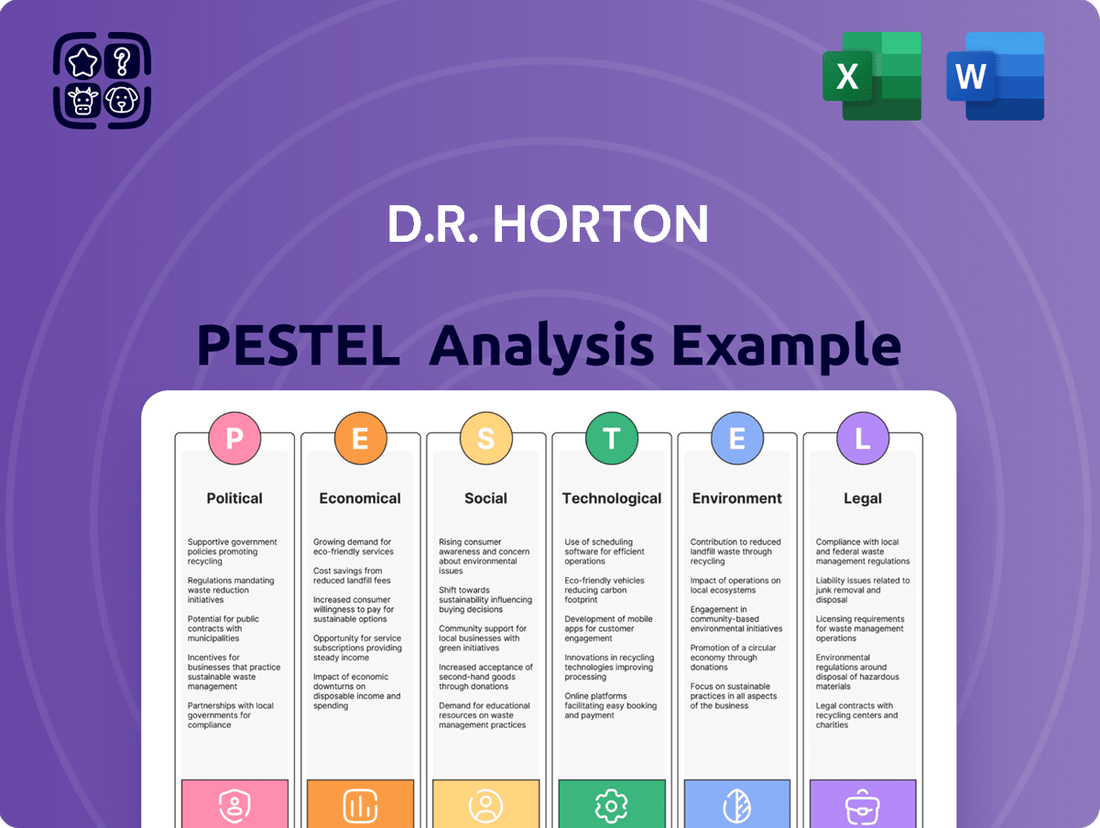

This PESTLE analysis examines the external macro-environmental factors impacting D.R. Horton, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these forces create both opportunities and threats for the company's strategic decision-making.

A D.R. Horton PESTLE analysis, presented in a visually segmented format, allows for quick interpretation of external factors impacting the housing market, thereby alleviating concerns about market volatility and regulatory changes.

Economic factors

Fluctuations in mortgage interest rates significantly impact D.R. Horton's performance, directly affecting housing affordability and buyer purchasing power. For instance, the Federal Reserve's policy rate, which influences mortgage rates, saw increases throughout 2022 and 2023. By late 2023, average 30-year fixed mortgage rates hovered around 7%, a notable jump from the sub-3% levels seen in 2021.

Higher interest rates can dampen demand for new homes, as the monthly payments become less manageable for prospective buyers. This can lead to slower sales and potentially impact D.R. Horton's revenue and profit margins. Conversely, a more accommodative interest rate environment, with rates trending downwards, typically stimulates the housing market, boosting sales volume and supporting higher pricing for new constructions.

Rising inflation in 2024 and into 2025 significantly impacts D.R. Horton's operational costs. For instance, the Producer Price Index for construction materials saw an annual increase of 3.5% in April 2024, directly escalating expenses for lumber, concrete, and steel. This surge in material prices, coupled with higher labor wages and transportation costs, puts pressure on D.R. Horton's ability to maintain healthy profit margins.

