Dollar General PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dollar General Bundle

Discover how political shifts, economic volatility, and evolving social trends are impacting Dollar General's unique business model. Our comprehensive PESTLE analysis breaks down these critical external forces, offering actionable insights for strategic planning. Don't just react to change—anticipate it. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

Dollar General navigates a complex regulatory landscape, operating in numerous U.S. states and Mexico. This involves adhering to diverse local, state, and federal laws, encompassing labor practices, zoning for new store locations, and health and safety protocols. For instance, in early 2024, Dollar General agreed to pay $2.7 million to settle allegations from the Occupational Safety and Health Administration (OSHA) concerning repeated workplace safety violations, highlighting the financial impact of non-compliance.

As Dollar General ventures into international markets, like its expansion into Mexico, it directly confronts evolving international trade policies. These policies, including tariffs and import/export regulations, can significantly influence supply chain costs. For instance, shifts in US-Mexico trade relations could directly affect the profitability of goods moved across borders.

Monitoring these trade dynamics is essential for Dollar General's sustained international growth. In 2023, the US imported approximately $474.9 billion worth of goods from Mexico, highlighting the significant trade flows that companies like Dollar General navigate. Any changes to these established trade agreements could introduce new cost structures or operational complexities.

Fluctuations in minimum wage laws across different states directly impact Dollar General's operating costs, especially with its substantial low-wage retail workforce. For example, as of January 1, 2024, 22 states and numerous cities increased their minimum wages, with some reaching $15 or more per hour.

Beyond minimum wage, other labor laws such as those concerning benefits, working conditions, and potential unionization efforts can significantly influence labor expenses and employee relations. These regulations require careful management to ensure compliance and maintain a positive workforce environment.

Dollar General's history includes settlements with the Department of Labor, such as a 2023 agreement addressing workplace safety violations, underscoring the critical importance of adhering to worker safety and fair labor practices to avoid penalties and maintain operational continuity.

Political Stability in Operating Regions

Dollar General's operational model, heavily reliant on small towns and rural areas, makes political stability at the local level a critical factor. Changes in local governance or economic development policies can directly impact their store performance and expansion plans. For instance, government initiatives aimed at improving rural infrastructure, such as broadband expansion or road improvements, could enhance Dollar General's supply chain efficiency and customer accessibility.

Government incentives for businesses operating in economically distressed rural communities can also influence Dollar General's site selection and operational costs. Conversely, shifts in local tax policies or zoning regulations could present challenges. The company's strategy of serving these often underserved markets means they are closely tied to the political and economic health of these specific regions.

- Rural Infrastructure Investment: Federal and state investments in rural infrastructure, like the USDA's ReConnect Program, aim to improve broadband access, potentially aiding Dollar General's digital initiatives and customer engagement in these areas.

- Local Business Incentives: Many states offer tax credits or grants for businesses creating jobs in rural areas; for example, in 2024, states like Arkansas continued to offer such incentives, which could benefit Dollar General's expansion.

- Community Development Block Grants: Local governments often utilize CDBG funds for community improvements that can indirectly support retail businesses, such as enhancing local shopping districts or public safety.

Government Spending and Social Programs

Changes in government spending on social programs, like SNAP (formerly food stamps) or unemployment benefits, directly impact the disposable income of Dollar General's primary customer demographic. For instance, the Supplemental Nutrition Assistance Program (SNAP) benefits saw a significant increase during the COVID-19 pandemic, boosting purchasing power for many low-income households. As a retailer heavily reliant on consumables, Dollar General's sales performance is closely tied to the economic stability of these households.

The sensitivity of Dollar General to shifts in social program funding is notable. In 2023, the expiration of enhanced SNAP benefits, which had provided a temporary boost, led to concerns about reduced consumer spending among lower-income segments. This highlights how policy decisions regarding social safety nets can have a tangible effect on the company's revenue streams, particularly for its essential goods offerings.

- Government spending on social programs directly influences the purchasing power of Dollar General's core customer base.

- Dollar General's sales of consumables are particularly sensitive to the economic well-being of lower-income households.

- Changes in programs like SNAP can lead to fluctuations in consumer demand for discount retailers.

Political stability and government policies significantly shape Dollar General's operating environment, particularly its rural focus. Shifts in minimum wage laws, like the 2024 increases in 22 states, directly impact labor costs for its extensive low-wage workforce.

Regulatory compliance, including workplace safety, remains a key concern; Dollar General settled for $2.7 million in early 2024 with OSHA for safety violations. International expansion into markets like Mexico necessitates navigating evolving trade policies and tariffs, which can affect supply chain economics.

