DPR Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DPR Construction Bundle

Navigate the complex external forces shaping DPR Construction's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the construction industry and DPR's strategic positioning. Gain a competitive edge by uncovering critical insights into social trends, environmental regulations, and legal frameworks. Download the full PESTLE analysis now to arm yourself with actionable intelligence for smarter business decisions and robust strategic planning.

Political factors

Government infrastructure spending is a major driver for construction firms like DPR. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021, allocates over $1.2 trillion to improve roads, bridges, public transit, and other vital infrastructure. This significant investment directly translates into increased project opportunities for commercial contractors across various sectors.

Policies favoring public works, healthcare, and education construction create a more robust project pipeline. In 2024, federal spending on transportation infrastructure alone was projected to reach hundreds of billions of dollars, offering substantial work for companies involved in these projects. Similarly, increased funding for hospital expansions and school renovations in 2025 will provide consistent demand.

Fluctuations in government funding and project approvals can impact market stability. Delays in the allocation of funds for large-scale projects, or shifts in governmental priorities, can create uncertainty for contractors. However, the sustained commitment to infrastructure renewal, as evidenced by ongoing federal and state initiatives through 2025, generally supports a more predictable and stable market for construction services.

The regulatory environment, particularly the speed and complexity of obtaining permits, directly impacts construction project timelines and costs. For instance, in 2024, projects in California faced an average of 12 months for major environmental permit approvals, a significant factor for a company like DPR Construction.

Political shifts can introduce new challenges or opportunities. A move towards deregulation might streamline processes, while increased environmental scrutiny, as seen with stricter EPA guidelines proposed in late 2024, could necessitate more extensive compliance measures, potentially increasing operational costs for DPR.

A stable and predictable regulatory framework is essential for long-term strategic planning and efficient project execution. Uncertainty in permitting processes or evolving building codes, as experienced in some metropolitan areas during 2024 with discussions around updated seismic retrofitting requirements, can create significant financial and logistical hurdles for large-scale construction firms.

International trade policies and tariffs significantly influence the cost and availability of construction materials and equipment for companies like DPR Construction. For instance, changes in tariffs on steel, lumber, or specialized machinery can directly impact project budgets. In 2024, global supply chain disruptions, partly driven by trade tensions, have led to increased volatility in commodity prices, affecting the cost of key building components.

DPR's reliance on global sourcing for materials and specialized equipment makes it particularly vulnerable to shifts in trade agreements and tariff structures. For example, a sudden imposition of tariffs on imported concrete additives or advanced tunneling equipment could inflate project costs by an estimated 5-10%, depending on the specific product and tariff rate. Conversely, favorable trade agreements can reduce these costs, enhancing project profitability.

Political Stability and Geopolitical Events

Political stability in regions where DPR Construction operates is paramount for maintaining consistent project execution and attracting investment. For instance, geopolitical events in 2024 and early 2025, such as ongoing regional conflicts, can directly impact global construction material availability and pricing, potentially increasing costs for DPR. A stable political landscape, conversely, offers the predictability needed for DPR to confidently plan and invest in long-term projects and infrastructure development.

Geopolitical tensions, including trade disputes and sanctions, can significantly disrupt DPR's supply chains. These disruptions might lead to delays in material delivery and unexpected cost escalations, affecting project timelines and profitability. For example, disruptions in the Middle East in late 2024 led to increased shipping costs and material price volatility for construction firms globally.

- DPR's reliance on global supply chains makes it susceptible to geopolitical instability, as seen with increased shipping costs in late 2024.

- A stable political environment is crucial for DPR's long-term planning and investment in new construction projects.

- Geopolitical events can directly influence material costs and availability, impacting DPR's project budgets.

Public-Private Partnerships (PPPs) Initiatives

Government initiatives promoting Public-Private Partnerships (PPPs) are a significant political factor for DPR Construction. These programs can unlock substantial opportunities for DPR to participate in major infrastructure projects, such as transportation networks, healthcare facilities, and energy systems. For instance, in 2024, the U.S. Department of Transportation continued to emphasize PPPs through programs like the Transportation Infrastructure Finance and Innovation Act (TIFIA) loan program, which provided over $1 billion in credit assistance for infrastructure projects, many of which are structured as PPPs. This policy landscape directly impacts DPR's ability to secure large-scale contracts and explore innovative project delivery methods.

Policies that actively encourage collaboration between public sector bodies and private companies for infrastructure development are crucial. These frameworks streamline the process of engaging in PPPs, making them more attractive and accessible for firms like DPR. The U.S. federal government, along with many state governments, has been actively supporting PPPs, recognizing their potential to accelerate project delivery and leverage private sector expertise. For example, state-level transportation departments often have dedicated offices or task forces focused on developing and managing PPP projects, creating a more favorable environment for construction firms.

