Dollar General Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dollar General Bundle

Unlock the strategic genius behind Dollar General's success with our comprehensive Business Model Canvas. Discover how they efficiently serve value-conscious consumers, optimize their supply chain, and maintain a low-cost structure. This detailed blueprint is your key to understanding their market dominance.

Partnerships

Dollar General relies on a diverse supplier base for its wide array of affordable products, from national brands to its own private label lines. In 2024, the company continued to strengthen these relationships, ensuring consistent inventory of essential goods like groceries, health and beauty items, and apparel.

A significant aspect of their supplier strategy involves fostering private label development, which contributed to a substantial portion of their sales growth. This focus allows Dollar General to offer value to customers while managing costs effectively.

Furthermore, Dollar General actively cultivates relationships with small businesses, as evidenced by its ongoing Small Business Development Program. This initiative aims to bring unique products and local flavor into their stores, supporting entrepreneurship and expanding their product assortment.

Dollar General relies heavily on its logistics and distribution partners to keep its over 19,000 stores stocked efficiently. These partners are crucial for managing the flow of goods from manufacturers to their extensive network, ensuring products reach their destinations on time and at a reasonable cost.

In 2024, Dollar General continued to invest in its supply chain infrastructure, including the development of new distribution centers. For instance, the company announced plans for new facilities to enhance its ability to serve its growing store base, aiming to improve delivery speed and reduce transportation expenses.

Dollar General collaborates with technology and service providers to bolster its operational backbone. These partnerships are crucial for implementing and maintaining advanced point-of-sale systems, robust e-commerce platforms, and sophisticated supply chain optimization tools.

In 2024, Dollar General continued to invest in technology to improve efficiency and customer engagement. For instance, their ongoing rollout of new store formats and digital initiatives relies heavily on seamless integration with technology partners. This focus aims to enhance the customer shopping experience and streamline inventory management, contributing to their overall cost-effectiveness.

Community Organizations and Non-Profits

Dollar General actively cultivates key partnerships with community organizations and non-profits, exemplified by its significant collaboration with Feeding America. This strategic alliance directly addresses food insecurity, a critical issue impacting many of the communities Dollar General serves.

These philanthropic endeavors do more than just contribute to social good; they bolster Dollar General's brand reputation and foster stronger customer loyalty. By demonstrating a commitment to community well-being, the company enhances its appeal and strengthens its connection with its customer base.

- Feeding America Partnership: Dollar General's collaboration with Feeding America aims to combat hunger, with the company having donated over 250 million pounds of food since 2007.

- Disaster Relief Efforts: The company also partners with organizations like the American Red Cross to provide essential supplies and support during natural disasters, reinforcing its role as a community resource.

- Local Community Support: Dollar General often supports local initiatives and charities through grants and employee volunteerism, further embedding itself within the fabric of the communities it operates in.

Marketing and Brand Collaborations

Dollar General actively pursues marketing and brand collaborations to enhance its market presence and product offerings. A notable example from 2024 is its partnership with entertainment icon Dolly Parton, launching a curated collection of kitchen and housewares items. This initiative not only diversifies Dollar General's product assortment but also leverages Parton's widespread appeal to attract new customer demographics.

Further demonstrating its commitment to inclusive marketing, Dollar General has also partnered with multicultural influencers for its 'Days of Beauty' campaigns. These collaborations are designed to resonate with a broader customer base, fostering deeper connections and expanding the brand's reach within diverse communities. Such strategic alliances are crucial for staying competitive and relevant in the evolving retail landscape.

- Dolly Parton Collaboration (2024): Expanded product lines with kitchen and housewares, leveraging celebrity appeal.

- 'Days of Beauty' Initiatives: Partnered with multicultural influencers to connect with diverse customer segments.

- Strategic Goals: Aim to broaden product portfolios, strengthen customer relationships, and access new markets.

Dollar General's key partnerships are vital for its business model, spanning suppliers, logistics, technology, and community engagement. These collaborations ensure a steady supply of affordable goods, efficient operations, and a strong brand presence.

In 2024, the company continued to deepen relationships with its diverse supplier base, including a focus on private label development which contributes significantly to sales. Furthermore, strategic alliances with organizations like Feeding America highlight Dollar General's commitment to community well-being and brand enhancement.

The company also leverages marketing partnerships, such as the 2024 collaboration with Dolly Parton, to expand product offerings and attract new customer segments. These diverse partnerships are fundamental to Dollar General's ability to deliver value and maintain its competitive edge.

What is included in the product

This Dollar General Business Model Canvas provides a comprehensive, pre-written business model tailored to their strategy of serving rural and suburban value-conscious consumers.

It covers customer segments, channels, and value propositions in full detail, reflecting Dollar General's real-world operations and plans for affordability and convenience.

Dollar General's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that quickly identifies how their low-price, convenient store model addresses the pain points of budget-conscious consumers seeking essential goods in underserved areas.

Activities

Merchandise procurement at Dollar General focuses on sourcing a wide array of essential goods, from groceries and health products to apparel, all at budget-friendly prices. This strategy is crucial for their value proposition, ensuring customers can find necessities without overspending.

Inventory management and product assortment optimization are key. Dollar General carefully curates its offerings to cater to the specific needs of its customer base, often in rural and suburban areas. In fiscal year 2023, Dollar General reported net sales of $38.7 billion, underscoring the scale of their procurement and management operations.

The development and expansion of private brands are integral to this activity. These brands, such as DG Home and Clover Valley, allow Dollar General to control costs, enhance margins, and offer unique value to shoppers, contributing significantly to their overall sales volume.

