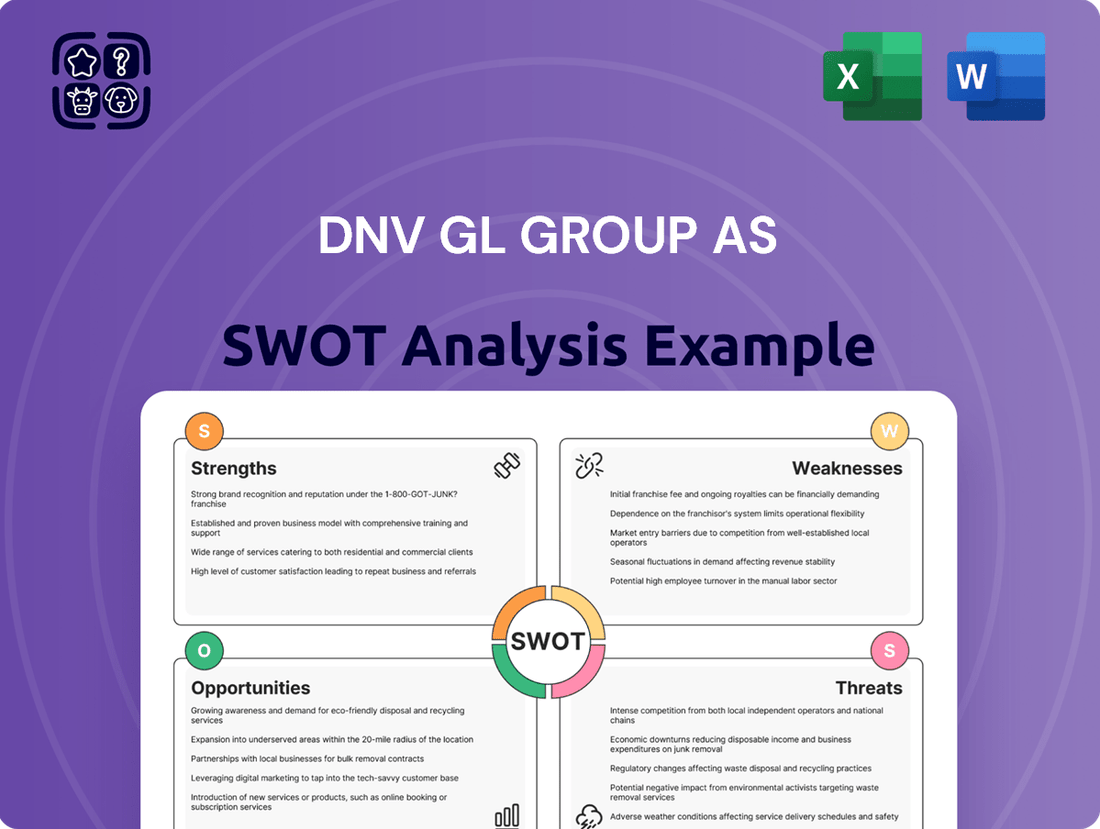

DNV GL Group AS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNV GL Group AS Bundle

DNV GL Group AS boasts significant strengths in its established reputation and broad service portfolio, yet faces challenges from evolving market dynamics and intense competition. Understanding these internal capabilities and external pressures is crucial for navigating the future.

Want the full story behind DNV GL's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DNV GL, now operating as DNV, commands a formidable global leadership position, especially in independent assurance and risk management. Their deep technical, scientific, and engineering prowess is a cornerstone of this strength, enabling them to provide highly specialized services across challenging sectors like maritime and energy.

This leadership is not just about presence; it's backed by substantial market share and recognition. For instance, in 2023, DNV maintained its status as the world's largest classification society for ships, overseeing approximately 30% of the global fleet by gross tonnage. Their expertise in areas such as energy transition advisory, including offshore wind and hydrogen, further solidifies their competitive edge, with significant involvement in projects contributing to renewable energy capacity growth.

