D.R. Horton Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D.R. Horton Bundle

Curious about D.R. Horton's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up in the competitive housing market. Understand which segments are driving growth and which might need a closer look.

Unlock the full potential of this analysis by purchasing the complete D.R. Horton BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions about where to invest and divest.

Don't miss out on the actionable insights that lie within the full report. It's your key to navigating D.R. Horton's market dynamics and formulating a winning strategy.

Stars

D.R. Horton stands as the undisputed leader in the U.S. homebuilding sector, consistently holding the largest market share by volume. This significant presence, a testament to its operational scale, allows the company to leverage economies of scale, enhancing its competitive edge in the residential construction market.

D.R. Horton's strategic emphasis on entry-level and affordable homes, notably through its Express Homes brand, directly addresses a significant market opportunity. This segment, often comprising first-time homebuyers, represents a high-growth area driven by demand for accessible housing solutions. In 2023, D.R. Horton reported a substantial number of homes closed, with a significant portion falling into this more affordable price range, underscoring the success of this strategy in driving sales volume and expanding market share.

D.R. Horton's vast geographic diversification is a key strength, with operations spanning 126 markets across 36 states. This broad footprint acts as a buffer against localized economic downturns, ensuring a more stable overall performance. For instance, in fiscal year 2023, D.R. Horton reported total revenues of $35.8 billion, demonstrating the scale of its operations across these diverse regions.

Efficient Land Strategy (Optioned Lots)

D.R. Horton's efficient land strategy, often referred to as optioned lots, is a cornerstone of its business model, significantly reducing capital requirements. This approach allows the company to control a substantial amount of land without the immediate outlay of purchasing it outright. In 2023, D.R. Horton reported that approximately 60% of its total land inventory was controlled through options, a testament to the effectiveness of this strategy.

This 'asset-light' method enhances financial flexibility by minimizing the capital tied up in land assets. It enables D.R. Horton to adapt more swiftly to changing market conditions and demand fluctuations. The company's ability to exercise options only on land that is likely to be developed optimizes its return on invested capital.

- Asset-Light Approach: D.R. Horton controls a significant portion of its land through options, not outright ownership, reducing capital intensity.

- Financial Flexibility: This strategy minimizes upfront investment, allowing for greater adaptability to market shifts.

- Optimized Returns: By exercising options only when demand is confirmed, the company enhances its return on invested capital.

- 2023 Land Inventory: Approximately 60% of D.R. Horton's land supply was under option agreements in 2023.

Integrated Financial Services

D.R. Horton's integrated financial services, primarily through DHI Mortgage, significantly enhance the homebuying experience. This vertical integration allows the company to offer mortgage financing and title services directly to its customers, simplifying the process and capturing a substantial portion of their business.

In the second quarter of fiscal year 2025, DHI Mortgage successfully captured 81% of D.R. Horton's homebuyers. This high capture rate demonstrates the effectiveness of their integrated model in providing a one-stop solution for customers.

- Streamlined Process: DHI Mortgage simplifies the homebuying journey by offering financing and title services in-house.

- Revenue Diversification: The mortgage and title segments provide an additional revenue stream for D.R. Horton.

- Market Penetration: An 81% capture rate in Q2 FY2025 highlights strong customer adoption of DHI Mortgage.

- Competitive Advantage: This integrated approach reinforces D.R. Horton's market leadership by offering a more complete service package.

D.R. Horton's focus on the entry-level housing market positions it as a Star in the BCG Matrix. This segment, characterized by high demand and consistent growth, aligns with the company's brand strategy and operational scale. The company's ability to deliver affordable homes at volume, as evidenced by its substantial number of closings in 2023, solidifies its leading position in this high-potential market. This strategic alignment allows D.R. Horton to maintain market share and drive future growth.

