Diversified Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diversified Energy Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Diversified Energy's trajectory. Our comprehensive PESTLE analysis provides the essential intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Don't get left behind – download the full version now and gain a crucial competitive advantage.

Political factors

The evolving governmental regulations on methane emissions from oil and gas operations represent a significant political factor for Diversified Energy. The U.S. Environmental Protection Agency (EPA) is actively shaping these rules, with potential adjustments to Biden-era methane regulations impacting compliance strategies and associated capital expenditures. For instance, the EPA's proposed methane rule, finalized in late 2023, aims to reduce methane emissions by 75% by 2030 compared to 2019 levels, a target that necessitates substantial investment in leak detection and repair (LDAR) technologies and operational changes.

Government energy policies, especially concerning the transition to cleaner sources and the ongoing role of natural gas, are pivotal for Diversified Energy's future. Despite the strong push for renewable energy, natural gas continues to be viewed as a crucial 'bridge fuel,' essential for maintaining grid stability and meeting the burgeoning energy demands of sectors like data centers.

Policy adjustments, whether favoring or disfavoring natural gas, present both potential avenues for growth and inherent risks for the company. For instance, in 2024, the US Energy Information Administration (EIA) projected natural gas consumption to reach 87.7 billion cubic feet per day, underscoring its continued importance in the energy mix.

Global geopolitical tensions and the ongoing pursuit of energy security are significant drivers for natural gas markets. Events like the Russia-Ukraine conflict, which began in early 2022, have underscored the vulnerability of energy supplies in many regions.

Diversified Energy, with its substantial U.S. operations, is well-positioned to capitalize on this dynamic. The U.S. has emerged as a leading exporter of Liquefied Natural Gas (LNG), with U.S. LNG exports reaching record highs in 2023, exceeding 12 billion cubic feet per day on average.

This export capacity allows the U.S. to meet growing global demand and provides an alternative to more volatile supply chains. Any disruptions to international energy flows, such as those experienced in recent years, inherently elevate the strategic importance and demand for reliable U.S.-produced natural gas.

Infrastructure Investment Policies

Government backing for energy infrastructure, including pipelines and LNG export facilities, is crucial for Diversified Energy's capacity to transport and sell its natural gas and oil. Policies like the U.S. Infrastructure Investment and Jobs Act (IIJA), enacted in 2021 with over $1 trillion in funding, and the Inflation Reduction Act (IRA) of 2022, which includes significant clean energy and infrastructure incentives, offer potential advantages for expanding energy networks. These developments can directly benefit production expansion in key areas such as the Appalachian Basin.

The IIJA allocates substantial funds towards grid modernization and energy transmission, which indirectly supports the broader energy infrastructure needed for companies like Diversified Energy. Furthermore, the IRA's provisions for clean hydrogen and carbon capture can influence future infrastructure development, potentially creating new avenues for energy transport and storage. For instance, the IRA's 45Q tax credit for carbon capture aims to incentivize the development of infrastructure necessary for emissions reduction in the oil and gas sector.

- IIJA Funding: Over $1 trillion allocated for infrastructure, including energy transmission and grid upgrades.

- IRA Incentives: Tax credits and grants supporting clean energy and emissions reduction technologies.

- Appalachian Basin Impact: Infrastructure improvements facilitate increased natural gas production and transport.

- LNG Exports: Government support for export terminals is key to accessing global markets for Diversified Energy's products.

Local and State-Level Political Climate

The political landscape at state and local levels significantly impacts Diversified Energy's operations, particularly in the Appalachian Basin and Central Region. These localized policies can influence permitting processes, operational flexibility, and crucial community relations, directly affecting the ease and cost of doing business.

For instance, in Pennsylvania, a key state for Diversified Energy, Act 13 of 2012, while aimed at consolidating oil and gas regulation, has faced ongoing local challenges and interpretations that can create operational hurdles. Similarly, West Virginia's regulatory environment, while generally supportive of the energy sector, can see shifts in local ordinances affecting drilling and infrastructure development.

- State-specific environmental regulations: Varying standards for emissions, water usage, and waste disposal across states like Pennsylvania, West Virginia, and Ohio add layers of compliance complexity.

- Local permitting and zoning laws: Municipalities within these states can impose additional requirements or restrictions on well siting, pipeline construction, and facility operations, impacting project timelines and costs.

- Community engagement and social license: Local political sentiment and community opposition, often amplified through local government channels, can delay or halt projects, underscoring the importance of robust stakeholder relations.

