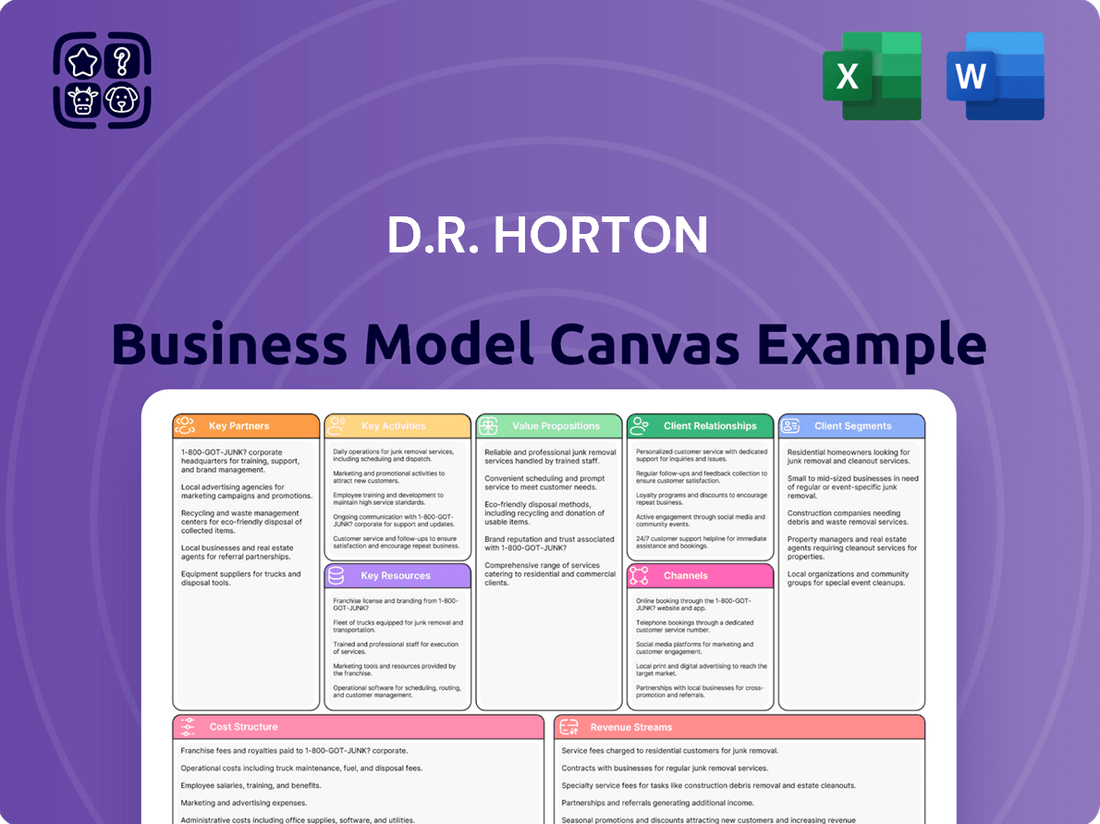

D.R. Horton Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D.R. Horton Bundle

Unlock the strategic blueprint behind D.R. Horton's industry dominance with our comprehensive Business Model Canvas. This detailed analysis dissects their customer segments, value propositions, and revenue streams, offering a clear picture of their operational success. Ideal for anyone seeking to understand how a leading homebuilder thrives in a dynamic market.

Partnerships

D.R. Horton's strategic alliance with Forestar Group Inc., a major residential lot developer where D.R. Horton holds a controlling interest, is a cornerstone of its operational strategy. This partnership guarantees a steady and predictable flow of lots ready for construction, directly boosting D.R. Horton's financial efficiency and operational agility.

By controlling a substantial portion of its lots through options rather than direct ownership, D.R. Horton maintains an asset-light model. This approach, exemplified by its relationship with Forestar, allows for greater flexibility in managing capital and responding to market shifts. As of early 2024, Forestar's substantial lot position, managed through this integrated model, underpins D.R. Horton's capacity to scale operations effectively.

D.R. Horton's success hinges on its extensive network of material and component suppliers. These partnerships are critical for securing everything from lumber and drywall to plumbing fixtures and roofing materials, ensuring construction projects stay on schedule and within budget.

The sheer volume of D.R. Horton's operations, completing over 100,000 homes in 2023, grants significant leverage in negotiating pricing and terms with these suppliers. This scale is vital for managing costs, especially in a market where material prices can fluctuate significantly, as seen with the volatility in lumber prices throughout 2023 and early 2024.

D.R. Horton relies heavily on a vast network of trade partners and subcontractors for everything from framing to intricate finishing work. These skilled professionals are the backbone of their rapid construction process, ensuring homes are built efficiently and to a high standard.

Maintaining robust relationships with these partners is crucial for D.R. Horton to control labor costs and uphold quality across their diverse projects. In 2023, D.R. Horton reported that its cost of sales, which includes payments to subcontractors, represented a significant portion of its revenue, underscoring the importance of these partnerships.

Financial Institutions and Mortgage Lenders

D.R. Horton leverages key partnerships with financial institutions and mortgage lenders beyond its in-house DHI Mortgage. These collaborations are crucial for offering a wider array of financing solutions to potential homebuyers, thereby facilitating smoother and more accessible transactions. In 2024, this approach continues to be vital in a market where diverse financing options can significantly impact sales volume.

These external partnerships not only broaden access to capital for D.R. Horton’s customers but also bolster the company's financial services segment. By working with various lenders, D.R. Horton ensures that more buyers can secure the necessary funding, which directly supports its sales pipeline and overall revenue generation. This strategic network is a cornerstone of their business model, aiming to provide a complete homeownership solution.

- Expanded Financing Options: Partnerships provide buyers with access to a wider range of mortgage products and rates than DHI Mortgage might offer alone.

- Increased Sales Conversion: By accommodating more buyer financial profiles, these alliances help convert more leads into closed sales.

- Risk Mitigation: Diversifying financing partners can help mitigate risks associated with reliance on a single mortgage origination channel.

- Complementary Services: Collaborations can extend to other financial services, creating a more integrated and attractive offering for buyers.