A primary activity for Dollar General is the efficient day-to-day running of its vast store network, aiming for customer convenience and a pleasant shopping environment. This involves managing store staff, upholding quality store presentation, and integrating new technologies such as upgraded checkout systems to streamline transactions.

In 2024, Dollar General continued to refine its store operations, with a focus on labor management and enhancing the in-store experience. The company operates over 19,000 stores, a testament to the scale of its operational management.

Dollar General focuses on optimizing its supply chain by managing a network of distribution centers and enhancing transportation efficiency. This ensures timely and cost-effective product delivery to its vast store base, a critical element in their low-price strategy.

In 2024, Dollar General continued its efforts to reduce shrink, which refers to inventory losses due to damage, theft, or administrative errors. Efficient inventory management and product flow are paramount to maintaining their competitive pricing and operational effectiveness.

New Store Development and Remodeling

Dollar General's growth engine is fueled by its strategic new store development and remodeling efforts. The company consistently expands its footprint, focusing on underserved small towns and rural areas where it can establish a strong market presence. In fiscal year 2023, Dollar General opened approximately 970 new stores, demonstrating a robust commitment to physical expansion.

Remodeling existing stores is also a critical activity, aimed at improving the shopping environment and introducing new product categories or service offerings. Initiatives like Project Elevate and Project Renovate are designed to enhance customer experience and drive incremental sales. For instance, the company reported that stores with remodels, particularly those incorporating the new formats, often see a significant uplift in sales performance.

- New Store Openings: In fiscal year 2023, Dollar General added around 970 new locations to its network.

- Strategic Focus: New store development prioritizes small towns and rural communities.

- Remodeling Initiatives: Projects like Elevate and Renovate aim to boost sales and customer satisfaction in existing stores.

- Performance Impact: Remodeled stores, especially those with updated formats, typically experience improved sales.

Marketing and Customer Engagement

Dollar General actively engages customers through targeted marketing, with a significant portion of its 2024 strategy focusing on digital channels and personalized promotions. They are also expanding efforts to attract a broader demographic, including higher-income shoppers, by highlighting value and convenience.

Key marketing and customer engagement activities include:

- Digital Marketing: Utilizing social media, email campaigns, and their mobile app to deliver tailored offers and product information.

- Loyalty Programs: The DG Digital Savings program encourages repeat business by offering exclusive discounts and rewards.

- In-Store Promotions: Frequent sales, coupons, and seasonal events drive traffic and purchase frequency.

- Brand Messaging: Communicating their core value proposition of affordability and accessibility to a wide range of consumers.

Dollar General's key activities revolve around efficient merchandise procurement, optimized inventory management, and the strategic expansion and remodeling of its extensive store network. These efforts are supported by robust supply chain management and targeted customer engagement strategies, all designed to uphold their value proposition.

In 2024, Dollar General continued to focus on enhancing the in-store experience and managing labor effectively across its over 19,000 locations. The company also actively worked on reducing inventory shrink to maintain competitive pricing.

New store openings remained a significant driver of growth, with approximately 970 new stores added in fiscal year 2023, primarily in rural and suburban areas. Remodeling initiatives, such as Project Elevate, are in place to improve store performance and customer satisfaction.

Marketing efforts in 2024 emphasized digital channels and personalized promotions to attract a broader customer base, including higher-income shoppers, while leveraging loyalty programs and in-store events to drive repeat business.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Merchandise Procurement | Sourcing essential goods at budget-friendly prices. | Net sales of $38.7 billion in FY2023. |

| Store Operations | Managing day-to-day store network efficiency and customer experience. | Operates over 19,000 stores. |

| Supply Chain Management | Optimizing distribution for timely and cost-effective product delivery. | Focus on reducing shrink in 2024. |

| Store Expansion & Remodeling | Opening new stores and updating existing ones. | Opened ~970 new stores in FY2023. |

| Customer Engagement | Targeted marketing and promotions to drive traffic and loyalty. | Emphasis on digital marketing and DG Digital Savings program in 2024. |

