Diversified Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diversified Energy Bundle

Diversified Energy faces significant competitive forces, with the threat of new entrants being a key consideration in the energy sector. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this landscape. The intensity of rivalry among existing players also shapes the company's strategic options.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Diversified Energy’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The oilfield services sector, crucial for operations like drilling and well maintenance, has seen robust growth, with forecasts suggesting this trend will continue past 2025. This expansion, fueled by rising global energy needs and advanced extraction techniques, can significantly boost the leverage of specialized service providers.

Diversified Energy Company's dependence on these specialized services for optimizing its existing wells means that suppliers offering critical, in-demand capabilities can wield considerable bargaining power. For instance, the market for hydraulic fracturing services, a key component of well completion, saw significant investment in 2024, reflecting the high demand for such specialized expertise.

Consolidation among major oil producers can shrink the customer pool for oilfield service firms, potentially heightening competition among these service providers. This trend might also foster larger, more integrated service companies that gain greater leverage over their clients, such as Diversified Energy.

For instance, in 2024, the oil and gas sector continued to see significant M&A activity, with major players acquiring smaller entities to enhance scale and efficiency. This ongoing consolidation directly impacts the bargaining power dynamics within the supply chain.

Therefore, closely observing mergers and acquisitions within the oilfield services industry is essential for understanding any shifts in supplier influence that could affect Diversified Energy.

The bargaining power of suppliers for Diversified Energy Company is significantly shaped by how easily it can find alternative sources for its operational inputs. While some highly specialized equipment might present fewer substitution options, the general market for drilling supplies, chemicals, and routine maintenance services is typically quite competitive. This competitive landscape allows Diversified Energy to leverage multiple sourcing choices, thereby reducing any single supplier's ability to dictate terms.

Switching Costs for Diversified Energy

Diversified Energy Company's (DEC) asset acquisition strategy, focusing on mature, existing wells, often involves integrating supplier technologies and processes. This integration can lead to significant switching costs if DEC has heavily invested in specific supplier platforms or proprietary operational software. These costs, which might include retraining staff, reconfiguring equipment, or data migration, can make it economically challenging to change suppliers, thereby enhancing supplier bargaining power.

For instance, if DEC's operational framework relies on a particular supplier's advanced monitoring or production optimization technology, the cost and disruption of switching to a competitor could be substantial. This dependency strengthens the position of those key suppliers who can command better terms or pricing due to DEC's embedded reliance on their solutions.

- High Integration Costs: DEC's operational model may involve significant upfront investment in integrating specific supplier technologies, creating a barrier to switching.

- Proprietary Technology Dependence: Reliance on proprietary platforms from suppliers for well management or data analytics can lock DEC into existing relationships.

- Operational Disruption: Changing suppliers could lead to temporary production halts or reduced efficiency, adding to the financial burden of switching.

Regulatory Impact on Supplier Services

Increasing environmental regulations, especially those focused on methane emissions and well abandonment, can significantly boost the bargaining power of suppliers who provide specialized solutions for these challenges. For instance, companies offering advanced leak detection and repair (LDAR) technologies or specialized plugging and abandonment services can command higher prices due to the critical nature and increasing demand for their expertise.

Diversified Energy Company's strategic approach includes internalizing some of these compliance-related services through its well retirement subsidiary, Next LVL Energy. This move aims to mitigate reliance on external suppliers for certain environmental mandates, potentially softening supplier power in those specific areas. However, for highly technical or emerging environmental solutions, the bargaining power of specialized suppliers is likely to remain substantial.

In 2024, the energy sector continued to face heightened scrutiny regarding environmental performance. Companies like Diversified Energy reported progress in their sustainability efforts, with specific metrics on methane intensity reduction being key performance indicators. For example, Diversified Energy's 2023 sustainability report highlighted a continued focus on operational efficiency and emissions reduction, underscoring the market demand for environmentally compliant services.

- Methane Emission Reduction Targets: Many energy producers, including Diversified Energy, are setting aggressive targets for methane emission reductions, often driven by regulatory pressure and investor expectations.