Real Estate Agents and Brokers

External real estate agents and brokers are crucial partners for D.R. Horton, acting as a vital bridge to potential homebuyers. These collaborations significantly broaden D.R. Horton's market penetration and diversify its sales avenues. In 2024, D.R. Horton reported that a substantial portion of its sales were facilitated through real estate agents, underscoring their importance in reaching a wider customer base and leveraging local market expertise.

These partnerships are particularly valuable in navigating competitive housing markets where established relationships and deep buyer insights are paramount. Agents and brokers contribute directly to lead generation, identifying and nurturing prospective buyers. Furthermore, they play a key role in the smooth facilitation of transactions, ensuring a more efficient closing process for D.R. Horton homes.

- Expanded Reach: Real estate agents and brokers open up new channels to connect with buyers who might not directly engage with D.R. Horton's marketing efforts.

- Local Market Expertise: Their understanding of local demand, pricing, and buyer preferences is invaluable for D.R. Horton's sales strategies.

- Lead Generation: Agents actively bring qualified leads to D.R. Horton, reducing the company's direct marketing burden.

- Transaction Facilitation: They streamline the buying process, from initial interest to closing, enhancing customer experience.

D.R. Horton's key partnerships extend to technology providers for its construction and sales platforms. These collaborations enhance operational efficiency and customer engagement, crucial in a competitive market. For instance, integrating advanced CRM systems and construction management software streamlines processes from initial contact to home delivery, with D.R. Horton actively adopting digital tools throughout 2023 and into 2024 to improve project tracking and customer communication.

What is included in the product

This D.R. Horton Business Model Canvas outlines a strategy focused on delivering affordable, quality homes to first-time and move-up buyers through efficient land acquisition, streamlined construction, and broad distribution channels.

It details customer segments, value propositions, and revenue streams, reflecting the company's scale and market penetration in the homebuilding industry.

D.R. Horton's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, allowing for rapid identification of efficiencies and potential bottlenecks in homebuilding.

This structured approach helps D.R. Horton streamline complex processes, reducing the pain of inefficient resource allocation and project management.

Activities

D.R. Horton's core operations revolve around identifying, acquiring, and developing land for new residential communities. This crucial step involves thorough due diligence, navigating zoning regulations, and investing in necessary infrastructure to prepare sites for home construction.

The company's strategic alignment with Forestar Group Inc. plays a vital role in this land acquisition and development process. Forestar provides D.R. Horton with a steady stream of finished lots, streamlining the development pipeline and ensuring a consistent supply for their building operations.

In 2023, D.R. Horton reported land and lot inventory valued at approximately $15.8 billion. This substantial investment underscores the importance of their land acquisition and development activities in fueling their market presence.

Home construction and project management are D.R. Horton's core operational activities. This involves everything from initial design and securing permits to the actual building and rigorous quality checks. Effective management of these processes is essential for keeping projects on schedule, managing expenses, and ensuring homes are built to high standards.

D.R. Horton emphasizes streamlining its construction cycle times. For instance, in the fiscal year 2023, the company delivered 76,872 homes, showcasing their ability to manage a high volume of projects efficiently.

D.R. Horton's key sales and marketing activities revolve around actively promoting its homes to a broad audience of potential buyers. This includes managing a network of sales centers, which serve as crucial touchpoints for customer interaction and engagement. Direct sales efforts are paramount, with dedicated teams working to guide customers through the purchasing process.

Developing and executing comprehensive marketing campaigns is essential. D.R. Horton utilizes a variety of channels to reach its target demographics, employing strategies designed to capture interest and drive demand. Offering incentives, such as mortgage rate buydowns, is a common tactic to make homeownership more accessible and appealing, especially in fluctuating market conditions.

In 2024, D.R. Horton reported significant sales activity. For the fiscal year ended September 30, 2024, the company's total revenue reached $32.4 billion, with home sales revenue accounting for the majority of this figure. This highlights the effectiveness of their sales and marketing engine in generating substantial business volume.

Mortgage and Title Services Provision

D.R. Horton's commitment to vertical integration shines through its mortgage and title services, primarily through DHI Mortgage and its affiliated title companies. This strategic move ensures a streamlined home-buying journey for customers by offering in-house financing and title insurance solutions. It's not just about convenience; it’s a significant revenue driver for the company.

This integrated approach allows D.R. Horton to maintain tighter control over the entire sales cycle, from initial purchase to closing. By keeping these crucial services in-house, they can better manage timelines and customer experience, ultimately enhancing profitability. For the fiscal year ending September 30, 2023, D.R. Horton's mortgage segment, DHI Mortgage, generated approximately $1.2 billion in revenue, highlighting the financial impact of these integrated services.

- Vertical Integration: DHI Mortgage and title services are core to D.R. Horton's operational model, providing a seamless experience for homebuyers.

- Revenue Generation: These in-house services capture additional revenue streams beyond home sales, contributing significantly to overall financial performance.

- Process Control: Offering these services internally grants D.R. Horton greater oversight and efficiency in managing the closing process.

- Customer Convenience: Bundling mortgage and title services simplifies the complex home-buying process for D.R. Horton's customers.

Rental Property Development and Management

D.R. Horton actively develops, constructs, and manages both single-family and multi-family rental properties. This segment of their business involves strategically selecting locations, overseeing the entire construction process, and then deciding whether to operate these properties as long-term rentals or sell them in larger packages to institutional investors.

This diversification strategy allows D.R. Horton to generate revenue streams beyond its core home-building and selling operations. For instance, in the first quarter of fiscal year 2024, D.R. Horton reported a significant increase in its rental revenue, showcasing the growing contribution of this segment to its overall financial performance.

- Property Identification and Acquisition: D.R. Horton identifies and acquires land suitable for rental property development, considering market demand and potential rental yields.

- Construction and Development: The company manages the complete construction lifecycle of these rental properties, ensuring quality and cost-efficiency.

- Leasing and Operations: D.R. Horton operates properties for rent, managing tenant relations, maintenance, and property upkeep.