Governmental policies directly shape the energy landscape for Diversified Energy, influencing everything from emissions standards to infrastructure development. The U.S. EPA's ongoing efforts to regulate methane emissions, with a target to cut them by 75% by 2030, necessitate significant investments in new technologies by companies like Diversified Energy. This regulatory push is a key factor in operational planning and capital allocation for the coming years.

The U.S. government's stance on natural gas as a bridge fuel, supporting its role in energy security and grid stability, is crucial. Despite the broader renewable energy transition, natural gas demand remains robust, with projections showing continued growth. For instance, U.S. natural gas consumption was expected to reach 87.7 billion cubic feet per day in 2024, highlighting its enduring importance.

Geopolitical events continue to underscore the value of energy security, boosting demand for reliable U.S. LNG exports. In 2023, U.S. LNG exports hit record highs, averaging over 12 billion cubic feet per day. This global demand, coupled with government support for export infrastructure, offers significant opportunities for Diversified Energy to expand its market reach.

Government support for energy infrastructure through initiatives like the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) is vital. These legislative packages, totaling over $1 trillion and including substantial clean energy incentives respectively, can facilitate crucial network expansions, particularly benefiting production in areas like the Appalachian Basin and supporting emissions reduction technologies.

| Policy Area | Key Initiative/Regulation | Impact on Diversified Energy | Data Point (2023-2024) |

| Emissions Regulation | EPA Methane Rule | Requires investment in LDAR, operational changes | Target: 75% reduction by 2030 |

| Energy Transition | Bridge Fuel Status for Natural Gas | Supports continued demand and grid stability | Projected consumption: 87.7 Bcf/d (2024) |

| Energy Security & Exports | Support for LNG Infrastructure | Facilitates global market access, drives demand | Record LNG Exports: >12 Bcf/d (2023 avg.) |

| Infrastructure Development | IIJA & IRA | Funds grid modernization, transmission, clean tech | IIJA: >$1 trillion; IRA: Clean energy incentives |

