DPR Construction Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DPR Construction Bundle

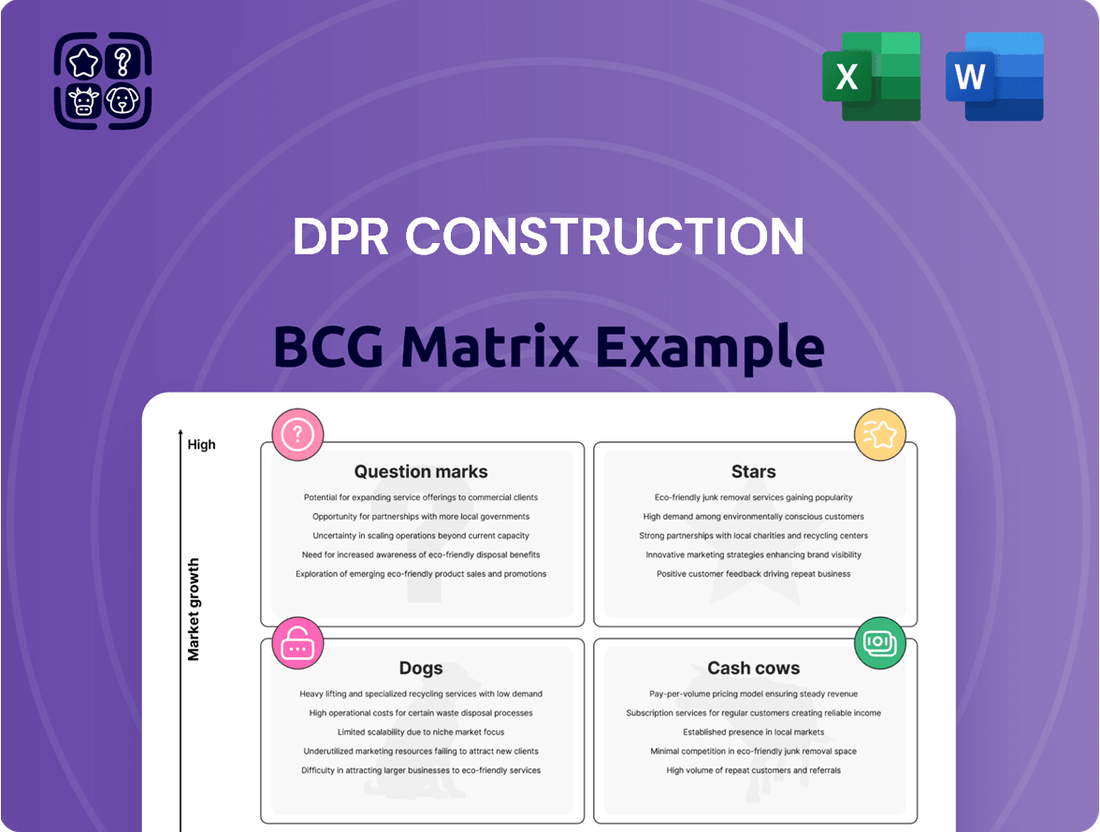

Curious about DPR Construction's strategic product portfolio? Our preview offers a glimpse into how their offerings might fit into the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, or Question Marks.

To truly unlock DPR Construction's market potential and make informed decisions, dive into the full BCG Matrix. This comprehensive report provides detailed quadrant placements and data-backed recommendations, empowering you to strategize with confidence.

Don't miss out on the complete picture; purchase the full BCG Matrix today for a clear roadmap to smart investment and product decisions for DPR Construction.

Stars

DPR Construction is a dominant force in the advanced technology construction segment, specializing in data centers and cutting-edge manufacturing plants. This sector is booming, driven by the exponential growth in artificial intelligence, cloud services, and the reshoring of manufacturing. For instance, the global data center construction market was valued at approximately $200 billion in 2023 and is projected to grow significantly through 2030.

Life Sciences Construction, specifically biopharmaceutical manufacturing, represents a Stars category for DPR Construction. This sector is experiencing robust growth, with substantial construction underway for major facilities such as bulk biologic, API, and fill-finish plants.