Delivered as Displayed

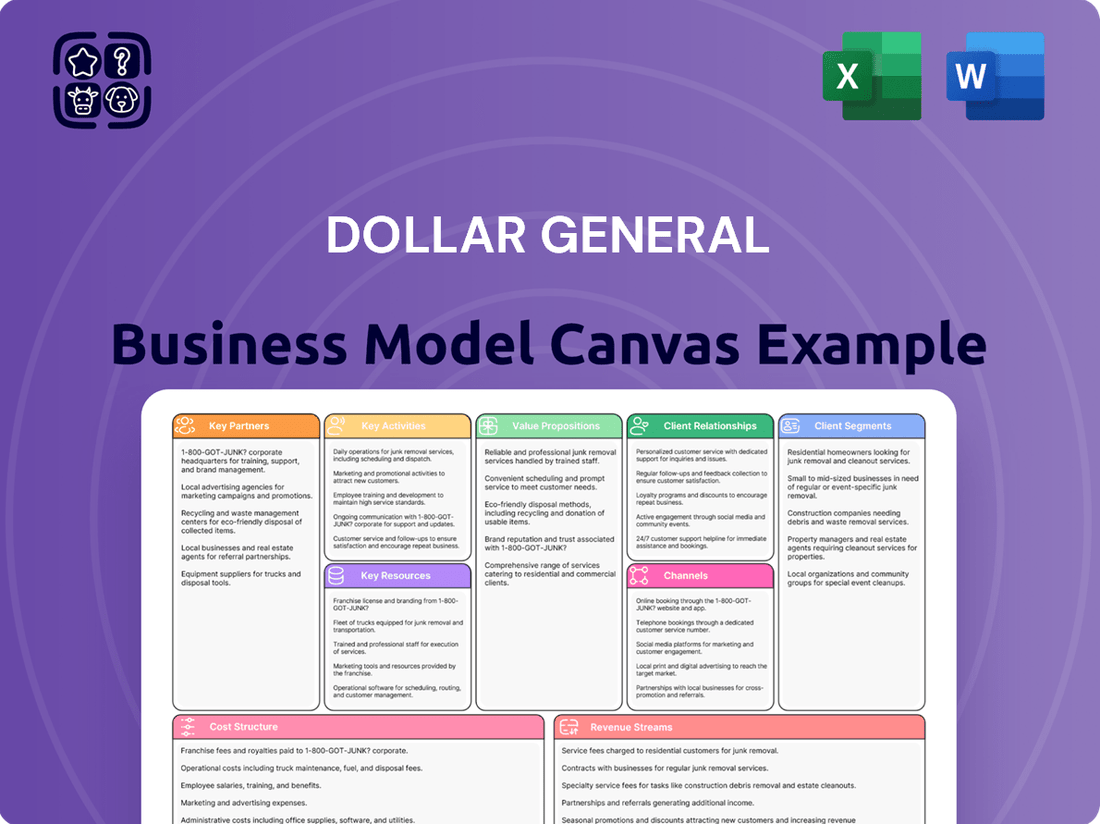

Business Model Canvas

The Dollar General Business Model Canvas you are previewing is the authentic document you will receive upon purchase. This is not a representation or sample, but an exact snapshot of the complete file, ensuring you know precisely what you are acquiring. Once your order is processed, you will gain full access to this same comprehensive analysis, ready for your immediate use.

Resources

Dollar General's extensive store network, boasting over 20,000 locations primarily in rural and small-town America, is its most critical physical asset. This vast footprint ensures unparalleled accessibility to everyday essentials for its core customer base, a key differentiator in the discount retail sector.

By the end of fiscal year 2023, Dollar General operated 19,905 stores, with plans to open approximately 800 new stores in fiscal year 2024. This continued expansion reinforces their commitment to serving underserved communities and solidifies their position as a convenient, go-to retailer.

Dollar General's extensive network of distribution centers is a cornerstone of its operational efficiency. As of early 2024, the company operates over 20 strategically placed distribution centers across the United States, ensuring timely and cost-effective delivery to its more than 19,000 stores. This robust infrastructure is vital for managing the vast inventory required to stock its diverse product offerings.

These distribution centers are not just warehouses; they are sophisticated hubs designed for optimized inventory management and rapid product replenishment. By leveraging advanced logistics and technology, Dollar General can ensure that its stores have the right products at the right time, minimizing stockouts and maximizing sales opportunities. This efficiency directly translates into lower operating costs and better product availability for customers.

Dollar General's strong portfolio of private label brands, such as Clover Valley for food and DG Home for household essentials, is a cornerstone of its business model. These brands allow the company to control quality and cost, directly impacting profitability and customer value.

In 2023, private label brands represented a significant portion of Dollar General's sales, contributing to its ability to offer everyday low prices. This strategy fosters customer loyalty by providing reliable, affordable options that meet daily needs, differentiating them from national brands.

Human Capital and Retail Workforce

Dollar General's extensive workforce, encompassing over 190,000 employees as of early 2024, is a cornerstone of its business model. This vast team includes store associates, district managers, and supply chain professionals, all crucial for the day-to-day operations, efficient logistics, and customer service that define the company's retail presence.

The company places a significant emphasis on employee development, recognizing that a skilled and motivated workforce directly impacts customer satisfaction and operational efficiency. This investment aims to equip employees with the necessary tools and knowledge to excel in their roles.

- Workforce Size: Over 190,000 employees (as of early 2024).

- Key Roles: Store associates, management, supply chain personnel.

- Strategic Importance: Essential for store operations, logistics, and customer service.

- Development Focus: Investing in employee training and growth to enhance performance.

Brand Recognition and Customer Trust

Dollar General has cultivated significant brand recognition and customer trust by consistently delivering on its promise of low prices and convenient shopping experiences. This deep-seated trust is a powerful intangible asset, reinforcing its value proposition for millions of shoppers.

This brand equity translates directly into customer loyalty and repeat business. For instance, in fiscal year 2023, Dollar General reported net sales of $38.7 billion, a testament to its broad customer appeal and the trust placed in its offerings.

- Brand Recognition: Dollar General is a household name, particularly in rural and suburban areas, synonymous with value.

- Customer Trust: Consistent low prices and accessible store locations have built a loyal customer base that relies on the brand.

- Intangible Asset: The trust and recognition Dollar General enjoys are invaluable, reducing marketing costs and enhancing customer acquisition.

- Fiscal Year 2023 Performance: Net sales reached $38.7 billion, reflecting the strength of its brand in the market.

Dollar General's key resources are its vast physical store network, efficient distribution centers, strong private label brands, extensive workforce, and significant brand recognition. These elements collectively enable the company to deliver on its value proposition of low prices and convenience to its core customer base.

The company's commitment to expansion is evident, with plans for approximately 800 new stores in fiscal year 2024, building upon its 19,905 stores at the end of fiscal year 2023. This growth is supported by over 20 strategically located distribution centers ensuring timely inventory replenishment.