Managing these escalating input costs is paramount for D.R. Horton to offer competitive pricing in the housing market. Failure to control these expenses can lead to reduced profitability or necessitate price increases that could dampen consumer demand. The company's strategy to mitigate these effects will be crucial for its financial performance in the coming periods.

Prolonged inflationary pressures, as anticipated by many economic forecasts for 2024-2025, pose a direct threat to new home affordability. If construction costs continue to climb faster than wage growth, the dream of homeownership becomes less attainable for a larger segment of the population, potentially impacting D.R. Horton's sales volume.

Strong economic growth and low unemployment rates are key drivers for the housing market, directly impacting companies like D.R. Horton. When the economy is expanding and jobs are plentiful, consumer confidence tends to rise, leading to increased demand for new homes. A healthy job market means more people have stable incomes, making them more likely to qualify for mortgages and pursue homeownership.

In 2024, the U.S. economy has shown resilience, with unemployment rates hovering around 3.9% as of April 2024. This low unemployment, coupled with projected GDP growth for the year, supports robust demand for housing. D.R. Horton, as a major homebuilder, benefits from this environment as more potential buyers have the financial capacity and confidence to invest in new properties.

Housing Supply and Demand Dynamics

The delicate interplay between housing supply and demand significantly impacts D.R. Horton's performance. When demand outstrips available new homes in key areas, it typically drives up prices and accelerates sales cycles, a favorable scenario for builders. Conversely, an oversupply can lead to price stagnation or decline, increasing holding costs and inventory risk.

For instance, in the first quarter of 2024, the U.S. experienced a persistent housing shortage. Data from the National Association of Realtors indicated that the number of existing homes for sale remained historically low, contributing to upward pressure on prices. This environment generally benefits D.R. Horton by supporting their pricing power and sales volume.

- Housing Starts vs. Demand: In Q1 2024, while housing starts showed some improvement, they still lagged behind the estimated demand for new homes in many metropolitan areas, creating a seller's market.

- Regional Disparities: Supply and demand imbalances vary significantly by region. Areas with strong job growth and population influx, such as Texas and Florida, often exhibit tighter supply conditions.

- Impact on Pricing: D.R. Horton's average selling price for homes in Q1 2024 was $471,000, reflecting the sustained demand and limited supply in many of its operating markets.

- Inventory Management: The company's ability to manage its inventory levels effectively, aligning production with anticipated demand, is crucial for profitability and avoiding costly price reductions.

Consumer Confidence and Access to Credit

Consumer confidence is a critical driver for D.R. Horton, as it directly impacts the willingness and ability of individuals to purchase new homes. When consumers feel optimistic about the economy and their personal finances, they are more likely to make significant investments like buying a house.

Access to credit, particularly mortgage financing, is equally vital. Favorable lending conditions and readily available mortgage options empower potential buyers to secure the necessary funds. Conversely, stricter lending standards or a downturn in consumer confidence can significantly shrink the market of eligible homebuyers.

- Consumer Confidence Index: The Conference Board's Consumer Confidence Index stood at 102.0 in May 2024, indicating a slight dip from April's 104.7, suggesting a cautious consumer sentiment.

- Mortgage Rates: As of early June 2024, the average 30-year fixed mortgage rate hovered around 7.0%, a level that can impact affordability and buyer demand.

- Credit Availability: While credit markets remain generally accessible, lenders may tighten standards in response to economic uncertainty or rising interest rates, potentially limiting mortgage approvals.

- Homebuyer Affordability: The interplay of home prices, mortgage rates, and consumer income directly affects affordability, a key determinant of demand for new homes.

Economic factors significantly influence D.R. Horton's business, with interest rates and inflation being primary concerns. Rising mortgage rates, like the average 7.0% for a 30-year fixed in early June 2024, directly affect buyer affordability. Inflation, evidenced by a 3.5% increase in the Producer Price Index for construction materials in April 2024, escalates building costs, impacting D.R. Horton's profitability and pricing strategies.

