DNV GL Group AS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNV GL Group AS Bundle

Curious about DNV GL Group AS's strategic positioning? Our BCG Matrix preview reveals the potential for growth and stability within their diverse portfolio. Understand which areas are driving revenue and which require careful consideration.

Unlock the full potential of this analysis by purchasing the complete DNV GL Group AS BCG Matrix. Gain access to detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your investment and resource allocation.

Don't miss out on the strategic advantage. The full BCG Matrix report provides the in-depth understanding you need to make informed decisions and navigate the competitive landscape with confidence.

Stars

DNV Cybersecurity Services, established in 2024, represents a strategic consolidation of over 500 cybersecurity experts. This move underscores DNV GL Group AS's commitment to this rapidly expanding sector, particularly as energy companies increasingly prioritize cybersecurity, identifying it as a paramount risk. The company’s significant investment in responsible AI and AI assurance research, evidenced by securing key projects in 2024 for AI-enabled systems, positions it strongly within this high-demand market.

DNV is making significant strides in digital health and the secure application of artificial intelligence within industrial settings, marking these as key growth sectors. This strategic focus is evident in their expanded certification and training offerings, which now encompass AI process governance, aiding businesses in their digitalization journeys.

By bolstering its capabilities in these rapidly evolving fields, DNV is well-positioned to benefit from the widespread adoption of digital tools and AI across diverse industries. For instance, DNV's work in AI assurance is crucial as industries increasingly rely on AI for operational efficiency and safety, with the global AI market projected to reach over $1.5 trillion by 2030.

DNV GL Group AS is a major player in the maritime sector, focusing on decarbonization technologies. They are a leader in ship classification and actively assist clients navigating the energy transition. In 2024, a significant 29% of all new ship orders were classified under DNV rules, with an impressive 37% of those orders specifically for vessels using LNG or methanol, highlighting the growing acceptance of these alternative fuels.

Further demonstrating their commitment to innovation, DNV has introduced new class notations for hydrogen-fueled vessels and onboard carbon capture and storage (OCCS) systems. This forward-thinking approach positions DNV at the forefront of a rapidly expanding market for sustainable maritime solutions.

ESG & Sustainability Assurance Services

DNV GL Group AS has been recognized as a leader in ESG & Sustainability Assurance Services for 2024. This positioning highlights their robust technical capabilities and deep understanding of various industries, with a notable strength in verifying carbon emissions data.

The market for sustainability certifications is experiencing substantial growth. This expansion is fueled by heightened consumer interest in environmentally responsible products, stricter governmental regulations, and the increasing adoption of digital tools for verification.

- Market Growth: The global sustainability and ESG reporting market was valued at approximately USD 1.5 billion in 2023 and is projected to reach over USD 4.5 billion by 2030, growing at a CAGR of around 17%.

- DNV's Strength: DNV's leadership in this sector is underscored by its extensive experience in providing assurance for a wide range of sustainability metrics, including greenhouse gas emissions, renewable energy certificates, and social impact reporting.

- Key Drivers: Increased regulatory pressure, such as the EU's Corporate Sustainability Reporting Directive (CSRD), and investor demand for transparent ESG data are primary catalysts for this market's expansion.

- Digital Integration: DNV is actively integrating digital solutions and AI-powered platforms to enhance the efficiency and accuracy of its assurance services, meeting the evolving needs of businesses and stakeholders.

Renewable Energy Sector Services

DNV GL Group AS (now DNV) demonstrates a robust commitment to the renewable energy sector, with significant expansion in both maritime and energy domains driven by the global green transition.

Despite potential short-term hesitations in certain investment segments, the enduring megatrends of electrification and decarbonization foster sustained confidence in the long-term prospects of this industry.

DNV's specialized services, including carbon capture and storage (CCS) and advanced battery solutions for energy storage, are pivotal to facilitating the ongoing energy transformation, positioning them within a high-growth market segment.

- Market Growth: The global renewable energy market is projected to reach USD 1,977.6 billion by 2030, growing at a CAGR of 8.4% from 2023, according to various industry reports.

- DNV's Focus Areas: DNV's expertise in areas like offshore wind, hydrogen, and energy storage solutions aligns with key drivers of this market expansion.

