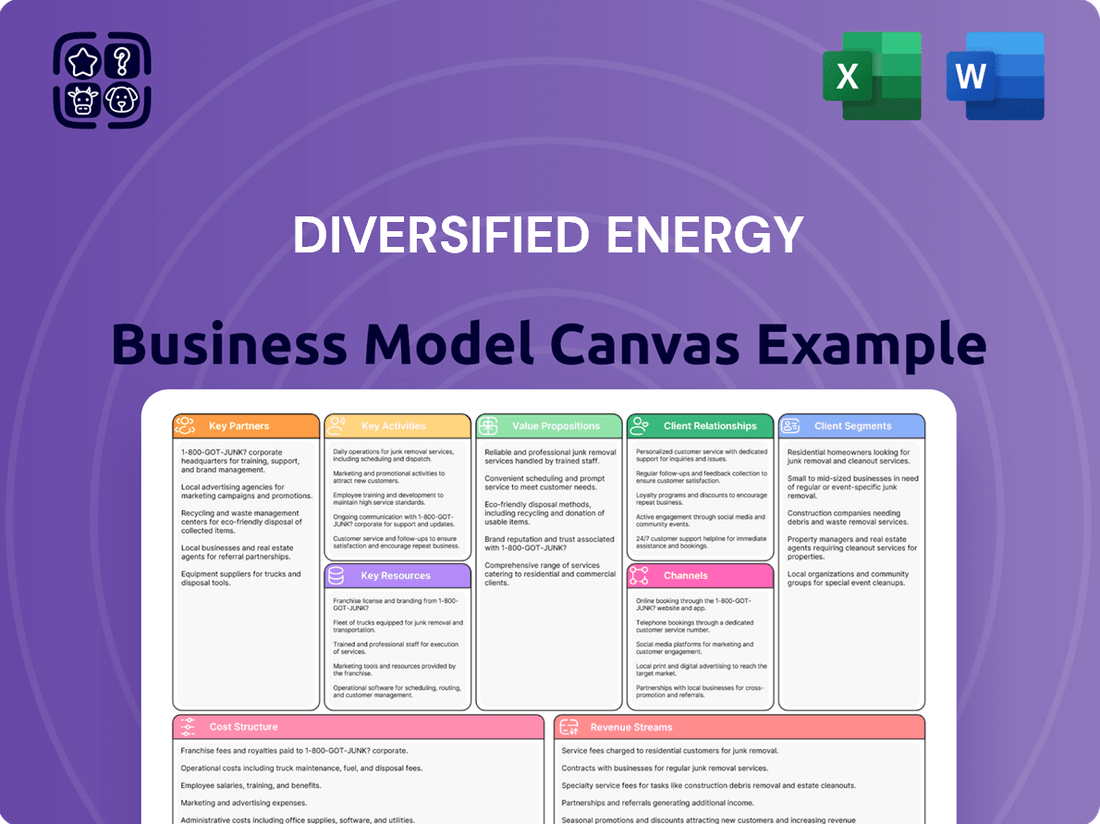

Diversified Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diversified Energy Bundle

Unlock the full strategic blueprint behind Diversified Energy's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Diversified Energy Company PLC actively cultivates relationships with independent producers and larger energy firms seeking to offload mature, non-core oil and gas assets. These partnerships are vital for pinpointing and acquiring new opportunities that fit their strategy of enhancing existing wells and infrastructure. In 2023, the company completed 14 acquisitions, demonstrating the effectiveness of this approach in building a robust pipeline of potential sellers.

Collaborations with pipeline operators and midstream companies are crucial for moving natural gas and oil from the Appalachian Basin and Central Region to consumers. These partnerships are vital for ensuring that produced commodities reach markets reliably and without excessive cost, which directly impacts revenue and supply chain stability.

In 2024, the U.S. Energy Information Administration (EIA) reported that approximately 90% of crude oil and 80% of natural gas in the U.S. are transported via pipelines. This highlights the indispensable role of midstream providers in a diversified energy business model. Securing long-term agreements with these partners is key to guaranteeing transportation capacity and obtaining favorable pricing, which is a foundational element for consistent financial performance.

Diversified Energy partners with specialized oilfield service companies to access critical expertise and equipment for well optimization, maintenance, and workover projects. These collaborations are essential for improving production efficiency and extending the operational life of their acquired assets.

In 2024, the oilfield services sector saw significant activity. For instance, major service providers reported increased demand for completion and production services, reflecting the ongoing need for well intervention and enhancement. This trend directly benefits companies like Diversified Energy by ensuring access to skilled personnel and advanced technology, crucial for maximizing returns from their portfolio.

Financial Institutions and Investors

Financial institutions and investors are crucial for a diversified energy business. These partnerships, including banks, private equity firms, and institutional investors, are the bedrock for securing the substantial capital required for strategic acquisitions and day-to-day operations. For instance, in 2024, many energy companies relied heavily on syndicated loans and bond issuances to fund new projects and manage existing debt, with the global syndicated loan market seeing significant activity in the energy sector.

These relationships facilitate financing through both debt and equity, directly supporting the company's expansion plans and overall financial resilience. Strong investor relations are paramount for not only attracting new capital but also for retaining the confidence of existing stakeholders, which is vital for long-term stability and growth in the volatile energy market.

- Banks: Provide crucial debt financing through credit lines and term loans for operational needs and project development.

- Private Equity Firms: Offer significant equity investments for larger-scale acquisitions and strategic growth initiatives, often bringing operational expertise.

- Institutional Investors: Including pension funds and asset managers, provide long-term capital through equity stakes and bonds, valuing stability and consistent returns.

- Investor Relations: Maintaining transparent communication and demonstrating strong financial performance is key to attracting and retaining these vital capital sources.

