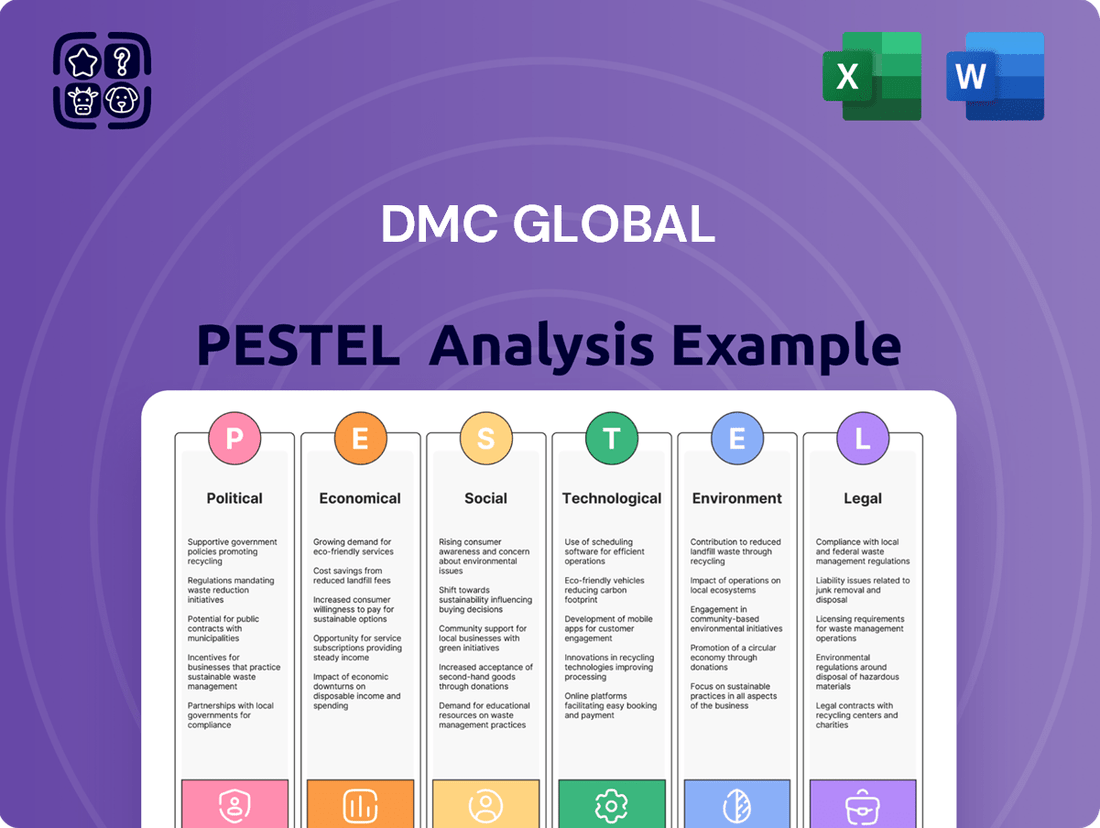

DMC Global PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMC Global Bundle

Navigate the complex external forces impacting DMC Global with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are shaping the company's strategic landscape. Gain a crucial competitive advantage by leveraging these expert insights. Download the full PESTLE analysis now and unlock actionable intelligence to inform your decisions.

Political factors

Government policies significantly shape DMC Global's operating landscape, particularly within the energy, industrial, and infrastructure sectors. Changes in energy regulations, such as those promoting or restricting fossil fuels, directly affect demand for DMC's specialized products used in these industries. For instance, increased government investment in renewable energy infrastructure, like wind or solar farms, could boost demand for DMC's components, while a pivot away from traditional energy sources might temper it.

Infrastructure spending initiatives are a critical driver for DMC Global. In 2024, many governments, including the United States with its Bipartisan Infrastructure Law, are allocating substantial funds to modernize roads, bridges, and energy grids. This focus on infrastructure development creates direct opportunities for DMC's engineered products, which are essential for these large-scale projects. The pace and scale of these government-backed projects directly correlate with DMC's revenue potential in these segments.

Global trade policies, including tariffs and trade agreements, significantly influence DMC Global's supply chain and pricing. As an international operator with a worldwide customer base, import/export duties and trade disputes can directly impact costs and competitiveness. For instance, the ongoing evolution of U.S. tariff policies and reciprocal measures by other nations are closely monitored by DMC Global, as these can affect the cost of raw materials and finished goods.