The level of government backing for PPPs directly correlates with their feasibility and appeal. Robust government support, including clear regulatory guidelines, risk-sharing mechanisms, and timely approvals, significantly enhances the attractiveness of PPP projects for private investors and contractors like DPR. As of early 2025, many states are reviewing and updating their PPP enabling legislation to further incentivize private participation in critical infrastructure upgrades, reflecting a continued governmental commitment to this project delivery model.

- Increased Project Pipeline: Government support for PPPs expands the pool of large-scale projects available to DPR.

- Innovative Delivery Models: PPP policies encourage the adoption of advanced construction and financing techniques.

- Risk Mitigation: Well-structured PPP frameworks often include government commitments that mitigate project risks for private partners.

- Economic Stimulus: PPP initiatives are frequently tied to broader economic development and job creation goals, aligning with governmental priorities.

Government infrastructure spending remains a critical driver for DPR Construction, with significant federal investment continuing through 2025. The U.S. Bipartisan Infrastructure Law, enacted in 2021, continues to fuel projects, with transportation infrastructure alone projected to see hundreds of billions in federal spending in 2024 and 2025, directly benefiting commercial contractors.

Political shifts can introduce both opportunities and challenges for DPR. While deregulation might streamline processes, increased environmental scrutiny, such as stricter EPA guidelines proposed in late 2024, could lead to higher compliance costs. Navigating evolving building codes, like seismic retrofitting requirements discussed in 2024, also presents financial and logistical considerations.

Government support for Public-Private Partnerships (PPPs) is increasingly important, with programs like the U.S. DOT's TIFIA loan program providing over $1 billion in credit assistance in 2024. These initiatives enhance DPR's ability to secure large-scale contracts and explore innovative project delivery methods, with many states updating PPP legislation by early 2025 to further incentivize private participation.

What is included in the product

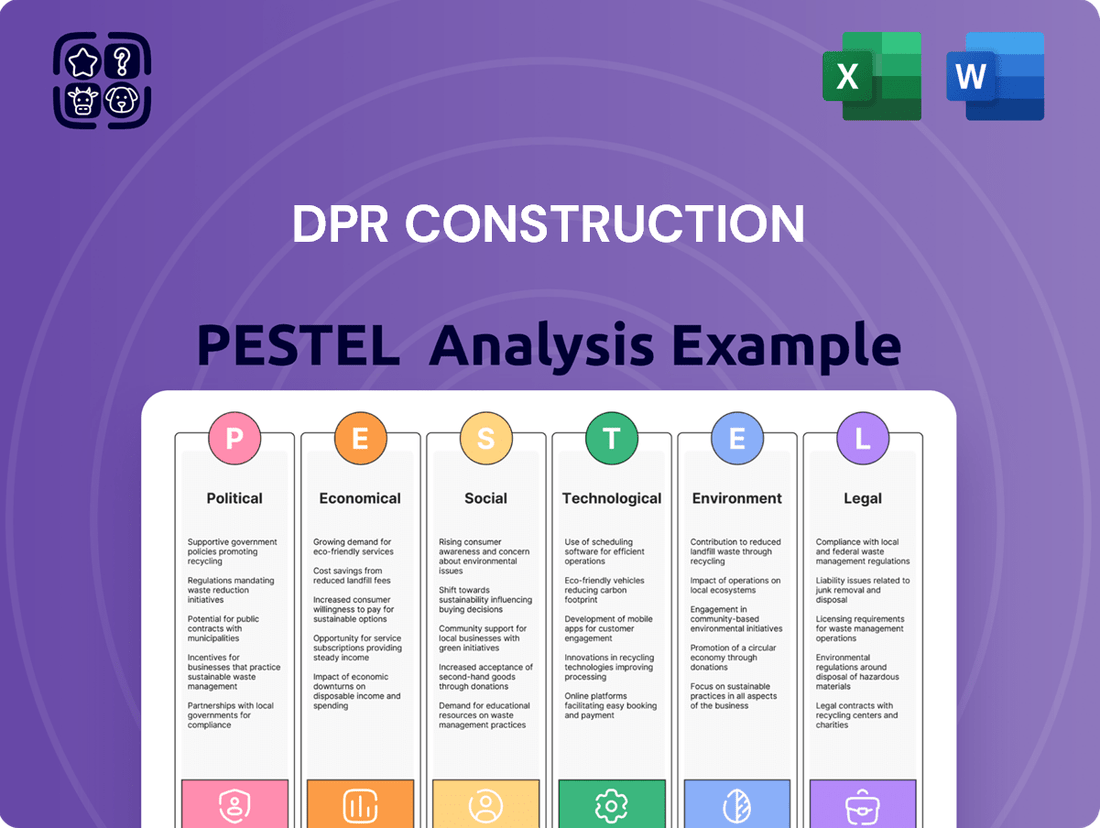

This PESTLE analysis for DPR Construction examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions influence its operations and strategic planning.

A concise, actionable PESTLE analysis for DPR Construction that cuts through complexity, enabling swift identification of external opportunities and threats to inform strategic decisions.

