DPR Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DPR Construction Bundle

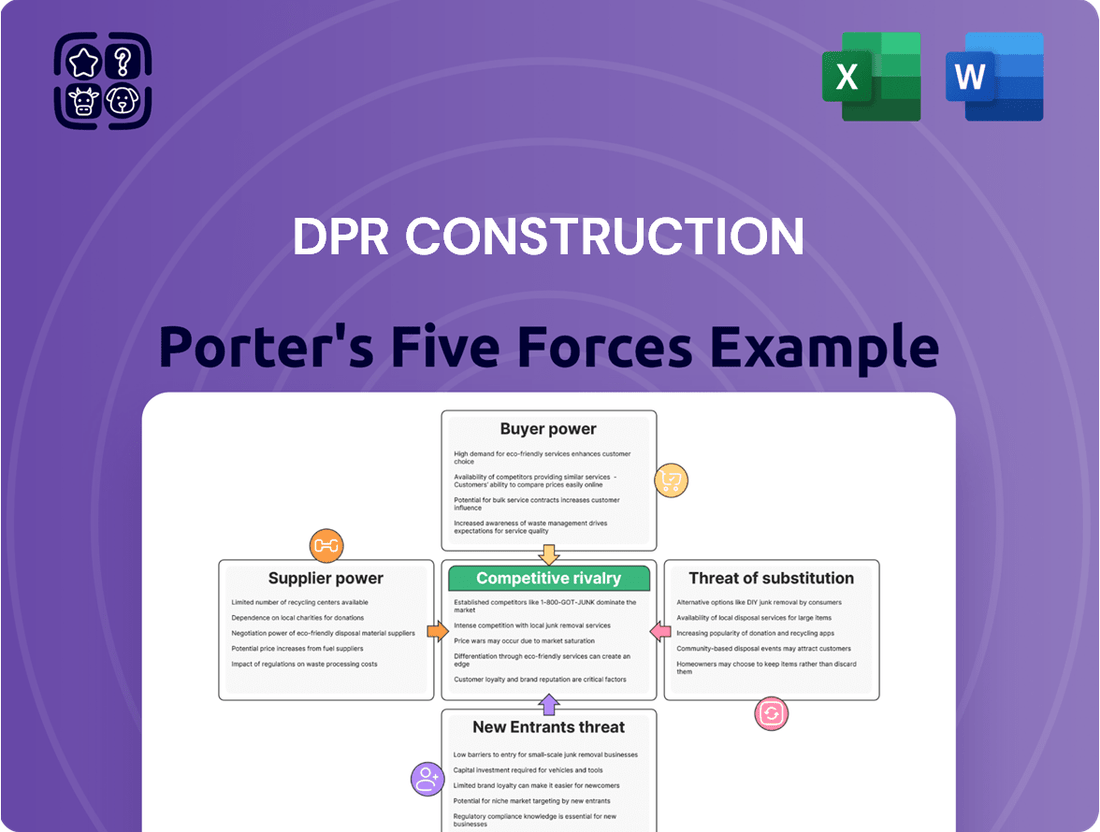

DPR Construction operates within a dynamic industry shaped by intense rivalry, the bargaining power of buyers, and the constant threat of substitutes. Understanding these forces is crucial for navigating the competitive landscape and identifying strategic opportunities.

The complete report reveals the real forces shaping DPR Construction’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DPR Construction's reliance on specialized labor, such as highly skilled tradespeople, engineers, and project managers, particularly for intricate projects in sectors like advanced technology and life sciences, highlights a key aspect of supplier power. The availability and cost of this specialized expertise directly influence DPR's operational capacity and profitability.

In 2024, the construction industry continued to grapple with labor shortages, especially for specialized roles. For instance, reports indicated a significant deficit in skilled trades across many regions, a trend that directly impacts companies like DPR. This scarcity empowers skilled workers and labor unions, allowing them to negotiate higher wages and more favorable working conditions, thereby increasing their bargaining power.

The ability to attract and retain top talent becomes a critical differentiator for DPR. Challenges in securing specialized expertise can lead to project delays and increased costs, directly affecting DPR's competitive position. Managing these labor supply dynamics is therefore essential for maintaining project efficiency and financial performance.

