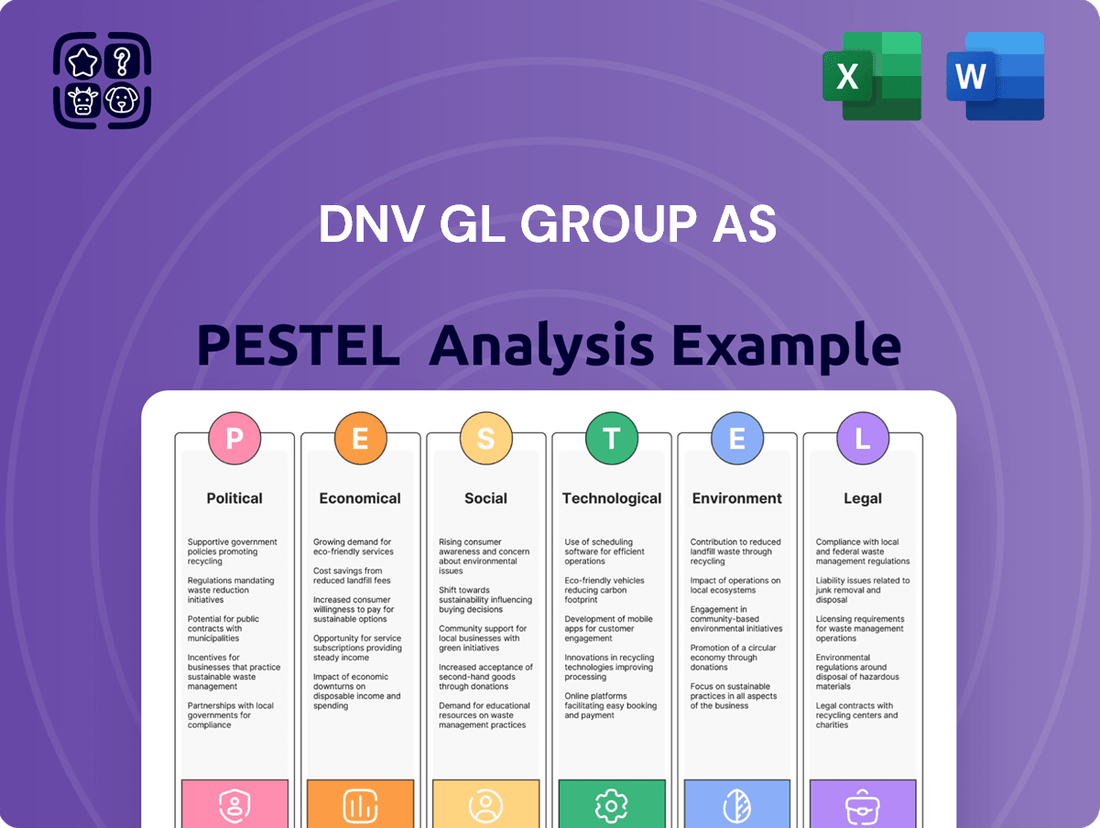

DNV GL Group AS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNV GL Group AS Bundle

Unlock the critical external factors shaping DNV GL Group AS's trajectory. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental forces at play, offering you a strategic advantage. Don't just react to change; anticipate it. Download the full PESTLE analysis now for actionable intelligence to refine your own market approach.

Political factors

DNV's global operations in maritime, oil & gas, and energy make it particularly sensitive to geopolitical instability and shifts in trade policies. Conflicts and rising tensions can disrupt vital supply chains, leading to volatility in energy prices and increased regulatory uncertainty, directly impacting DNV's client base and the demand for its risk management expertise.

The company's 2024 financial disclosures underscore the persistent challenges posed by the current geopolitical climate, noting its significant influence on global security and economic stability. For instance, ongoing trade disputes between major economic blocs continue to create headwinds for international trade volumes, a key driver for the maritime sector DNV serves.

Governmental commitments to decarbonization, including the Paris Agreement, directly shape DNV's operational landscape. Initiatives like the EU Emissions Trading System and FuelEU Maritime are critical policy drivers impacting the energy sector, DNV's core market.

DNV's Energy Transition Outlook 2024 highlights that current emission reduction rates are insufficient to meet climate targets, underscoring the ongoing necessity for robust policy support for renewables, carbon capture, and alternative fuels.