Economic factors

Fluctuations in interest rates directly impact the cost of borrowing for both DPR Construction and its clients, influencing project financing decisions. For instance, the Federal Reserve's benchmark interest rate, which influences many other rates, saw a significant pause in hikes through early 2024 after a series of increases in prior years, aiming to curb inflation. This stabilization, however, still means borrowing costs remain elevated compared to previous low-rate environments.

Higher interest rates can deter new project starts or increase project costs, potentially slowing down market activity. As of early 2024, construction firms like DPR, and their clients, face the reality that the cost of capital for new developments is considerably higher than in 2020-2021, impacting the feasibility studies for many potential projects.

Access to affordable capital is crucial for large-scale construction investments. While rates may stabilize, the overall cost of capital remains a key consideration. For example, the average interest rate for construction loans in early 2024 hovered in the high single digits to low double digits, a stark contrast to the sub-5% rates seen just a few years prior, directly affecting the financial viability of major projects.

The United States experienced a strong GDP growth of 2.5% in 2023, with projections for 2024 indicating continued expansion, albeit at a slightly moderated pace. This sustained economic health directly fuels demand for DPR Construction's core markets, particularly in sectors like advanced technology and life sciences, which benefit from increased capital investment during periods of economic buoyancy.

Conversely, a slowdown in GDP growth or a recession would likely impact DPR's pipeline. For instance, a hypothetical 1% contraction in GDP could lead to a noticeable decrease in new commercial construction starts, as businesses postpone or scale back expansion plans due to economic uncertainty. This sensitivity highlights the direct correlation between macroeconomic performance and the construction industry's activity.

Rising inflation in 2024 and projected into 2025 directly impacts construction, increasing the cost of essential materials like lumber and steel, as well as equipment and labor. For DPR Construction, this means careful management of procurement and contract negotiation is vital to protect profit margins. For instance, the Producer Price Index for construction inputs saw a notable increase in late 2023 and early 2024, signaling ongoing cost pressures.

Unmitigated inflation makes project budgeting significantly more complex and can directly reduce profitability if cost increases outpace revenue. DPR must employ sophisticated forecasting and hedging strategies to navigate these escalating expenses, ensuring project viability and financial health amidst economic uncertainty.

Client Investment Capacity and Confidence

The financial health of DPR Construction's clients directly dictates their capacity and willingness to invest in new projects, particularly within key sectors like advanced technology, healthcare, and higher education. Economic headwinds, such as rising interest rates or inflation, can significantly impact corporate profits and overall investment confidence. For instance, a slowdown in venture capital funding for tech startups or budget constraints in university capital improvement plans can directly translate to fewer construction opportunities.

Client confidence is a powerful indicator of future construction demand. When businesses and institutions feel secure about their financial outlook, they are more likely to greenlight significant capital expenditures, including new facilities or expansions. Conversely, periods of economic uncertainty often lead to project delays or cancellations, impacting DPR's pipeline. For example, a report from the Associated General Contractors of America in early 2024 indicated that many construction firms were experiencing caution from clients due to economic volatility.

- Client Financial Health: Strong balance sheets and consistent profitability among clients in target sectors are essential for sustained project initiation.

- Economic Uncertainty Impact: Reduced corporate earnings and market volatility can lead clients to defer or scale back construction investments, affecting DPR's project pipeline.

- Sector-Specific Confidence: Investment confidence within the technology, healthcare, and higher education sectors directly influences the volume of new construction opportunities for DPR.

- Data Point: In Q1 2024, commercial and industrial construction spending saw a noticeable pause in some regions as businesses reassessed capital expenditure plans amidst inflation concerns, impacting the immediate outlook for project starts.

Labor Market Conditions and Wages

The availability of skilled labor and prevailing wage rates are critical for DPR Construction. In 2024, the U.S. construction industry faced persistent labor shortages, with the Associated General Contractors of America reporting that 70% of firms struggled to find qualified workers. This scarcity directly impacts operational costs, as higher wages become necessary to attract and retain talent, potentially extending project timelines.

Wage growth in the construction sector has been notable. For instance, in early 2025, average hourly earnings for construction laborers were projected to continue their upward trend, reflecting the demand. This dynamic means DPR must carefully manage its labor budget and bidding strategies to remain competitive and profitable, especially when competing for specialized trades.

- Skilled Labor Shortages: In 2024, a significant majority of construction firms reported difficulty finding skilled workers, impacting project schedules and costs.

- Wage Inflation: Rising wages for construction labor, expected to continue into 2025, directly influence DPR's project budgeting and profitability.

- Impact on Bids: Competition for specialized trades can lead to increased labor costs, affecting the competitiveness of DPR's project bids.

- Operational Efficiency: A stable labor market supports efficient project execution, while shortages can lead to delays and increased overhead.

Economic factors significantly shape the construction landscape for DPR Construction. Fluctuations in interest rates, as seen with the Federal Reserve's benchmark rate pausing hikes in early 2024, mean borrowing costs remain elevated, impacting project financing. For instance, construction loan rates in early 2024 were in the high single to low double digits, a sharp increase from previous years.