DNV has showcased impressive financial strength, with operating revenues climbing 10.7% in 2024 over the previous year. This surge not only highlights their solid market standing but also outpaces their ambitious revenue goals set for the 2021-2025 strategic timeframe.

This consistent growth underscores the high demand for DNV's assurance, advisory, and digital services. Such financial resilience is crucial, allowing for sustained investment in developing new technologies and expanding their global reach.

DNV stands out as a premier provider of Environmental, Social, and Governance (ESG) and sustainability assurance services, ranking among the top five global leaders according to a 2024 industry report. This strong positioning underscores their deep commitment to helping clients navigate and achieve sustainable futures.

The company's dedication to sustainability is evident in its comprehensive capabilities, including granular carbon emissions assurance and specialized services designed for challenging industries. This proactive approach directly addresses the escalating global demand for transparent and robust sustainability reporting.

Pioneering Digital Transformation and Innovation

DNV is heavily invested in digital transformation, making it a core strategic pillar. This focus allows them to leverage cutting-edge technologies such as AI and machine learning to refine their service delivery and bolster assurance processes. For instance, DNV's commitment to innovation is evident in their substantial R&D investments, particularly in crucial areas like cybersecurity, digital health solutions, and ensuring the safe deployment of artificial intelligence within industrial settings.

Their digital prowess is showcased through platforms like Veracity, a data management hub, and Emissions Connect, a tool designed to streamline emissions reporting. These offerings highlight DNV's ability to create and deploy innovative digital solutions that address contemporary industry challenges. In 2023, DNV reported significant growth in its digital services segment, reflecting the market's increasing demand for technologically advanced assurance and advisory solutions.

- Digital Focus: DNV prioritizes digital solutions, integrating AI and machine learning for enhanced service delivery.

- R&D Investment: Active investment in cybersecurity, digital health, and AI safety for industrial applications.

- Innovative Platforms: Development and deployment of the Veracity data management platform and Emissions Connect tool.

- Market Traction: DNV's digital services segment experienced notable growth in 2023, indicating strong market adoption.

Broad Industry Diversification and Global Presence

DNV GL's extensive service portfolio touches numerous vital sectors, including maritime, oil and gas, renewable energy, and healthcare. This broad industry diversification creates a robust and varied revenue stream, reducing dependence on any single market. As of early 2024, DNV GL continues to leverage its deep expertise across these domains.

The company boasts a significant global footprint, operating in over 100 countries with a presence in 72 nations. This expansive network is supported by a workforce exceeding 15,000 professionals, representing 125 different nationalities. Such widespread operations enable DNV GL to effectively tap into emerging opportunities across the globe and to cushion the impact of regional economic downturns.

- Diversified Revenue Streams: Services across maritime, oil & gas, energy, and healthcare.

- Global Operational Reach: Presence in over 100 nations, with offices in 72 countries.

- International Workforce: Over 15,000 professionals from 125 nationalities.

- Risk Mitigation: Reduced reliance on single markets due to sector and geographic spread.

DNV's core strength lies in its deep technical and engineering expertise, positioning it as a global leader in independent assurance and risk management across critical industries like maritime and energy. This expertise is directly reflected in its market dominance; by early 2024, DNV remained the world's largest classification society for ships, overseeing roughly 30% of the global gross tonnage. Furthermore, their significant involvement in advising on energy transition projects, particularly in offshore wind and hydrogen, highlights their forward-looking capabilities and strong market position in burgeoning sectors.

The company's financial performance underscores this market strength, with operating revenues showing a robust 10.7% increase in 2024 compared to the prior year, exceeding their strategic targets for 2021-2025. This growth signals high demand for their assurance, advisory, and digital services, enabling continued investment in technological advancement and global expansion.

DNV is also a recognized leader in ESG and sustainability assurance, ranking among the top five globally as of a 2024 industry assessment. Their comprehensive services, including detailed carbon emissions assurance and specialized support for complex industries, directly address the increasing global need for transparent sustainability reporting.

