Diodes PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diodes Bundle

Uncover the critical external forces shaping Diodes's future, from evolving technological landscapes to shifting geopolitical influences. Our PESTLE analysis provides a strategic roadmap to navigate these complexities and identify opportunities for growth. Gain the competitive edge you need by understanding the complete picture—download the full analysis now.

Political factors

Geopolitical tensions, especially between the U.S. and China, continue to shape the semiconductor landscape. Tariffs and export controls, like those implemented in 2023 impacting advanced chip sales to China, directly affect companies like Diodes Incorporated by increasing costs and potentially disrupting supply chains. These policies can lead to higher production expenses and necessitate strategic adjustments to sourcing and manufacturing locations.

Governments globally are actively promoting domestic semiconductor production through significant financial support. For instance, the U.S. CHIPS and Science Act, enacted in 2022, allocates over $52 billion in subsidies and tax credits to bolster domestic manufacturing and research. This strategic move aims to decrease dependence on overseas chipmakers and enhance national technological security.

Diodes Incorporated is positioned to leverage these governmental programs, potentially for expanding its manufacturing capabilities within the United States or for investing in cutting-edge semiconductor technologies. However, it's important to note that access to these funds often comes with specific requirements, such as geographical limitations for investment and operational activities.

The semiconductor industry operates within a complex web of national and international regulations. These frameworks govern everything from trade practices and manufacturing standards to the very technology developed. For Diodes, staying compliant with evolving rules is paramount to maintaining market access and operational efficiency.

Recent developments highlight the impact of these regulations. For instance, in late 2023 and early 2024, various countries continued to implement or refine export control measures on advanced semiconductor technologies, directly influencing global supply chains and market dynamics. Diodes must navigate these shifts to ensure its products can reach key markets and that its manufacturing processes meet diverse compliance standards.

Political Stability in Key Manufacturing Regions

Political stability in regions where Diodes Incorporated operates manufacturing facilities or sources critical materials is a significant factor. For instance, the geopolitical landscape surrounding Taiwan, a major hub for semiconductor manufacturing, remains a key consideration for supply chain continuity. Any significant policy shifts or instability in such regions could directly impact Diodes' production capacity and lead times.

Unrest, unexpected policy changes, or even martial law orders in countries with a high concentration of semiconductor production can severely disrupt global supply chains. This was evident in early 2024 discussions surrounding potential geopolitical tensions that could affect key Asian manufacturing centers, a scenario that directly threatens the flow of essential components for companies like Diodes.

To counter these potential disruptions, Diodes, like many in the semiconductor industry, focuses on diversifying its manufacturing locations and building more resilient supply chains. This strategy aims to mitigate the risks associated with relying too heavily on any single region, ensuring a more stable flow of goods even amidst political uncertainties.

- Geopolitical Risk in Taiwan: Taiwan is responsible for over 60% of global semiconductor manufacturing, making its political stability paramount for companies like Diodes.

- Supply Chain Vulnerability: Political instability in key manufacturing countries can lead to production stoppages, impacting lead times and increasing costs for semiconductor components.

- Diversification Strategies: Companies are investing in expanding manufacturing capabilities in regions like the United States and Europe to reduce reliance on single geographic areas.

Nationalization of Semiconductor Technology

Several nations are increasingly enacting policies aimed at nationalizing or asserting greater control over semiconductor technology and manufacturing. This geopolitical shift directly impacts Diodes' strategic decisions regarding research and development investments and the location of its manufacturing facilities, potentially fostering a more fragmented global supply chain. For instance, the US CHIPS and Science Act, signed in 2022, allocated $52.7 billion to boost domestic semiconductor manufacturing and research, reflecting a broader trend of governments seeking to onshore critical technology.

These nationalistic approaches can significantly influence intellectual property rights and the viability of international partnerships. Countries prioritizing domestic control may implement stricter regulations on technology transfer and foreign investment, creating hurdles for companies like Diodes that rely on global collaboration and a free flow of innovation. The European Union's European Chips Act, aiming to double its market share in semiconductors by 2030, further underscores this trend of regionalized semiconductor strategies.