Numerous national elections are scheduled globally through 2025, creating a dynamic political landscape. This electoral activity inherently introduces regulatory and policy uncertainty, directly affecting sectors DNV GL Group AS supports, such as renewable energy and maritime. For instance, shifts in government can alter energy subsidy programs or environmental compliance mandates, necessitating agile adjustments in DNV's consulting and certification offerings to meet evolving standards.

International Cooperation and Standards

The effectiveness of international agreements and collaborations significantly shapes DNV's operational landscape, particularly in maritime safety, cybersecurity, and climate action. DNV's role as a classification and assurance provider is directly tied to the robustness of these global frameworks.

DNV actively engages with and champions international organizations and standards, including the UN Global Compact and the UN Sustainable Development Goals. This participation is vital for ensuring consistent global operations and fostering the development of innovative new services that meet evolving international needs.

- Maritime Safety: International Maritime Organization (IMO) conventions, like SOLAS, set global standards that DNV verifies, impacting over 90% of world trade.

- Cybersecurity: The International Electrotechnical Commission (IEC) standards, such as IEC 62443, are increasingly adopted globally, influencing DNV's assurance services in critical infrastructure.

- Climate Action: DNV's involvement in initiatives like the Task Force on Climate-related Financial Disclosures (TCFD) supports the global push for standardized climate reporting.

- UN Sustainable Development Goals (SDGs): DNV reported contributing to 15 of the 17 SDGs in its 2023 sustainability report, highlighting the alignment of its business with global development priorities.

Government Support for Green Technologies

Governments worldwide are actively channeling significant financial backing into green technologies, a crucial driver for DNV's expansion in the energy transition. These initiatives include substantial subsidies, tax credits, and direct investments in areas like offshore wind, hydrogen production, and carbon capture and storage (CCS). For instance, the United States' Inflation Reduction Act (IRA) of 2022, with its projected $370 billion in clean energy and climate provisions, is a prime example of this policy direction.

DNV's own research underscores the indispensable role of government support in accelerating the adoption of these vital technologies. Their reports frequently emphasize that policy frameworks must align with ambitious climate targets and provide market-stimulating incentives to foster widespread deployment and scaling.

- Government incentives: Many nations are offering tax credits and grants for renewable energy projects, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC) in the US, which have been extended and enhanced.

- Subsidies for emerging technologies: Support for nascent sectors like green hydrogen is growing, with countries like Germany providing substantial funding through their National Hydrogen Strategy.

- Strategic investments: Public funds are being directed towards research, development, and demonstration (RD&D) of critical decarbonization technologies, including CCS infrastructure.

- Policy alignment: DNV’s analysis indicates that clear, long-term policy signals are essential for de-risking investments and encouraging private sector participation in the green transition.

Political stability and government policy are paramount for DNV GL Group AS, influencing everything from maritime regulations to energy transition investments. Geopolitical tensions and trade disputes create market volatility, impacting DNV's clients in sectors like oil & gas and shipping. For instance, ongoing trade friction between major economies directly affects global trade volumes, a key market for DNV's maritime services.

Government commitments to climate action, such as the EU Emissions Trading System and FuelEU Maritime, are critical policy drivers for DNV's energy sector operations. DNV's own Energy Transition Outlook 2024 highlights that current emission reduction efforts are insufficient, emphasizing the continued need for government backing of renewables and alternative fuels.

The global political landscape is dynamic, with numerous national elections through 2025 potentially altering regulatory frameworks for renewable energy and maritime safety. Shifts in government can impact energy subsidies and environmental standards, requiring DNV to adapt its consulting and certification services accordingly.

International agreements and collaborations, like those championed by the UN Global Compact and the UN SDGs, are foundational to DNV's global operations and service development. DNV reported contributing to 15 of the 17 SDGs in its 2023 sustainability report, demonstrating its alignment with global development priorities.

What is included in the product

This PESTLE analysis of DNV GL Group AS examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides a comprehensive overview of how these external forces create both challenges and opportunities for DNV GL Group AS in the global market.

A streamlined PESTLE analysis for DNV GL Group AS that highlights key external factors impacting their strategy, simplifying complex market dynamics for informed decision-making.

