Dollar General Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dollar General Bundle

Dollar General navigates a landscape shaped by intense rivalry among existing competitors and a constant threat from new entrants eager to capture market share. Understanding these pressures is crucial for any business operating in the discount retail sector.

The full analysis reveals the real forces shaping Dollar General’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dollar General's bargaining power of suppliers is relatively low, largely due to its extensive network of approximately 1,400 suppliers. This broad sourcing strategy across categories like consumables, seasonal items, home goods, and apparel means no single supplier holds significant leverage over the company. In 2024, this diversification continues to be a key strength, preventing any one supplier from dictating terms or prices to Dollar General.

Dollar General's massive purchasing power, evidenced by its $22.3 billion in merchandise procurement in 2023 against $34.6 billion in net sales, gives it considerable sway with suppliers. This scale allows the company to negotiate favorable terms and volume discounts, typically in the range of 12-15%, which directly impacts its cost of goods sold.

Dollar General's ability to switch suppliers significantly bolsters its bargaining power. With around 25% of its suppliers being interchangeable for certain product categories, the company can readily shift to alternatives if pricing or quality becomes unfavorable. This flexibility ensures competitive pricing and maintains high standards across its merchandise.

Importance of Volume to Suppliers

Dollar General's sheer size makes it a crucial customer for many of its suppliers, directly influencing their sales volumes. For example, in fiscal year 2023, Dollar General reported net sales of $38.8 billion. This substantial revenue stream means suppliers are keen to maintain a strong relationship with Dollar General, often leading them to prioritize the retailer's needs.

This dependence on Dollar General's business incentivizes suppliers to offer favorable terms. They are motivated to provide competitive pricing and ensure high product quality to secure and retain Dollar General's significant order volumes. This dynamic inherently limits the suppliers' bargaining power.

- Dollar General's substantial annual revenue of $38.8 billion (FY2023) makes it a key client for its suppliers.

- Suppliers' reliance on Dollar General's volume encourages them to offer competitive pricing and maintain high product standards.

- This reliance reduces the suppliers' ability to dictate terms, thus weakening their bargaining power.

Supplier Diversity Initiatives

Dollar General's commitment to supplier diversity, exemplified by its annual call for diverse merchandise suppliers, directly addresses the bargaining power of suppliers. By actively seeking out businesses owned by minorities, women, LGBTQIA+ individuals, veterans, and disabled persons, Dollar General broadens its sourcing options. This diversification inherently reduces reliance on any single supplier or a concentrated group of suppliers, thereby diminishing their individual leverage.

This strategic initiative fosters a more competitive supplier landscape. When Dollar General has a wider array of potential partners, it gains an advantage in negotiations regarding pricing, terms, and service levels. For instance, in 2023, Dollar General reported a significant increase in the number of diverse suppliers participating in its programs, indicating a growing pool of alternative sourcing options.

- Supplier Diversity Program: Dollar General actively recruits and partners with businesses owned by minority groups, women, LGBTQIA+ individuals, veterans, and people with disabilities.

- Increased Sourcing Options: This initiative expands the company's supplier base, reducing dependence on a limited number of providers.

- Enhanced Negotiating Power: A diverse supplier network strengthens Dollar General's ability to negotiate favorable terms and pricing, mitigating supplier leverage.

- Competitive Landscape: By fostering competition among suppliers, Dollar General can secure better value and innovation.

Dollar General's bargaining power with its suppliers remains robust, a situation amplified by its considerable scale and strategic sourcing. The company's vast network, encompassing approximately 1,400 suppliers across diverse product categories, ensures that no single supplier holds undue influence. This broad supplier base, a continuous strength in 2024, prevents any one entity from dictating terms or prices.

| Metric | Value (FY2023/2024 Estimate) | Impact on Supplier Bargaining Power |

|---|---|---|

| Net Sales | $38.8 Billion | Makes Dollar General a crucial customer, increasing supplier dependence. |

| Merchandise Procurement | ~$22.3 Billion | Leverage for negotiating favorable terms and volume discounts. |

| Supplier Interchangeability | ~25% | Allows Dollar General to switch suppliers easily if terms are unfavorable. |

What is included in the product

This analysis unpacks the competitive forces impacting Dollar General, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the discount retail sector.