Government spending on social programs, such as SNAP, directly influences the disposable income of Dollar General's core customer base, impacting sales of essential goods. For instance, the expiration of enhanced SNAP benefits in 2023 raised concerns about reduced consumer spending.

| Policy Area | Impact on Dollar General | 2024/2025 Relevance |

|---|---|---|

| Minimum Wage Laws | Increased labor costs | 22 states increased minimum wage as of Jan 1, 2024 |

| Workplace Safety Regulations | Potential fines and operational disruption | $2.7M OSHA settlement in early 2024 |

| International Trade Policies | Supply chain costs and profitability | US-Mexico trade relations impact |

| Social Program Funding (e.g., SNAP) | Consumer purchasing power and sales | Expiration of enhanced SNAP benefits in 2023 |

What is included in the product

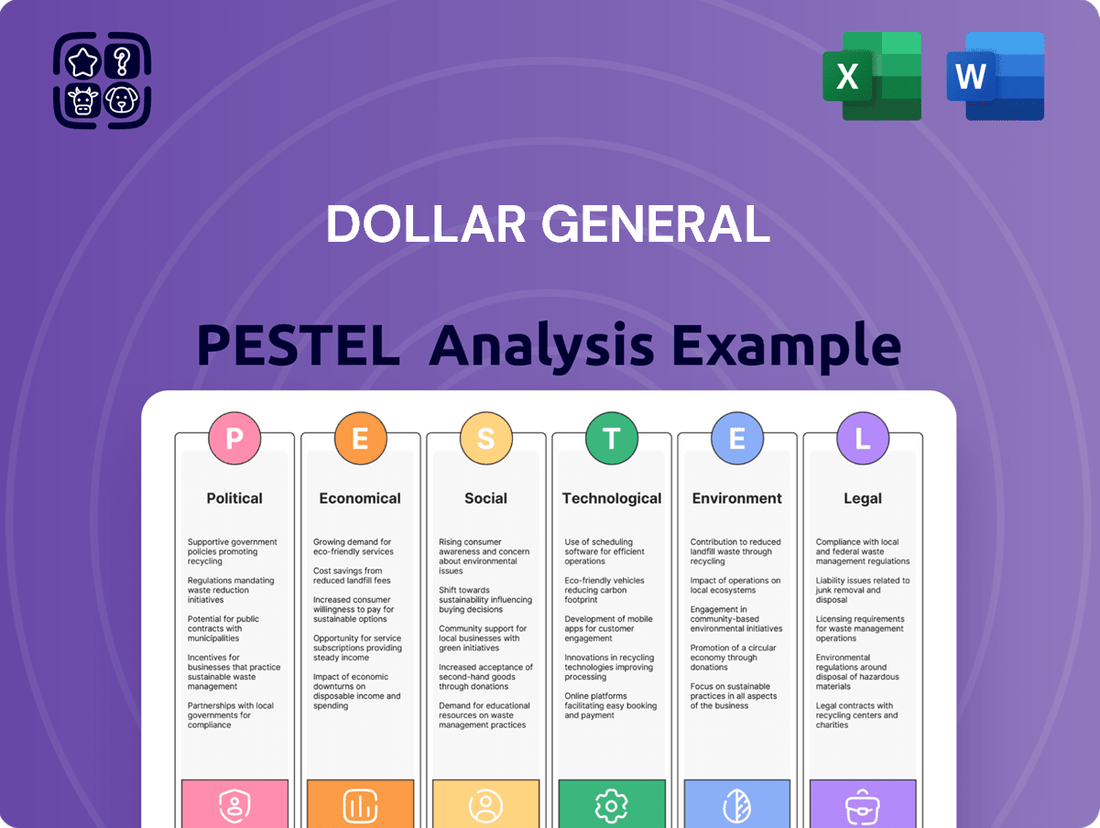

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Dollar General's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate market dynamics and capitalize on emerging opportunities.

This PESTLE analysis for Dollar General offers a clean, summarized version of external factors for easy referencing during meetings, highlighting how understanding political, economic, social, technological, environmental, and legal trends can alleviate strategic planning pain points.

Economic factors

Persistent inflation directly impacts Dollar General's core customer base, many of whom are budget-conscious. Even with Dollar General's focus on low prices, sustained inflation can erode the purchasing power of these consumers, forcing them to make difficult choices about what to buy.

This can lead to a shift in spending habits, potentially reducing the purchase of discretionary or non-essential items in favor of necessities, which could affect Dollar General's sales performance, particularly for categories beyond everyday groceries.