Economic factors

DNV Group's financial health is intrinsically linked to the pulse of the global economy and the vigor of key industrial sectors like maritime, oil & gas, and energy. When the world economy is robust, businesses tend to ramp up investments in new ventures, essential maintenance, and technological upgrades, directly boosting the demand for DNV's specialized classification, technical assurance, and consulting services.

The company's own performance reflects this correlation; DNV reported a notable increase in revenue during 2024, a clear signal of a favorable economic climate that supports and drives demand for its offerings. This growth suggests that the sectors DNV serves are experiencing heightened activity, translating into more opportunities for the group.

Fluctuations in global energy prices, particularly for oil, natural gas, and electricity, significantly influence investment patterns within the energy sector. For DNV GL Group AS, these price shifts directly impact the profitability and strategic direction of its Oil & Gas and Energy Systems business areas.

DNV's Energy Transition Outlook 2024 highlights a long-term trend towards renewable energy sources. However, in the short to medium term, volatile energy prices can lead to investment deferrals or a preference for smaller, more manageable projects, especially in traditional fossil fuel segments.

The shift towards a greener economy presents considerable expenses for industries, especially maritime, as they integrate novel fuels and energy-saving technologies. DNV's Maritime Forecast to 2050 projects significant rises in shipping expenses for decarbonized operations, impacting decisions on new vessel investments and the demand for DNV's associated services.

Market Demand for Certification and Assurance

The market for management system certification and assurance services, a key area for DNV, is experiencing robust and stable growth. This expansion is directly linked to the increasing complexity of global supply chains and a heightened emphasis on effective risk management across industries.

Regulatory pressures are also a significant contributor, compelling businesses to seek external validation of their processes and compliance. For instance, the global market for management system certification is projected to reach approximately $20 billion by 2025, indicating a consistent upward trend.

This demand is underpinned by several factors:

- Compliance Needs: Businesses require certification to meet evolving national and international regulations, ensuring legal and operational adherence.

- Performance Improvement: Companies utilize certification frameworks like ISO 9001 to enhance operational efficiency and product/service quality.

- Stakeholder Trust: Assurance services build confidence among customers, investors, and partners by demonstrating a commitment to quality, safety, and sustainability.

- Risk Mitigation: Certification helps organizations identify and manage potential risks, safeguarding reputation and financial stability.

Currency Exchange Rates and Inflation

As a global entity operating in over 100 countries, DNV GL Group AS is inherently exposed to the volatility of currency exchange rates. Fluctuations in these rates can significantly impact the translation of foreign earnings and expenses into DNV's reporting currency, affecting its overall financial performance. For instance, DNV's 2024 operating revenues were reported in Norwegian Krone (NOK), underscoring this direct exposure to currency movements.

Inflationary pressures present another critical economic factor for DNV. Rising inflation can lead to increased operational costs, from labor and materials to energy. This necessitates robust financial management to maintain project profitability and ensure competitive pricing for its services. The ability to pass on these increased costs to clients or to achieve efficiency gains becomes paramount in mitigating the impact of inflation on DNV's bottom line.

- Currency Exposure: DNV's global footprint means its financial statements are subject to translation adjustments from various currencies, impacting reported revenues and profits.

- Inflationary Impact: Rising costs due to inflation can erode profit margins if not effectively managed through pricing strategies or cost-saving initiatives.

- 2024 Revenue Reporting: The reporting of DNV's 2024 operating revenues in NOK highlights the direct influence of the Krone's exchange rate on its financial results.

The global economic landscape significantly shapes DNV's operational environment, influencing demand for its assurance, certification, and consulting services. A strong economy generally translates to increased investment in new projects and technological advancements within the maritime, energy, and oil & gas sectors, which are DNV's core markets. For instance, DNV reported a revenue increase in 2024, reflecting a positive economic climate that supports its service offerings.

Inflationary pressures and currency exchange rate volatility are key economic considerations for DNV, given its extensive international operations. Rising costs due to inflation can impact profitability if not effectively managed through pricing strategies or efficiency improvements. Furthermore, fluctuations in currency exchange rates, such as the Norwegian Krone in which DNV reports its 2024 revenues, can affect the translation of foreign earnings and expenses.

