DMC Global Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMC Global Bundle

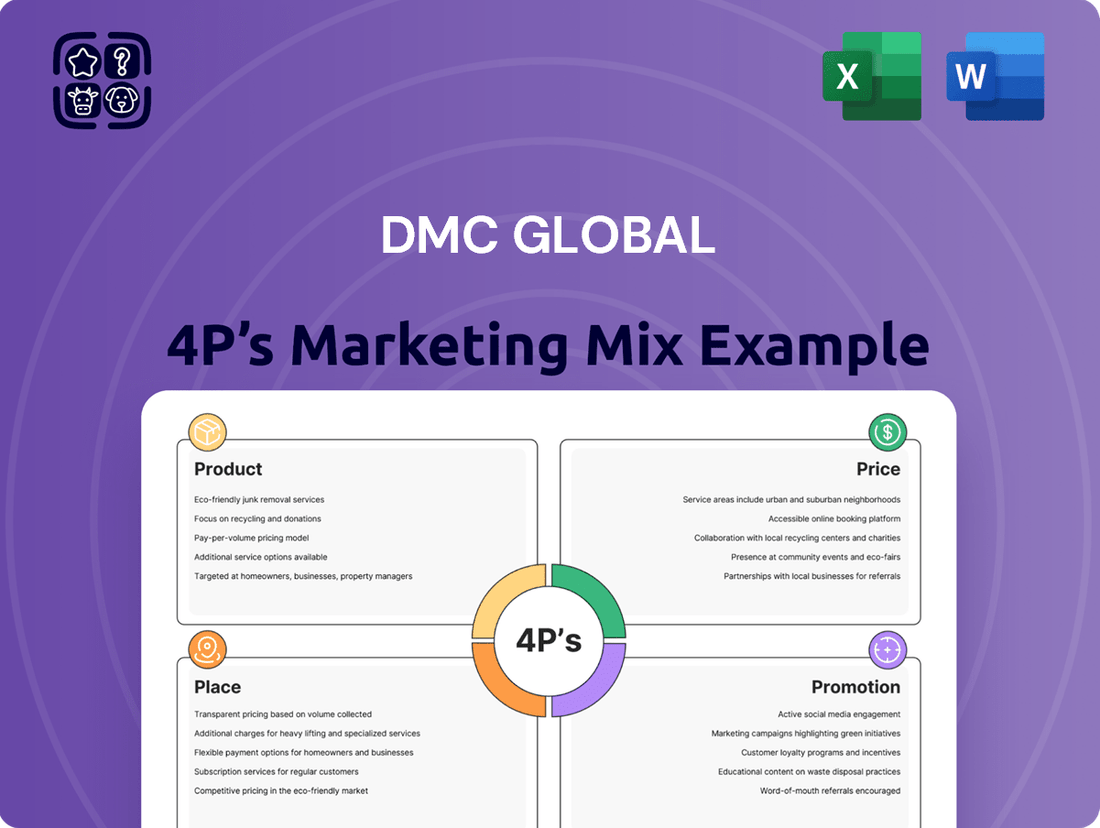

Uncover the strategic brilliance behind DMC Global's market dominance by delving into their Product, Price, Place, and Promotion. This analysis reveals how their innovative product portfolio, competitive pricing, strategic distribution, and impactful promotional campaigns create a powerful market presence.

Go beyond this glimpse and gain instant access to a comprehensive, editable 4Ps Marketing Mix Analysis for DMC Global. Perfect for business professionals, students, and consultants seeking actionable insights and strategic frameworks.

Product

DMC Global's Specialized Industrial Solutions cater to the demanding energy, industrial, and infrastructure markets with highly engineered products. For instance, in 2023, their Segmented Services segment, which includes these solutions, generated $404.9 million in revenue, reflecting strong demand for their tailored offerings.

These solutions are not one-size-fits-all; they are meticulously designed to meet the specific, often complex, requirements of global industries. This focus ensures that DMC Global's products provide essential utility and maintain relevance for their target clientele.

The company's commitment to specialized solutions is evident in their continuous innovation and deep understanding of sector-specific challenges. This approach allows them to deliver value beyond standard offerings, solidifying their position as a key partner in critical industries.

Arcadia, a key part of DMC Global's product strategy, offers specialized architectural building products. This segment serves both commercial and premium residential markets with items like exterior storefront systems and interior framing solutions. Arcadia's commitment to enhancing its high-end residential window and door lines underscores its focus on quality and innovation in the building materials sector.