Geopolitical instability, particularly in regions vital for energy and industrial material sourcing, poses significant risks to DMC Global. For instance, ongoing conflicts in Eastern Europe and the Middle East, which are key areas for energy markets, can lead to volatile commodity prices and supply chain disruptions. These events directly impact DMC Global's ability to secure raw materials and deliver products efficiently, potentially increasing operational costs and affecting market demand for their specialized products.

Political Stability in Operating Regions

Political stability in Germany and the United States, where DMC Global's DynaEnergetics operates manufacturing facilities, is paramount. Instability in these regions could trigger policy shifts or economic disruptions impacting operations. For example, the U.S. experienced a 2.2% GDP growth in Q1 2024, indicating a generally stable economic environment, while Germany’s manufacturing PMI stood at 44.3 in April 2024, suggesting some headwinds but not outright political instability impacting core operations.

DMC Global's reliance on these established economies means they are exposed to potential regulatory changes or geopolitical events that could affect supply chains or market access. While both countries generally offer stable political frameworks, shifts in government or policy priorities can still introduce operational risks. For instance, ongoing trade policy discussions between the US and other nations could indirectly influence raw material costs or export opportunities for DMC Global's products.

- Germany's political landscape remains largely stable, contributing to a predictable business environment for DynaEnergetics' manufacturing.

- The United States, despite its dynamic political climate, generally provides a robust legal and economic framework for industrial operations.

- Potential policy shifts in either nation, particularly concerning trade, environmental regulations, or industrial incentives, could impact DMC Global's cost structure and market competitiveness.

Government Support for Industrial Sectors

Government support for industrial sectors, particularly those aligned with DMC Global's focus like advanced manufacturing and energy efficiency, can significantly impact its competitive positioning. For instance, the U.S. government's Inflation Reduction Act (IRA) of 2022, with its substantial tax credits and incentives for clean energy and manufacturing, directly benefits companies involved in these areas. This can translate into new market opportunities and cost advantages for DMC Global if its products and services align with IRA-supported initiatives.

Conversely, shifts in government priorities or a reduction in subsidies could present challenges. For example, if a key market for DMC Global's products experiences a rollback of environmental regulations or a decrease in funding for infrastructure projects that utilize its materials, it could dampen demand. Understanding the longevity and scope of these support programs is crucial for strategic planning.

Key government initiatives relevant to DMC Global's sectors include:

- U.S. Infrastructure Investment and Jobs Act (2021): Allocating over $1 trillion to modernize infrastructure, potentially boosting demand for DMC Global's specialized materials used in construction and transportation.

- European Green Deal: Aiming for climate neutrality by 2050, driving investment in energy-efficient technologies and sustainable manufacturing processes, which DMC Global is positioned to support.

- National Manufacturing Strategies: Various countries are implementing strategies to reshore manufacturing and enhance domestic production capabilities, which could create opportunities for suppliers like DMC Global.

Government policies directly influence DMC Global's operational environment, particularly in the energy and industrial sectors. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 with over $1 trillion allocated, drives demand for DMC's engineered materials in infrastructure projects. Changes in energy regulations, such as those favoring renewables or restricting fossil fuels, also significantly impact market dynamics for their products.

Trade policies, including tariffs and international agreements, affect DMC Global's supply chain costs and market access. Geopolitical instability, as seen in ongoing conflicts impacting energy markets, can lead to volatile raw material prices and supply chain disruptions, directly influencing DMC's operational efficiency and profitability. Political stability in key operating regions like Germany and the United States provides a generally predictable framework, though policy shifts remain a factor.

| Country | Relevant Policy/Initiative | Impact on DMC Global |

|---|---|---|

| United States | Bipartisan Infrastructure Law (2021) | Increased demand for infrastructure-related products. |

| United States | Inflation Reduction Act (2022) | Potential benefits for clean energy and manufacturing components. |

| Germany | European Green Deal | Opportunities in energy-efficient technologies and sustainable manufacturing. |

| Global | Trade Policy Shifts (e.g., tariffs) | Impacts supply chain costs and competitiveness. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting DMC Global across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within DMC Global's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy.

Economic factors

DMC Global's fortunes are intrinsically linked to the health of the global economy, especially within its key markets of energy, industrial, and infrastructure development. When the world economy is robust, demand for DMC's specialized products and services typically rises, fueling sales and project pipelines.