Energy price fluctuations directly influence investment decisions in the energy sector, impacting DNV's Oil & Gas and Energy Systems business areas. While the long-term trend favors renewables, short-term price volatility can lead to project deferrals, particularly in traditional fossil fuel segments. DNV's own Energy Transition Outlook 2024 underscores this dynamic.

| Economic Factor | Impact on DNV | Supporting Data/Trend |

|---|---|---|

| Global Economic Growth | Increased demand for DNV's services | DNV reported revenue increase in 2024 |

| Energy Prices (Oil, Gas, Electricity) | Influences investment in energy sector | DNV's Energy Transition Outlook 2024 |

| Inflation | Potential increase in operational costs | Requires robust cost management and pricing strategies |

| Currency Exchange Rates | Affects translation of foreign earnings | DNV's 2024 revenues reported in NOK |

Same Document Delivered

DNV GL Group AS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of DNV GL Group AS delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. Gain immediate access to actionable insights and a detailed breakdown of market influences.

Sociological factors

In today's world, where trust in institutions can be shaky, DNV's position as an independent assurance and risk management firm is more important than ever. They help build confidence between different parties involved in a business or project.

DNV's CEO highlighted in 2024 that the company's ability to foster trust is a key driver for the demand for their services. This is particularly relevant as societal trust in various sectors has seen a decline.

The global workforce is changing, and companies like DNV, which operate in vital sectors like energy and maritime, are feeling the impact. A key challenge is finding and keeping people with the right skills for emerging technologies such as artificial intelligence, cybersecurity, and the growing renewable energy field. This is crucial as these areas are central to DNV's future growth and the transition to a more sustainable world.

DNV's commitment to a global presence is evident in its 2024 workforce expansion, which saw an increase in employees across 72 countries. This diversity is a strength, but it also highlights the need to bridge skill gaps and ensure a pipeline of talent capable of navigating complex technological advancements and evolving industry demands.

Societal expectations for enhanced health and safety in industrial and healthcare settings directly shape DNV GL Group AS's business model. As of early 2025, there's a palpable increase in public scrutiny and regulatory pressure on companies to demonstrate robust safety protocols, particularly following high-profile industrial incidents in late 2023 and early 2024.

DNV's accreditation services in healthcare, for instance, are increasingly focused on measurable outcomes related to patient safety and public health. In 2024, DNV reported a 15% year-over-year increase in demand for its patient safety accreditation programs, underscoring the growing societal emphasis on these critical areas.

Customer and Consumer Demand for Sustainability

Consumers are increasingly prioritizing sustainability, influencing purchasing decisions across sectors. This shift compels businesses to adopt and showcase environmentally and socially responsible practices. For instance, a 2024 survey indicated that 65% of consumers are willing to pay more for products from brands committed to sustainability.

This heightened demand directly fuels the need for independent verification of sustainability claims. Companies are actively seeking certifications and audits from reputable bodies like DNV GL to validate their Environmental, Social, and Governance (ESG) performance. In 2023, DNV reported a 20% increase in demand for its ESG assurance services.

The drive for sustainability is reshaping corporate strategies, pushing for innovation in product development and supply chain management. This includes a focus on circular economy principles and reducing carbon footprints. The global market for sustainable goods and services is projected to reach $150 trillion by 2025, reflecting the significant economic impact of this trend.

- Growing Consumer Preference: A significant majority of consumers now consider sustainability when making purchase decisions.

- Demand for Verification: Businesses are increasingly relying on third-party validation of their ESG efforts.

- Market Transformation: Sustainability is a key driver of innovation and market growth across industries.

- Economic Impact: The market for sustainable products and services represents a substantial and expanding economic opportunity.

Digitalization and Societal Adaptation

The rapid integration of digital technologies, including artificial intelligence and automation, is fundamentally reshaping industries and how people interact. This shift necessitates a societal adaptation to new ways of working and living, creating both opportunities and challenges.

DNV GL Group AS is strategically positioned to address these changes, with a strong emphasis on developing digital solutions, enhancing cybersecurity, and providing AI assurance. This focus underscores the critical need for safe and responsible adoption of advanced technologies within business operations and society at large.

- Digital Transformation Impact: By 2025, it's projected that AI will contribute trillions to the global economy, highlighting the significant societal and business implications of this technological wave.

- Cybersecurity Demand: The increasing reliance on digital infrastructure means cybersecurity services are in high demand, with the global cybersecurity market expected to reach over $300 billion by 2025.