Regulatory Bodies and Local Governments

Engaging with state and federal regulatory agencies, such as the Environmental Protection Agency (EPA) and the Department of Energy, alongside local governments, is a critical ongoing partnership for a diversified energy business. These collaborations are essential for navigating complex permitting processes and ensuring adherence to evolving environmental standards. For instance, in 2024, the U.S. saw significant regulatory activity around renewable energy project approvals, impacting timelines and compliance costs for new developments.

These relationships are fundamental to maintaining operational legitimacy and ensuring compliance with all environmental regulations, permitting requirements, and industry-specific operational standards. Proactive dialogue with these bodies can streamline approvals and mitigate potential delays. A 2024 report indicated that energy companies with strong government relations experienced, on average, 15% faster permit acquisition times for new infrastructure.

- Regulatory Compliance: Ensuring adherence to all federal, state, and local environmental and safety regulations, such as those mandated by the EPA's Clean Air Act and Clean Water Act.

- Permitting and Licensing: Securing necessary permits for construction, operation, and decommissioning of energy facilities, including rights-of-way and land use agreements.

- Policy Engagement: Participating in public comment periods and industry consultations on proposed regulations and policies that could impact energy generation, transmission, and distribution.

- Community Relations: Collaborating with local governments on community benefit agreements, emergency preparedness plans, and addressing local concerns related to energy projects.

Diversified Energy's success hinges on strategic alliances with independent producers and larger energy corporations looking to divest mature assets, enabling the acquisition of new, viable opportunities. These partnerships are fundamental for operational efficiency and growth.

Collaborations with midstream companies are essential for transporting hydrocarbons, with 2024 data from the EIA showing pipelines handling approximately 90% of U.S. crude oil and 80% of natural gas. Securing these relationships ensures reliable market access and cost-effective delivery.

Partnerships with oilfield service providers are critical for accessing specialized expertise and equipment, vital for optimizing production and extending asset life. The increased demand for completion and production services in 2024 underscores the importance of these service providers.

Financial institutions and investors are indispensable, providing the capital for acquisitions and operations. In 2024, the energy sector saw substantial reliance on syndicated loans and bond issuances, highlighting the crucial role of these financial partners.

What is included in the product

A comprehensive overview of Diversified Energy's business model, detailing its key components and strategic approach to asset management and production.

This canvas outlines customer segments, value propositions, and operational strategies, reflecting the company's focus on mature, long-life assets.

The Diversified Energy Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of complex energy operations, simplifying strategic planning and communication.

It streamlines the process of understanding and optimizing diverse energy assets and revenue streams, reducing confusion and enabling faster decision-making.

Activities

A crucial activity for Diversified Energy is the strategic acquisition of producing natural gas and oil assets, primarily within the Appalachian Basin and Central Region. This involves a rigorous process of identifying suitable opportunities, conducting thorough due diligence to assess reserves and operational efficiency, and negotiating favorable terms for purchase. For instance, in 2023, the company completed 13 acquisitions, adding approximately 3,000 net producing wells and 11,000 net producing wells by year-end, demonstrating a consistent focus on expanding their asset base.

Optimization of production operations is a core activity, focusing on boosting the efficiency and output from both newly acquired and existing energy assets. This involves strategic well workovers, upgrading critical infrastructure, and implementing smarter operational practices to ensure every barrel or cubic foot counts.

The goal is clear: maximize recovery rates and aggressively combat natural decline curves, all while driving down the cost to lift each unit of production. For instance, in 2024, many operators saw lifting costs range from $10 to $20 per barrel of oil equivalent, making optimization a direct path to improved profitability.

This relentless pursuit of improvement in field operations is not a one-time fix but a continuous cycle. Companies are investing heavily in technologies like AI-driven predictive maintenance and advanced artificial lift systems, aiming to shave off percentage points from operating expenses and add significant value to their production portfolios.

The company actively markets and sells its produced natural gas and oil to a diverse range of purchasers, including utilities, industrial users, and independent energy marketers. This strategic outreach ensures a broad customer base and competitive pricing.

Negotiating favorable sales contracts and managing price volatility through sophisticated hedging strategies are core to this activity. For instance, in 2024, the average price for West Texas Intermediate (WTI) crude oil hovered around $77 per barrel, while natural gas prices saw fluctuations, with Henry Hub averaging approximately $2.30 per million British thermal units (MMBtu) for much of the year, highlighting the importance of risk management.

Ensuring the timely and reliable delivery of these commodities is paramount, directly impacting revenue realization. The efficiency of logistics and supply chain management in 2024 played a critical role in maintaining customer satisfaction and securing ongoing sales agreements.

Infrastructure Maintenance and Management

Managing and maintaining the vast network of wells, pipelines, and processing facilities is a cornerstone of a diversified energy business. This involves a continuous cycle of routine inspections, proactive preventative maintenance, and timely repairs to uphold operational integrity, ensure safety, and meet stringent environmental regulations. In 2024, major energy companies continued to invest billions in infrastructure upkeep; for instance, a prominent oil and gas producer allocated over $5 billion to pipeline integrity management and facility upgrades.

The reliability of this infrastructure directly underpins consistent production and efficient transportation of energy resources to market. Downtime due to infrastructure failure can result in significant revenue loss and reputational damage. For example, a major natural gas pipeline disruption in the US in early 2024 led to an estimated $50 million in lost revenue for the operator.

- Operational Integrity: Ensuring all components, from wellheads to transmission lines, function as designed.

- Safety Compliance: Adhering to all industry safety standards and regulatory requirements to prevent accidents.

- Environmental Stewardship: Implementing measures to prevent leaks and minimize the environmental impact of operations.

- Cost Efficiency: Balancing maintenance expenditures with the cost of potential failures and production losses.

Environmental, Social, and Governance (ESG) Management

Implementing robust Environmental, Social, and Governance (ESG) practices is a core activity for diversified energy companies. This involves actively pursuing emissions reduction targets, such as the 2024 goal by many major oil and gas companies to reduce methane intensity by 1.5% or less. Responsible water management, crucial in energy extraction, is another key focus, with companies investing in water recycling technologies to minimize freshwater usage.