The burgeoning demand for GLP-1 drugs, used to treat diabetes and obesity, is a significant catalyst for this expansion. DPR's substantial commitment to this area, which accounts for 20% of their total revenue, underscores their strong position in a rapidly expanding market.

DPR Construction's dedication to sustainable building, including significant strides in carbon reduction and regenerative design, positions them strongly in a market that's rapidly expanding. Their commitment to responsible resource management is a key differentiator.

Innovation is central to DPR's strategy, with 70 patents and advancements in areas like Virtual Design and Construction (VDC) and prefabrication. This focus enables them to deliver buildings that are not only high-performing but also resilient to climate challenges.

Healthcare Construction (Complex Facilities)

Healthcare Construction (Complex Facilities) is a star in DPR Construction's BCG Matrix. The company consistently ranks as a top builder in this sector, focusing on intricate, patient-focused projects like new bed towers and advanced medical units.

This segment is experiencing high growth due to the increasing need for resilient, technologically integrated healthcare infrastructure that adapts to changing patient demands. DPR's expertise in complex facilities positions them strongly in this lucrative market.

- Market Share: High

- Industry Growth Rate: High

- DPR's Specialization: Technically complex and patient-centered facilities.

- Key Project Types: New bed towers, comprehensive liver care units, medical office pavilions.

Integrated Project Delivery (IPD) & Self-Perform Work

DPR Construction leverages Integrated Project Delivery (IPD) and self-perform work to gain significant control over project execution. This strategy allows for enhanced management of scope, sequencing, and timelines, crucial in demanding markets. In 2024, DPR's focus on these core competencies helped them navigate labor shortages effectively, ensuring project predictability and solidifying their market position.

This integrated approach translates directly into tangible benefits, particularly in complex projects. By controlling more aspects of the build, DPR can optimize workflows and respond swiftly to challenges. For instance, their self-perform capabilities in concrete and steel erection in 2024 allowed for greater schedule certainty, a key differentiator for clients facing tight deadlines.

- Enhanced Schedule Control: Self-perform work directly impacts project timelines, reducing reliance on external subcontractors and mitigating potential delays.

- Improved Quality Assurance: Direct oversight of self-performed trades allows for stricter adherence to quality standards throughout the construction process.

- Cost Predictability: By managing self-perform labor and materials internally, DPR can achieve more accurate cost forecasting and control.

- Risk Mitigation: Integrating IPD and self-perform work helps to identify and manage project risks more proactively, leading to more successful outcomes.

DPR Construction's Life Sciences and Healthcare Construction segments are clearly positioned as Stars within their BCG Matrix. These sectors exhibit high market share and rapid growth rates, driven by strong underlying demand. DPR's specialized expertise in complex, technologically advanced facilities allows them to capture significant value in these expanding markets.

The company's strategic focus on these areas, evidenced by substantial revenue contribution and a high number of patents, highlights their competitive advantage. By leveraging integrated project delivery and self-perform capabilities, DPR ensures superior execution and client satisfaction in these high-growth segments.

| Segment | Market Share | Industry Growth Rate | DPR's Strength |

|---|---|---|---|

| Life Sciences Construction | High | High | Expertise in biopharmaceutical manufacturing, GLP-1 drug demand |

| Healthcare Construction (Complex Facilities) | High | High | Focus on patient-centered, technologically integrated facilities |

What is included in the product

DPR Construction's BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which areas to grow, maintain, or divest for optimal resource allocation.

Clear visualization of DPR's business units, identifying growth opportunities and resource allocation needs.

Cash Cows

DPR Construction's established commercial construction arm functions as a Cash Cow within its business portfolio. The company consistently engages in a wide array of commercial projects, from intricate office fit-outs to substantial new construction endeavors, demonstrating a broad market reach.

This sector, despite potential cyclicality in commercial real estate, provides a steady and significant revenue stream for DPR. For instance, in 2023, DPR Construction reported revenues exceeding $7 billion, with a substantial portion attributed to its diverse commercial building activities, highlighting the robust cash-generating capacity of this segment.

DPR Construction actively engages in building academic, research, student housing, and athletic facilities within the higher education sector. This segment represents a significant portion of their market share due to consistent demand for renovations and new construction, especially from public universities and major research institutions.