- Increased government investment in domestic semiconductor production, exemplified by the US CHIPS Act's $52.7 billion allocation.

- Regionalization of the semiconductor industry, as seen with the EU's goal to double its market share by 2030.

- Potential impact on intellectual property protection and cross-border R&D collaborations due to national control policies.

Geopolitical tensions, particularly between major economic powers, continue to influence global trade policies and supply chains. For Diodes, this means navigating potential tariffs and export controls, which can increase operational costs and necessitate adjustments to sourcing strategies. For example, ongoing trade discussions between the U.S. and China in 2024 continue to create uncertainty for semiconductor companies with significant international operations.

Governments worldwide are actively investing in domestic semiconductor manufacturing to bolster national security and economic competitiveness. The U.S. CHIPS and Science Act, with its over $52 billion in funding, is a prime example, encouraging onshoring of production. Similarly, the European Union's Chips Act aims to significantly increase its share of the global semiconductor market by 2030, signaling a trend toward regionalized industrial policy.

These government initiatives present opportunities for companies like Diodes to benefit from subsidies and incentives for expanding manufacturing or research within specific regions. However, these programs often come with stipulations, such as geographical investment requirements, that Diodes must carefully consider in its strategic planning.

The semiconductor industry is subject to a complex and evolving regulatory environment. Compliance with international trade laws, manufacturing standards, and technology transfer regulations is crucial for market access and operational efficiency. In 2024, many nations continued to refine export control measures on advanced technologies, impacting global supply dynamics for companies like Diodes.