For highly technical and sustainable builds, DPR Construction frequently depends on suppliers who provide proprietary materials or cutting-edge equipment. Suppliers with patents or exclusive control over these essential inputs wield significant bargaining power, as DPR may have few viable alternatives.

DPR Construction often relies on specialized subcontractors for critical project components like MEP systems or complex facade work. These niche providers, particularly those with a strong reputation or unique skills, can wield considerable influence over project costs and timelines. For instance, in 2024, the average cost for specialized MEP installations in large commercial projects saw an increase of approximately 7-10% compared to the previous year, reflecting this supplier power.

Technology and Software Providers

Technology and software providers hold significant bargaining power over construction firms like DPR Construction, particularly those offering specialized or industry-standard solutions. For instance, companies providing advanced Building Information Modeling (BIM) software or integrated project management platforms that demonstrably boost efficiency can command higher prices. The market for these critical technologies is often concentrated, meaning fewer suppliers can dictate terms.

The switching costs associated with adopting new technology are a major factor. If DPR has heavily invested in a particular software suite for project management or sustainable design, migrating to an alternative can be costly and time-consuming, involving data conversion, retraining staff, and potential disruptions to ongoing projects. This inertia strengthens the hand of existing technology suppliers.

- Concentration in Tech: The construction technology market, while growing, still sees dominant players in areas like BIM and project management software, limiting buyer options.

- High Switching Costs: For example, implementing a new enterprise resource planning (ERP) system for construction can incur millions in costs and months of integration effort.

- Proprietary Solutions: Suppliers of unique, patented software or hardware that offer significant competitive advantages to DPR can exert strong pricing power.

Raw Material Volatility and Supply Chain Disruptions

The construction sector, including companies like DPR Construction, faces significant challenges from raw material price swings and supply chain interruptions. For instance, the price of lumber, a critical component, saw substantial volatility in 2023 and early 2024, impacting project budgets. Suppliers of essential materials such as steel, concrete, and lumber can wield considerable influence, particularly when demand is high or when global events disrupt production and logistics, as seen with shipping delays impacting material availability.

DPR Construction needs to proactively manage these risks. Strategies such as securing long-term supply agreements, diversifying their supplier base across different regions, and exploring alternative materials are crucial for mitigating the effects of price volatility and potential disruptions. For example, by entering into multi-year contracts for steel, DPR can lock in prices and ensure a more predictable cost structure for its projects.

- Raw Material Price Fluctuations: Lumber prices, a key input for construction, experienced significant year-over-year increases in certain periods of 2023, with some futures contracts showing gains of over 20% before moderating.

- Supply Chain Vulnerabilities: Global shipping costs and transit times remained elevated throughout much of 2023, directly affecting the cost and availability of imported construction materials like specialized steel components.

- Supplier Bargaining Power: When demand for critical materials like cement or aggregates outpaces local supply, suppliers can dictate higher prices, impacting DPR's project profitability.

- Mitigation Strategies: DPR's focus on strategic sourcing and building strong relationships with multiple suppliers helps to buffer against the concentrated power of individual material providers.

DPR Construction's bargaining power with suppliers is significantly influenced by the concentration of specialized labor and proprietary material providers. The scarcity of skilled trades, a persistent issue in 2024 with reports of substantial deficits, allows these workers and their unions to negotiate better terms, impacting DPR's project costs and timelines.

Furthermore, suppliers of unique or patented materials and advanced technologies, such as BIM software, hold considerable sway due to limited alternatives and high switching costs for DPR. This dynamic is exacerbated by supply chain vulnerabilities and raw material price volatility, as seen with lumber and steel costs in 2023-2024, where global events influenced availability and pricing, empowering material suppliers.

| Supplier Type | Key Factors Influencing Power | Impact on DPR Construction | 2024 Data/Trend |

|---|---|---|---|

| Specialized Labor | Scarcity of skilled trades, unionization | Higher wages, increased labor costs, potential project delays | Continued labor shortages reported, impacting project scheduling and budgets. |

| Proprietary Materials/Tech | Patents, exclusive control, high switching costs | Higher input costs, limited sourcing options, reliance on specific vendors | Concentration in BIM software market limits buyer options; high implementation costs for new systems. |

| Raw Materials | Price volatility, supply chain disruptions, demand | Fluctuating project budgets, potential material shortages | Lumber prices saw significant year-over-year increases in parts of 2023; elevated global shipping costs impacted material availability. |

What is included in the product

This analysis of DPR Construction's competitive environment examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the construction industry.

