DPR Construction SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DPR Construction Bundle

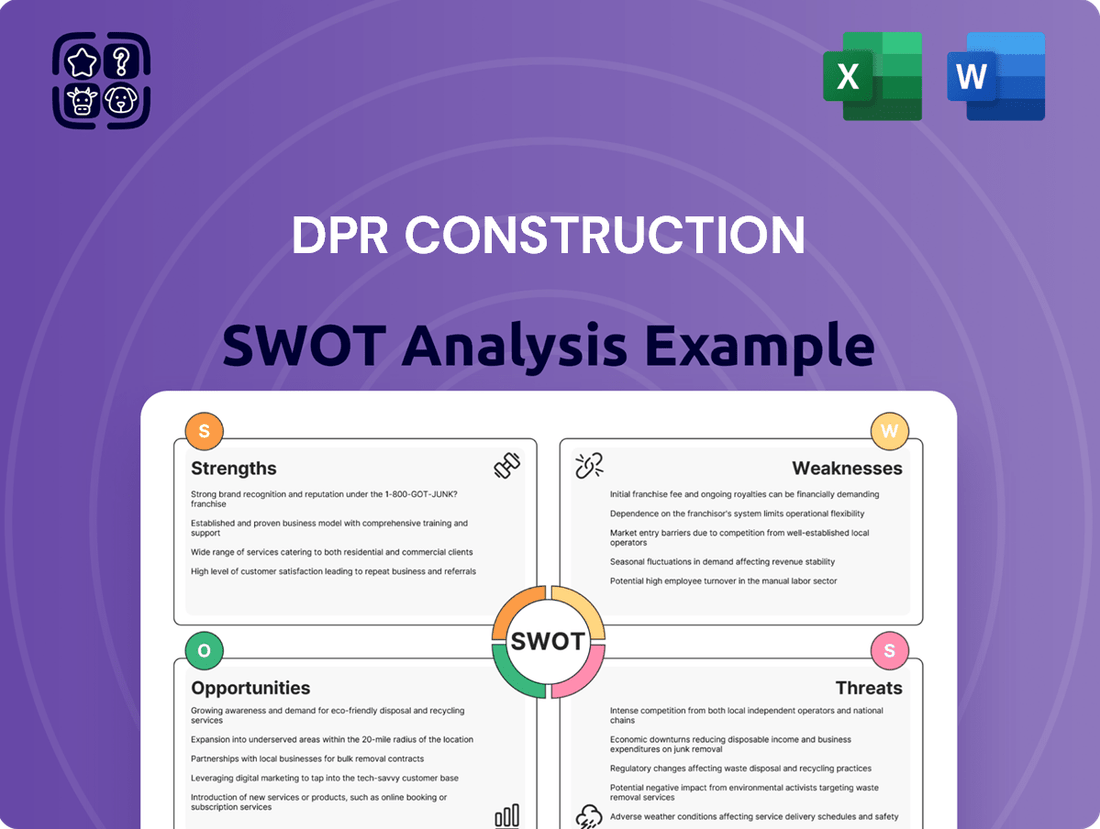

DPR Construction's market position is strong, but understanding its full potential requires a deeper dive. Our analysis reveals key strengths in its innovative approach and commitment to quality, alongside potential threats in the competitive landscape. Don't miss out on the strategic advantage this detailed report offers.

Want the full story behind DPR Construction's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DPR Construction's strength lies in its deep specialization in complex and sustainable projects, a niche that positions them favorably in high-growth sectors. This focus allows them to tackle technically demanding builds within advanced technology, life sciences, healthcare, and higher education. Their proven ability to execute these sophisticated projects translates into a strong market reputation and the capacity to secure premium contracts.

DPR Construction boasts a comprehensive suite of services, encompassing preconstruction, design-build, general contracting, and integrated project delivery. This end-to-end capability ensures a seamless project journey for clients, minimizing coordination challenges and maximizing efficiency. Their ability to manage projects from the initial concept through to completion provides a significant advantage.

DPR Construction's dedication to innovation is a significant strength, particularly their embrace of Virtual Design & Construction (VDC), prefabrication, and data analytics. This technological adoption directly translates to more predictable and efficient project execution.