- Investment Trends: Global investment in the energy transition reached USD 1.1 trillion in 2023, a 17% increase from 2022, highlighting strong financial backing for decarbonization efforts.

- Strategic Importance: Services supporting decarbonization technologies, such as CCS, are crucial for industries aiming to meet net-zero targets, indicating a vital role for DNV's offerings.

Stars in the BCG matrix represent high-growth, high-market-share business units. DNV's cybersecurity services, established in 2024 with over 500 experts and significant investment in AI assurance, fit this category due to the rapidly expanding market and critical need for these services. Similarly, their leadership in ESG & Sustainability Assurance, a market projected for substantial growth driven by regulation and demand, also positions them as a Star. The renewable energy sector, where DNV is actively involved in decarbonization technologies like hydrogen and CCS, is another clear Star, supported by strong global investment and market growth projections.

| DNV Business Area | Market Growth Potential | DNV Market Share/Position | BCG Matrix Category |

|---|---|---|---|

| Cybersecurity Services | Very High (Global AI market > $1.5T by 2030) | Strong (Established in 2024, significant expert base) | Star |

| ESG & Sustainability Assurance | High (Market projected to reach > $4.5B by 2030, CAGR ~17%) | Leader (Extensive experience, strong technical capabilities) | Star |

| Renewable Energy Solutions (Maritime & Energy) | High (Market projected to reach $1,977.6B by 2030, CAGR 8.4%) | Leader (Significant role in decarbonization tech, high ship classification share) | Star |

What is included in the product

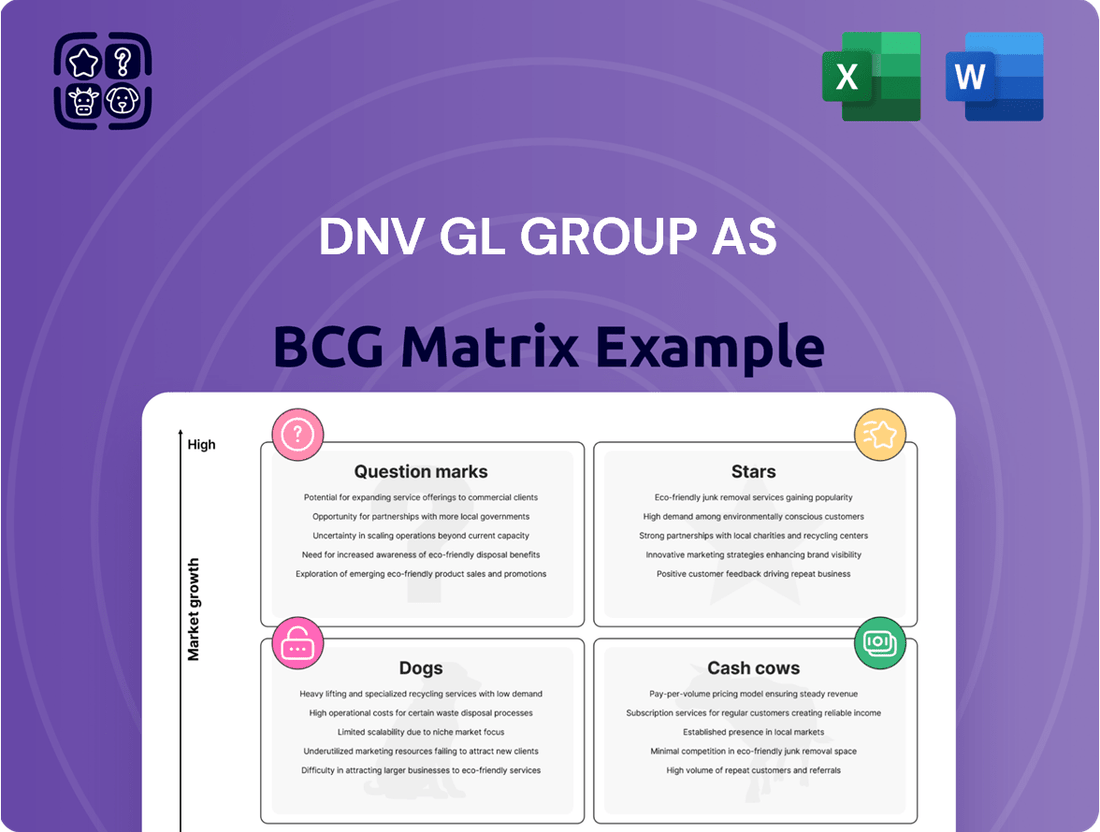

This analysis highlights which DNV GL business units to invest in, hold, or divest based on their market share and growth.