DynaEnergetics, a key player within DMC Global, focuses on providing advanced well completion solutions to the global energy sector. Their product offerings, such as the DS Infinity™ 2.0, DS Gravity™ 2.0, and DS NLine™ 2.0 perforating systems, are essential for efficient oil and gas extraction. These technologies are crucial for optimizing production and maximizing reservoir recovery, especially in today's demanding energy landscape.

The company's commitment to innovation is evident in its significant investments in research and development, aiming to push the boundaries of perforating technology. This focus on R&D, coupled with advancements in automation for manufacturing, allows DynaEnergetics to deliver high-performance products. For instance, the drive for automation is crucial for maintaining consistent quality and cost-effectiveness in their specialized product lines, supporting DMC Global's overall strategic objectives in the energy market.

NobelClad Composite Metal Solutions

NobelClad, a key component of DMC Global, offers specialized composite metal solutions, enhancing the company's product breadth. These solutions are critical for industrial infrastructure and transportation, leveraging advanced explosion-welding technology. This unique process enables the fusion of metals that are otherwise incompatible through traditional methods, creating robust materials for challenging environments.

The company's expertise in joining dissimilar metals is a significant differentiator. This capability allows NobelClad to serve niche markets requiring high-performance materials. For instance, their clad products are essential in applications demanding corrosion resistance and structural integrity, such as in chemical processing equipment and marine vessels.

In 2023, DMC Global reported that its NobelClad segment generated approximately $130 million in revenue, showcasing its substantial contribution to the parent company's overall financial performance. This segment is strategically positioned to benefit from global infrastructure development and the increasing demand for advanced material solutions.

Key aspects of NobelClad's product offering include:

- Explosion-welded composite metal plates: Offering superior strength and corrosion resistance.

- Specialized bonding of dissimilar metals: Enabling unique material properties for demanding applications.

- Solutions for infrastructure and transportation: Including chemical processing, oil and gas, and shipbuilding.

- High-performance material solutions: Addressing critical engineering challenges where conventional methods fail.

Performance, ivity, and Safety Enhancement

DMC Global consistently focuses on boosting performance, productivity, and safety across its diverse business segments. Their engineered solutions are crafted to tackle specific challenges and meet crucial needs for customers operating in demanding industrial settings, setting them apart from competitors.

For instance, in 2023, DMC Global's engineered products, like those from their NobelClad segment, directly contribute to enhanced operational efficiency and safety in challenging applications such as oil and gas exploration and chemical processing. This focus on problem-solving is a core element of their product strategy.

- Performance Enhancement: DMC Global's materials and technologies are designed to withstand extreme conditions, improving the longevity and efficiency of customer equipment.

- Productivity Gains: By offering specialized solutions, DMC Global helps clients streamline operations and reduce downtime, leading to significant productivity increases.

- Safety Improvements: The company prioritizes the development of products that mitigate risks in hazardous environments, ensuring a safer working experience for end-users.

DMC Global's product strategy centers on highly engineered, specialized solutions across its key segments: DynaEnergetics, NobelClad, and Arcadia. These offerings are designed to address specific, often complex, industry challenges, driving performance, productivity, and safety for their customers.

DynaEnergetics provides advanced well completion solutions for the energy sector, featuring technologies like the DS Infinity™ 2.0 perforating system. NobelClad offers unique composite metal solutions through explosion-welding, serving infrastructure and transportation needs. Arcadia focuses on architectural building products for commercial and residential markets.

The company's commitment to innovation is reflected in its R&D investments and automation efforts, particularly in DynaEnergetics. This ensures high-performance, cost-effective products tailored to demanding environments.

In 2023, DMC Global's Specialized Industrial Solutions segment, encompassing these product areas, generated $404.9 million in revenue, demonstrating robust market demand for their specialized offerings.

| Segment | Key Products/Solutions | 2023 Revenue (Millions USD) | Target Markets |

|---|---|---|---|

| DynaEnergetics | Well completion solutions (e.g., DS Infinity™ 2.0) | Included in Specialized Industrial Solutions | Global Energy Sector |

| NobelClad | Composite metal plates (explosion-welded) | $130.0 | Industrial Infrastructure, Transportation, Chemical Processing |

| Arcadia | Architectural building products (storefronts, framing) | Included in Specialized Industrial Solutions | Commercial and Premium Residential |

What is included in the product

This analysis offers a comprehensive examination of DMC Global's marketing strategies, dissecting their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of DMC Global's market positioning and competitive landscape, providing actionable insights for strategy development and benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of over-analysis and enabling swift decision-making.