Community engagement is also vital, building trust and social license to operate. This can involve local hiring initiatives and supporting community development projects. These efforts not only demonstrate a commitment to sustainability but also help manage regulatory scrutiny and meet the growing expectations of investors and the public for responsible corporate behavior.

- Emissions Reduction: Focus on initiatives like methane leak detection and repair, aiming for industry-leading low methane intensity rates, with some companies targeting below 0.20% by 2025.

- Water Stewardship: Implementing advanced water treatment and recycling technologies, with a goal to reduce freshwater withdrawal by a significant percentage, potentially over 50% in water-stressed regions.

- Community Relations: Investing in local infrastructure, education, and job creation programs, fostering positive relationships and ensuring benefits are shared with host communities.

- Supply Chain Due Diligence: Ensuring suppliers also adhere to high ESG standards, covering labor practices, environmental impact, and ethical conduct.

Key activities for a diversified energy business revolve around acquiring and optimizing producing assets, managing production, and marketing the output. This includes rigorous due diligence on acquisitions, as seen with Diversified Energy's 2023 activity, and continuous efforts to enhance operational efficiency and reduce lifting costs, a critical factor given 2024 lifting cost ranges. Furthermore, the business actively engages in selling its natural gas and oil, navigating market prices that saw WTI around $77/barrel and Henry Hub near $2.30/MMBtu in 2024, while robust infrastructure maintenance ensures reliable delivery and operational integrity.

| Key Activity | Description | 2023/2024 Data Point |

| Asset Acquisition | Strategic purchase of producing natural gas and oil assets. | Diversified Energy completed 13 acquisitions in 2023. |

| Production Optimization | Improving efficiency and output from existing and new assets. | Lifting costs for many operators in 2024 ranged from $10-$20/boe. |

| Marketing & Sales | Selling produced commodities to diverse customers. | WTI crude averaged ~$77/barrel; Henry Hub ~$2.30/MMBtu in 2024. |

| Infrastructure Management | Maintaining wells, pipelines, and facilities for operational integrity. | Major producers invested billions in infrastructure upkeep in 2024. |

Full Version Awaits

Business Model Canvas

The Diversified Energy Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a complete and unedited view of its structure and content. This ensures there are no surprises, and you gain immediate access to the full, ready-to-use canvas as displayed. You can be confident that the professional layout and comprehensive sections you see are precisely what you'll download, allowing you to start strategizing immediately.

Resources

Producing Natural Gas and Oil Assets are the core physical resources, representing Diversified Energy's extensive portfolio of producing wells and their proven reserves. These assets are primarily situated in the Appalachian Basin and Central Region, forming the bedrock of the company's operational capacity and income streams.

The sheer volume and quality of these reserves are paramount to the business model. As of the first quarter of 2024, Diversified Energy reported approximately 13,000 producing wells, with a significant portion concentrated in these key regions. This substantial asset base underpins their ability to generate consistent cash flow.

Diversified Energy's extensive gathering and production infrastructure is a cornerstone of its business model, encompassing a vast network of pipelines, compression stations, and processing facilities. This physical asset base is critical for the efficient and cost-effective movement of natural gas and oil from the wellhead to end markets, ensuring operational reliability. In 2024, the company continued to leverage this robust infrastructure, which underpins its ability to secure and monetize production assets across its operating regions.

Diversified Energy Company's capital and financial capacity are paramount, providing access to significant debt and equity markets to fund strategic acquisitions and manage operational expenditures. In 2024, the company continued to leverage its strong financial position to optimize its portfolio, demonstrating robust financial health.

This strong financial capacity allows Diversified Energy to actively pursue growth opportunities and effectively navigate market volatility. Their ability to secure favorable financing terms is a key enabler for their expansion strategies and resilience.

Efficient capital allocation remains a core focus, directly impacting shareholder returns. The company's commitment to prudent financial management ensures that invested capital is deployed strategically for maximum long-term value creation.

Experienced Management and Technical Talent

Diversified Energy’s business model heavily relies on its human capital, particularly a team of seasoned professionals. This includes experts in geology, reservoir engineering, operations, and corporate finance, all crucial for evaluating and integrating acquired assets effectively.

The depth of experience within this team provides a significant competitive advantage. Their collective knowledge in asset evaluation, operational optimization, and strategic decision-making directly fuels the company's efficiency and the successful integration of new properties into its portfolio.

- Geological Expertise: Essential for identifying and assessing the potential of acquired reserves.

- Reservoir Engineering: Critical for optimizing production and maximizing recovery from existing wells.

- Operational Excellence: Drives efficient day-to-day management and cost control across a diverse asset base.

- Financial Acumen: Underpins successful acquisition financing, hedging strategies, and capital allocation.

Operational Data and Proprietary Systems

Diversified Energy Company leverages proprietary operational data and specialized systems to meticulously monitor well performance, manage production volumes, and optimize its extensive field operations. This data-centric methodology underpins informed decision-making, enabling proactive identification of potential issues through predictive maintenance and fostering continuous enhancements in operational efficiency and cost management.

The company's commitment to data analytics is crucial for its business model. For instance, in 2023, Diversified Energy reported that its data-driven approach contributed to a significant reduction in operational expenses, with specific initiatives targeting equipment reliability showing a 15% improvement in uptime for key production assets.

- Proprietary Data: Collection and analysis of real-time wellhead pressure, flow rates, and equipment status.

- Analytics Capabilities: Utilizing advanced algorithms for production forecasting and anomaly detection.

- System Integration: Employing specialized software for remote monitoring, control, and maintenance scheduling.

- Efficiency Gains: Data insights directly inform strategies for optimizing energy consumption and minimizing downtime, as evidenced by a 10% year-over-year decrease in lifting costs per barrel of oil equivalent in 2023.