A strong economy and low unemployment, with the U.S. unemployment rate around 3.9% in April 2024, generally boost housing demand. However, persistent inflation and higher interest rates can temper consumer confidence, as indicated by the Conference Board's Consumer Confidence Index at 102.0 in May 2024, creating a cautious market environment.

| Economic Factor | Data Point | Impact on D.R. Horton |

| 30-Year Fixed Mortgage Rate | ~7.0% (Early June 2024) | Reduces buyer affordability, potentially slowing sales. |

| Producer Price Index (Construction Materials) | +3.5% (April 2024) | Increases building costs, squeezing profit margins. |

| U.S. Unemployment Rate | ~3.9% (April 2024) | Supports demand due to stable incomes and job security. |

| Consumer Confidence Index | 102.0 (May 2024) | Reflects consumer sentiment; lower confidence can reduce demand. |

Preview Before You Purchase

D.R. Horton PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive D.R. Horton PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the external forces shaping the housing market and D.R. Horton's position within it.

Sociological factors

Demographic shifts are a major driver for homebuilders like D.R. Horton. For instance, the large millennial generation, born between 1981 and 1996, is now firmly in their prime homebuying years. In 2024, this cohort represents a significant portion of the potential buyer pool. Simultaneously, there's a noticeable rise in single-person households, a trend that influences the demand for smaller, more accessible homes.

D.R. Horton needs to be agile in its product development to meet these changing needs. This means offering a diverse range of housing options, from starter homes suitable for young professionals to larger family residences. The company's ability to anticipate and respond to these evolving household compositions and generational preferences is crucial for sustained success. Furthermore, understanding where people are moving, such as observing the continued population growth in Sun Belt states throughout 2024, directly informs strategic land acquisition decisions.

Evolving lifestyle trends, such as the sustained rise of remote work, are significantly influencing housing preferences. A 2024 survey indicated that over 60% of remote workers desire a dedicated home office space, a feature D.R. Horton is increasingly incorporating. This shift also fuels a demand for larger homes and a move towards suburban and exurban areas offering more space and potentially lower costs of living.

Consumers are also prioritizing community amenities and integrated services, with master-planned communities seeing robust demand. D.R. Horton's focus on these developments, often featuring parks, walking trails, and community centers, aligns with a desire for enhanced quality of life and convenience. This trend is supported by data showing that homes in master-planned communities can command a premium.

Urbanization and suburbanization trends significantly shape D.R. Horton's strategic focus. As of late 2024 and into 2025, the company is actively responding to evolving housing preferences. For instance, while urban centers still attract some buyers, the persistent demand for larger homes and yards continues to fuel suburban growth, a key market for D.R. Horton.

D.R. Horton's success hinges on its adaptability to these demographic movements. In 2024, data indicated that a substantial portion of new home sales, particularly in the Sun Belt regions where D.R. Horton is a major player, continued to favor suburban and exurban locations. This trend suggests that D.R. Horton's ongoing investment in these areas is well-aligned with market demand.

Affordability and Wealth Distribution

The persistent gap between income and housing costs continues to be a significant hurdle for many, especially first-time homebuyers. In 2024, the median home price in the U.S. remained elevated, creating affordability challenges for a broad segment of the population. This societal trend directly influences the demand for entry-level housing options.

D.R. Horton's business model is designed to address these affordability concerns by offering homes across various price points. Their focus on developing communities with more accessible price tags, particularly in 2024 and projected into 2025, directly caters to buyers with limited down payments or lower overall purchasing power. This strategy is crucial for tapping into a larger market share.

- Wealth Disparity: The U.S. Census Bureau reported in 2023 that the top 10% of households held approximately 70% of the nation's wealth, highlighting a significant wealth distribution gap that affects housing accessibility.

- Affordability Index: Housing affordability indexes, which measure the ability of a typical family to afford a median-priced home, have shown declining trends in many markets through 2024, underscoring the pressure on buyers.

- Entry-Level Market Focus: D.R. Horton's continued emphasis on building starter homes and communities in more affordable regions is a direct response to the financial realities faced by a substantial portion of the potential buyer pool.

- Product Development: Understanding the varying financial capacities of different buyer demographics, from young families to retirees, is critical for D.R. Horton's ongoing product development and sales strategies to ensure broad market appeal.

Cultural Values and Homeownership Aspirations

The deeply ingrained cultural value of homeownership in the United States remains a significant driver for D.R. Horton. This aspiration, often seen as a cornerstone of financial security and personal freedom, continues to motivate a substantial portion of the population. In 2024, the National Association of Realtors reported that homeownership rates hovered around 65%, a testament to its enduring appeal.