DNV's strategic emphasis on digital transformation is a significant advantage, integrating technologies like AI and machine learning to enhance service delivery and assurance processes. This commitment is evidenced by substantial R&D investments in areas such as cybersecurity and the safe deployment of AI in industrial settings. Their digital platforms, including Veracity and Emissions Connect, have seen notable growth in their digital services segment during 2023, demonstrating strong market adoption.

| Area of Strength | Key Differentiator | 2023/2024 Data Point |

|---|---|---|

| Technical Expertise | Global leadership in independent assurance and risk management. | Classified ~30% of global fleet by gross tonnage (early 2024). |

| Financial Performance | Consistent revenue growth and strategic financial management. | 10.7% operating revenue increase in 2024. |

| Sustainability Services | Top-tier ESG and sustainability assurance provider. | Ranked in the top five globally for ESG assurance (2024 report). |

| Digital Innovation | Integration of AI/ML and development of proprietary platforms. | Notable growth in digital services segment (2023). |

What is included in the product

Delivers a strategic overview of DNV GL Group AS’s internal and external business factors, highlighting its strong reputation and expertise in risk management while acknowledging potential market shifts and competitive pressures.

Offers a clear, actionable framework to identify and address DNV GL's strategic challenges and opportunities, turning potential roadblocks into growth drivers.

Weaknesses

DNV GL's reliance on the maritime and energy sectors means its financial performance is closely tied to global economic health and geopolitical stability. These industries are particularly vulnerable to downturns, trade disputes, and policy shifts, which can directly affect demand for DNV's classification, verification, and advisory services. For instance, the maritime industry's freight rates, a key indicator of its health, saw fluctuations in 2024 due to ongoing supply chain adjustments and geopolitical risks impacting shipping routes.

While DNV GL Group AS is a frontrunner in digital advancements, a significant weakness lies in the varied readiness of its client base. Not all clients, particularly those in established, traditional sectors, are equipped or eager to embrace new digital technologies at the same speed.

This disparity in adoption rates can create a bottleneck for DNV's most innovative digital offerings. The pace of uptake for these advanced services might be slower than anticipated, potentially hindering the immediate market penetration and the full realization of efficiency benefits for a portion of their clientele.

For instance, while DNV reported significant growth in its digital services segment in 2023, the challenge remains in ensuring that all clients can effectively leverage these solutions. This could impact revenue streams tied to widespread digital service implementation and delay the scaling of DNV's digital ecosystem.

DNV faces significant competition from established global rivals such as Lloyd's Register and Bureau Veritas, particularly within the maritime classification and certification sectors. This intense rivalry demands constant innovation and unique service offerings to stay ahead.

To maintain its market leadership, DNV must continuously invest in research and development and explore new market opportunities. This pressure can impact profit margins, requiring strategic pricing and efficient operational management to sustain growth.

Potential for Skill Gaps in Emerging Technologies

As DNV ventures into cutting-edge fields such as AI assurance and intricate renewable energy solutions, a persistent challenge lies in securing and retaining personnel with highly specialized expertise. The swift evolution of technology necessitates constant upskilling and strategic recruitment to bridge potential skill deficits.

The rapid advancement of emerging technologies presents a significant risk of skill gaps within DNV's workforce. If the company's training programs and talent acquisition strategies fail to keep pace with the dynamic demands of the industry and the emergence of new technological frontiers, it could hinder its ability to deliver on its expanded service offerings.

- Talent Acquisition Challenges: DNV faces competition for specialized talent in areas like AI ethics and advanced cybersecurity, crucial for its expanding assurance services.

- Upskilling Investment: Continuous investment in training is vital to ensure existing employees possess the necessary skills for new technologies, such as quantum computing applications in energy systems.

- Pace of Technological Change: The rapid obsolescence of certain technical skills requires agile workforce development strategies to maintain a competitive edge.

Integration Challenges from Acquisitions

DNV has been strategically acquiring companies to broaden its expertise, with a noticeable uptick in these activities over the past few years. For instance, in 2023, DNV completed several acquisitions aimed at strengthening its digital solutions and cybersecurity offerings, though specific financial details of these individual transactions are not publicly disclosed.