- Specialized Service Demand: The need for advanced technologies in methane detection, capture, and reporting is growing, creating opportunities for suppliers with unique capabilities.

- Well Abandonment Compliance: Stricter regulations on the safe and environmentally sound abandonment of legacy wells increase the demand for specialized plugging and remediation services.

- Internalization vs. Outsourcing: Companies weigh the benefits of developing in-house expertise against the cost and efficiency of outsourcing specialized environmental services to third-party suppliers.

Suppliers of specialized oilfield services, particularly those offering advanced drilling, completion, and environmental compliance solutions, hold significant bargaining power. This is amplified by the ongoing consolidation within the oilfield services sector, creating larger, more dominant players. For instance, the demand for hydraulic fracturing services saw substantial investment in 2024, indicating a strong supplier position in this critical area.

Diversified Energy Company's reliance on specific proprietary technologies or integrated operational platforms can lead to high switching costs, further strengthening supplier leverage. The increasing regulatory focus on environmental performance, such as methane emission reduction, also elevates the power of suppliers providing specialized compliance services.

While Diversified Energy aims to mitigate some supplier power through internalizing certain services, the market for highly technical or novel environmental solutions remains dominated by capable external providers. Observing M&A activity within the services sector is key to understanding these shifting power dynamics.

| Factor | Impact on Supplier Bargaining Power | Relevance to Diversified Energy | 2024 Data/Trend |

|---|---|---|---|

| Specialized Services Demand | High | DEC relies on specialized services for well optimization. | Increased investment in hydraulic fracturing services in 2024. |

| Supplier Consolidation | High | Fewer, larger service providers can dictate terms. | Ongoing M&A in the oilfield services sector. |

| Switching Costs | Moderate to High | Integration of proprietary technologies can create lock-in. | DEC's asset acquisition strategy may involve significant integration. |

| Environmental Regulations | High | Demand for compliance services (e.g., methane reduction). | DEC reported progress on emissions reduction in 2023 sustainability efforts. |