D.R. Horton strategically aligns its marketing and sales narratives with these fundamental societal desires. By emphasizing the benefits of stability, investment, and a place to call one's own, the company effectively resonates with potential buyers. This connection is crucial, especially as economic conditions evolve, reinforcing the long-term desirability of owning a home.

The company's ability to tap into this cultural imperative is evident in its consistent market presence. For instance, D.R. Horton's 2024 fiscal year saw them deliver over 82,000 homes, showcasing their capacity to meet this persistent demand. This success underscores how well their offerings align with the American dream of homeownership.

Societal attitudes towards homeownership remain a powerful motivator for D.R. Horton. The enduring cultural emphasis on owning a home as a symbol of stability and achievement continues to drive demand, with homeownership rates in the U.S. hovering around 65% in 2024. D.R. Horton’s marketing effectively taps into this aspiration, linking their homes to the concept of the American dream.

The company's substantial delivery volume, exceeding 82,000 homes in their 2024 fiscal year, directly reflects their success in meeting this deep-seated societal desire. This consistent performance underscores the alignment between D.R. Horton's product offerings and the cultural value placed on owning property.

Furthermore, evolving lifestyle preferences, such as the increased demand for home office spaces fueled by remote work, are reshaping housing needs. A 2024 survey indicated over 60% of remote workers desire dedicated office space, a feature D.R. Horton is increasingly integrating into its designs to cater to these shifts.

The persistent affordability challenge, with elevated median home prices in 2024, creates a significant societal hurdle, particularly for first-time buyers. D.R. Horton's strategy of offering homes across various price points, with a continued focus on more accessible entry-level options into 2025, directly addresses this economic reality for a broad segment of the population.

| Societal Factor | 2024 Data/Trend | Impact on D.R. Horton |

|---|---|---|

| Value of Homeownership | Homeownership rate ~65% (2024) | Strong cultural demand, D.R. Horton aligns marketing with this aspiration. |

| Remote Work Impact | >60% remote workers desire home office space (2024) | Increased demand for larger homes with dedicated workspaces. |

| Affordability Challenges | Elevated median home prices (2024) | D.R. Horton's focus on entry-level pricing and diverse price points is crucial. |

Technological factors

D.R. Horton is increasingly leveraging advanced construction techniques like prefabrication and modular building. These methods are crucial for boosting efficiency and shortening project timelines, which is vital in the current housing market. For instance, modular construction can reduce on-site build times by up to 50%, directly addressing labor constraints.

The adoption of off-site assembly also allows for more controlled manufacturing environments, leading to higher and more consistent quality. This is particularly beneficial given the persistent skilled labor shortages impacting the construction industry. In 2024, the U.S. Bureau of Labor Statistics reported a significant gap in skilled construction trades, making these technological adaptations a strategic necessity for D.R. Horton.

By embracing these innovative approaches, D.R. Horton can achieve greater production scalability and maintain a competitive edge. This focus on technological advancement in construction methods is a key factor in their ability to meet demand effectively and manage costs in a dynamic market environment.

The demand for smart home technology is surging, with a significant portion of new homebuyers actively seeking these features. In 2024, surveys indicated that over 60% of prospective buyers consider smart home capabilities a desirable amenity, impacting their purchasing decisions. D.R. Horton's strategic integration of energy-efficient systems, advanced security, and automated controls directly addresses this trend, boosting home desirability and market competitiveness.

By offering smart home features, either as standard inclusions or attractive upgrades, D.R. Horton enhances the perceived value and modern appeal of its properties. This aligns with consumer expectations for convenience and technological advancement in residential living. Keeping pace with evolving smart home innovations is therefore crucial for D.R. Horton to maintain its market position and satisfy the preferences of today's tech-savvy homeowners.

Building Information Modeling (BIM) is increasingly becoming a standard in the construction industry, and D.R. Horton leverages this technology to create sophisticated digital models of its homes. This allows for enhanced collaboration among architects, engineers, and contractors, leading to a significant reduction in design and construction errors. For instance, BIM can identify clashes between different building systems early in the process, potentially saving millions in rework.

The detailed data within BIM models optimizes material procurement and usage, contributing to cost efficiency and waste reduction. D.R. Horton's adoption of BIM directly supports its goal of delivering homes efficiently and affordably. Industry reports from 2024 indicate that BIM adoption can lead to a 10-20% reduction in project costs and a 5-10% improvement in project delivery times.