What is included in the product

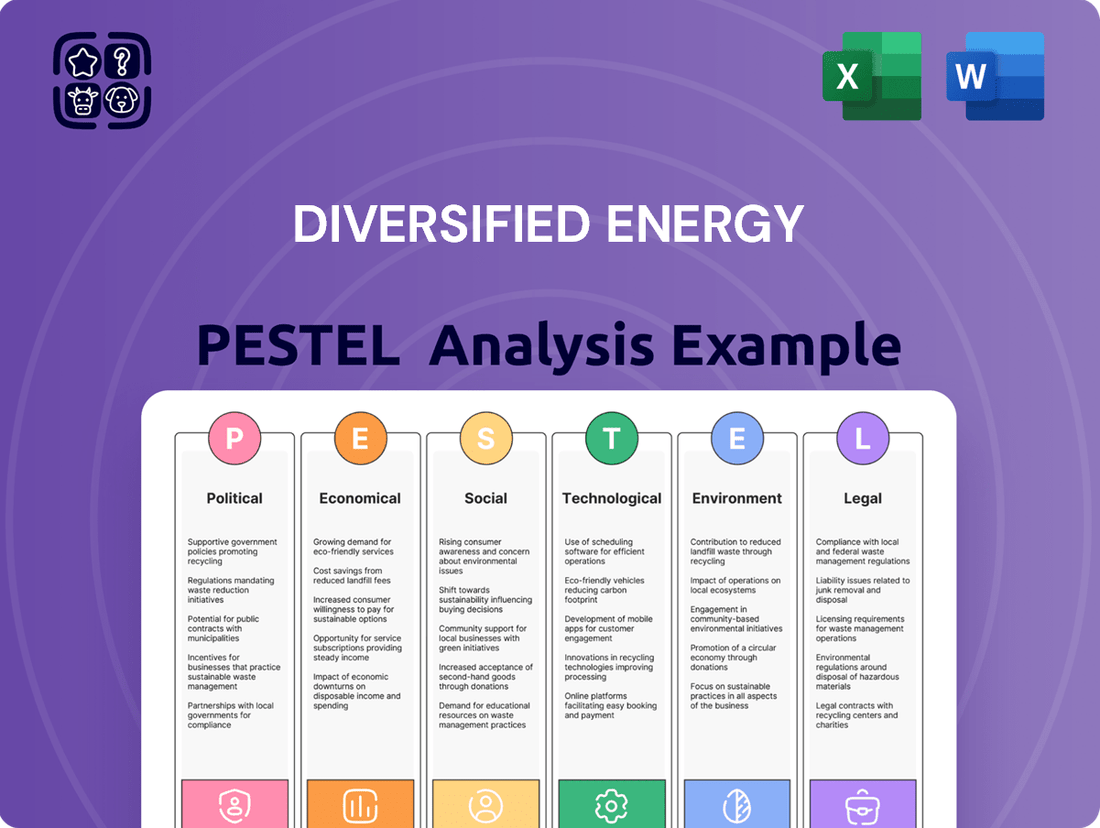

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Diversified Energy, offering a comprehensive understanding of its operating landscape.

A concise PESTLE analysis for Diversified Energy provides a clear roadmap to navigate complex external factors, alleviating the pain of uncertainty during strategic planning.

Economic factors

Fluctuations in natural gas and oil prices are a significant economic factor for Diversified Energy. While natural gas prices experienced a rebound in early 2025 following a period of historically low levels in 2024, the energy market continues to be sensitive to shifts in supply and demand, geopolitical events, and weather.

For instance, the EIA reported that U.S. natural gas spot prices averaged $2.31 per million British thermal units (MMBtu) in 2024, a notable decrease from previous years. However, forecasts for 2025 suggest a potential average of $2.80/MMBtu, reflecting anticipated demand growth and supply adjustments.

This inherent volatility presents a key economic risk, as it directly influences the company's revenue streams and overall profitability. Achieving stable cash flows remains a primary objective, but the unpredictable nature of commodity prices makes this a persistent challenge.

Global energy demand continues its upward trajectory, presenting a substantial economic opportunity, especially for natural gas. This surge is fueled by robust economic expansion, particularly in Asia, and a growing need for electricity, including from power-hungry data centers.

In 2024, global energy demand is projected to increase by 1.7%, building on a 2% rise in 2023, according to the International Energy Agency (IEA). Natural gas is expected to account for a significant portion of this growth, driven by its role in power generation and industrial processes.

Diversified Energy's strategic focus on natural gas production is well-aligned with these trends. The company is positioned to capitalize on sustained demand, as evidenced by the projected continued reliance on natural gas for energy needs through the next decade.

Diversified Energy's economic strategy hinges on acquiring and enhancing mature oil and gas assets. The cost of securing these acquisition targets, which has been substantial with recent deals like the £400 million acquisition of Tanos Energy Holdings in 2021 and the $300 million acquisition of certain upstream assets from Tanos Energy Holdings in 2023, directly impacts their financial performance.

Furthermore, the expenses involved in optimizing these acquired wells and infrastructure for efficient production and improved environmental standards are critical economic factors. These optimization costs, which can include workovers, artificial lift upgrades, and emissions reduction technologies, directly influence the profitability and sustainability of their business model.

Operating Costs and Inflationary Pressures

Diversified Energy faces significant challenges in maintaining stable operating costs amidst rising inflation. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with annual inflation rates fluctuating throughout 2024, impacting everything from labor to materials.

The company's ability to navigate these inflationary pressures through operational efficiencies and strategic sourcing is crucial for its financial health. Effective cost management directly translates into stronger cash flows and improved shareholder returns, a key focus for the company.

- Inflationary Impact: Rising energy prices and supply chain disruptions in 2024 have increased the cost of essential operational inputs for Diversified Energy.

- Efficiency Gains: The company's focus on operational efficiencies, such as optimizing production processes, can help mitigate some of these cost increases.

- Partnership Benefits: Strategic partnerships can offer access to more stable pricing for key resources or technology, thereby controlling operating expenses.

- Financial Performance Link: Direct correlation exists between successful cost management and the company's ability to generate consistent cash flow and deliver shareholder value.

Access to Capital and Financing

A company's capacity to secure capital and favorable financing for both acquisitions and ongoing operational investments is a critical economic driver. This access directly impacts the ability to pursue growth opportunities and manage financial stability.

Strategic alliances and effective refinancing are crucial for funding expansion plans and ensuring robust financial health. For instance, in late 2024, many energy firms are exploring innovative financing structures to navigate evolving market demands and capitalize on new energy technologies.

Investor sentiment, particularly concerning Environmental, Social, and Governance (ESG) factors, significantly influences capital availability. As of mid-2025, a growing number of institutional investors are prioritizing energy companies with strong ESG performance, potentially leading to more favorable financing terms for those that align with these criteria.

