DMC Global Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMC Global Bundle

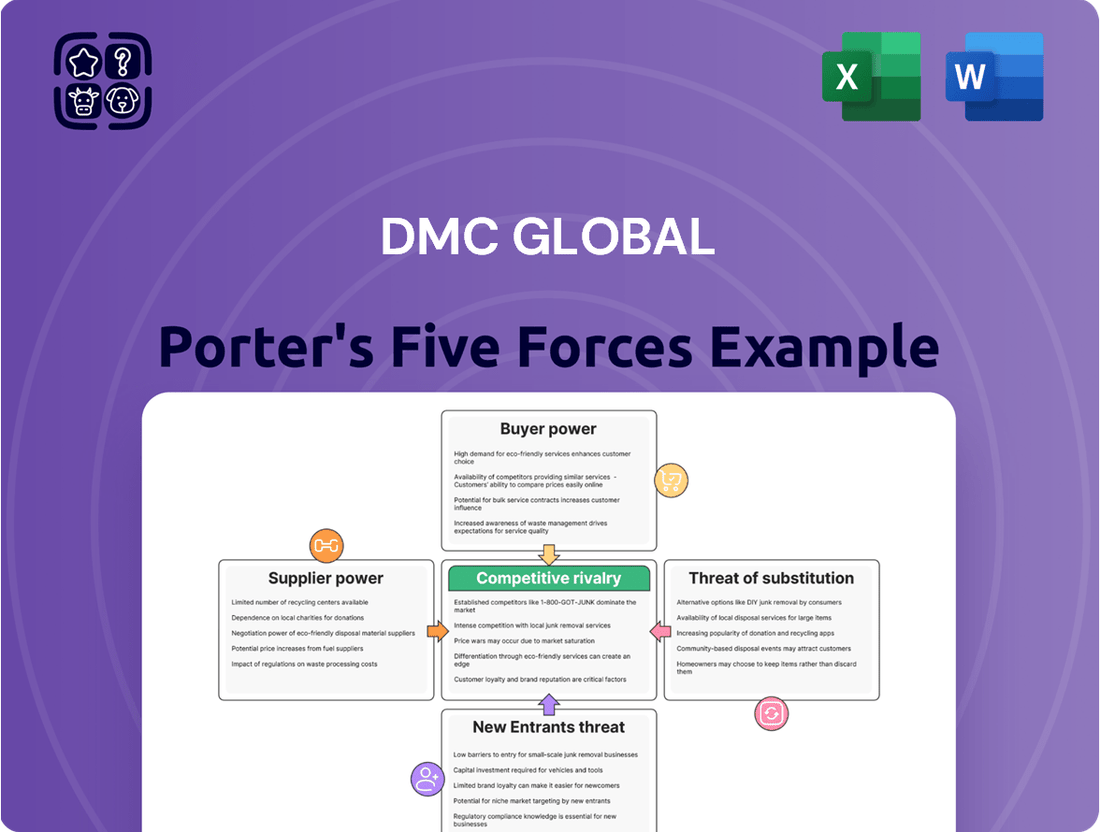

DMC Global faces moderate buyer power, with customers seeking value but often locked into specific solutions. The threat of substitutes is also present, though significant switching costs can mitigate this for some offerings. Understanding these pressures is crucial for strategic planning.

The full Porter's Five Forces Analysis reveals the real forces shaping DMC Global’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration can significantly impact DMC Global's bargaining power. For instance, the NobelClad segment relies on aluminum, and if only a few suppliers can provide this critical raw material, those suppliers gain leverage. Limited alternatives for specialized components further amplify this supplier power.

DMC Global mitigates this risk by sourcing aluminum from several major suppliers, indicating that raw materials are generally available from numerous sources. This diversified sourcing strategy helps prevent any single supplier from wielding excessive influence over pricing or supply availability.

The bargaining power of suppliers for DMC Global is significantly influenced by switching costs. For specialized products and services, these costs can be substantial, encompassing the expense and effort of qualifying new suppliers, the risk of supply chain disruptions, and the potential need to re-engineer existing processes. These factors collectively enhance a supplier's leverage.

For instance, in 2023, DMC Global reported that its cost of goods sold was $886.8 million, highlighting the critical nature of its raw material sourcing. The company's stated strategy to proactively manage raw material availability and pricing underscores its awareness of these supplier-related switching costs and the importance of maintaining stable supplier relationships.