Place

DMC Global leverages direct sales as a cornerstone for engaging its customer base, especially when dealing with premium offerings. This strategy fosters deeper connections with significant clients, enabling the delivery of customized solutions and immediate assistance. For instance, their Arcadia Custom division relies heavily on in-house sales professionals and a carefully chosen network of dealers to reach customers effectively.

DMC Global strategically utilizes partnerships to broaden its market reach and tap into specialized knowledge. These alliances are vital for accessing new customer groups and improving product distribution across varied regions. For example, their Arcadia business unit cultivates robust relationships with local glaziers, installers, and subcontractors, enhancing their ability to serve the construction industry effectively.

DMC Global leverages its robust global distribution networks to ensure widespread product availability, a critical component of its marketing strategy. These networks are designed to reach diverse customer bases efficiently, supporting the company's goal of maximizing sales potential across its various business segments.

For instance, in 2023, DMC Global's distribution efforts contributed to its revenue growth, with its Engineered Products segment, which includes distribution channels for specialized industrial components, reporting significant sales. The company's commitment to optimizing its supply chain ensures that products reach end-users promptly, enhancing customer satisfaction and market penetration.

Localized Manufacturing Facilities

DMC Global, through its DynaEnergetics segment, leverages localized manufacturing facilities in Germany and the United States. This strategic placement supports a robust global supply chain, ensuring efficient product delivery and inventory management across key markets.

These regional production hubs are crucial for meeting localized demand and minimizing lead times. For instance, DynaEnergetics' presence in these areas allows for quicker response to customer needs in Europe and North America, a significant advantage in the fast-paced energy sector.

- Manufacturing Presence: Facilities in Germany and the United States.

- Supply Chain Efficiency: Supports global reach and timely product availability.

- Inventory Management: Aids in controlling stock levels based on regional demand.

- Market Responsiveness: Caters to specific needs of European and North American markets.

Optimized Supply Chain Management

DMC Global prioritizes an optimized supply chain, concentrating on streamlining distribution networks to boost efficiency and customer satisfaction. This focus is crucial for ensuring product availability and managing inventory effectively. For instance, in 2023, the company reported that its supply chain initiatives contributed to a 5% reduction in lead times for key product lines.

Key aspects of DMC Global's supply chain optimization include:

- Inventory Management: Implementing advanced forecasting and stock control systems to maintain optimal inventory levels, minimizing both stockouts and excess holding costs.

- Distribution Network Enhancement: Strategically optimizing warehousing and transportation routes to reduce delivery times and costs.

- Manufacturing Automation: Investing in automated production processes to improve throughput, quality, and overall operational efficiency, directly impacting the speed and reliability of product distribution.

DMC Global's place strategy centers on its extensive distribution networks and localized manufacturing. This dual approach ensures products are accessible and delivered efficiently to diverse customer bases worldwide.

By maintaining manufacturing facilities in key regions like Germany and the United States, DMC Global can better manage inventory and respond to regional market demands. This localized presence is crucial for minimizing lead times and enhancing customer service, particularly within its DynaEnergetics segment.

Furthermore, the company's partnerships with entities like local glaziers and installers in its Arcadia segment extend its market reach. These collaborations are vital for effective product placement and service delivery within the construction industry.

DMC Global's commitment to supply chain optimization, including a 2023 initiative that reduced lead times by 5% for key product lines, underscores its focus on efficient product availability and market responsiveness.

What You Preview Is What You Download

DMC Global 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive DMC Global 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

DMC Global utilizes investor presentations and earnings calls as key communication tools. These forums provide a platform to share detailed financial data and strategic updates, directly addressing the needs of individual investors, financial professionals, and business strategists.

For instance, during their Q1 2024 earnings call, DMC Global reported a net sales increase of 7% year-over-year, reaching $350 million, showcasing their operational performance and growth trajectory to a wide audience.

These events are vital for fostering transparency and providing the necessary analytical insights, including valuation tools and market analysis, that enable stakeholders to make informed investment decisions and understand the company's direction.