Private label brands, such as Clover Valley, are crucial for profitability and customer value, representing a significant portion of sales in 2023. The brand's equity, underscored by $38.7 billion in net sales for fiscal year 2023, fosters customer loyalty and reduces marketing overhead.

| Key Resource | Description | Data Point (as of early 2024/FY23) |

|---|---|---|

| Store Network | Extensive physical presence in rural and small-town America. | 19,905 stores (end of FY23), ~800 planned for FY24. |

| Distribution Centers | Logistical hubs for efficient inventory management. | Over 20 centers supporting store replenishment. |

| Private Label Brands | Owned brands offering value and controlling costs. | Significant sales contribution in FY23. |

| Workforce | Employees essential for operations and customer service. | Over 190,000 employees. |

| Brand Recognition & Trust | Customer loyalty built on consistent value and convenience. | $38.7 billion in net sales (FY23). |

Value Propositions

Dollar General's business model thrives on convenience, placing its stores in rural and underserved areas where access to essential goods is often scarce. This strategic placement means customers don't have to travel long distances for everyday items.

In 2023, Dollar General operated over 19,000 stores, with a significant portion located in towns with populations under 20,000, underscoring their commitment to accessibility in these communities. This widespread presence ensures that a vast number of Americans can easily reach a Dollar General for their shopping needs.

Dollar General's core value proposition centers on offering a wide array of everyday necessities at consistently low prices. This focus on affordability is a major draw for consumers who are mindful of their spending, enabling them to make their budgets go further.

This commitment to "Everyday Low Prices" directly fuels customer acquisition and loyalty. For instance, in fiscal year 2023, Dollar General reported net sales of $38.8 billion, underscoring the significant customer traffic generated by its pricing strategy.

Dollar General's broad selection of necessities is a cornerstone of its value proposition, offering customers a convenient and affordable way to stock up on everyday essentials. This includes a wide array of food items, snacks, health and beauty products, cleaning supplies, and even basic apparel, positioning the retailer as a go-to destination for household needs.

This extensive product mix directly addresses the core needs of its customer base, who often seek value and accessibility. For instance, in fiscal year 2024, Dollar General reported net sales of $37.7 billion, underscoring the significant demand for its curated selection of essential goods.

Value-Driven Private Brands

Dollar General's private label brands are a cornerstone of their value proposition, offering customers high-quality products that rival national brands but at significantly lower prices. This strategy directly appeals to their core customer base, who prioritize affordability without compromising on essential goods. For instance, in fiscal year 2023, Dollar General reported that its private brands represented approximately 27% of its total sales, demonstrating their immense popularity and impact on the company’s financial performance.

These brands are meticulously developed to meet customer needs and expectations, ensuring that the perceived value is consistently high. This focus on quality and price allows Dollar General to capture a substantial market share, particularly in value-conscious segments. The company's commitment to offering these affordable alternatives is a key differentiator in the competitive retail landscape.

- Comparable Quality: Private brands provide quality on par with national brands.

- Competitive Pricing: Offerings are priced more affordably than national brand equivalents.

- Customer Value Enhancement: Direct increase in customer purchasing power and satisfaction.

- Sales Contribution: Private brands accounted for about 27% of Dollar General's sales in fiscal year 2023.

Strategic Store Formats and Enhancements

Dollar General actively refines its store formats and undertakes remodels, such as the ongoing Project Elevate, to elevate the customer journey and product visibility.

These strategic enhancements aim to better align with changing consumer preferences and improve operational efficiency.

For fiscal year 2023, Dollar General reported approximately 19,500 stores, with ongoing initiatives to optimize store count and format mix.

The company's focus on strategic store formats includes:

- Project Elevate: A remodel initiative designed to improve store appearance, product assortment, and the overall shopping environment.

- New Store Growth: Continued expansion, often focusing on smaller, more convenient formats in rural and suburban areas.

- Format Optimization: Testing and implementing different store sizes and layouts to maximize sales per square foot and meet diverse community needs.

Dollar General's primary value proposition is its accessibility, achieved by strategically locating stores in rural and underserved communities. This ensures customers have convenient access to essential goods without extensive travel.

The retailer's commitment to "Everyday Low Prices" is a significant draw, allowing customers to stretch their budgets further. This affordability is a key factor in customer acquisition and retention.

Dollar General offers a broad assortment of everyday necessities, from groceries to health and beauty items, making it a one-stop shop for essential household needs.

Furthermore, its robust private label brands provide comparable quality to national brands at lower price points, significantly enhancing customer value and contributing substantially to sales.

| Value Proposition Element | Description | Supporting Data |

|---|---|---|

| Accessibility | Convenient store locations in rural/underserved areas | Operated over 19,000 stores in fiscal year 2023, many in towns under 20,000 population. |

| Affordability | Consistently low prices on everyday essentials | Net sales of $38.8 billion in fiscal year 2023 reflect strong customer traffic driven by pricing. |

| Product Assortment | Wide range of necessities including food, health, beauty, and apparel | Curated selection addresses core needs of value-conscious customers. |

| Private Brands | High-quality, lower-priced alternatives to national brands | Private brands represented approximately 27% of total sales in fiscal year 2023. |

Customer Relationships

Dollar General's customer relationships are primarily transactional, driven by the core promise of everyday low prices and convenient access to essential goods. This focus on affordability and proximity forms the bedrock of their customer engagement, attracting a broad base of shoppers seeking value and efficiency.