For instance, the U.S. Consumer Price Index (CPI) saw an increase of 3.4% year-over-year as of April 2024, demonstrating ongoing price pressures that directly affect the disposable income available to Dollar General shoppers.

Dollar General, as a discount retailer, typically benefits from economic uncertainty as consumers trade down to save money. For instance, during periods of heightened inflation, like that seen in late 2023 and early 2024, demand for value-oriented products often surges.

However, a severe or prolonged recession can present challenges. If unemployment rates climb significantly, even essential spending might decrease, impacting Dollar General's sales volumes. For example, if the U.S. unemployment rate, which hovered around 3.9% in early 2024, were to rise substantially, it could dampen overall consumer purchasing power.

Rising costs across transportation, logistics, and raw materials are directly impacting Dollar General's cost of goods sold. For instance, the average cost per mile for trucking saw an increase in 2023, affecting delivery expenses.

To counter these pressures, Dollar General is focusing on supply chain streamlining. This includes initiatives like reducing product assortment to simplify inventory management and investing in new, strategically located distribution centers to shorten transit times.

Furthermore, the company is bolstering its internal trucking fleet. This investment aims to gain greater control over transportation costs and enhance overall delivery efficiency, a critical factor in maintaining competitive pricing for its value-oriented customer base.

Interest Rates and Access to Capital

Interest rate fluctuations directly impact Dollar General's cost of capital. For instance, if the Federal Reserve maintains or increases its benchmark interest rate in 2024-2025, Dollar General's expenses for new store financing or renovations will rise. This could temper the pace of their aggressive expansion plans.

Dollar General's substantial real estate development pipeline, a key growth driver, becomes more sensitive to interest rate changes. Higher borrowing costs can diminish the expected return on investment for new store openings and remodels, potentially leading to a more cautious approach to capital allocation.

- Federal Reserve Rate Hikes: The Federal Reserve has signaled a data-dependent approach to monetary policy, with potential for interest rate adjustments throughout 2024 and 2025.

- Impact on Debt: Dollar General's long-term debt obligations, reported at approximately $7.9 billion as of Q1 2024, will face increased servicing costs if rates climb.

- Capital Expenditure Sensitivity: The company's planned capital expenditures, which often involve significant borrowing, will see their economic viability scrutinized more closely in a higher-rate environment.

Competitive Landscape and Market Saturation

Dollar General operates in a highly competitive discount retail environment. While its expansion into rural areas offers some strategic advantage by targeting less saturated markets, the overall sector remains intense. The company faces ongoing pressure from a variety of players, including other dollar stores, mass merchandisers, and even traditional grocery chains that are increasingly focusing on value offerings.

The competitive landscape is characterized by aggressive pricing strategies and a constant push for market share. For instance, Dollar General's primary competitors like Dollar Tree and Family Dollar are also pursuing growth, often through store openings and acquisitions. Furthermore, large retailers such as Walmart and Target, while not exclusively discount, offer a significant portion of their inventory at competitive price points, directly impacting Dollar General's customer base.

- Market Saturation: Despite expansion, key markets often see a high density of discount retailers, leading to increased competition for customer traffic and sales.

- Competitor Strategies: Competitors are actively innovating with store formats, private label brands, and digital integration to capture market share.

- Pricing Pressure: The core value proposition of discount retailers necessitates constant price monitoring and competitive adjustments.

- Emerging Threats: Online retailers and specialized discount chains continue to pose evolving competitive challenges.

Persistent inflation continues to impact Dollar General's budget-conscious customer base, potentially reducing discretionary spending. While the company's value proposition is generally a benefit during economic uncertainty, a severe downturn could still curb essential purchases. For example, the U.S. CPI rose 3.4% year-over-year in April 2024, highlighting ongoing price pressures affecting consumer purchasing power.

Rising operational costs, particularly in transportation and logistics, are a significant concern for Dollar General. The company is actively addressing this by investing in its supply chain, including expanding its private trucking fleet and optimizing distribution networks to mitigate these increasing expenses.

Interest rate hikes directly affect Dollar General's cost of capital for expansion and operations. With approximately $7.9 billion in long-term debt as of Q1 2024, higher rates increase servicing costs, potentially influencing the pace of new store development and capital expenditures.

The discount retail sector remains intensely competitive, with Dollar General facing pressure from direct competitors like Dollar Tree and mass retailers such as Walmart. This necessitates continuous price monitoring and strategic adjustments to maintain market share.