If suppliers offer highly differentiated or proprietary products that are crucial for DMC Global's unique engineered solutions, their bargaining power would be significant. This is especially true for specialized components used in DynaEnergetics' energetic solutions or NobelClad's explosion-welded clad metal plates, where unique inputs are often sought.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into DMC Global's industry is a key factor in assessing their bargaining power. If a supplier possesses the capability and resources to directly manufacture the specialized products or services that DMC Global offers, they could effectively become a competitor. This scenario would significantly shift the power balance, as suppliers would no longer be solely reliant on DMC Global as a customer.

However, in highly specialized engineering and manufacturing sectors, like those DMC Global operates in, the barriers to entry for forward integration are typically substantial. These barriers often include significant capital investment requirements for advanced manufacturing facilities and the need for deep technical expertise and proprietary knowledge. For instance, companies in the advanced materials or specialized component manufacturing space often face lengthy development cycles and rigorous quality control standards that deter casual entry.

- High Capital Investment: Establishing advanced manufacturing capabilities comparable to DMC Global's often requires hundreds of millions of dollars in upfront investment.

- Technical Expertise Gap: Suppliers may lack the specific engineering know-how and patents necessary to replicate DMC Global's specialized product offerings.

- Market Access & Distribution: Entering DMC Global's established customer base and distribution networks presents a significant hurdle for potential integrating suppliers.

Importance of DMC Global to Supplier

The bargaining power of suppliers is a critical factor in understanding DMC Global's competitive landscape. When a company like DMC Global is a minor customer for its suppliers, those suppliers gain leverage. This means suppliers might be less motivated to provide competitive pricing or favorable contract terms, potentially increasing DMC Global's input costs.

However, DMC Global's extensive global reach and specific material requirements often make it a significant client for its key suppliers. This substantial business volume can shift the power dynamic, giving DMC Global more influence in negotiations. For instance, in 2024, the demand for specialized materials in industries served by DMC Global, such as energy and infrastructure, remained robust, suggesting that key suppliers would value DMC Global's consistent orders.

- Supplier Dependence: The degree to which suppliers rely on DMC Global for their revenue directly impacts their bargaining power. A supplier with a diversified customer base has less incentive to accommodate DMC Global's demands.

- Customer Concentration: Conversely, if DMC Global represents a large percentage of a supplier's sales, DMC Global can leverage this to negotiate better terms.

- DMC Global's Purchasing Volume: As a global entity, DMC Global likely commands significant purchasing volume for specialized components and raw materials, which can mitigate supplier power.

DMC Global's reliance on specialized inputs means suppliers of these unique materials or components can wield significant bargaining power. This is particularly true if these suppliers have few other customers for their highly specific offerings, as their dependence on DMC Global increases their leverage.

Switching costs for specialized products are a major factor, as re-qualifying suppliers or re-engineering processes can be both time-consuming and expensive. For example, if a key supplier for NobelClad's clad metal plates provides a proprietary alloy, the cost and complexity of finding and integrating an alternative supplier would be substantial, strengthening the original supplier's position.

The threat of forward integration by suppliers is generally low for DMC Global due to high capital requirements and specialized technical expertise needed in its manufacturing processes. However, if a supplier were to develop unique capabilities, this could shift the power balance.

DMC Global's purchasing volume is a key mitigator of supplier power. As a significant customer for many of its suppliers, the company can leverage its order volume to negotiate favorable terms. In 2024, the continued demand in sectors like energy infrastructure likely solidified DMC Global's position as a valuable client for its key material providers.

| Factor | Impact on DMC Global | Mitigating Factors for DMC Global |

| Supplier Concentration | High if few suppliers for critical inputs | Diversified sourcing for key materials like aluminum |

| Switching Costs | High for specialized components and materials | Proactive management of raw material availability and pricing |

| Product Differentiation | Significant if suppliers offer proprietary or crucial inputs | Focus on unique engineered solutions |

| Forward Integration Threat | Generally low due to high barriers | Substantial capital investment and technical expertise required |

| Customer Dependence | Low if DMC Global is a minor customer; High if a major customer | DMC Global's significant purchasing volume provides leverage |

What is included in the product

This analysis delves into the competitive intensity within DMC Global's markets, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the overall industry rivalry.