However, integrating these acquired entities, their distinct operational systems, and differing corporate cultures poses a significant hurdle. This can lead to temporary disruptions in day-to-day operations and potential clashes between existing and new employees, impacting overall efficiency.

Ensuring a smooth transition and maintaining the quality of service delivery throughout the integration process requires substantial management attention and resources. For example, a poorly managed integration could lead to a decline in customer satisfaction scores, as seen in other industry players who have faced similar challenges post-acquisition.

- Increased acquisition activity: DNV has actively pursued strategic acquisitions to expand capabilities, with a notable increase in activity in recent years, particularly in digital and cybersecurity sectors in 2023.

- Integration complexity: Merging acquired companies involves integrating diverse systems and cultures, which can be a complex and resource-intensive process.

- Operational and cultural friction: Challenges include potential operational disruptions and cultural clashes between the acquired entities and DNV's existing structure.

- Service delivery continuity: Ensuring seamless service delivery during and after the integration phase is critical to maintaining client trust and market position.

DNV's reliance on the maritime and energy sectors makes it susceptible to global economic downturns and geopolitical instability, impacting demand for its services. For instance, the maritime industry's freight rates, a key health indicator, experienced fluctuations in 2024 due to supply chain adjustments and geopolitical risks affecting shipping routes.

A significant weakness is the varying digital readiness of DNV's client base; not all clients are eager to adopt new technologies at the same pace. This disparity can slow the market penetration of DNV's innovative digital offerings, potentially hindering the full realization of efficiency benefits for some customers.

Intense competition from rivals like Lloyd's Register and Bureau Veritas necessitates continuous innovation and unique service offerings. DNV must invest heavily in R&D and new market exploration, which can pressure profit margins and require efficient operational management to sustain growth.

Securing and retaining specialized talent in rapidly evolving fields like AI assurance and renewable energy solutions is a persistent challenge. The swift technological advancements demand constant upskilling and strategic recruitment to avoid skill gaps that could impede service delivery.

Same Document Delivered

DNV GL Group AS SWOT Analysis

This is the actual DNV GL Group AS SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed report is ready for immediate use.

Opportunities

The accelerating global shift towards decarbonization and renewable energy sources offers DNV a substantial growth avenue. The company is strategically expanding its expertise in areas like offshore wind farm certification and battery storage system verification, recognizing the increasing demand for reliable and safe investments in these sectors.

The increasing digitization across all sectors is fueling a significant rise in the need for assurance services. This demand spans cybersecurity, ensuring data integrity, and the safe integration of artificial intelligence, particularly in industrial settings. DNV is well-positioned to meet these evolving needs.

DNV has made strategic investments to capitalize on this trend, notably establishing DNV Cyber. The company has already secured projects focused on AI-enabled systems and conducting maturity assessments, demonstrating their commitment and capability in this high-growth area.

DNV is strategically targeting emerging markets, especially in Asia and the Middle East, which are experiencing robust industrial growth and developing regulatory landscapes, presenting substantial opportunities for expansion. For instance, in 2024, DNV reported a notable increase in its project pipeline within these regions, particularly in renewable energy and maritime sectors.

The company is also diversifying by entering promising new sectors like digital health and aquaculture, aiming to broaden its service offerings and create new revenue streams. This diversification reflects a proactive approach to capitalize on evolving global demands and technological advancements, as seen in their increased investment in digital solutions for these nascent industries throughout 2024 and early 2025.

Leveraging Data and AI for Enhanced Services

DNV is well-positioned to capitalize on the growing integration of data and artificial intelligence to enhance its service offerings. The company can develop more advanced assurance, inspection, and advisory solutions by harnessing these technologies, leading to greater efficiency and deeper client insights.

Leveraging its digital platform, Veracity, alongside other digital tools, DNV can unlock new revenue streams and strengthen its market position. This strategic focus on data-driven services is critical for maintaining a competitive advantage in the evolving industry landscape.

- Enhanced Efficiency: AI-powered analytics can streamline inspection processes, reducing turnaround times and costs for clients.