What is included in the product

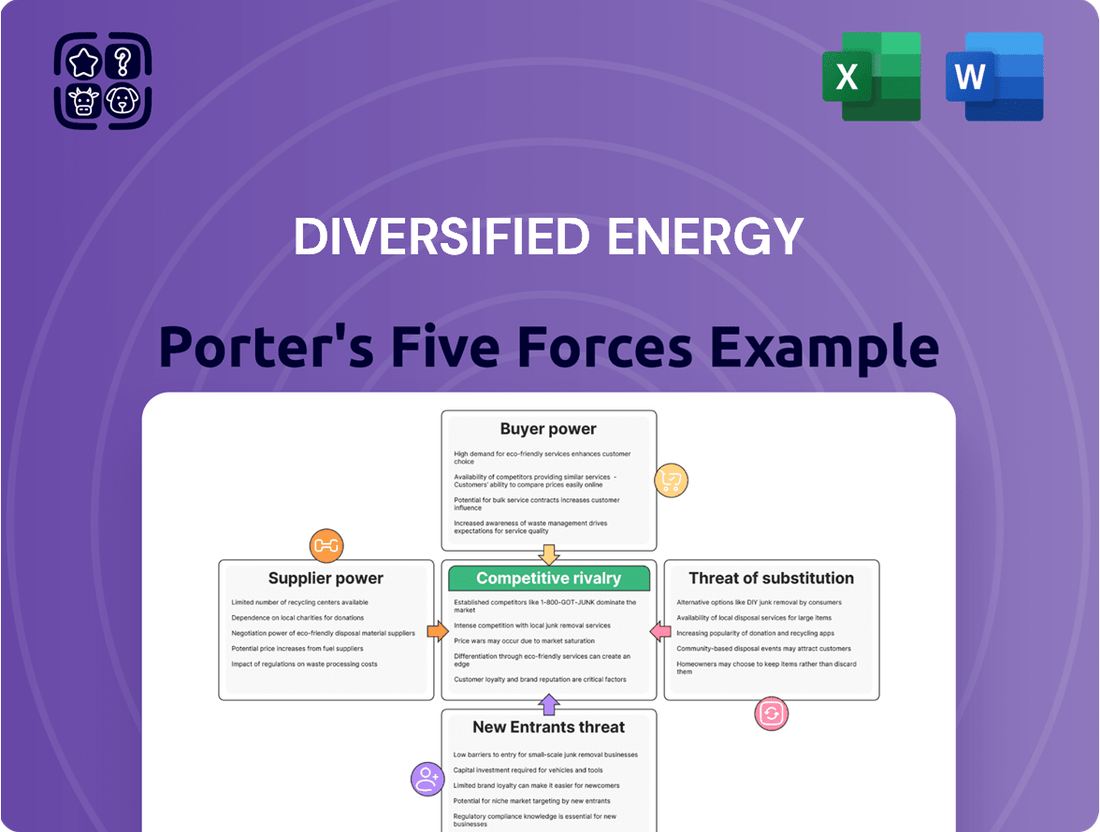

This analysis dissects the competitive landscape for Diversified Energy, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the energy sector.

Quickly identify and address competitive pressures by visualizing the intensity of each of Porter's Five Forces for Diversified Energy.

Customers Bargaining Power

Natural gas and oil are fundamentally commodity products, meaning they are largely interchangeable and lack significant differentiation. This forces customers to focus primarily on price when making purchasing decisions.

This price-driven dynamic inherently grants customers substantial bargaining power, particularly when supply is abundant. For instance, in 2024, global oil prices experienced significant fluctuations, with Brent crude averaging around $83 per barrel for the year, demonstrating the sensitivity to supply and demand that empowers buyers.

As a producer of these undifferentiated commodities, Diversified Energy Company must maintain operational efficiency to compete effectively on price. Their ability to control costs directly impacts their competitiveness and profitability in such a market.

Customers in the natural gas and oil markets are keenly aware of price swings. These shifts are often driven by global events, imbalances between what's available and what's needed, and even the weather. This sensitivity gives them significant leverage.

For instance, the low Henry Hub natural gas prices seen in 2024 clearly demonstrate this customer power when supply exceeds demand. Diversified Energy's approach focuses on creating consistent cash flow by running its operations smoothly, which helps buffer against these unpredictable price changes.

Major utilities and industrial consumers, as large-volume purchasers, wield significant bargaining power in the energy sector. Their substantial demand allows them to negotiate favorable terms, impacting pricing and contract conditions for energy providers like Diversified Energy Company.

The increasing global demand for natural gas, notably driven by liquefied natural gas (LNG) exports, further amplifies the leverage of these key customers. For instance, in 2023, US LNG exports reached record highs, underscoring the critical role of these large buyers in the market.

Diversified Energy Company can mitigate this customer bargaining power by securing long-term supply agreements, which provide revenue stability and predictable cash flows. Integrating with midstream infrastructure and marketing operations also enhances the company's ability to manage customer relationships and optimize value.

Availability of Alternative Energy Sources

The growing accessibility of alternative energy sources, like solar and wind power, directly empowers customers by offering them more choices beyond traditional fossil fuels. This increasing availability acts as a significant threat of substitution, allowing consumers to shift towards cleaner or potentially cheaper energy options as they become more prevalent.

This trend directly bolsters customer bargaining power. As more alternatives emerge and mature, the cost or inconvenience of switching for customers diminishes, forcing energy providers to be more competitive. For instance, by mid-2024, global renewable energy capacity continued its upward trajectory, with solar photovoltaic installations alone projected to add a substantial amount of new capacity, according to the International Energy Agency.

- Increased Customer Choice: Availability of renewables provides alternatives to natural gas and oil.

- Threat of Substitution: Customers can switch to cleaner or more cost-effective options.

- Impact on Bargaining Power: More alternatives mean greater leverage for customers.

- Diversified Energy's Position: The company acknowledges its role in the ongoing energy transition.