A clear BCG matrix visualizes DNV GL's portfolio, identifying underperforming "dogs" and high-potential "stars" to guide strategic resource allocation and relieve portfolio management pain.

Cash Cows

DNV GL's traditional ship classification remains a robust cash cow, holding a dominant market share in a mature industry. In 2024, a substantial portion of new vessel orders are being built under DNV's stringent rules, underscoring their continued leadership. This core business generates consistent revenue due to the mandatory nature of classification and DNV's strong reputation.

The group's commitment to staying relevant is evident with their updated rules for ships and offshore structures, effective January 2025. This proactive approach ensures compliance for their vast existing fleet, solidifying the stable and significant revenue stream from this established segment.

DNV's Business Assurance division, encompassing management system certifications, experienced a robust 15% revenue growth in 2024. This expansion underscores the persistent demand for its services in a critical and stable market segment.

Key standards such as ISO 9001 for quality management, ISO 14001 for environmental stewardship, and ISO 45001 for workplace safety are fundamental to DNV's offerings. Businesses worldwide depend on these certifications for regulatory adherence and operational excellence, solidifying DNV's significant market presence.

DNV's Oil & Gas Technical Assurance and Advisory services remain a cornerstone, even as the energy sector evolves. Despite the shift towards renewables, oil and gas continue to be critical for global energy needs, and DNV is well-positioned to support this vital industry. The company anticipates continued demand for its expertise in 2024, helping clients manage the complexities of this dynamic market.

This segment functions as a cash cow, drawing strength from enduring client partnerships and the indispensable nature of risk management in the oil and gas domain. These established relationships and the ongoing need for safety and compliance ensure a steady stream of revenue, solidifying its position as a reliable performer within DNV's portfolio.

Inspection and Verification Services

DNV's inspection and verification services are a cornerstone of its operations, acting as a stable cash generator within the BCG matrix. These services are essential for safety and compliance across sectors like maritime, oil & gas, and energy, ensuring consistent demand. In 2023, DNV reported revenue of NOK 27.5 billion, with a significant portion attributable to these core assurance activities.

The inherent nature of regulatory requirements and the mature status of many industries DNV serves mean that these services represent a low-growth, high-cash-flow business. This stability allows DNV to fund investments in other areas of its portfolio. For instance, DNV’s maritime classification services, a key inspection area, saw over 13,000 vessels classed in 2023, demonstrating the scale and recurring nature of this business.

- Stable Revenue Stream: Inspection and verification services provide predictable, recurring income due to regulatory mandates and ongoing operational needs.

- Low Investment Needs: Mature industries require consistent, rather than rapidly expanding, inspection services, leading to lower reinvestment requirements.

- Broad Client Base: DNV serves a diverse range of clients across multiple critical industries, mitigating sector-specific downturns.

- Foundation for Growth: The cash generated supports DNV's strategic investments in higher-growth areas, such as digital solutions and renewable energy advisory.

Training and Competence Services

DNV's Training and Competence Services, a component of its Business Assurance division, demonstrated robust revenue growth in 2024. These offerings are critical for industries navigating evolving regulatory landscapes and technological advancements, ensuring workforce proficiency and compliance.

The demand for DNV's training and competence services is driven by the persistent need for upskilling and reskilling in sectors like maritime, energy, and food safety. For example, in 2024, DNV reported a significant increase in enrollments for courses related to digitalization and sustainability, reflecting industry priorities.

- Revenue Growth: DNV's Training and Competence Services experienced notable revenue expansion in 2024.

- Industry Support: These services are vital for industries needing to maintain compliance and develop essential skills amid new regulations and technologies.

- Recurring Revenue: The segment benefits from the recurring nature of training needs for a seasoned workforce, ensuring stable cash flow.

- Expertise Leverage: DNV capitalizes on its deep industry expertise to deliver high-value, essential training programs.