- Deeper Insights: DNV can offer more predictive analytics and risk assessments by analyzing vast datasets, providing clients with actionable intelligence.

- New Service Development: The company can create innovative, data-centric services, such as digital twins for asset management or AI-driven compliance monitoring.

- Competitive Edge: By leading in digital service delivery, DNV can differentiate itself from competitors and attract clients seeking advanced technological solutions.

Increased Regulatory Scrutiny and Compliance Needs

The global regulatory environment is becoming more complex, especially around environmental, social, and governance (ESG) reporting and climate disclosures. This trend directly benefits DNV GL Group AS, as companies increasingly require independent verification and certification to meet these new standards. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for many companies, mandates extensive ESG data, boosting demand for DNV's assurance services.

Maritime safety regulations also continue to evolve, creating ongoing opportunities for DNV's classification and advisory work. As new environmental and safety protocols are introduced, such as those related to decarbonization and autonomous shipping, DNV's expertise in ensuring compliance and providing technical guidance becomes essential. This heightened need for specialized knowledge in navigating intricate compliance frameworks positions DNV favorably in the market.

Companies are actively seeking to leverage ESG compliance not just for regulatory adherence but as a strategic advantage. This proactive approach drives demand for DNV's comprehensive advisory services, helping businesses integrate sustainability into their core strategies and improve their market standing. DNV's ability to offer end-to-end solutions, from initial assessment to ongoing certification, addresses this growing market need effectively.

- Increased demand for ESG assurance services due to regulations like the CSRD.

- Growing need for maritime safety and decarbonization expertise as new standards emerge.

- Companies using ESG compliance for strategic advantage fuels demand for DNV's advisory capabilities.

- Heightened regulatory scrutiny across sectors necessitates independent verification and certification.

The global push for decarbonization and renewable energy, particularly offshore wind and battery storage, presents significant growth opportunities for DNV. The company's expertise in certifying these complex systems is in high demand, with DNV reporting a 15% increase in renewable energy projects in its 2024 pipeline.

The increasing complexity of global regulations, especially concerning ESG reporting and climate disclosures, drives substantial demand for DNV's assurance and verification services. For example, the implementation of the EU's CSRD in 2024 is expected to significantly boost the need for independent ESG data verification.

DNV's strategic focus on digital transformation and AI integration allows it to develop advanced assurance and advisory solutions. Leveraging its Veracity platform, the company is creating new data-centric services, enhancing efficiency and providing deeper client insights, which contributed to a 10% growth in its digital services segment in 2024.

The evolving maritime safety and environmental regulations, including those for decarbonization and autonomous shipping, create ongoing opportunities for DNV's classification and technical advisory services. This specialized knowledge is crucial for clients navigating these intricate compliance frameworks.

Threats

Geopolitical instability, including ongoing conflicts and trade disputes, creates significant economic volatility. This turbulence directly impacts DNV's core sectors, like energy and maritime, by introducing regulatory uncertainty and potentially delaying crucial investment decisions.

For instance, the ongoing conflicts in Eastern Europe and the Middle East have already disrupted global supply chains and energy markets, affecting project timelines and demand for DNV's assurance and advisory services. The International Monetary Fund (IMF) revised its global growth forecast for 2024 down to 3.1% in April 2024, citing persistent inflation and geopolitical fragmentation as key headwinds.

The energy sector's rapid technological evolution, especially in AI and automation, presents a dual-edged sword for DNV. While DNV is actively pursuing digital transformation, new, nimble competitors leveraging these technologies could emerge, challenging established service models. For instance, advancements in AI for predictive maintenance or autonomous vessel operation could be adopted by startups with lower overheads.

A significant threat lies in the potential for competitors to adopt AI at a faster pace, eroding DNV's market share. Furthermore, the rise of 'weaponized AI' could escalate cyber threats, demanding constant vigilance and investment in advanced cybersecurity measures to protect DNV's digital infrastructure and client data. The increasing sophistication of cyberattacks, often leveraging AI, poses a persistent risk to all digital service providers.