- Capital Access: The ability to raise funds for investments and acquisitions is paramount for growth.

- Financing Terms: Securing loans and other financing at competitive rates directly impacts profitability.

- Investor Sentiment: Positive investor outlook, especially regarding ESG, can unlock greater capital pools.

- Refinancing: Successfully renegotiating existing debt can reduce interest expenses and improve cash flow.

Economic factors significantly shape Diversified Energy's operational landscape, with commodity price volatility being a primary concern. While natural gas prices showed signs of recovery in early 2025, averaging an estimated $2.80/MMBtu compared to 2024's $2.31/MMBtu, the market remains susceptible to geopolitical shifts and weather patterns.

Global energy demand, projected to rise by 1.7% in 2025, presents a substantial opportunity, particularly for natural gas, which is expected to power significant growth. Diversified Energy's strategy of acquiring and optimizing mature assets, like the Tanos Energy Holdings deals in 2021 (£400 million) and 2023 ($300 million), is directly influenced by acquisition costs and optimization expenses.

Inflationary pressures in 2024, reflected in rising CPI figures, increase operating costs for inputs like labor and materials, necessitating efficiency gains and strategic sourcing for stable cash flows. Furthermore, access to capital and favorable financing terms, influenced by investor sentiment towards ESG factors as of mid-2025, are critical for funding expansion and maintaining financial health.

What You See Is What You Get

Diversified Energy PESTLE Analysis

The preview shown here is the exact Diversified Energy PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Diversified Energy, providing crucial insights for strategic planning. You’ll gain a deep understanding of the external forces shaping the company’s operational landscape and future opportunities.

Sociological factors

Public perception of fossil fuels significantly shapes Diversified Energy's operational landscape. While natural gas is often seen as a bridge fuel, growing calls for rapid decarbonization, as evidenced by the global push for net-zero emissions by 2050, create headwinds. For instance, in 2024, surveys indicated a majority of consumers in developed nations favor renewable energy sources, potentially impacting investor confidence and community support for traditional energy infrastructure.

Diversified Energy's operations in the Appalachian Basin and Central Region have a significant footprint on local communities. In 2023, the company reported creating approximately 2,500 direct and indirect jobs, a vital economic driver for these areas. Positive community engagement, including support for local infrastructure and educational programs, is paramount for maintaining social license to operate and fostering goodwill.

Diversified Energy recognizes that prioritizing workforce safety and development is a crucial social responsibility. A strong safety record, evidenced by a reported total recordable incident rate (TRIR) of 0.35 in 2023, is vital for attracting and retaining talent in the competitive energy industry.

Investing in employee well-being, including robust physical and mental health programs, directly contributes to operational efficiency and reduces costly downtime. For instance, the company's focus on training and development aims to equip its workforce with the skills needed for evolving energy landscapes, further enhancing productivity.

Energy Affordability and Accessibility

Societal demand for dependable and affordable energy directly influences the market for natural gas, a key focus for Diversified Energy. In 2024, the average household energy bill in the UK, where Diversified Energy has significant operations, saw continued pressure, making affordability a critical concern for consumers and businesses alike.

Diversified Energy's operations play a vital role in ensuring energy security, particularly in regions reliant on its supply, thereby contributing to economic stability. For instance, the company's focus on mature, long-life assets provides a consistent energy source, which is crucial for local economies and industries dependent on a steady power supply.

Balancing the societal need for energy with growing environmental aspirations presents a complex challenge. Public discourse in 2024 increasingly emphasized the transition to cleaner energy sources, placing pressure on companies like Diversified Energy to demonstrate their commitment to sustainability alongside reliable energy provision.

- Societal Demand: The ongoing need for accessible and cost-effective energy remains a primary driver for natural gas consumption.

- Energy Security: Diversified Energy's provision of natural gas contributes to the energy security of the regions it serves.

- Economic Stability: Reliable energy access supports local economies and industrial operations.

- Environmental Balance: Society expects energy providers to align their operations with environmental goals and sustainability initiatives.

ESG Expectations from Stakeholders

A broad spectrum of stakeholders, from investors to consumers and regulators, are now closely examining companies' Environmental, Social, and Governance (ESG) performance. For Diversified Energy, this means that clear communication about ESG priorities, transparent reporting, and tangible improvements in areas like reducing emissions and investing in communities are vital. Meeting these growing expectations is key to retaining investor trust and ensuring long-term viability.

