Dollar General Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dollar General Bundle

Curious about Dollar General's product portfolio performance? This preview offers a glimpse into their market positioning, hinting at which items are driving growth and which might be lagging.

To truly understand Dollar General's strategic landscape, you need the full BCG Matrix. Gain a comprehensive view of their Stars, Cash Cows, Dogs, and Question Marks, and unlock actionable insights for your own business decisions.

Purchase the complete BCG Matrix now for a detailed breakdown and expert recommendations that will empower you to navigate the competitive retail environment with confidence.

Stars

Dollar General is heavily focused on its private label brands, recognizing their significant contribution to overall sales. The Clover Valley brand alone achieved $2.3 billion in sales in fiscal 2023, highlighting the strength and customer acceptance of these offerings.

The company's commitment to expanding its private label segment is evident in its plans to launch around 100 new products in the first quarter of 2025 and over 1,000 new items throughout the year. This aggressive expansion signals a belief in continued high market penetration and growth within Dollar General's store base.

The strong customer adoption of private labels is a key indicator of their potential. With over half of customer baskets already featuring at least one private label item, Dollar General is well-positioned to leverage this trend as it introduces new products and further develops its private label strategy.

Dollar General is strategically increasing its presence with larger format DG Market stores, generally ranging from 8,500 to 9,500 square feet. This expansion allows for a more diverse product offering, notably including fresh produce and a wider selection of grocery items.

The company's fiscal 2025 plans emphasize these larger formats for both new store openings and relocations. The goal is to attract new customer demographics and boost sales per store by providing a more comprehensive assortment of goods.

These expanded stores are engineered to elevate the customer shopping journey and foster additional sales growth, particularly in markets experiencing development.

Dollar General's strategic store remodels, often referred to as Project Elevate or Renovate, are a key component of its growth strategy. These initiatives focus on improving the in-store experience, optimizing product assortments, and expanding service offerings to better meet customer needs. This aggressive investment in its existing store base is crucial for maintaining competitiveness.

The company has ambitious plans, targeting around 4,250 remodels for the fiscal year 2025. Early results from Project Elevate, specifically designed for its more mature locations, are encouraging, with these revamped stores projected to see a comparable sales increase of 3% to 5% in their initial year post-remodel. These upgrades are expected to drive significant improvements in operational efficiency and financial performance.

Consumables Category

The consumables category, covering essentials like food, snacks, and health and beauty items, is a powerhouse for Dollar General, consistently delivering positive same-store sales growth. This segment is crucial to the company's performance.

In the first quarter of 2025, consumables played a significant role in the company's overall same-store sales increase, which reached 2.4%. This highlights the category's strength and its contribution to the bottom line.

Dollar General's high market share in consumables is driven by the essential nature of these products and the company's commitment to offering value. As consumers increasingly focus on essential spending, this segment is poised for continued expansion.

- Category Driver: Consumables are the primary engine for Dollar General's same-store sales growth.

- Q1 2025 Performance: This segment contributed to a 2.4% overall same-store sales increase in Q1 2025.

- Market Position: High market share is maintained due to product necessity and Dollar General's value proposition.

- Consumer Trend Alignment: Growth is fueled by consumers prioritizing essential purchases.

Supply Chain Optimization and SKU Rationalization

Dollar General is actively working to optimize its supply chain and reduce inventory. This includes cutting around 1,000 high-shrink Stock Keeping Units (SKUs). This strategic move is designed to boost efficiency and lower operational expenses.

This focus on core operations, often described as a 'back to basics' strategy, is directly improving product availability. By ensuring popular items are consistently in stock, Dollar General is seeing an increase in sales speed and driving profitable growth throughout its operations. For instance, in fiscal year 2023, the company reported a 7.7% increase in net sales, reaching $38.7 billion, partly attributed to these operational enhancements.

- Supply Chain Streamlining: Efforts to reduce overall inventory levels and cut approximately 1,000 high-shrink SKUs are improving efficiency and reducing costs.

- Enhanced In-Stock Levels: The 'back to basics' approach ensures high-demand products are readily available, increasing sales velocity.

- Profitable Growth Support: These operational improvements directly contribute to the growth of profitable product categories.

- Fiscal Year 2023 Performance: Net sales reached $38.7 billion, a 7.7% increase, demonstrating the positive impact of such strategic initiatives.