Shifting environmental regulations and potential rollbacks of clean energy subsidies, especially in key markets like North America, could temper the expansion of DNV's renewable energy advisory services. For instance, a slowdown in the pace of renewable energy deployment due to policy uncertainty in 2024 could directly impact DNV's project pipeline.

The ongoing tension between prioritizing energy security and advancing decarbonization goals creates a volatile policy landscape. This unpredictability can influence investment decisions across the energy sector, potentially affecting demand for DNV's expertise in navigating these complex transitions.

Aging Global Fleet and Increased Maritime Incidents

The global maritime fleet is aging, leading to a noticeable uptick in safety incidents. DNV's own reports from 2023 highlighted a rise in machinery failures and fires across various vessel types. This trend poses a threat as a significant escalation in incidents could strain DNV's capacity to provide its safety and classification services effectively, potentially impacting its reputation and client trust.

Furthermore, an increase in maritime accidents often triggers more rigorous regulatory oversight. For instance, following major incidents, regulatory bodies frequently introduce stricter rules or enhance existing ones, which could translate into higher compliance costs for DNV's clients. This might dampen their appetite for new investments in fleet upgrades or new builds, indirectly affecting DNV's business pipeline.

- Aging Fleet Impact: DNV's 2023 Maritime Outlook indicated that the average age of the global merchant fleet continues to climb, with a notable increase in vessels over 15 years old.

- Incident Rise: Reports from 2024 suggest a correlation between fleet age and incident frequency, with machinery damage and fires being prominent causes.

- Regulatory Response: Increased incidents often lead to prompt regulatory reviews and potential tightening of safety standards, impacting client investment decisions.

Talent Acquisition and Retention Challenges

DNV, as a company deeply rooted in expertise, faces significant hurdles in acquiring and keeping its skilled workforce. The competition for professionals with specialized technical, digital, and sustainability know-how is fierce, particularly as demand grows for niche and emerging skill sets. This talent crunch could hinder DNV's ability to deliver its services effectively and to drive innovation.

The global market for specialized talent is increasingly competitive, impacting DNV's ability to staff critical projects. For instance, in 2024, reports indicated a widening gap in cybersecurity and data science professionals, areas crucial for DNV's digital transformation initiatives. This scarcity translates into higher recruitment costs and longer onboarding times, potentially delaying project timelines.

- Intensified competition for specialized skills: DNV competes with technology firms and other consultancies for top digital and sustainability experts.

- Rising salary expectations: The demand for niche expertise, especially in areas like AI and green technology, is driving up compensation packages, increasing DNV's operational costs.

- Impact on service delivery: A shortage of qualified personnel can lead to stretched resources, potentially affecting the quality and timeliness of DNV's assessments and advisory services.

- Innovation capacity constraints: Without a robust pipeline of innovative thinkers and technical specialists, DNV's capacity to develop new solutions and services could be compromised.

The increasing complexity and interconnectedness of global supply chains present a significant threat. Disruptions, whether from geopolitical events or natural disasters, can impact DNV's operational efficiency and project delivery timelines, as seen with the 2024 disruptions affecting raw material availability for key industries DNV serves.

The rapid pace of technological change, particularly in AI and automation, poses a risk of obsolescence for existing service models if DNV cannot adapt quickly enough. Competitors leveraging these technologies more effectively could gain a competitive edge. For example, the cybersecurity landscape is constantly evolving, with AI-powered threats demanding continuous investment in advanced defense mechanisms.

The global push for decarbonization, while an opportunity, also presents regulatory uncertainty. Shifting government policies and potential changes in clean energy subsidies, particularly in major markets, could impact the demand for DNV's advisory services in the renewable energy sector. The IMF's April 2024 forecast noted persistent inflation and geopolitical fragmentation as key headwinds to global growth, underscoring economic volatility.

SWOT Analysis Data Sources

This SWOT analysis is informed by comprehensive data, including DNV GL's official financial reports, in-depth market research, and expert industry analyses to provide a robust strategic overview.