Instantly identify and mitigate competitive threats with a dynamic visualization of DPR Construction's Porter's Five Forces.

Customers Bargaining Power

DPR Construction frequently works with large, sophisticated clients in demanding sectors like advanced technology, life sciences, and healthcare. These clients, often possessing substantial project management expertise and dedicated procurement departments, wield considerable influence in negotiations. For instance, a major university campus expansion project, a common scenario for DPR, would involve a client with a clear understanding of construction costs and timelines, enabling them to push for competitive bids and specific contractual clauses.

DPR Construction often tackles massive projects, with many exceeding hundreds of millions or even billions of dollars. This sheer scale inherently gives clients significant leverage during initial negotiations. For instance, a single large healthcare or technology campus project can represent a substantial percentage of DPR's annual revenue, making those clients highly influential.

The availability of alternative contractors significantly impacts customer bargaining power. While DPR Construction focuses on specialized projects, numerous other commercial contractors can undertake similar work, offering clients a choice. This competitive landscape allows customers to solicit bids from multiple firms, fostering an environment where they can negotiate terms like price, project timelines, and service scope more assertively.

Customer's Ability to Self-Perform or Integrate

The bargaining power of customers can be amplified when they possess the capability to perform construction tasks themselves or integrate project delivery components internally. For instance, major clients with substantial real estate holdings or established internal facilities management departments might explore self-performing certain construction activities. This potential for in-house execution, even if only a threat for complex projects, grants them leverage in negotiations with firms like DPR Construction.

This ability to self-perform or integrate gives clients a stronger negotiating stance. They can potentially reduce costs or gain more control over project outcomes. This dynamic is particularly relevant for large-scale projects where the client has the resources and expertise to manage aspects of the construction process.

- Self-Performance Capability: Clients with in-house construction or facilities management teams can undertake parts of projects, reducing reliance on external contractors.

- Integration of Project Delivery: Sophisticated clients may manage multiple project phases or trades directly, diminishing the need for a general contractor.

- Negotiating Leverage: The latent threat of clients bringing work in-house or managing it differently provides them with significant bargaining power during contract discussions.

- Reduced Dependence: For clients with substantial resources, this capability lessens their dependence on any single construction firm, increasing their negotiating strength.

Long-Term Relationships and Repeat Business

While individual project negotiations can be intense, DPR Construction actively cultivates long-term relationships and repeat business with its clients. This strategy aims to shift the balance of power over time, as a proven track record and successful project execution build significant trust and loyalty. For instance, in 2024, DPR reported that approximately 80% of its revenue came from repeat clients, highlighting the success of this relationship-focused approach.

However, the initial negotiations for new clients or highly competitive bids for even repeat work still heavily favor the customer. Clients can leverage the potential for future projects to secure more favorable terms, particularly in a market where construction demand remains robust, as seen in the sustained high levels of construction spending throughout 2024.

- Client Loyalty: DPR's focus on long-term relationships aims to reduce the bargaining power of customers by fostering loyalty.

- Repeat Business Data: In 2024, around 80% of DPR Construction's revenue was generated from repeat clients.

- Initial Negotiation Power: Despite relationship building, customers retain significant power during initial negotiations for new projects.

- Market Influence: Strong construction demand in 2024 allowed clients to leverage their potential for future work to negotiate better terms.

DPR Construction's clients, particularly those in specialized sectors like advanced technology and healthcare, often possess significant bargaining power. This is due to their project scale, sophisticated procurement processes, and the availability of alternative contractors. For example, a large-scale campus expansion for a major university would involve a client well-versed in construction costs, enabling them to negotiate competitive bids and specific contractual terms.