Their investment in advanced technologies like VDC and prefabrication isn't just about staying current; it demonstrably improves project outcomes. For instance, DPR's work on data centers showcases how these technologies streamline complex builds, enhancing safety and quality throughout the process.

This forward-thinking approach is not theoretical. DPR's Richmond office expansion, for example, highlights their practical application of innovative construction methods, underscoring their commitment to leveraging technology for superior results in the field.

Robust Employee-Owned Culture and Talent Development

DPR Construction’s commitment to its employee-owned culture is a significant strength, consistently earning it accolades as a top employer. This dedication translates into a highly motivated workforce, which is crucial in an industry facing skilled labor challenges.

The company actively addresses the skilled labor shortage by investing substantially in talent development. This includes robust apprenticeship programs and comprehensive internal training initiatives, ensuring a pipeline of skilled professionals.

This focus on people development directly impacts employee satisfaction and retention. In 2023, DPR reported a voluntary turnover rate significantly below the industry average, a testament to its employee-centric approach.

- Employee Ownership: Fosters a deeply ingrained culture of shared responsibility and commitment.

- Talent Development: Apprenticeship programs and internal training combat industry labor shortages.

- High Retention: Investments in employees lead to industry-leading retention rates, ensuring a stable, skilled workforce.

- Best Place to Work Recognition: Consistently acknowledged for its positive work environment and employee well-being.

Financial Stability and Market Position

DPR Construction demonstrates robust financial stability, consistently ranking among the top building contractors in the United States. For instance, in 2023, the company reported revenues exceeding $7 billion, solidifying its position as a major player in the construction industry. This strong financial performance underpins its capacity for significant project execution and strategic investments.

Their market position is further enhanced by strategic growth initiatives, including key acquisitions. The integration of GE Johnson Construction Company in 2023, for example, expanded DPR's geographic reach and bolstered its expertise in specific market sectors like healthcare and advanced technology facilities. These moves not only increase revenue potential but also diversify their service offerings and client base.

- Strong Revenue Generation: DPR Construction consistently achieves multi-billion dollar annual revenues, indicating a healthy and in-demand business.

- Industry Recognition: The company is frequently listed among the top contractors, reflecting its significant market share and reputation.

- Strategic Acquisitions: Acquisitions like GE Johnson Construction Company enhance market penetration and operational capacity.

- Financial Resilience: A solid financial foundation allows for continued investment in innovation and expansion.

DPR Construction's specialization in complex, sustainable projects within sectors like advanced technology and life sciences is a key strength, allowing them to secure high-value contracts. Their comprehensive service offering, from preconstruction to completion, ensures project efficiency and client satisfaction. Furthermore, their commitment to innovation through VDC, prefabrication, and data analytics leads to more predictable and superior project outcomes.

What is included in the product

Delivers a strategic overview of DPR Construction’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Identifies key internal strengths and weaknesses to proactively address potential project risks.

Weaknesses

DPR Construction's focus on specialized sectors, such as advanced technology and life sciences, presents a vulnerability. While this specialization drives growth, a significant slowdown in these niche markets, perhaps due to economic recession or shifts in R&D spending, could disproportionately affect DPR's project pipeline compared to competitors with broader market exposure.

The construction sector, especially for large commercial projects and specialized skills, continues to grapple with a significant shortage of qualified labor. Even with DPR's focus on internal training, this industry-wide issue can cause project timelines to slip and expenses to rise, particularly for major undertakings demanding a substantial and specific workforce.

DPR Construction faces significant risks from supply chain disruptions and fluctuating material costs, common challenges for general contractors. For instance, the cost of lumber, a key construction material, saw substantial price increases in late 2023 and early 2024, impacting project budgets. Tariffs on imported goods, such as steel and aluminum, can further inflate expenses and create uncertainty in project planning.

Potential for Permitting and Regulatory Delays

Complex construction projects, like those DPR Construction undertakes, frequently encounter permitting and regulatory delays. These hurdles can significantly lengthen project schedules and inflate overall expenses, impacting profitability and client satisfaction. For instance, in 2024, the average construction project in the US experienced a 15% increase in delays attributed to regulatory and permitting issues, up from 12% in 2023, according to industry reports.

While DPR Construction prioritizes early engagement with agencies to mitigate these risks, the inherent nature of bureaucratic processes means they remain an external factor beyond direct control. These delays can disrupt the carefully planned workflows, leading to unforeseen cost overruns and potential impacts on project milestones.