Full Version Awaits

Dollar General PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Dollar General PESTLE analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Dollar General's strategic focus on rural and small-town America places it directly in the path of significant demographic shifts. As of 2024, many of these communities are experiencing an aging population, which often translates to a need for more accessible, everyday essentials and potentially a greater reliance on local retail options. For instance, in many Midwestern rural counties, the median age has been steadily increasing, impacting purchasing power and product preferences.

Migration patterns also play a role; while some rural areas see out-migration, others are experiencing a resurgence driven by affordability or lifestyle changes. Understanding these evolving population dynamics, including income levels and household sizes in these specific locales, is vital for Dollar General to effectively adjust its product assortment and store placement strategies to meet the changing needs of its core customer base.

Dollar General's strength lies in its ability to attract consumers prioritizing affordability and convenience. In 2023, the company reported net sales of $38.9 billion, underscoring its broad appeal to budget-conscious shoppers.

Shifts in consumer preferences, such as a rising interest in healthier food choices or a greater embrace of store-brand products, directly impact Dollar General's product mix and promotional efforts. For instance, the company has been expanding its DG Fresh initiative, aiming to offer more fresh produce and refrigerated items, responding to evolving consumer demands.

Dollar General's aggressive expansion, particularly into rural areas, has sparked conversations about its effect on existing local businesses. For instance, in 2023, Dollar General announced plans to open 1,000 new stores, many of which are in underserved communities. This growth, while providing convenience, can create competitive pressures for smaller, independent grocery stores that have long served these areas.

Maintaining strong community ties and proactively addressing concerns about market dominance are crucial for Dollar General's continued success. Local acceptance is key to avoiding negative sentiment or regulatory hurdles. The company's ability to demonstrate a commitment to the communities it serves, perhaps through local sourcing or community engagement initiatives, will be vital.

Workforce Demographics and Labor Relations

Dollar General's significant reliance on a large, often lower-wage workforce, particularly in its stores, makes workforce demographics a crucial sociological factor. In 2023, the company employed approximately 190,000 individuals, with a substantial portion in entry-level positions. Addressing employee concerns regarding fair compensation, safety protocols, and overall working conditions is paramount for maintaining operational stability and employee morale.

The company's labor relations strategy directly impacts its ability to retain talent and mitigate potential disruptions. As of early 2024, while Dollar General has not faced widespread unionization efforts comparable to some larger retail competitors, maintaining positive relationships with its vast employee base is essential. Focusing on initiatives that enhance worker well-being and provide avenues for feedback can proactively manage potential labor disputes.

- Employee Base: Dollar General's workforce of around 190,000 employees (as of 2023) is largely comprised of individuals in hourly, customer-facing roles.

- Wage Environment: The retail sector, where Dollar General operates, often faces scrutiny regarding entry-level wages, making competitive compensation and benefits a key consideration for employee satisfaction.

- Safety and Conditions: Ensuring a safe working environment and addressing employee feedback on working conditions are vital for retention and preventing grievances.

- Labor Relations: Proactive engagement with employees and fair treatment are critical to fostering positive labor relations and avoiding costly disputes.

Health and Wellness Trends

Consumers are increasingly prioritizing health and wellness, influencing their purchasing decisions. This trend presents an opportunity for Dollar General to expand its offerings beyond basic necessities.

By incorporating more health-conscious food items, such as fresh produce or healthier snack options, and expanding its selection of natural or organic beauty products, Dollar General can align with these evolving preferences. For instance, in 2024, the U.S. health and wellness market was valued at over $1.5 trillion, indicating a significant consumer investment in these areas.

- Growing Demand: Consumers are actively seeking healthier food and personal care items.

- Market Opportunity: Expanding into health-conscious categories can attract new demographics.

- Competitive Edge: Offering better-for-you options can differentiate Dollar General from competitors focused solely on low prices.

- Increased Spending: In 2024, U.S. consumers spent an average of $3,500 annually on health and wellness products and services.

Dollar General's store expansion, with plans for 1,000 new locations in 2023, primarily targets rural and suburban areas. This growth strategy directly impacts community dynamics, potentially affecting local businesses and employment. For example, in many small towns, Dollar General's presence can be a significant source of local jobs, with the company employing approximately 190,000 individuals nationwide as of 2023.

The company's focus on affordability resonates with a broad consumer base, particularly in regions with lower average incomes. As of 2023, Dollar General reported net sales of $38.9 billion, reflecting its success in serving budget-conscious shoppers. This economic positioning is crucial in understanding its sociological impact.

Consumer preferences are evolving, with a growing emphasis on health and wellness. Dollar General is responding by expanding its DG Fresh initiative to include more fresh produce and healthier options, acknowledging that U.S. consumers spent an average of $3,500 annually on health and wellness in 2024.