Instantly visualize Dollar General's competitive landscape with a user-friendly dashboard, simplifying complex industry pressures.

Easily adapt the analysis to reflect shifting supplier power or emerging substitute threats, ensuring strategic agility.

Customers Bargaining Power

Dollar General's customers experience very low switching costs. This means it's incredibly easy for shoppers to choose a competitor like Walmart or Dollar Tree if they find better deals, more convenient locations, or a wider selection of goods. This ease of movement directly boosts the bargaining power of these customers.

For instance, in early 2024, discount retailers like Dollar General saw continued strong customer traffic, partly due to consumers actively seeking value. This indicates that price and convenience remain paramount, reinforcing the impact of low switching costs as customers can readily shift their spending to meet these needs elsewhere.

Dollar General's primary customer base, often situated in smaller towns and rural areas, exhibits significant price sensitivity. This means they actively seek out the lowest prices and are quick to switch to competitors if a better deal is found. For instance, in 2024, Dollar General continued to emphasize its low-price strategy, a crucial factor given that over 75% of its stores are located in towns with populations of 20,000 or fewer, where economic options are often more limited.

The market for everyday necessities is incredibly competitive, meaning Dollar General customers have plenty of other places to shop. Think about giants like Walmart and Target, or even other dollar store chains like Dollar Tree.

This abundance of choices directly translates to significant bargaining power for consumers. They can easily shop around, comparing prices and product offerings to find the best deals.

In 2024, the discount retail sector saw continued growth, with Dollar General reporting net sales of $10.5 billion for the first quarter of fiscal year 2024, indicating ongoing customer engagement despite competitive pressures.

Increased Consumer Demand for Value

Amidst persistent economic pressures and inflation, consumers are increasingly prioritizing value over brand loyalty. This shift is directly driving more foot traffic to discount retailers like Dollar General. For instance, in the first quarter of 2024, Dollar General reported a 7.7% increase in same-store sales, indicating a strong consumer response to their value proposition.

This heightened demand for affordable goods significantly amplifies the customer's power to dictate terms on pricing. When consumers actively seek out lower-cost alternatives, retailers face greater pressure to maintain competitive pricing to retain market share. This dynamic forces companies to be more responsive to price sensitivity.

- Consumer focus on affordability: Inflationary periods naturally lead shoppers to seek out the best deals.

- Discount retailer growth: The success of companies like Dollar General in 2024 underscores this trend.

- Price sensitivity impact: Customers gain leverage when price becomes the primary purchasing driver.

'Trade-in' Customers and Digital Integration

Dollar General's strategy to attract higher-income 'trade-in' customers seeking value is increasing the bargaining power of these consumers. The company's integration of SNAP and EBT into online orders also expands its reach, potentially bringing in customers with different purchasing habits and expectations regarding digital convenience.

This broader customer base, while beneficial for growth, can lead to more diverse demands and a greater ability for customers to negotiate or switch if their expectations aren't met. For instance, in 2024, Dollar General reported a slight increase in average ticket size, suggesting a mix of higher-income shoppers alongside its traditional base, which could amplify the influence of value-seeking customers.

- Attracting Value-Conscious Higher-Income Shoppers: Dollar General's efforts to appeal to a demographic that prioritizes price and value, even among those with higher incomes, strengthens their position as discerning buyers.

- Digital Integration and New Customer Segments: The incorporation of SNAP and EBT into online ordering broadens accessibility, potentially introducing a larger pool of customers who are digitally savvy and expect seamless online experiences.

- Increased Customer Expectations: A more diverse customer base naturally brings a wider array of needs and preferences, including a growing demand for digital integration and personalized shopping experiences.