- Permitting & Regulatory Hurdles: A persistent challenge impacting project timelines and budgets.

- External Bureaucratic Processes: Factors outside DPR's direct control that can cause delays.

- Impact on Project Delivery: Delays can lead to increased costs and affect the efficiency of project completion.

Competition in a Highly Competitive Industry

The commercial construction sector is intensely competitive, featuring many well-established companies. DPR Construction, despite its strong position, contends with formidable rivals, potentially affecting its capacity to win new contracts and retain its market standing.

This intense rivalry means DPR must constantly innovate and maintain operational efficiency to differentiate itself. For instance, in 2023, the U.S. construction industry saw significant competition for skilled labor, with demand often outstripping supply, a trend projected to continue into 2024 and 2025.

- Intense Market Saturation: Numerous large and specialized construction firms vie for projects, creating a crowded marketplace.

- Price Sensitivity: Clients often prioritize cost, putting pressure on margins for all competitors, including DPR.

- Talent Acquisition Challenges: The ongoing shortage of skilled labor in the construction industry (estimated to be a deficit of over 500,000 workers in the US by 2024) intensifies competition for qualified personnel, impacting project timelines and costs.

DPR Construction's reliance on specialized sectors like advanced technology and life sciences, while a strength, also poses a weakness. A downturn in these niche markets, potentially due to reduced R&D spending or economic slowdowns, could impact DPR's project pipeline more severely than competitors with broader market diversification.

The construction industry, including DPR's specialized areas, faces ongoing labor shortages. This persistent issue, projected to continue through 2025, can lead to project delays and increased labor costs, affecting overall project profitability and timely completion.

Supply chain volatility and fluctuating material costs remain a significant concern. For example, the price of key materials like steel and lumber experienced notable increases in late 2023 and early 2024, impacting project budgets and requiring careful cost management strategies.

Intense competition within the commercial construction sector presents a challenge. DPR competes with numerous established firms, necessitating continuous innovation and operational efficiency to secure new contracts and maintain market share. The competition for skilled labor, a critical factor in project execution, is particularly fierce, with industry estimates suggesting a deficit of over 500,000 workers in the US by 2024.

What You See Is What You Get

DPR Construction SWOT Analysis

This is a real excerpt from the complete DPR Construction SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of their strategic positioning.

Opportunities

The surge in demand for data centers, advanced manufacturing, and life sciences facilities is a major opportunity for DPR Construction. This growth is fueled by the expansion of artificial intelligence, the shift towards electrification, and reshoring initiatives. DPR's established expertise in these specialized areas positions them to capture a significant share of this expanding market.

The construction industry is seeing a significant shift towards sustainable and resilient building, with clients actively seeking energy-efficient, low-carbon, and climate-ready structures. This trend is a major opportunity for DPR Construction, as their established commitment to sustainability and their "Path to Regeneration" strategy directly addresses this growing demand. For instance, in 2024, the U.S. Green Building Council reported a 15% increase in LEED certifications compared to the previous year, highlighting the market's embrace of green building practices.

The growing adoption of prefabrication and modular construction presents a significant opportunity for DPR Construction. These methods can directly address the persistent labor shortages impacting the industry, allowing projects to move forward more efficiently. For instance, the global modular construction market was valued at approximately $102.4 billion in 2023 and is projected to reach $157.5 billion by 2028, indicating strong industry momentum.

By embracing and further developing these off-site construction techniques, DPR can achieve faster project completion times, a critical factor in client satisfaction and profitability. Furthermore, the controlled factory environment inherent in prefabrication leads to enhanced quality control compared to traditional on-site building, reducing rework and potential delays.

DPR's existing proficiency in these areas provides a solid foundation. Continued investment in research, development, and the implementation of advanced prefabrication technologies will solidify DPR's competitive advantage in a market increasingly valuing speed, quality, and cost-efficiency.

Strategic Partnerships and Acquisitions

DPR Construction can leverage strategic partnerships and acquisitions to broaden its operational footprint and service capabilities. The company's acquisition of GE Johnson Construction Company in 2023, a significant move that integrated a respected player in the Mountain West region, exemplifies this strategy. This expansion enhances DPR's ability to serve clients across a wider geographic area and access specialized construction expertise.

