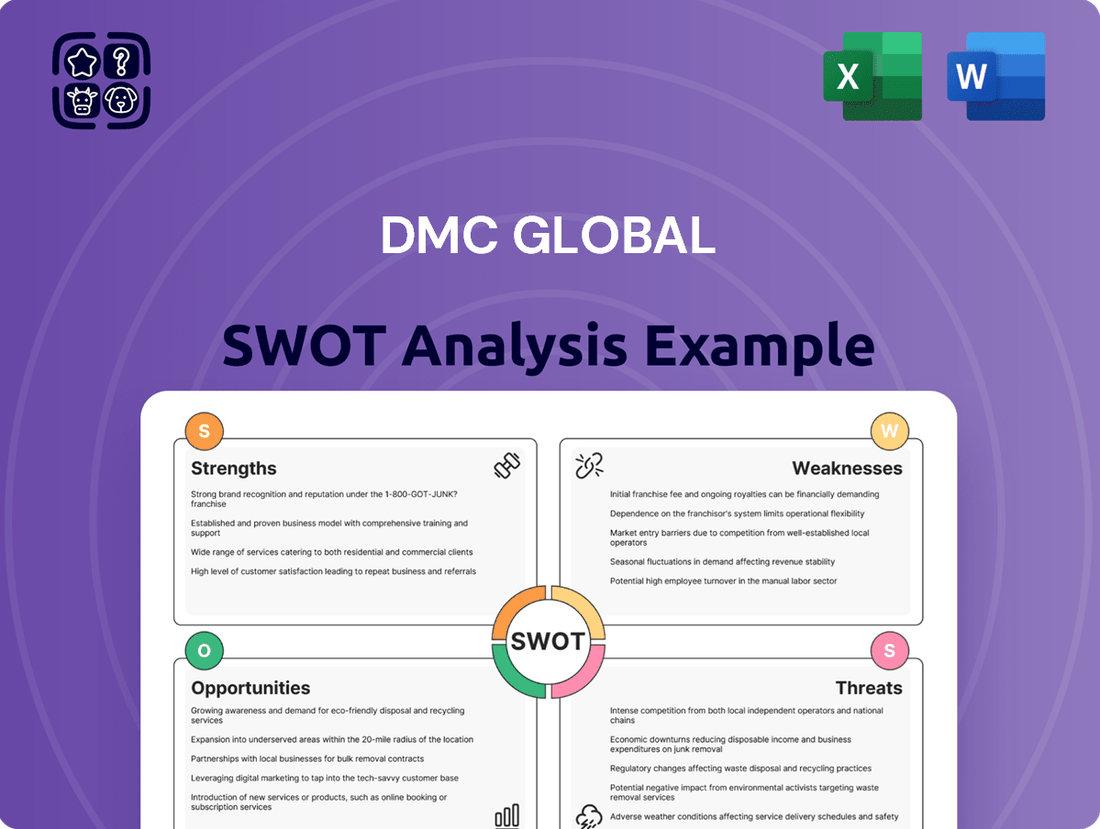

DMC Global SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMC Global Bundle

DMC Global's strengths lie in its diversified product portfolio and strong customer relationships, while its opportunities stem from growing demand in key end markets. However, potential threats include raw material price volatility and increasing competition.

Want the full story behind DMC Global's market position and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

DMC Global's diversified business portfolio, encompassing architectural building products (Arcadia), energy products (DynaEnergetics), and composite metals (NobelClad), significantly reduces its vulnerability to downturns in any single sector. This broad market presence across energy, industrial, and infrastructure industries allows for varied revenue streams and a wider customer base, enhancing overall business resilience.

DMC Global's strategic focus on engineered and differentiated products is a significant strength, allowing it to command premium pricing and foster customer loyalty. This specialization enables the company to address complex challenges within its target markets, such as the energy sector, where performance and reliability are paramount.

For instance, in fiscal year 2023, DMC Global's NobelClad segment, which offers advanced explosive welding solutions for demanding applications, continued to demonstrate robust demand. While specific segment revenue figures for engineered products are integrated within broader reporting, the consistent performance of these specialized offerings underscores their value proposition to customers seeking enhanced productivity and safety in critical operations.