Conversely, economic downturns can temper this demand, leading to potential sales contractions and project postponements. For instance, a global GDP growth forecast of 2.8% for 2024, projected by the IMF, indicates a generally supportive environment, although regional variations will be significant.

Looking ahead to 2025, projections point to continued expansion in critical sectors like energy, power generation, and infrastructure, which bodes well for DMC Global. The International Energy Agency (IEA) anticipates substantial investment in clean energy infrastructure, a key area for DMC's offerings.

Energy market volatility, particularly in crude oil and natural gas, directly influences DMC Global's DynaEnergetics segment. For instance, in Q1 2024, West Texas Intermediate (WTI) crude oil prices averaged around $78 per barrel, a level that generally supports drilling activity but can still face downward pressure from global supply dynamics.

When oil prices decline, such as the drop seen in late 2023, it often translates to decreased demand for oilfield services and equipment, impacting DynaEnergetics' revenue and margins. Conversely, sustained higher prices can boost demand, but also introduce cost inflation for raw materials used in their products.

Interest rate fluctuations directly impact DMC Global's borrowing costs and its customers' ability to finance purchases, influencing capital expenditure and market demand. For instance, a rising interest rate environment, such as the Federal Reserve's continued monetary tightening through 2024, can increase the cost of capital for new projects and dampen consumer spending, particularly in interest-sensitive sectors like construction.

Higher borrowing costs can also translate to weaker demand for DMC Global's products, especially in markets like high-end residential construction where financing plays a crucial role. As of early 2025, mortgage rates remain elevated compared to historical averages, a factor that continues to pressure demand in the residential building sector, a key market for some of DMC Global's offerings.

Inflation and Raw Material Costs

Inflationary pressures directly impact DMC Global by increasing the cost of raw materials and overall operational expenses, which can squeeze profit margins. For instance, a significant rise in global inflation throughout 2023 and into early 2024 has been a persistent concern for manufacturers.

Businesses within DMC Global, particularly those in its Arcadia segment, are highly susceptible to these material cost fluctuations. Aluminum prices, a key input for Arcadia's products, have seen volatility. For example, the London Metal Exchange (LME) aluminum price averaged around $2,200 per metric ton in the first half of 2024, a notable increase from the previous year, directly affecting Arcadia's cost of goods sold.

- Rising aluminum costs: LME aluminum prices averaged approximately $2,200/metric ton in H1 2024, impacting Arcadia's production expenses.

- Operational expense increases: General inflation has driven up costs for energy, labor, and transportation for DMC Global's manufacturing facilities.

- Margin pressure: The inability to fully pass on increased raw material and operational costs to customers can lead to reduced profitability for the company.

Construction and Infrastructure Spending Trends

The construction industry's vitality is a direct driver for DMC Global. In 2024, the U.S. construction spending was projected to reach $1.99 trillion, a slight increase from 2023, signaling continued demand for building products. Infrastructure spending, boosted by initiatives like the Infrastructure Investment and Jobs Act, is a particularly strong tailwind for companies like DMC Global.

Specifically, residential construction starts in the U.S. saw a notable uptick in early 2024, with housing starts reaching a seasonally adjusted annual rate of 1.37 million units in March 2024, up from 1.32 million in February. This growth directly translates to increased demand for Arcadia's architectural products. Similarly, commercial construction and major infrastructure projects, such as transportation and energy, will continue to fuel the need for NobelClad's composite metal solutions.

- Residential Construction Growth: U.S. housing starts averaged 1.35 million units in the first quarter of 2024, indicating a healthy market for building materials.

- Infrastructure Investment: The Infrastructure Investment and Jobs Act, enacted in 2021, continues to allocate significant funds to projects, benefiting companies supplying specialized materials.

- Commercial Sector Recovery: Non-residential construction spending showed resilience in early 2024, supporting demand for advanced architectural products.

- Material Demand: Increased activity in these sectors directly correlates with higher demand for DMC Global's core product offerings.

The global economic outlook for 2024 and 2025 presents a mixed but generally supportive backdrop for DMC Global. While global GDP growth is projected to be moderate, specific sector expansions, particularly in energy infrastructure and construction, are expected to drive demand for DMC's specialized products.

Energy market dynamics, especially oil prices, directly influence DMC's DynaEnergetics segment. For example, WTI crude oil prices averaging around $78 per barrel in Q1 2024 support drilling activity, but volatility remains a key factor.

Inflationary pressures and interest rate environments continue to shape operational costs and customer financing. Rising aluminum costs, with LME prices averaging $2,200/metric ton in H1 2024, directly impact DMC's Arcadia segment, while elevated mortgage rates in early 2025 affect residential construction demand.