DPR Construction's preconstruction planning and design-build services act as a stable cash cow within their business model. These services are crucial for early client engagement and strategic decision-making, forming the bedrock of project acquisition and client retention. While not experiencing explosive growth, they consistently generate reliable revenue streams, contributing significantly to DPR's overall financial health.

Renovation and Fit-Out Projects

DPR Construction actively engages in a multitude of renovation and fit-out projects across diverse industries. These projects, though typically smaller in scope than new construction, offer a steady revenue stream and bolster consistent cash flow, particularly in established markets experiencing a slowdown in new development.

These renovation and fit-out endeavors often function as Cash Cows within DPR's portfolio. They represent mature business lines with established processes and client relationships, generating predictable revenue with relatively lower investment needs compared to growth-oriented ventures. For instance, in 2024, the commercial construction sector, which heavily features fit-out work, saw continued demand, with the U.S. commercial construction spending projected to reach approximately $500 billion, demonstrating the sustained market for such projects.

- Consistent Revenue Generation: Renovation and fit-out projects provide a reliable income source due to ongoing demand in existing building stock.

- Mature Market Presence: These projects are well-suited for established markets where new construction is less prevalent, ensuring a stable client base.

- Lower Investment Needs: Compared to large-scale new builds, fit-outs generally require less capital outlay, leading to higher profit margins and cash generation.

- Contribution to Cash Flow: Their predictable nature makes them crucial for maintaining robust and stable cash flow within the company's operations.

Long-Term Client Relationships

DPR Construction's long-term client relationships are a significant asset, acting as a powerful cash cow within their business strategy. This consistent repeat business across various markets, including healthcare and advanced technology facilities, demonstrates a deep-seated trust and satisfaction from their clientele.

These established relationships translate into predictable revenue streams, a hallmark of a cash cow. For instance, DPR's focus on sectors like life sciences, which saw substantial investment and growth leading up to 2024, allows them to leverage existing client partnerships for ongoing projects. This stability reduces the financial burden and risk associated with constantly acquiring new customers, freeing up resources for other strategic initiatives.

- Predictable Revenue: Long-term relationships ensure a steady flow of income, minimizing revenue volatility.

- Reduced Acquisition Costs: Repeat business significantly lowers the cost of sales and marketing compared to securing new clients.

- Market Stability: A loyal client base provides a buffer against market downturns, especially in sectors DPR serves.

- Client Retention: DPR's ability to maintain strong client ties, evidenced by their high project completion rates, reinforces their cash cow status.

DPR Construction's expertise in healthcare construction serves as a prime example of a cash cow. The company consistently secures projects in this sector, driven by ongoing demand for facility upgrades and new medical centers.

This segment generates substantial and reliable revenue, contributing significantly to DPR's overall financial stability. In 2023, the healthcare construction market alone represented a significant portion of DPR's revenue, with the company reporting a robust backlog in this area, underscoring its cash-generating strength.

DPR's established presence in advanced technology and life sciences facilities also functions as a cash cow. The company leverages its deep understanding and specialized capabilities to win repeat business in these high-growth, yet stable, sectors.

These specialized sectors, while demanding, offer predictable project pipelines and strong client retention, characteristic of cash cows. For instance, investments in life sciences research and development continued to be a priority for many organizations leading into 2024, ensuring a steady demand for DPR's services in this area.

| DPR Construction Cash Cow Segments | Description | 2023/2024 Relevance |

|---|---|---|

| Commercial Construction (General) | Broad range of office, retail, and mixed-use projects. | Exceeded $7 billion in revenue in 2023, with a significant portion from commercial builds. |

| Higher Education Facilities | Academic, research, student housing, and athletic facilities. | Consistent demand for renovations and new builds, particularly from public institutions. |

| Renovation & Fit-Out Projects | Smaller-scale upgrades and interior modifications across industries. | U.S. commercial construction spending projected around $500 billion in 2024, highlighting sustained demand. |

| Long-Term Client Relationships | Repeat business across healthcare, advanced technology, and life sciences. | Leverages existing partnerships in sectors like life sciences with substantial investment leading up to 2024. |

What You’re Viewing Is Included

DPR Construction BCG Matrix

The DPR Construction BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis. You can confidently use this preview as a direct representation of the high-quality, actionable insights that will be delivered to you immediately after your transaction.