Furthermore, virtual reality (VR) and augmented reality (AR) are being integrated into the sales process, offering potential buyers immersive walkthroughs of homes before they are built. This technology not only improves client visualization but also streamlines the sales cycle, a critical factor in D.R. Horton's high-volume business model.

Sustainable Building Materials and Energy Efficiency

Technological advancements in sustainable and energy-efficient building materials are increasingly vital for D.R. Horton. Innovations like advanced insulation, integrated solar panels, and high-efficiency HVAC systems are becoming standard expectations. For instance, the U.S. Department of Energy reported that in 2024, homes built to ENERGY STAR standards were 20% more energy-efficient than those built to the latest national building code, translating to lower utility bills for homeowners.

Incorporating these technologies allows D.R. Horton to meet evolving environmental regulations and attract a growing segment of buyers prioritizing sustainability and long-term cost savings. This focus on green building practices can also enhance a home's marketability and resilience. By 2025, it's projected that the global green building materials market will reach over $400 billion, indicating a significant consumer demand.

Continued investment in research and development for these materials can lead to more cost-effective and superior building solutions. This includes exploring materials with lower embodied carbon and improved lifecycle performance. For example, cross-laminated timber (CLT) is gaining traction as a sustainable alternative to concrete and steel, offering both environmental benefits and structural advantages.

- Advanced Insulation: Technologies like spray foam and rigid foam boards offer superior thermal resistance, reducing energy loss.

- Renewable Energy Systems: The integration of rooftop solar panels is becoming more common, with U.S. residential solar installations projected to grow by 15% in 2025.

- High-Efficiency HVAC: Heat pumps and variable-speed air conditioners significantly cut energy consumption compared to traditional systems.

- Sustainable Materials: Use of recycled content, low-VOC paints, and sustainably sourced wood are key technological drivers.

Digital Sales and Marketing Platforms

Digital sales and marketing platforms are fundamentally reshaping how D.R. Horton connects with potential buyers. The increasing reliance on online channels for everything from initial property discovery to virtual tours and even online closings means companies must have a robust digital presence. D.R. Horton's investment in advanced websites, interactive virtual reality tours, and online customization tools directly addresses this shift, aiming to broaden their reach and make the buying process smoother.

Effective digital marketing is no longer optional; it's crucial for capturing the attention of today's homebuyers. These strategies are key to showcasing properties and engaging a wider demographic. For instance, in 2024, online channels are expected to continue their dominance in real estate lead generation, with a significant portion of buyers starting their search on company websites or third-party listing platforms.

- Increased Digital Engagement: Homebuyers increasingly initiate their search and engagement with builders online, making sophisticated websites and virtual tours essential.

- Streamlined Sales Funnel: D.R. Horton utilizes digital tools to guide customers from initial interest through to purchase, improving efficiency.

- Broader Audience Reach: Online platforms allow D.R. Horton to connect with a national and even international audience of potential buyers.

- Data-Driven Marketing: Digital marketing efforts provide measurable results, allowing D.R. Horton to refine strategies based on buyer behavior and engagement metrics.

D.R. Horton's technological strategy centers on integrating advanced construction methods and digital tools to enhance efficiency and buyer experience. The company's embrace of prefabrication and modular building directly combats labor shortages, with modular construction potentially halving on-site build times. This focus on off-site assembly also guarantees more consistent quality, a critical advantage given the persistent skilled labor gaps reported by the U.S. Bureau of Labor Statistics in 2024.

The surge in demand for smart home technology, with over 60% of prospective buyers in 2024 considering these features desirable, is addressed by D.R. Horton's integration of energy-efficient systems and automated controls. Building Information Modeling (BIM) further optimizes design and construction, with industry reports from 2024 suggesting BIM adoption can reduce project costs by 10-20% and improve delivery times by 5-10%. Virtual and augmented reality are also enhancing the sales process, offering immersive walkthroughs and streamlining the buying journey.

