Diversified Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diversified Energy Bundle

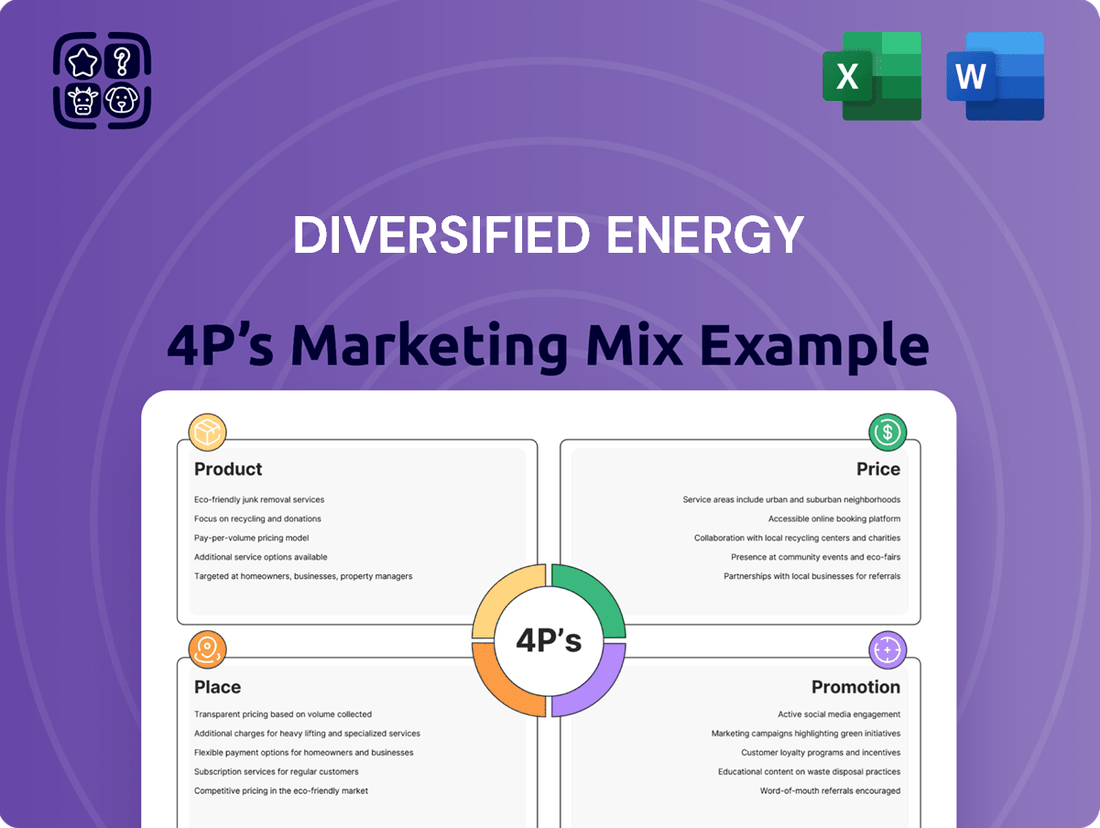

Diversified Energy's marketing success hinges on a finely tuned 4Ps strategy. Their product offerings are designed to meet specific market needs, while their pricing reflects value and competitive positioning. Understanding their distribution channels and promotional activities is key to grasping their market impact.

Dive deeper into how Diversified Energy leverages Product, Price, Place, and Promotion to achieve its business objectives. This comprehensive analysis is your shortcut to understanding their strategic brilliance and applying similar insights to your own ventures.

Unlock the full picture of Diversified Energy's marketing mix. Gain access to an in-depth, editable report that meticulously breaks down each of the 4Ps, providing actionable insights for students, professionals, and consultants alike.

Product

Diversified Energy's core product is the consistent and responsible extraction of natural gas and oil from its extensive portfolio of existing, long-life wells. This focus on mature assets, predominantly located in the Appalachian Basin and Central US, ensures a stable energy supply. In the first quarter of 2024, the company reported producing approximately 125,000 barrels of oil equivalent per day, with a significant portion derived from natural gas.