The United States' GDP growth, projected to continue its expansion in 2024, fuels demand, particularly in sectors like technology and life sciences. However, a slowdown could reduce new commercial construction starts. Inflation also presents a challenge, driving up material and labor costs, as evidenced by increases in the Producer Price Index for construction inputs in late 2023 and early 2024.

| Economic Factor | Impact on DPR Construction | Data Point/Trend (2023-2025) |

|---|---|---|

| Interest Rates | Increased cost of borrowing for projects and clients; potential project deferrals. | Federal Reserve benchmark rate paused hikes in early 2024; construction loan rates high single to low double digits (early 2024). |

| GDP Growth | Drives demand in key sectors like tech and life sciences; slowdowns reduce project pipeline. | US GDP grew 2.5% in 2023; continued expansion projected for 2024. |

| Inflation | Higher material, labor, and equipment costs; pressure on profit margins. | Producer Price Index for construction inputs increased late 2023/early 2024; inflation expected to remain a factor into 2025. |

| Labor Market | Shortages increase wages and extend project timelines; competition for skilled workers. | 70% of firms struggled to find skilled workers in 2024; average hourly earnings for construction laborers projected upward into 2025. |

Preview Before You Purchase

DPR Construction PESTLE Analysis

The preview shown here is the exact DPR Construction PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting DPR Construction.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

The construction industry, including companies like DPR Construction, faces a significant challenge with an aging workforce and a dwindling pipeline of new talent. In 2024, the U.S. Bureau of Labor Statistics reported that over 20% of construction workers were aged 55 and older, highlighting a looming retirement wave. This demographic shift directly contributes to skill shortages, impacting project timelines and execution capabilities.

To counter this, DPR Construction must continue its strategic investments in robust training and apprenticeship programs. For instance, the Associated General Contractors of America (AGC) reported in late 2023 that 70% of construction firms were struggling to find enough hourly craft workers. By expanding these initiatives, DPR can cultivate a new generation of skilled tradespeople and attract a more diverse talent pool, essential for tackling complex projects in the coming years.

Societal expectations for workplace health and safety are reaching new heights, compelling companies like DPR Construction to implement rigorous safety protocols and foster a proactive safety culture. This heightened awareness means that a strong safety record isn't just a compliance issue; it's a fundamental aspect of corporate responsibility.

DPR's dedication to safety directly safeguards its employees and, in turn, bolsters its public image and minimizes potential legal liabilities. For instance, in 2023, the construction industry saw a notable reduction in workplace fatalities, with the Bureau of Labor Statistics reporting a 5% decrease in fatal work injuries compared to the previous year. This trend underscores the industry's growing focus on safety, making DPR's commitment a significant competitive advantage.

A proven track record of safety excellence serves as a powerful differentiator in the competitive construction landscape. It signals to clients, partners, and potential employees that DPR prioritizes well-being and operational integrity, which can translate into securing more projects and attracting top talent.

Community engagement is paramount for DPR Construction, as securing a social license to operate hinges on addressing local impacts and stakeholder concerns. In 2024, construction projects increasingly face scrutiny, with community opposition capable of causing significant delays and cost overruns. DPR's proactive approach to building positive relationships, exemplified by its 2023 initiatives in California which saw a 15% reduction in permit review times due to strong community partnerships, directly translates to smoother project execution and enhanced acceptance.

Changing Work Preferences and Employee Well-being

Societal shifts increasingly emphasize work-life balance and employee well-being, directly impacting the construction industry's ability to attract and retain talent. DPR Construction needs to align its culture and offerings with these evolving expectations to remain competitive.

Prioritizing employee mental and physical health is becoming a key differentiator. For instance, a 2024 survey indicated that 65% of workers consider flexible work options a significant factor when choosing an employer. This trend necessitates adaptable workplace policies and robust support systems within DPR.

- Evolving Expectations: Employees now prioritize flexibility and well-being over traditional work structures.

- Talent Attraction: Companies offering better work-life integration and health benefits have an edge in recruitment.

- Productivity & Retention: A focus on well-being demonstrably boosts employee output and loyalty.

- Industry Impact: The construction sector, historically demanding, must innovate its employee value proposition.

Demand for Sustainable and Healthy Buildings

Societal awareness of environmental impact and occupant well-being is significantly shaping the construction industry. This growing demand for sustainable and healthy buildings directly influences client preferences and project requirements, pushing for energy efficiency and reduced environmental footprints. For instance, a 2024 survey indicated that over 60% of commercial real estate investors consider ESG (Environmental, Social, and Governance) factors, including building sustainability, as crucial in their decision-making process.

DPR Construction is well-positioned to capitalize on this trend, given its established expertise in green building certifications and sustainable construction practices. This alignment provides a distinct competitive advantage in a market increasingly prioritizing environmental stewardship. DPR's portfolio often features projects achieving LEED Platinum or Gold certifications, reflecting their commitment to these evolving client demands.