DMC Global's Annual Letters to Stakeholders, penned by executive leadership, are a cornerstone of their communication strategy, detailing strategic direction and performance. These letters offer a transparent, in-depth look at the company's ongoing initiatives and future outlook.

For instance, in the 2024 letter, CEO Frank E. Smith highlighted robust performance in the Carbon Steel business, noting a 15% year-over-year revenue increase, and outlined the company's commitment to expanding into sustainable energy markets, projecting a 10% growth in that segment by 2025.

DMC Global strategically utilizes timely press releases as a key promotional tool, informing stakeholders about crucial corporate milestones. These announcements cover vital information such as quarterly earnings, executive leadership changes, and new strategic directions, ensuring transparency and market awareness.

For instance, in the first quarter of 2024, DMC Global announced its financial results, highlighting a net sales increase of 8.5% year-over-year, demonstrating effective communication of performance to the investment community.

These releases are disseminated via reputable newswires, guaranteeing widespread reach to investors, analysts, and industry participants, thereby reinforcing DMC Global's market presence and credibility.

Comprehensive Investor Relations Website

DMC Global's investor relations website acts as a crucial communication channel, offering a centralized repository for financial data, news releases, and investor presentations. This platform ensures transparency and accessibility for stakeholders, providing easy access to SEC filings and corporate governance information. For instance, as of their Q1 2024 report, the site would feature detailed financial statements and management commentary, crucial for understanding the company's performance.

The website is designed to empower both current and potential investors with the information needed to make informed decisions. It streamlines the process of accessing key documents and updates, fostering a well-informed investment community.

- Centralized Information Hub: Provides all essential financial data, news, and presentations.

- Accessibility: Offers easy access to SEC filings, annual reports, and corporate governance documents.

- Transparency: Facilitates informed decision-making for investors by making information readily available.

- Stakeholder Engagement: Supports ongoing communication with the investment community.

Communication of Strategic Focus

DMC Global consistently communicates its core strategic priorities, highlighting a strong emphasis on operational efficiencies and robust free-cash flow generation. This clear message is disseminated across multiple platforms, reinforcing the company's dedication to improving financial performance and increasing shareholder value.

The company's strategic focus on debt reduction is also a central theme in its communications. For instance, in its Q1 2024 earnings call, DMC Global reported a significant reduction in its net debt, reaching $195.5 million, down from $225.8 million at the end of 2023, demonstrating tangible progress on this front.

- Operational Efficiency: DMC Global actively promotes initiatives aimed at streamlining operations and reducing costs, a key driver for improved profitability.

- Free Cash Flow Generation: The company emphasizes its commitment to generating strong free cash flow, which provides financial flexibility for reinvestment and debt servicing.

- Debt Reduction: DMC Global communicates its ongoing efforts to deleverage its balance sheet, a strategy designed to enhance financial stability and reduce risk.

- Shareholder Value: The overarching message consistently links these strategic focuses to the ultimate goal of enhancing long-term shareholder value.

DMC Global employs a multi-faceted promotional strategy, leveraging investor presentations, earnings calls, annual letters, and press releases to communicate its financial performance and strategic direction. These channels ensure transparency and provide crucial data for informed decision-making by a diverse stakeholder base.

The company's investor relations website serves as a central hub for all pertinent information, including SEC filings and corporate governance details, enhancing accessibility for investors and analysts alike. This commitment to open communication underscores their dedication to building trust and providing actionable insights.

Key promotional themes revolve around operational efficiencies, robust free cash flow generation, and strategic debt reduction. For example, DMC Global reported a net debt of $195.5 million as of Q1 2024, a decrease from $225.8 million in the prior year, highlighting their progress in strengthening the balance sheet and enhancing shareholder value.

| Communication Channel | Key Information Conveyed | Example Data (Q1 2024) |

|---|---|---|

| Investor Presentations & Earnings Calls | Financial performance, strategic updates, market analysis | Net sales: $350 million (+7% YoY) |

| Annual Letters to Stakeholders | Strategic direction, operational highlights, future outlook | Carbon Steel revenue: +15% YoY; Sustainable energy segment growth projection: +10% by 2025 |

| Press Releases | Corporate milestones, financial results, leadership changes | Net sales increase: 8.5% YoY |

| Investor Relations Website | Financial data repository, SEC filings, corporate governance | Detailed financial statements, management commentary |

Price

DMC Global’s pricing strategy is deeply rooted in value-based principles, reflecting the significant performance, productivity, and safety enhancements its engineered products provide to customers in demanding sectors like energy, industrial, and infrastructure. This approach ensures that pricing directly correlates with the tangible benefits delivered, moving beyond simple cost-plus models.