The company's strategy centers on optimizing production from these established fields, rather than relying on new exploration. This approach, exemplified by their operations in the Appalachian Basin, allows for efficient resource utilization and predictable output. Diversified Energy's commitment to responsible production is a key differentiator in the market, aiming to meet energy demands while adhering to environmental standards.

Diversified Energy Company prioritizes Asset Optimization and Enhancement by going beyond basic extraction. They invest in improving infrastructure and employ advanced management techniques to boost efficiency and prolong the life of their wells, a key part of their 4P's marketing mix.

In 2023, Diversified Energy's capital expenditures for asset retirement obligations and midstream infrastructure were $215 million, demonstrating a commitment to enhancing their existing asset base rather than solely focusing on new acquisitions.

This strategic focus on operational improvements, including well workovers and de-watering projects, directly contributes to maximizing production and cash flow from their mature assets, aligning with their goal of sustainable, long-term value creation.

Diversified Energy's midstream and marketing segment plays a crucial role in its integrated strategy, focusing on the transportation and sale of natural gas and liquids. This segment ensures that the energy produced from the company's upstream operations reaches end markets efficiently, thereby capturing additional value. For instance, in the first quarter of 2024, Diversified Energy's marketing segment contributed significantly to its overall financial performance, with realized commodity prices for natural gas averaging $2.15 per Mcf and for natural gas liquids averaging $21.24 per barrel.

Well Retirement and Environmental Stewardship

Diversified Energy's commitment to responsible well retirement is a core part of its product, setting it apart in the energy sector. This focus on environmental stewardship, particularly through its subsidiary Next LVL Energy, addresses a critical industry challenge.

Next LVL Energy is actively engaged in plugging and abandoning wells, aiming to minimize environmental impact. A significant part of this effort involves reducing methane emissions, a key greenhouse gas. For instance, in 2023, Diversified reported a 20% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to their 2021 baseline, with well retirement playing a crucial role in this achievement.

- Methane Emission Reduction: Next LVL Energy's primary objective is to mitigate methane leaks from retired wells.

- Environmental Stewardship: This commitment goes beyond regulatory compliance, aiming for proactive environmental protection.

- Operational Efficiency: The well retirement process is integrated into Diversified's broader operational strategy, enhancing long-term sustainability.

- 2023 Performance: Diversified achieved a 20% reduction in GHG emissions intensity, partly due to its well retirement program.

Strategic Acquisitions for Portfolio Growth

Strategic acquisitions are a cornerstone of this company's approach to growing its energy portfolio. They focus on acquiring proved, developed, producing (PDP) assets, which are already generating revenue. This strategy is designed to create a predictable stream of cash flow and deliver consistent returns to investors.

A prime example of this strategy in action is the acquisition of Maverick Natural Resources. This deal, completed in late 2023, significantly expanded the company's operational footprint and asset base. Such targeted acquisitions are key to their business model, ensuring a steady income generation capability.

- Acquisition Focus: Primarily targets Proved, Developed, Producing (PDP) assets for immediate cash flow generation.

- Strategic Rationale: Aims to build a robust portfolio that yields stable cash flows and attractive investor returns.

- Maverick Natural Resources Deal: A recent example that demonstrably expanded the company's asset base and operational scale.

- Portfolio Enhancement: Acquisitions are central to continuously strengthening and diversifying the company's energy assets.

Diversified Energy's product is the reliable and responsible supply of natural gas and oil, primarily from mature, long-life wells. Their strategy emphasizes optimizing existing assets, like those in the Appalachian Basin, to ensure predictable output and meet energy demands efficiently.

The company's commitment extends to environmental stewardship, particularly through its subsidiary Next LVL Energy, which focuses on plugging and abandoning wells to reduce methane emissions. This proactive approach to well retirement contributed to a 20% reduction in their greenhouse gas emissions intensity in 2023 compared to a 2021 baseline.