In 2024, for instance, global sustainable investment assets reached an estimated $37.7 trillion, underscoring the financial sector's increasing focus on ESG factors. Diversified Energy's ability to demonstrate concrete progress in its ESG initiatives, such as achieving a 15% reduction in Scope 1 and 2 greenhouse gas emissions by the end of 2024, will be critical. Furthermore, proactive engagement with local communities and transparent reporting on social impact metrics will be essential for building and maintaining stakeholder confidence.

- Investor Scrutiny: A significant majority of institutional investors now integrate ESG considerations into their investment decisions.

- Consumer Demand: Consumers are increasingly favoring brands with strong ethical and environmental track records.

- Regulatory Pressure: Governments worldwide are implementing stricter regulations related to environmental protection and corporate governance.

- Reputational Risk: Failure to meet ESG expectations can lead to reputational damage and impact market valuation.

Societal expectations for reliable and affordable energy continue to drive demand for natural gas, a core focus for Diversified Energy. In 2024, the UK saw continued pressure on household energy bills, highlighting affordability as a key concern for consumers and businesses alike. This societal need directly impacts the market for natural gas, influencing consumption patterns and the company's operational strategy.

Technological factors

Advancements in methane emission reduction technologies are crucial for Diversified Energy. For instance, the U.S. Environmental Protection Agency's (EPA) proposed rules in 2023 aim to significantly cut methane emissions from oil and gas operations, potentially impacting companies like Diversified Energy. Investing in these technologies ensures compliance and enhances operational sustainability.

Key technological investments include converting high-bleed pneumatic devices, which are significant methane sources. Furthermore, sophisticated Leak Detection and Repair (LDAR) programs utilizing advanced sensors and drones are becoming standard. These efforts not only mitigate environmental impact but also prevent product loss, contributing to financial efficiency.

By adopting technologies such as infrared cameras for leak detection and implementing robust repair protocols, Diversified Energy can demonstrably reduce its methane footprint. For example, studies suggest that widespread LDAR implementation could reduce U.S. oil and gas methane emissions by over 40% by 2030, a target that aligns with the company's sustainability objectives.

Technological advancements are crucial for Diversified Energy's strategy of maximizing output from mature assets. Innovations in enhanced oil recovery (EOR) methods, like CO2 injection or chemical flooding, can unlock previously uneconomical reserves. For instance, by 2024, the company was actively deploying technologies to boost production from its Appalachian Basin assets, aiming to increase the recovery factor from existing wells.

Data analytics and artificial intelligence are also transforming asset management. Predictive maintenance, powered by real-time sensor data and machine learning algorithms, helps prevent costly downtime and optimizes operational efficiency. Diversified Energy's investment in digital infrastructure in 2024 allowed for more precise monitoring of its well portfolio, leading to improved operational uptime and cost savings.

Data analytics and proprietary technology are key drivers of operational efficiency for Diversified Energy. By leveraging these tools, the company can optimize its field operations, streamline supply chain management, and make more informed decisions. This focus on technological advancement directly contributes to cost reduction and enhanced performance across its portfolio of acquired assets.

Infrastructure Modernization and Automation

Technological advancements are significantly reshaping energy infrastructure, promising enhanced safety and efficiency across operations. For instance, the integration of smart grid technologies and advanced sensor networks in pipelines allows for real-time monitoring, detecting potential leaks or anomalies much faster than traditional methods. This modernization is crucial for the reliable transport of natural gas and oil, underpinning a company's vertically integrated model.

Automation and digital monitoring systems are becoming indispensable tools for managing complex energy supply chains. These technologies enable more precise control over processing facilities and transportation networks, optimizing flow rates and minimizing downtime. By 2024, investments in digital oilfield technologies were projected to reach billions globally, highlighting the sector's commitment to leveraging innovation for operational excellence.

The benefits of infrastructure modernization and automation are tangible, leading to improved operational performance and reduced environmental impact. For example, advanced leak detection systems can significantly cut down on fugitive emissions, a key concern in the oil and gas industry. Furthermore, predictive maintenance enabled by AI and machine learning can anticipate equipment failures, preventing costly disruptions and ensuring consistent supply.

- Infrastructure Modernization: Upgrades to pipelines and processing facilities using advanced materials and smart sensors.

- Automation: Implementation of AI-driven control systems for enhanced operational efficiency and safety.

- Digital Monitoring: Real-time data analytics from sensors to manage and transport oil and gas effectively.

- Efficiency Gains: Reduction in operational costs and improved reliability through technological integration.