Customer Information and Transparency

In today's energy market, customers, from large industrial users to individual households, benefit from unprecedented access to information. This transparency regarding pricing, fuel sources, and the offerings of competing energy providers significantly empowers them. For instance, by mid-2024, consumer advocacy groups regularly publish comparative energy cost analyses, readily available online, highlighting price differentials between suppliers.

This heightened market transparency directly reduces information asymmetry, allowing customers to make more informed choices and engage in more effective price negotiations. Diversified Energy, therefore, faces the challenge of consistently offering competitive pricing and superior service to not only attract new customers but also to retain its existing base. Failing to do so can lead to customer churn, especially as switching providers becomes increasingly streamlined.

- Increased Information Availability: Customers can easily compare pricing, service quality, and contract terms across multiple energy providers.

- Reduced Information Asymmetry: This transparency levels the playing field, enabling customers to negotiate from a position of knowledge.

- Impact on Diversified Energy: The company must maintain competitive offerings to counter the enhanced bargaining power of its customer base.

Customers in the energy sector, particularly those purchasing natural gas and oil, hold significant bargaining power due to the commodity nature of these products. This means they are largely interchangeable, forcing buyers to focus on price. For instance, Brent crude prices averaged around $83 per barrel in 2024, reflecting the market's sensitivity to supply and demand, which directly empowers buyers.

Major consumers like utilities and industrial clients, due to their large-volume purchases, can negotiate favorable terms, impacting Diversified Energy Company's pricing and contracts. The rise of LNG exports, reaching record highs in 2023 for the US, further amplifies the leverage of these key buyers.

The growing availability of alternative energy sources, such as solar and wind, also bolsters customer power by offering more choices. By mid-2024, renewable energy capacity continued to expand, with solar installations alone adding significant new capacity, according to the IEA, making it easier for customers to switch away from traditional fuels.

| Factor | Impact on Diversified Energy | Supporting Data (2023-2024) |

| Commodity Nature | Price-sensitive customers, limited differentiation | Brent Crude average: ~$83/barrel (2024) |

| Concentration of Buyers | Large utilities/industrials negotiate favorable terms | US LNG exports hit record highs (2023) |

| Availability of Substitutes | Customers can switch to renewables | Continued growth in solar PV capacity (mid-2024) |

| Information Transparency | Informed customers negotiate better | Consumer advocacy cost analyses readily available |

Preview the Actual Deliverable

Diversified Energy Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Diversified Energy, offering an in-depth examination of industry competition. You'll receive this exact, professionally formatted document immediately after purchase, providing actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the sector. This comprehensive analysis is ready for your immediate use, ensuring no surprises or missing information.

Rivalry Among Competitors

The US oil and gas sector, especially in prolific regions like the Appalachia basin, is characterized by a significant number of independent energy companies. Diversified Energy, while specializing in acquiring and optimizing producing wells, faces competition from these numerous players, many of whom also target mature assets or pursue similar cost-efficiency strategies.

This crowded competitive landscape, with many entities vying for similar opportunities, can naturally drive up acquisition costs and intensify price competition for both assets and talent. For instance, in 2023, the average transaction multiple for PDP-heavy assets in the US onshore market saw fluctuations, reflecting the demand from various E&P companies seeking to bolster their portfolios.

While global natural gas demand continues its upward trajectory, the specific market for acquiring and optimizing mature, low-decline assets presents a distinct growth dynamic compared to the more volatile frontier exploration sector. This focus on established reserves shapes the competitive landscape for companies like Diversified Energy.

Diversified Energy's proactive acquisition strategy, highlighted by substantial transactions such as the Maverick Natural Resources deal in 2021 for $1.1 billion, underscores the active competition for desirable, producing assets. This ongoing M&A activity suggests a robust market for these types of opportunities.

The availability of these mature oil and gas assets, alongside the rate at which new discoveries are made and brought online, directly impacts the intensity of rivalry among companies vying for acquisition targets. A tighter supply of attractive, low-decline assets would naturally escalate competition.