What is included in the product

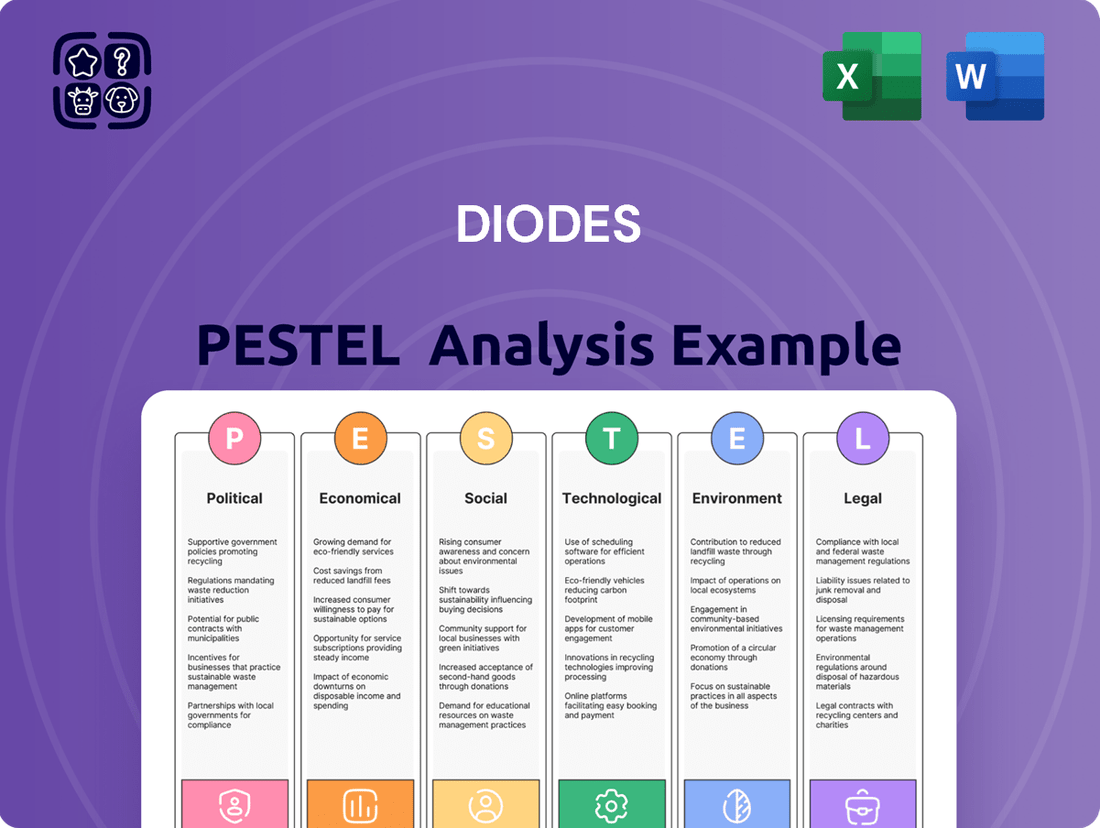

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Diodes across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help navigate market dynamics and capitalize on emerging opportunities.

A Diodes PESTLE analysis provides a structured framework, relieving the pain of navigating complex external factors by offering a clear, actionable overview of political, economic, social, technological, environmental, and legal influences impacting the business.

Economic factors

The global semiconductor market is on a robust growth trajectory, with forecasts anticipating double-digit annual expansion continuing into 2025. This surge is fueled by escalating demand across a wide array of applications, from automotive and industrial sectors to consumer electronics and advanced computing.

Diodes Incorporated is strategically positioned to capitalize on this widespread market uplift. The company's focus on high-growth segments within the semiconductor industry, such as automotive and industrial applications, aligns perfectly with the key drivers of this expansion.

Industry analysts project the global semiconductor market to achieve a monumental milestone, reaching $1 trillion in sales by the year 2030. This significant market size underscores the immense opportunity for companies like Diodes Incorporated to expand their market share and revenue.

Diodes Incorporated's performance is closely tied to the health of its key end markets. The automotive sector, a significant revenue driver, is experiencing robust growth, fueled by the increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). This trend is expected to continue, with the automotive semiconductor market projected to reach $115 billion by 2025, up from $60 billion in 2020.

The computing and communications sectors also represent crucial demand areas. While the consumer electronics market faced some headwinds in recent periods, the burgeoning demand for AI-enabled devices is creating new opportunities. The global AI chip market alone is anticipated to grow substantially, reaching an estimated $140 billion by 2028, presenting a significant upside for Diodes.

The semiconductor industry, including companies like Diodes, has navigated significant supply chain disruptions and inventory adjustments. While 2024 saw some lingering oversupply in certain segments, projections for 2025 indicate a broader market recovery, suggesting a more balanced supply-demand environment.

For Diodes, effectively managing its capacity utilization and inventory levels is paramount. This strategic approach directly impacts its ability to maintain robust gross margins and ensures overall operational efficiency in a dynamic market. For instance, by Q1 2025, industry analysts anticipate inventory days for many semiconductor firms to normalize closer to historical averages, a trend Diodes will likely leverage.

Research and Development Investment

Diodes Incorporated's commitment to research and development is a cornerstone of its competitive strategy, particularly in rapidly evolving sectors like advanced packaging, AI-enabled semiconductors, and high-efficiency power components. This continuous investment is crucial for maintaining technological leadership and introducing next-generation products.

The company's ability to fund these vital R&D initiatives is intrinsically linked to prevailing economic conditions and its own financial performance. Robust profitability allows for sustained investment, which is a direct driver of future growth and innovation.

- 2024 R&D Focus: Diodes is prioritizing advancements in low-power solutions for automotive and industrial markets, alongside expanding its portfolio of analog and mixed-signal products.

- Investment Outlook: While specific R&D spending figures fluctuate with market cycles, the company consistently allocates significant resources to product development, aiming to capture emerging opportunities in IoT and 5G infrastructure.

- Impact of Economic Cycles: Downturns can pressure R&D budgets, potentially slowing innovation, whereas economic upswings generally bolster the capacity for increased research investment.