DMC Global's individual businesses, including Arcadia, DynaEnergetics, and NobelClad, hold strong leadership positions within their specialized markets. This dominance is a direct result of their consistent innovation and the delivery of distinctive solutions, which fuels market share growth and enhances profitability.

Commitment to Innovation and Technology

DMC Global's commitment to innovation and technology is a significant strength. The company actively invests in research and development, aiming for continuous improvement across its operations. This focus is clearly visible in DynaEnergetics' significant automation initiatives.

These automation projects are designed to streamline manufacturing processes and boost overall efficiency. Such advancements are anticipated to positively impact adjusted EBITDA margins, a key indicator of profitability. For example, the company has been investing in advanced manufacturing technologies to enhance its production capabilities.

- Investment in R&D: DMC Global prioritizes research and development to drive technological advancements.

- Automation Initiatives: DynaEnergetics is implementing major automation projects to improve manufacturing efficiency.

- Margin Improvement: These technological upgrades are expected to strengthen adjusted EBITDA margins.

Strategic Operational Improvements and Cost Control

DMC Global has been diligently implementing strategic operational improvements and cost control measures throughout its various business segments. These efforts are designed to enhance efficiency and profitability.

Key initiatives include streamlining production processes, reducing fixed overhead expenses, and tackling inventory management inefficiencies. These actions are already yielding tangible benefits, as evidenced by improvements in gross margins.

For instance, in the first quarter of 2024, DMC Global reported a gross profit margin of 26.5%, an increase from 24.2% in the same period of 2023, reflecting the positive impact of these operational enhancements and cost-saving strategies.

- Streamlined Operations: Focused on optimizing workflows and resource allocation across all segments.

- Reduced Fixed Overhead: Implemented measures to lower non-essential operating costs.

- Inventory Efficiency: Addressed and improved inventory turnover and management practices.

- Margin Improvement: These initiatives contributed to a noticeable uptick in gross profit margins in early 2024.

DMC Global's diversified business model, spanning architectural products, energy services, and composite metals, provides significant resilience against sector-specific downturns. This broad market exposure across energy, industrial, and infrastructure sectors cultivates varied revenue streams and a wider customer base, bolstering overall business stability.

The company's strategic emphasis on engineered and differentiated products allows for premium pricing and fosters strong customer loyalty. This specialization enables DMC Global to effectively address complex challenges in its target markets, particularly in the energy sector where performance and reliability are critical.

DMC Global's individual business units, including Arcadia, DynaEnergetics, and NobelClad, maintain robust leadership positions within their respective niche markets. This market dominance is a direct outcome of their ongoing innovation and the delivery of unique solutions, driving market share expansion and improving profitability.

DMC Global's commitment to innovation and technology is a core strength, evidenced by consistent investment in research and development. For example, DynaEnergetics' significant automation initiatives aim to enhance manufacturing efficiency and are projected to positively impact adjusted EBITDA margins.

| Metric | Q1 2023 | Q1 2024 | Change |

|---|---|---|---|

| Gross Profit Margin | 24.2% | 26.5% | +2.3 pp |

| Revenue (Millions USD) | 184.2 | 178.9 | -2.9% |

What is included in the product

Delivers a strategic overview of DMC Global’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable framework to identify and leverage DMC Global's competitive advantages while mitigating potential risks.

Weaknesses

DMC Global's reliance on the energy and construction sectors makes it susceptible to market swings. For instance, the DynaEnergetics segment, which serves the oil and gas industry, saw its revenue impacted by a 15% drop in global oil prices during the first half of 2024. This volatility directly affects demand for its products and services.

Similarly, the Arcadia segment, focused on architectural products, faces challenges from the cyclical nature of the construction industry. A projected 5% slowdown in commercial construction spending for 2025, coupled with a 3% decrease in high-end residential projects, is expected to put pressure on Arcadia's sales volumes and profitability.

DMC Global's DynaEnergetics segment faced headwinds in 2024 due to intensified competition in the U.S. market, leading to pricing adjustments and a decline in unit sales. This competitive pressure, coupled with a shift towards a customer base with lower profit margins, directly impacted the segment's top-line revenue and its adjusted EBITDA performance.

DMC Global's Q3 2024 results were impacted by a substantial non-cash goodwill impairment charge, largely stemming from its acquisition of Arcadia. This charge, amounting to $153.6 million, highlights that Arcadia's financial performance has not met the company's initial expectations, leading to a reassessment of its future earnings potential.