Natural gas and oil are primarily seen as undifferentiated commodities, meaning the competition often boils down to price. This dynamic naturally fuels intense rivalry among energy producers. Diversified Energy's strategy of focusing on operational efficiency and generating consistent cash flow does offer a degree of distinction in its approach to the market, but the core product itself remains a commodity.

The ease with which customers can switch from one natural gas supplier to another significantly amplifies this direct competition. For instance, in 2024, the average household in the US paid approximately $1.70 per therm for natural gas, a price point that can fluctuate based on supply and demand, making price a critical factor in customer retention.

High Fixed Costs and Exit Barriers

The oil and gas sector is defined by substantial upfront investments in exploration, drilling, refining, and transportation infrastructure. These massive fixed costs mean that companies must maintain production levels to recoup their capital, even when market prices are depressed. For instance, in 2024, major oil and gas companies continued to invest billions in new projects despite fluctuating commodity prices, underscoring the long-term commitment and high fixed cost nature of the industry.

These high fixed costs act as significant exit barriers. Companies are often compelled to keep operating and selling at lower prices rather than shutting down and incurring losses on their sunk investments. This dynamic can lead to an oversupply situation, especially during economic downturns, intensifying competition as firms fight to cover their operational expenses. The need to service debt and cover these fixed expenditures drives a relentless pursuit of market share.

- High Capital Expenditures: Exploration and production (E&P) companies often face capital expenditures in the tens or hundreds of billions of dollars for large-scale projects.

- Operational Overhead: Maintaining offshore platforms, refineries, and pipelines incurs continuous, significant operational and maintenance costs.

- Exit Barriers: The inability to easily divest specialized assets like refineries or deep-sea drilling rigs traps capital and discourages exiting the market.

- Price Volatility Impact: Periods of low oil prices in 2024 put pressure on companies to maintain production to cover these fixed costs, exacerbating competitive pressures.

Strategic Acquisitions and Market Consolidation

Diversified Energy Company's approach to growth is heavily reliant on strategic acquisitions, aiming to bolster its asset portfolio and operational reach. This aggressive merger and acquisition (M&A) strategy directly influences competitive rivalry by creating a dynamic where companies actively pursue valuable assets and market dominance.

The sector’s ongoing consolidation, exemplified by Diversified's substantial recent acquisitions, is actively reshaping the competitive environment. This trend can lead to a reduction in the number of direct competitors for particular types of energy assets, intensifying the competition among the remaining players.

- Acquisition-driven Growth: Diversified Energy’s strategy centers on acquiring existing, producing assets, a common tactic in the energy sector to expand scale and cash flow.

- Market Consolidation Impact: As companies like Diversified acquire competitors or their assets, the overall number of independent operators in specific plays or regions decreases, concentrating market power.

- Asset Competition: The pursuit of attractive, long-life assets often leads to bidding wars or strategic maneuvering, increasing the intensity of rivalry among energy producers.

- 2024 M&A Activity: While specific 2024 deal data for Diversified will become clearer throughout the year, the trend of consolidation in the upstream oil and gas sector, driven by efficiency and scale, remained a significant factor influencing competitive dynamics. For instance, in early 2024, the broader energy sector saw major consolidation announcements, indicating a continued focus on M&A as a competitive tool.

The oil and gas industry, particularly for mature assets, is highly competitive due to a large number of players vying for similar opportunities. This intense rivalry is driven by the commodity nature of oil and gas, where price is a primary differentiator, and high fixed costs that compel companies to maintain production. For example, in 2024, the average residential natural gas price in the U.S. hovered around $1.70 per therm, a key competitive metric.