Dogs

Projects in markets with declining investment, often termed 'dogs' in a BCG matrix analysis, represent areas where DPR Construction might see reduced activity or profitability. These could be sectors experiencing a significant and sustained drop in capital expenditure or consumer demand, impacting the viability of new projects.

For instance, if certain types of retail construction or speculative office development face headwinds, projects within these segments would fall into the 'dog' category. As of early 2024, some analysts noted a slowdown in new large-scale speculative office construction in certain metropolitan areas due to shifts towards remote work and evolving office space needs.

These 'dog' projects are characterized by low growth and low market share, offering little potential for future expansion. DPR's strategy would likely involve minimizing new investment in these areas or strategically divesting from them to reallocate resources to more promising segments of the market.

Projects in remote locations that demand extensive manual labor and forgo prefabrication or DPR's self-perform expertise might be classified as 'dogs' in a BCG matrix. These ventures often grapple with acute skilled labor scarcity, extended utility lead times, and protracted permitting processes.

For instance, a 2024 industry report indicated that projects in remote areas experienced an average cost overrun of 15% due to labor challenges alone, significantly impacting profitability. Such projects, even with robust demand, can yield meager returns due to these inherent operational inefficiencies and escalating costs.

Small, one-off projects that stray from DPR Construction's core expertise in complex, sustainable building can represent a challenge within their business portfolio. These ventures might not fully utilize DPR's established strengths in advanced construction techniques or their commitment to green building practices.

For instance, if DPR undertakes a small residential renovation outside their typical large-scale commercial or healthcare projects, the specialized knowledge and efficiency that usually drive profitability might be less impactful. This can lead to thinner profit margins compared to their flagship projects, as seen in the construction industry where economies of scale significantly influence project economics.

In 2024, the construction sector continued to see a demand for specialized skills, and projects that don't align with a company's core competencies often require a steeper learning curve and may incur higher overheads relative to their revenue. DPR's focus on innovation and technical excellence means that projects lacking these elements might not contribute as significantly to their overall strategic growth or financial performance.

Projects Heavily Impacted by Rapidly Fluctuating Tariffs and Supply Chain Volatility

Projects that are highly susceptible to sudden and unpredictable increases in material costs due to tariffs and global supply chain disruptions could be classified as dogs in the BCG matrix. These projects face significant headwinds from fluctuating input prices, making profitability a challenge. For instance, the construction industry in 2024 continued to grapple with the aftermath of 2023's supply chain issues, with some material costs remaining volatile. A study by the Associated General Contractors of America in early 2024 indicated that over 70% of construction firms reported experiencing project delays due to material shortages or price spikes.

While DPR Construction likely employs robust mitigation strategies, projects with inflexible budgets or tight timelines that cannot absorb these cost escalations are particularly vulnerable. Such constraints can lead to reduced profit margins or even losses if unexpected cost overruns occur. For example, a fixed-price contract for a large commercial building initiated in late 2023, without adequate escalation clauses, could easily fall into the dog category if tariffs on steel or lumber, for example, were to surge unexpectedly in 2024, impacting the project’s bottom line.

- High Susceptibility to Cost Increases: Projects relying on imported materials or those with long lead times for components are at greater risk from tariff changes and supply chain bottlenecks.

- Inflexible Budgets and Timelines: Fixed-price contracts or projects with rigid completion deadlines offer little room for absorbing unexpected cost escalations, pushing them towards dog status.

- Impact on Profitability: Unforeseen increases in material expenses, exacerbated by tariffs and supply chain volatility, directly erode profit margins, potentially turning a planned profitable venture into a loss-making one.

- Industry Data: In 2024, a significant percentage of construction firms continued to report material cost volatility, with some experiencing cost increases of 10-20% on key inputs compared to pre-pandemic levels, underscoring the risks for vulnerable projects.