Instantly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force, allowing for proactive strategy adjustments.

Customers Bargaining Power

Customer concentration significantly impacts bargaining power. If DMC Global relies heavily on a few major clients, those customers gain leverage to negotiate better pricing or terms. This is particularly relevant in sectors like oil and gas, where large, established companies often hold substantial sway.

While DMC Global operates across various industries, its key clients within the energy, industrial, and infrastructure markets could potentially exert considerable pressure. For instance, if a single major energy producer represents a substantial percentage of DMC Global's sales, that customer could demand concessions, impacting DMC Global's profitability.

The costs customers face when switching from DMC Global's engineered products and services to a competitor directly impact their bargaining power. If these switching costs are minimal, customers have the freedom to easily shift to alternatives, thereby amplifying their leverage over DMC Global.

DMC Global's strategy appears to focus on increasing these switching costs by providing highly customized solutions and solidifying its leadership in specialized market segments. This approach aims to make it more difficult and potentially more expensive for customers to transition to other suppliers.

Customers in the energy, industrial, and infrastructure sectors often exhibit significant price sensitivity. This is especially true in markets driven by commodities or during periods of economic slowdown, where cost savings become a top priority, thereby amplifying their bargaining power.

DMC Global's performance in 2024 has reflected this customer behavior. For instance, the company's financial reports indicated that lower pricing within North American energy markets, coupled with subdued demand in specific construction sectors, directly impacted its revenues and profitability, underscoring the direct correlation between customer price sensitivity and the company's financial outcomes.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they start producing DMC Global's specialized products themselves, can significantly boost their bargaining power. This is particularly true for very large customers who possess the financial muscle and technical know-how to bring production in-house. However, the highly engineered and specialized nature of DMC Global's offerings, such as their explosion-welded clad metal plates and energetic solutions, often creates substantial hurdles for customers attempting such a move.

This specialized nature acts as a strong deterrent. For instance, the complex processes involved in creating clad metal plates require specific expertise and equipment that many customers may not readily possess or find economical to replicate. While a large customer might consider insourcing, the significant capital investment and the need for specialized R&D capabilities make backward integration a less feasible option for most, thereby tempering their bargaining power.

- High Capital Investment: The machinery and facilities required for producing specialized clad metals or energetic solutions represent a significant upfront cost, often in the tens or hundreds of millions of dollars, making it prohibitive for most customers.

- Technical Expertise Barrier: DMC Global's products often involve proprietary technologies and deep engineering knowledge, creating a steep learning curve and a talent acquisition challenge for potential integrating customers.

- Limited Scalability for Customers: Many customers require these specialized products in specific quantities that might not justify the massive investment and operational complexity of setting up their own production lines.

Availability of Substitute Products/Services for Customers

The availability of substitute products significantly boosts customer bargaining power. When customers have multiple options that fulfill similar needs, they are less reliant on DMC Global's specific offerings, leading to increased price sensitivity and demands for better terms. This is particularly true if these substitutes are readily accessible and offer comparable value.

For instance, in the industrial products sector where DMC Global operates, customers might find alternative materials or solutions from different suppliers or even entirely different industries that can achieve similar functional outcomes. This necessitates DMC Global to continuously innovate and differentiate its product portfolio to maintain its competitive edge and mitigate the impact of substitutes.

- Customer Choice: A wide array of substitutes empowers customers to switch easily if pricing or quality at DMC Global becomes unfavorable.

- Price Pressure: The existence of alternatives forces DMC Global to maintain competitive pricing to avoid losing market share.

- Innovation Imperative: DMC Global must focus on product differentiation, such as superior performance or unique features, to make its offerings more attractive than available substitutes.

- Market Dynamics: In 2024, the industrial materials market continues to see innovation in sustainable alternatives, potentially increasing the threat of substitutes for traditional products.

The bargaining power of customers for DMC Global is influenced by several factors, including customer concentration, switching costs, price sensitivity, and the threat of backward integration or substitutes. In 2024, these dynamics continue to shape the company's operating environment.

High customer concentration can significantly empower buyers. If a few large clients represent a substantial portion of DMC Global's revenue, these customers gain considerable leverage to negotiate favorable pricing and terms. This is especially pertinent in the energy sector, where major players often command significant influence.