- Potential for Amplified Bargaining Power: As Dollar General expands its reach and caters to varied customer segments, the collective bargaining power of its customers can increase, especially if they perceive readily available alternatives for value-focused shopping.

Dollar General's customers hold considerable bargaining power due to extremely low switching costs; they can easily opt for competitors like Walmart or Dollar Tree if better prices or convenience are found. The company's focus on rural and small-town markets, where over 75% of its stores are located, means its core customer base is highly price-sensitive, actively seeking the lowest prices. This sensitivity, amplified by economic pressures in 2024, forces Dollar General to maintain competitive pricing to retain market share.

| Metric | Dollar General (Q1 2024) | Industry Trend (2024) |

|---|---|---|

| Same-Store Sales Growth | 7.7% | Continued growth in discount retail |

| Net Sales | $10.5 billion | Strong customer engagement |

| Store Locations in Small Towns | Over 75% (pop. <= 20,000) | Reinforces price sensitivity |

What You See Is What You Get

Dollar General Porter's Five Forces Analysis

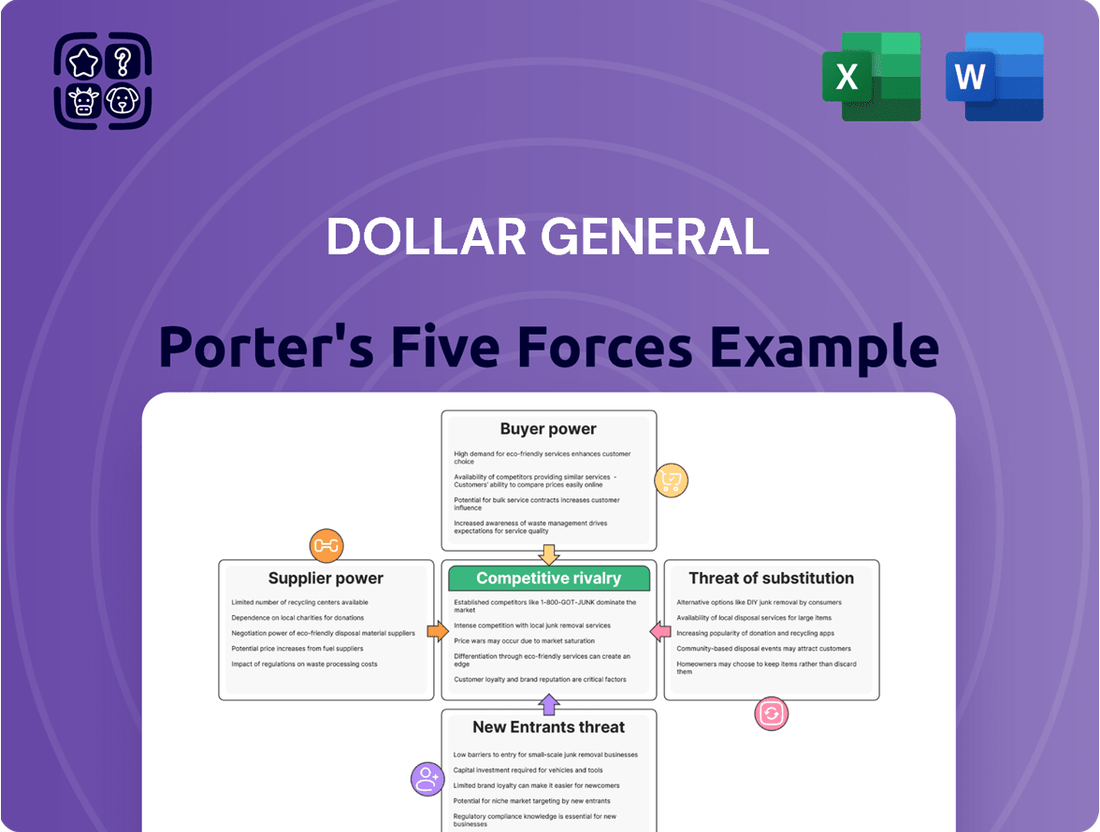

This preview showcases the complete Dollar General Porter's Five Forces Analysis, offering a thorough examination of industry competition. The document you see here is precisely what you will receive instantly after purchase, providing actionable insights into competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. You're looking at the actual, professionally formatted analysis, ready for your immediate use and understanding of Dollar General's strategic landscape.