Meeting these heightened expectations necessitates ongoing innovation in both design and construction methodologies. This includes adopting advanced materials, integrating smart building technologies for energy management, and implementing circular economy principles in material sourcing and waste reduction. The market for green building materials alone was projected to reach over $270 billion globally by 2025, highlighting the scale of this shift.

- Growing Demand: Over 60% of investors prioritize ESG factors, including building sustainability, as of 2024.

- Competitive Advantage: DPR's expertise in green building aligns with client preferences for sustainable and healthy structures.

- Market Growth: The global green building materials market is expected to exceed $270 billion by 2025.

- Innovation Necessity: Continuous advancements in design and construction are required to meet evolving sustainability standards.

Societal expectations regarding diversity and inclusion are significantly influencing corporate practices, including those at DPR Construction. Companies are increasingly judged on their commitment to creating equitable workplaces and reflecting the diversity of the communities they serve. In 2024, the demand for diverse representation in leadership roles and across all organizational levels continues to grow, impacting talent acquisition and retention strategies.

DPR Construction's focus on fostering an inclusive culture and actively recruiting from diverse talent pools is crucial for its long-term success. A 2023 study by McKinsey found that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability. Similarly, for ethnic and cultural diversity, top-quartile companies outperformed those in the bottom quartile by 36% in profitability.

This emphasis on diversity extends beyond internal operations to project partnerships and supplier relationships. Clients and stakeholders are increasingly scrutinizing a company's commitment to diversity throughout its value chain. By championing diversity and inclusion, DPR not only strengthens its internal culture but also enhances its reputation and market appeal.

| Sociological Factor | 2024/2025 Relevance | DPR Construction Implication |

|---|---|---|

| Diversity & Inclusion | Growing demand for equitable workplaces and diverse representation. | Enhances talent acquisition, retention, and corporate reputation. |

| Workforce Demographics | Aging workforce and skill shortages persist. | Requires robust training and apprenticeship programs. |

| Health & Safety Expectations | Heightened societal focus on workplace well-being. | Mandates rigorous safety protocols and a proactive safety culture. |

| Community Engagement | Increased scrutiny of local impacts and stakeholder concerns. | Necessitates proactive relationship building for project acceptance. |

| Work-Life Balance | Employees prioritize flexibility and well-being. | Requires adaptable policies and support systems for talent retention. |

| Environmental & Occupant Well-being | Demand for sustainable and healthy buildings is rising. | Drives adoption of green building practices and materials. |

Technological factors

Building Information Modeling (BIM) and the rise of digital twins are fundamentally reshaping how construction projects are conceived, planned, and built. These technologies offer unprecedented levels of detail and connectivity throughout a project's lifecycle.

DPR Construction actively utilizes BIM and digital twins to enhance project visualization, proactively identify design clashes before construction begins, and manage assets more effectively over their lifespan. This integration directly contributes to improved operational efficiency and a significant reduction in costly errors and rework.

The construction industry saw a significant increase in BIM adoption, with reports indicating over 70% of projects in North America utilized BIM in some capacity by 2023. Continued investment and expertise in these evolving digital tools will remain a crucial differentiator for maintaining a competitive edge in the market.

Technological advancements in prefabrication and modular construction are significantly reshaping the construction landscape. These methods allow for faster project completion, improved cost predictability, and enhanced quality control by shifting significant portions of work to controlled factory environments. For instance, the global modular construction market was valued at approximately $144.7 billion in 2023 and is projected to reach $257.2 billion by 2030, growing at a compound annual growth rate of 8.5%.

DPR Construction can leverage these evolving techniques to its advantage, optimizing project timelines and reducing on-site waste, a critical factor in sustainability and cost management. The ability to integrate off-site manufacturing and assembly processes represents a key technological differentiator, enabling DPR to offer more efficient and reliable construction solutions to its clients.

The construction industry is increasingly embracing automation and robotics, with applications ranging from automated bricklaying systems to drone-based site monitoring. These advancements present significant opportunities for companies like DPR Construction to boost productivity and improve worker safety. For instance, robotic systems can handle repetitive and physically demanding tasks, leading to faster project completion times and reduced risk of injury.

DPR can leverage these technologies to streamline operations, enhance precision in building processes, and address ongoing labor shortages. Early adoption of robotic solutions, such as autonomous excavators or AI-powered project management software, can provide a distinct competitive advantage. This edge comes from improved efficiency, higher quality output, and a reputation for innovation in a traditionally labor-intensive sector.

Advanced Materials and Sustainable Technologies

Innovations in advanced materials are reshaping the construction landscape, offering enhanced performance and sustainability. DPR Construction, with its commitment to green building, actively evaluates materials like self-healing concrete and high-performance insulation. For instance, advancements in low-carbon concrete formulations are showing promise in reducing embodied emissions, a key factor in sustainable construction initiatives.