Construction in Stagnant or Oversupplied R&D Life Sciences Markets

The life sciences R&D sector, especially in mature markets experiencing high vacancy rates, is currently facing headwinds. This segment, unlike the booming biopharmaceutical manufacturing (a Star), can be considered a Dog in the BCG Matrix.

In 2024, several established life science hubs reported significant R&D space vacancy rates. For instance, Boston's Kendall Square, a prime life sciences cluster, saw vacancy rates tick up to around 10% by mid-2024, indicating a softening demand for R&D facilities in that specific, though still strong, market. This oversupply can make new construction projects in such areas a riskier proposition.

- Strained R&D Markets: Established life sciences R&D markets are currently oversupplied with commercial real estate.

- High Vacancy Rates: This oversupply translates into elevated vacancy rates, impacting the viability of new construction.

- Potential 'Dog' Status: Construction projects in these areas could be classified as Dogs until market conditions improve and vacancy rates decrease.

- Market Normalization: The performance of these R&D construction projects is contingent on the normalization of vacancy rates in these specific markets.

Projects in declining markets or those with low market share and low growth potential are classified as Dogs in the BCG matrix. These can include speculative office construction facing reduced demand due to remote work trends, as observed in some metropolitan areas in early 2024.

Projects in remote locations with significant labor shortages and logistical challenges also fall into this category, often experiencing cost overruns. For example, a 2024 industry report highlighted average cost overruns of 15% in remote projects due to labor issues alone.

Small, one-off projects outside a company's core expertise, like minor renovations for DPR Construction, may yield thinner profit margins compared to their larger, specialized ventures.

Projects highly vulnerable to material cost increases due to tariffs and supply chain disruptions, especially those with inflexible budgets, are also considered Dogs. In 2024, over 70% of construction firms reported project delays from material shortages or price spikes.

| BCG Category | DPR Construction Project Examples | Market Characteristics | 2024 Data/Observations |

|---|---|---|---|

| Dogs | Speculative Office Construction (declining demand) | Low market growth, low market share | Slowdown in new large-scale speculative office development in some cities. |

| Dogs | Remote Projects (labor/logistics issues) | High operational costs, potential for low profitability | Average cost overruns of 15% due to labor challenges in remote areas. |

| Dogs | Small, Non-Core Renovations | Lower economies of scale, potentially thinner margins | Projects outside core expertise may incur higher overheads relative to revenue. |

| Dogs | Projects with Volatile Material Costs | Susceptible to price spikes, inflexible budgets | 70%+ of firms reported delays due to material shortages/price spikes in 2024. |

Question Marks

DPR Construction is actively investigating advanced IoT integration to enhance worker safety and streamline asset management on its construction sites. This focus on emerging technologies positions them to potentially capture future market share in a more digitized construction landscape.

While the potential benefits of IoT in construction are significant, including real-time monitoring and predictive maintenance, these technologies are still in their nascent stages within the industry. Significant upfront investment is required for development and widespread adoption, meaning consistent high returns are not yet guaranteed.

DPR Construction's potential expansion into new geographic markets can be viewed through the lens of the BCG Matrix as question marks. These are regions where DPR might have a relatively small presence but where the construction market is experiencing significant growth. For example, exploring opportunities in emerging markets in Southeast Asia or specific high-growth urban centers in Europe could represent such ventures.

These new markets require substantial investment to build brand recognition, establish local partnerships, and navigate regulatory landscapes. In 2024, the global construction market was projected to grow by approximately 3.5%, with certain developing regions showing even higher rates. DPR would need to allocate capital for business development, talent acquisition, and potentially setting up new offices or facilities in these promising, yet unproven, territories.

DPR Construction's dedication to pioneering new approaches often leads them to fund pilot programs for groundbreaking construction materials and methods. These ventures, while promising significant future growth, currently represent a small segment of the market and come with considerable inherent risk.

For instance, a hypothetical pilot program in 2024 might focus on advanced self-healing concrete, a material still in its nascent stages of commercialization. While the potential for reduced maintenance costs and extended infrastructure lifespan is immense, the initial investment and uncertain market acceptance place it firmly in the question mark category of a BCG matrix, demanding careful observation and strategic development.