Inflation and Cost Pressures

Inflationary pressures and rising production costs significantly impact Diodes' profitability. For instance, the average price of semiconductors saw an increase in late 2024 and early 2025 due to persistent demand and supply chain challenges. These cost increases extend to raw materials, energy, and labor, directly affecting Diodes' bottom line.

Geopolitical tensions and trade policies, including tariffs, further exacerbate these economic factors. In 2024, ongoing trade disputes led to increased import costs for certain components, impacting the broader semiconductor industry. Effectively managing these escalating cost pressures is paramount for Diodes to sustain its financial performance and competitive edge.

- Rising Energy Costs: Global energy prices, a key component of manufacturing, remained volatile throughout 2024, contributing to higher operational expenses for semiconductor firms.

- Labor Market Dynamics: Skilled labor shortages in the semiconductor sector in 2024 led to increased wage demands, adding to production cost pressures for companies like Diodes.

- Raw Material Price Volatility: The cost of essential materials such as silicon wafers and specialized chemicals experienced upward trends in 2024, directly impacting manufacturing expenses.

Economic factors significantly influence Diodes Incorporated's operational landscape. Persistent inflation throughout 2024 and into early 2025 has driven up manufacturing costs, impacting raw materials, energy, and labor. Geopolitical tensions and trade policies have also contributed to increased import expenses for critical components, adding further pressure on profitability and competitive pricing strategies.

The semiconductor industry, including Diodes, is navigating a dynamic economic environment. While demand remains strong in key sectors like automotive and industrial, cost pressures are a significant consideration. For example, the average price of semiconductors saw an increase in late 2024 and early 2025 due to persistent demand and supply chain challenges.

Skilled labor shortages in 2024 led to increased wage demands, directly impacting production costs. Additionally, the cost of essential materials such as silicon wafers and specialized chemicals experienced upward trends, further squeezing margins. These economic headwinds necessitate careful cost management and strategic pricing for Diodes to maintain its financial health.

The global energy prices remained volatile throughout 2024, contributing to higher operational expenses for semiconductor firms like Diodes. This volatility in energy costs, coupled with other rising input prices, underscores the importance of efficient operations and supply chain resilience.

| Economic Factor | Trend (Late 2024 - Early 2025) | Impact on Diodes |

| Inflation | Persistent upward pressure on costs | Reduced profit margins, increased pricing challenges |

| Energy Prices | Volatile, generally increasing | Higher operational expenses |

| Labor Costs | Increased due to shortages and wage demands | Higher production costs |

| Raw Material Costs | Upward trend for silicon wafers, chemicals | Increased manufacturing expenses |

| Geopolitical Tensions/Trade Policies | Tariffs and trade disputes | Increased import costs for components |

Preview Before You Purchase

Diodes PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the diode industry. It provides a comprehensive overview of the external forces shaping market dynamics and strategic decision-making for companies operating within this sector.

Understand the critical influences on the diode market, from government regulations and economic trends to societal shifts and technological advancements, all presented within this complete, ready-to-download report.

Sociological factors

The semiconductor industry, including companies like Diodes, is grappling with a pronounced global talent shortage, especially for highly specialized roles in AI, advanced chip design, and sophisticated manufacturing processes. This scarcity directly impacts innovation and production capacity.

To counter this, Diodes must prioritize substantial investment in employee training, upskilling initiatives, and comprehensive development programs. This is crucial for building a resilient talent pipeline capable of meeting future industry demands. For instance, reports from 2024 highlight a growing need for engineers with expertise in next-generation lithography and advanced packaging technologies.

Furthermore, forging strategic partnerships with universities and technical colleges is becoming paramount. Offering competitive compensation packages and attractive career advancement opportunities are also key strategies to attract and retain top talent in this competitive landscape.

Shifting consumer demographics and lifestyles directly impact the demand for electronic components like those Diodes Incorporated provides. For instance, the growing preference for connected living fuels the market for smart home devices, a sector where Diodes' products are essential for functionality. By 2025, the global smart home market is projected to reach over $150 billion, a significant increase from previous years, indicating robust demand for the underlying semiconductor technology.