Rivalry Among Competitors

Dollar General operates in a crowded discount retail landscape, facing numerous competitors. Direct rivals like Dollar Tree and Family Dollar aggressively vie for market share. Larger players such as Walmart and Target also compete, offering a broad range of products, while emerging online platforms like Temu introduce new competitive pressures.

Dollar General's competitive landscape is marked by substantial product overlap, especially in categories like consumables and basic apparel. This means shoppers can find very similar items at competitors such as Walmart, Family Dollar, and Dollar Tree, making it harder for Dollar General to stand out based on its product selection alone.

This homogeneity in offerings naturally fuels a price-sensitive market. When many retailers sell the same types of goods, customers are more likely to choose the cheapest option. For Dollar General, this means constantly battling on price, which can squeeze profit margins.

In fiscal year 2023, Dollar General reported net sales of $38.7 billion, a slight increase from the previous year, highlighting the ongoing challenge of maintaining sales volume in a highly competitive, price-driven environment where product differentiation is minimal.

Dollar General, along with its competitors in the discount retail space, is actively pursuing aggressive expansion. This involves not only opening new stores but also renovating existing ones to enhance their appeal and capture a larger share of the market.

For fiscal year 2025, Dollar General has announced plans to open 575 new stores across the United States and to remodel a significant 2,000 existing locations. This relentless pace of expansion intensifies the competitive rivalry within the sector, as companies vie for prime locations and customer attention.

Focus on Rural and Underserved Markets

Dollar General's strategic focus on rural and underserved markets, where its dense store network provides a distinct advantage and often limits direct competition, is a key factor in managing rivalry. However, this niche is not entirely uncontested, as other discount retailers are increasingly recognizing the potential in these areas, leading to a growing presence and a more competitive landscape.

While Dollar General benefits from being an early mover in many small towns, this doesn't insulate it from all competitive pressures. For instance, in 2024, Dollar General continued to expand its footprint, aiming for over 3,000 new stores by fiscal year 2024, which inherently increases its proximity to potential rivals also targeting these less saturated markets.

- Market Penetration: Dollar General's strategy of saturating rural markets means it often faces fewer large-scale competitors but may encounter smaller, local businesses or other national discounters entering the same underserved areas.

- Competitive Response: The success of Dollar General's model has prompted competitors like Dollar Tree and Walmart (with its Neighborhood Market format) to also consider or increase their presence in similar geographic segments.

- Store Density Advantage: By late 2023, Dollar General operated over 19,000 stores, a significant density that can deter new entrants and make it challenging for competitors to achieve similar scale and efficiency in these specific markets.

Evolving Consumer Behavior and Economic Pressures

Dollar General operates in a retail landscape increasingly shaped by evolving consumer habits and economic headwinds. A significant trend is the heightened consumer focus on value, driven by persistent inflation. This economic pressure is directly channeling shoppers towards discount retailers, intensifying the competitive battleground for this price-sensitive demographic.

The retail sector is actively responding to these shifts. Consumers are demonstrating a clear preference for affordability and convenience, with online shopping continuing its upward trajectory. This dual focus on value and digital accessibility means retailers must innovate to capture and retain customers.

- Consumer Shift to Value: Inflationary pressures in 2024 have amplified the demand for discount retailers, as consumers actively seek ways to manage household budgets.

- Online Channel Growth: E-commerce penetration in the retail sector continued its robust expansion throughout 2024, forcing traditional brick-and-mortar stores to enhance their digital offerings.