In 2024, Dollar General continued to emphasize this transactional approach, with over 19,000 stores across the United States, making it highly convenient for many consumers. Their strategy revolves around offering a curated selection of everyday necessities, from groceries and cleaning supplies to seasonal decor, at price points that appeal to budget-conscious shoppers.

Dollar General cultivates strong customer relationships by actively participating in the fabric of the local communities it serves. This often means being the sole or primary retail provider, which naturally fosters a sense of reliance and connection among residents.

This deep local integration builds significant trust, as Dollar General stores are seen as neighborhood fixtures rather than transient businesses. For instance, in 2024, Dollar General continued its focus on smaller towns and rural areas, where its presence is often critical for everyday shopping needs, reinforcing this community bond.

Dollar General actively cultivates customer relationships through robust digital engagement. Their user-friendly online store, a dedicated mobile app, and active social media presence allow for direct interaction, special deals, and loyalty rewards. This digital ecosystem is key to fostering repeat business and building a loyal customer base.

In 2024, Dollar General continued to emphasize its DG digital offerings, aiming to enhance customer convenience and personalize the shopping experience. By providing targeted promotions and easy access to savings through their app, they are strengthening their connection with a broad customer segment seeking value and accessibility.

In-Store Customer Service and Experience

Dollar General is actively working to elevate its in-store customer service and overall shopping experience. This includes a concerted effort to improve store cleanliness and organization, streamline checkout lines for faster transactions, and invest in associate training to ensure friendly and efficient customer interactions.

These initiatives are crucial for customer retention and attracting new shoppers. In 2024, Dollar General continued to emphasize these operational improvements as a key differentiator in the discount retail space.

- Improved Store Standards: Focus on cleaner, better-organized stores to enhance browsing and shopping ease.

- Efficient Checkout: Implementing technology and processes to reduce wait times at the point of sale.

- Associate Training: Equipping employees with the skills to provide prompt, helpful, and friendly customer service.

- Customer Feedback: Utilizing customer input to identify areas for improvement in the in-store experience.

Feedback and Responsiveness

Dollar General's customer relationships likely focus on accessibility and value, with mechanisms for gathering feedback to enhance their discount retail model. While specific details on feedback systems aren't public, a strong relationship hinges on addressing customer needs effectively.

The company's vast store footprint, with over 19,000 locations as of early 2024, allows for direct, localized customer interaction. This proximity is a key element in understanding and responding to community-specific preferences and concerns.

- Customer Feedback Channels: While not publicly detailed, Dollar General likely utilizes in-store interactions, customer service lines, and potentially online surveys or social media monitoring to gather feedback.

- Responsiveness to Concerns: Addressing customer complaints and suggestions promptly is crucial for maintaining loyalty in the competitive discount retail sector.

- Continuous Improvement: Feedback directly informs decisions on product assortment, store layout, and service quality, aiming to better meet the needs of their value-conscious customer base.

- Loyalty Programs: Although not a primary focus historically, exploring or enhancing loyalty programs could further strengthen customer relationships by rewarding repeat business.

Dollar General's customer relationships are built on a foundation of accessibility, affordability, and community integration. Their extensive store network, exceeding 19,000 locations by early 2024, ensures a convenient presence for a broad customer base, particularly in rural and underserved areas. This proximity fosters a sense of reliance and connection.

The company actively engages customers through digital channels, including a mobile app and social media, offering personalized deals and loyalty rewards to drive repeat business. In 2024, continued investment in these digital offerings aims to enhance the shopping experience and strengthen customer loyalty.

Dollar General also prioritizes improving the in-store experience, focusing on cleaner stores, efficient checkout processes, and enhanced associate training. These operational improvements, a key focus in 2024, are vital for customer retention and attracting new shoppers in the competitive discount retail market.

| Aspect | Description | 2024 Focus/Data |

|---|---|---|

| Accessibility | Extensive store network for convenient shopping. | Over 19,000 stores nationwide, serving many rural communities. |

| Affordability | Everyday low prices on essential goods. | Core strategy to attract budget-conscious consumers. |

| Digital Engagement | Mobile app, social media for deals and loyalty. | Continued investment in DG digital offerings for personalized experiences. |

| In-Store Experience | Improved store standards, efficient checkout, associate training. | Key initiatives for customer retention and acquisition. |

Channels

Dollar General's primary channel is its extensive network of over 20,000 physical discount retail stores. These stores are strategically placed, often in small towns and rural areas across the United States and Mexico, offering customers convenient, local access to essential goods.

This vast physical footprint ensures Dollar General reaches underserved communities. As of early 2024, the company continues to expand this channel, with plans to open approximately 800 new stores in fiscal year 2024, reinforcing its commitment to brick-and-mortar accessibility.

Dollar General’s e-commerce website and mobile app serve as key touchpoints for customers. Through these platforms, shoppers can browse a wide selection of products, access exclusive digital coupons, and engage with features like customer reviews and loyalty program benefits. This digital integration enhances convenience and provides an additional avenue for sales.

In 2024, Dollar General continued to invest in its digital capabilities. The company reported that its digital channels, including its app and website, contributed to its overall sales growth, with a significant portion of customers utilizing these platforms for both browsing and purchasing. The mobile app, in particular, has become a vital tool for customer engagement, offering personalized promotions and easy access to savings.

Dollar General is actively enhancing its omnichannel offerings, notably through collaborations with third-party delivery providers such as DoorDash. This strategic move aims to broaden customer access and convenience by bringing essential goods directly to their homes.