Technological advancements in sustainable building materials, such as advanced insulation and high-efficiency HVAC systems, are crucial for D.R. Horton. Homes built to ENERGY STAR standards in 2024 were 20% more energy-efficient, a key selling point. The company's investment in digital sales and marketing platforms, including interactive virtual tours, is vital for reaching today's homebuyers, with online channels dominating real estate lead generation in 2024.

| Technology Area | Impact on D.R. Horton | Key Data/Trend (2024/2025) |

|---|---|---|

| Prefabrication/Modular Construction | Increased efficiency, reduced build times, improved quality control | Modular construction can reduce on-site build times by up to 50%. |

| Smart Home Technology | Enhanced home desirability, meeting buyer expectations | Over 60% of prospective buyers in 2024 consider smart home features desirable. |

| Building Information Modeling (BIM) | Reduced errors, optimized material usage, cost efficiency | BIM adoption can lead to 10-20% reduction in project costs (2024 industry reports). |

| Sustainable/Energy-Efficient Materials | Meeting environmental regulations, attracting eco-conscious buyers | ENERGY STAR homes are 20% more energy-efficient than standard code homes (2024 data). |

| Digital Sales & Marketing | Broader audience reach, streamlined sales funnel, data-driven insights | Online channels continue to dominate real estate lead generation (2024 trend). |

Legal factors

D.R. Horton, like all homebuilders, navigates a labyrinth of federal, state, and local building codes and safety regulations. These rules are the bedrock of construction, covering everything from how a house stands up (structural integrity) to how safe it is in a fire and if everyone can get around it easily (accessibility). They also set standards for the quality of materials used, all of which directly influence the cost and complexity of building.

Staying compliant means D.R. Horton must constantly adapt. For instance, in 2024, many jurisdictions are updating energy efficiency codes, requiring better insulation and window standards. These changes can add thousands to the cost of a new home, impacting affordability for buyers. Furthermore, the International Residential Code (IRC), a widely adopted standard, sees regular updates, meaning D.R. Horton’s design and construction teams must continuously train and adjust their practices and material sourcing to meet the latest requirements.

D.R. Horton must navigate a complex web of environmental protection laws, impacting everything from land acquisition to construction. These regulations cover wetlands, endangered species, air and water quality, and hazardous waste. For instance, in 2023, the Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Water Act, which significantly affects development near waterways.

Failure to comply can lead to substantial financial penalties and project stoppages. In 2024, developers are facing increased scrutiny and potential fines for environmental non-compliance, with some penalties reaching millions of dollars. Environmental impact assessments are a standard requirement, often adding time and cost to D.R. Horton's development timelines.

D.R. Horton, like all homebuilders, must navigate a complex web of consumer protection and warranty laws designed to safeguard homebuyers. These regulations dictate everything from how homes are advertised to the specific warranties offered on new constructions, ensuring transparency and accountability. For instance, many states have disclosure requirements for known defects or issues with a property, and warranty laws often specify the duration and coverage for structural components, plumbing, and electrical systems. In 2024, the Federal Trade Commission (FTC) continued to emphasize enforcement of deceptive advertising practices, a key area impacting homebuilders' marketing.

Failure to comply with these consumer protection mandates can lead to significant legal repercussions, including fines, lawsuits, and damage to D.R. Horton's reputation. Maintaining high standards in disclosures and honoring warranty obligations are therefore not just legal necessities but also critical for building and preserving customer trust. The company's commitment to quality and transparent dealings directly impacts its ability to avoid costly litigation and maintain a positive brand image in the competitive housing market.

Labor Laws and Employment Regulations

D.R. Horton, as a major employer and construction contractor, navigates a complex web of labor laws. These regulations dictate everything from minimum wages and overtime pay to workplace safety standards, such as those enforced by OSHA. For instance, in 2024, the federal minimum wage remains $7.25 per hour, but many states and localities have enacted higher rates, directly affecting D.R. Horton's labor costs in those areas.

Changes in these legal frameworks can significantly influence the company's operational expenses and employment practices. For example, shifts in legislation regarding unionization or stricter enforcement of safety protocols could necessitate increased investment in training and compliance.

The company's ability to attract and retain a skilled construction workforce hinges on its commitment to providing fair wages and safe working conditions.

- Federal Minimum Wage: $7.25 per hour (as of July 2025), though many states have higher rates.

- OSHA Compliance: Adherence to Occupational Safety and Health Administration standards is critical to prevent workplace accidents and associated penalties.

- Worker Classification: Ensuring proper classification of employees versus independent contractors is a key legal consideration to avoid back wages and penalties.

- State-Specific Labor Laws: D.R. Horton must comply with varying state regulations on wages, benefits, and employment practices across its operating regions.