DNV's classification services for ships and offshore units are a prime example of a cash cow. This segment benefits from a mature market with consistent demand, driven by regulatory requirements. In 2023, DNV classed over 13,000 vessels, highlighting the scale and recurring revenue from this established business.

The Business Assurance division, particularly management system certifications, also functions as a cash cow. With a 15% revenue growth in 2024, this area demonstrates strong performance in a stable market. Key certifications like ISO 9001 and ISO 14001 are essential for businesses, ensuring a steady income stream for DNV.

DNV's Oil & Gas Technical Assurance and Advisory services, despite industry shifts, remain a significant cash cow. The ongoing need for risk management and compliance in this sector, coupled with established client relationships, provides a reliable revenue base. This segment's stability allows DNV to allocate resources to emerging growth areas.

Inspection and verification services across maritime, oil & gas, and energy sectors represent a stable cash generator. These services are critical for safety and compliance, ensuring consistent demand. DNV's total revenue in 2023 was NOK 27.5 billion, with a substantial portion stemming from these core assurance activities.

| Business Segment | BCG Category | Key Characteristics | 2023 Data/2024 Trend | Revenue Impact |

|---|---|---|---|---|

| Maritime Classification | Cash Cow | Mature market, regulatory driven, high market share | 13,000+ vessels classed (2023) | Stable, significant revenue |

| Business Assurance (Certifications) | Cash Cow | Persistent demand for standards (ISO 9001, 14001), stable market | 15% revenue growth (2024) | Consistent and growing income |

| Oil & Gas Technical Assurance | Cash Cow | Essential risk management, established client base | Continued demand anticipated (2024) | Reliable revenue stream |

| Inspection & Verification Services | Cash Cow | Mandatory for safety/compliance, broad industry application | Part of NOK 27.5 billion total revenue (2023) | Foundation for growth funding |

What You See Is What You Get

DNV GL Group AS BCG Matrix

The preview of the DNV GL Group AS BCG Matrix you are currently viewing is the identical, fully-formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, analysis-ready strategic document designed for immediate application in your business planning.

Dogs

DNV's 2024 Energy Transition Outlook significantly revised its hydrogen forecast for road transport, cutting it from 3% to a mere 1% by mid-century. This downward revision stems from the unexpectedly rapid advancements in battery electric vehicle (BEV) technology, particularly for heavy-duty, long-haul trucking. Previously, this segment was seen as a prime candidate for hydrogen fuel cell adoption.

This recalibration positions hydrogen in road transport as a "dog" within the BCG matrix framework. The reduced market share and slower-than-expected growth trajectory suggest limited potential for DNV's services directly related to hydrogen fuel cell deployment in this specific sector. For instance, DNV's consulting on hydrogen infrastructure for trucking might see diminished demand compared to earlier projections.

DNV's 2024 outlook revised its projection for hydrogen's share in building heating down to 1% from 1.3%. This adjustment reflects the high cost of hydrogen for this application compared to the declining costs of heat pumps.

The continued cost-competitiveness of heat pumps presents a significant challenge for hydrogen adoption in building heating. This makes the hydrogen for heating segment a likely candidate for the 'Dog' quadrant in the BCG Matrix, indicating low market share and limited growth prospects for related services.

Within DNV GL Group AS's BCG Matrix, legacy software solutions that haven't undergone digital transformation can be categorized as 'Dogs'. These are products that may have a declining market share and low growth prospects, especially as the industry increasingly favors digital-first offerings.

For instance, if DNV GL has older, on-premise software that requires significant maintenance and lacks integration with cloud-based platforms like Veracity, these could fall into the Dog quadrant. Such solutions often demand considerable operational expenditure for upkeep but fail to attract new customers or generate substantial revenue growth, potentially impacting overall profitability.

Services Tied to Outdated Maritime Technologies

Services tied to outdated maritime technologies are likely to be classified as dogs within the DNV GL Group AS BCG Matrix. As the industry pivots towards decarbonization and new operational paradigms, demand for support on older, less efficient systems is naturally diminishing. For instance, DNV's increasing focus on class notations for ammonia and methanol-fueled vessels, as highlighted in their 2023 annual report, signifies a strategic shift away from legacy technologies.