The company is also investing in its own same-day delivery pilot program. This in-house initiative allows Dollar General to have more control over the customer experience and potentially offer more competitive delivery times and costs, further strengthening its competitive position in the market.

Marketing and Advertising (Traditional and Digital)

Dollar General employs a multi-channel marketing approach, blending traditional and digital strategies to connect with its value-conscious customer base. This includes targeted advertising campaigns designed to highlight affordability and convenience, often leveraging local media and direct mail to reach specific communities.

Digitally, Dollar General actively uses social media platforms like Instagram, Facebook, and Twitter to engage customers, share promotions, and build brand loyalty. Their strategy also incorporates search engine optimization (SEO) to ensure that consumers searching for everyday essentials can easily find nearby Dollar General locations.

- Targeted Advertising: Focuses on value and convenience, often localized.

- Social Media Engagement: Active presence on platforms like Instagram and Facebook for promotions and community building.

- Search Engine Optimization (SEO): Enhances online visibility for local searches.

- Digital Promotions: Leverages online coupons and loyalty programs to drive traffic.

Supply Chain and Distribution Network

Dollar General's extensive network of distribution centers (DCs) and its private fleet of trucks form the backbone of its supply chain, acting as a vital internal channel. This infrastructure ensures that products efficiently move from suppliers to its over 19,000 stores, directly impacting product availability for its customer base.

The company's strategic investment in its supply chain is evident in its continuous expansion and optimization efforts. For instance, in fiscal year 2023, Dollar General operated 20 distribution centers, a number that has grown to support its vast store footprint. This robust network is key to maintaining low operating costs and offering value to customers.

- Network Scale: Operates a significant number of distribution centers strategically located across the United States to serve its widespread store base.

- Efficiency Focus: Employs advanced logistics and technology to streamline the flow of goods, minimizing transit times and costs.

- Product Availability: The efficient functioning of this channel is critical for ensuring shelves are stocked, meeting customer demand, and driving sales.

- Cost Advantage: A well-managed supply chain contributes directly to Dollar General's ability to maintain its everyday low-price strategy.

Dollar General’s primary channels are its vast network of over 20,000 physical discount retail stores, strategically located in small towns and rural areas. These stores provide convenient, local access to essential goods, with plans to open around 800 new stores in fiscal year 2024. Additionally, their e-commerce website and mobile app offer a wide selection, digital coupons, and loyalty program benefits, enhancing sales and customer engagement.

The company is actively expanding its omnichannel capabilities, partnering with third-party delivery services like DoorDash and piloting its own same-day delivery. This multi-channel approach is supported by targeted advertising, social media engagement, and SEO to reach its value-conscious customer base effectively.

Dollar General's robust supply chain, powered by a significant number of distribution centers and a private fleet, acts as a crucial internal channel. This infrastructure ensures efficient product movement to its stores, critical for maintaining low operating costs and product availability, thereby supporting its everyday low-price strategy.

| Channel Type | Description | 2024 Focus/Data |

|---|---|---|

| Physical Stores | Extensive network of discount retail locations | Approx. 800 new stores planned for FY24; over 20,000 locations |

| E-commerce/Mobile App | Online browsing, purchasing, digital coupons, loyalty program | Contributes to overall sales growth, vital for customer engagement |

| Omnichannel Delivery | Partnerships (DoorDash) and in-house same-day delivery pilots | Broadening customer access and convenience |

| Supply Chain (DCs & Fleet) | Internal logistics network for product distribution | 20 distribution centers operated in FY23, crucial for cost management and availability |

Customer Segments

Dollar General's primary customer segment is lower to middle-income households, representing a significant portion of the population seeking value. These consumers are highly attuned to price, making affordability a key driver in their purchasing decisions for essential goods.

In 2024, Dollar General continued to serve this demographic by offering everyday necessities at accessible price points. The company's strategy directly addresses the budget constraints faced by these households, aiming to stretch their dollars further on items like groceries, cleaning supplies, and personal care products.

Rural and small-town residents represent a core customer segment for Dollar General. Many of these communities, often with populations under 20,000, have limited access to larger discount retailers or supermarkets, making Dollar General a convenient and essential shopping destination.

In 2024, Dollar General continued to serve these areas, with a significant number of its over 19,000 stores located in rural settings. This strategic placement directly addresses the needs of populations that may have fewer shopping options within a reasonable distance.

Convenience-seeking shoppers are a cornerstone for Dollar General. These customers value having essential goods readily available, often within a short drive or walk from their homes. This accessibility is a primary driver for their loyalty.

Dollar General's strategic placement of stores in rural and suburban areas, often in communities underserved by larger retailers, directly caters to this segment. In 2023, Dollar General operated over 19,000 stores, highlighting their commitment to widespread convenience.

'Trade-in' Customers (Higher-Income, Value-Seeking)

Dollar General is increasingly attracting 'trade-in' customers, a segment comprising individuals from middle and higher-income households. These shoppers are actively seeking value and more affordable alternatives due to prevailing economic shifts and inflationary pressures. This trend indicates a broader consumer behavior change, where even those with higher disposable incomes are prioritizing cost-effectiveness in their purchasing decisions.

In 2024, Dollar General's strategy to cater to this value-seeking demographic has become even more pronounced. The company's focus on providing everyday necessities at accessible price points resonates strongly with these customers. This approach is vital for maintaining market share and driving traffic, especially as consumers become more discerning about where they spend their money.