The impairment signals that the value attributed to Arcadia at the time of acquisition is no longer considered recoverable, necessitating a write-down. This situation suggests that the integration of Arcadia or its market conditions have presented greater challenges than anticipated, impacting the overall carrying value of the acquired asset on DMC Global's balance sheet.

Supply Chain Disruptions and Raw Material Costs

DMC Global has grappled with significant supply chain disruptions, particularly affecting product availability for its Arcadia business. These external pressures directly impact the company's ability to meet customer demand consistently.

Furthermore, the ongoing increases in raw material costs present a persistent challenge. For instance, fluctuations in steel and aluminum prices, key inputs for many of DMC Global's products, can squeeze profit margins if not effectively managed through pricing strategies or hedging.

- Supply Chain Vulnerabilities: Recent years have highlighted the fragility of global supply chains, leading to extended lead times and stockouts for critical components, impacting Arcadia's order fulfillment.

- Rising Input Costs: DMC Global, like many manufacturers, faces pressure from escalating costs of essential raw materials, affecting the cost of goods sold and potentially impacting pricing competitiveness.

- Operational Efficiency Impact: These combined challenges can hinder operational efficiency, requiring greater inventory buffer management and potentially increasing logistics expenses to mitigate delays.

Uncertainty from Tariff Policies

DMC Global's NobelClad segment faces significant headwinds due to the unpredictable nature of tariff policies. Discussions around import/export duties have directly led to a noticeable slowdown in incoming orders, as customers adopt a wait-and-see approach. This uncertainty can make forecasting demand and revenue for this crucial business unit quite challenging.

The impact of these trade policy shifts is not merely theoretical. For instance, in late 2023 and early 2024, the anticipation of potential tariffs on certain metals used in their products caused some clients to postpone significant capital expenditure decisions, directly affecting NobelClad's order pipeline. This volatility creates a weakness by introducing unpredictability into a key revenue stream.

- Customer Order Delays: Tariff uncertainty prompts customers to delay placing orders, impacting NobelClad's revenue visibility.

- Revenue Unpredictability: External tariff policies create significant unpredictability in demand and financial performance for the segment.

- Strategic Planning Challenges: The fluctuating trade environment makes long-term strategic planning and resource allocation more difficult for DMC Global.

DMC Global's financial performance is hindered by its concentrated exposure to the volatile energy and construction sectors, which experienced revenue impacts from fluctuating oil prices and projected construction slowdowns in 2024-2025. Intensified competition within the DynaEnergetics segment has led to pricing pressures and a shift toward lower-margin customers, directly affecting profitability.

A significant goodwill impairment charge of $153.6 million in Q3 2024, related to the Arcadia acquisition, signals that the acquired business has underperformed initial expectations, impacting its carrying value and future earnings potential. This, combined with persistent supply chain disruptions affecting product availability and rising raw material costs for key inputs like steel and aluminum, continues to squeeze profit margins and challenge operational efficiency.

Furthermore, the NobelClad segment faces substantial uncertainty due to unpredictable tariff policies, causing customer order delays and revenue unpredictability as clients adopt a wait-and-see approach, complicating strategic planning.

| Segment | Key Weakness | Impact (2024-2025 Data/Projections) | Financial Metric Impact |

|---|---|---|---|

| DynaEnergetics | Market Volatility & Competition | 15% drop in global oil prices (H1 2024); intensified U.S. market competition | Revenue decline, reduced unit sales, lower EBITDA |

| Arcadia | Construction Cycle & Integration Issues | Projected 5% slowdown in commercial construction (2025); $153.6M goodwill impairment (Q3 2024) | Pressure on sales volumes and profitability; underperformance vs. acquisition expectations |

| NobelClad | Tariff Uncertainty | Customer order delays due to anticipated import/export duties (late 2023-early 2024) | Revenue visibility reduction, strategic planning challenges |

| All Segments | Supply Chain & Input Costs | Extended lead times, stockouts; rising steel/aluminum prices | Hinders order fulfillment, squeezes profit margins |

Full Version Awaits

DMC Global SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. You're viewing a live preview of the actual SWOT analysis file, ensuring transparency and quality. The complete version of the DMC Global SWOT Analysis becomes available immediately after checkout.