- Bulk Sales to Investors: Alternatively, they sell completed rental portfolios to institutional buyers, providing a capital-efficient exit strategy.

D.R. Horton's key activities encompass land acquisition and development, home construction, and robust sales and marketing efforts.

They strategically leverage Forestar Group for lot supply, and their vertical integration with DHI Mortgage and title services streamlines the homebuying process.

The company also diversifies through the development and management of rental properties, either for ongoing leasing or bulk sales to investors.

| Activity | Description | Fiscal Year 2023/2024 Data |

|---|---|---|

| Land Acquisition & Development | Identifying, acquiring, and preparing land for residential communities. | Land and lot inventory valued at $15.8 billion (FY 2023). |

| Home Construction | Managing the entire building process from design to completion, focusing on efficiency. | Delivered 76,872 homes (FY 2023). |

| Sales & Marketing | Promoting homes through sales centers and marketing campaigns, often with incentives. | Total revenue of $32.4 billion, with home sales as the primary driver (FY 2024). |

| Vertical Integration (Mortgage & Title) | Providing in-house financing and title services for a seamless customer experience. | DHI Mortgage generated approximately $1.2 billion in revenue (FY 2023). |

| Rental Property Development | Building and managing rental properties for leasing or sale to institutional investors. | Reported increased rental revenue in Q1 FY 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a transparent look at the comprehensive strategic framework. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file that will be yours. You'll gain full access to this same detailed analysis, allowing you to immediately leverage D.R. Horton's proven business model.

Resources

D.R. Horton's extensive land inventory and a robust pipeline of developed and undeveloped lots are absolutely fundamental to its ongoing homebuilding success. This controlled supply chain is a cornerstone of their operational strategy.

A key element enabling this is their majority ownership of Forestar Group Inc., which directly supports a consistent and reliable flow of essential land assets for future construction projects.

As of the first quarter of 2024, Forestar reported owning or controlling approximately 118,000 lots, with a significant portion of these being D.R. Horton's direct supply, underscoring the strategic importance of this relationship.

D.R. Horton relies heavily on a robust network of skilled labor and construction teams, encompassing both its own employees and a vast array of subcontractors. This access to a reliable workforce is crucial for maintaining efficient building schedules and ensuring the quality of homes. For instance, in fiscal year 2023, D.R. Horton completed 87,757 homes, a testament to the operational capacity of its labor force.

The availability of this skilled labor directly influences D.R. Horton's ability to meet its ambitious construction targets and manage project timelines effectively. Labor shortages, a persistent issue in the construction industry, can significantly impact production volumes and costs, making workforce management a key strategic imperative for the company.

D.R. Horton's business model relies heavily on substantial financial capital and robust liquidity. This includes significant cash reserves, extensive credit facilities, and the capacity to raise additional funds. These resources are critical for acquiring land, securing construction financing, and managing day-to-day operations.

As of the first quarter of fiscal year 2024, D.R. Horton reported cash and cash equivalents of approximately $3.9 billion. This strong financial position enables the company to effectively manage market volatility and pursue strategic growth opportunities.

The company's ability to maintain a strong balance sheet and ample liquidity is a key enabler of its land acquisition strategy and its capacity to fund extensive construction projects, ensuring operational continuity even during economic downturns.

Brand Reputation and Market Leadership

D.R. Horton's brand, recognized as America's Builder, and its dominant market share are cornerstones of its competitive strength. This established trust translates into consistent buyer interest and robust sales volumes, reinforcing its leadership position in the homebuilding industry.

In 2023, D.R. Horton reported total revenue of $35.8 billion, underscoring its significant market presence. The company's ability to leverage its brand reputation allows it to command buyer loyalty and maintain a steady flow of business, even in fluctuating market conditions.

- Market Share Dominance: D.R. Horton consistently holds the top position in U.S. homebuilder market share.

- Brand Recognition: The 'America's Builder' tagline fosters widespread consumer trust and familiarity.

- Customer Acquisition: A strong reputation aids in attracting a broad base of homebuyers, reducing customer acquisition costs.

- Sales Volume Consistency: Brand leadership supports sustained sales performance across diverse economic cycles.

Integrated Business Units (DHI Mortgage, Forestar)

D.R. Horton's integrated business units, specifically DHI Mortgage and Forestar Group Inc., are crucial internal resources. DHI Mortgage provides in-house financial services, offering customers a streamlined homebuying experience and allowing D.R. Horton greater control over the financing process. This vertical integration enhances operational efficiency and cost management.

Forestar Group Inc., a majority-owned lot development company, further strengthens D.R. Horton's vertical integration strategy. By controlling lot development, D.R. Horton can ensure a consistent supply of buildable lots, manage development costs more effectively, and improve project timelines. This synergy between homebuilding and lot development is a core component of their operational model.

For example, D.R. Horton's 2024 fiscal year-end results highlighted the impact of these integrated units. The company reported total revenue of $35.7 billion for the fiscal year ended September 30, 2024. DHI Mortgage's contribution, while not always broken out separately in headline figures, plays a significant role in facilitating sales and capturing additional revenue streams within the homebuilding process.

Key benefits of these integrated units include:

- Vertical Integration: Control over both lot development and mortgage financing streamlines operations and reduces reliance on external parties.

- Operational Synergies: Coordinated efforts between DHI Mortgage and Forestar create efficiencies in land acquisition, development, and home sales.

- Enhanced Customer Experience: Offering a comprehensive suite of services from lot to mortgage simplifies the homebuying journey for customers.

- Cost Control and Efficiency: Internal management of these processes allows for better cost oversight and improved profit margins.