Labor practices are a key sociological consideration, given Dollar General's large workforce, predominantly in hourly roles. Ensuring competitive wages and positive working conditions is vital for employee retention and community relations.

| Sociological Factor | Description | Dollar General Relevance (2023-2024 Data) |

| Demographics | Population age, income, migration patterns in target communities. | Aging rural populations need accessible essentials; migration affects customer base. |

| Consumer Behavior | Shifts in spending habits, health consciousness, brand loyalty. | Increased demand for affordable goods and healthier options; expansion of DG Fresh initiative. |

| Community Impact | Effect of store presence on local businesses and employment. | Provides local jobs (190,000 employees); expansion creates competition for small businesses. |

| Labor Force | Workforce demographics, wages, working conditions, labor relations. | Large hourly workforce; focus on competitive compensation and employee well-being. |

Technological factors

Dollar General is making significant investments in technology to streamline its supply chain. This includes rolling out automation and robotics within its distribution centers, a move designed to tackle issues like shrink and boost inventory accuracy.

The company's focus on automation aims to speed up the flow of goods to its stores, directly impacting operational costs. For instance, by the end of fiscal 2023, Dollar General had implemented new supply chain initiatives, and while specific cost savings from automation were not detailed, the company highlighted improved inventory availability as a key benefit.

Dollar General's digital transformation is a key technological factor, focusing on enhancing its online presence and e-commerce capabilities. This involves optimizing its website and mobile app to provide a seamless shopping experience, which is crucial for reaching a broader customer base and competing in the evolving retail landscape.

The company is actively exploring and implementing buy-online-pickup-in-store (BOPIS) options, a strategy that saw significant growth in 2023 as consumers increasingly sought convenient shopping solutions. This integration of digital and physical retail channels aims to leverage Dollar General's extensive store network for customer fulfillment, driving traffic and sales.

Furthermore, Dollar General is investing in data analytics to better understand customer behavior and preferences. This allows for more targeted marketing campaigns and personalized offers, enhancing customer engagement and loyalty, a trend that continued to be a priority throughout 2024.

Dollar General is increasingly leveraging advanced data analytics to refine demand forecasting and inventory management. This focus is critical for optimizing stock levels across its vast store network, aiming to reduce both waste and the costs associated with overstocking or stockouts. For instance, in fiscal year 2023, the company reported a net sales increase of 2.2%, highlighting the importance of efficient inventory to meet customer demand.

The implementation of sophisticated analytics allows Dollar General to better predict what products customers will want and where, ensuring timely replenishment. This data-driven approach directly impacts operational efficiency and profitability by minimizing lost sales due to unavailability and reducing carrying costs for excess inventory. The company's commitment to technology is evident as they continue to invest in systems that provide granular insights into consumer purchasing patterns.

In-store Technology and Customer Experience

Dollar General is integrating technology in-store to refine the customer journey. This includes advanced point-of-sale (POS) systems and digital signage aimed at improving efficiency and engagement. For instance, in early 2024, the company was evaluating its self-checkout strategy, with some locations reportedly scaling back these options to address inventory shrink concerns, a common challenge in retail.

The company's approach to self-checkout illustrates a dynamic adaptation to operational realities. While self-checkout can speed up transactions, its implementation is being carefully managed. Dollar General's focus remains on creating a seamless and secure shopping environment, leveraging technology where it demonstrably benefits both the customer and the business’s bottom line.

- Point-of-Sale Systems: Upgraded POS technology is crucial for faster, more accurate checkout processes.

- Self-Checkout Strategy: The company is adjusting its self-checkout rollout based on performance and shrink data.

- Digital Signage: In-store digital displays can offer dynamic promotions and product information.

- Customer Experience Focus: Technology investments are strategically aimed at enhancing shopper convenience and store operations.

Cybersecurity and Data Privacy

Cybersecurity is paramount for Dollar General, given its extensive collection of customer and employee data. Protecting this information from breaches is crucial for maintaining operational integrity and customer confidence. In 2024, the retail sector continued to face significant cyber threats, with data breaches costing companies an average of $4.73 million, according to IBM's 2024 Cost of a Data Breach Report.

Compliance with evolving data privacy regulations, such as GDPR and CCPA, is a key technological factor for Dollar General. Failure to adhere to these laws can result in substantial fines and reputational damage. For instance, in 2023, regulatory bodies imposed billions of dollars in fines for data privacy violations globally, highlighting the financial risks associated with non-compliance.