Dollar General's private label brands, like Clover Valley which generated $2.3 billion in fiscal 2023, are positioned as Stars due to their strong sales performance and planned expansion. The company aims to introduce over 1,000 new private label items in 2025, building on the over half of customer baskets already containing these products. This focus on high-growth, high-market share brands signifies their star potential within the BCG matrix.

| Category | Market Share | Growth Rate | Notes |

|---|---|---|---|

| Private Label Brands | High | High | Strong sales, aggressive new product pipeline (100+ in Q1 2025, 1000+ in 2025). Clover Valley sales $2.3B in FY23. |

| Consumables | High | High | Drives same-store sales growth (2.4% in Q1 2025). Essential nature aligns with consumer spending priorities. |

| Larger Format DG Market Stores | Growing | High | Expansion strategy (new openings/relocations) to attract new demographics and boost sales per store. |

| Store Remodels (Project Elevate) | High (within existing base) | Moderate to High | Targeting 4,250 remodels in FY25. Projected 3-5% comparable sales increase in remodeled stores. |

What is included in the product

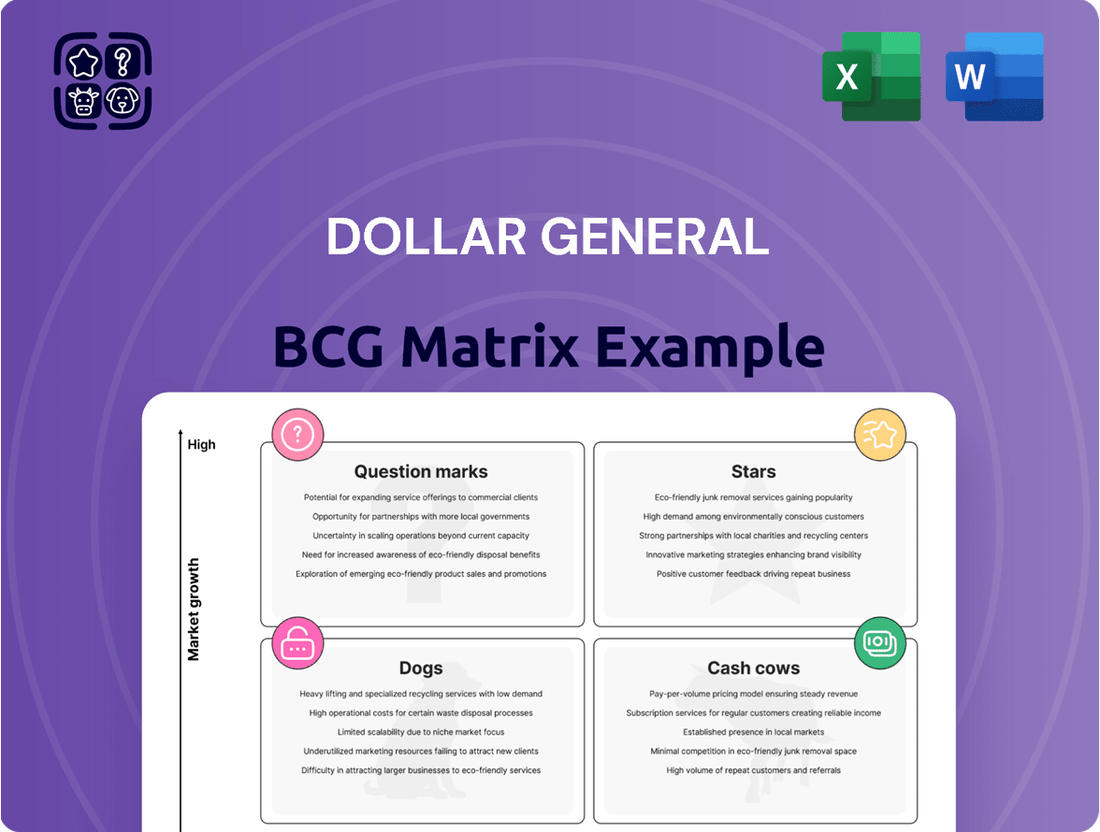

This BCG Matrix analysis highlights Dollar General's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

The Dollar General BCG Matrix offers a clear, one-page overview of each business unit's strategic position, relieving the pain of complex analysis.

Cash Cows

Dollar General's extensive network of over 20,000 traditional stores, predominantly in small towns and rural areas, solidifies its position as a Cash Cow. This mature, high-market-share presence, as of early 2024, generates consistent and substantial revenue and cash flow, demonstrating the enduring strength of its convenient, accessible model.