- Increased Appeal: Dollar General's expansive store footprint and focus on essential goods make it a convenient and attractive option for higher-income consumers looking to stretch their budgets.

- Value Proposition: The retailer's commitment to low prices on a wide range of products, from groceries to household items, directly addresses the value-seeking behavior of this customer segment.

- Economic Sensitivity: This customer group, while historically less price-sensitive, is demonstrating a heightened awareness of inflation and actively seeking ways to reduce spending on routine purchases.

- Market Adaptation: Dollar General's ability to adapt its merchandise mix and marketing to appeal to these new value-conscious shoppers is a key factor in its continued growth.

Diverse Demographics (e.g., Multicultural Beauty Consumers)

Dollar General is actively working to broaden its customer base by focusing on diverse demographics, including multicultural beauty consumers. This strategic push aims to capture a larger share of a growing market segment. For instance, their 'Days of Beauty' campaigns highlight inclusive product selections, directly addressing the needs of underserved communities.

This focus is particularly relevant given the increasing diversity of the U.S. population. By 2024, the U.S. Hispanic population alone is projected to reach over 65 million people, representing a significant consumer group with specific beauty and personal care preferences. Dollar General's efforts to cater to these consumers through targeted marketing and product assortment are crucial for sustained growth.

- Expanding Product Assortment: Offering a wider range of beauty and personal care products that cater to various skin tones, hair types, and cultural preferences.

- Targeted Marketing Campaigns: Utilizing advertising and promotional efforts that resonate with multicultural consumers, showcasing diversity and inclusivity.

- Community Engagement: Building relationships within diverse communities to better understand and meet their specific needs and desires.

- Partnerships: Collaborating with brands and influencers popular within multicultural segments to enhance product visibility and appeal.

Dollar General's core customer base remains individuals and families in lower to middle-income brackets, prioritizing affordability for essential goods. This segment's purchasing decisions are heavily influenced by price, making Dollar General's value proposition critical. In 2024, the company continued to focus on providing these necessities at accessible price points to help consumers manage their budgets effectively.

Rural and small-town residents are another key demographic, often with limited access to other retail options. Dollar General's extensive store network, with a significant presence in communities under 20,000 people, ensures convenience for these shoppers. As of early 2024, Dollar General operated over 19,000 stores, reinforcing its commitment to serving these underserved areas.

The retailer is also seeing growth in the 'trade-in' segment, which includes middle and higher-income consumers actively seeking value amid economic shifts. These shoppers are increasingly prioritizing cost-effectiveness for routine purchases, a trend Dollar General's pricing strategy effectively addresses.

Cost Structure

Dollar General's Cost of Goods Sold (COGS) is a substantial part of its business model, representing the direct expenses of acquiring the products it sells to customers. In fiscal year 2023, Dollar General reported a COGS of $28.4 billion, a significant portion of its total revenue.

Factors like inventory shrinkage, which includes theft and damage, and the need for markdowns to move slow-selling items can directly reduce gross profit. For instance, rising shrink levels, as noted by the company in recent reports, put pressure on margins by increasing the effective cost of each item sold.

Selling, General, and Administrative (SG&A) expenses for Dollar General encompass a broad spectrum of operational costs. These include the wages and benefits for retail associates, the depreciation of store assets and amortization of intangible items, and performance-based incentive compensation for employees. In fiscal year 2023, SG&A as a percentage of net sales was 22.6%, highlighting the significant investment in staffing and store upkeep.

Further breakdown of SG&A reveals costs like repairs and maintenance essential for store functionality and the various administrative overheads supporting both store-level and corporate operations. These administrative costs are crucial for managing the vast network of Dollar General stores and ensuring efficient business processes. The company's focus on cost management within SG&A is a key element of its value proposition.

Dollar General's cost structure heavily features expenses tied to its vast supply chain and distribution network. These include the operational costs of its numerous distribution centers, the significant outlays for transportation and logistics to move goods across its extensive store base. In fiscal year 2023, the company reported total operating expenses of $27.7 billion, a portion of which is directly attributable to these supply chain functions.

The company is committed to optimizing these supply chain and distribution costs. Efforts are focused on improving efficiency within its distribution centers and leveraging technology to streamline transportation routes. For instance, Dollar General has been investing in its supply chain infrastructure, aiming to reduce per-unit costs and enhance delivery speed, which is crucial for maintaining its low-price strategy.

Real Estate and Store Development Costs

Dollar General's cost structure heavily features real estate and store development expenses. These include the significant capital expenditures required for opening new locations, which involves site acquisition or leasing, construction, and outfitting. Remodeling existing stores to maintain a fresh appearance and improve functionality also represents a substantial ongoing cost. Relocating underperforming stores to more advantageous sites is another factor contributing to these development outlays.

These costs encompass a wide range of investments. Leasehold improvements, which are modifications made to a leased property to suit the business's needs, are a major component. Additionally, fixtures, such as shelving, signage, and checkout counters, along with essential equipment like refrigeration units and point-of-sale systems, add to the initial investment for each store. For fiscal year 2024, Dollar General planned to invest approximately $1.2 billion in capital expenditures. This investment is allocated towards opening new stores, remodeling existing ones, and enhancing their supply chain and technology infrastructure.

- New Store Openings: Costs associated with acquiring sites, construction, and initial inventory for approximately 800 new stores planned for fiscal year 2024.

- Store Remodels: Investments in updating and improving approximately 1,500 existing stores to enhance the customer experience and operational efficiency.

- Relocations: Expenses related to moving approximately 70 stores to new, potentially more profitable locations.