The rise of wearable technology and the accelerating adoption of electric vehicles (EVs) also showcase evolving consumer preferences for sophisticated, efficient, and sustainable electronics. Diodes' components are integral to the advanced power management and signal integrity required in these rapidly expanding markets. The global EV market alone is expected to exceed $1.5 trillion by 2030, underscoring the long-term growth potential driven by these lifestyle shifts.

The relentless march of digitalization is a powerful tailwind for Diodes, directly fueling demand for their semiconductor solutions. As more of our lives and industries move online, the need for the chips that power this connectivity only grows. This trend is a fundamental driver for Diodes' business.

The explosion of the Internet of Things (IoT) is a prime example. By 2025, the number of connected IoT devices is projected to reach over 27 billion globally, each requiring various semiconductor components. Similarly, the ongoing rollout of 5G infrastructure, which promises significantly faster data speeds and lower latency, necessitates advanced chips for base stations, smartphones, and other connected devices. Cloud computing's continued expansion also relies heavily on sophisticated semiconductors for data centers.

These interconnected technological advancements create a robust and sustained market for Diodes' broad range of products, from discrete components to analog and mixed-signal integrated circuits. The demand for more efficient, smaller, and powerful chips to support these growing digital ecosystems is a key factor underpinning growth across numerous end markets that Diodes serves.

Ethical Considerations in Technology Use

Societal expectations regarding ethical technology use are increasingly shaping the semiconductor industry. As AI and autonomous systems become more prevalent, concerns about data privacy, algorithmic bias, and the responsible development of artificial intelligence are paramount. For Diodes, a supplier of critical components, this translates into a need to understand how these societal values might influence the design choices and market adoption of the technologies their products enable.

The growing focus on ethical AI and data protection presents both challenges and opportunities for semiconductor companies. For instance, a 2024 survey indicated that over 70% of consumers are concerned about how their personal data is used by AI-powered devices. This sentiment can drive demand for components that offer enhanced security features or support privacy-preserving processing, areas where Diodes can potentially differentiate itself.

The ethical landscape directly impacts the demand for specific types of semiconductor solutions.

- Data Privacy: Increased consumer and regulatory scrutiny on data privacy (e.g., GDPR, CCPA) may favor components designed for secure data handling and on-device processing.

- Algorithmic Bias: Societal awareness of bias in AI algorithms could lead to demand for specialized processing units or architectures that facilitate fairer outcomes.

- Responsible AI: The push for transparent and accountable AI systems might influence the need for components supporting explainable AI (XAI) functionalities.

- Supply Chain Ethics: Broader ethical considerations, including labor practices and environmental impact within the technology supply chain, are also becoming more important for brand reputation and market access.

Public Perception and Corporate Social Responsibility

Public perception of the semiconductor industry is increasingly shaped by concerns over its environmental footprint and labor conditions. As a result, Diodes' proactive approach to corporate social responsibility, particularly in sustainable manufacturing and ethical sourcing, is crucial for bolstering its brand image. This commitment can attract not only environmentally and socially conscious consumers but also investors who prioritize Environmental, Social, and Governance (ESG) principles. For instance, in 2024, a significant percentage of institutional investors reported increasing their allocations to companies with strong ESG performance, demonstrating a clear market preference.

Embracing ESG principles also directly impacts talent acquisition and retention. Companies demonstrating a genuine commitment to sustainability and ethical practices are more appealing to the modern workforce, especially younger generations entering the job market. In 2025 surveys, a growing majority of job seekers indicated that a company's social and environmental impact is a key factor in their employment decisions. This trend suggests that Diodes' investment in these areas can provide a competitive edge in attracting and keeping top talent, which is vital in the highly specialized semiconductor sector.

- Growing Investor Focus: In 2024, over 70% of surveyed institutional investors stated that ESG factors significantly influence their investment decisions.