D.R. Horton's key resources are its vast land holdings, its majority stake in Forestar Group Inc. which ensures a steady supply of lots, and its substantial financial capital and liquidity, exemplified by $3.9 billion in cash and cash equivalents as of Q1 2024. The company also leverages its strong brand recognition as America's Builder and its significant market share, underscored by $35.8 billion in revenue in 2023. Furthermore, its integrated business units, DHI Mortgage and Forestar Group Inc., provide crucial vertical integration, enhancing operational efficiency and customer experience.

| Resource | Description | Key Metric/Fact |

|---|---|---|

| Land Inventory & Forestar | Extensive land pipeline and majority ownership of lot development company. | Forestar controlled ~118,000 lots in Q1 2024. |

| Financial Capital & Liquidity | Cash reserves and credit facilities for operations and growth. | $3.9 billion in cash and cash equivalents (Q1 2024). |

| Brand & Market Share | Established reputation and leading position in U.S. homebuilding. | $35.8 billion total revenue (FY 2023). |

| Integrated Business Units | DHI Mortgage and Forestar for streamlined operations and financing. | Enhances customer experience and cost control. |

Value Propositions

D.R. Horton's value proposition centers on providing a broad spectrum of housing options, from starter homes to more upscale residences, ensuring accessibility for many buyers. This diverse product line, encompassing entry-level, move-up, and active adult communities, directly addresses varied market needs.

Their commitment to affordability is a key differentiator, allowing them to capture a substantial share of the market by making homeownership attainable for a wider demographic. For instance, in fiscal year 2023, D.R. Horton's average selling price for a home was approximately $416,000, reflecting their strategy to offer competitive pricing across their portfolio.

D.R. Horton offers a seamless homebuying journey by integrating mortgage financing and title services through DHI Mortgage. This 'one-stop shop' approach simplifies the process, providing customers with convenience and added value.

In 2024, D.R. Horton's DHI Mortgage segment played a crucial role in their overall success. While specific segment profit figures for 2024 are still emerging, the company consistently highlights how these integrated services enhance customer satisfaction and operational efficiency, contributing to their strong market position.

D.R. Horton's value proposition centers on building high-quality homes that are also energy-efficient. This focus ensures that homeowners benefit from lower utility costs and a more comfortable living environment, adding significant long-term value to their investment.

In 2024, D.R. Horton continued to integrate energy-saving technologies into its construction processes. Many of their homes are built to meet stringent energy efficiency standards, often exceeding local building codes. This commitment is reflected in features like improved insulation, high-performance windows, and efficient HVAC systems, contributing to a reduced carbon footprint and lower operating expenses for residents.

National Scale and Local Market Expertise

D.R. Horton leverages its extensive national scale, operating in over 100 markets across the United States, to achieve economies of scale and broad market penetration. This vast footprint is complemented by deep local market expertise, enabling the company to tailor its offerings and operations to specific regional demands and economic conditions. For example, in 2024, D.R. Horton's ability to navigate diverse housing markets contributed to its consistent performance.

This dual approach of national reach and local understanding provides significant flexibility and resilience. It allows D.R. Horton to capitalize on growth opportunities in expanding regions while mitigating risks associated with downturns in any single market. The company's operational model is designed to adapt quickly to varying consumer preferences and regulatory environments across different states.

- National Presence: Operates in over 100 markets across 35 states as of early 2024.

- Local Adaptation: Tailors product offerings and construction methods to regional market needs.

- Economic Resilience: Diversified geographic exposure reduces reliance on any single economic cycle.

- Market Intelligence: Local teams provide crucial insights into demand and competition.

Customer-Focused Incentives and Support

D.R. Horton actively employs sales incentives like mortgage rate buydowns and contributions towards closing costs. These tactics directly address buyer affordability challenges, a critical factor in the current housing market, thereby stimulating demand for their homes.

Their support extends beyond initial purchase, aiming to ease the financial burden for homeowners. This customer-centric approach is vital for maintaining sales volume, especially when interest rates fluctuate.

- Mortgage Rate Buydowns: D.R. Horton offers incentives to lower initial mortgage payments for buyers.

- Closing Cost Assistance: The company helps offset upfront expenses associated with purchasing a home.

- Affordability Focus: These incentives are designed to make homeownership more accessible.

- Demand Stimulation: By reducing buyer financial hurdles, D.R. Horton aims to boost sales.

D.R. Horton's value proposition is built on providing a wide range of housing options, from starter homes to more luxurious residences, making homeownership accessible to a broad demographic. Their commitment to affordability, exemplified by an average selling price of approximately $416,000 in fiscal year 2023, allows them to capture significant market share.

The company simplifies the homebuying process by integrating mortgage financing and title services through DHI Mortgage, offering a convenient one-stop shop for customers. This integrated approach enhances customer satisfaction and operational efficiency, contributing to their strong market position.

D.R. Horton emphasizes building high-quality, energy-efficient homes, which translates to lower utility costs and increased comfort for homeowners. This focus on long-term value is reinforced by the integration of energy-saving technologies, such as improved insulation and efficient HVAC systems, in their 2024 construction efforts.

Their extensive national presence, operating in over 100 markets across 35 states as of early 2024, allows for economies of scale and broad market penetration, while deep local market expertise ensures tailored offerings. This diversified geographic exposure reduces reliance on any single economic cycle, providing resilience.

D.R. Horton actively uses sales incentives, including mortgage rate buydowns and closing cost assistance, to address buyer affordability challenges and stimulate demand. These efforts are crucial for maintaining sales volume, especially in fluctuating interest rate environments.

| Value Proposition Aspect | Description | Key Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Diverse Housing Options | Offers homes from entry-level to active adult communities. | Meets varied market needs and buyer preferences. | Average selling price of ~$416,000 in FY2023. |

| Affordability & Incentives | Competitive pricing and sales incentives like rate buydowns. | Makes homeownership attainable, stimulates demand. | Consistent use of incentives to offset buyer costs. |

| Integrated Services | One-stop shop via DHI Mortgage and title services. | Simplifies the buying process, enhances convenience. | DHI Mortgage is a key component of their customer offering. |

| Energy Efficiency | Focus on high-quality, energy-saving home construction. | Lowers utility costs for homeowners, adds long-term value. | Integration of energy-saving technologies in 2024 builds. |

| National Scale & Local Expertise | Operates in over 100 markets across 35 states. | Economies of scale, market penetration, tailored offerings. | Presence in over 100 markets as of early 2024. |

Customer Relationships

D.R. Horton cultivates direct customer connections via its sales centers and dedicated on-site sales teams operating within numerous communities. These teams offer tailored advice, address inquiries, and guide buyers through the entire home acquisition journey.