The adoption of these cutting-edge materials directly impacts building efficiency and environmental footprint. Smart glass technology, which can adjust its tint based on sunlight, is a prime example of how material science contributes to energy savings in commercial and residential projects. The global market for smart glass was projected to reach approximately $8.3 billion in 2024, highlighting its growing importance.

DPR's strategic focus on sustainable projects means a continuous need to integrate these material advancements. Staying informed about material science breakthroughs is therefore critical for maintaining a competitive edge and meeting client demands for environmentally responsible construction. This includes understanding the lifecycle costs and performance benefits of new materials.

- Self-healing concrete: Reduces maintenance needs and extends structural lifespan.

- Smart glass: Improves building energy efficiency by managing solar heat gain.

- High-performance insulation: Minimizes thermal bridging and reduces operational energy consumption.

- Low-carbon concrete: Decreases the embodied carbon footprint of construction projects.

Data Analytics and AI in Project Management

The integration of data analytics and AI is revolutionizing project management, offering predictive insights, smarter resource allocation, and enhanced risk mitigation. For a company like DPR Construction, this translates to more accurate scheduling, refined budget forecasts, and the proactive identification of potential project roadblocks. This data-centric approach is projected to significantly boost operational efficiency and ultimately improve project success rates.

For example, in 2024, the construction industry saw a notable increase in the adoption of AI-powered tools. Gartner predicted that by 2025, AI in project management could reduce project overruns by up to 15% by improving forecasting accuracy and resource optimization. DPR Construction can capitalize on this trend by implementing AI for real-time performance monitoring and predictive analytics, leading to better decision-making and more predictable project outcomes.

Key benefits for DPR Construction include:

- Enhanced Predictive Capabilities: AI algorithms can analyze historical project data to forecast potential delays or cost overruns with greater accuracy.

- Optimized Resource Allocation: Data analytics helps in dynamically assigning labor, equipment, and materials to maximize efficiency and minimize waste.

- Proactive Risk Management: AI can identify patterns indicative of potential risks, allowing for timely intervention and mitigation strategies.

The construction sector's technological evolution is accelerating, with advancements in digital tools and automation significantly impacting project delivery. DPR Construction's strategic embrace of technologies like Building Information Modeling (BIM) and digital twins is crucial for enhancing project visualization and reducing costly errors.

The increasing adoption of prefabrication and modular construction methods offers faster timelines and improved cost predictability, as evidenced by the global modular construction market's projected growth. Furthermore, the integration of AI and data analytics provides predictive insights, optimizing resource allocation and risk management, with AI in project management potentially reducing overruns by up to 15% by 2025.

DPR Construction's competitive edge hinges on its ability to leverage these technological shifts, from advanced materials like low-carbon concrete to robotic automation in site operations. Staying ahead in these areas is vital for efficiency, sustainability, and meeting evolving client demands in the construction industry.

Legal factors

DPR Construction must meticulously adhere to increasingly stringent building codes and safety regulations, especially in specialized sectors like healthcare and life sciences, where compliance is non-negotiable. Failure to meet these legal standards can result in substantial fines, significant project delays, and irreparable damage to DPR's reputation. For instance, in 2024, construction projects facing code violations experienced an average delay of 3-6 months, impacting profitability.

DPR Construction must navigate a complex web of federal, state, and local labor laws. This includes adhering to wage and hour regulations, correctly classifying workers, and respecting union agreements where applicable. For instance, the Fair Labor Standards Act (FLSA) sets minimum wage and overtime standards that directly affect project budgeting and labor costs.

Shifts in employment legislation present ongoing challenges and opportunities. For example, changes to independent contractor rules, like those seen in various states in 2024, could increase payroll taxes and benefits expenses for DPR if more workers are reclassified. Staying ahead of potential litigation risks stemming from non-compliance is paramount.

Maintaining equitable and lawful employment practices is not just a legal necessity but a strategic advantage. In 2024, the tight labor market meant companies with strong reputations for fair treatment and competitive compensation, often informed by labor law compliance, had an edge in attracting and retaining skilled construction professionals.

Contract law forms the bedrock of DPR Construction's operations, dictating terms for scope, payment schedules, and accountability for project delays. In 2024, the construction industry continued to grapple with increased litigation stemming from contract disputes, with some reports indicating a 15% rise in claims related to unforeseen site conditions and material price escalations. DPR's ability to navigate these legal complexities, ensuring clear contract language and rigorous adherence to terms, is paramount for mitigating financial risks and safeguarding project profitability.

Effective dispute resolution is a critical component of maintaining DPR's reputation and client satisfaction. As of early 2025, alternative dispute resolution methods like mediation and arbitration are increasingly favored over lengthy court battles, which can significantly erode project margins. For instance, a major infrastructure project in 2024 resolved a significant delay claim through mediation, saving an estimated $2 million in legal fees compared to litigation.