Diversified Energy's acquisition-focused strategy means it actively competes for attractive assets, often leading to bidding wars. The sector's ongoing consolidation, with companies like Diversified making significant acquisitions, further intensifies competition among the remaining players. For instance, in early 2024, major consolidation announcements in the broader energy sector highlighted M&A as a key competitive strategy.

| Competitive Factor | Description | 2024 Relevance/Example |

|---|---|---|

| Number of Competitors | Many independent energy companies and larger E&P firms target similar mature assets. | Prolific basins like Appalachia host numerous operators. |

| Commodity Nature | Oil and natural gas are largely undifferentiated, making price a key competitive driver. | U.S. residential natural gas prices in 2024 averaged approximately $1.70 per therm. |

| High Fixed Costs & Exit Barriers | Substantial capital investment and operational overhead necessitate continuous production, even at lower prices. | Companies continued investing billions in 2024 despite price volatility to cover sunk costs. |

| M&A Activity | Consolidation intensifies rivalry as companies compete for acquisition targets. | Early 2024 saw significant M&A announcements across the energy sector. |

SSubstitutes Threaten

The accelerating adoption of renewable energy sources like solar and wind presents a substantial long-term threat to traditional energy providers. By 2024, global renewable energy capacity continued its upward trajectory, with solar PV and wind power leading the charge. This growth directly challenges the demand for fossil fuels, including natural gas.

While natural gas has been positioned as a transitional fuel due to its comparatively lower emissions, the ultimate objective for many nations is a complete shift to renewable energy grids. This strategic pivot fundamentally alters the long-term demand outlook for natural gas, intensifying the threat of substitution.

Technological leaps in energy storage, like advancements in lithium-ion and solid-state batteries, coupled with significant gains in energy efficiency across industries, are starting to erode the dominance of traditional fossil fuels. For instance, by the end of 2023, global battery storage capacity had surpassed 30 GW, a substantial increase that directly lessens the need for peaking natural gas power plants.

These innovations make renewable energy sources more reliable and reduce the demand for natural gas in heating and power generation. As the cost of solar and wind power continues to fall, and storage solutions become more affordable, the economic incentive to rely on hydrocarbon-based energy sources diminishes, impacting companies heavily invested in natural gas infrastructure.

The increasing governmental focus on climate change, exemplified by policies promoting decarbonization and renewable energy adoption, significantly accelerates the threat of substitutes for traditional energy sources. For instance, in 2024, many nations continued to strengthen their commitments to emissions reduction targets, pushing industries and consumers towards cleaner alternatives. This regulatory push, including mechanisms like carbon pricing and incentives for green energy, directly encourages the shift away from fossil fuels.

Diversified Energy, as a company with a broad energy portfolio, must actively navigate this evolving regulatory landscape. The implementation of policies such as the Inflation Reduction Act in the United States, which offers substantial tax credits for renewable energy projects, directly enhances the competitiveness of solar and wind power, posing a direct substitute threat to conventional energy generation. The global push for net-zero emissions by mid-century, with many countries setting interim targets for 2030, further solidifies this trend.

Consumer and Investor Pressure for Sustainability

Growing environmental awareness is a significant force, pushing consumers and investors toward cleaner energy. This trend amplifies the threat from substitutes, as demand shifts away from traditional fossil fuels. For instance, by mid-2024, renewable energy sources continued to capture a larger share of new power generation capacity globally, driven by policy support and falling costs.

Diversified Energy is actively addressing this by emphasizing its commitment to sustainability. Initiatives like reducing methane emissions, which are potent greenhouse gases, and responsibly retiring old wells are key communication points. In 2023, the company reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to the previous year, showcasing efforts to mitigate its environmental impact.

- Consumer Demand Shift: Consumers are increasingly prioritizing products and services with a lower environmental footprint, directly impacting energy choices.

- Investor Activism: A growing number of institutional investors are integrating Environmental, Social, and Governance (ESG) criteria into their investment decisions, pressuring companies for sustainable operations.

- Renewable Energy Growth: The cost-competitiveness and technological advancements in solar and wind power continue to make them increasingly attractive alternatives.

- Regulatory Tailwinds: Government policies and incentives worldwide are favoring renewable energy development, further strengthening the substitute threat.