- Discount Retailer Competition: Dollar General faces stiff competition not only from other dollar stores but also from mass merchandisers and grocery chains that are increasingly emphasizing their value propositions.

The competitive rivalry within the discount retail sector is intense, with Dollar General facing pressure from direct rivals like Dollar Tree and Family Dollar, as well as larger players such as Walmart and Target. New online entrants like Temu are also adding to this competitive pressure, particularly as consumers increasingly prioritize value amidst ongoing inflation.

Dollar General's strategy of expanding into rural and underserved markets, while historically an advantage, is now attracting increased attention from competitors. This aggressive expansion, with plans to open hundreds of new stores and remodel thousands more in fiscal year 2025, means more direct confrontations with rivals in these less saturated areas.

The market is characterized by significant product overlap, forcing retailers to compete heavily on price, which can impact profit margins. In fiscal year 2023, Dollar General reported net sales of $38.7 billion, underscoring the challenge of growth in this price-sensitive environment.

By late 2023, Dollar General operated over 19,000 stores, a density that can deter some competition but doesn't prevent rivals from targeting similar customer demographics or geographic segments.

| Competitor | Approximate Store Count (Late 2023/Early 2024) | Key Overlapping Product Categories |

|---|---|---|

| Dollar General | 19,000+ | Consumables, Apparel, Home Goods |

| Dollar Tree | 16,000+ | Consumables, Party Supplies, Seasonal Items |

| Family Dollar | 8,000+ | Consumables, Apparel, Health & Beauty |

| Walmart | 4,700+ (US Supercenters/Neighborhood Markets) | Broad range: Groceries, Apparel, Electronics, Home Goods |

| Target | 1,900+ (US Stores) | Groceries, Apparel, Home Goods, Electronics |

SSubstitutes Threaten

Customers have numerous readily available substitutes for Dollar General, ranging from traditional supermarkets and drugstores to large discount retailers like Walmart and Target. Even convenience stores can serve as alternatives for immediate needs. For example, in 2024, Dollar General competes directly with over 4,700 Walmart Supercenters and over 1,900 Target stores in the US alone, all offering a broad selection of similar consumer staples.

The growing popularity of e-commerce platforms like Amazon and specialized online grocery services presents a substantial threat of substitution for Dollar General. These online retailers provide an extensive selection of products, frequently coupled with the convenience of home delivery, potentially diverting customers from traditional discount stores.

In 2024, the e-commerce sector continued its robust expansion, with online retail sales projected to reach over $2.7 trillion globally. This digital shift means consumers have readily accessible alternatives for many of the everyday goods Dollar General offers, directly impacting its customer base.

The increasing popularity of direct-to-consumer (DTC) brands presents a growing threat of substitution for Dollar General. These brands, often focusing on health and beauty aids or cleaning supplies, bypass traditional retail by selling directly to customers online. This approach can offer specialized products and competitive pricing, potentially drawing consumers away from Dollar General's offerings in specific, high-margin categories.

Farmers' Markets and Local Stores

For certain essential goods, particularly fresh produce and some convenience items, local farmers' markets and independent rural stores present a degree of substitutability. These alternatives cater to a niche segment of customers who value locally sourced products or a more personalized shopping experience. While their overall market share is modest, they offer a distinct choice that can divert some consumer spending, especially in areas where Dollar General's presence might be the primary option.

- Niche Appeal: Farmers' markets and local stores attract consumers seeking unique or farm-fresh items, offering a different value proposition than Dollar General's everyday essentials.

- Limited Scale: The threat is generally localized and doesn't represent a significant diversion of sales on a national level for Dollar General.

- Price Sensitivity: While some consumers may pay a premium for local goods, Dollar General's core strength lies in its value pricing for a broad range of necessities.

Changing Consumer Priorities

Changing consumer priorities represent a significant threat of substitutes for Dollar General. As shoppers increasingly seek premium, organic, or specialty items, or desire a more curated and engaging retail environment, they may opt for alternatives. This shift can divert customers who previously found value in Dollar General's low-price, convenience-focused model.