Dollar General’s core everyday necessities, like food and household essentials, are its Cash Cows. These items are bought frequently and reliably, making them the bedrock of the company’s sales and consistent cash generation. In fiscal year 2023, consumables represented approximately 80% of Dollar General’s net sales, underscoring their importance.

Dollar General's value-driven pricing strategy, featuring around 2,000 items priced at or below $1, is a cornerstone of its success. This commitment to affordability acts as a powerful magnet for its price-conscious customer base.

This consistent focus on low prices drives significant customer traffic and robust sales volumes, generating reliable cash flow even in the competitive, mature retail sector. It's a strategy that underpins their market stability.

Established Customer Loyalty in Rural Markets

Dollar General has cultivated deep customer loyalty in rural and small-town markets by consistently offering convenience and value. This loyalty translates into a predictable demand and a strong base of repeat customers, solidifying its high market share in these areas. The trust these communities place in Dollar General ensures a stable and reliable revenue stream.

This loyalty is a significant asset, contributing to Dollar General's financial stability. For instance, in fiscal year 2023, Dollar General reported net sales of $38.7 billion. The company's focus on underserved markets, where it often holds a dominant position, fuels this consistent performance.

- Dominant Market Share: Dollar General often operates with minimal direct competition in many of its rural locations, leading to a commanding market share.

- Predictable Revenue: The established customer base ensures consistent sales volumes, making revenue forecasting more reliable.

- Cost Efficiency: Operating in less competitive, often lower-cost rural areas can contribute to operational efficiencies that bolster profitability.

- Brand Trust: Decades of service have built significant brand trust, making Dollar General a go-to retailer for essential goods in these communities.

Efficient Store Operations and Management

Dollar General's commitment to operational excellence, particularly in its established stores, is a cornerstone of its Cash Cow strategy. By concentrating on being a low-cost provider, the company actively refines its store execution. This includes enhanced inventory management and improved customer service, which directly contribute to the profitability of its mature business segments.

These efficiencies translate into robust profit margins and consistent cash flow. In fiscal year 2023, Dollar General reported net sales of $38.7 billion, demonstrating the scale and stability of its operations. The company's ongoing efforts to optimize its existing store base ensure that these mature units continue to generate substantial returns, solidifying their position as Cash Cows.

- Focus on Low-Cost Operations: Dollar General leverages its scale to maintain a competitive cost structure.

- Improved Store Execution: Investments in inventory control and customer service enhance profitability.

- High Profit Margins: Operational efficiencies drive strong margins in mature business units.

- Consistent Cash Flow: Stable, high-market-share stores reliably generate significant cash.

Dollar General's extensive network of over 20,000 stores, particularly in rural areas where it often dominates, firmly establishes these locations as Cash Cows. This high market share in mature, stable markets, as seen in fiscal year 2023 with net sales of $38.7 billion, generates predictable and substantial cash flow. The company's focus on essential, frequently purchased items like consumables, which made up about 80% of net sales in fiscal year 2023, further solidifies these stores as reliable cash generators.

| Metric | Value (FY 2023) | Significance for Cash Cows |

| Net Sales | $38.7 billion | Demonstrates the scale and stability of its mature operations. |

| Consumables as % of Net Sales | ~80% | Highlights the consistent demand for essential, high-frequency purchase items. |

| Store Count | Over 20,000 | Represents a vast, established footprint in stable, high-market-share areas. |

What You See Is What You Get

Dollar General BCG Matrix

The Dollar General BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready report intended for immediate strategic application.

Rest assured, the BCG Matrix report you see here is the final, complete version that will be delivered to you upon purchase. It has been meticulously crafted to provide clear insights into Dollar General's product portfolio, ready for your business planning and competitive analysis.

Dogs

Dollar General’s strategic review identified underperforming store locations, leading to the planned closure of 96 Dollar General and 45 pOpshelf stores in Q1 fiscal 2025. These closures are a direct response to specific sites failing to meet profitability benchmarks, signifying a reallocation of capital away from areas with limited growth potential and low market share.

The company incurred $232 million in charges associated with these closures and asset impairments, underscoring the financial impact of these underperforming locations. This action aligns with a broader effort to optimize the store portfolio, ensuring resources are directed towards more productive and profitable segments of the business.

Dollar General is strategically pruning its product catalog, aiming to cut around 1,000 SKUs. A significant portion of these are identified as high-shrink items, meaning they are prone to losses from theft or damage.