Switching costs are a key determinant of customer power. When it is easy and inexpensive for customers to transition to a competitor's products or services, their bargaining power increases. DMC Global aims to mitigate this by offering specialized, customized solutions that raise these switching costs, making it more difficult for clients to move elsewhere.

Price sensitivity among customers, particularly in commodity-driven markets or during economic downturns, amplifies their bargaining power. DMC Global's 2024 financial performance, marked by impacts from lower energy market pricing and subdued construction demand, illustrates this direct correlation between customer price sensitivity and company profitability.

| Factor | Impact on Customer Bargaining Power | DMC Global's Mitigation Strategy | 2024 Relevance |

|---|---|---|---|

| Customer Concentration | High for few major clients | Diversify customer base | Ongoing challenge in energy sector |

| Switching Costs | Low switching costs increase power | Offer specialized, customized solutions | Key to retaining clients |

| Price Sensitivity | High in certain markets | Focus on value and differentiation | Influenced by energy prices and economic conditions |

| Backward Integration Threat | Low due to high capital/expertise | Maintain technological leadership | Specialized products deter insourcing |

| Availability of Substitutes | High availability increases power | Continuous innovation and product differentiation | Emergence of sustainable alternatives |

Preview the Actual Deliverable

DMC Global Porter's Five Forces Analysis

This preview displays the complete DMC Global Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You can confidently expect to download this professionally formatted and ready-to-use analysis without any alterations or missing sections.

Rivalry Among Competitors

The competitive landscape for DMC Global is shaped significantly by the number and size of its rivals. In the markets where DMC Global operates, companies such as Core Laboratories and Oil States International are key players, often competing in similar or overlapping business segments. This presence of established competitors, alongside a potentially fragmented market with numerous smaller entities, can escalate the intensity of rivalry.

Competitive rivalry intensifies in industries with slower growth or declining markets, as companies aggressively vie for existing market share. DMC Global operates within sectors like energy and construction, which are inherently susceptible to cyclical demand patterns. For instance, reports in 2024 highlighted weakness and volatility within the energy market, alongside a slowdown in commercial and high-end residential construction. This environment naturally fuels more aggressive competition among players seeking to maintain or expand their positions.

The intensity of competition within an industry is significantly shaped by how distinct competitors' offerings are. When products are largely interchangeable, the focus often shifts to price as the main competitive lever. DMC Global actively counters this by highlighting its 'highly engineered products and differentiated solutions,' a strategy aimed at sidestepping pure price wars and securing leading market positions.

Exit Barriers

High exit barriers in sectors where DMC Global operates, such as energy and industrial markets, can significantly fuel competitive rivalry. When it's costly or difficult for companies to leave these industries, even those performing poorly may continue to operate, leading to market overcapacity and intensified price competition. For instance, the significant investments in specialized equipment and long-term contractual obligations common in these sectors create substantial hurdles for firms looking to exit.

These exit barriers mean that companies might stay in the market longer than economically optimal, exacerbating competitive pressures. This situation can lead to a scenario where firms are willing to accept lower profit margins or even operate at a loss to avoid the upfront costs associated with shutting down operations or divesting assets. This dynamic directly impacts profitability and strategic flexibility for all players.

Consider the energy sector, where assets like refineries or pipelines represent massive capital outlays. The cost of decommissioning or selling such specialized infrastructure can be prohibitive. In 2024, the global oil and gas sector continued to grapple with the economic realities of stranded assets, with some estimates suggesting trillions of dollars in potential write-downs for fossil fuel reserves that may become uneconomical to extract due to energy transition policies.

- High Capital Investment: Specialized machinery and infrastructure in industrial sectors can cost millions, making divestment difficult.

- Long-Term Contracts: Commitments to supply or service agreements can lock companies into operations for years, even if unprofitable.

- Workforce Commitments: Severance packages and obligations to employees can add substantial costs to exiting a market.

- Regulatory Hurdles: Environmental regulations and permitting requirements for closure can be complex and expensive.

Strategic Stakes

When competitors have high strategic stakes in achieving success, the rivalry within an industry intensifies. This often means that companies are deeply invested in gaining market share, diversifying their operations, or safeguarding their most critical business segments. For DMC Global, its continuous focus on increasing shareholder value and refining its business portfolio underscores these substantial strategic interests.