For instance, the growing demand for natural and organic foods, a segment where Dollar General has historically had limited offerings, presents a clear substitute. Retailers specializing in these categories, even at higher price points, can attract a segment of the market that prioritizes these attributes. In 2024, the global organic food market was projected to continue its robust growth, indicating a sustained consumer interest that Dollar General may not fully capture.

- Shifting Consumer Preferences: A growing segment of consumers is prioritizing health, wellness, and sustainability, leading them to seek out organic and natural products.

- Demand for Curated Experiences: Some shoppers are looking for more than just low prices; they desire a pleasant shopping atmosphere and a well-organized selection of goods.

- Competitive Landscape: Retailers focusing on niche markets or offering enhanced customer experiences can draw away Dollar General's customer base, even if their price points are higher.

The threat of substitutes for Dollar General is substantial, stemming from a wide array of retail channels. Traditional supermarkets, drugstores, and large discounters like Walmart and Target offer comparable everyday essentials, directly competing for customer spending. For example, in 2024, Dollar General faced intense competition from over 4,700 Walmart Supercenters and 1,900 Target stores in the US, all providing a broad selection of similar goods.

Online retail, including giants like Amazon and specialized grocery services, presents a significant substitute threat due to its convenience and extensive product selection. In 2024, global online retail sales were projected to exceed $2.7 trillion, highlighting the massive shift towards digital shopping channels that bypass traditional brick-and-mortar discount stores.

Direct-to-consumer (DTC) brands, particularly in health and beauty and cleaning supplies, offer another layer of substitution. These brands often provide specialized products online at competitive prices, potentially siphoning off customers from Dollar General's core offerings. Furthermore, niche alternatives like farmers' markets cater to consumers seeking local or organic products, though their impact remains localized.

| Substitute Type | Key Characteristics | Impact on Dollar General |

| Large Discounters (Walmart, Target) | Broad product selection, competitive pricing, extensive store networks | Direct competition for everyday essentials, broad customer overlap |

| Online Retailers (Amazon, E-grocers) | Convenience, vast selection, home delivery | Diverts customers seeking ease and wider choice, growing market share |

| Direct-to-Consumer (DTC) Brands | Specialized products, online-only sales, often niche focus | Captures customers seeking specific product attributes or better value in certain categories |

| Niche/Local Retailers (Farmers' Markets) | Unique or local products, personalized experience | Attracts a segment prioritizing quality or origin over price, localized impact |

Entrants Threaten

The sheer scale of Dollar General's operations presents a formidable barrier to entry. Establishing a retail network comparable to its over 20,000 stores across 47 states in 2024 demands a colossal capital investment. This includes substantial outlays for real estate acquisition, developing robust infrastructure, and building an efficient supply chain network, effectively deterring many potential new competitors.

Dollar General's established supply chain and distribution network presents a significant barrier to new entrants. The company has made substantial investments in this area, including the development of new distribution centers and the implementation of DG Fresh, a program focused on self-distribution of perishable goods. In 2023, Dollar General operated 19 distribution centers, with plans for further expansion. This robust infrastructure allows for efficient inventory management and cost savings, making it difficult for newcomers to compete on price and availability.

Dollar General's deep-rooted brand recognition, especially in rural areas, presents a formidable barrier. New competitors would need substantial investment to build comparable customer loyalty and trust, a challenge underscored by Dollar General's consistent revenue growth, reaching $38.5 billion in fiscal year 2023.

Economies of Scale in Purchasing

Dollar General's immense purchasing power, a direct result of its extensive store network, presents a significant barrier to new entrants. In 2023, Dollar General operated over 19,000 stores, enabling it to secure substantial discounts from suppliers due to the sheer volume of goods it procures. This scale allows them to negotiate pricing that smaller, newer competitors simply cannot match.