Price Competitiveness of Substitutes

The declining cost of renewable energy technologies is making them increasingly price-competitive with traditional fossil fuels, directly impacting natural gas. For instance, the levelized cost of electricity (LCOE) for utility-scale solar photovoltaic (PV) projects in the US was projected to be around $24-$35 per megawatt-hour (MWh) in 2024, a significant drop from previous years. Similarly, onshore wind LCOE was estimated between $24-$32 per MWh. This economic advantage makes renewables more attractive for power generation, directly pressuring natural gas's long-term viability and pricing power.

This trend is further amplified by policy support and technological advancements. As the LCOE for solar and wind continues to fall, these substitutes become more appealing for a wider range of energy applications beyond just electricity generation. This economic pressure on natural gas is a critical consideration for any energy sector analysis.

- Declining Renewable LCOE: Solar PV LCOE in the US projected around $24-$35/MWh in 2024.

- Onshore Wind Competitiveness: Onshore wind LCOE estimated between $24-$32/MWh in 2024.

- Economic Advantage: Renewables are becoming more economically attractive than natural gas.

- Impact on Natural Gas: Direct pressure on natural gas pricing power and long-term demand.

The threat of substitutes for natural gas is significant and growing, driven by advancements and cost reductions in renewable energy and energy storage technologies. By 2024, the global energy landscape continued its rapid shift towards cleaner alternatives, directly challenging the dominance of traditional fossil fuels.

Renewable energy sources like solar and wind are becoming increasingly cost-competitive, making them viable substitutes for natural gas in power generation. For instance, the levelized cost of electricity (LCOE) for utility-scale solar PV in the US was projected to be around $24-$35 per megawatt-hour (MWh) in 2024, with onshore wind estimated between $24-$32 per MWh. These figures highlight the economic advantage renewables now hold.

Furthermore, improvements in energy storage, such as battery technology, are enhancing the reliability of renewables, reducing the need for natural gas in peaking power plants. Global battery storage capacity surpassed 30 GW by the end of 2023, a key indicator of this trend. This combination of falling renewable costs and improved storage capabilities intensifies the substitution threat for natural gas.

| Substitute Technology | 2024 LCOE (US$) | Key Advantage |

| Utility-Scale Solar PV | $24-$35/MWh | Falling costs, policy support |

| Onshore Wind | $24-$32/MWh | Cost-competitiveness, scalability |

| Battery Storage | N/A (System Cost) | Grid stability, renewable integration |

Entrants Threaten

Entering the diversified energy sector, especially for acquiring and optimizing existing wells, requires immense capital. Diversified Energy Company's significant acquisitions, often in the multi-billion dollar range, underscore this substantial financial barrier. This high capital requirement effectively deters many potential new competitors from entering the market.

Diversified Energy Company's substantial operational scale and deep expertise in managing mature producing assets present a formidable barrier to new entrants. Acquiring or developing the necessary capabilities to efficiently optimize existing wells, a core competency for Diversified, requires significant investment and specialized knowledge.

For instance, as of the first quarter of 2024, Diversified Energy reported operating approximately 57,000 wells, a testament to their established infrastructure and operational footprint. This scale allows for significant cost efficiencies and a proven ability to extract value from mature fields, making it challenging for newcomers to compete on a similar cost basis.

The oil and gas sector faces a dense web of evolving environmental regulations, from stringent permitting processes to emissions standards and the significant costs associated with well abandonment liabilities. New companies entering this market must grapple with this complex regulatory landscape, which demands substantial investment in compliance.

Diversified Energy Company PLC, for instance, proactively addresses these challenges through its dedicated well retirement subsidiary. This internal capability not only ensures compliance but also represents a significant operational and financial barrier for potential new entrants seeking to operate within similar regulatory frameworks.

Access to Existing Infrastructure and Markets

Establishing a foothold in key energy-producing regions like the Appalachian Basin and Central Region necessitates access to sophisticated midstream infrastructure. This infrastructure is crucial for the efficient transportation and marketing of both natural gas and oil. Without this, new players face a formidable barrier.

The construction of new midstream facilities is an exceptionally capital-intensive undertaking. Furthermore, these projects are often mired in complex regulatory approval processes and can encounter significant opposition from local communities, significantly delaying or even halting development.