The competitive landscape for DMC Global is shaped by players who view success in this market as crucial for their broader corporate objectives. These companies might be striving for industry leadership, seeking to expand into new revenue streams through diversification, or determined to protect the profitability and market position of their foundational businesses. DMC Global's own strategic maneuvers, such as its reported focus on optimizing its portfolio and enhancing shareholder returns, highlight the high stakes involved for all participants.

- Market Leadership Ambitions: Competitors often engage in aggressive pricing and innovation to capture a dominant market position.

- Portfolio Diversification: Companies may see this market as a key area for expanding their offerings and reducing reliance on other sectors.

- Core Business Protection: For some, success here is vital to reinforcing the strength and profitability of their existing core operations.

- DMC Global's Strategic Focus: DMC Global's ongoing efforts to enhance shareholder value and optimize its portfolio demonstrate its significant strategic commitment.

Competitive rivalry within DMC Global's operating sectors is intense due to the presence of established players like Core Laboratories and Oil States International. This rivalry is amplified in cyclical markets such as energy and construction, which experienced volatility and slowdowns in 2024, forcing companies to aggressively compete for market share.

DMC Global differentiates itself through highly engineered products and unique solutions to avoid price-based competition. However, high exit barriers, including significant capital investments in specialized equipment and long-term contracts, keep even underperforming companies in the market, leading to overcapacity and sustained price pressure.

| Competitor | Key Markets | 2024 Revenue (Approx.) | 2024 Net Income (Approx.) |

|---|---|---|---|

| Core Laboratories | Oil & Gas Services | $500M - $600M | $20M - $40M |

| Oil States International | Oil & Gas Equipment & Services | $1.5B - $1.7B | $100M - $150M |

| DMC Global | Industrial Products & Services | $600M - $700M | $30M - $50M |

SSubstitutes Threaten

The attractiveness of substitute products hinges on their price-performance ratio compared to DMC Global's offerings. If alternatives provide comparable or superior performance at a reduced cost, the threat posed by substitutes escalates significantly.

For instance, within DMC Global's NobelClad segment, alternative materials or less specialized bonding solutions could present a competitive challenge. In 2023, the global industrial coatings market, which includes some substitute solutions for corrosion and wear resistance, saw significant growth, indicating a robust demand for protective materials that could potentially divert customers from specialized clad products.

Customer willingness to switch to alternatives is a key factor in the threat of substitutes for DMC Global. This propensity is influenced by how much customers value DMC's brand, their perceived risk when trying something new, and how simple it is to start using a different product or service. For instance, in the industrial manufacturing sector, switching costs can be significant, potentially deterring customers from readily adopting substitutes if the integration process is complex or requires substantial investment.

Rapid technological progress constantly creates new and often superior alternatives to existing products and services. For DMC Global, this means new drilling technologies could potentially reduce the need for DynaEnergetics' specialized energetic solutions. Similarly, innovative construction techniques might lessen the demand for Arcadia's architectural building components. In 2023, DMC Global reported R&D expenses of $36.3 million, demonstrating a commitment to innovation to counter these evolving threats.

Indirect Substitution from Broader Solutions

The threat of substitutes for DMC Global extends beyond direct product replacements to encompass broader solutions that address the fundamental customer need in alternative ways. For instance, a significant push towards energy efficiency, driven by both regulatory changes and consumer demand, could diminish the overall market for certain energy-intensive building materials or components that DMC Global supplies. In 2024, the global focus on sustainability and reduced carbon footprints continued to intensify, with many regions implementing stricter building codes and offering incentives for energy-saving retrofits and new constructions. This trend directly impacts demand for products that might be perceived as less energy-efficient.

Furthermore, the rise of modular and prefabricated construction methods presents another significant indirect substitution threat. These approaches can streamline building processes, reduce waste, and potentially lower costs, thereby substituting for traditional, on-site construction methods that rely on more conventional building components. As of early 2025, the modular construction market is experiencing robust growth, with projections indicating continued expansion driven by labor shortages and the desire for faster project completion times. This shift could lead to a reduced demand for certain specialized architectural building components that DMC Global offers, as alternative, integrated systems gain traction.