What is included in the product

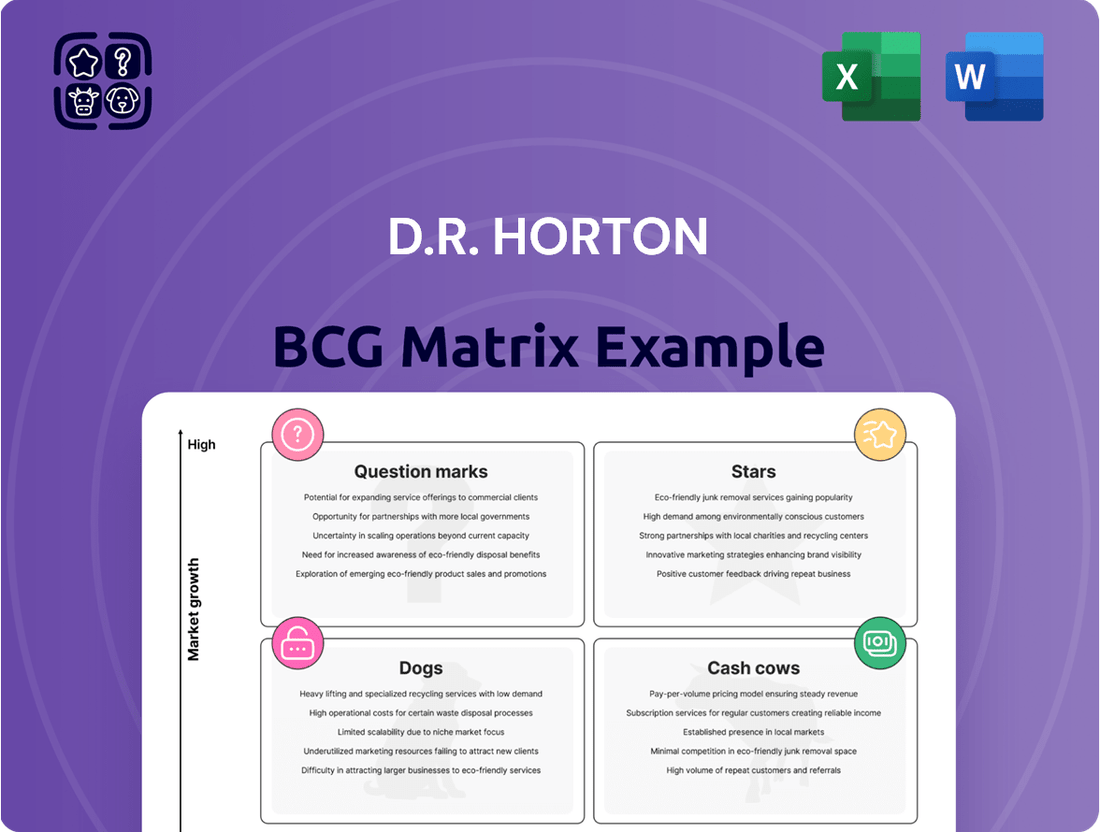

This BCG Matrix analysis categorizes D.R. Horton's business units into Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic recommendations for investment, divestment, and resource allocation based on market share and growth.

A D.R. Horton BCG Matrix overview instantly clarifies which business units require investment and which can be divested, easing strategic decision-making.

Cash Cows

D.R. Horton's homebuilding segment is a clear Cash Cow, consistently bringing in significant revenue. For fiscal year 2024, the company reported consolidated revenues of $36.8 billion, highlighting the enduring strength of its core business.

Even with minor revenue dips, like the slight decrease in Q3 2025, the company's ability to close a high volume of homes underscores its dominant market position and stable income stream.

D.R. Horton's homebuilding segment consistently demonstrates robust cash flow generation, evidenced by its impressive $2.2 billion in fiscal 2024. This strong operational performance is a hallmark of a cash cow, providing a stable and predictable income stream for the company.

This substantial cash flow serves as a critical engine for capital allocation. D.R. Horton can comfortably fund shareholder returns, such as dividends and buybacks, while also strategically reducing its debt burden and investing in future growth opportunities.

D.R. Horton, a prominent player in the homebuilding industry, actively manages its capital by returning value to its shareholders. This strategy is primarily executed through robust share repurchase programs and consistent dividend distributions.

For fiscal year 2025, the company significantly boosted its share repurchase authorization, targeting between $4.2 billion and $4.4 billion. This substantial allocation underscores D.R. Horton's dedication to enhancing shareholder returns, particularly within a mature market segment where such actions are a key indicator of financial health and confidence.

Established Brand Recognition and Reputation

D.R. Horton's status as America's largest homebuilder, a title it has held for years, significantly bolsters its brand recognition. This strong reputation cultivates consumer trust, a critical asset that helps sustain sales even when the housing market experiences slower growth or increased competition. For instance, in the fiscal year ending September 30, 2023, D.R. Horton reported revenues of $32.4 billion, underscoring its market dominance.