- Talent Attraction: By 2025, an estimated 65% of millennials and Gen Z prioritize working for companies with strong social and environmental values.

- Brand Reputation: Positive public perception linked to CSR initiatives can lead to a 10-15% increase in brand loyalty among ethically-minded consumers.

Societal expectations around ethical technology use are increasingly influencing the semiconductor sector. Concerns about data privacy, algorithmic bias, and the responsible development of AI are paramount, impacting how Diodes' components are integrated into end products. For instance, a 2024 survey revealed that over 70% of consumers worry about personal data usage in AI-powered devices, potentially driving demand for components with enhanced security features.

Technological factors

The swift progress in Artificial Intelligence (AI) is a major force pushing innovation in semiconductors, creating a greater need for powerful computing. Diodes, with its analog and mixed-signal components, is well-positioned to support AI growth by supplying crucial parts for data centers, AI accelerators, and edge AI devices, including demand for High Bandwidth Memory (HBM) and neuromorphic architectures.

As Moore's Law encounters physical limitations, the semiconductor industry is increasingly turning to advanced packaging. Innovations like 3D stacking and chiplets are becoming vital for boosting chip performance and energy efficiency. These methods enable greater integration and smaller chip sizes, which Diodes can utilize in its product development to cater to the growing demand for high-density applications such as smartphones and IoT devices.

The semiconductor industry is experiencing significant advancements in power components, with materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) enabling greater efficiency and enhanced performance. These next-generation materials are crucial for handling higher voltages and temperatures, leading to smaller, more powerful electronic devices.

Diodes Incorporated, with its strong emphasis on discrete and analog power solutions, is well-positioned to benefit from this trend. The growing demand for energy-efficient components, particularly in rapidly expanding sectors such as electric vehicles (EVs) and renewable energy systems, presents a substantial opportunity for Diodes.

For instance, the global SiC power semiconductor market was valued at approximately $1.5 billion in 2023 and is projected to reach over $6 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 30%. Similarly, the GaN power semiconductor market is expected to grow from $1.2 billion in 2023 to over $5 billion by 2028, with a CAGR exceeding 30%. Diodes' product portfolio directly addresses the needs of these high-growth markets.

5G and Next-Generation Connectivity

The ongoing global deployment of 5G networks and the research into even more advanced wireless technologies are significant drivers for specialized semiconductor demand. Diodes Incorporated's product portfolio is directly aligned with this trend, supplying essential components for the communications infrastructure and the devices that utilize it. This includes enabling faster data speeds and improved connectivity across a wide array of applications.

These advancements are particularly impactful in areas like automotive V2X (vehicle-to-everything) communication, where reliable and high-speed data exchange is critical for safety and efficiency. Diodes' semiconductors play a crucial role in facilitating these next-generation communication systems.

Looking ahead, the market for 5G infrastructure and devices is projected for substantial growth. For instance, the global 5G services market was valued at approximately $47.24 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of over 40% from 2024 to 2030, reaching hundreds of billions of dollars. This expansion directly translates into increased demand for the types of semiconductor solutions Diodes provides.

- 5G Rollout: The expansion of 5G infrastructure globally necessitates a vast number of semiconductor components for base stations, network equipment, and user devices.

- Automotive Connectivity: Diodes' components are vital for automotive applications like V2X, which rely on robust and high-speed wireless communication for enhanced safety and autonomous driving features.

- Market Growth: The global 5G services market is experiencing rapid expansion, with projections indicating significant growth through 2030, creating sustained demand for advanced semiconductor solutions.

Automation and Smart Manufacturing

The semiconductor industry's embrace of automation and smart manufacturing is a significant technological trend. This shift directly enhances production efficiency and product quality. For Diodes, this means opportunities to integrate these advanced processes into its own operations, potentially leading to cost savings and improved output. In 2024, investments in industrial automation are projected to reach hundreds of billions globally, highlighting the scale of this transformation.