Diversified Energy also integrates its midstream and marketing operations to efficiently transport and sell its produced energy, capturing additional value. In Q1 2024, their marketing segment saw realized natural gas prices of $2.15 per Mcf and natural gas liquids prices of $21.24 per barrel.

The company's product offering is further strengthened by strategic acquisitions of proved, developed, producing assets, such as the late 2023 acquisition of Maverick Natural Resources, which bolstered their operational scale and cash flow generation capabilities.

| Metric | Value | Period |

|---|---|---|

| Daily Production (BOE) | ~125,000 | Q1 2024 |

| GHG Emissions Intensity Reduction | 20% | 2023 (vs. 2021 baseline) |

| Realized Natural Gas Price | $2.15/Mcf | Q1 2024 |

| Realized NGL Price | $21.24/barrel | Q1 2024 |

What is included in the product

This analysis provides a comprehensive examination of Diversified Energy's marketing strategies across Product, Price, Place, and Promotion, offering practical insights for strategic decision-making.

Simplifies complex marketing strategies into actionable insights, directly addressing the pain point of understanding Diversified Energy's market positioning.

Place

Diversified Energy Company PLC's core operations are strategically concentrated within the Appalachian Basin, encompassing key states such as Kentucky, Ohio, Pennsylvania, and West Virginia. This deliberate geographic focus fosters significant operational synergies and cultivates deep regional expertise, crucial for effectively managing its extensive portfolio of conventional gas and oil assets.

Diversified Energy Company has made a significant move by expanding its operational footprint into the Central Region of the United States, specifically targeting key energy-producing states like Louisiana and Texas. This strategic expansion is designed to broaden the company's asset portfolio, reducing reliance on any single geographic area.

This expansion into the Central Region, encompassing areas known for substantial U.S. onshore energy production, further strengthens Diversified Energy's market position. As of early 2024, the company has been actively acquiring mature, long-life producing assets in these regions, aiming to enhance operational efficiency and cash flow generation.

Diversified Energy Company plc (DEC) effectively utilizes its extensive integrated infrastructure network, comprising gathering systems and pipelines, to facilitate the delivery of its upstream oil and gas production. This existing network is a cornerstone of their operational efficiency, enabling the seamless transportation of commodities from the wellhead directly to market hubs. For instance, in Q1 2024, DEC reported that its infrastructure transported approximately 1.3 billion cubic feet equivalent (Bcfe) of natural gas per day, underscoring the scale and importance of this asset base in their business model.

Direct Sales to Customers and Market Hubs

A key element of Diversified Energy's marketing strategy is direct sales of natural gas and oil. This approach bypasses intermediaries, allowing the company to connect directly with major consumers.

This direct channel is particularly evident in their dealings with significant demand centers, such as Gulf Coast LNG export terminals. By securing fixed-price contracts with these facilities, Diversified Energy establishes a clear path to market and enhances revenue predictability.

This strategy is crucial for revenue stability, especially given market fluctuations. For instance, in 2024, the company's focus on securing these direct, stable offtake agreements helped mitigate some of the volatility seen in broader energy commodity prices.

- Direct Sales: Eliminates intermediaries for natural gas and oil.

- Key Customers: Focus on major facilities like Gulf Coast LNG export terminals.

- Revenue Stability: Achieved through fixed-price contracts with these large buyers.

- Market Access: Ensures a direct route to significant demand centers.

Strategic Partnerships for Market Access

Diversified Energy Company actively pursues strategic partnerships to broaden its market reach and operational efficiency. A prime example is their collaboration with Carlyle, which has facilitated significant investment in and consolidation of energy assets. This approach allows them to tap into new markets and refine their distribution networks for both natural gas and oil production.