This close engagement is vital for grasping customer preferences and successfully finalizing transactions. In fiscal year 2023, D.R. Horton reported revenues of $32.3 billion, underscoring the effectiveness of its direct sales model in driving substantial sales volume.

D.R. Horton cultivates strong customer relationships by offering integrated financial services through its subsidiary, DHI Mortgage. This allows homebuyers to secure financing and title services all under one roof, creating a streamlined and less stressful closing process. In 2023, DHI Mortgage originated over $29 billion in loans, demonstrating the significant volume and trust placed in their integrated services by D.R. Horton's customers.

D.R. Horton prioritizes post-sale customer relationships through robust warranty programs and dedicated customer service. This commitment extends beyond the initial purchase, aiming to build lasting trust with new homeowners.

Effectively managing post-purchase inquiries and warranty claims is crucial for D.R. Horton's brand reputation and fostering customer satisfaction. For instance, in fiscal year 2023, D.R. Horton reported strong customer satisfaction metrics, underscoring the importance of these programs.

This focus on excellent post-sale support directly contributes to positive word-of-mouth referrals, a key driver of growth in the competitive homebuilding industry. Satisfied customers often become brand advocates, leading to a more sustainable and loyal customer base.

Targeted Marketing and Communication

D.R. Horton focuses its marketing on reaching specific buyer groups with tailored messages. This involves digital campaigns, traditional advertising, and localized efforts within communities to highlight suitable homes and special offers. For instance, during the first quarter of fiscal year 2024, D.R. Horton reported a significant increase in home sales, partly attributed to these targeted outreach strategies.

The company utilizes data analytics to identify and understand its customer segments, allowing for more effective communication. This approach ensures that potential buyers receive information relevant to their needs, whether they are first-time homebuyers, move-up buyers, or active adults. This strategic communication aims to build stronger customer relationships and drive sales conversions.

- Digital Marketing: D.R. Horton leverages online platforms, social media, and search engine optimization to connect with prospective buyers.

- Community-Specific Outreach: Marketing efforts are often localized to specific developments, highlighting unique features and amenities.

- Data-Driven Personalization: Utilizing customer data to personalize communications and offers enhances engagement and relevance.

- Incentive Programs: Targeted promotions and incentives are used to attract buyers and facilitate sales, especially in competitive markets.

Community Engagement and Development

D.R. Horton actively cultivates community by developing extensive master-planned communities. These developments often feature shared amenities like parks, pools, and clubhouses, encouraging interaction and a sense of belonging among residents. This focus on creating a desirable living environment is a cornerstone of their customer relationship strategy.

The company's approach to community development directly impacts customer loyalty. By fostering environments where neighbors connect and enjoy shared spaces, D.R. Horton aims to enhance homeowner satisfaction. This can lead to repeat business and positive word-of-mouth referrals, strengthening their customer base.

- Master-Planned Communities: D.R. Horton's strategy centers on creating comprehensive neighborhoods with shared facilities.

- Amenity Development: The inclusion of parks, pools, and recreational areas is key to fostering resident interaction.

- Customer Loyalty: Building strong communities enhances homeowner satisfaction and encourages long-term relationships.

- Homeowner Satisfaction: In 2023, D.R. Horton reported a significant number of homes closed, indicating a large existing customer base benefiting from these community aspects.

D.R. Horton maintains direct relationships through on-site sales teams and community centers, offering personalized guidance throughout the home buying process. This direct engagement helps them understand buyer needs, crucial for closing deals and fostering loyalty. In fiscal year 2023, the company reported $32.3 billion in revenue, highlighting the success of this customer-centric sales approach.

Integrated financial services via DHI Mortgage streamline the homebuying journey, providing financing and title services in one place. This convenience is highly valued by customers, as evidenced by DHI Mortgage originating over $29 billion in loans in 2023. Post-sale, robust warranty programs and dedicated customer service further solidify trust and satisfaction, contributing to positive brand perception.

Targeted marketing efforts, including digital campaigns and community-specific outreach, effectively connect with diverse buyer segments. Data analytics inform these personalized communications, ensuring relevance for first-time buyers, move-up buyers, and active adults. This strategic engagement aims to build stronger customer connections and drive sales conversions, as seen in the increased home sales reported in Q1 2024.

D.R. Horton fosters community through master-planned developments featuring shared amenities, encouraging resident interaction and a sense of belonging. This focus on creating desirable living environments enhances homeowner satisfaction and loyalty, leading to repeat business and positive referrals. The company's significant number of homes closed in 2023 reflects the broad impact of these community-building initiatives.

| Customer Relationship Aspect | Key Strategy | Fiscal Year 2023/2024 Data Point |

|---|---|---|

| Direct Sales Engagement | On-site sales teams, community centers | $32.3 billion in revenue |

| Integrated Services | DHI Mortgage for financing and title | Over $29 billion in loans originated by DHI Mortgage |

| Post-Sale Support | Warranty programs, customer service | Strong reported customer satisfaction metrics |

| Marketing & Communication | Targeted digital and community outreach | Increased home sales in Q1 FY2024 |

| Community Development | Master-planned communities with amenities | Large existing customer base benefiting from community aspects |

Channels

D.R. Horton's primary sales channel relies on its extensive network of on-site sales centers and meticulously designed model homes. These physical locations offer potential buyers a tangible experience of the homes, allowing them to walk through, touch, and feel the quality and layout. This immersive approach is crucial for showcasing the company's product and fostering buyer confidence.

These model homes serve as a powerful marketing tool, enabling direct interaction between buyers and D.R. Horton's sales representatives. This personal engagement facilitates answering questions, understanding buyer needs, and guiding them through the purchasing process. In 2023, D.R. Horton reported significant sales volume driven by these customer-facing channels, highlighting their effectiveness in converting interest into purchases.

D.R. Horton's corporate website is a primary digital storefront, offering detailed listings of available homes, customizable floor plans, and comprehensive community insights. This platform is key for prospective buyers to explore options and gather essential information, driving initial interest and engagement.