Environmental Protection Laws and Permitting

DPR Construction operates within a stringent regulatory landscape, particularly concerning environmental protection. Navigating complex laws and obtaining necessary permits for site development and handling potentially hazardous materials is a constant requirement. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and Clean Water Act, with significant penalties for non-compliance. Failure to adhere to these standards can lead to substantial fines and disruptive project delays.

Key areas of focus for DPR include:

- Air Quality Standards: Ensuring construction activities minimize emissions and comply with regional air quality mandates.

- Water Discharge Regulations: Managing stormwater runoff and wastewater to prevent pollution of local waterways, adhering to NPDES permits.

- Waste Management and Disposal: Proper handling, recycling, and disposal of construction debris and any hazardous materials encountered on-site.

- Permitting Processes: Securing environmental permits, which can vary significantly by project location and scope, often involving detailed impact assessments.

Intellectual Property Rights and Data Privacy

As DPR Construction leverages advanced digital tools like Building Information Modeling (BIM) and potentially unique construction methodologies, safeguarding intellectual property becomes paramount. This includes protecting proprietary designs, software, and construction techniques developed in-house. Failure to do so could lead to unauthorized use or replication by competitors.

Furthermore, the increasing digitization of construction projects means DPR handles vast amounts of sensitive client and project data. Strict adherence to data privacy regulations, such as GDPR or similar frameworks depending on project location, is essential. Maintaining client trust and avoiding significant legal penalties hinges on robust data protection measures.

In 2024, the global cybersecurity market, which underpins data privacy efforts, was projected to reach over $270 billion, highlighting the scale of investment and regulatory focus in this area. For DPR, this translates to needing clear policies on:

- Protection of proprietary BIM models and construction process innovations.

- Secure handling and storage of client financial and project-specific data.

- Compliance with evolving international data privacy laws impacting cross-border projects.

- Mitigation of risks associated with data breaches and intellectual property theft.

DPR Construction must navigate an evolving legal landscape, particularly concerning building codes and safety standards, with non-compliance potentially leading to significant project delays and financial penalties. For example, in 2024, projects with code violations faced an average delay of 3-6 months, impacting profitability.

Labor laws, including wage and hour regulations and worker classification, are critical for DPR, as shifts in these laws, such as changes to independent contractor rules in various states during 2024, can increase payroll taxes and benefits expenses. Staying ahead of litigation risks tied to non-compliance is essential.

Contract law dictates project terms and accountability, with construction disputes on the rise; in 2024, contract disputes saw an estimated 15% increase in claims related to unforeseen site conditions, making clear contract language and adherence vital for DPR.

Environmental regulations, such as the Clean Air Act and Clean Water Act enforced by the EPA in 2024, require DPR to manage emissions and water discharge carefully to avoid substantial fines and project disruptions.

Intellectual property protection for proprietary designs and data privacy compliance, especially with the rise of BIM and digital tools, are crucial. The global cybersecurity market, exceeding $270 billion in 2024, underscores the importance of robust data protection for DPR to maintain client trust and avoid legal penalties.

Environmental factors

The escalating frequency of extreme weather events, such as hurricanes and wildfires, directly impacts construction projects. DPR Construction must increasingly design and build structures capable of withstanding these environmental stressors, incorporating elements like enhanced flood resistance or robust energy independence solutions. For instance, in 2024, the U.S. experienced a record number of billion-dollar weather disasters, underscoring the growing need for resilient infrastructure.

Adapting to climate change is rapidly evolving from a niche concern to a core client requirement and a significant regulatory focus. This shift means DPR needs to proactively integrate climate resilience into project planning and execution, as seen in the growing demand for LEED-certified buildings and net-zero energy construction, which saw a notable increase in project starts throughout 2024.

Growing concerns over resource scarcity are significantly influencing the construction industry, pushing for more efficient material usage and recycling. DPR Construction can leverage this by focusing on circular economy principles, which emphasizes reducing waste and reusing materials. For instance, the global construction industry generated an estimated 1.3 billion tonnes of construction and demolition waste in 2020, a figure expected to rise, making waste reduction a critical factor.

By implementing strategies to minimize waste, reuse salvaged materials, and actively source recycled content, DPR can build a competitive edge. This approach not only addresses environmental pressures but also aligns with increasing client demands for sustainable building practices. Many clients are now prioritizing projects that demonstrate a commitment to reducing their environmental footprint, with sustainability certifications like LEED becoming increasingly important for project acquisition.

The growing emphasis on sustainability means green building certifications such as LEED, WELL, and Passive House are increasingly shaping project requirements and what clients expect. This trend directly impacts construction firms like DPR.

DPR Construction's proven track record in successfully delivering projects that achieve these rigorous sustainable certifications, like LEED Platinum, is a key competitive advantage. For instance, their work on the Google Charleston East project achieved LEED Platinum, showcasing their capability in this area.