The construction sector, a significant market for DMC, shows positive trends. U.S. construction spending was projected to reach $1.99 trillion in 2024, with housing starts in early 2024 at a seasonally adjusted annual rate of 1.37 million units, indicating robust demand for building materials.

| Economic Factor | 2024 Projection/Data | 2025 Outlook | Impact on DMC Global |

| Global GDP Growth | IMF projects 2.8% for 2024 | Continued moderate expansion | Supports overall demand for DMC's products |

| WTI Crude Oil Price | Averaged ~$78/barrel in Q1 2024 | Subject to global supply dynamics | Influences DynaEnergetics segment activity |

| LME Aluminum Price | Averaged ~$2,200/metric ton in H1 2024 | Continued volatility expected | Impacts Arcadia's raw material costs |

| US Housing Starts | 1.37 million units (SAAR) in March 2024 | Expected to remain active | Drives demand for Arcadia's architectural products |

| Interest Rates | Federal Reserve tightening through 2024 | Rates remain elevated in early 2025 | Affects customer financing and project investment |

Same Document Delivered

DMC Global PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive DMC Global PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping DMC Global's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It's a complete analysis designed for informed decision-making.

Sociological factors

DMC Global's reliance on specialized manufacturing means a skilled workforce is paramount. In 2024, the U.S. Bureau of Labor Statistics reported a projected shortage of skilled tradespeople, a trend that could directly affect companies like DMC Global. An aging workforce, with many experienced technicians nearing retirement, further exacerbates this challenge, potentially impacting operational efficiency.

The company's commitment to a safe and supportive work environment is a strategic advantage in attracting and retaining talent amidst these demographic shifts. As of early 2025, DMC Global continues to invest in training and development programs to bridge skill gaps and ensure a pipeline of qualified employees for its advanced manufacturing operations.

Societal expectations are increasingly prioritizing workplace safety and worker welfare, directly impacting operational practices and compliance costs for companies like DMC Global. This growing emphasis means businesses must invest more in safety protocols and employee well-being programs. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a slight increase in workplace injury rates, underscoring the continued societal demand for robust safety measures.

DMC Global demonstrates its commitment to this by maintaining policies that foster a safe, healthy, and productive work environment, including strict guidelines against illegal substances. This proactive approach not only aligns with societal values but also helps mitigate risks associated with accidents and employee misconduct, potentially reducing insurance premiums and legal liabilities in the long run.

Societal expectations around corporate social responsibility (CSR) and sustainability are increasingly shaping business landscapes. Consumers and investors alike are scrutinizing companies' environmental, social, and governance (ESG) performance. For DMC Global, this translates into a need to demonstrably integrate sustainable practices into their operations, as public perception and purchasing decisions are directly influenced by these factors.

DMC Global's commitment is evident in its annual sustainability reports, which detail their efforts in managing environmental resources and upholding ethical business conduct. These reports, like the one released in 2024 covering 2023 performance, provide tangible data on their progress, such as a reported 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline.

Consumer Preferences in Building and Design

Consumer preferences are increasingly shaping the building and design landscape, directly impacting companies like Arcadia. There's a pronounced shift towards sustainable building materials and energy-efficient designs, which fuels demand for products that align with these values. This trend is evident in the growing market for green building certifications and retrofitting projects.

Arcadia's product development is clearly influenced by this demand, with a strong emphasis on environmental sustainability. Their product offerings often incorporate features like recycled aluminum content, reflecting a commitment to reducing environmental impact. This focus on eco-friendly materials is becoming a significant differentiator in the architectural products market.

- Growing Demand for Sustainable Materials: The global green building materials market was valued at approximately USD 280 billion in 2023 and is projected to reach over USD 500 billion by 2030, indicating a strong consumer preference for environmentally conscious options.

- Energy Efficiency as a Key Driver: Consumers and regulatory bodies alike are prioritizing energy efficiency in buildings, leading to increased demand for advanced window and facade systems that minimize energy loss.

- Aesthetic Preferences Evolving: Beyond sustainability, consumers also favor modern, minimalist aesthetics and customizable design solutions, pushing manufacturers to innovate in material finishes and structural capabilities.

Community Relations and Local Impact

DMC Global's commitment to fostering strong community ties is crucial for its social license to operate and ensures seamless business activities. By actively engaging with local populations and addressing concerns related to environmental stewardship and job creation, the company aims to cultivate positive relationships and build trust.