Dollar General's investment in robust cybersecurity infrastructure directly impacts its ability to safeguard sensitive information. This includes advanced threat detection systems, secure data storage, and regular security audits. The company's commitment to these measures is essential to prevent potential financial losses and maintain customer loyalty in an increasingly digital landscape.

Key considerations for Dollar General regarding cybersecurity and data privacy include:

- Implementing multi-factor authentication for all employee access points to critical systems.

- Conducting regular vulnerability assessments and penetration testing on all digital platforms.

- Ensuring all third-party vendors with access to customer data adhere to strict security protocols.

- Providing ongoing cybersecurity awareness training for all employees to mitigate human error.

Dollar General is actively enhancing its supply chain through technological advancements, including the deployment of automation and robotics in distribution centers. This initiative aims to improve inventory accuracy and reduce operational costs, with the company reporting improved inventory availability as a key benefit of its supply chain modernization efforts by the end of fiscal 2023.

The company's digital transformation is a significant technological driver, focusing on strengthening its online presence and e-commerce capabilities. Dollar General is optimizing its website and mobile app to offer a more integrated shopping experience, including the expansion of buy-online-pickup-in-store (BOPIS) options, which saw increased customer adoption in 2023.

Data analytics plays a crucial role in understanding customer behavior and refining demand forecasting. By leveraging these insights, Dollar General aims to optimize inventory management across its extensive store network, minimizing stockouts and reducing carrying costs. This data-driven approach is vital for enhancing operational efficiency and profitability.

In-store technology, such as upgraded point-of-sale (POS) systems and digital signage, is being implemented to improve customer experience and operational efficiency. However, the company is also carefully evaluating strategies like self-checkout, adjusting their rollout based on performance and shrink data, as observed in early 2024.

Cybersecurity remains a critical technological factor, with Dollar General investing in robust infrastructure to protect sensitive customer and employee data. Given the rising threat landscape in retail, where data breaches averaged $4.73 million in cost in 2024, strong cybersecurity measures are essential for maintaining operational integrity and customer trust.

| Technology Area | Dollar General's Focus | Impact/Goal | Data Point/Context |

|---|---|---|---|

| Supply Chain Automation | Robotics and automation in distribution centers | Improved inventory accuracy, reduced costs, faster goods flow | Improved inventory availability reported by end of FY2023 |

| Digital Transformation | E-commerce, website/app optimization, BOPIS | Enhanced customer experience, broader reach, increased sales | BOPIS adoption increased in 2023 |

| Data Analytics | Customer behavior analysis, demand forecasting | Optimized inventory, reduced waste, better targeting | Continued investment in systems for consumer purchasing patterns |

| In-Store Technology | POS systems, digital signage, self-checkout evaluation | Improved checkout efficiency, dynamic promotions, customer journey refinement | Self-checkout strategy being adjusted based on shrink data (early 2024) |

| Cybersecurity | Data protection, threat detection | Safeguarding sensitive data, maintaining customer confidence | Retail data breaches averaged $4.73 million cost in 2024 (IBM) |

Legal factors

Dollar General has been under intense legal scrutiny for workplace safety issues, culminating in a substantial $12 million settlement with the Occupational Safety and Health Administration (OSHA) in early 2024. This settlement highlights the company's ongoing challenges in maintaining compliance with federal safety standards.

Continued adherence to OSHA regulations remains a paramount legal obligation for Dollar General. Key areas of focus include rectifying persistent issues such as blocked emergency exits and unsafe product storage practices, which pose significant risks to employees.

Dollar General must strictly adhere to a complex web of labor laws, encompassing minimum wage regulations, overtime pay, and mandated employee benefits. Failure to comply can lead to significant penalties and legal challenges.

The company has faced legal scrutiny over labor practices. For instance, past lawsuits have addressed issues like healthcare surcharges and the provision of adequate employee breaks, underscoring the persistent legal risks associated with employee relations.

Dollar General operates under a stringent framework of product safety and consumer protection laws. These regulations mandate that all items sold, from food to general merchandise, meet specific safety standards and are truthfully advertised. For instance, in 2024, the Consumer Product Safety Commission (CPSC) continued its focus on enforcing standards for children's products, a category Dollar General carries.

Failure to comply can result in severe penalties. In 2024, several retailers faced significant fines and product recalls due to violations of these laws, impacting their financial performance and consumer trust. Dollar General's commitment to these regulations is crucial to avoid costly recalls, legal battles, and reputational damage, ensuring sustained consumer confidence.