- Energy Efficiency Initiatives: Growing global emphasis on sustainability and reduced carbon footprints in 2024 led to stricter building codes and incentives for energy-saving solutions, potentially lowering demand for less efficient building materials.

- Modular Construction Growth: The modular construction sector, projected for continued expansion into 2025, offers faster project completion and potential cost savings, posing a substitution threat to traditional building components.

- Broader Solution Adoption: Customers may opt for integrated systems or alternative materials that offer a more holistic approach to building performance, bypassing specialized components.

- Technological Advancements: Innovations in material science and construction technology could introduce entirely new ways to meet building performance needs, rendering existing product categories obsolete.

Regulatory or Environmental Shifts Favoring Substitutes

Changes in government regulations or increasing environmental concerns can significantly boost the appeal of substitute products or processes. For example, a stronger push for sustainability might make alternative materials, like advanced composites or bio-based plastics, more attractive than traditional options. This shift could directly impact industries relying on conventional materials, forcing them to adapt or lose market share to these emerging alternatives.

DMC Global itself recognizes the potential impact of these shifts, noting in its disclosures the acknowledgment of legal, regulatory, or market measures aimed at addressing climate change. This indicates an awareness within the company that future policy decisions could influence the competitive landscape, potentially favoring substitutes that offer a lower environmental footprint. For instance, stricter emissions standards or carbon pricing mechanisms could make energy-intensive manufacturing processes less competitive compared to cleaner alternatives.

The growing emphasis on lightweight materials in sectors like automotive and aerospace further amplifies the threat of substitutes. As manufacturers seek to improve fuel efficiency and reduce emissions, materials that offer comparable performance with less weight become increasingly desirable. This trend could see traditional metal components being replaced by engineered plastics or advanced composites, directly challenging the market for existing product lines. In 2024, the global lightweight materials market was valued at over $100 billion and is projected to grow substantially, highlighting the increasing demand for these alternatives.

- Regulatory Shifts: New environmental laws or policies favoring sustainable practices can increase the attractiveness of substitute products.

- Environmental Priorities: A heightened focus on sustainability drives demand for materials and processes with lower ecological impact.

- Lightweight Materials Trend: Industries like automotive and aerospace are increasingly adopting lightweight alternatives, impacting traditional material suppliers.

- DMC Global's Awareness: The company acknowledges potential regulatory and market measures related to climate change, indicating an understanding of this threat.

The threat of substitutes for DMC Global is significant, driven by evolving customer needs and technological advancements. For instance, in 2024, the global lightweight materials market exceeded $100 billion, indicating a strong preference for alternatives that enhance fuel efficiency, directly impacting traditional material suppliers.

Furthermore, the increasing adoption of modular construction, projected for continued expansion into 2025, presents a substitution threat to conventional building components by offering faster project completion and cost savings. This trend, coupled with broader energy efficiency initiatives in 2024 that led to stricter building codes, potentially reduces demand for less efficient materials.

DMC Global's own acknowledgment of climate change-related measures suggests an awareness that future policies could favor substitutes with lower environmental footprints, such as advanced composites or bio-based plastics, impacting industries reliant on conventional materials.

Entrants Threaten

The substantial capital needed to establish operations in the energy, industrial, and infrastructure sectors presents a significant hurdle for potential new competitors. For instance, building specialized manufacturing plants and investing in research and development, as DMC Global does with its DynaEnergetics and NobelClad segments, demands millions, if not billions, of dollars.

Established players like DMC Global leverage significant economies of scale in their operations. This means they can produce goods or services at a lower per-unit cost due to their large production volumes, bulk purchasing power, and efficient distribution networks. For instance, in 2023, DMC Global's segment revenues reached $720.2 million, demonstrating a substantial operational footprint that underpins these cost advantages.

Newcomers face a formidable barrier in matching these cost efficiencies. To compete effectively on price, a new entrant would need to invest heavily to achieve a comparable scale of operations from day one, which is often financially prohibitive. DMC Global's strategic focus on asset-light manufacturing further enhances its efficiency, making it even harder for new, asset-heavy competitors to undercut their pricing.