Land Use and Property Rights Legislation

Laws dictating land acquisition, property rights, and eminent domain are crucial for D.R. Horton's growth, directly impacting where and how they can build. Zoning regulations, which can change, also play a significant role in project feasibility and timing. For instance, in 2024, the housing market continued to see localized zoning battles impact development timelines across various states.

Legal hurdles, such as disputes over land entitlements or community opposition to new developments, can lead to costly delays and increased expenses for D.R. Horton. These challenges are common in the homebuilding industry, where local regulations and resident concerns often intersect. In 2023, several large-scale D.R. Horton projects faced permit delays due to environmental impact reviews and zoning appeals.

- Land Acquisition Laws: D.R. Horton must comply with federal, state, and local regulations concerning the purchase and ownership of land, influencing site selection and expansion.

- Property Rights and Zoning: Understanding and adhering to property rights legislation and zoning ordinances is essential for obtaining development permits and avoiding legal challenges.

- Eminent Domain: While less common for private developers, the government's power of eminent domain can impact land availability and value in areas targeted for infrastructure improvements that might indirectly affect D.R. Horton's projects.

- Legal Challenges: The company frequently navigates legal complexities related to land use, environmental compliance, and community objections, which can significantly affect project schedules and budgets.

D.R. Horton's operations are heavily influenced by a dynamic legal landscape, encompassing building codes, environmental regulations, consumer protection laws, labor standards, and land use ordinances. Staying abreast of these evolving legal requirements is paramount for compliance and operational efficiency.

In 2024, the company continues to navigate updated building codes, such as those pertaining to energy efficiency, which can increase construction costs. Environmental laws, including the Clean Water Act, also necessitate careful compliance, with potential fines for violations. Consumer protection laws and warranty requirements demand transparency and accountability in sales and post-sale service.

Labor laws, including minimum wage and safety standards enforced by OSHA, directly impact operational expenses and workforce management. Furthermore, land acquisition and zoning laws, along with potential community objections, can significantly affect development timelines and project feasibility. Legal challenges related to these areas are a constant consideration for D.R. Horton.

Environmental factors

The increasing frequency and intensity of extreme weather events, like hurricanes and wildfires, pose significant challenges for D.R. Horton. These events directly affect construction schedules, the availability and cost of building materials, and insurance premiums. For instance, in 2023, the U.S. experienced 28 separate weather and climate disasters with losses exceeding $1 billion each, totaling over $150 billion in damages, according to NOAA.

Building homes in areas prone to these risks necessitates incorporating more resilient construction methods and factoring in future climate projections. D.R. Horton must consider how events like increased rainfall or higher temperatures might impact building foundations and energy efficiency, potentially increasing upfront costs but reducing long-term risks and maintenance for homeowners.

Furthermore, the escalating threat of extreme weather can alter property desirability and market value. Regions frequently impacted by floods or wildfires may see decreased demand or reduced property appreciation, influencing D.R. Horton's land acquisition and development strategies in such locations.

D.R. Horton, like all homebuilders, is heavily influenced by the availability and cost of key natural resources. Timber prices, for example, have seen significant volatility. In 2023, lumber futures experienced fluctuations, impacting construction budgets. Water usage during construction and for landscaping also presents an environmental challenge, particularly in drought-prone regions where D.R. Horton operates extensively.

The rising cost of energy, impacting everything from material transportation to on-site power, is another crucial factor. D.R. Horton's commitment to sustainable sourcing and efficient resource management is therefore not just an environmental consideration but a direct driver of cost control and profitability. The company is increasingly exploring and adopting building materials with lower environmental footprints, such as recycled content and sustainably harvested wood, to mitigate these risks and meet growing consumer demand for eco-friendly homes.

D.R. Horton, like many in the homebuilding sector, faces increasing pressure from consumers and regulators to adopt sustainable building practices. This trend is reflected in growing demand for homes that are energy-efficient and environmentally friendly. For instance, the U.S. Green Building Council reported a steady rise in LEED certifications across various building types, indicating a broader market shift towards green construction by 2024.

Adhering to recognized green building standards, such as Energy Star or local building codes, can significantly boost a home's appeal and lower its long-term operating expenses for homeowners. This translates to potential cost savings on utilities, a key selling point in the current market. By 2025, it's projected that homes with superior energy efficiency will command a premium, making compliance a strategic advantage.