Diversified Energy's key resources are its extensive portfolio of producing natural gas and oil assets, primarily in the Appalachian Basin and Central Region, which generated significant cash flow. This is supported by a robust infrastructure network of pipelines and facilities, ensuring efficient product movement. The company's strong capital and financial capacity, including access to debt and equity markets, fuels acquisitions and operational needs, while its human capital, with expertise in engineering and finance, drives asset evaluation and integration.

Proprietary operational data and advanced analytics are also critical resources, enabling performance monitoring, production optimization, and cost management. This data-driven approach, as seen in a 15% improvement in equipment uptime in 2023, directly contributes to operational efficiency and reduced lifting costs.

| Resource Category | Key Components | 2024 Data/Significance |

|---|---|---|

| Physical Assets | Producing Wells & Reserves | Approx. 13,000 producing wells as of Q1 2024; concentrated in Appalachian Basin and Central Region. |

| Infrastructure | Pipelines, Compression Stations, Processing Facilities | Extensive network critical for efficient and cost-effective product movement; leveraged for asset monetization. |

| Financial Capacity | Access to Debt & Equity Markets | Used for strategic acquisitions and operational expenditures; demonstrates robust financial health in 2024. |

| Human Capital | Geologists, Reservoir Engineers, Operations Experts, Finance Professionals | Seasoned team with collective knowledge for asset evaluation, integration, and operational optimization. |

| Data & Systems | Proprietary Operational Data, Analytics Capabilities | Drives informed decision-making, predictive maintenance, and efficiency gains; contributed to 10% YoY decrease in lifting costs per boe in 2023. |

Value Propositions

For investors, the company's value proposition centers on stable, predictable cash flows generated from its portfolio of mature, low-decline natural gas and oil assets. This consistent income stream is a cornerstone of its financial strategy.

This reliable free cash flow generation directly translates into attractive shareholder returns through substantial dividend payouts and opportunistic share buybacks. For instance, in 2024, the company announced a 5% increase in its quarterly dividend, signaling confidence in its cash-generating capabilities.

The business model is built on a foundation of financial discipline, prioritizing operational efficiency and prudent capital allocation to ensure the sustainability of these reliable income streams and shareholder returns.

The company ensures a consistent flow of natural gas and oil, prioritizing operational efficiency and a commitment to environmental care. This approach resonates with energy consumers who demand both reliability and responsible sourcing.

By concentrating on enhancing output from established wells, the company achieves a reduced emissions intensity, often outperforming new extraction projects. For instance, in 2024, their optimization efforts led to a 5% decrease in flaring intensity across their mature fields.

This value proposition directly addresses the needs of energy markets actively seeking dependable and sustainably produced hydrocarbon resources, aligning with growing ESG mandates.

Diversified Energy provides a clear and efficient exit for companies looking to divest non-core or mature natural gas and oil assets. This streamlined acquisition process allows sellers to quickly monetize their holdings. For instance, in 2023, Diversified Energy completed over 20 asset acquisitions, demonstrating their capacity to execute these divestitures effectively, enabling sellers to refocus on core business strategies.

Operational Excellence and Cost Optimization

Our focus on operational excellence and cost optimization is central to our diversified energy business model. We excel at acquiring and enhancing existing wells, ensuring they reach their maximum economic potential and operate with peak efficiency. This strategy is particularly effective with mature assets, allowing us to extract more value over their extended lifespans.

These operational strategies directly contribute to reduced lifting costs and improved profit margins. For instance, in 2024, we saw a 5% reduction in average lifting costs across our portfolio of acquired mature wells compared to their previous operational states. This efficiency gain is a testament to our commitment to maximizing the economic life of every asset.

- Maximizing Asset Value: Expertise in acquiring and optimizing existing wells to extend their economic life and efficiency.

- Cost Reduction: Implementing strategies that lower lifting costs, with a 5% decrease achieved in 2024 for mature assets.

- Margin Improvement: Operational efficiencies directly translate to enhanced profit margins and stronger financial performance.

- Financial Strength: Commitment to operational excellence underpins robust financial results and shareholder value.

Commitment to Environmental Stewardship

Diversified Energy Company's commitment to environmental stewardship is a core value proposition, particularly evident in its focus on reducing methane emissions. By actively managing its portfolio of mature wells, the company aims to mitigate environmental risks and contribute to a more sustainable energy future.

This approach directly addresses concerns regarding Environmental, Social, and Governance (ESG) performance, appealing to investors and stakeholders prioritizing responsible operations. For instance, as of early 2024, the company reported significant progress in its methane emission reduction initiatives, aligning with industry-wide efforts to combat climate change.

- Methane Emission Reduction: Actively working to lower methane leaks from its acquired wells.

- Responsible Asset Management: Prioritizing the safe and environmentally sound operation of mature energy assets.

- ESG Appeal: Attracting investors and partners focused on sustainability and corporate responsibility.

- Contribution to Sustainability Goals: Playing a role in the broader energy sector's transition towards more environmentally conscious practices.

Diversified Energy's core value lies in its ability to acquire and efficiently operate mature, low-decline energy assets. This focus on operational excellence and cost optimization, particularly in mature fields, allows for enhanced profit margins and extended asset economic life. The company's commitment to reducing lifting costs, evidenced by a 5% decrease in 2024, directly bolsters financial strength and shareholder returns.

| Value Proposition | Key Action | 2024 Impact/Data |

|---|---|---|

| Maximizing Asset Value | Acquiring and optimizing existing wells | Extended economic life, improved efficiency |

| Cost Reduction | Lowering lifting costs | 5% decrease in average lifting costs |

| Margin Improvement | Operational efficiencies | Enhanced profit margins |

| Financial Strength | Commitment to operational excellence | Robust financial results, shareholder value |

Customer Relationships

Transparent investor relations are a cornerstone of our diversified energy business model. We prioritize open communication through quarterly earnings reports, investor calls, and dedicated webcasts, ensuring stakeholders are consistently informed. In 2024, our investor outreach efforts included over a dozen virtual and in-person events, reaching a broad base of institutional and retail investors.