These high-shrink products often represent a drain on profitability, contributing little to the company's bottom line despite occupying shelf space. Their removal is a calculated effort to streamline operations and free up capital that might otherwise be tied up in these problematic items.

Dollar General's decision to convert nearly 9,000 self-checkout lanes back to cashier-assisted and remove them from 300 stores highlights a significant challenge. This move suggests the self-checkout technology, initially aimed at boosting efficiency, has become a financial drain.

The primary driver for this reversal appears to be substantial 'shrink,' which includes losses from theft and scanning errors. In 2023, Dollar General reported a net sales increase of 2.2% to $38.9 billion, but the increasing costs associated with shrink, partly attributed to self-checkout, impacted profitability. This makes self-checkout a 'dog' within their business model, as its costs outweigh its benefits.

Temporary Warehouse Facilities

Dollar General's strategic shift away from temporary warehouse facilities highlights a move towards greater efficiency. By December 2024, the company had already shuttered 15 out of 18 such locations, with the remaining three slated for closure in 2025. This action indicates that these temporary sites, while serving a purpose, are being phased out due to potential inefficiencies or higher operational costs compared to more permanent solutions.

The divestment of these temporary warehouses is a critical step in optimizing Dollar General's supply chain.

- Reduced Operational Costs: Phasing out less efficient temporary facilities is expected to lower overall supply chain expenses.

- Improved Distribution Efficiency: The company is consolidating operations to streamline its distribution network.

- Strategic Resource Allocation: Closing these sites allows Dollar General to redirect resources towards more productive assets.

- Focus on Core Operations: This move supports a sharper focus on core distribution and retail strategies.

Declining Discretionary Categories

Dollar General's fiscal year 2024 saw certain discretionary categories like seasonal items, home goods, and apparel experience a downturn, with same-store sales declining in both the full year and the fourth quarter.

These segments, while part of the company's diverse product mix, are showing signs of reduced demand and potentially lower market share compared to essential consumables.

This underperformance suggests these areas may not be significant growth drivers and could warrant a strategic re-evaluation.

- Declining Sales in Discretionary Segments: Fiscal year 2024 and Q4 2024 data indicates a slump in same-store sales for seasonal, home products, and apparel categories.

- Market Share and Demand Concerns: These discretionary areas may hold smaller market shares and face reduced consumer demand relative to core consumable offerings.

- Impact on Growth and Profitability: The underperformance of these categories contributes less to overall company growth and profitability, necessitating careful management.

Dollar General's self-checkout lanes are a prime example of a "dog" in the BCG matrix. The company's decision to revert many self-checkout lanes to cashier-assisted in 300 stores highlights significant issues, primarily driven by high shrink rates, including theft and errors. This reversal indicates that the cost of managing self-checkout, due to these losses, outweighs its intended efficiency benefits, impacting profitability.

Similarly, underperforming store locations, with 96 Dollar General and 45 pOpshelf stores slated for closure in Q1 fiscal 2025, represent "dogs." These closures, coupled with $232 million in associated charges, signify capital being withdrawn from segments with low market share and limited growth potential, a clear characteristic of a dog in the portfolio.

Discretionary categories like seasonal items, home goods, and apparel also fall into the "dog" classification, as evidenced by declining same-store sales in fiscal year 2024 and the fourth quarter. These segments are not significant growth drivers and face reduced consumer demand compared to essential consumables, warranting strategic re-evaluation.

The phasing out of temporary warehouse facilities by December 2024, with 15 of 18 closed, also points to these operations being "dogs." These sites are being discontinued due to potential inefficiencies and higher operational costs, signaling a move to consolidate and improve supply chain efficiency by shedding underperforming assets.

| Category | BCG Classification | Rationale |

|---|---|---|

| Self-Checkout Lanes | Dog | High shrink rates (theft, errors) outweigh efficiency benefits, impacting profitability. |

| Underperforming Stores | Dog | Low market share and limited growth potential leading to closures (96 DG, 45 pOpshelf in Q1 FY25). |

| Discretionary Categories (Seasonal, Home, Apparel) | Dog | Declining same-store sales in FY24 and Q4 FY24, indicating reduced demand and growth. |

| Temporary Warehouse Facilities | Dog | Phased out due to inefficiencies and higher costs, with 15 of 18 closed by December 2024. |

Question Marks

Dollar General's pOpshelf concept stores are currently positioned as a question mark in the BCG matrix. While launched with the aim of capturing a different customer segment, the recent closure of 45 stores and conversion of 6 others back to Dollar General format, coupled with impairment charges, signals a reevaluation of their strategic fit and profitability.