Projects in Underserved, High-Growth Niche Sectors

DPR Construction, in its strategic application of the BCG Matrix, would likely identify projects in underserved, high-growth niche sectors as question marks. These are areas where DPR has minimal current market share but sees significant future potential, necessitating focused investment to build capability and capture demand.

For instance, consider the burgeoning market for specialized life sciences facilities, such as advanced biomanufacturing or gene therapy production sites. While these sectors are experiencing rapid expansion, driven by breakthroughs in medical research and increased demand for novel treatments, DPR's current footprint might be relatively small. The global biopharmaceutical contract manufacturing market, for example, was valued at approximately $17.8 billion in 2023 and is projected to grow at a CAGR of over 10% through 2030, indicating substantial opportunity.

- Focus on Advanced Healthcare Infrastructure: Targeting sectors like specialized medical research labs, proton therapy centers, or advanced rehabilitation facilities where technological innovation drives demand.

- Invest in Sustainable and Resilient Building Technologies: Developing expertise in constructing facilities that meet stringent environmental standards and can withstand climate-related challenges, such as net-zero energy buildings for research institutions or climate-resilient data centers for biotech firms.

- Cultivate Niche Expertise and Talent: Building specialized teams with deep knowledge in areas like cleanroom construction, advanced HVAC systems for sensitive environments, or specialized laboratory equipment integration.

- Strategic Partnerships and Acquisitions: Collaborating with or acquiring smaller, specialized firms that already possess established expertise and client relationships within these high-growth niches to accelerate market penetration.

Investments in Workforce Development and Training Programs

DPR Construction's commitment to workforce development, including apprenticeships and extensive training programs, positions these initiatives as question marks within the BCG framework. While these investments are vital for tackling the construction industry's persistent skilled labor deficit, their substantial upfront costs and delayed, indirect financial returns place them in a category requiring careful consideration for future growth.

These programs are critical for building a sustainable talent pipeline. For instance, in 2024, the construction industry continued to face significant labor shortages, with reports indicating millions of unfilled positions. DPR's investment in training directly addresses this, aiming to cultivate a highly skilled workforce capable of handling complex projects.

- Addressing Labor Shortages: DPR's apprenticeship programs are designed to directly combat the skilled labor gap impacting the construction sector.

- Long-Term Strategic Value: Investments in training are crucial for ensuring future project capacity and maintaining DPR's competitive edge.

- Deferred Financial Returns: The significant capital outlay for training may not translate into immediate, quantifiable financial gains, characteristic of question mark assets.

- Industry Trend Alignment: In 2024, the broader construction industry continued to emphasize workforce development as a key strategy for resilience and growth.

DPR Construction's exploration of new geographic markets and niche sectors, alongside investments in innovative technologies and workforce development, all represent potential question marks on the BCG matrix. These ventures require significant upfront investment and carry inherent risks, but they also hold the promise of substantial future growth and market leadership.

For example, DPR's foray into specialized life sciences construction, a market projected for robust growth, exemplifies a question mark. The company's investment in training programs to address industry-wide labor shortages also falls into this category, demanding resources now for future competitive advantage.

These question mark initiatives are critical for DPR's long-term strategy, aiming to build capabilities in high-growth areas and mitigate future challenges like labor scarcity.

The global construction market growth in 2024, estimated around 3.5%, highlights the opportunities in expanding markets, while specific sectors like biopharmaceutical contract manufacturing, valued at $17.8 billion in 2023, showcase the potential of niche specialization.

| BCG Category | DPR Construction Example | Market Attractiveness | DPR's Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Marks | Emerging Geographic Markets | High (e.g., Southeast Asia growth rates) | Low | Requires investment to build presence and gain share. |

| Question Marks | Advanced IoT Integration | Growing, but nascent in construction | Low | Invest in R&D and pilot programs for future competitive advantage. |

| Question Marks | Specialized Life Sciences Facilities | High (e.g., 10%+ CAGR in biopharma manufacturing) | Low to Moderate | Develop niche expertise and target specific high-growth segments. |

| Question Marks | Workforce Development Programs | Critical for industry sustainability | N/A (Internal investment) | Long-term investment to address skilled labor deficit and ensure future capacity. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.