The sheer size of many DPR projects amplifies client leverage, as a single project can represent a substantial portion of DPR's annual revenue. Furthermore, the presence of numerous other commercial contractors capable of undertaking similar specialized work allows clients to solicit multiple bids, strengthening their position to negotiate price, timelines, and scope. This competitive environment means clients can assertively demand favorable terms.

| Factor | Impact on DPR Construction | Client Leverage Example |

|---|---|---|

| Client Sophistication | High | Clients with dedicated procurement departments can negotiate detailed terms. |

| Project Scale | High | A single large project can be a significant revenue source, giving clients leverage. |

| Availability of Alternatives | Moderate to High | Multiple contractors compete, allowing clients to solicit bids and negotiate aggressively. |

| Repeat Business (2024 Data) | Mitigates Power | ~80% of DPR's 2024 revenue from repeat clients indicates some reduced customer power over time. |

Preview Before You Purchase

DPR Construction Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of DPR Construction details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. You’re previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

The commercial construction sector, particularly for significant and specialized projects, features many robust, long-standing competitors. Companies such as Turner Construction, Skanska, Clark Construction, and Gilbane Building Company are direct rivals to DPR Construction within their core markets.

This fierce competition often results in aggressive pricing strategies, squeezing profit margins, and necessitates continuous innovation in specialized offerings or project execution to stand out.

For instance, in 2023, the U.S. construction industry saw substantial activity, with major players like Turner Construction reporting significant revenue, highlighting the scale of competition DPR faces.

DPR Construction operates within a sector characterized by substantial exit barriers. The construction industry demands significant capital outlay for specialized heavy machinery, extensive land holdings for operations and storage, and the continuous maintenance of a highly skilled, often unionized, labor force. These considerable fixed costs and the unique nature of industry-specific assets make it economically challenging for companies to simply cease operations and exit the market.

This difficulty in exiting the construction market means that firms often remain active even when economic conditions are unfavorable. Companies must continue to secure projects to offset their substantial overheads and the depreciation of their assets. Consequently, this environment fosters intense and persistent competitive rivalry, as businesses are compelled to compete aggressively for available work to ensure their survival and cover their ongoing expenses.

DPR Construction distinguishes itself by concentrating on complex, sustainable building projects and embracing innovation through integrated project delivery. The competitive landscape intensifies when rivals can effectively mimic these specialized skills or innovative approaches. For example, in 2024, the construction industry saw continued investment in Building Information Modeling (BIM) and prefabrication by many firms, directly challenging DPR's innovative edge.

Should competitors successfully replicate DPR's unique value proposition, such as their expertise in healthcare or advanced technology facilities, the pressure on DPR to maintain its market position will increase significantly. This forces ongoing investment in core competencies and the development of new differentiators to stay ahead in a market where replicating specialized knowledge and client loyalty is a key competitive strategy.

Industry Growth Rates and Project Availability

The intensity of competition for DPR Construction is closely tied to the construction industry's growth trajectory and the pipeline of projects in its core areas. When the market expands and new opportunities are plentiful, the pressure among firms tends to ease. However, during economic downturns or periods of slower development, the fight for each contract becomes fiercer, often resulting in price wars and squeezed profitability.

In 2024, the U.S. construction industry experienced varied growth, with nonresidential construction showing resilience driven by manufacturing and infrastructure investments. For instance, the U.S. Census Bureau reported a notable increase in nonresidential construction spending throughout the year. This environment directly impacts DPR, as more projects mean less direct competition for each bid, while a scarcity of work amplifies rivalry among general contractors.

- U.S. nonresidential construction spending saw a year-over-year increase in many months of 2024, indicating a generally positive, albeit uneven, market.

- Increased project availability in sectors like advanced manufacturing facilities and public infrastructure projects can temper direct competitive rivalry for firms like DPR.

- Conversely, a slowdown in sectors like commercial office space development in 2024 heightened competition for the remaining projects in that segment.

Reputation and Track Record

In the commercial construction sector, a company's reputation is a critical differentiator. DPR Construction, like its peers, understands that a solid track record for quality, punctuality, and safety directly translates into securing new contracts and fostering repeat business. This emphasis on reputation means firms are in a perpetual race to build and showcase their achievements, making consistent high performance essential for DPR to maintain its competitive standing.