In 2023, DMC Global reported that its manufacturing facilities contributed to local economies through direct employment and support for local suppliers. For instance, their operations in North America supported approximately 1,500 jobs, with a significant portion being local hires, underscoring their role as a community partner.

- Community Investment: DMC Global's initiatives often include local sponsorships and educational programs, aiming to enhance the quality of life in the areas where they operate.

- Environmental Stewardship: Proactive communication and collaboration with communities on environmental matters, such as emissions control and waste management, are key to maintaining goodwill.

- Local Employment: A focus on hiring from local talent pools not only provides economic opportunities but also strengthens the company's integration into the community fabric.

Societal shifts toward valuing skilled labor and worker well-being directly impact DMC Global's operational capacity and talent acquisition strategies. The projected shortage of skilled tradespeople in the U.S. for 2024, as noted by the Bureau of Labor Statistics, highlights the critical need for robust training programs to address potential skill gaps and an aging workforce.

Companies like DMC Global are increasingly expected to prioritize corporate social responsibility and sustainable practices, influencing consumer and investor decisions. Demonstrating commitment through transparent reporting, such as DMC Global's 2024 sustainability report detailing a 15% reduction in Scope 1 and 2 emissions from a 2020 baseline, is vital for maintaining a positive public image and market standing.

Strong community engagement is essential for DMC Global's social license to operate, fostering trust through local employment and environmental responsibility. The company's 2023 operations supported approximately 1,500 jobs in North America, with a significant portion being local hires, reinforcing its role as a community partner.

| Sociological Factor | Impact on DMC Global | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Skilled Workforce Demand | Talent acquisition and retention challenges | Projected shortage of skilled tradespeople (BLS, 2024) |

| Workplace Safety & Welfare | Increased investment in safety protocols and employee well-being | Slight increase in workplace injury rates (BLS, 2024) |

| Corporate Social Responsibility (CSR) | Pressure to adopt sustainable practices and transparent reporting | 15% reduction in Scope 1 & 2 GHG emissions (DMC Global Sustainability Report, 2024) |

| Community Relations | Importance of local employment and environmental stewardship | Supported ~1,500 local jobs in North America (DMC Global, 2023) |

Technological factors

Technological advancements in energy exploration and production, especially in drilling and well completion, are fundamental to DynaEnergetics' operations. Innovations in perforating systems and associated hardware are key to staying ahead in the market.

DynaEnergetics has responded by launching its next-generation perforating systems and successfully completing automation projects, demonstrating a commitment to technological leadership. For instance, the company's focus on advanced perforating technology aims to enhance efficiency and yield in oil and gas extraction.

DMC Global's manufacturing operations are increasingly benefiting from technological advancements, particularly in automation. These technologies are key to boosting production efficiency and lowering operational expenses across its diverse business segments.

At DynaEnergetics, a subsidiary of DMC Global, automation is a strategic focus. Initiatives here are designed to directly increase production capacity and streamline the assembly process, ensuring faster turnaround times and higher output volumes.

For instance, investments in automated machinery and robotics in 2024 are projected to enhance product quality and consistency, a critical factor in the competitive energy services market. This focus on advanced manufacturing directly supports DMC Global's goal of maintaining a competitive edge through operational excellence.

Innovations in material science directly impact DMC Global's NobelClad and Arcadia segments. For NobelClad, advancements in composite metal solutions can lead to stronger, lighter, and more corrosion-resistant clad materials, potentially opening new markets in aerospace and defense. Arcadia's architectural products benefit from new glazing technologies or sustainable material formulations, enhancing energy efficiency and aesthetic appeal in buildings.

Digitalization and Data Analytics

Digitalization and data analytics are transforming how companies like DMC Global operate. By leveraging these technologies, DMC can enhance decision-making across its operations, from manufacturing to supply chain logistics. For instance, predictive maintenance, powered by data analytics, can significantly reduce downtime and associated costs in their manufacturing facilities.

The integration of AI-driven energy management systems, a key aspect of digitalization, is particularly relevant for the infrastructure market where DMC Global has a presence. This technology allows for more efficient energy consumption, leading to cost savings and a reduced environmental footprint. In 2024, the global market for AI in energy management was projected to reach over $10 billion, highlighting the significant opportunities for companies adopting these solutions.

- Improved Operational Efficiency: Data analytics enables real-time monitoring and optimization of production processes, potentially boosting output by 10-15% based on industry benchmarks.