- Fixtures and Equipment: Capital outlay for shelving, refrigeration, POS systems, and other necessary store furnishings and technology.

Marketing and Advertising Expenses

Dollar General invests significantly in marketing and advertising to drive customer traffic and build brand loyalty. These expenses are crucial for communicating value and promotions to their broad customer base.

In fiscal year 2023, Dollar General reported selling, general, and administrative (SG&A) expenses of $8.3 billion. While not all of this is marketing, a substantial portion is allocated to advertising, digital engagement, and promotional activities aimed at attracting and retaining their core customer demographic.

- Targeted Advertising: Dollar General utilizes targeted advertising across various channels, including traditional media and digital platforms, to reach specific customer segments.

- Digital Engagement: Investments in digital marketing, social media engagement, and mobile app promotions are key to interacting with customers and driving in-store visits.

- Promotional Activities: Frequent sales, coupons, and loyalty programs are core to their strategy, requiring ongoing investment in their execution and communication.

- Brand Building: Marketing efforts also focus on reinforcing Dollar General's image as a provider of everyday essentials at affordable prices.

Dollar General's cost structure is heavily influenced by its expansive store footprint and the need to efficiently manage inventory across thousands of locations. Key expenses include Cost of Goods Sold (COGS), which was $28.4 billion in fiscal year 2023, and Selling, General, and Administrative (SG&A) expenses, totaling $8.3 billion in the same year.

Significant investments are made in supply chain and distribution, encompassing the operation of numerous distribution centers and transportation logistics to serve its vast store network. Capital expenditures are also substantial, with approximately $1.2 billion planned for fiscal year 2024 to support new store openings, remodels, and infrastructure enhancements.

| Expense Category | Fiscal Year 2023 (in billions) | Fiscal Year 2024 Planned Capex (in billions) |

| Cost of Goods Sold (COGS) | $28.4 | N/A |

| Selling, General, and Administrative (SG&A) | $8.3 | N/A |

| Capital Expenditures (Total) | N/A | $1.2 |

Revenue Streams

Dollar General's core revenue engine is the sale of highly consumable everyday items. These include groceries, snacks, health and beauty products, and household cleaning supplies, forming the bulk of their sales volume.

In fiscal year 2023, Dollar General reported net sales of $38.7 billion, with consumables representing a substantial majority of that figure, underscoring their importance to the business model.

Dollar General also brings in money from selling things people use around the house, seasonal decorations, and clothes. While these sales are important, they have dipped a bit lately.

In the first quarter of 2024, Dollar General reported that sales of home products and apparel experienced a decline, contributing to a broader slowdown in non-consumable categories.

Dollar General's private label brands are a cornerstone of their revenue, often commanding higher profit margins than national brands. In fiscal year 2023, private label sales represented a substantial portion of their overall sales, demonstrating their importance to the company's profitability.

Ancillary Services

Dollar General enhances its revenue streams by offering ancillary services that cater to customer needs beyond basic retail. These services, like check cashing and money transfers, provide significant convenience and draw traffic into their stores.

These offerings contribute to customer loyalty and create additional touchpoints for engagement. For instance, in fiscal year 2023, Dollar General reported that its net sales reached $38.7 billion, with a portion of this growth being supported by the consistent traffic generated by these value-added services.

The company strategically integrates these services to maximize store utility and customer convenience.

- Check Cashing: A vital service for many customers, providing immediate access to funds.

- Money Transfers: Facilitates remittances and payments, serving a broad demographic.

- Bill Payment: Offers a convenient location for customers to manage their utility and other bills.

- Prepaid Services: Including prepaid debit cards and wireless services, adding to the financial ecosystem within stores.

New Store Openings and Remodels

Dollar General's revenue growth is significantly fueled by its ongoing store expansion strategy. This includes the consistent opening of new locations, which directly contribute to top-line sales by reaching new customer bases. In fiscal year 2023, the company opened approximately 950 new stores, demonstrating a commitment to expanding its physical presence.

Remodeling existing stores also plays a crucial role in boosting revenue. These remodels often involve store enhancements, updated product assortments, and improved customer experiences, leading to increased sales per square foot. For example, remodeled stores typically see a sales lift, which directly translates into higher revenue for Dollar General.

- New Store Openings: Contributes directly to revenue by expanding market reach and customer access.

- Store Remodels: Drives revenue through enhanced customer experience and increased sales per square foot.

- Fiscal Year 2023 Performance: Approximately 950 new stores were opened, underscoring the importance of physical expansion.

Dollar General's revenue is primarily driven by the sale of everyday consumables, which form the largest segment of their sales. Beyond these essentials, the company also generates income from non-consumable items such as home goods and apparel, though these categories have seen recent softness. A significant portion of their profit comes from private label brands, offering higher margins and customer loyalty.

| Revenue Stream | Description | Fiscal Year 2023 Impact |

|---|---|---|

| Consumables | Everyday essentials like groceries, health, and beauty products. | Formed the substantial majority of $38.7 billion in net sales. |

| Non-Consumables | Home products, seasonal items, and apparel. | Experienced a decline in early 2024, impacting overall sales growth. |

| Private Label Brands | Dollar General's own brands, offering competitive pricing and higher margins. | Represented a substantial portion of sales, boosting profitability. |

Business Model Canvas Data Sources

The Dollar General Business Model Canvas is constructed using a blend of internal financial statements, publicly available market research reports, and competitive analysis. These data sources provide a comprehensive view of Dollar General's operations, customer base, and market positioning.