Zoning and Land Use Regulations

Dollar General's aggressive expansion strategy, aiming for approximately 950 new stores in fiscal year 2024, necessitates careful navigation of varied zoning and land use regulations across numerous municipalities. Compliance with local development ordinances, including setbacks, parking requirements, and signage restrictions, is a continuous legal hurdle. The company must secure the appropriate permits for each new location, a process that can vary significantly in complexity and timeline from one jurisdiction to another. For instance, a new store opening in a densely populated urban area might face more stringent zoning laws than one in a rural setting, impacting development costs and schedules.

These regulations directly influence site selection and construction timelines. In 2023, Dollar General reported opening 2,700 new stores over the past five years, highlighting the scale of their development efforts and the consistent need to manage these legal requirements. Failure to adhere to zoning laws can result in fines, construction delays, or even the inability to open a store, posing a significant operational risk.

- Permitting Processes: Each new store requires specific local permits, which can add weeks or months to project timelines depending on the municipality's efficiency and the complexity of the application.

- Land Use Restrictions: Zoning laws dictate where Dollar General can build, impacting the availability of suitable locations and potentially increasing land acquisition costs.

- Development Ordinances: Compliance with local building codes, parking minimums, and aesthetic requirements adds to construction expenses and can influence store design.

Anti-Trust and Competition Law

Dollar General's substantial market share, especially in underserved rural communities, necessitates careful adherence to anti-trust and competition laws. Regulatory bodies closely monitor large retailers to prevent monopolistic practices.

Any significant acquisitions or aggressive market expansion could attract scrutiny from agencies like the Federal Trade Commission (FTC) if they are seen as potentially limiting consumer choice or unfairly disadvantaging smaller competitors. For instance, in 2023, the FTC continued its focus on retail consolidation, reviewing several large mergers across various sectors.

- Regulatory Scrutiny: Dollar General faces potential review of its market dominance, particularly concerning its high store density in certain regions.

- Merger & Acquisition Oversight: Future growth through acquisitions must navigate strict anti-trust regulations to ensure fair competition.

- Pricing Practices: The company must also ensure its pricing strategies do not violate anti-competition statutes, especially in areas with limited retail options.

Dollar General's legal landscape is significantly shaped by workplace safety regulations, as evidenced by a substantial $12 million settlement with OSHA in early 2024 for ongoing safety violations. This underscores the critical need for strict adherence to federal standards, particularly concerning blocked exits and product storage, to avoid further penalties and ensure employee well-being.

Labor laws are another crucial area, requiring compliance with minimum wage, overtime, and benefits mandates. Past legal challenges related to employee breaks and healthcare surcharges highlight the persistent risks associated with employee relations and the importance of fair labor practices.

Product safety and consumer protection laws are paramount, especially with the CPSC's continued focus on children's products in 2024. Non-compliance can lead to costly recalls, legal battles, and damage to consumer trust.

Navigating zoning and land use regulations is vital for Dollar General's aggressive expansion, with approximately 950 new stores planned for fiscal year 2024. Each location requires permits and adherence to local ordinances, impacting development timelines and costs.

Environmental factors

Dollar General's extensive retail footprint, encompassing over 19,000 stores as of early 2024, inherently leads to substantial energy consumption. This includes powering store operations, refrigeration, and lighting, as well as the energy required for its vast distribution network and transportation fleet.

The company is actively pursuing initiatives to enhance energy efficiency across its operations. For instance, Dollar General has been investing in LED lighting retrofits in its stores, a move expected to yield significant energy savings. In 2023, they reported progress on their sustainability goals, including a focus on reducing Scope 1 and Scope 2 greenhouse gas emissions, which are directly tied to their energy usage.

Reducing its carbon footprint is becoming a critical aspect of Dollar General's environmental strategy, driven by both regulatory pressures and increasing consumer demand for sustainable business practices. Their efforts in optimizing transportation routes and exploring more fuel-efficient vehicles are key components in mitigating their environmental impact and enhancing their corporate reputation.

Dollar General's significant sales volume, particularly in low-cost, high-volume goods, inherently creates substantial waste from both products and their packaging. This necessitates robust waste management strategies. For instance, in 2023, the company reported efforts to reduce waste sent to landfills, though specific quantifiable reductions in waste volume were not detailed in their latest sustainability reports.

Increasing recycling efforts across its vast network of stores and distribution centers is a critical environmental focus for Dollar General. While specific recycling rates are not publicly disclosed, the company has stated its commitment to expanding these programs. Exploring more sustainable packaging options is also a key consideration to mitigate the environmental impact of its extensive product offerings.