DPR Construction's strong reputation is a significant asset, allowing them to command client trust and attract top talent. For instance, in 2023, DPR was recognized by ENR (Engineering News-Record) as one of the top contractors in the nation, a testament to their consistent project delivery and client satisfaction. This ongoing commitment to excellence is not just about winning bids; it's about solidifying their position in a market where past performance is a strong indicator of future success.

- Reputation as a Competitive Weapon: Firms like DPR leverage their history of successful projects, adherence to safety standards, and on-time completion to win new business and retain clients.

- Client Loyalty Driven by Performance: A strong track record builds trust, encouraging repeat engagements and referrals, which are vital in the construction industry.

- Market Recognition: Consistent delivery of quality work and client satisfaction leads to industry accolades and rankings, further bolstering a firm's competitive edge.

- Talent Attraction: A reputable company is more attractive to skilled professionals, ensuring access to the human capital necessary for project success.

Competitive rivalry within the commercial construction sector is intense, with numerous established players like Turner Construction and Skanska directly competing with DPR Construction for projects. This rivalry often leads to aggressive bidding, impacting profit margins, and necessitates continuous innovation to maintain a competitive edge.

The difficulty in exiting the construction market, due to high capital requirements and specialized assets, means firms remain active even in challenging economic periods, fueling persistent competition. DPR differentiates itself through specialized projects and innovation, but rivals are increasingly adopting similar strategies, such as advanced Building Information Modeling (BIM) and prefabrication, as seen in 2024 trends.

Market conditions significantly influence rivalry; a robust project pipeline, like the increased nonresidential construction spending in the U.S. during 2024, can temper competition. Conversely, a slowdown in specific sectors, such as commercial office development, intensifies the fight for remaining contracts.

A strong reputation for quality and timely delivery is a critical differentiator, with firms like DPR leveraging their track record to secure new business. DPR's recognition by ENR in 2023 highlights the importance of consistent high performance in maintaining its competitive standing.

SSubstitutes Threaten

The increasing popularity of modular and prefabricated construction offers a viable alternative to traditional building methods. This shift poses a threat to general contractors like DPR Construction as clients may opt for off-site manufactured components, potentially reducing the demand for on-site assembly and traditional general contracting services.

In 2023, the global modular construction market was valued at approximately $100 billion and is projected to grow significantly. This growth is driven by factors like speed, cost-efficiency, and sustainability, all of which can be attractive to clients seeking alternatives to conventional construction.

While DPR Construction can leverage prefabrication within its projects, a widespread client preference for fully modular solutions could diminish the scope of work for traditional general contractors. This necessitates adaptability and a strategic approach to integrating or competing with these evolving construction models.

Very large organizations, like major healthcare systems or university campuses, might consider building their own construction departments for ongoing needs. This could be a substitute for external firms like DPR Construction, particularly for less complex or smaller projects where cost control is a primary driver. For instance, a hospital system with a consistent need for facility upgrades might find it economical to manage these internally.

Emerging alternative project delivery models pose a threat. For instance, pure owner-managed projects bypass the need for a traditional general contractor altogether, reducing DPR's potential market share.

Highly integrated design-build-operate (DBO) contracts, where a single entity handles all phases, also serve as a substitute for DPR's conventional services. While DPR excels in design-build and integrated project delivery, these alternative models fundamentally redefine the primary contractor's role, potentially shrinking the demand for their traditional offerings.

Advanced Robotics and Automation in Construction

The long-term threat of advanced robotics and automation in construction presents a potential substitute for traditional labor-intensive methods. As these technologies mature, they could alter project execution, potentially reducing the reliance on certain aspects of general contracting. For instance, by 2024, the global construction robotics market was projected to reach billions, indicating significant investment and development in this area.

This evolution might allow clients to engage directly with specialized robotics firms or automation integrators. Such a shift could bypass some of the traditional project management and general contracting services that DPR Construction currently offers. While this is a more distant threat, the increasing adoption of AI and automated systems in construction, with companies like Built Robotics already deploying autonomous heavy equipment, signals a clear direction of change.