- AI Adoption Challenges: While AI offers immense potential, DNV's role in AI assurance addresses concerns around ethical deployment and the need for robust governance frameworks to ensure public trust and safety.

Societal trust is a cornerstone for DNV, as emphasized by their CEO in 2024, with demand for their independent assurance services growing amidst declining public confidence in various sectors. The evolving global workforce presents a challenge, particularly in acquiring skilled personnel for emerging fields like AI and renewables, a critical area for DNV's growth and the sustainability transition.

DNV's expansion in 2024 across 72 countries highlights its global reach but also the imperative to address skill gaps in advanced technologies. Societal expectations for enhanced health and safety are directly influencing DNV's business, with a notable 15% increase in demand for patient safety accreditation programs in 2024, reflecting heightened public and regulatory scrutiny.

The growing consumer prioritization of sustainability, with 65% of consumers willing to pay more for eco-conscious brands in 2024, drives demand for DNV's ESG assurance services, which saw a 20% increase in 2023. This trend is transforming markets, with the sustainable goods and services sector projected to reach $150 trillion by 2025.

The rapid integration of digital technologies, including AI, necessitates societal adaptation. DNV is focusing on digital solutions, cybersecurity, and AI assurance to ensure responsible adoption, addressing the projected trillions AI will contribute to the global economy by 2025 and the over $300 billion global cybersecurity market by the same year.

Technological factors

Digitalization is a major driver of progress in all the industries DNV serves, enabling better operational efficiency, improved safety, and the development of entirely new services. This trend is particularly evident in areas like maritime, where digital twins are transforming vessel management and predictive maintenance is reducing downtime.

DNV's commitment to artificial intelligence is substantial, with significant investment in research focused on responsible AI development and assurance. To bolster its capabilities in this rapidly evolving field, DNV established DNV Cyber in 2024, a dedicated unit comprising over 500 experts focused on tackling the critical cybersecurity challenges within both Information Technology (IT) and Operational Technology (OT) environments.

Technological advancements in alternative fuels like ammonia, methanol, and hydrogen are reshaping the energy landscape. DNV GL's classification and advisory services are instrumental in guiding clients through the safe adoption of these evolving energy systems, as emphasized in their 2024 Energy Transition Outlook.

Innovations in battery technology and carbon capture and storage (CCS) are also pivotal for a successful energy transition. DNV GL's expertise ensures that these critical technologies are implemented effectively and safely, supporting the global shift towards cleaner energy solutions.

The maritime and oil & gas sectors are increasingly integrating autonomous features, remote control capabilities, and smart systems. DNV's own Technology Outlook 2025 report anticipated that by 2025, vessels would function as advanced sensor hubs, generating substantial data to enable remote operations and boost efficiency through sophisticated data analytics.

Innovations in Materials and Manufacturing

Innovations in materials science and advanced manufacturing, including additive manufacturing (3D printing), are reshaping asset design, construction, and maintenance across numerous sectors. For DNV GL Group AS, these advancements offer pathways to developing safer, more efficient, and environmentally responsible solutions for its clientele.

DNV's engagement with these technological shifts is evident in its research and development. The company actively explores how new materials and manufacturing techniques can improve the performance and longevity of critical infrastructure and equipment. For instance, advancements in high-strength, lightweight composites could lead to more robust and fuel-efficient designs for offshore structures and vessels, a key area for DNV's expertise.

The impact is quantifiable. The global 3D printing market, for example, was projected to reach over $50 billion by 2027, signaling significant industry adoption. DNV's role involves certifying the quality and reliability of components produced through these novel methods, ensuring they meet stringent industry standards. This includes validating new material properties and manufacturing process integrity, crucial for sectors like maritime, energy, and aerospace.

- Material Advancements: Development of novel alloys and composites offering enhanced durability, reduced weight, and improved corrosion resistance.

- Additive Manufacturing: Increased use of 3D printing for complex parts, reducing lead times and enabling on-demand production, particularly for spare parts in remote locations.

- Process Optimization: Integration of AI and automation in manufacturing to improve precision, reduce waste, and ensure consistent quality in asset production and repair.

- Sustainability Focus: Exploration of bio-based materials and circular economy principles in manufacturing to minimize environmental impact.