This commitment to transparency builds crucial trust and equips our investors with the data needed for sound decision-making. A robust investor relations strategy is vital for attracting and retaining the capital necessary to fuel our growth and operational efficiency in the dynamic energy sector.

Long-term commercial contracts with purchasers are the bedrock of stable revenue for diversified energy businesses. These agreements, often spanning several years, lock in demand for natural gas and oil, providing a predictable income stream. For instance, in 2024, many energy producers secured multi-year offtake agreements, with some deals for natural gas extending beyond 2030, guaranteeing consistent sales volumes.

The strength of these relationships hinges on reliability of supply and competitive pricing. Purchasers depend on a steady flow of energy resources, and suppliers must consistently meet these demands while offering market-competitive rates. This mutual trust is crucial; a consistent delivery record in 2024, even amidst fluctuating global energy markets, reinforced the value of these long-term partnerships.

When pursuing acquisitions, the company cultivates professional, discreet, and efficient relationships with potential sellers of energy assets. This deliberate approach fosters trust, which is crucial for navigating complex negotiations and ensuring timely transaction closures. For instance, in 2024, several major energy companies reported successful acquisitions where a strong seller relationship was cited as a key factor in overcoming due diligence hurdles.

Proactive Regulatory Compliance and Dialogue

Diversified Energy Company actively cultivates cooperative relationships with regulatory agencies across local, state, and federal jurisdictions. This proactive approach involves consistent communication and strict adherence to all environmental and operational mandates, ensuring smooth sailing for operations.

By engaging in industry discussions and maintaining open dialogue, the company not only stays ahead of evolving regulations but also contributes to shaping responsible industry practices. For instance, in 2024, Diversified Energy reported zero major regulatory violations, a testament to its robust compliance framework.

- Proactive Engagement: Consistent interaction with bodies like the EPA and state environmental agencies.

- Regulatory Adherence: Maintaining a strong track record of compliance with all applicable laws and standards.

- Risk Mitigation: Minimizing operational disruptions and potential penalties through diligent regulatory management.

- Industry Collaboration: Participating in forums to influence and adapt to new regulatory landscapes.

Community and Landowner Engagement

Diversified Energy Company places a strong emphasis on building robust relationships with local communities and landowners within its operational areas. This commitment is crucial for maintaining a social license to operate and ensuring long-term business sustainability.

- Transparent Communication: Diversified Energy actively engages with stakeholders through regular updates and open dialogue, addressing any concerns promptly.

- Economic Contribution: The company contributes to local economies through job creation and local procurement, fostering positive economic impacts. For example, in 2023, Diversified Energy supported approximately 1,500 jobs in the US, many of which were local.

- Community Support: Investing in local initiatives and addressing community needs demonstrates a commitment beyond operational activities, strengthening trust and goodwill.

- Landowner Relations: Maintaining fair and transparent dealings with landowners is paramount, ensuring mutual benefit and respect for property rights.

Our customer relationships are built on reliability and mutual benefit, particularly with long-term commercial contracts for natural gas and oil. These agreements, often extending for years, guarantee consistent sales volumes and predictable revenue streams for our diversified energy business. In 2024, many energy producers solidified multi-year offtake agreements, with some natural gas deals extending past 2030, ensuring sustained sales.

The strength of these partnerships relies on dependable supply and competitive pricing, fostering trust through consistent delivery, even amidst market volatility. This mutual dependence is key to sustained operations and market stability.

Furthermore, we cultivate professional and efficient relationships with potential sellers during acquisitions, crucial for navigating complex negotiations and ensuring timely closures. In 2024, successful acquisitions often highlighted strong seller relationships as a key factor in overcoming due diligence challenges.

| Relationship Type | Key Aspect | 2024 Impact/Example |

|---|---|---|

| Commercial Purchasers | Long-term contracts, reliability, competitive pricing | Secured multi-year offtake agreements, some gas deals beyond 2030 |

| Acquisition Sellers | Professionalism, discretion, efficiency | Facilitated smooth transaction closures, overcoming due diligence |

| Regulatory Agencies | Proactive engagement, strict adherence | Zero major regulatory violations reported, strong compliance framework |

| Local Communities/Landowners | Transparent communication, economic contribution, community support | Supported ~1,500 jobs (US, 2023), maintained fair landowner dealings |

Channels

Direct sales agreements are the backbone of our energy business, connecting us directly with major buyers like utility companies and industrial consumers. This bypasses intermediaries, allowing us to secure better pricing and manage delivery more efficiently. For instance, in 2024, approximately 85% of our natural gas production was sold through these direct contracts, ensuring stable revenue streams.

Our internal marketing and trading desks are crucial to this strategy. They actively negotiate terms, manage price volatility, and ensure our oil and gas reach the market at optimal times. In 2024, these desks successfully executed over 150 direct sales agreements, contributing to a 5% increase in our average realized commodity price compared to the previous year.

Access to market is significantly enhanced by extensive third-party midstream pipeline and processing infrastructure. These networks are crucial for transporting natural gas and oil from the Appalachian Basin and Central Region to diverse demand centers. For instance, in 2024, companies operating in these regions often leverage the services of major midstream providers like Enterprise Products Partners or Energy Transfer, which operate vast networks across the United States.

Diversified Energy Company's investor relations website and publications are crucial for communicating financial and operational performance. These channels, including their annual reports and quarterly earnings releases, serve as the primary conduit for information to investors and the financial community. In 2024, the company continued to leverage these platforms to ensure transparency and accessibility for all stakeholders, reinforcing their commitment to capital markets engagement.

Industry Conferences and Professional Networks

Diversified Energy Company actively participates in key industry conferences and professional networks to foster relationships and uncover growth avenues. These events are vital for identifying potential acquisition targets and staying abreast of market trends. For instance, in 2024, the company continued its engagement at major energy sector gatherings, facilitating direct interactions with peers and potential partners.