These alliances are crucial for optimizing the 'Place' element of their marketing mix. By partnering, Diversified Energy can leverage established infrastructure and customer bases, thereby enhancing access to end-users for their commodities. For instance, in 2023, the company completed a significant asset acquisition funded in part by strategic capital, which directly improved their logistical capabilities in key Appalachian Basin regions.

- Carlyle Partnership: Facilitates investment and consolidation of energy assets, enhancing financial capacity.

- Market Access: Strategic alliances improve reach to end-users for natural gas and oil.

- Distribution Optimization: Partnerships help streamline logistics and reduce transportation costs.

- 2023 Asset Acquisition: A key move in 2023, supported by strategic capital, bolstered logistical networks.

Diversified Energy Company's strategic placement is anchored in its concentrated operations within the Appalachian Basin, covering states like Kentucky, Ohio, Pennsylvania, and West Virginia. This focus creates operational synergies and deep regional knowledge. The company has also expanded into the Central US, including Louisiana and Texas, to broaden its asset base and reduce geographic concentration. As of early 2024, this expansion involved acquiring mature, long-life producing assets to boost efficiency and cash flow.

The company leverages its integrated infrastructure, including gathering systems and pipelines, for efficient delivery of upstream production. In Q1 2024, this infrastructure transported about 1.3 billion cubic feet equivalent of natural gas daily. Diversified Energy also emphasizes direct sales to major consumers, such as Gulf Coast LNG export terminals, securing revenue stability through fixed-price contracts. These agreements helped mitigate commodity price volatility throughout 2024.

Strategic partnerships, like the one with Carlyle, enhance market reach and operational efficiency by facilitating investment and asset consolidation. These alliances improve access to end-users and optimize distribution networks. A 2023 asset acquisition, supported by strategic capital, significantly bolstered their logistical capabilities in the Appalachian Basin.

| Geographic Focus | Key States | Infrastructure Metric (Q1 2024) | Strategic Partnership Example |

|---|---|---|---|

| Appalachian Basin | KY, OH, PA, WV | 1.3 Bcf/d Natural Gas Transported | Carlyle |

| Central US Expansion | LA, TX | N/A | N/A |

| Asset Acquisition Strategy | Mature, Long-Life | N/A | 2023 Appalachian Acquisition |

Same Document Delivered

Diversified Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Diversified Energy's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Diversified Energy's investor relations program is a cornerstone of its promotional strategy, offering a direct line to financially-literate decision-makers. This includes detailed annual reports, interim results, and investor presentations that provide transparent financial and operational performance data.

For instance, in their 2024 first-quarter update, Diversified Energy reported adjusted EBITDA of $284 million, showcasing a commitment to clear communication of their financial health to investors. This data-driven approach empowers stakeholders to make informed decisions.

Diversified Energy Company actively showcases its dedication to environmental, social, and governance (ESG) principles via its annual sustainability reports. These reports detail tangible progress, such as their 2023 methane intensity reduction to 0.24% of net production and the retirement of over 1,000 wells, resonating with investors prioritizing responsible operations.

This focus on ESG initiatives, including significant community contributions totaling over $2 million in 2023, positions Diversified Energy as a responsible operator. Such transparency and demonstrable action in areas like emissions reduction and well integrity appeal strongly to the growing segment of socially conscious investors and stakeholders seeking sustainable investment opportunities.

Diversified Energy Company PLC maintains a robust public relations strategy, consistently engaging with key financial news outlets and specialized industry publications. This proactive approach ensures timely dissemination of critical company updates, including significant acquisition news and operational milestones, thereby fostering transparency and building investor confidence.

Their media engagement efforts are designed to cultivate a strong public profile, reinforcing Diversified Energy's established market position and strategic direction. For instance, their consistent reporting on production efficiency and asset optimization, often highlighted in industry journals, underscores their commitment to operational excellence and sustainable growth.