Cybersecurity and Data Integrity

The increasing reliance on digital platforms and interconnected systems makes robust cybersecurity essential for DNV's operational safety and data integrity. DNV's strategic investment in DNV Cyber, a dedicated entity focused on industrial cybersecurity, underscores the critical need to safeguard digital assets and infrastructure against sophisticated and evolving cyber threats. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the significant financial and operational risks companies like DNV must mitigate.

DNV's commitment to cybersecurity also extends to ensuring the integrity of the vast amounts of data it collects and analyzes for its clients across various industries. This focus is crucial as digital transformation accelerates, making every connection point a potential vulnerability. In 2024, reports indicated a significant rise in ransomware attacks targeting critical infrastructure sectors, further emphasizing the importance of DNV's proactive cybersecurity measures.

- Growing Cyber Threat Landscape: The global increase in sophisticated cyberattacks necessitates continuous investment in advanced security solutions.

- DNV's Strategic Response: The establishment of DNV Cyber demonstrates a clear commitment to addressing industrial cybersecurity challenges.

- Data Integrity Imperative: Protecting the accuracy and reliability of data is paramount for DNV's service offerings and client trust.

- Financial Implications: The substantial financial impact of cybercrime globally underscores the economic rationale for prioritizing cybersecurity investments.

Technological advancements are reshaping DNV's operational landscape, driving efficiency and new service development. The company's significant investments in AI and cybersecurity, highlighted by the 2024 establishment of DNV Cyber with over 500 experts, underscore a proactive approach to the evolving digital and threat environment. DNV's Technology Outlook 2025 anticipates vessels becoming advanced sensor hubs, generating data for remote operations and analytics.

| Technological Factor | Description | DNV's Engagement/Impact | Relevant Data/Outlook |

| Digitalization & AI | Enhanced operational efficiency, predictive maintenance, new service development. | Investment in AI research, establishment of DNV Cyber (2024) for IT/OT security. | Vessels as sensor hubs by 2025 (DNV Outlook). |

| Alternative Fuels & Energy Storage | Development and adoption of ammonia, methanol, hydrogen, and battery technologies. | Classification and advisory for safe adoption of new energy systems. | DNV's 2024 Energy Transition Outlook guiding clients. |

| Advanced Manufacturing | Additive manufacturing (3D printing), new materials, process automation. | Ensuring quality and reliability of novel manufacturing methods. | Global 3D printing market projected over $50 billion by 2027. |

| Cybersecurity | Protection against sophisticated cyber threats in IT and OT environments. | Dedicated DNV Cyber unit, safeguarding data integrity and client trust. | Global cost of cybercrime projected at $10.5 trillion annually by 2025. |

Legal factors

International and national regulations on greenhouse gas emissions are a major driver for DNV GL. The International Maritime Organization (IMO) and the European Union, for instance, are implementing increasingly stringent rules for emissions in the maritime and energy sectors. These regulations directly affect DNV's clients, creating a demand for compliance and advisory services.

DNV plays a crucial role in helping its clients navigate these complex regulatory landscapes. Services include ensuring adherence to initiatives like the EU Emissions Trading System (ETS) and the upcoming FuelEU Maritime regulation. These frameworks often involve direct costs for emissions and mandate rigorous reporting, areas where DNV's expertise is highly valued.

For example, the EU ETS for maritime transport, which began in 2024, requires shipping companies to surrender allowances for their CO2 emissions. This has created a new market and a significant compliance burden, directly benefiting DNV’s verification and consulting services. Similarly, FuelEU Maritime, set to phase in from 2025, will mandate the use of cleaner fuels, further increasing the need for DNV’s technical assessments and certification.

DNV GL's classification and technical assurance services are deeply intertwined with rigorous industry-specific safety regulations across maritime, oil & gas, and energy sectors. These rules, constantly evolving to address new technologies and risks, directly shape DNV's operational framework and service offerings.

For instance, the International Maritime Organization (IMO) mandates strict safety standards for vessels, influencing DNV's classification activities. In 2023, DNV approved over 13,000 vessels, a testament to its role in ensuring compliance with these vital safety protocols.