Dollar General's vast distribution network, relying heavily on trucking, contributes significantly to its carbon footprint. In 2023, transportation and logistics accounted for a substantial portion of the company's Scope 1 and Scope 3 emissions, a trend that continued into early 2024 as the company expanded its store base. Efforts to optimize delivery routes and explore more fuel-efficient vehicles are underway to address this environmental challenge.

Climate Change and Extreme Weather Events

Climate change is increasingly manifesting as more frequent and severe extreme weather events, posing significant operational challenges for Dollar General. These events, such as hurricanes, floods, and severe storms, can directly disrupt the company's extensive supply chain, leading to delays in product delivery and increased transportation costs. For instance, the 2023 Atlantic hurricane season saw an above-average number of named storms, highlighting the persistent risk to retail operations in vulnerable regions.

Furthermore, extreme weather can cause direct physical damage to Dollar General's vast network of over 19,000 stores, necessitating costly repairs and potentially leading to temporary closures. This impacts not only sales but also customer access to essential goods, particularly in rural and underserved communities where Dollar General often plays a critical role. The company's environmental strategy must therefore include robust risk assessment and mitigation plans for these climate-related threats to ensure business continuity and resilience.

- Supply Chain Vulnerability: Increased frequency of hurricanes and floods can disrupt transportation routes and warehousing, impacting inventory availability and delivery times.

- Store Damage and Access: Extreme weather events can lead to physical damage to retail locations, hindering customer access and causing sales losses.

- Operational Costs: Repairing storm damage and managing supply chain disruptions due to climate events can significantly increase operational expenses.

- Mitigation Strategies: Dollar General needs to invest in climate risk assessments and resilience planning to safeguard its assets and operations against environmental impacts.

Water Conservation and Resource Management

While the direct impact of water conservation on a discount retailer like Dollar General might seem less pronounced than for other industries, responsible water usage in its operational footprint and a keen eye on water-intensive products within its vast supply chain are crucial for demonstrating environmental stewardship. For instance, in 2023, Dollar General reported progress on its environmental goals, including efforts to reduce water consumption in its stores and distribution centers, though specific water usage data for 2024 and 2025 is still emerging.

Considering the global water scarcity challenges, which are projected to intensify, Dollar General's approach to water management in its supply chain, particularly for private label goods that might involve agriculture or manufacturing processes, becomes increasingly important. The company's commitment to sustainability, as outlined in its ESG reports, includes evaluating suppliers on their environmental practices, which implicitly covers water resource management.

- Operational Efficiency: Implementing water-saving technologies in store restrooms and cleaning processes can lead to incremental but consistent reductions in water usage across its more than 19,000 locations.

- Supply Chain Scrutiny: Assessing the water footprint of key product categories, such as apparel or certain food items, allows for strategic sourcing decisions that favor suppliers with robust water management practices.

- Risk Mitigation: Proactive water resource management helps mitigate risks associated with water scarcity, such as potential disruptions in supply chains or increased operational costs due to water pricing or regulations.

- Reputational Enhancement: Demonstrating a commitment to water conservation can positively influence consumer perception and investor relations, aligning with growing market demand for sustainable business practices.

Dollar General's environmental strategy is increasingly focused on reducing its carbon footprint, with significant investments in energy efficiency. By early 2024, the company had made progress on LED lighting retrofits across its stores, aiming to lower energy consumption and associated greenhouse gas emissions. Their transportation and logistics operations, a major contributor to Scope 1 and Scope 3 emissions, are also being optimized through route planning and the exploration of more fuel-efficient vehicles.

Waste reduction is another key environmental pillar, with efforts to minimize landfill waste from both products and packaging. While specific waste volume reduction figures for 2023-2024 are not yet fully detailed, the company is expanding recycling programs across its extensive network of over 19,000 locations. Furthermore, Dollar General is evaluating more sustainable packaging options to lessen the environmental impact of its high-volume sales model.

Climate change presents tangible risks, with extreme weather events like hurricanes and floods impacting supply chain reliability and potentially causing direct damage to stores. In response, Dollar General is focusing on climate risk assessment and resilience planning to ensure operational continuity and protect its assets against these environmental challenges.

Responsible water usage is also a growing consideration, with initiatives to reduce consumption in stores and distribution centers. The company is also scrutinizing the water footprint of its supply chain, particularly for private label goods, to promote sustainable sourcing practices and mitigate risks associated with water scarcity.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Dollar General is built on a robust foundation of data from government agencies, economic indicators, and reputable market research firms. We incorporate insights from industry publications, environmental reports, and technological trend analyses to ensure comprehensive coverage.