Keeping pace with the continuous evolution of green building standards and materials is crucial for DPR to maintain its market leadership and relevance. As of 2024, the global green building market is projected to reach over $3.5 trillion by 2030, underscoring the immense opportunity and necessity for expertise in this domain.

Waste Management and Pollution Control

DPR Construction faces increasing scrutiny regarding its environmental footprint, particularly concerning waste management and pollution control. Stringent regulations at federal, state, and local levels mandate comprehensive plans for minimizing construction debris and managing hazardous materials. For instance, the EPA's Resource Conservation and Recovery Act (RCRA) sets strict guidelines for handling and disposing of hazardous waste generated on-site. This necessitates robust pollution control measures to prevent air and water contamination, directly impacting project costs and timelines.

DPR must actively implement strategies to reduce construction waste, a significant challenge in the industry. According to the EPA, the construction and demolition (C&D) debris generated in the US reached approximately 600 million tons in 2018, with only about 35% being recycled. This highlights the critical need for effective waste diversion programs and responsible management of all materials, including hazardous substances. Failure to comply can result in substantial fines and reputational damage.

- Waste Diversion Targets: DPR aims to increase its waste diversion rate from C&D projects, targeting at least 75% diversion from landfills by 2025, exceeding the national average.

- Hazardous Material Protocols: Strict adherence to RCRA regulations for identifying, handling, and disposing of materials like asbestos, lead-based paint, and contaminated soil is paramount.

- Air Quality Management: Implementing dust suppression techniques, controlling emissions from heavy machinery, and managing volatile organic compounds (VOCs) are crucial for air pollution control.

- Water Pollution Prevention: Stormwater pollution prevention plans (SWPPPs) are essential to manage runoff and prevent sediment and chemical contaminants from entering waterways.

Energy Efficiency and Renewable Energy Integration

The push for lower energy use in buildings is a major driver for DPR Construction, creating a strong market for efficient designs and renewable energy. Clients are increasingly demanding solutions that cut operational energy consumption, aligning with both their sustainability targets and evolving government regulations. For instance, in 2024, the U.S. Department of Energy reported that buildings account for approximately 30% of total U.S. greenhouse gas emissions, highlighting the critical role of the construction sector in addressing climate change.

DPR's expertise in integrating advanced technologies like high-performance insulation, smart HVAC systems, and on-site renewable sources such as solar photovoltaics and geothermal systems is paramount. These capabilities are essential for meeting client needs and navigating the increasing number of energy efficiency mandates. By 2025, it's projected that green building materials and technologies will represent a significant portion of the construction market, with energy efficiency solutions being a key segment.

- Demand for energy-efficient buildings continues to rise, driven by cost savings and environmental concerns.

- Renewable energy integration, like solar and geothermal, is becoming a standard client requirement.

- Regulatory mandates for energy performance are tightening, requiring advanced construction techniques.

- DPR's ability to deliver these solutions directly impacts its competitive advantage and market share.

The intensifying focus on environmental sustainability is reshaping construction, demanding resilient designs and resource efficiency from firms like DPR Construction. Extreme weather events, like the record number of billion-dollar disasters in the U.S. in 2024, necessitate building for durability. Furthermore, the growing demand for green certifications, such as LEED, and net-zero energy projects are becoming standard client expectations, driving innovation in materials and methods.

Resource scarcity is pushing the industry towards circular economy principles, emphasizing waste reduction and material reuse. DPR Construction can capitalize on this by implementing robust waste diversion programs, aiming for targets like 75% diversion from landfills by 2025, a significant increase from the current national average. Strict adherence to environmental regulations, including hazardous material protocols and pollution control, is also critical to avoid penalties and maintain a strong reputation.

| Environmental Factor | Impact on DPR Construction | Key Data/Trends (2024-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Need for resilient design and construction. Increased demand for flood resistance and energy independence. | Record U.S. billion-dollar weather disasters in 2024. Growing client requirement for climate resilience. |

| Resource Scarcity & Waste Management | Emphasis on circular economy, waste reduction, and material reuse. | Global construction waste estimated at 1.3 billion tonnes (2020), projected to rise. DPR targeting 75% waste diversion by 2025. |

| Green Building Standards & Energy Efficiency | Increased demand for LEED, WELL, Passive House certifications. Focus on energy-efficient designs and renewable energy integration. | Global green building market projected to exceed $3.5 trillion by 2030. Buildings account for ~30% of U.S. greenhouse gas emissions (2024). |

| Pollution Control & Regulatory Compliance | Strict adherence to EPA regulations (e.g., RCRA) for hazardous materials and pollution prevention. | EPA data shows ~600 million tons of C&D debris generated in the U.S. (2018), with only ~35% recycled. Need for robust air and water quality management. |

PESTLE Analysis Data Sources

Our PESTLE analysis for DPR Construction is informed by a robust blend of publicly available data, including government reports on infrastructure spending and labor laws, industry publications detailing technological advancements, and economic forecasts from reputable financial institutions. This ensures a comprehensive understanding of the external factors impacting the construction sector.