DNV GL Group AS, now operating as DNV, navigates a complex landscape of data protection and privacy laws worldwide. With its increasing reliance on digital platforms for services like maritime classification and energy consulting, the company handles vast amounts of sensitive customer and operational data. Failure to comply with regulations such as the EU's General Data Protection Regulation (GDPR) or similar frameworks in other jurisdictions could lead to significant fines and reputational damage. For instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Accreditation and Certification Requirements

DNV GL Group AS's ability to offer critical certification and assurance services hinges on its continued accreditation by various national and international bodies. For instance, in 2024, DNV GL's Maritime classification society maintained accreditations from over 100 flag states, a testament to its global reach and adherence to diverse regulatory frameworks.

Any shifts in these accreditation processes or evolving requirements can significantly impact DNV's operational procedures and market access. A notable example is the evolution of DNV Healthcare's NIAHO (National Integrated Accreditation for Healthcare Organizations) program, which in 2024 continued to adapt to new healthcare regulations, influencing how DNV provides its services to hospitals.

- Maintaining Global Accreditations: DNV GL's extensive network of accreditations, covering maritime, energy, and healthcare sectors, is crucial for its service delivery.

- Impact of Regulatory Changes: Evolving accreditation standards, such as those affecting healthcare organizations, directly influence DNV's service offerings and market positioning.

- NIAHO Program Evolution: The ongoing development of DNV Healthcare's NIAHO program in 2024 highlights the dynamic nature of accreditation requirements in specialized industries.

Anti-Corruption and Compliance Regulations

DNV GL Group AS, as a global leader in assurance and risk management, is deeply committed to upholding stringent anti-corruption and compliance regulations across all its operations. This commitment is critical for maintaining its esteemed reputation and preventing significant legal and financial penalties. The company actively adheres to international standards such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, alongside country-specific legislation.

In 2023, DNV reported a strong focus on compliance training, with over 90% of its global employees completing mandatory anti-corruption modules. This proactive approach is designed to embed ethical conduct throughout the organization. The company's robust compliance framework includes regular risk assessments, due diligence on third parties, and clear whistleblowing channels to identify and address potential violations promptly.

- Global Compliance Standards: DNV adheres to key international anti-corruption laws like the FCPA and UK Bribery Act.

- Employee Training: In 2023, over 90% of DNV employees underwent mandatory anti-corruption training.

- Risk Mitigation: The company employs regular risk assessments and third-party due diligence to prevent corrupt practices.

- Ethical Business Practices: Maintaining integrity and ethical conduct is paramount to DNV's operational strategy and long-term sustainability.

Legal factors significantly shape DNV's operations, particularly concerning environmental regulations like the EU ETS for maritime transport, which commenced in 2024, and FuelEU Maritime, slated for 2025. These mandates directly drive demand for DNV's verification and advisory services, as clients require assistance with emissions reporting and compliance with cleaner fuel usage. Furthermore, DNV's global accreditations, such as the over 100 maritime flag state accreditations maintained in 2024, are vital for its service delivery and market access, with evolving standards, like those impacting its NIAHO program in healthcare, continuously influencing its offerings.

| Regulatory Area | Key Legislation/Initiative | Year Introduced/Impacted | DNV's Role/Service Demand |

|---|---|---|---|

| Environmental Emissions | EU Emissions Trading System (ETS) for Maritime | 2024 | Verification, Compliance Advisory |

| Environmental Emissions | FuelEU Maritime | Phasing in from 2025 | Technical Assessments, Certification |

| Accreditation & Standards | Maritime Flag State Accreditations | Ongoing (e.g., 100+ maintained in 2024) | Classification Services, Assurance |

| Accreditation & Standards | NIAHO Program (Healthcare) | Evolving (e.g., 2024 adaptations) | Service Adaptation, Market Positioning |

Environmental factors

Climate change is a core driver for DNV's operations, particularly within the energy and maritime industries, as businesses globally focus on reducing their carbon emissions. The company's Energy Transition Outlook 2024 underscores the critical need to speed up decarbonization to achieve international climate targets.

DNV's analysis indicates that achieving the Paris Agreement goals requires a significant acceleration in the deployment of renewable energy sources and a substantial reduction in fossil fuel consumption. For instance, the outlook projects that by 2030, global renewable energy capacity will need to triple compared to 2023 levels to stay on track for net-zero emissions by 2050.