Opportunities

DMC Global's Arcadia segment is well-positioned to benefit from the expanding natural gas export market, with over 90 projects currently being monitored. This growth in energy infrastructure directly fuels demand for architectural building products, creating a substantial opportunity for Arcadia.

DMC Global can tap into growing international demand for its specialized materials, particularly in emerging economies where industrialization and infrastructure development are accelerating. For instance, the global advanced materials market was projected to reach over $110 billion in 2024, presenting a significant opportunity for expansion.

Expanding into new geographic regions allows DMC Global to diversify its revenue base, mitigating risks associated with economic downturns or regulatory changes in its current operating markets. This strategic move can stabilize financial performance and enhance long-term growth prospects.

DMC Global is strategically expanding its product line by developing innovative clad metal plates. This includes exploring new applications in high-growth sectors such as renewable energy, particularly in solar and wind power components, and the automotive industry, focusing on lightweight and durable materials.

This diversification aims to significantly broaden DMC Global's customer base beyond its traditional reliance on the energy and construction markets. For instance, in 2023, the company saw revenue growth in its specialty products segment, signaling the early success of such diversification efforts.

Strategic Partnerships and Collaborations

DMC Global can leverage strategic partnerships to enhance its market reach and accelerate growth. Collaborating with established industry leaders offers access to new technologies and customer bases, as seen in the energy sector where such alliances are crucial for project development.

These partnerships can unlock opportunities for joint ventures, co-development of innovative solutions, and shared market entry strategies. For instance, in 2024, many industrial companies are actively seeking collaborations to navigate complex supply chains and regulatory environments, a trend DMC Global can capitalize on.

- Expanded Market Access: Partnerships can provide entry into new geographic regions or industry verticals where DMC Global currently has limited presence.

- Technology Sharing and Innovation: Collaborations can facilitate the co-development of advanced products or services, leveraging complementary R&D capabilities.

- Risk Mitigation: Sharing resources and expertise through partnerships can help mitigate the financial and operational risks associated with large-scale projects or market entries.

Leveraging Automation and Operational Efficiencies

DMC Global's commitment to automation, exemplified by its DynaEnergetics segment, presents a significant opportunity. By continuing to invest in advanced manufacturing and process optimization, the company can unlock substantial gains in operational efficiency. This focus directly translates to a leaner operational structure, potentially reducing labor costs and streamlining production cycles, which in turn bolsters profitability.

These internal improvements are crucial for enhancing DMC Global's competitive standing in the market. For instance, the company reported that its DynaEnergetics segment saw revenue growth in recent periods, partly driven by improved operational throughput. Further automation can amplify these gains, leading to:

- Increased Production Capacity: Enabling the company to meet higher demand more effectively.

- Reduced Operating Costs: Through optimized resource utilization and fewer manual processes.

- Improved Profit Margins: Resulting from a combination of higher output and lower expenses.

- Enhanced Agility: Allowing for quicker adaptation to market shifts and customer needs.

DMC Global can capitalize on the increasing demand for natural gas exports, with numerous infrastructure projects underway that will drive demand for its architectural building products through its Arcadia segment. The company is also well-positioned to expand its global reach by tapping into the growing international market for specialized materials, particularly in developing economies undergoing industrialization.

Threats

DMC Global faces ongoing threats from persistent volatility in key markets. The energy sector, especially well completion activity in North America, continues to show weakness, directly impacting DynaEnergetics. This instability can lead to unpredictable demand for their products and services.

Furthermore, a prolonged slowdown in both residential and commercial construction presents a significant risk to Arcadia. For instance, housing starts in the U.S. saw a slight dip in early 2024 compared to the previous year, indicating potential headwinds for Arcadia's building products segment. This broader market contraction could dampen sales and profitability.

DMC Global is experiencing heightened competition, especially within the U.S. market for its DynaEnergetics segment. This intensified rivalry puts pressure on pricing strategies and can erode market share.

The competitive landscape directly impacts DMC Global's ability to maintain profitability as it navigates the need to remain competitive on price while also investing in product development and market reach. For instance, in the oil and gas services sector, where DynaEnergetics operates, market share can shift rapidly based on pricing and technological advancements.

A general economic slowdown and elevated interest rates pose significant challenges for DMC Global. These conditions can dampen demand, particularly impacting the premium residential sector where their Arcadia brand operates. For instance, persistent inflation and rising borrowing costs throughout 2024 have already shown a cooling effect on discretionary spending in housing markets.