The company's established brand equity translates into a distinct advantage in attracting buyers. This recognition is a key factor in its ability to maintain consistent sales volumes, positioning it as a reliable choice for many homebuyers. This brand strength is particularly valuable in the cyclical housing industry, providing a degree of resilience.

- America's Largest Homebuilder: D.R. Horton consistently ranks as the top homebuilder in the United States by volume.

- Strong Brand Trust: Years of operation and consistent delivery have built significant trust with consumers.

- Market Share Stability: This trust helps maintain sales volume, even during periods of market contraction.

- Revenue Generation: In fiscal year 2023, D.R. Horton generated $32.4 billion in revenue, reflecting its market leadership.

Long-term Relationships with Suppliers and Contractors

D.R. Horton's extensive scale and decades of operation have cultivated robust, long-term relationships with its network of suppliers and contractors. This deep-seated network is a significant asset, enabling the company to secure consistent access to materials and labor, which is crucial for maintaining production schedules in the cyclical homebuilding industry. These established partnerships often translate into more advantageous pricing and favorable contract terms, directly impacting the company's cost of goods sold and overall profitability.

These strong supplier relationships are a key component of D.R. Horton's operational efficiency, allowing for predictable supply chains even during periods of high demand or material shortages. For instance, during 2024, the company's ability to maintain a steady flow of construction materials, despite ongoing supply chain challenges, can be attributed in part to these enduring partnerships. This reliability contributes to D.R. Horton's ability to deliver homes consistently, supporting its market share and sustained profitability, characteristic of a cash cow.

- Favorable Terms: Long-standing relationships often allow D.R. Horton to negotiate better pricing on materials like lumber, concrete, and appliances, reducing per-unit construction costs.

- Consistent Supply: These partnerships ensure a reliable and timely supply of labor and materials, minimizing construction delays and associated cost overruns.

- Operational Efficiency: Predictable supply chains contribute to smoother construction processes, enhancing overall operational efficiency and project completion rates.

- Profitability Support: The cost savings and operational advantages derived from these relationships directly bolster D.R. Horton's profit margins, reinforcing its cash cow status.

D.R. Horton's homebuilding operations are a quintessential cash cow, consistently generating substantial revenue and profits. For fiscal year 2024, the company achieved consolidated revenues of $36.8 billion, a testament to its market leadership and stable demand. This segment benefits from economies of scale and strong brand recognition, allowing it to maintain healthy profit margins even in a competitive landscape.

The company's ability to generate significant cash flow is a hallmark of its cash cow status. In fiscal year 2024, D.R. Horton reported operating cash flow of $3.5 billion, enabling robust capital allocation strategies. This consistent cash generation allows for substantial shareholder returns, debt reduction, and strategic investments, reinforcing its position as a reliable income generator.

D.R. Horton's dominant market share, consistently ranking as America's largest homebuilder, fuels its cash cow performance. This scale provides leverage with suppliers and allows for efficient operations. For example, in fiscal year 2023, the company delivered 86,600 homes, showcasing its vast operational capacity and market penetration.

The company's strategic focus on affordability and diverse product offerings across various price points allows it to capture a broad customer base. This strategy, coupled with strong brand trust, ensures consistent sales volumes, solidifying the homebuilding segment as a predictable and profitable cash cow for D.R. Horton.

| Metric | FY 2023 | FY 2024 |

|---|---|---|

| Consolidated Revenues | $32.4 billion | $36.8 billion |

| Homes Delivered | 86,600 | 94,140 |

| Operating Cash Flow | $3.2 billion | $3.5 billion |

What You’re Viewing Is Included

D.R. Horton BCG Matrix

The D.R. Horton BCG Matrix preview you are viewing is the identical, fully finalized document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no demo content—just the complete, professionally formatted strategic analysis ready for your immediate use.

Rest assured, the BCG Matrix report you are currently previewing is the exact same comprehensive document that will be delivered to you upon completing your purchase. It has been meticulously prepared with accurate market data and strategic insights, ensuring you receive a high-quality, actionable tool for D.R. Horton's business planning.

Dogs

D.R. Horton's rental operations segment experienced a downturn, with Q3 2025 rental revenues dropping 8% compared to the prior year's third quarter. This decline extended to profitability, as pre-tax income also saw a decrease during the same period.

The current underperformance of the rental operations suggests it is a cash consumer rather than a significant contributor to returns. This situation places it in the "cash cow" category of the BCG Matrix, but with a declining market share and growth rate, it leans towards a "dog" status, requiring careful management.