Future opportunities lie in identifying and integrating firms that complement DPR's existing strengths, particularly in high-growth sectors or emerging markets. Such moves can provide immediate market access and valuable talent.

- Geographic Expansion: Acquiring or partnering with firms in underserved or rapidly developing regions, such as the Sun Belt or international markets, can drive revenue growth.

- Service Offering Enhancement: Targeting companies with specialized expertise in areas like advanced manufacturing construction, healthcare facilities, or sustainable building technologies can diversify DPR's project portfolio.

- Talent Acquisition: Strategic acquisitions can also be a way to bring in skilled labor and leadership, addressing potential workforce shortages in key construction trades.

Investment in Workforce Development and Training

DPR Construction can leverage workforce development as a significant opportunity to combat the construction industry's ongoing labor shortage. By expanding internal training programs, including apprenticeships and vocational outreach, DPR can cultivate a more skilled and readily available talent pool. This proactive approach is vital for securing the company's future operational capacity and supporting sustained growth.

Investing in the development of skilled tradespeople is paramount. This strategy not only addresses immediate staffing needs but also builds a robust foundation for long-term project execution and innovation. Cultivating a diverse talent pipeline ensures a broader range of perspectives and skills, further strengthening DPR's competitive edge in the market.

- Addressing Labor Shortages: The U.S. Bureau of Labor Statistics projected a need for over 500,000 additional construction workers annually over the next decade to meet demand.

- Internal Training Expansion: Enhancing apprenticeship programs can directly increase the number of qualified workers within DPR, reducing reliance on external hiring.

- Talent Pipeline Cultivation: Outreach to high schools and trade schools can attract younger generations, diversifying the workforce and bringing fresh skills.

- Skilled Trades Development: Focused training in specialized trades ensures DPR can handle complex projects efficiently and maintain high quality standards.

DPR Construction is well-positioned to capitalize on the increasing demand for specialized construction services in high-growth sectors like data centers, advanced manufacturing, and life sciences. The company's demonstrated expertise in these areas, coupled with the ongoing expansion driven by AI and reshoring initiatives, presents a significant revenue growth opportunity. For example, the data center construction market alone was projected to exceed $100 billion globally by 2025, a testament to the sector's robust expansion.

Threats

A general economic downturn poses a significant threat to DPR Construction. Reduced capital investment across industries can lead to fewer new projects, impacting demand for construction services. For instance, a prolonged recession could see commercial real estate development slow considerably, a key sector for many construction firms.

Sustained high interest rates further exacerbate these challenges. Higher borrowing costs make financing for new construction projects more expensive and less attractive, potentially delaying or canceling planned developments. This can directly affect DPR's pipeline and the overall financial viability of projects they might pursue.

While DPR's focus on sectors like healthcare and education may offer some resilience, a broad economic slowdown necessitates careful financial management and strategic project selection. The U.S. construction industry, for example, experienced a slowdown in non-residential construction starts in late 2023 and early 2024 due to these economic pressures, indicating a sector-wide vulnerability.

The commercial construction sector is intensely competitive, with numerous large, established players and a growing number of agile new entrants all bidding for the same projects. This crowded landscape means DPR Construction faces constant pressure to differentiate itself and maintain market share.

This heightened competition can directly impact profitability by driving down project margins as companies underbid to secure work. For instance, in 2024, the average profit margin for general contractors in the US hovered around 1-3%, a tight range exacerbated by competitive bidding environments.

Furthermore, securing high-value contracts, especially in specialized or high-growth sectors like advanced manufacturing or healthcare construction, becomes significantly more challenging when multiple capable firms are vying for the same opportunities.

Changes in government regulations, building codes, or environmental policies can significantly affect project requirements, costs, and timelines for construction firms like DPR Construction. For instance, a sudden increase in material import tariffs, as seen with certain steel products in past years, could directly inflate project budgets and impact profitability.

Shifts in infrastructure spending priorities by federal or state governments can also create unforeseen challenges or opportunities. A pivot away from public transit projects towards highway expansion, for example, would require strategic adjustments in resource allocation and project bidding for DPR.

Material Price Escalation and Supply Chain Disruptions

DPR Construction faces ongoing threats from volatile material prices and supply chain disruptions. For instance, the Producer Price Index for construction materials saw significant increases throughout 2024, impacting project costs. This volatility makes it challenging to maintain predictable budgeting and can directly affect profitability if not managed proactively.