Furthermore, economic uncertainty often prompts businesses to scale back investment. This means that planned capital expenditures for industrial and infrastructure projects, key markets for DMC Global's other segments, may be deferred or reduced, directly impacting sales volumes and revenue streams.

Supply Chain and Geopolitical Risks

DMC Global, through its NobelClad segment, faces significant threats from ongoing supply chain disruptions. These issues can directly impact the availability of critical raw materials and components, leading to production delays and increased costs. For instance, the global shipping container shortage experienced in 2023-2024 continued to exert upward pressure on logistics expenses, affecting margins for companies like DMC Global.

Evolving U.S. tariff policies and reciprocal measures from other nations present another substantial risk. These trade policies can alter the cost-competitiveness of NobelClad's products in international markets, potentially impacting order volumes and profitability. For example, the imposition of new tariffs on steel or other key inputs in late 2024 could necessitate price adjustments or sourcing shifts.

Geopolitical tensions worldwide contribute to market instability, creating an unpredictable operating environment. Conflicts or political unrest in key sourcing regions or major markets can disrupt trade flows, affect currency exchange rates, and dampen overall demand for industrial products. The ongoing global geopolitical landscape, marked by various regional conflicts and trade disputes throughout 2024, underscores this vulnerability.

- Supply Chain Volatility: Continued disruptions in global logistics and raw material availability, as seen throughout 2023 and into 2024, can increase lead times and operational costs for NobelClad.

- Trade Policy Uncertainty: Shifting tariff structures and trade agreements between the U.S. and other nations can impact the cost and competitiveness of NobelClad's offerings in international markets.

- Geopolitical Instability: Global political tensions and regional conflicts can create market volatility, affecting demand, currency stability, and the security of international supply chains.

Execution Challenges of Strategic Initiatives

DMC Global faces significant hurdles in executing its strategic realignments and operational enhancements. Successfully navigating these complex changes is crucial for the company’s ability to achieve its turnaround objectives and improve profitability. For instance, the integration of new technologies or restructuring of supply chains can encounter unexpected delays or cost overruns, impacting the timeline for margin recovery.

Failure to effectively implement these strategies poses a direct threat to DMC Global's financial performance. If the intended benefits of these initiatives, such as cost savings or increased efficiency, are not realized, the company may struggle to meet its financial targets. This could manifest in continued pressure on operating margins, potentially affecting shareholder value.

- Execution Risks: Delays or inefficiencies in implementing strategic initiatives can derail margin recovery efforts.

- Operational Integration: Challenges in integrating new systems or processes may lead to unforeseen costs and disruptions.

- Market Responsiveness: A slower-than-expected response from the market to strategic shifts could impede progress.

DMC Global contends with persistent market volatility, particularly in the energy sector, impacting DynaEnergetics' demand. A slowdown in construction also poses a threat to Arcadia's building products segment, with U.S. housing starts showing a slight decline in early 2024. Heightened competition in the U.S. for DynaEnergetics further pressures pricing and market share.

Economic headwinds, including elevated interest rates and inflation throughout 2024, dampen demand for premium residential products from Arcadia and could delay industrial investments. Supply chain disruptions continue to affect NobelClad, increasing lead times and costs, as exemplified by ongoing global logistics challenges. Evolving U.S. trade policies and geopolitical instability add further layers of risk, impacting international competitiveness and market predictability.

| Threat Category | Specific Impact | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Market Volatility | Weakness in energy sector (DynaEnergetics) | North American well completion activity showed fluctuations. |

| Economic Slowdown | Reduced demand in construction (Arcadia) | U.S. housing starts experienced a slight dip in early 2024. |

| Competition | Pricing pressure and market share erosion (DynaEnergetics) | Intensified rivalry noted in the U.S. oil and gas services sector. |

| Supply Chain Disruptions | Increased costs and delays (NobelClad) | Global shipping costs remained elevated due to container shortages. |

| Trade Policy Uncertainty | Impact on international competitiveness (NobelClad) | Ongoing discussions and potential adjustments to tariffs. |

SWOT Analysis Data Sources

This DMC Global SWOT analysis is built upon a robust foundation of data, drawing from verified financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate strategic assessment.