Furthermore, Diodes is well-positioned to capitalize on this trend by supplying essential components that power automation solutions for its diverse customer base. As industries increasingly rely on automated systems, the demand for reliable semiconductors that enable these technologies grows. This presents a dual benefit: improving Diodes' internal manufacturing and expanding its market reach.

The rise of artificial intelligence (AI) and machine learning is fundamentally altering the manufacturing landscape. This necessitates a workforce equipped with new skill sets to effectively manage and collaborate with automated systems. Diodes will need to invest in training and development to ensure its employees can operate alongside these advanced technologies, maintaining a competitive edge.

- Increased Efficiency: Automation can reduce cycle times and improve yield in semiconductor fabrication.

- Component Demand: Diodes' products are crucial for sensors, control systems, and connectivity in automated industrial equipment.

- Workforce Adaptation: The need for skilled technicians in AI-driven manufacturing is growing rapidly.

The semiconductor industry is witnessing a significant push towards advanced packaging techniques like 3D stacking and chiplets to overcome Moore's Law limitations, enhancing performance and efficiency. Diodes can leverage these innovations for high-density applications such as smartphones and IoT devices, aligning with the demand for miniaturization and increased functionality.

Legal factors

International trade regulations and export controls, especially concerning advanced technologies, significantly shape Diodes' global operations. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, impacting companies' ability to export certain goods and technologies. Failure to comply can result in substantial fines, as seen in past cases where companies faced millions in penalties for export control violations.

Restrictions on selling to specific nations or particular end-users directly affect Diodes' market reach and require agile adjustments to its supply chain and distribution networks. The semiconductor industry, in particular, is subject to stringent controls due to its dual-use nature. In 2023, global trade disputes and the implementation of new tariffs continued to create uncertainty, influencing sourcing and sales strategies for companies like Diodes.

Adherence to these dynamic legal frameworks is not merely a suggestion but a critical necessity to prevent severe penalties and maintain operational integrity. The ongoing geopolitical landscape means that trade policies can shift rapidly, demanding constant vigilance and proactive compliance measures from Diodes to safeguard its international business activities.

Protecting intellectual property (IP) is absolutely crucial in the fast-paced, innovation-heavy semiconductor sector where Diodes Incorporated operates. The company heavily depends on patents, trademarks, and trade secrets to safeguard its unique product designs and advanced manufacturing processes.

Legal frameworks governing IP rights, including their strength and enforceability across different jurisdictions, directly influence Diodes' competitive edge. Robust patent protection allows Diodes to prevent competitors from copying its technologies, thereby enabling it to capture market share and generate revenue from its R&D investments.

In 2023, Diodes reported spending $171.4 million on research and development, highlighting the significant investment in innovation that requires strong IP safeguards. The company's ability to effectively enforce its IP rights against infringement is a key determinant of its long-term profitability and market position.

Diodes Incorporated operates in a fiercely competitive semiconductor industry, making adherence to antitrust and competition laws paramount. These regulations, enforced by bodies like the U.S. Federal Trade Commission (FTC) and the European Commission, are designed to prevent monopolistic behavior and ensure a level playing field for all market participants. Failure to comply can result in significant penalties; for instance, in 2023, the FTC continued its aggressive stance against anti-competitive practices across various sectors.

Any strategic moves by Diodes, such as mergers, acquisitions, or even marketing strategies, must be carefully vetted against these legal frameworks. For example, a proposed acquisition by a major player in the semiconductor space might face intense scrutiny to ensure it doesn't stifle innovation or reduce consumer choice. In 2024, we anticipate continued regulatory focus on market concentration within technology sectors, requiring Diodes to proactively manage its market conduct to avoid legal entanglements and potential fines that could impact its financial performance.

Product Liability and Safety Standards

As a provider of semiconductor components integral to automotive and industrial sectors, Diodes Incorporated faces stringent legal obligations concerning product liability and safety. These regulations are paramount, given the critical nature of their products in systems where failure can have severe consequences, including potential harm to individuals or significant financial losses.