The inability to secure essential materials efficiently or at stable costs presents a substantial risk. Supply chain bottlenecks, as seen with the shortages of specialized electrical components in late 2024, can lead to project delays. These delays not only increase labor costs but also damage client relationships and future business prospects.

- Volatile Material Costs: Continued fluctuations in prices for steel, lumber, and concrete in 2024-2025 directly challenge fixed-price contracts.

- Supply Chain Vulnerabilities: Reliance on global suppliers for key components means disruptions, like those experienced with HVAC systems in early 2025, can halt progress.

- Project Schedule Impacts: Delays in material delivery, sometimes by weeks, can cascade through project timelines, increasing overall project duration and cost.

- Profit Margin Erosion: Unforeseen cost escalations without the ability to pass them on to clients directly squeeze profit margins for construction projects.

Skilled Labor Shortage and Wage Inflation

The construction industry, including companies like DPR Construction, faces a significant threat from the ongoing shortage of skilled labor. This scarcity is particularly acute in specialized trades such as electrical, plumbing, and HVAC, which are critical for project completion. For instance, a 2024 Associated General Contractors of America survey found that 70% of construction firms reported difficulty finding skilled workers, a persistent issue impacting project timelines and costs.

This persistent labor gap directly fuels wage inflation. As demand for qualified workers outstrips supply, companies are compelled to offer higher wages and more attractive benefits to attract and retain talent. This increased labor cost can significantly impact project profitability and competitiveness. The U.S. Bureau of Labor Statistics reported that wages in construction occupations rose by an average of 5.5% in 2023, a trend expected to continue into 2024 and 2025 due to the labor deficit.

- Skilled Trade Gap: Shortages in electricians, HVAC technicians, and other specialized roles remain a critical challenge.

- Wage Pressures: Increased competition for limited skilled workers drives up labor costs, impacting project budgets.

- Project Delays: Insufficient availability of qualified personnel can lead to extended project schedules and potential cost overruns.

- Impact on Profitability: Higher labor expenses directly affect margins for construction firms.

Intense competition within the commercial construction sector presents a significant threat to DPR Construction, potentially driving down project margins. For example, in 2024, U.S. general contractors saw average profit margins around 1-3%, a narrow range that becomes even tighter under competitive bidding pressures.

Regulatory changes and shifts in government infrastructure priorities can also disrupt DPR's operations. Increased material tariffs or a pivot in public spending, such as from transit to highways, would necessitate strategic adjustments, impacting project viability and resource allocation.

Volatility in material costs and supply chain disruptions, evidenced by rising construction material prices in 2024 and shortages of components like HVAC systems in early 2025, directly challenge DPR's ability to maintain predictable budgeting and profitability.

The persistent shortage of skilled labor, with 70% of firms reporting difficulties in finding workers in 2024, fuels wage inflation. This, coupled with project delays from material scarcity, directly squeezes profit margins for construction firms like DPR.

| Threat Category | Specific Challenge | Impact on DPR Construction | 2024/2025 Data Point |

|---|---|---|---|

| Economic Conditions | General economic downturn, high interest rates | Reduced project demand, higher financing costs | U.S. non-residential construction starts slowed late 2023/early 2024 |

| Market Competition | Intense competition, pressure on margins | Difficulty securing profitable contracts | Average contractor profit margins 1-3% in 2024 |

| Regulatory & Policy | Changing regulations, infrastructure spending shifts | Increased project costs, need for strategic adaptation | Potential impact of material tariffs or infrastructure priority changes |

| Operational Risks | Material cost volatility, supply chain disruptions | Budgeting challenges, project delays, profit erosion | Producer Price Index for construction materials increased in 2024; HVAC component shortages early 2025 |

| Labor Market | Skilled labor shortage, wage inflation | Project delays, increased labor costs, reduced profitability | 70% of firms reported difficulty finding skilled workers (AGC 2024); Construction wages rose 5.5% in 2023 |

SWOT Analysis Data Sources

This DPR Construction SWOT analysis is built upon a foundation of credible data, drawing from their official financial filings, comprehensive market intelligence reports, and insights from industry experts. This ensures a robust and data-driven assessment of their strengths, weaknesses, opportunities, and threats.