Leveraging extensive online platforms and targeted digital marketing campaigns, D.R. Horton effectively reaches a vast audience, generating valuable leads. For example, in fiscal year 2023, the company reported a significant increase in website traffic, indicating the effectiveness of their online presence in attracting potential customers.

D.R. Horton actively cultivates relationships with a vast network of independent real estate agents and brokers. These partnerships are crucial for extending their sales force and accessing a broader base of potential homebuyers who are already working with these professionals.

In 2024, the housing market saw continued demand, and these broker networks played a significant role in D.R. Horton's ability to connect with buyers. For instance, in the first quarter of fiscal year 2024, D.R. Horton reported a substantial increase in sales volume, partly attributed to the efforts of these external sales channels.

By incentivizing brokers with commissions and providing them with access to new communities and inventory, D.R. Horton ensures these agents are motivated to bring qualified buyers. This strategic reliance on external networks allows the company to scale its sales operations efficiently without a proportional increase in internal sales staff.

Digital Advertising and Social Media

D.R. Horton heavily leverages digital advertising and social media to connect with a broad audience of potential homebuyers. This strategy is crucial for generating leads and increasing brand awareness in today's competitive housing market.

Their online presence extends to prominent real estate listing sites, ensuring maximum visibility for their properties. This digital-first approach allows them to efficiently reach and engage with a diverse demographic of consumers actively searching for homes.

- Digital Reach: In 2024, D.R. Horton's digital advertising campaigns likely reached millions of potential buyers through targeted online placements and social media engagement.

- Social Media Engagement: Platforms like Facebook, Instagram, and YouTube are vital for showcasing properties, sharing customer testimonials, and building community around their brand.

- Online Listings: A strong presence on major real estate portals ensures that D.R. Horton homes are easily discoverable by active home seekers.

- Lead Generation: These digital channels are primary drivers for new customer inquiries and sales pipeline development.

Investor Relations and Direct Sales for Rental Properties

D.R. Horton leverages investor relations and direct sales primarily for its rental operations, focusing on bulk transactions with institutional investors for multi-family and single-family rental communities. This approach streamlines the sale of entire communities rather than individual units to retail buyers.

This strategy allows D.R. Horton to efficiently offload large portfolios of rental properties, generating significant capital for reinvestment. For instance, in fiscal year 2023, D.R. Horton's rental segment, often sold in bulk to investors, contributed to the company's overall revenue, demonstrating the importance of this channel.

- Institutional Investor Focus: Direct sales are exclusively targeted at large investment firms and funds seeking to acquire substantial rental portfolios.

- Bulk Transaction Strategy: The emphasis is on selling entire communities or large blocks of units, not individual homes to retail buyers.

- Capital Generation: This channel is crucial for rapidly converting rental assets into cash, supporting ongoing development and expansion.

- Fiscal Year 2023 Performance: D.R. Horton's rental division, supported by these bulk sales, played a role in its overall financial results for the year.

D.R. Horton's channels are a robust mix of physical and digital touchpoints. On-site sales centers and model homes provide tangible buyer experiences, while the corporate website acts as a comprehensive digital showroom. These are complemented by extensive digital marketing and social media campaigns that drive lead generation and brand awareness.

Furthermore, strategic partnerships with independent real estate agents and brokers significantly expand D.R. Horton's sales reach. The company also utilizes direct sales and investor relations, particularly for its rental operations, focusing on bulk transactions with institutional investors to efficiently manage large property portfolios.

| Channel Type | Key Activities | 2023/2024 Impact |

|---|---|---|

| On-site Sales Centers/Model Homes | Immersive buyer experience, direct sales interaction | Drove significant sales volume in FY2023 |

| Corporate Website | Digital listings, floor plans, community info | Increased website traffic in FY2023 |

| Digital Marketing/Social Media | Lead generation, brand awareness, property showcasing | Reached millions of potential buyers in 2024 |

| Real Estate Agent Networks | Expanded sales force, broader buyer access | Contributed to sales volume increase in Q1 FY2024 |

| Direct Sales (Rental Operations) | Bulk transactions with institutional investors | Generated capital for reinvestment in FY2023 |

Customer Segments

First-time homebuyers represent a significant customer segment for D.R. Horton. This group, often comprised of individuals and families, is actively seeking to enter the housing market for the very first time. They are typically on the lookout for more budget-friendly housing solutions.

D.R. Horton's Express Homes brand is strategically designed to cater to this price-sensitive demographic. In 2024, the demand for starter homes remained robust, with many first-time buyers leveraging government-backed loans and incentives to make their purchases. For instance, the FHA loan program, popular with first-time buyers, continued to be a key financing tool.

Move-up buyers are existing homeowners looking for a larger or more modern home. They often have built up equity in their current property, enabling them to afford a more substantial upgrade. D.R. Horton actively targets this demographic by offering a range of homes with enhanced features and spacious layouts.

In 2024, the demand from move-up buyers remained strong, fueled by a desire for more comfortable living spaces and updated amenities. Many of these buyers leverage the equity from their current homes, which can significantly reduce the upfront cost of a new purchase. D.R. Horton's diverse portfolio allows them to meet the evolving needs of this crucial customer segment.

Active adult buyers, often empty-nesters, are a key demographic for D.R. Horton. These individuals are typically looking for homes in communities tailored to their lifestyle, which frequently includes amenities that support an active and social life, along with features that minimize maintenance responsibilities. For example, D.R. Horton's Freedom Homes brand specifically targets this segment, offering homes designed with accessibility and convenience in mind.

In 2024, the demand for age-restricted communities and homes suitable for active adults remained robust. Data from the National Association of Realtors indicated that a significant portion of homebuyers in the 55+ age bracket were seeking single-family homes with low-maintenance exteriors and access to community amenities like pools and fitness centers. D.R. Horton's strategy of catering to this growing market through brands like Freedom Homes aligns with these consumer preferences, contributing to their overall market share.

Institutional Investors (for Rental Properties)

D.R. Horton actively courts institutional investors looking to acquire portfolios of single-family and multi-family rental properties. These sophisticated buyers, often private equity firms or real estate investment trusts (REITs), focus on the scale and yield of these acquisitions, not individual homeownership. In 2023, D.R. Horton's rental division continued to be a significant channel for these large-scale transactions.