Industry Conferences and Presentations

Diversified Energy Company actively engages in industry conferences and presentations, offering a direct channel to showcase its innovative business model and operational efficiencies to key stakeholders. This strategic approach allows for clear communication of its unique value proposition and future growth trajectory to a discerning audience of investors and financial professionals. For instance, in 2024, the company participated in several significant energy sector forums, providing updates on its asset optimization strategies and financial performance.

These platforms are crucial for building investor confidence and fostering relationships within the financial community. By presenting its data-driven approach to production and emissions management, Diversified Energy can effectively highlight its competitive advantages. In the first half of 2025, the company is scheduled to present at three major investor conferences, aiming to reinforce its narrative of sustainable and profitable operations.

- Showcasing Business Model: Direct communication of unique operational and financial strategies to investors and analysts.

- Investor Relations: Building confidence and transparency through presentations at key financial events.

- Strategic Advantage: Highlighting competitive edge in asset management and emissions reduction.

- Future Outlook: Communicating growth plans and financial targets to a targeted audience.

Digital Presence and Online Resources

Diversified Energy Company actively cultivates a robust digital footprint, anchored by its comprehensive corporate website. This platform acts as a vital conduit for stakeholders, providing in-depth details on operational activities, environmental, social, and governance (ESG) initiatives, and investor relations materials. For instance, in 2023, the company reported significant engagement on its investor portal, with website traffic increasing by 15% year-over-year, indicating a growing interest in its transparent disclosure practices.

The company leverages its online presence not just for information dissemination but also for fostering stakeholder relationships and demonstrating its commitment to sustainability. Their digital resources are designed to be easily accessible, offering a centralized repository for news, financial reports, and strategic updates. This focus on digital accessibility is crucial in today's market, where investors and partners increasingly rely on online channels for their initial research and ongoing engagement.

- Website Traffic Growth: 15% increase in website visits in 2023, highlighting enhanced stakeholder engagement.

- Investor Resources: Comprehensive section dedicated to financial reports, presentations, and governance policies.

- Sustainability Hub: Detailed information on ESG performance and strategic commitments available online.

- Digital Accessibility: Focus on user-friendly navigation and readily available operational and financial data.

Diversified Energy’s promotional efforts focus on transparent communication of its financial performance and operational strategies. This includes detailed investor relations materials, participation in industry conferences, and a robust digital presence.

The company highlights its commitment to ESG principles through sustainability reports, aiming to attract socially conscious investors. For example, their 2023 methane intensity was reported at 0.24% of net production.

Their proactive public relations strategy ensures timely dissemination of company updates through financial news outlets and industry publications, reinforcing market position and investor confidence.

| Metric | 2023 Data | 2024 (H1) Projections/Updates |

|---|---|---|

| Adjusted EBITDA | $1.12 billion (FY 2023) | $592 million (H1 2024) |

| Methane Intensity | 0.24% (2023) | Targeting further reduction |

| Website Traffic Growth | 15% year-over-year (2023) | Continued engagement expected |

Price

Diversified Energy's revenue hinges on the volatile prices of natural gas and oil, dictated by global supply and demand. For instance, in early 2024, natural gas prices saw fluctuations, with benchmarks like Henry Hub averaging around $2.00 per MMBtu, impacting the company's top line.

Regional market conditions also play a crucial role. For example, differences in pipeline capacity and local demand can lead to price disparities between regions, affecting Diversified Energy's realized prices for its produced commodities.

The company's financial performance is therefore directly tied to these external commodity market forces, making price risk management a key strategic consideration.

Diversified Energy actively uses hedging to smooth out the bumps from fluctuating commodity prices, aiming for more predictable revenue streams. For example, in the first quarter of 2024, the company reported that its hedging program covered approximately 70% of its projected oil and gas production, effectively securing prices for a significant portion of its output.

These financial derivative contracts, such as futures and options, allow Diversified Energy to lock in prices for its production, offering a crucial layer of stability against market swings. This strategy is vital for maintaining consistent cash flow, which is essential for ongoing operations and investment planning, especially in the volatile energy sector.