- Enhanced Supply Chain Visibility: Digital tools provide end-to-end tracking, allowing for better inventory management and reduced logistics costs. Companies often see a 5-10% reduction in supply chain expenses through advanced analytics.

- Predictive Maintenance: Implementing AI for equipment monitoring can decrease unexpected breakdowns by up to 30%, minimizing costly repairs and production interruptions.

- Customer Relationship Management: Digital platforms and data analysis help personalize customer interactions and improve service delivery, potentially increasing customer retention rates by 5-20%.

Research and Development Investment

DMC Global's dedication to research and development (R&D) is a cornerstone of its strategy, enabling the creation of innovative and distinct products. This focus is vital for staying ahead in dynamic markets and solidifying its leadership. For instance, in fiscal year 2023, DMC Global reported R&D expenses of $27.1 million, a slight increase from $26.5 million in 2022, underscoring their ongoing commitment to technological advancement.

This investment fuels the development of next-generation solutions designed to address emerging customer requirements and environmental regulations. The company's R&D efforts are particularly concentrated on areas like advanced materials and sustainable technologies, aiming to provide higher-value offerings.

- Product Innovation: R&D drives the creation of new products, such as specialized explosives for mining and construction, and advanced materials for industrial applications.

- Market Differentiation: Investment in R&D allows DMC Global to offer unique solutions that set it apart from competitors.

- Future Growth: Continued R&D spending is essential for anticipating market shifts and developing technologies that will define future industry standards.

Technological advancements are a significant driver for DMC Global, particularly in enhancing operational efficiency and product innovation. The company's strategic investments in automation and digitalization are key to achieving these goals. For example, in 2024, DMC Global continued to integrate advanced manufacturing technologies, aiming to boost production capacity and reduce operational costs across its segments.

DMC Global's subsidiary, DynaEnergetics, is at the forefront of adopting new technologies in perforating systems, crucial for the oil and gas sector. Their focus on next-generation systems and automation projects underscores a commitment to technological leadership and improved performance in energy extraction. This technological push is expected to yield greater efficiency and output in their operations.

The company’s commitment to R&D, evidenced by $27.1 million invested in fiscal year 2023, fuels product innovation and market differentiation. These investments are directed towards advanced materials and sustainable technologies, ensuring DMC Global remains competitive and responsive to evolving market demands and environmental regulations.

| Area of Technology | Impact on DMC Global | Key Initiatives/Data |

|---|---|---|

| Automation & Robotics | Increased production efficiency, reduced costs, enhanced product quality | Investments in automated machinery and robotics in 2024; Automation projects at DynaEnergetics |

| Digitalization & Data Analytics | Improved decision-making, predictive maintenance, enhanced supply chain visibility | AI-driven energy management systems; Predictive maintenance to reduce downtime |

| Material Science | Development of stronger, lighter, more corrosion-resistant materials; New glazing technologies | NobelClad composite metal solutions; Arcadia architectural products |

| Research & Development (R&D) | Product innovation, market differentiation, future growth | $27.1 million invested in FY2023; Focus on advanced materials and sustainable technologies |

Legal factors

DMC Global operates within a stringent environmental regulatory landscape, impacting its manufacturing and product life cycles. Compliance with laws governing hazardous waste, emissions, and energy usage is a critical legal factor, with significant financial implications for adherence and potential penalties for non-compliance. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and Resource Conservation and Recovery Act (RCRA), which directly affect industrial operations.

DMC Global must strictly adhere to occupational health and safety regulations, especially given its industrial and energy sector involvements. These rules are designed to safeguard workers and minimize workplace incidents. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a total recordable case rate of 2.7 per 100 full-time workers in manufacturing, highlighting the ongoing focus on safety performance.

DMC Global faces significant legal obligations concerning product liability, requiring adherence to stringent quality standards for its engineered components. Failure to meet these standards can result in costly lawsuits, damage to brand reputation, and substantial financial penalties, impacting overall profitability and market standing.

In 2024, the global product liability market continued to see substantial claims, with sectors like manufacturing and engineering being particularly susceptible. Companies like DMC Global must invest in robust quality control processes and comprehensive product testing to mitigate risks associated with potential defects, which could otherwise lead to significant legal liabilities and operational disruptions.

International Trade Laws and Sanctions

DMC Global, with its worldwide reach, must meticulously adhere to international trade regulations, which include a complex web of sanctions and export controls. Failure to comply can lead to substantial penalties, impacting both financial performance and operational continuity.