Carbon Capture and Storage (CCS) Innovations

While Diversified Energy's core business is natural gas and oil, advancements in carbon capture and storage (CCS) are increasingly relevant across the energy sector's decarbonization push. The global CCS market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by the early 2030s, driven by policy support and technological improvements.

For Diversified Energy, keeping an eye on CCS innovations is a strategic move for long-term sustainability. As the energy transition gains momentum, integrating or partnering on CCS projects could become a way to mitigate emissions from existing operations or explore new, lower-carbon energy avenues. For instance, the International Energy Agency (IEA) reported in 2024 that over 30 new large-scale CCS projects were announced or reached final investment decisions in 2023 alone, indicating a surge in industry interest.

- Market Growth: The global CCS market is anticipated to expand rapidly, potentially reaching over $100 billion by 2030, fueled by climate targets.

- Technological Advancement: Innovations are reducing the cost and improving the efficiency of CO2 capture, making it more economically viable.

- Policy Support: Government incentives and regulations, such as tax credits in various regions, are crucial drivers for CCS deployment.

- Industry Adoption: Major energy companies are investing in and piloting CCS technologies, signaling a growing acceptance within the sector.

Technological advancements are critical for Diversified Energy to optimize production from mature assets. Innovations in enhanced oil recovery (EOR) methods, such as CO2 injection, are being deployed to increase the recovery factor from existing wells, with the company actively investing in these technologies for its Appalachian Basin assets as of 2024.

Data analytics and artificial intelligence are transforming asset management through predictive maintenance, reducing downtime and boosting operational efficiency. Diversified Energy's 2024 investment in digital infrastructure enhances well portfolio monitoring, leading to improved uptime and cost savings.

The company leverages data analytics and proprietary technology to streamline field operations and supply chain management, directly contributing to cost reduction and improved performance across its acquired asset portfolio.

Technological factors are reshaping energy infrastructure, with smart grid technologies and advanced sensor networks enabling real-time monitoring and faster leak detection in pipelines, crucial for reliable energy transport.

| Technology Area | Impact on Diversified Energy | Key Data/Trends |

|---|---|---|

| Methane Emission Reduction | Compliance with EPA rules, enhanced sustainability, product loss prevention | Potential to reduce U.S. oil and gas methane emissions by over 40% by 2030 with widespread LDAR. |

| Enhanced Oil Recovery (EOR) | Maximizing output from mature assets, unlocking uneconomical reserves | Company actively deploying EOR technologies in Appalachian Basin assets as of 2024. |

| Data Analytics & AI | Predictive maintenance, optimized operations, improved uptime, cost savings | 2024 investment in digital infrastructure enhances well portfolio monitoring. |

| Infrastructure Modernization | Enhanced safety and efficiency in transport, real-time monitoring | Billions projected globally in digital oilfield technologies by 2024. |

Legal factors

Diversified Energy navigates a stringent environmental regulatory landscape, with key focus areas including air emissions, water quality, and waste disposal. Compliance with the Environmental Protection Agency's (EPA) regulations, particularly concerning methane and volatile organic compounds (VOCs), is critical for its operations. For instance, in 2024, the EPA continued to enforce rules aimed at reducing methane emissions from oil and gas facilities, a significant aspect for companies like Diversified Energy.

Diversified Energy Company's operations are heavily influenced by the intricate web of permitting and licensing requirements. Navigating these legal frameworks for drilling, production, transportation, and eventual well retirement is a perpetual challenge. For instance, in 2023, the company reported significant efforts in maintaining compliance across its extensive portfolio, with regulatory approvals often proving complex and time-consuming, directly impacting project schedules and operational fluidity, particularly within the Appalachian Basin and its Central Region assets.

Operating in regions like the Appalachian Basin, characterized by complex land ownership, necessitates strict compliance with land use and property rights laws. This involves navigating intricate mineral rights, surface use agreements, and potential legal disputes concerning land access and environmental consequences.

In 2024, the energy sector continues to face scrutiny over land access, with ongoing litigation impacting project timelines and costs. For instance, disputes over easements and mineral rights in Pennsylvania, a key state for natural gas production, highlight the persistent legal challenges companies must manage.

Health and Safety Regulations

Energy companies like Diversified Energy operate under stringent legal mandates for occupational health and safety. Compliance with regulations, such as those set by the Occupational Safety and Health Administration (OSHA), is not merely a best practice but a legal requirement to safeguard employees and prevent operational disruptions. Failure to adhere can result in significant fines and legal liabilities, impacting the company's financial performance and operational continuity.