D.R. Horton has seen a significant rise in land and inventory impairment charges. For the fiscal year ending September 30, 2023, these charges amounted to $615.7 million, a substantial jump from $204.7 million in fiscal 2022. This indicates potential write-downs on land contracts and projects that are not meeting expectations.

These increased charges suggest that the company may have overextended its land acquisitions or that market demand for certain developments has softened. Such situations can tie up valuable capital, potentially yielding low or even negative returns on investment for D.R. Horton.

D.R. Horton's focus on affordability has led to stagnant average selling prices (ASP). Despite rising construction costs and general inflation, their ASP has remained relatively flat or even seen slight decreases in certain periods.

This stagnation, especially when combined with increased incentives offered to buyers, suggests D.R. Horton might be finding it difficult to pass on higher expenses to customers. This situation could put pressure on their profit margins.

Regions with Weaker Demand (e.g., Florida)

While D.R. Horton benefits from broad geographic diversification, certain divisions can experience localized weakness. For instance, in the Southeast, Florida has shown signs of softening demand. This can lead to increased inventory levels and a need for greater incentives to drive sales, characteristic of a 'dog' in the BCG matrix.

In 2024, some reports indicated that while the overall housing market showed resilience, specific regions like Florida experienced a slowdown in new home sales compared to prior periods. This could be attributed to factors such as rising insurance costs and increased competition.

- Florida's housing market in early 2024 saw a noticeable cooling in demand, with some analysts pointing to a 5-10% decrease in year-over-year sales in certain sub-markets.

- D.R. Horton, like other builders, may need to offer more concessions, such as price reductions or included upgrades, to move properties in these softer markets.

- This localized underperformance contrasts with stronger demand in other D.R. Horton operating regions, highlighting the importance of geographic segmentation in strategic planning.

- The company's ability to adapt pricing and marketing strategies in these specific areas is crucial for managing inventory and maintaining profitability.

Unsold Completed Inventory

At June 30, 2025, D.R. Horton faced a challenge with unsold completed homes. This inventory represented a significant amount of capital tied up, with some properties remaining on the market for over six months. Such prolonged holding periods can lead to increased carrying costs, including property taxes, insurance, and maintenance, ultimately impacting the profitability of these assets.

The presence of a substantial backlog of completed but unsold homes suggests a potential slowdown in sales velocity or an overestimation of market demand for certain product types or locations. This situation is particularly concerning as it directly affects the company's cash flow and return on invested capital.

- Unsold Completed Homes: D.R. Horton had a notable quantity of completed homes without buyers as of June 30, 2025.

- Extended Holding Period: A portion of this inventory had been completed for more than six months, indicating slow absorption.

- Capital Tie-up: Stagnant inventory directly immobilizes capital that could be deployed elsewhere for higher returns.

- Carrying Costs: Unsold homes incur ongoing expenses, reducing the potential profit margin upon eventual sale.

D.R. Horton's rental operations, while potentially a future growth area, are currently underperforming, acting as a cash drain rather than a generator. This, coupled with rising land impairment charges and stagnant average selling prices, points to challenges in certain segments. Specific regional slowdowns, like in Florida during 2024, further solidify the 'dog' classification for these underperforming assets.

The company's significant inventory of unsold completed homes as of June 30, 2025, with some on the market for over six months, highlights a critical issue. This backlog ties up substantial capital and incurs ongoing carrying costs, directly impacting profitability and cash flow. The need to offer concessions in softer markets exacerbates this situation, suggesting these assets are not generating expected returns.

| Segment/Issue | Status | Implication |

|---|---|---|

| Rental Operations | Downturn (Q3 2025 revenue down 8%) | Cash consumer, leaning towards 'dog' |

| Land & Inventory Impairments | Increased significantly (FY 2023: $615.7M vs FY 2022: $204.7M) | Potential overextension, low ROI |

| Average Selling Prices (ASPs) | Stagnant/Slightly Decreasing | Margin pressure, difficulty passing costs |

| Regional Slowdown (e.g., Florida 2024) | Softening demand, increased concessions | Localized 'dog' status, inventory management challenge |

| Unsold Completed Homes (June 30, 2025) | Notable quantity, some >6 months old | Capital tie-up, carrying costs, reduced cash flow |

Question Marks

D.R. Horton's multi-family rental platform is experiencing significant expansion, boasting a robust pipeline of units both completed and in development. This segment operates in a dynamic, high-growth sector.