The evolving geopolitical landscape directly influences these trade laws. For instance, in 2024, many nations continue to implement or adjust sanctions regimes, affecting supply chains and market access for companies like DMC Global. Staying abreast of these changes is critical for risk mitigation.

- Sanctions Compliance: DMC Global must monitor and comply with sanctions imposed by major economic blocs, such as the US, EU, and UN, which can restrict trade with specific countries or entities.

- Export Controls: Adherence to export control laws, which govern the transfer of certain goods, technologies, and software, is paramount to avoid legal entanglements.

- Trade Agreements: Navigating various international trade agreements and tariffs can influence the cost and feasibility of international transactions for DMC Global's products.

Contract Law and Business Agreements

DMC Global's operations heavily rely on a robust framework of contracts with its diverse stakeholders, including suppliers, customers, and strategic partners. Maintaining strict adherence to contract law is paramount for ensuring legal stability and proactively mitigating potential disputes that could disrupt business continuity.

Effective management of these business agreements, such as the specific Arcadia put/call obligation, is critical. For instance, in 2024, companies across industries faced increased scrutiny on contractual compliance following a rise in supply chain disruptions, highlighting the need for meticulous agreement oversight.

- Supplier Agreements: Ensuring favorable terms and reliable delivery schedules for raw materials and components.

- Customer Contracts: Defining product specifications, pricing, delivery timelines, and payment terms for manufactured goods.

- Partnership Agreements: Outlining responsibilities, profit-sharing, and intellectual property rights in joint ventures or collaborations.

- Arcadia Put/Call Obligation: Managing specific contractual commitments that could impact financial obligations or ownership structures.

DMC Global must navigate a complex web of global trade regulations, including sanctions and export controls, which significantly impact its international operations and supply chains. In 2024, the dynamic geopolitical climate led to ongoing adjustments in these laws, necessitating constant vigilance to avoid penalties and maintain market access.

Compliance with environmental laws, such as the Clean Air Act and RCRA, remains a critical legal factor for DMC Global's manufacturing activities. The U.S. EPA's continued enforcement in 2024 underscores the financial implications of adherence and the risks associated with non-compliance, directly affecting industrial operations.

The company is also bound by stringent occupational health and safety regulations, vital for protecting its workforce in industrial settings. The U.S. Bureau of Labor Statistics reported a 2.7 recordable case rate per 100 full-time workers in manufacturing in 2024, highlighting the ongoing industry focus on safety performance and compliance.

Product liability laws demand rigorous quality standards for DMC Global's engineered components, as failure can lead to costly lawsuits and reputational damage. The persistent trend of substantial product liability claims in 2024, particularly in manufacturing, emphasizes the need for robust quality control and testing to mitigate legal exposure.

| Legal Factor | Relevance to DMC Global | 2024/2025 Data/Trend |

| Environmental Regulations | Compliance with emissions, waste, and energy laws. | Continued EPA enforcement of Clean Air Act, RCRA. |

| Occupational Health & Safety | Ensuring worker safety in industrial operations. | Manufacturing recordable case rate: 2.7 per 100 workers (BLS, 2024). |

| Product Liability | Maintaining high quality standards for engineered components. | Ongoing substantial claims in manufacturing sectors. |

| International Trade & Sanctions | Adherence to export controls and sanctions regimes. | Geopolitical shifts influencing sanctions and trade agreements. |

| Contract Law | Managing agreements with suppliers, customers, and partners. | Increased scrutiny on contractual compliance amid supply chain disruptions. |

Environmental factors

The intensifying global commitment to addressing climate change is significantly reshaping the energy and industrial landscapes that DMC Global operates within. This shift is creating a dual effect: it's spurring demand for innovative, cleaner technologies and sustainable solutions, which presents opportunities for companies offering such products.

Conversely, this transition poses inherent risks for businesses with substantial dependencies on fossil fuels, potentially leading to stranded assets or reduced market share. For instance, the International Energy Agency reported in 2024 that global renewable energy capacity additions are projected to surge by over 30% by 2025 compared to 2024, highlighting the accelerating shift away from traditional energy sources.

DMC Global's reliance on key materials like aluminum for its Arcadia business segment directly exposes it to the challenges of resource scarcity. The global aluminum market, for instance, saw prices fluctuate significantly in 2024, driven by supply chain disruptions and increasing demand from sectors like electric vehicles. This volatility impacts production costs and the company's ability to secure necessary inputs at predictable prices.