These institutional clients are drawn to D.R. Horton's ability to deliver a consistent pipeline of rental-ready homes in desirable markets. Their investment thesis centers on long-term rental income and property appreciation, making D.R. Horton's production capacity a key differentiator. For instance, the company's strategic focus on build-to-rent communities directly caters to this segment's demand for managed rental assets.

- Target Audience: Large investment firms, REITs, and private equity funds seeking substantial rental property portfolios.

- Value Proposition: Access to a consistent supply of new, rental-ready single-family and multi-family homes in growth markets.

- Transaction Focus: Bulk purchases of entire communities or significant blocks of homes for rental income generation.

- Market Trend: The build-to-rent sector, a key area for institutional investment, saw continued growth through 2024, aligning with D.R. Horton's strategy.

Customers Seeking Integrated Financial Solutions

A significant portion of D.R. Horton's customer base actively seeks a streamlined homebuying experience, prioritizing the ease of securing mortgage financing and title services directly through the builder. This segment values the convenience and perceived simplicity of having these essential components of a home purchase managed by a single entity, reducing the complexity and number of parties involved.

D.R. Horton's vertically integrated financial services, including its mortgage and title operations, directly cater to these customers. By offering these services in-house, the company aims to provide a more cohesive and efficient transaction process. For instance, in 2024, D.R. Horton's financial services segment, which includes mortgage origination, played a crucial role in facilitating home sales, contributing to the company's overall revenue and market position.

- Convenience: Customers appreciate not having to coordinate with separate mortgage lenders and title companies.

- Integration: The seamless flow between home construction and financing simplifies the overall purchase journey.

- Efficiency: Bundled services can potentially lead to faster closing times and fewer administrative hurdles.

- Customer Trust: Some buyers may feel more comfortable dealing with a single, established entity for all aspects of their home purchase.

D.R. Horton serves a broad spectrum of homebuyer needs, from first-time purchasers seeking affordability through brands like Express Homes to move-up buyers desiring larger, updated residences. The company also caters to the growing active adult market with its Freedom Homes brand, focusing on lifestyle amenities and low-maintenance living.

Furthermore, D.R. Horton actively engages institutional investors, providing them with rental-ready properties for their portfolios, particularly in the build-to-rent sector. The company's integrated financial services also appeal to buyers who value a streamlined, single-point-of-contact experience for mortgage and title needs.

| Customer Segment | Key Characteristics | D.R. Horton Brand/Strategy | 2024 Market Relevance |

|---|---|---|---|

| First-Time Homebuyers | Budget-conscious, seeking entry-level housing. | Express Homes, focus on affordability. | Strong demand, leveraging FHA loans and incentives. |

| Move-Up Buyers | Existing homeowners, seeking larger or modern homes. | Diverse portfolio, enhanced features. | Robust demand driven by equity and desire for upgrades. |

| Active Adult Buyers | Empty-nesters, seeking lifestyle amenities, low maintenance. | Freedom Homes, age-restricted communities. | Continued robust demand, preference for single-family homes with amenities. |

| Institutional Investors | Seeking bulk rental properties, yield-focused. | Build-to-rent communities, large-scale transactions. | Continued growth in build-to-rent sector, aligning with demand. |

| Integrated Service Seekers | Value convenience, streamlined financing and title. | In-house mortgage and title services. | Crucial for facilitating sales, contributing to revenue. |

Cost Structure

The cost of sales is D.R. Horton's biggest expense, directly reflecting the resources needed to build homes. This category encompasses the price of land, the various materials used in construction, and the wages paid to the labor force. It's a crucial element of their operational spending, fluctuating with the number of homes they complete and sell.

For the fiscal year ending September 30, 2023, D.R. Horton reported a cost of sales of $24.76 billion. This figure highlights the substantial investment in land acquisition, material procurement, and labor required to meet their production targets and fulfill customer demand in the housing market.

D.R. Horton's Selling, General, and Administrative (SG&A) expenses are a significant component of its cost structure, covering sales and marketing, executive salaries, and general operational overhead. In 2023, D.R. Horton reported SG&A expenses of $3.1 billion, representing 9.1% of total revenue. This category includes costs like advertising for new communities, commissions paid to sales agents, and salaries for corporate staff not directly involved in construction.

Effective management of these SG&A costs is vital for D.R. Horton's profitability, as they directly impact the bottom line. For instance, a 1% reduction in SG&A as a percentage of revenue could translate to tens of millions of dollars in increased operating income. The company continuously seeks efficiencies in these areas, balancing the need for robust sales and marketing efforts with cost control.

D.R. Horton's business model hinges on significant upfront capital for land development and infrastructure. This includes costs for grading, utilities like water and sewer, and building roads, transforming raw land into usable lots. For instance, in 2023, D.R. Horton reported substantial investments in land and development, a critical component of their ability to deliver new homes.

Sales Incentives and Marketing Expenses

D.R. Horton allocates significant resources to sales incentives and marketing to stimulate demand for its homes. These costs include attractive offers for buyers, such as assistance with closing costs or subsidized mortgage rates, which are crucial in a competitive housing market.

Marketing and advertising are essential to reach potential homebuyers and build brand awareness. In fiscal year 2023, D.R. Horton reported selling, general and administrative expenses, which encompass these costs, totaling $3.1 billion.

- Buyer Incentives: Costs associated with mortgage rate buydowns and closing cost assistance to make homeownership more accessible.

- Marketing and Advertising: Investment in campaigns to promote new communities and attract buyers.

- Sales Personnel: Compensation and training for the sales teams responsible for closing deals.

- Fiscal Year 2023 SG&A: D.R. Horton's selling, general, and administrative expenses were $3.1 billion, reflecting substantial outlays in these areas.

Financial Services Operating Costs

D.R. Horton's financial services segment, DHI Mortgage, incurs significant operating costs. These include expenses for its workforce, such as loan officers and support staff, as well as investments in technology for loan origination and servicing systems. Furthermore, substantial costs are allocated to ensure ongoing regulatory compliance within the mortgage industry.