The threat of new entrants is significantly mitigated by strong product differentiation and established brand loyalty within DMC Global's operating segments. Companies like DMC Global have cultivated deep customer trust and loyalty over time, particularly in specialized, high-performance product categories where reliability and quality are paramount. For instance, DMC Global's success in engineered products and industrial materials is built on years of delivering consistent performance, making it challenging for newcomers to replicate this trust and market penetration without substantial investment and proven track records.

Access to Distribution Channels

New companies entering the markets served by DMC Global, particularly in energy, industrial, and infrastructure, can find it difficult to secure access to existing distribution channels and robust supply networks. These established relationships are crucial for reaching customers effectively.

DMC Global's DynaEnergetics segment actively works to strengthen its sales, supply chain, and distribution network. This focus underscores the significant barrier to entry that controlling or having access to these vital channels represents for potential competitors.

For instance, in 2023, the oil and gas industry, a key market for DynaEnergetics, saw significant investment in infrastructure and supply chain resilience. Companies that lack established distribution agreements may struggle to compete with those that already have them.

- Distribution Channel Access: New entrants face hurdles in accessing established networks critical for market penetration.

- Supply Chain Integration: Building reliable supply chains comparable to incumbents is a significant challenge.

- Customer Relationships: Existing players benefit from long-standing customer ties within these sectors.

- DynaEnergetics Focus: DMC Global's strategic emphasis on its distribution network highlights its importance as a competitive advantage.

Government Policy and Regulations

Government policy and regulations present a substantial threat of new entrants for companies like DMC Global, particularly within the energy, industrial, and infrastructure sectors. Stringent environmental, safety, and operational mandates necessitate significant upfront investment and ongoing compliance, creating high barriers to entry.

For instance, the energy sector often requires extensive permitting processes and adherence to evolving emissions standards, which can be costly and time-consuming for newcomers. In 2024, continued focus on sustainable practices and decarbonization efforts globally means new entrants must factor in substantial capital for environmentally compliant technologies and operations.

DMC Global, operating in these sensitive industries, actively monitors shifts in U.S. and international trade policies, including tariffs. For example, changes in tariffs on raw materials or finished goods can directly impact the cost structure for new market participants, potentially making it more challenging to compete with established players who have existing supply chain efficiencies.

- Regulatory Hurdles: Compliance with environmental, safety, and operational regulations in the energy and industrial sectors requires significant capital and expertise, acting as a deterrent to new entrants.

- Permitting Complexity: Obtaining necessary permits for operations in these sectors can be a lengthy and complex process, adding to the cost and time-to-market for new companies.

- Tariff Impact: Evolving U.S. and reciprocal tariff policies can alter the cost of materials and finished products, influencing the competitive landscape and the viability of new entrants.

- Policy Uncertainty: Changes in government policy, such as shifts in energy incentives or trade agreements, can create uncertainty and increase the risk for potential new competitors.

The threat of new entrants into the markets where DMC Global operates is generally considered moderate to low. The substantial capital requirements for establishing specialized manufacturing facilities and navigating complex regulatory landscapes in sectors like energy and industrial manufacturing act as significant deterrents.

Furthermore, DMC Global's established economies of scale, demonstrated by its 2023 segment revenues of $720.2 million, allow it to achieve lower per-unit costs. New entrants would struggle to match these efficiencies without considerable upfront investment.

Strong brand loyalty and product differentiation, particularly in high-performance engineered products, create another barrier. Access to established distribution channels, which DMC Global's DynaEnergetics segment actively strengthens, also presents a challenge for newcomers seeking market penetration.

Government regulations and evolving trade policies, including tariffs, add further complexity and cost, making it difficult for new players to compete effectively against incumbents with established operational efficiencies.

| Factor | Impact on New Entrants | DMC Global's Position |

| Capital Requirements | High Barrier | Established Operations |

| Economies of Scale | Challenging to Match | Cost Advantage (2023 Revenue: $720.2M) |

| Product Differentiation & Brand Loyalty | Difficult to Replicate | Strong Customer Trust |

| Distribution Channels | Limited Access | Strengthened Network (DynaEnergetics) |

| Regulatory & Policy Environment | Complex & Costly | Navigates Effectively |

Porter's Five Forces Analysis Data Sources

Our DMC Global Porter's Five Forces analysis leverages a comprehensive suite of data sources, including company annual reports, industry-specific market research, and financial databases like Bloomberg and S&P Capital IQ, to provide a robust assessment of the competitive landscape.