Investing in sustainable design and construction is evolving from a niche consideration to a crucial competitive differentiator for D.R. Horton. Builders who proactively integrate green technologies and materials are better positioned to attract environmentally conscious buyers and potentially reduce construction waste, aligning with evolving industry best practices and consumer preferences.

Waste Management and Recycling in Construction

The construction sector is a significant contributor to waste generation, making robust waste management and recycling essential for both regulatory adherence and financial prudence. D.R. Horton actively works to minimize construction debris, redirect materials away from landfills, and identify avenues for recycling and material reuse.

Effective waste management strategies are not just about compliance; they are a core component of D.R. Horton's commitment to environmental stewardship. By focusing on diversion and reuse, the company aims to lessen its ecological footprint.

- Waste Diversion Goals: D.R. Horton aims to divert a significant percentage of construction waste from landfills, with targets often set in the range of 75% or higher for many projects, reflecting industry best practices and regulatory pressures.

- Recycling Initiatives: Common materials recycled include concrete, drywall, wood, metals, and asphalt. For instance, recycled concrete can be used as aggregate in new construction projects, reducing the need for virgin materials.

- Cost Savings: Implementing efficient waste management can lead to substantial cost reductions through lower disposal fees and potential revenue from selling recyclable materials. Studies suggest that effective waste reduction can save construction companies up to 10% on project costs.

- Regulatory Compliance: Adhering to local and national environmental regulations regarding waste disposal and recycling is paramount. Non-compliance can result in hefty fines and project delays.

Water Conservation and Landscaping Requirements

Growing concerns about water scarcity are driving stricter regulations and a stronger consumer demand for homes and landscapes that use less water. For D.R. Horton, this means integrating water-saving fixtures, drought-tolerant plants, and smart irrigation systems into their building plans. These adaptations not only ensure compliance with evolving environmental rules but also attract buyers looking for reduced utility costs and a commitment to sustainability. In 2024, for instance, several states in the American Southwest saw significant water restrictions, influencing new homebuyer preferences towards water-wise features.

These environmental shifts translate into tangible operational considerations for D.R. Horton:

- Regulatory Compliance: Adhering to local and state water usage mandates, which can vary significantly by region.

- Design Integration: Incorporating low-flow toilets, efficient showerheads, and xeriscaping principles in new developments.

- Consumer Demand: Capitalizing on the market trend for eco-friendly and cost-saving home features, boosting sales appeal.

- Operational Efficiency: Implementing water-efficient construction practices to minimize waste during the building process.

D.R. Horton faces significant risks from extreme weather events, with 2023 seeing 28 U.S. disasters exceeding $1 billion in damages, totaling over $150 billion. This necessitates resilient construction and consideration of climate impacts on foundations and energy efficiency.

The company must also manage volatile natural resource costs, such as lumber, and address water usage in construction, especially in drought-prone areas. By 2025, energy-efficient homes are projected to command a premium, making sustainable practices a competitive advantage.

Increasing regulatory and consumer pressure for sustainable building practices is evident, with a rise in green certifications by 2024. D.R. Horton's waste diversion goals often exceed 75%, and effective management can reduce project costs by up to 10%.

Water scarcity concerns are leading to stricter regulations and demand for water-wise homes. By 2024, water restrictions in some states are influencing buyer preferences towards features that reduce utility costs.

| Environmental Factor | Impact on D.R. Horton | 2023/2024 Data/Trend |

| Extreme Weather Events | Construction delays, material costs, insurance, property desirability | 28 U.S. billion-dollar disasters in 2023; total damages over $150 billion. |

| Natural Resource Availability & Cost | Volatility in timber prices, water usage challenges | Lumber futures experienced fluctuations in 2023. |

| Sustainability & Green Building | Consumer demand, regulatory compliance, competitive advantage | Steady rise in LEED certifications by 2024; energy-efficient homes projected to command a premium by 2025. |

| Waste Management | Cost savings, regulatory compliance, environmental stewardship | Targets often exceed 75% waste diversion; effective reduction can save up to 10% on project costs. |

| Water Scarcity | Stricter regulations, demand for water-wise features | Increased water restrictions in some U.S. regions influencing buyer preferences in 2024. |

PESTLE Analysis Data Sources

Our D.R. Horton PESTLE Analysis is built on a robust foundation of data from government housing statistics, economic forecasting reports, and industry-specific publications. We incorporate insights from regulatory bodies, market research firms, and technological trend analyses to provide a comprehensive view.