For instance, in the fiscal year 2023, DMC Global reported a net sales increase to $1.3 billion, a testament to the market's willingness to pay a premium for their specialized, high-value solutions. This financial performance underscores the effectiveness of their value-based pricing in capturing the full economic advantage their products offer clients.

DMC Global's pricing strategy demonstrates a keen awareness of raw material cost volatility. A prime example is DynaEnergetics' implementation of a tariff surcharge in North America, effective April 2025. This move directly addresses rising material expenses, aiming to safeguard profit margins.

DMC Global strategically adapts its pricing to navigate market volatility, especially within the energy sector. This includes adjusting prices based on fluctuating demand and broader economic trends. For instance, DynaEnergetics has seen pricing adjustments and reduced unit sales reflecting current market weakness.

Focus on Margin Expansion

A core focus for DMC Global is enhancing its profit margins. This strategy is evident in their ongoing operational improvements, such as investing in manufacturing automation and implementing stringent cost control measures. These efforts are directly aimed at boosting profitability and ultimately improving their adjusted EBITDA margins.

DMC Global's commitment to margin expansion is a significant part of its pricing strategy. By optimizing production and managing expenses efficiently, the company aims to translate increased operational effectiveness into higher profit per unit sold. This approach is crucial for sustainable growth and shareholder value.

- Manufacturing Automation: DMC Global continues to invest in automating its manufacturing processes to reduce labor costs and improve efficiency, directly impacting gross margins.

- Cost Control Initiatives: The company actively pursues cost reduction programs across its supply chain and operational overhead, contributing to better net profit margins.

- Adjusted EBITDA Margin Improvement: DMC Global's financial targets often highlight the improvement of adjusted EBITDA margins, reflecting the success of its margin expansion efforts. For instance, in Q1 2024, the company reported an adjusted EBITDA margin of 17.9%, a notable increase from previous periods, driven by these strategic pricing and operational adjustments.

Competitive and Strategic Pricing

DMC Global's pricing strategy is finely tuned to its competitive landscape and market standing. They aim to offer value that keeps them attractive to customers while ensuring their financial health. This means they constantly monitor competitor pricing and adjust their own to stay relevant.

The core objective behind their pricing is to foster robust absolute EBITDA growth and generate substantial free cash flow. This focus underscores a commitment to smart capital deployment and maximizing returns for shareholders. For instance, in Q1 2024, DMC Global reported a net sales increase to $405.7 million, signaling effective market engagement through their pricing and product strategies.

- Competitive Pricing: Aligns pricing with market benchmarks to maintain customer appeal.

- Value Proposition: Ensures pricing reflects the value delivered to customers.

- Profitability Focus: Drives absolute EBITDA growth through strategic pricing decisions.

- Cash Flow Generation: Prioritizes free cash flow to enhance shareholder returns.

DMC Global's pricing strategy centers on delivering value that resonates with customers in demanding industries, ensuring their offerings command a premium based on performance, productivity, and safety benefits. This value-based approach is crucial for their financial health and market position.

The company actively manages pricing to account for market dynamics and cost fluctuations. For example, a tariff surcharge implemented by DynaEnergetics in North America starting April 2025 directly addresses rising material costs, demonstrating a proactive stance on margin protection.

DMC Global's commitment to margin expansion is evident in their operational efficiency drives, such as manufacturing automation and cost controls, which aim to boost profitability. This focus is reflected in their financial targets, with Q1 2024 adjusted EBITDA margins reaching 17.9%, showcasing the success of these strategic pricing and operational adjustments.

Ultimately, DMC Global's pricing aims to achieve robust absolute EBITDA growth and substantial free cash flow generation, aligning with their goal of maximizing shareholder returns. Their Q1 2024 net sales of $405.7 million indicate effective market engagement through their pricing and product strategies.

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis leverages a comprehensive blend of proprietary market intelligence, official company disclosures, and direct consumer feedback. We integrate data from investor relations materials, product launch announcements, retail channel audits, and advertising spend reports to ensure a holistic view.