New entrants would struggle to achieve similar economies of scale in purchasing immediately. This lack of purchasing leverage would force them to pay higher per-unit costs for inventory, directly undermining their ability to compete on price with Dollar General's deeply ingrained low-cost strategy. For instance, a new entrant might face a 5-10% higher cost of goods sold initially, making it challenging to achieve Dollar General's everyday low prices.

- Massive Purchasing Volume: Dollar General's 19,000+ stores in 2023 translate into enormous buying power.

- Supplier Negotiation Power: This volume allows for favorable terms and significant discounts from suppliers.

- Cost Advantage: New entrants lack this immediate scale, making it difficult to compete on price.

- Barrier to Entry: The inability to match Dollar General's purchasing efficiency creates a substantial hurdle for new players.

Regulatory and Operational Hurdles

The retail sector, particularly for a company like Dollar General, is laden with significant regulatory and operational barriers to entry. New competitors must contend with a complex web of compliance requirements, including those related to product safety, labeling, and consumer protection. For instance, in 2024, retailers continue to navigate evolving data privacy regulations, impacting how they collect and utilize customer information.

Zoning laws also present a substantial hurdle, dictating where new stores can be established and often requiring lengthy approval processes. Beyond physical locations, operational complexities are immense. Effective inventory management, crucial for maintaining profitability and customer satisfaction, demands sophisticated supply chain logistics and technology investments. Dollar General, with its extensive network of over 19,000 stores as of early 2024, has honed these processes over decades, creating a significant advantage.

Furthermore, managing labor relations, including hiring, training, and retention in a competitive market, alongside controlling shrink—losses due to theft, damage, or administrative errors—adds layers of difficulty. In 2023, the retail industry reported an average shrink rate of 1.4% of sales, according to the National Retail Federation, a figure that can significantly impact a new entrant's bottom line.

- Regulatory Compliance: Navigating diverse federal, state, and local regulations related to retail operations, product safety, and consumer data privacy.

- Zoning and Location Challenges: Securing prime real estate and obtaining necessary permits, which can be time-consuming and geographically restrictive.

- Operational Scale: Mastering efficient inventory management, supply chain logistics, and labor management to compete on cost and availability.

- Shrinkage Control: Implementing robust measures to minimize losses from theft, damage, and administrative errors, a critical factor for profitability in discount retail.

The threat of new entrants for Dollar General is considerably low, primarily due to the immense capital required to replicate its vast operational scale. Building a comparable network of over 19,000 stores, as Dollar General operated in 2023, demands billions in investment for real estate, infrastructure, and supply chain development, effectively creating a significant financial barrier.

Dollar General's established, highly efficient supply chain and distribution network, including its DG Fresh initiative for perishables, represents another substantial hurdle. This infrastructure, supported by 19 distribution centers in 2023, allows for cost savings and inventory control that new entrants would struggle to match in their initial stages.

Furthermore, Dollar General's strong brand loyalty, particularly in its core rural markets, and its massive purchasing power, stemming from its sheer volume of sales reaching $38.5 billion in fiscal year 2023, make it difficult for newcomers to compete on price and customer trust.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Establishing a store network comparable to DG's 19,000+ stores (2023) requires massive investment. | High barrier due to immense upfront costs for real estate and infrastructure. |

| Supply Chain & Distribution | DG's extensive network and DG Fresh program offer significant efficiencies. | New entrants face challenges in matching logistical capabilities and cost-effectiveness. |

| Brand Loyalty & Purchasing Power | DG's strong rural presence and $38.5 billion (FY23) revenue grant significant buying leverage. | Newcomers struggle to achieve similar economies of scale and competitive pricing. |

Porter's Five Forces Analysis Data Sources

Our Dollar General Porter's Five Forces analysis is built upon a foundation of credible data, including SEC filings, annual reports, and industry-specific market research from firms like IBISWorld and Statista. This allows for a comprehensive understanding of the competitive landscape.