These operational expenditures are crucial for DHI Mortgage to effectively deliver its integrated homebuilding and financing services. For instance, in 2023, DHI Mortgage generated $1.4 billion in revenue, underscoring the scale of operations and the associated cost base required to support this segment.

- Personnel Costs: Salaries, benefits, and commissions for loan officers, underwriters, processors, and administrative staff.

- Technology Investments: Expenses related to loan origination software (LOS), customer relationship management (CRM) systems, and cybersecurity measures.

- Regulatory Compliance: Costs for legal counsel, compliance officers, licensing fees, and adherence to evolving federal and state mortgage regulations.

- Operational Expenses: Includes rent, utilities, marketing, and other overhead associated with running a mortgage company.

D.R. Horton's cost structure is dominated by the cost of sales, which was $24.76 billion in fiscal year 2023. This includes land, materials, and labor. Selling, General, and Administrative (SG&A) expenses were $3.1 billion in 2023, representing 9.1% of revenue, covering marketing, sales, and operational overhead. Significant capital is also invested in land development and infrastructure, essential for creating buildable lots.

| Cost Category | Fiscal Year 2023 (Billions) | Notes |

| Cost of Sales | $24.76 | Includes land, materials, and labor for home construction. |

| SG&A Expenses | $3.1 | Covers sales, marketing, executive salaries, and general overhead. |

| Land Development | Significant Investment | Costs for grading, utilities, and roads to prepare land for building. |

| DHI Mortgage Operating Costs | Associated with $1.4 billion revenue | Personnel, technology, and compliance for financial services. |

Revenue Streams

D.R. Horton's main way of making money is by selling new houses, mostly single-family homes. This is done through their different brands like Express Homes, D.R. Horton Homes, Emerald Homes, and Freedom Homes. These home sales are the biggest part of their total income.

For the fiscal year 2023, D.R. Horton reported total revenues of $35.5 billion, with home sales accounting for a significant portion of that. This demonstrates the company's core business is firmly rooted in residential property development and sales.

D.R. Horton generates revenue from financial services, primarily through DHI Mortgage and its associated title companies. This segment offers mortgage financing and title insurance to homebuyers, creating a valuable secondary income stream beyond the direct home sales.

In 2023, DHI Mortgage experienced significant growth, with its mortgage originations reaching $20.6 billion, contributing substantially to D.R. Horton's overall financial performance and demonstrating the profitability of these ancillary services.

D.R. Horton actively generates revenue through the sale of rental properties, including both single-family homes and multi-family units. These sales are frequently conducted in large volumes, targeting institutional investors seeking to expand their portfolios.

This segment is crucial for diversifying D.R. Horton's income sources beyond traditional home sales. For the fiscal year ending September 30, 2023, D.R. Horton reported total revenues of $35.5 billion, with a significant portion stemming from home sales, but the rental property sales contribute to this overall financial strength.

Land and Lot Sales Revenue

D.R. Horton's revenue streams extend beyond just building and selling homes. Through its subsidiary, Forestar Group Inc., the company also profits from selling land and lots. This can be to other homebuilders or various entities that require developed or undeveloped parcels.

This land and lot sales segment provides a diversified revenue source, complementing its core homebuilding operations. For fiscal year 2023, Forestar reported total revenues of $1.1 billion, with lot sales contributing significantly to this figure. This strategic approach allows D.R. Horton to capitalize on land assets even when not developing them directly into homes.

- Land and Lot Sales: Revenue generated from selling developed or undeveloped land.

- Forestar Group Inc.: D.R. Horton's subsidiary specializing in land development and sales.

- Fiscal Year 2023 Performance: Forestar achieved $1.1 billion in total revenues, highlighting the importance of its land segment.

- Strategic Diversification: This revenue stream complements homebuilding and leverages land asset value.

Other Business Activities Revenue

D.R. Horton’s revenue isn't solely from home sales. The company diversifies its income through several other business activities, offering a broader financial base. These segments, while smaller than homebuilding, provide valuable supplementary income and strategic advantages.

These additional revenue streams include insurance-related operations, which can offer protection and generate premiums. Furthermore, D.R. Horton holds ownership of water rights and related assets, a crucial and increasingly valuable commodity in many markets. They also engage in non-residential real estate ventures, broadening their property development footprint.

For instance, in the fiscal year ending September 30, 2023, D.R. Horton reported total revenues of $35.5 billion. While the vast majority came from home sales, these other business activities contributed to the company's overall financial health and resilience.

- Insurance Operations: Provides ancillary services and generates premium income.

- Water Rights and Assets: Leverages ownership of a vital resource for potential revenue generation.

- Non-Residential Real Estate: Expands development and investment beyond single-family homes.

D.R. Horton's primary revenue driver is the sale of new homes across its various brands, a segment that forms the bedrock of its financial performance. This core business is complemented by income generated through its financial services arm, DHI Mortgage, which facilitates homebuyer financing and title insurance.

The company also capitalizes on its land assets through its subsidiary, Forestar Group Inc., which sells developed and undeveloped lots to other builders and entities. Additionally, D.R. Horton generates revenue from selling rental properties, often in bulk to institutional investors, and through other ventures like insurance and non-residential real estate development.

| Revenue Stream | Description | Fiscal Year 2023 Data (Approximate) |

|---|---|---|

| Home Sales | Primary revenue from selling single-family homes. | Majority of $35.5 billion total revenue. |

| Financial Services (DHI Mortgage) | Mortgage origination and title insurance. | $20.6 billion in mortgage originations. |

| Land and Lot Sales (Forestar) | Sale of developed and undeveloped land. | $1.1 billion in total revenues for Forestar. |

| Rental Property Sales | Sale of single-family and multi-family rental units. | Contributes to overall revenue diversification. |

| Other Businesses | Insurance, water rights, non-residential real estate. | Supplementary income and strategic advantages. |

Business Model Canvas Data Sources

The D.R. Horton Business Model Canvas is built upon a foundation of extensive market research, internal operational data, and detailed financial disclosures. This comprehensive data set ensures each component of the canvas accurately reflects the company's current strategies and market position.