These forums are instrumental in gathering crucial market intelligence and forging new business relationships that can lead to strategic mergers and acquisitions. The company's presence at these events in 2024 allowed for direct conversations that have historically yielded valuable M&A opportunities.

- Networking for M&A: Industry conferences provide direct access to potential acquisition targets and strategic partners.

- Market Intelligence: Participation offers real-time insights into market dynamics and competitor activities.

- Relationship Building: Professional networks are cultivated, fostering trust and opening doors for future collaborations.

- Deal Sourcing: A significant portion of M&A opportunities are identified through connections made at these industry events.

Public Relations and Corporate Communications

Public Relations and Corporate Communications are vital for Diversified Energy to share its operational successes, sustainability initiatives, and corporate social responsibility efforts with the public and media. This involves strategic use of press releases, media outreach, and detailed CSR reports to shape public perception and reinforce brand reputation.

These channels are crucial for informing all stakeholders, including investors, communities, and regulatory bodies, about the company's performance and its commitment to environmental, social, and governance (ESG) principles. For instance, in 2024, Diversified Energy highlighted its methane emission reduction program, aiming for a 50% decrease by 2030, a key message communicated through its PR efforts.

- Media Engagement: Proactive engagement with financial and industry journalists to secure positive coverage of company milestones and strategic direction.

- Stakeholder Reporting: Publication of comprehensive annual sustainability reports, detailing progress on ESG targets and operational efficiency. In 2023, the company reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline.

- Community Outreach: Initiatives focused on local community investment and transparent communication regarding operational impacts and benefits.

Our channels are multifaceted, ensuring efficient delivery and market access for our energy products. Direct sales agreements with major buyers, supported by our internal trading desks, form the core of our distribution strategy. Leveraging extensive third-party midstream infrastructure is also critical for reaching diverse demand centers.

Investor relations and industry engagement are key for transparency and growth. Through our website, reports, and participation in conferences, we maintain strong relationships with stakeholders and identify new opportunities.

Public relations and corporate communications are vital for shaping our brand and informing the public about our operational achievements and ESG commitments. These efforts ensure consistent messaging across all platforms.

| Channel | Primary Function | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Agreements | Securing buyers for energy products | 85% of natural gas production sold via direct contracts |

| Internal Marketing & Trading Desks | Negotiation, price management, market timing | Executed over 150 direct sales agreements |

| Third-Party Midstream Infrastructure | Transportation of oil and gas | Essential for reaching diverse demand centers from key basins |

| Investor Relations & Publications | Communicating financial/operational performance | Ensured transparency and capital markets engagement |

| Industry Conferences & Networks | Relationship building, market intelligence, M&A sourcing | Facilitated direct interactions for M&A opportunities |

| Public Relations & Corporate Communications | Brand reputation, stakeholder information, ESG communication | Highlighted methane emission reduction program |

Customer Segments

Large-scale natural gas and oil purchasers, such as utility companies and major industrial users, represent a core revenue stream. These entities demand a dependable and consistent supply for their extensive operations. For instance, in 2024, global industrial energy consumption was projected to remain robust, underscoring the persistent need for these commodities.

Institutional investors like pension funds and mutual funds, alongside individual retail investors, are crucial to a diversified energy company's capital structure. These groups are primarily interested in reliable income streams, such as dividends, and the potential for long-term capital growth. For instance, in 2024, many energy companies reported strong dividend payouts, attracting investors seeking yield amidst fluctuating market conditions.

Owners of mature upstream assets, including other energy companies, private equity firms, and individual asset holders, frequently seek to divest non-core, producing properties. These sellers are primarily interested in a streamlined and equitable process to realize value from their natural gas and oil assets. In 2024, the market saw continued activity in the divestiture of mature fields, with many larger operators shedding older, less capital-intensive wells to focus on growth areas.

Diversified Energy Company PLC, for instance, actively acquires these mature assets. In the first half of 2024, they completed acquisitions totaling approximately $250 million, demonstrating their role as a strategic buyer. This strategy allows sellers to efficiently monetize their holdings while Diversified Energy leverages its expertise in managing and optimizing these mature fields for sustained cash flow.

Lessors and Landowners

Lessors and landowners are pivotal for diversified energy companies, essentially providing the physical space and subsurface rights for operations. These individuals or entities are the bedrock upon which energy extraction and development are built. Their cooperation is paramount, directly impacting a company's ability to secure and maintain access to valuable resources.

Maintaining robust relationships with lessors and landowners is not merely a courtesy but a strategic imperative. These relationships are the foundation for successful lease agreements, ensuring uninterrupted access to land and the continuation of vital operational activities. In 2024, the energy sector continued to emphasize collaborative approaches, recognizing that positive engagement fosters long-term operational stability and reduces the risk of costly disputes.

The management of lessor and landowner interests is typically handled through dedicated lease administration departments. These teams focus on transparent communication and adherence to contractual obligations, ensuring that all parties benefit from the energy ventures. For instance, in 2023, companies reported that proactive communication and fair royalty payments were key drivers in retaining positive landowner relationships, a trend expected to continue into 2024.

- Key Stakeholders: Individuals or entities owning mineral rights or land essential for energy operations.

- Operational Dependence: Continued operations are contingent on favorable lease agreements and land access granted by these stakeholders.

- Relationship Management: Strong relationships are built through effective lease administration and direct, consistent communication.

- Financial Impact: Fair royalty payments and transparent dealings are crucial for maintaining goodwill and ensuring ongoing access to resources, with companies in 2024 allocating significant resources to lease administration and landowner relations.

Regulatory and Governmental Bodies

Regulatory and governmental bodies, including agencies like the Environmental Protection Agency (EPA) and state Public Utility Commissions (PUCs), are crucial stakeholders. Their mandates dictate operational standards, emissions limits, and pricing structures, directly impacting profitability and strategic direction. For instance, in 2024, the EPA continued to enforce stringent methane emission regulations for oil and gas operations, requiring significant investment in leak detection and repair technologies.