Diversified Energy's acquisition strategy prioritizes purchasing existing producing wells and infrastructure at attractive prices, often around a PV17 valuation. This disciplined approach aims to boost shareholder value and cash flow.

Cost Management and Operational Efficiency

Diversified Energy prioritizes cost management and operational efficiency to ensure competitive pricing and robust profit margins. Their 'Smarter Asset Management' strategy is designed to lower per-unit operating expenses, bolstering profitability even when market conditions shift.

This focus is evident in their ongoing efforts to optimize production and reduce overhead. For instance, in the first quarter of 2024, Diversified Energy reported a continued focus on cost discipline, with operational expenses per barrel of oil equivalent remaining a key performance indicator.

- Reduced Operating Costs: The company aims to lower operating costs per unit through efficient asset management.

- Competitive Pricing: Prudent expense management allows for competitive pricing in the energy market.

- Margin Health: Operational efficiency directly contributes to maintaining healthy profit margins.

- Resilience to Market Fluctuations: Cost control measures enhance profitability regardless of energy price volatility.

Shareholder Returns and Debt Management

Diversified Energy's pricing strategies are designed to foster robust shareholder returns by ensuring consistent cash flow generation. This stability allows for reliable dividend payouts, a key component of investor value. For instance, in the first quarter of 2024, Diversified Energy announced a quarterly dividend of $0.17 per share, underscoring their commitment to returning capital to shareholders.

Beyond dividends, the company's approach to pricing also directly supports debt reduction efforts. By optimizing revenue streams, Diversified Energy can more effectively manage its leverage ratios, which is crucial for long-term financial health. As of the end of 2023, the company reported a net debt of $1.5 billion, and their strategy aims to deleverage this position over time.

- Dividend Consistency: The company's pricing supports regular dividend payments, rewarding shareholders directly.

- Debt Reduction Focus: Stable cash flows from pricing strategies enable the company to actively reduce its debt burden.

- Investor Confidence: Prudent financial management, including debt control, bolsters investor confidence in the company's long-term viability.

- Financial Health: The pricing framework is integral to maintaining a healthy balance sheet and sustainable operations.

Diversified Energy's pricing is fundamentally tied to commodity markets, with natural gas and oil prices being the primary drivers of revenue. The company's financial results are directly impacted by these volatile external forces, making effective price risk management a critical strategic element.

The company actively employs hedging strategies to mitigate price volatility, aiming for more predictable revenue. For instance, in Q1 2024, Diversified Energy had hedged approximately 70% of its projected production, securing prices for a substantial portion of its output. This financial derivative usage, including futures and options, provides a vital layer of stability against market fluctuations, ensuring consistent cash flow for operations and investments.

Diversified Energy's pricing strategy is also geared towards delivering shareholder value through consistent cash flow generation, which supports reliable dividend payouts. In the first quarter of 2024, the company announced a quarterly dividend of $0.17 per share, demonstrating this commitment. Furthermore, optimizing revenue streams aids in debt reduction efforts, with the company aiming to manage its leverage ratios effectively.

| Metric | Q1 2024 Value | Impact on Pricing Strategy |

|---|---|---|

| Natural Gas Avg. Price (Henry Hub) | ~$2.00/MMBtu | Directly influences revenue and profitability. |

| Hedging Coverage (Oil & Gas Production) | ~70% | Secures future revenue streams against price dips. |

| Quarterly Dividend per Share | $0.17 | Reflects cash flow stability driven by pricing. |

| Net Debt (End of 2023) | $1.5 billion | Pricing strategy supports deleveraging efforts. |

4P's Marketing Mix Analysis Data Sources

Our Diversified Energy 4P's Marketing Mix Analysis is grounded in a comprehensive review of public company filings, investor relations materials, and official company websites. We meticulously examine product portfolios, pricing strategies, distribution networks, and promotional activities to ensure accuracy and relevance.