The increasing global demand for renewable energy, driven by climate concerns and energy security, presents a substantial growth avenue for DNV GL Group AS. This trend directly fuels the need for DNV's expertise in areas like energy system consulting, certification of renewable technologies, and advisory services for the transition to cleaner power sources.

DNV's own research, such as their Energy Transition Outlook, consistently projects robust expansion in renewable energy capacity. For instance, their 2024 outlook anticipated that by 2050, solar and wind power would constitute the vast majority of global electricity generation, underscoring the long-term market potential for DNV's offerings even amidst occasional market volatility.

The escalating frequency and severity of natural disasters, a direct consequence of climate change, present significant risks to DNV's clientele across the maritime, oil & gas, and energy sectors. For instance, in 2023, global insured losses from natural catastrophes reached $110 billion, according to Swiss Re, highlighting the increasing exposure of these industries.

This trend directly fuels the demand for DNV's expertise in risk management, crucial inspection services, and the development of resilient infrastructure. As assets face greater threats from events like severe storms and rising sea levels, companies are investing more in preventative measures and operational continuity planning, areas where DNV excels.

Sustainable Resource Management and Circular Economy

The increasing global emphasis on sustainable resource use and the shift to a circular economy significantly impact the sectors DNV GL Group AS operates within, especially waste management, material efficiency, and the creation of sustainable supply chains. This trend is driving demand for services that help businesses minimize waste and maximize resource value.

DNV GL's expertise is crucial for clients navigating this transition. For instance, their work in material efficiency helps companies reduce their environmental footprint and operational costs. The circular economy model, which aims to keep resources in use for as long as possible, is gaining momentum. By 2024, the global circular economy market was estimated to be worth over $2 trillion, with projections for continued substantial growth.

- Resource Efficiency: DNV GL assists clients in optimizing their use of raw materials and energy, a key component of sustainable resource management.

- Waste Reduction: Their services support businesses in implementing strategies to minimize waste generation and improve recycling rates, aligning with circular economy principles.

- Supply Chain Sustainability: DNV GL helps companies build more resilient and environmentally responsible supply chains, ensuring materials are sourced and managed sustainably.

- Market Growth: The circular economy sector is experiencing rapid expansion, with significant investment flowing into solutions that promote resource longevity and waste valorization.

Pollution Control and Environmental Management Systems

Growing global awareness of environmental issues, coupled with increasingly stringent regulations on air, water, and waste pollution, is a significant driver for companies to adopt robust environmental management systems and seek certifications. This trend directly fuels demand for DNV GL's expertise in this area.

DNV GL plays a crucial role by offering services such as ISO 14001 certification, which helps businesses systematically manage their environmental impact. Their comprehensive approach assists companies in not only complying with regulations but also in improving their overall environmental performance and operational efficiency.

- ISO 14001 Certification Growth: The global market for ISO 14001 certification continues to expand, with DNV GL being a leading provider, indicating strong demand for environmental management solutions.

- Regulatory Impact: Stricter environmental laws enacted in major economies throughout 2024 and projected into 2025 are compelling more organizations to invest in environmental management systems.

- DNV GL's Role: DNV GL's services are essential for companies aiming to achieve compliance and demonstrate commitment to sustainability, thereby enhancing their brand reputation and market access.

Environmental factors are increasingly shaping DNV GL Group AS's strategic landscape, driven by global climate action and resource management imperatives. The company's positioning is directly influenced by the urgent need for decarbonization, as highlighted in its Energy Transition Outlook 2024, which calls for a tripling of renewable energy capacity by 2030 to meet climate targets.

The growing frequency of natural disasters, with 2023 insured losses from catastrophes reaching $110 billion, amplifies the demand for DNV's risk management and resilient infrastructure services across key industries. Simultaneously, the burgeoning circular economy, valued at over $2 trillion in 2024, creates significant opportunities for DNV's expertise in resource efficiency and sustainable supply chains.

Furthermore, stricter environmental regulations worldwide are compelling businesses to adopt robust environmental management systems, boosting demand for DNV's certification and advisory services, such as ISO 14001. These environmental shifts collectively underscore DNV's critical role in facilitating sustainable transitions for its global clientele.

PESTLE Analysis Data Sources

Our PESTLE Analysis for DNV GL Group AS is built on a robust foundation of data from reputable international organizations, government publications, and leading industry research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to provide a comprehensive overview.