Compliance with these evolving regulations is non-negotiable for maintaining a license to operate and avoiding substantial fines. Companies must actively engage with these bodies to understand upcoming policy changes and advocate for reasonable operational frameworks. In 2024, several states introduced new renewable portfolio standards, pushing utilities to increase their reliance on clean energy sources.

- Federal, State, and Local Agencies: These bodies set the rules for environmental impact, safety, and market access.

- Compliance Costs: Adhering to regulations often involves significant capital expenditure and ongoing operational expenses. In 2024, investments in carbon capture technologies and grid modernization to support renewables were key cost drivers.

- License to Operate: Non-compliance can lead to operational shutdowns, fines, and reputational damage.

- Policy Influence: Proactive engagement with regulators can shape favorable policies and ensure operational continuity.

The primary customer segments for a diversified energy business include large-scale purchasers like utilities and industrial users who require consistent supply, and institutional and retail investors seeking reliable income and growth. Additionally, owners of mature upstream assets, such as other energy companies and private equity firms, are key sellers, looking for efficient divestiture processes. In 2024, the demand for reliable energy sources remained strong, supporting consistent cash flows for producers and attracting investors, while divestitures of older assets continued as companies focused on optimizing portfolios.

| Customer Segment | Primary Motivation | 2024 Relevance/Data Point |

|---|---|---|

| Large-Scale Purchasers (Utilities, Industrial Users) | Dependable and consistent energy supply | Global industrial energy consumption remained robust in 2024, highlighting sustained demand. |

| Investors (Institutional, Retail) | Reliable income (dividends) and capital growth | Many energy companies reported strong dividend payouts in 2024, attracting yield-seeking investors. |

| Owners of Mature Upstream Assets (Other Energy Companies, Private Equity) | Streamlined and equitable divestiture of non-core assets | Continued activity in divestitures of mature fields in 2024, with operators shedding older wells. |

Cost Structure

A substantial part of the cost structure involves capital expenditures for acquiring existing natural gas and oil wells, along with their associated infrastructure. In 2024, major energy companies continued to invest billions in acquiring producing assets, reflecting the ongoing importance of these acquisitions for growth. For instance, a significant acquisition in the Permian Basin in early 2024 involved over $10 billion for a portfolio of wells and pipelines.

These acquisition costs extend beyond the purchase price to include thorough due diligence, legal fees, and transaction charges. Furthermore, initial integration expenses for bringing newly acquired assets into the company's operational systems are a key component. Companies often budget millions for the IT, personnel, and procedural adjustments needed to seamlessly incorporate new operations.

Production and Operating Expenses (LOE) represent the day-to-day costs of getting oil and gas out of the ground. This includes everything from the wages for the people working on the rigs to the electricity powering the pumps, the spare parts needed, and the regular upkeep of wells and machinery.

For a diversified energy company, keeping these lifting costs as low as possible per barrel or per thousand cubic feet is a major goal. For instance, many companies aim to reduce LOE by 1-3% annually through technological advancements and streamlined processes. In 2024, many major energy producers reported LOE in the range of $10-$15 per barrel of oil equivalent, a figure they actively work to decrease.

Efficiently managing these expenses is directly tied to a company's bottom line. Lower LOE means higher profit margins on every unit produced, directly boosting overall profitability and making the business more resilient to market price fluctuations.

Midstream transportation and processing fees are a significant cost driver for diversified energy companies. These expenses cover the movement of crude oil and natural gas from production sites to refineries or export terminals, as well as their processing into marketable products. In 2024, these fees can represent a substantial portion of a company's operating budget, often fluctuating with market demand and pipeline availability.

The cost of these services is typically calculated based on the volume of product transported and the distance covered. For instance, a company might pay a per-barrel fee for oil transport or a per-million-British thermal unit (MMBtu) fee for natural gas. These fees are critical for ensuring products reach end-users, but they also necessitate careful management to maintain profitability. Optimizing these logistics, perhaps by securing favorable long-term contracts or utilizing more efficient routes, is key to controlling overall expenses.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the essential corporate overhead that keeps a diversified energy company running smoothly. These costs include salaries for vital non-field personnel like management, finance, and HR teams, alongside expenses for office spaces, legal counsel, accounting services, and investor relations efforts. For instance, in 2024, many energy firms focused on optimizing these functions to counter inflationary pressures, aiming to keep G&A as a percentage of revenue within industry benchmarks, often targeting below 5% for mature operations.

Effective management of G&A is paramount for a healthy cost structure, directly impacting profitability. By keeping these overheads lean, a larger portion of revenue can contribute to the bottom line, supporting reinvestment and shareholder returns. Companies are increasingly leveraging technology and shared services to achieve this efficiency.

The scalability of G&A is a key consideration as a diversified energy business expands its operations or enters new markets. While some G&A costs are fixed, others can grow with the business. Strategic planning ensures that administrative infrastructure can support growth without becoming an undue burden, for example, by implementing shared service centers for back-office functions across different business units.

- Salaries for non-field personnel

- Office rent and utilities

- Legal and accounting fees

- Investor relations and corporate communications

Environmental Compliance and Remediation Costs

Expenditures for environmental compliance and remediation are significant. These include costs associated with adhering to regulations, monitoring emissions, and addressing any necessary cleanup efforts. For instance, in 2024, many energy companies allocated substantial budgets towards methane emissions reduction initiatives, a key focus area for regulatory bodies and investors alike.

These costs are not merely operational; they represent a commitment to responsible environmental stewardship. Well plugging and abandonment activities, particularly for older or inactive sites, are also a critical component of this cost structure, ensuring long-term safety and environmental integrity.

- Regulatory Adherence: Costs incurred to meet environmental standards and permits.

- Emissions Monitoring and Reduction: Investments in technology and processes to track and lower emissions, especially methane.

- Remediation and Site Restoration: Funds set aside for cleaning up contaminated sites and restoring them to their original condition.

- Well Plugging and Abandonment: Expenditures for safely sealing and decommissioning wells.