This move suggests that pOpshelf, despite its initial growth ambitions, is not yet a strong performer and requires significant investment to potentially become a star or may face divestiture. The financial impact of these changes, though not fully detailed publicly for pOpshelf specifically, contributes to its question mark status by highlighting operational challenges and potential underperformance relative to initial expectations.

The DG Media Network, Dollar General's retail media network, is a significant growth area. In Q1 2024, it saw retail media volume increase by over 25% compared to the same period in 2023.

This digital initiative focuses on using customer data to offer personalized experiences and better results for advertisers. While showing strong growth, its overall impact on Dollar General's total sales and its standing in the crowded digital advertising market are likely still developing, positioning it as a question mark with high potential but a smaller current market share.

DG Delivery, Dollar General's new same-day delivery service, has debuted in about 75 stores, aiming for broader reach across thousands more. This move positions Dollar General within the rapidly expanding convenience and e-commerce delivery sector.

Despite its potential, DG Delivery is currently a nascent service with a minimal market share. Analysts estimate the same-day delivery market in the US alone is projected to reach over $100 billion by 2025, highlighting the competitive landscape Dollar General is entering.

Significant capital will be necessary to build out the infrastructure and marketing efforts needed for DG Delivery to compete effectively with established players in the delivery market.

Broader E-commerce and Digital Tools

Dollar General is actively developing its digital presence, focusing on its mobile app and website to offer enhanced convenience. Features like SNAP/EBT integration and collaborations with last-mile delivery services are key components of this strategy.

Despite these investments, Dollar General's projected online sales for 2025 are estimated at $97.25 million. This figure, while indicating growth potential for digital channels, represents a minimal portion of the company's overall revenue.

- Digital Investment: Dollar General is enhancing its mobile app and website with features like SNAP/EBT integration and partnerships with last-mile delivery companies.

- Projected Online Sales: The company's projected online sales of $97.25 million in 2025 are a very small fraction of its total revenue.

- Strategic Focus: Investments are aimed at improving convenience and access, signaling high growth potential for digital tools.

- Current Market Share: The current market share of online sales remains low compared to the company's extensive physical store network.

Expansion into Fresh Produce

Dollar General’s expansion into fresh produce positions it as a potential star in the BCG matrix, given its significant rollout plans. The company aims to have fresh produce available in approximately 7,000 stores by the end of 2025. This strategic move capitalizes on growing customer demand for healthier options and seeks to boost average transaction values.

This initiative represents a high-growth opportunity for Dollar General. However, the fresh grocery sector is intensely competitive, demanding considerable investment in supply chain, refrigeration, and inventory management. Achieving a dominant market share will require operational excellence and a deep understanding of consumer preferences in this segment.

- Expansion Goal: Reach ~7,000 stores with fresh produce by end of 2025.

- Strategic Rationale: Address customer demand and increase basket size.

- Market Dynamics: High growth potential but faces intense competition in fresh groceries.

- Investment Needs: Requires substantial capital for infrastructure and operational expertise.

The pOpshelf concept stores represent a significant question mark for Dollar General. Recent actions, including the closure of 45 stores and conversion of 6 back to the traditional Dollar General format, alongside impairment charges, indicate a strategic reassessment. These moves highlight operational challenges and potential underperformance relative to initial growth expectations, necessitating further investment to elevate them to star status or consider divestiture.

Dollar General's digital initiatives, including its retail media network (DG Media Network) and same-day delivery service (DG Delivery), are also positioned as question marks. While DG Media Network saw a retail media volume increase of over 25% in Q1 2024, its overall impact on total sales and market share in the competitive digital advertising space is still developing. DG Delivery, though launched in approximately 75 stores with plans for broader expansion, is a nascent service entering a market projected to exceed $100 billion by 2025, requiring substantial capital for infrastructure and marketing to compete effectively.

Dollar General's projected online sales for 2025 are estimated at $97.25 million, a small fraction of its overall revenue, despite investments in its mobile app and website for enhanced convenience. This digital push, while promising for future growth, currently represents a low market share compared to the company's vast physical footprint, underscoring its question mark status due to high potential but limited current contribution.

BCG Matrix Data Sources

Our Dollar General BCG Matrix is constructed using comprehensive data from annual reports, investor presentations, and industry-specific market research to accurately reflect product performance and market share.