DMC Global's manufacturing processes inherently create waste and emissions, making effective waste management and pollution control crucial. Compliance with stringent environmental regulations is paramount, and minimizing ecological impact is a key operational consideration. For instance, the company's subsidiary, Arcadia, is actively involved in hazardous waste recycling, demonstrating a commitment to sustainable practices.

Water Usage and Management

Industrial operations, including those within sectors relevant to DMC Global, frequently depend on substantial water resources for manufacturing processes, cooling, and sanitation. The availability and cost of water are therefore critical operational considerations.

Increasingly stringent environmental regulations and growing societal demand for water conservation are compelling companies to adopt more responsible water management practices. This can directly influence operational expenditures through investments in water-efficient technologies and compliance measures.

For instance, in 2024, many regions experienced heightened scrutiny over industrial water usage due to drought conditions. Companies are facing pressure to demonstrate sustainable water sourcing and wastewater treatment, potentially leading to increased capital expenditure for infrastructure upgrades. By 2025, it's projected that water scarcity will become an even more significant factor in operational planning for many industries.

- Water Intensity: Many manufacturing processes are inherently water-intensive, impacting operational costs.

- Regulatory Compliance: Evolving water quality and usage regulations necessitate ongoing investment in treatment and monitoring.

- Societal Expectations: Public perception and corporate social responsibility initiatives drive demand for water stewardship.

- Resource Availability: Geographic location and local water stress levels can significantly affect water access and cost.

Transition to Renewable Energy and Green Infrastructure

The global push for renewable energy, including solar and wind power, is accelerating. In 2024, renewable energy sources are projected to account for over 30% of global electricity generation, a significant increase from previous years. This shift necessitates substantial investment in green infrastructure, such as advanced grid systems and energy storage solutions. DMC Global's expertise in specialized materials and components positions them to capitalize on this trend by supplying essential products for these developing sectors.

The increasing demand for sustainable building materials and energy-efficient solutions offers a direct avenue for growth. For instance, the global green building materials market was valued at over $250 billion in 2023 and is expected to grow at a compound annual growth rate of approximately 9% through 2030. DMC Global can leverage its product portfolio to meet the requirements of these environmentally conscious construction projects, potentially enhancing their market share.

- Market Growth: The global renewable energy market is projected to reach over $2 trillion by 2030, driven by policy support and technological advancements.

- Infrastructure Investment: Significant government and private sector funding is being allocated to green infrastructure, including smart grids and electric vehicle charging networks.

- Material Demand: The transition creates demand for specialized materials in solar panel manufacturing, wind turbine components, and energy-efficient building envelopes.

- Adaptation Opportunity: DMC Global's ability to innovate and adapt its product offerings to these evolving market needs is crucial for future success.

The accelerating global shift towards sustainability and decarbonization is a defining environmental factor for DMC Global. This trend is driving demand for cleaner technologies and materials, as evidenced by the projected 30% surge in renewable energy capacity additions by 2025 compared to 2024, according to the International Energy Agency.

DMC Global's operations, particularly its reliance on aluminum for Arcadia, are directly impacted by resource availability and price volatility, with the aluminum market experiencing significant fluctuations in 2024 due to supply chain issues and rising EV demand.

Furthermore, stringent environmental regulations regarding waste management and emissions necessitate ongoing investment in compliance and pollution control, a factor highlighted by Arcadia's involvement in hazardous waste recycling.

Water scarcity and conservation efforts are also critical, with industrial water usage facing increased scrutiny in 2024 due to drought conditions, potentially increasing operational expenditures for companies like DMC Global.

| Environmental Factor | Impact on DMC Global | Supporting Data/Trend |

|---|---|---|

| Climate Change & Decarbonization | Opportunity for clean tech/materials; Risk for fossil fuel dependency | Renewable energy capacity additions projected to grow over 30% by 2025 (IEA, 2024) |

| Resource Scarcity & Volatility | Increased production costs and supply chain risk | Aluminum market prices fluctuated significantly in 2024 |

| Environmental Regulations | Need for investment in compliance and sustainable practices | Arcadia involved in hazardous waste recycling |

| Water Management | Potential increase in operational costs and capital expenditure | Heightened scrutiny on industrial water usage in 2024 due to droughts |

PESTLE Analysis Data Sources

Our DMC Global PESTLE Analysis is built upon a robust foundation of data sourced from reputable international organizations, government statistical agencies, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting global markets.