These services face declining market share and revenue potential. The global maritime sector's commitment to the IMO's 2050 net-zero ambitions means a shrinking customer base for technologies that do not align with these goals. DNV's own investment in digital twin technology and AI for predictive maintenance on newer vessel types further illustrates this trend, diverting resources and attention from older service lines.

- Declining Demand: Services supporting combustion engines reliant on traditional heavy fuel oil are becoming obsolete.

- Reduced Investment: DNV's R&D is increasingly channeled into alternative fuel systems and digital solutions, not legacy tech.

- Market Contraction: Vessels utilizing outdated technologies are being phased out, shrinking the addressable market for associated services.

- Regulatory Pressure: Stricter environmental regulations worldwide disincentivize the continued operation and maintenance of non-compliant older vessels.

Low-Demand, Highly Specialized Niche Services

Within DNV GL Group AS's strategic portfolio, services that fall into the low-demand, highly specialized niche category are often classified as 'dogs' in the BCG matrix. These offerings cater to very specific, often small or shrinking, market segments where DNV GL may not possess a leading market share or competitive advantage. While these specialized services might achieve break-even status, their contribution to the group's overall growth and cash flow generation is typically minimal.

Identifying precise examples without proprietary internal data is difficult, but this classification would encompass services designed for industries facing significant disruption or decline, or those requiring extremely specialized expertise for a limited client base. For instance, a service focused on a very specific legacy industrial process that is being phased out globally could fit this description. Such offerings might continue to operate due to existing contracts or a minimal client commitment, but they represent a strategic drain on resources that could be better allocated elsewhere.

The strategic consideration for these 'dog' services often involves evaluating their potential for divestiture if their strategic value, such as maintaining a broad service offering or retaining key client relationships, is deemed low. Companies like DNV GL, with their extensive global reach and diverse service lines, inevitably manage such niche offerings. For example, in 2024, the maritime industry, a core sector for DNV GL, continued to navigate the complexities of decarbonization, with some older vessel types and associated regulatory compliance services potentially representing such niche, lower-growth areas.

- Niche Market Focus: Services targeting very specific, small, or declining market segments.

- Limited Market Share: DNV GL does not hold a dominant position in these specialized areas.

- Low Growth & Cash Flow Contribution: These services typically break even but do not drive significant growth or cash.

- Divestiture Potential: Candidates for divestiture if strategic value is minimal.

Services related to hydrogen in road transport and building heating are now considered "dogs" according to DNV's 2024 Energy Transition Outlook. This is due to lower-than-expected market share and slower growth, particularly as battery electric vehicles and heat pumps become more cost-competitive. These segments offer limited potential for DNV's services in these specific areas.

Legacy software and outdated maritime technologies also fall into the "dog" category. These offerings face declining demand and reduced investment as the industry shifts towards digital solutions and decarbonization. For example, DNV's focus on ammonia and methanol-fueled vessels in 2023 signifies a move away from older technologies.

Highly specialized, niche services with limited client bases or facing industry disruption are also classified as "dogs." These services may break even but contribute minimally to overall growth. The maritime sector's decarbonization efforts in 2024 highlight how older vessel compliance services could represent such lower-growth areas.

| BCG Quadrant | DNV Service Area Examples | Market Trend | DNV GL Strategic Implication |

|---|---|---|---|

| Dogs | Hydrogen for Road Transport | Revised 2024 forecast: 1% by mid-century (down from 3%) due to BEV advancements. | Reduced demand for related consulting and infrastructure services. |

| Dogs | Hydrogen for Building Heating | Revised 2024 forecast: 1% (down from 1.3%) due to heat pump cost-competitiveness. | Limited growth prospects for hydrogen heating solutions. |

| Dogs | Legacy Software Solutions | Declining market share as digital transformation favors cloud-based platforms. | High maintenance costs, low customer attraction, impacting profitability. |

| Dogs | Outdated Maritime Technologies | Shrinking customer base due to IMO 2050 net-zero ambitions. | DNV's R&D focus shifts to alternative fuels and digital solutions. |

| Dogs | Niche/Specialized Services (Declining Industries) | Small or shrinking market segments with limited competitive advantage. | Potential for divestiture if strategic value is minimal. |

Question Marks

Digital Health Services within DNV GL Group AS's BCG Matrix likely falls into the Question Mark category. DNV has been actively expanding its influence in this sector, signaling a high-growth market with significant future potential.