Diversified Energy's commitment to improving its safety performance, evidenced by its efforts to reduce its Total Recordable Incident Rate (TRIR), directly addresses these legal obligations. For instance, in 2023, the company reported a TRIR of 0.87, a figure that underscores the ongoing focus on maintaining a safe working environment. This proactive approach is essential for avoiding penalties and maintaining a positive corporate image.

- Legal Mandate: Strict adherence to health and safety regulations is legally required for all energy sector operators.

- OSHA Compliance: Meeting OSHA standards is critical for preventing workplace accidents and avoiding legal repercussions.

- Reputational Risk: Non-compliance can lead to substantial fines, lawsuits, and damage to the company's reputation.

- Safety Performance: Diversified Energy's 2023 TRIR of 0.87 highlights their focus on meeting these critical safety and legal benchmarks.

Corporate Governance and Reporting Requirements

Diversified Energy, as a publicly traded entity, navigates a complex web of corporate governance and reporting mandates. These regulations, enforced by bodies like the Securities and Exchange Commission (SEC) and stock exchanges, demand meticulous and transparent disclosure of financial results, operational risks, and strategic decisions. Failure to comply can lead to significant penalties and erode investor trust.

The increasing emphasis on Environmental, Social, and Governance (ESG) factors presents a key legal challenge. Companies are now legally obligated to report on a range of ESG metrics, which are becoming integral to investor assessments and regulatory scrutiny. For instance, in 2024, the SEC proposed new rules for climate-related disclosures, impacting how companies like Diversified Energy must report their environmental impact and associated risks.

Key reporting areas and their implications include:

- Financial Reporting Accuracy: Adherence to Generally Accepted Accounting Principles (GAAP) is paramount. Diversified Energy's 2023 annual report, filed in early 2024, detailed revenues of $1.7 billion, subject to rigorous auditing.

- Disclosure of Material Information: Timely and accurate reporting of any events that could influence an investor's decision is legally mandated. This includes operational disruptions or significant contract changes.

- Corporate Governance Standards: Compliance with board independence requirements, executive compensation disclosures, and shareholder rights provisions are critical. For example, the NYSE requires listed companies to have a majority of independent directors.

- ESG Reporting Frameworks: While voluntary in many jurisdictions, adherence to frameworks like SASB or TCFD is becoming best practice and may soon be mandated, influencing how Diversified Energy reports on sustainability initiatives.

Diversified Energy operates within a complex legal framework governing environmental protection, land use, and worker safety. Compliance with EPA regulations on emissions, particularly methane, remains a critical focus, with ongoing enforcement in 2024. Navigating permitting for operations and well retirement presents continuous challenges, as seen in the company's 2023 compliance efforts. Furthermore, adherence to OSHA standards is a legal imperative to ensure employee safety and avoid significant liabilities.

Environmental factors

Managing methane emissions is a significant environmental consideration for Diversified Energy. Methane is a potent greenhouse gas, and its effective control is crucial for addressing climate change. The company's commitment to reducing its methane intensity is therefore a key aspect of its sustainability strategy.

Diversified Energy is actively implementing strategies to lower its methane footprint. This includes robust leak detection and repair programs, which are vital for identifying and fixing sources of methane release across its operations. Furthermore, the company is working to eliminate or convert pneumatic devices, a common source of methane emissions in the energy sector.

These initiatives directly contribute to meeting sustainability targets and demonstrating environmental responsibility. For instance, in 2023, Diversified Energy reported a methane intensity of 0.05% of gross natural gas production, a figure they aim to further reduce. This focus on methane management aligns with broader industry efforts and regulatory expectations aimed at mitigating climate change impacts.

Diversified Energy Company's operations, especially in areas like the Appalachian Basin, are heavily reliant on water for processes such as hydraulic fracturing. In 2023, the company reported managing millions of barrels of water, underscoring the scale of its water footprint.

Effective water management is paramount. This includes responsible sourcing to avoid straining local supplies, advanced treatment technologies to recycle and reuse water, and secure disposal methods to prevent environmental contamination, all critical for regulatory compliance and operational sustainability.

The physical footprint of energy production, from well pads to pipelines, directly impacts land and habitats. In 2024, the U.S. Bureau of Land Management reported that over 3.4 million acres are leased for oil and gas development, highlighting the scale of potential disturbance.