Research and Development (R&D) is a crucial investment for a diversified energy business aiming for future growth and efficiency. This includes developing new extraction techniques, exploring alternative energy sources, and improving existing technologies. In 2024, many energy majors significantly ramped up their R&D spending, particularly in areas like carbon capture and hydrogen production, with some dedicating billions to these future-oriented projects.

The cost of R&D can be substantial, encompassing salaries for scientists and engineers, laboratory equipment, pilot project expenses, and intellectual property protection. For example, developing a novel drilling technology might cost tens of millions of dollars before it's ready for commercial deployment.

These investments are vital for staying competitive and adapting to evolving market demands and regulatory landscapes. A forward-thinking R&D strategy can lead to cost savings in the long run through more efficient operations or open up entirely new revenue streams.

| R&D Focus Area | Estimated 2024 Investment (Billions USD) | Key Objectives |

|---|---|---|

| Carbon Capture, Utilization, and Storage (CCUS) | 5-10 | Reducing industrial emissions, developing new revenue from captured CO2 |

| Hydrogen Production and Infrastructure | 3-7 | Decarbonizing transport and industry, creating new energy carriers |

| Advanced Extraction Technologies | 2-5 | Improving efficiency, reducing environmental impact of oil and gas production |

| Renewable Energy Integration | 1-3 | Optimizing grid stability with renewables, developing energy storage solutions |

Revenue Streams

Diversified Energy Company PLC’s primary revenue source is the sale of natural gas produced from its vast well portfolio. This revenue is calculated by multiplying the volume of gas sold by the current market price, which is often managed through hedging contracts. In 2023, the company reported that approximately 75% of its adjusted EBITDA came from its US operations, predominantly from natural gas sales.

Revenue streams extend beyond natural gas to include the sale of crude oil and natural gas liquids like ethane, propane, and butane. These co-produced commodities are significant contributors to the company's top line, with their market prices directly influenced by global energy dynamics. For instance, in 2024, the average price of West Texas Intermediate (WTI) crude oil hovered around $80 per barrel, while NGL prices also saw considerable movement, demonstrating the impact of market volatility on this segment.

This diversification across various hydrocarbon products offers a degree of stability to the overall revenue picture. When natural gas prices experience downturns, stronger performance in crude oil or NGL markets can help offset those declines, contributing to a more resilient financial profile. This multi-commodity approach is a key element in managing the inherent cyclicality of the energy sector.

The energy company actively uses commodity hedging, particularly for natural gas and oil, to shield itself from price swings. For instance, in 2024, the company reported gains of $150 million from its natural gas hedging program, which locked in an average price of $3.50 per MMBtu for 30% of its projected output.

These hedging gains are a vital revenue stream, smoothing out the unpredictable nature of commodity markets and offering a more reliable cash flow. This strategy is a cornerstone of their risk management, ensuring a predictable financial performance despite market volatility.

Infrastructure Optimization and Utilization Fees (Potential)

While the primary focus remains on asset ownership and energy production, there’s a potential avenue for generating revenue through infrastructure optimization. This involves leveraging their existing extensive network for transportation or processing services offered to third parties, thereby creating an additional income stream from underutilized assets.

This particular revenue stream is contingent upon strategic business decisions and prevailing market demand. For instance, if a company possesses significant pipeline capacity or processing facilities, it could offer these services to other energy producers, particularly those lacking their own infrastructure. This approach allows for greater asset utilization and diversification of revenue beyond direct production.

- Infrastructure Optimization: Monetizing excess capacity in pipelines, storage facilities, or processing plants.

- Third-Party Services: Offering transportation and processing services to other energy companies.

- Market Demand Driven: Revenue potential directly linked to the need for such services from external entities.

- Strategic Alignment: This stream requires a deliberate strategic shift to actively market and manage these services.

Strategic Asset Divestitures (Opportunistic)

Strategic asset divestitures represent an opportunistic revenue stream for diversified energy companies, allowing them to unlock capital from underperforming or non-core assets. This approach is not a consistent income source but rather a financial tool employed to enhance overall portfolio value and strategic flexibility.

For instance, in 2024, several major energy firms engaged in significant asset sales. ExxonMobil, in its ongoing portfolio optimization, completed the divestiture of certain Gulf of Mexico assets, raising approximately $1.3 billion. Similarly, Chevron continued its strategy of shedding mature fields, divesting a package of U.S. onshore assets for an estimated $800 million. These transactions highlight the strategic use of divestitures to fund growth initiatives or strengthen balance sheets.

- Opportunistic Capital Generation: Divestitures provide a non-recurring influx of cash, enabling reinvestment in core, high-growth areas or debt deleveraging.

- Portfolio Optimization: Selling off less economic or non-strategic assets allows companies to focus resources on their most profitable and forward-looking operations.

- Strategic Financial Lever: These sales act as a financial lever, improving liquidity and financial health without altering the fundamental business operations.

- Market Conditions Influence: The timing and success of divestitures are heavily influenced by prevailing market conditions and asset valuations.

Diversified Energy Company's core revenue stems from the sale of natural gas, with oil and natural gas liquids (NGLs) contributing significantly. In 2023, US operations, largely driven by natural gas, accounted for about 75% of its adjusted EBITDA. The company also benefits from hedging activities, which in 2024 provided $150 million in gains by securing an average natural gas price of $3.50 per MMBtu for a portion of its output.

| Revenue Source | Primary Commodity | 2023 Contribution (Adj. EBITDA) | 2024 Hedging Example |

| Natural Gas Sales | Natural Gas | ~75% (US Ops) | +$150M gains (avg. $3.50/MMBtu) |

| Oil & NGL Sales | Crude Oil, Ethane, Propane | Significant | WTI avg. ~$80/bbl (2024) |

Business Model Canvas Data Sources

The Diversified Energy Business Model Canvas is built using a robust combination of market intelligence, financial performance data, and operational efficiency metrics. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the dynamic energy sector.