Despite this growth, Digital Health is a relatively new area for DNV. Consequently, its current market share is probably modest when measured against more established competitors in the digital health landscape.

To elevate Digital Health Services from a Question Mark to a Star, DNV will need to commit substantial investment. This capital infusion is crucial for building market presence, developing innovative solutions, and capturing a larger share of this rapidly evolving market.

DNV notes a significant uptick in carbon capture and storage (CCS) activity, identifying it as a vital component of the energy transition. Their inaugural CCS forecast points to a market poised for substantial expansion. For instance, DNV's analysis in 2024 projected a compound annual growth rate of over 30% for the CCS market through 2030, driven by regulatory pressures and corporate net-zero commitments.

While CCS is recognized for its critical role, it remains an nascent technology. DNV is proactively creating essential frameworks and standards for these developing systems, indicating a strategic focus on this high-growth sector where market leadership is still being established. This positions DNV to capture early market share in a segment expected to see considerable investment and deployment in the coming years.

The burgeoning hydrogen economy, a significant growth area, necessitates the development of robust infrastructure and stringent safety protocols. DNV is actively contributing to this by supporting the creation of new and the adaptation of existing hydrogen infrastructure, while simultaneously building the safety case for this evolving technology.

DNV's involvement in initiatives like the H2MET joint industry project underscores its commitment to this sector. However, as the broader hydrogen market is still in its nascent stages of scaling, DNV's current market share within this emerging segment is still developing.

Services for Floating Spaceports

DNV has launched a new service notation specifically for floating spaceports, outlining essential requirements for units involved in launching or recovering spacecraft. This move positions DNV within a highly innovative and emerging sector poised for significant long-term expansion.

While the market for floating spaceports is still in its infancy, DNV's early involvement suggests it's a strategic play for future growth, likely categorizing it as a 'Question Mark' in the BCG matrix. The current market size is minimal, and DNV's initial share is expected to be negligible, necessitating substantial investment to cultivate this nascent industry.

- Market Entry: DNV's new service notation signifies a strategic entry into the nascent floating spaceport market.

- Growth Potential: This sector is characterized by high innovation and substantial long-term growth prospects.

- Current Status: The market size is currently very small, with DNV's initial market share likely minimal.

- Investment Needs: Significant investment and market development are required to capitalize on the potential of floating spaceports.

Autonomous Shipping and Remote Operations Assurance

DNV is a key player in ensuring the safety and efficiency of autonomous shipping and remote operations. They are actively developing guidelines and issuing statements of compliance for these advanced systems, reflecting the sector's high growth potential.

The market for autonomous shipping technologies is still nascent, meaning DNV's current market share in this specific niche is expanding. This necessitates ongoing investment to solidify their position as the technology matures and adoption accelerates.

- DNV's Role: Developing class notations and providing compliance statements for remotely operated vessels.

- Market Potential: High growth prospects driven by safety and efficiency gains in shipping.

- Current Status: Early adoption phase for widespread autonomous technology.

- Strategic Focus: Continued investment required to grow market share in this emerging segment.

DNV's involvement in the burgeoning hydrogen economy places it squarely in the Question Mark category of the BCG matrix. While the sector exhibits substantial growth potential, DNV's market share is still developing.

The company is actively supporting infrastructure development and safety case creation for hydrogen, indicating a strategic commitment. For example, DNV's 2024 outlook highlighted the growing demand for hydrogen as a clean energy source, projecting significant investment in production and distribution infrastructure globally.

To transition hydrogen services from a Question Mark to a Star, DNV needs to secure a larger market share by investing in technology, standardization, and market penetration. This will allow them to capitalize on the projected expansion of the hydrogen market, which is expected to play a crucial role in decarbonization efforts.

| Business Area | BCG Category | Rationale | Key DNV Activities | Market Outlook (2024 Data) |

| Hydrogen Economy | Question Mark | High growth potential, but DNV's market share is still developing. | Infrastructure support, safety case development, joint industry projects. | Projected significant global investment in hydrogen infrastructure and production. |

BCG Matrix Data Sources

Our BCG Matrix leverages DNV GL Group AS's comprehensive financial statements, internal performance metrics, and extensive market research to provide a robust strategic overview.