Diversified Energy benefits from its already established and extensive network of pipelines, storage facilities, and gathering systems. This existing infrastructure provides a significant competitive advantage, making it exceedingly difficult for new entrants to replicate the company's reach and market access. For instance, Diversified Energy reported significant operational throughput in its 2023 filings, showcasing the utilization of its existing infrastructure.

- Infrastructure Dependency: New entrants are heavily reliant on accessing or building costly midstream assets.

- Capital Requirements: The sheer scale of investment needed for new infrastructure deters many potential competitors.

- Regulatory Hurdles: Navigating environmental and community approvals for new infrastructure is a lengthy and uncertain process.

- Diversified's Advantage: Diversified Energy's existing, integrated infrastructure network presents a substantial barrier to entry.

Proprietary Technology and Data Advantages

Diversified Energy Company's proprietary technology and data advantages create a significant barrier for new entrants. Their advanced analytical tools and extensive operational data from optimizing mature wells, a core competency, would be costly and time-consuming for newcomers to replicate. For instance, in 2024, the company continued to invest in digital solutions aimed at enhancing production efficiency, a crucial element that new competitors would struggle to match without substantial upfront investment in similar infrastructure and expertise.

New entrants would face the considerable challenge of developing or acquiring comparable technological capabilities and amassing the deep operational data that Diversified Energy already possesses. This accumulated knowledge base, refined through years of experience in managing and optimizing unconventional, low-decline assets, represents a substantial hurdle. The cost and time required to build this level of data-driven operational intelligence would likely deter many potential competitors.

- Proprietary Technology: Diversified Energy utilizes a proprietary platform for asset optimization.

- Data Advantage: Accumulated operational data provides insights into maximizing value from mature wells.

- Barrier to Entry: New entrants need to invest heavily in similar advanced analytical and operational tools.

- Competitive Edge: This technological and data-driven approach offers a significant competitive moat.

The threat of new entrants in the diversified energy sector, particularly for acquiring and optimizing existing wells, is significantly mitigated by substantial capital requirements. Diversified Energy Company's business model, which involves large-scale acquisitions, highlights this barrier. For instance, their acquisition of assets in the Central Region for $225 million in 2023 demonstrates the considerable financial commitment needed to enter this market.

Furthermore, the established operational scale and deep expertise of companies like Diversified Energy present a formidable challenge. Operating approximately 57,000 wells as of Q1 2024, Diversified possesses economies of scale and proven optimization techniques that are difficult for newcomers to replicate without significant investment and specialized knowledge.

The regulatory environment, encompassing stringent environmental standards and well abandonment liabilities, adds another layer of complexity and cost. Diversified Energy's proactive approach, including a dedicated well retirement subsidiary, showcases an integrated strategy that new entrants would find costly and time-consuming to match.

Access to essential midstream infrastructure is also a critical barrier. Building or securing access to pipelines and storage facilities is capital-intensive and subject to lengthy regulatory approvals and potential community opposition. Diversified Energy's existing, extensive infrastructure network provides a significant competitive advantage, making it challenging for new players to achieve comparable market reach and cost efficiencies.

| Barrier Type | Description | Diversified Energy's Position |

|---|---|---|

| Capital Requirements | High investment needed for asset acquisition and infrastructure development. | Significant financial capacity, demonstrated by multi-million dollar acquisitions. |

| Operational Expertise | Need for specialized knowledge in optimizing mature, unconventional wells. | Extensive experience and proven track record in maximizing value from existing assets. |

| Regulatory Compliance | Navigating complex environmental regulations and abandonment liabilities. | Proactive compliance strategies and integrated operational subsidiaries. |

| Infrastructure Access | Reliance on or development of costly midstream transportation and storage. | Established, extensive, and efficient existing infrastructure network. |

Porter's Five Forces Analysis Data Sources

Our Diversified Energy Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, industry-specific market research from firms like Wood Mackenzie and IHS Markit, and regulatory filings from bodies such as the EIA and FERC.