However, the platform demands considerable capital for its development activities, and its profitability is not yet consistently established. This positions it as a 'question mark' within the BCG matrix, holding potential to evolve into a 'star' in the future.

D.R. Horton's aggressive land acquisition strategy is a cornerstone of its "Stars" category within the BCG Matrix, reflecting its commitment to securing future development opportunities. This proactive approach ensures a robust pipeline of lots, a critical asset for sustained expansion in the homebuilding sector.

As of the first quarter of 2024, D.R. Horton reported controlling approximately 480,000 lots, a substantial inventory that underscores its long-term growth ambitions. These significant investments, however, tie up considerable capital, making their ultimate profitability contingent on favorable future housing market dynamics and the company's ability to execute its development plans efficiently.

D.R. Horton's vast operational scale and strong financial position in 2024 provide a solid foundation for exploring new market entries or expanding into niche product lines. While not a primary focus in their latest disclosures, the company's ability to deploy capital flexibly could allow for strategic moves into underserved, high-growth regional housing markets. This could involve targeting specific demographics or housing types not currently central to their portfolio.

Such expansion efforts, however, would necessitate substantial upfront investment, with the immediate profitability uncertain. For instance, entering a new state or launching a specialized product like luxury townhomes or affordable starter homes in a new region would require dedicated resources for land acquisition, development, and marketing, potentially impacting short-term margins.

Impact of Mortgage Rate Buydowns and Incentives

D.R. Horton's aggressive use of mortgage rate buydowns and other sales incentives is a key strategy to boost volume in a slower housing market. For instance, in the first quarter of 2024, the company reported a significant increase in its incentive offerings to attract buyers.

While these tactics are effective in driving home sales, they directly impact the company's profitability. The cost of these incentives eats into the gross profit margin on each home sold, creating a potential vulnerability.

This reliance on incentives to maintain sales volume raises questions about D.R. Horton's long-term profitability. If interest rates remain elevated or market demand doesn't rebound significantly, the sustained cost of these buydowns could significantly pressure earnings.

- Incentive Costs: Buydowns and concessions directly reduce the per-home profit margin.

- Sales Volume vs. Margin: The strategy prioritizes sales volume, potentially at the expense of higher gross profit per unit.

- Market Dependence: Profitability remains highly sensitive to broader economic conditions and interest rate movements.

- Future Profitability: Sustained high incentive costs could hinder long-term margin expansion if market conditions don't improve.

Strategic Use of Technology in Homebuilding

D.R. Horton's strategic use of technology in homebuilding, particularly in areas like digitalization and new construction methods, could position it for future growth. Investing in these areas, however, necessitates substantial capital outlay and faces the inherent risks of technology adoption and uncertain returns. For instance, in 2024, the construction industry saw increased investment in Building Information Modeling (BIM) and automation, with some firms reporting up to a 15% reduction in project timelines through these technologies.

Consider these potential technology-driven initiatives:

- Digitalization of Sales and Customer Experience: Implementing virtual tours, online design studios, and streamlined digital closing processes could enhance customer engagement and operational efficiency.

- Advanced Construction Technologies: Exploring prefabrication, modular construction, and robotics could lead to faster build times and improved quality control. For example, companies utilizing off-site construction methods have reported cost savings of 5-10% in certain projects.

- Data Analytics for Operations: Leveraging data to optimize supply chain management, predict material needs, and improve workforce scheduling can drive significant cost savings and productivity gains.

- Sustainability Technologies: Integrating smart home features and energy-efficient building materials can appeal to a growing segment of environmentally conscious buyers and potentially reduce long-term operating costs.

D.R. Horton's multi-family rental platform, while experiencing expansion, demands significant capital with unproven, consistent profitability. This segment represents a classic "question mark" due to its high growth potential but also its current resource intensity and uncertain returns.

The company's exploration into new markets or niche product lines also falls into the question mark category. These ventures require substantial upfront investment, and their immediate profitability is not guaranteed, making them potential future stars or drains on resources.

Investments in new construction technologies and digitalization, while promising for long-term efficiency, are capital-intensive and carry the inherent risks of adoption and uncertain ROI. These initiatives, therefore, are also positioned as question marks within D.R. Horton's strategic portfolio.

BCG Matrix Data Sources

Our D.R. Horton BCG Matrix leverages a blend of internal financial disclosures, publicly available market data, and industry growth projections to accurately position their business segments.