- Robotics in Construction: The global construction robotics market is experiencing substantial growth, with projections indicating a significant compound annual growth rate (CAGR) in the coming years, suggesting increasing adoption.

- Automation Integration: Advanced automation could enable direct client engagement with specialized technology providers, potentially disintermediating traditional general contractors for certain project components.

- Shifting Service Needs: As automation advances, the demand for on-site labor and traditional project management might decrease, creating a substitute for core general contracting functions.

Renovation and Adaptive Reuse vs. New Construction

The growing popularity of renovating and adaptively reusing existing structures presents a significant threat of substitution for new construction projects. This trend diverts potential clients away from ground-up builds, impacting the demand for DPR Construction's core services.

For example, in 2024, the construction industry saw a notable increase in projects focused on modernizing older buildings. This shift means that while the overall construction market might remain robust, the portion dedicated to entirely new structures could contract, directly affecting companies like DPR that specialize in new builds.

- Shifting Demand: Clients choosing renovation over new construction reduces the pool of projects for ground-up specialists.

- Market Shrinkage: A greater focus on retrofitting can lead to a smaller overall market for new, complex building projects.

- 2024 Trends: Reports from early 2024 indicated a rise in adaptive reuse projects, signaling a potential long-term change in construction priorities.

- Service Diversification: Companies may need to adapt their service offerings to include more renovation and retrofitting capabilities to remain competitive.

The increasing adoption of modular and prefabricated construction represents a significant substitute. These methods offer faster completion times and cost savings, potentially drawing clients away from traditional general contracting. By 2024, the global modular construction market was projected to exceed $130 billion, highlighting its growing appeal.

Furthermore, alternative project delivery models like owner-managed projects or highly integrated design-build-operate contracts can bypass the need for a traditional general contractor, directly impacting DPR Construction's market share. Advanced robotics and automation also pose a long-term threat, potentially reducing reliance on traditional labor and project management services.

The trend towards renovating and adaptively reusing existing structures instead of new builds is another key substitute. This shift means fewer ground-up projects, directly affecting companies focused on new construction. In 2024, there was a noticeable increase in adaptive reuse projects, indicating a potential long-term change in client priorities.

| Substitute Type | Key Characteristics | Impact on DPR Construction | Market Data (Approx. 2024) |

|---|---|---|---|

| Modular/Prefabricated Construction | Speed, cost-efficiency, sustainability | Reduced demand for on-site assembly, potential disintermediation | Global Market: ~$130 billion (projected) |

| Alternative Project Delivery Models (e.g., DBO) | Single entity responsibility, integrated services | Bypass traditional GC role, reduced market share | N/A (model specific) |

| Renovation/Adaptive Reuse | Utilizing existing structures | Decreased demand for new construction projects | Increased project focus in 2024 |

| Robotics & Automation | Automated processes, reduced labor needs | Potential reduction in traditional labor/management services | Global Construction Robotics Market: Billions (growing) |

Entrants Threaten

The commercial construction sector, especially for large and intricate projects, necessitates massive upfront capital for equipment, advanced technology, and the working capital needed for bonding and project funding. Newcomers must overcome substantial financial obstacles to secure the essential resources and demonstrate the financial resilience required to contend with established players like DPR Construction.

For instance, in 2023, the average cost of major construction equipment like cranes can range from hundreds of thousands to millions of dollars, a significant barrier for any new entrant. Furthermore, securing the necessary bonding capacity, often a percentage of contract value, demands a strong balance sheet and a proven track record, which new firms lack.

DPR Construction, like many in the construction industry, benefits immensely from established client relationships and a solid reputation. These long-standing connections, built on years of successful project delivery, create a significant barrier for new entrants. Clients often prioritize proven reliability and a strong track record, which newcomers simply haven't had the time to develop.

The threat of new entrants in construction, particularly for firms like DPR Construction focusing on specialized sectors, is significantly mitigated by the need for highly specialized expertise. DPR's deep involvement in advanced technology, life sciences, and healthcare demands not just technical proficiency but also a thorough understanding of complex regulatory landscapes and project-specific requirements. This creates a substantial hurdle for newcomers aiming to compete in these high-stakes markets.