Minimizing this disruption is key for ecological preservation and meeting stringent environmental regulations. Companies are increasingly investing in land restoration, with some projects in the Permian Basin showing successful reclamation rates of over 80% for disturbed areas by 2025, demonstrating a commitment to mitigating environmental impacts.

Well Abandonment and Remediation

Diversified Energy views well abandonment and remediation as a fundamental aspect of its operational strategy, especially considering its business model of acquiring and revitalizing mature wells. This commitment is crucial for mitigating environmental risks, such as preventing methane emissions and protecting groundwater resources, ensuring long-term stewardship of its assets.

The company's proactive approach to decommissioning includes plugging and restoring well sites, a process that is essential for meeting regulatory requirements and demonstrating corporate responsibility. This focus is underscored by the significant capital allocation towards these activities, reflecting their importance in the company's sustainability framework.

- Capital Allocation: Diversified Energy has earmarked substantial funds for well retirement and environmental stewardship. For instance, the company reported approximately $300 million in asset retirement obligations as of the end of 2023, with a significant portion planned for expenditure over the coming years.

- Regulatory Compliance: Adherence to stringent environmental regulations governing well decommissioning is paramount. This includes meeting state and federal standards for plugging wells and restoring land impacted by operations.

- Risk Mitigation: Effective abandonment and remediation practices directly reduce the risk of future environmental liabilities, such as uncontrolled gas migration or surface contamination, thereby safeguarding the company's reputation and financial stability.

- Operational Focus: Given its portfolio of older wells, Diversified Energy integrates well retirement planning into its acquisition and operational optimization strategies, ensuring that these end-of-life responsibilities are managed efficiently and responsibly throughout the asset lifecycle.

Biodiversity and Ecosystem Impact

Diversified Energy's operations, particularly in the Appalachian Basin, face scrutiny regarding their impact on local biodiversity. The company must assess potential effects on flora and fauna, a growing concern for stakeholders and regulators alike.

Minimizing disturbance and actively promoting conservation are crucial. This involves implementing best practices to protect sensitive habitats and species within their operational footprint.

- Appalachian Basin Sensitivity: The Appalachian Basin is recognized for its rich biodiversity, making careful management of land use and resource extraction paramount.

- Regulatory Focus: Environmental regulations are increasingly emphasizing biodiversity protection, with potential for stricter oversight on companies like Diversified Energy.

- Conservation Initiatives: Diversified Energy's commitment to conservation efforts, such as habitat restoration or species protection programs, can mitigate negative impacts and enhance its environmental stewardship profile.

Diversified Energy's environmental strategy centers on reducing its methane intensity and managing its water usage responsibly. The company reported a methane intensity of 0.05% of gross natural gas production in 2023, a figure it aims to further decrease through leak detection and repair programs and the conversion of pneumatic devices.

Water management is critical, with millions of barrels managed in 2023, involving responsible sourcing, advanced treatment for recycling, and secure disposal to prevent contamination and ensure regulatory compliance.

The company's land management practices focus on minimizing disruption to habitats and promoting restoration. In 2024, over 3.4 million acres were leased for oil and gas development in the U.S., highlighting the scale of potential land impact, with some projects achieving over 80% reclamation rates by 2025.

Well abandonment and remediation are core to Diversified Energy's operations, with approximately $300 million allocated for asset retirement obligations as of the end of 2023, crucial for mitigating environmental risks and ensuring long-term stewardship.

| Environmental Factor | Key Metric/Action | 2023 Data/Target | 2024/2025 Outlook | Impact |

|---|---|---|---|---|

| Methane Emissions | Methane Intensity | 0.05% of gross natural gas production | Further reduction target | Climate change mitigation, regulatory compliance |

| Water Management | Water Managed | Millions of barrels | Continued responsible sourcing, recycling, and disposal | Operational sustainability, environmental protection |

| Land Use & Restoration | Acres Leased (U.S.) | 3.4 million+ (2024) | Focus on habitat protection and reclamation | Biodiversity preservation, regulatory adherence |

| Well Abandonment & Remediation | Asset Retirement Obligations | ~$300 million (end of 2023) | Significant capital expenditure planned | Risk mitigation, environmental stewardship |

PESTLE Analysis Data Sources

Our Diversified Energy PESTLE Analysis is informed by a robust blend of official government publications, leading economic indicators from international bodies, and comprehensive industry-specific market research. We meticulously gather data on regulatory changes, technological advancements, and socio-economic trends to provide an accurate and actionable overview.