New companies would find it exceedingly difficult to rapidly assemble a workforce possessing the necessary knowledge and hands-on experience in these niche areas. The scarcity of such specialized talent, coupled with the challenge of luring experienced professionals away from established, reputable firms like DPR, acts as a formidable barrier. For instance, in 2024, the demand for skilled construction labor, particularly those with experience in biotech facilities or advanced manufacturing plants, continued to outstrip supply, driving up recruitment costs and timelines for any new player.

Regulatory Hurdles and Licensing

The construction sector faces substantial regulatory hurdles that deter new entrants. Obtaining necessary permits, licenses, and adhering to stringent safety and environmental standards, which differ significantly by location and project scope, demands considerable investment and specialized knowledge. For instance, in 2024, the cost of compliance for new construction firms can easily run into tens of thousands of dollars before even breaking ground.

These multifaceted requirements create a significant barrier to entry. New companies must allocate substantial resources to understand and meet these complex regulations, adding to their initial operational burden and capital expenditure. This intricate web of compliance often favors established players with existing expertise and infrastructure.

- Regulatory Complexity: Navigating a patchwork of local, state, and federal regulations requires dedicated legal and compliance teams.

- Licensing Costs: Obtaining and maintaining various contractor licenses can cost new firms thousands annually.

- Safety Standards: Compliance with OSHA and other safety protocols necessitates investment in training and equipment, adding to overhead.

- Environmental Compliance: Meeting environmental regulations, such as those related to waste disposal and emissions, can involve significant upfront costs for new projects.

Economies of Scale and Supply Chain Integration

Established firms like DPR Construction often leverage significant economies of scale. This means they can spread their fixed costs over a larger volume of projects, leading to lower per-unit costs in areas like procurement, project management software, and even marketing. For instance, in 2023, the U.S. construction industry saw major players benefit from bulk purchasing power, which new, smaller firms simply cannot replicate initially.

Supply chain integration is another formidable barrier. DPR Construction likely has long-standing relationships with key suppliers and subcontractors, allowing them to negotiate better pricing, secure priority delivery, and ensure consistent quality. A new entrant would face the challenge of building these networks from scratch, potentially paying higher prices and experiencing less reliable service, impacting their ability to compete on cost and timeline.

Consider these points regarding the threat of new entrants for DPR Construction:

- Economies of Scale: Large-scale operations allow established firms to reduce per-project costs through bulk purchasing and efficient resource allocation, a significant hurdle for newcomers.

- Supply Chain Relationships: Incumbents benefit from established, often exclusive, relationships with suppliers and subcontractors, securing favorable terms and reliable access to materials and labor.

- Capital Requirements: The initial capital needed to match the operational scale and technological capabilities of established firms like DPR is substantial, deterring many potential entrants.

The threat of new entrants for DPR Construction is generally low due to substantial capital requirements, the need for specialized expertise, and established brand loyalty. In 2024, the construction industry continues to demand significant upfront investment for equipment, technology, and bonding, making it difficult for new companies to compete. Furthermore, DPR's reputation and existing client relationships are powerful deterrents.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | High initial investment for equipment, technology, and working capital. | Significant hurdle; deters many potential entrants. | Average cost of a tower crane: $1M - $5M+; Bonding capacity often 10-20% of contract value. |

| Specialized Expertise | Need for deep knowledge in sectors like life sciences, healthcare, and advanced manufacturing. | Difficult to replicate; requires extensive training and experience. | Demand for skilled labor in specialized construction sectors outstripping supply. |

| Brand Reputation & Client Relationships | Established trust and proven track record with clients. | New entrants lack credibility and face challenges securing initial contracts. | Long project cycles mean relationships are built over years, not months. |

| Regulatory Compliance | Navigating complex permits, licenses, and safety standards. | Adds significant cost and time to project initiation. | Compliance costs for new firms can exceed $50,000 annually. |

Porter's Five Forces Analysis Data Sources

Our DPR Construction Porter's Five Forces analysis is built upon a foundation of robust data, including DPR's annual reports, industry-specific market research from sources like Dodge Data & Analytics, and publicly available competitor financial filings.