Navigating these legal landscapes requires Diodes to maintain exceptionally high standards for product quality, reliability, and safety. Compliance is not merely a regulatory hurdle but a cornerstone for building and sustaining customer confidence. Failure to meet these benchmarks can expose the company to substantial litigation costs and reputational damage.

For instance, the automotive industry, a key market for Diodes, is governed by evolving safety standards such as ISO 26262 for functional safety. In 2024, the global automotive semiconductor market was valued at approximately $60 billion, with safety-related components representing a significant portion. Diodes' commitment to these standards directly impacts its market position and ability to secure business with major automotive manufacturers.

- Product Quality and Reliability: Diodes must ensure its semiconductor products meet rigorous performance specifications and longevity requirements, especially for automotive applications where component failure rates are meticulously monitored.

- Safety Standards Compliance: Adherence to international safety standards, such as those mandated by regulatory bodies like the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and specific industry standards like AEC-Q100 for automotive qualification, is non-negotiable.

- Liability Mitigation: Robust quality control, comprehensive testing, and clear documentation are essential to mitigate product liability risks and defend against potential claims arising from product defects or failures.

Labor Laws and Employment Regulations

Diodes Incorporated's global workforce operates under a complex web of labor laws and employment regulations, varying significantly by country. These regulations dictate critical aspects of employment, including minimum wages, working hours, workplace safety standards, and employee benefits. For instance, in 2024, countries like Germany maintained robust worker protections with strong union representation, while other regions might have more flexible employment laws. Adherence to these diverse legal frameworks is paramount for Diodes to ensure a stable and motivated workforce, thereby mitigating risks of labor disputes and associated financial penalties.

The company must navigate regulations concerning collective bargaining and unionization rights, which can impact operational flexibility and labor costs. For example, in the United States, the National Labor Relations Act (NLRA) governs union activities, while in Europe, works councils often play a significant role in employee relations. Failure to comply can lead to significant legal challenges, fines, and reputational damage, underscoring the importance of proactive legal counsel and robust HR policies across all operational geographies.

Key legal factors impacting Diodes' labor force include:

- Wage and Hour Laws: Adherence to national and regional minimum wage requirements and overtime regulations.

- Workplace Safety and Health: Compliance with standards set by bodies like OSHA in the US or similar agencies globally.

- Employee Benefits and Leave: Meeting mandates for health insurance, retirement contributions, and paid time off.

- Unionization and Collective Bargaining: Respecting employee rights to organize and engage in collective negotiations.

The global trade environment, particularly concerning advanced technologies, significantly impacts Diodes' international operations. Export controls, such as those managed by the U.S. Bureau of Industry and Security (BIS), can restrict sales to certain countries or entities, influencing market access and supply chain strategies. In 2023, ongoing trade disputes and tariffs continued to create market uncertainty for semiconductor companies.

Intellectual property (IP) protection is critical for Diodes, given its substantial investment in R&D, which totaled $171.4 million in 2023. Strong patent and trade secret laws enable the company to safeguard its innovations and maintain a competitive edge against rivals seeking to replicate its technologies.

Diodes must also comply with antitrust and competition laws to prevent monopolistic practices, a focus for regulators like the FTC in 2023. Strategic actions, including potential mergers or acquisitions, face scrutiny to ensure fair market competition and avoid stifling innovation.

As a supplier to the automotive sector, Diodes faces stringent product liability and safety regulations, such as ISO 26262 for functional safety. The automotive semiconductor market, valued around $60 billion in 2024, places a premium on reliability and adherence to standards like AEC-Q100.

Environmental factors

Semiconductor manufacturing, a core part of Diodes' operations, is inherently resource-intensive, demanding significant energy and water. This reality places the company under the watchful eye of environmental regulations focused on emissions, waste management, and water consumption. For instance, the European Union is increasingly advocating for tighter water usage restrictions in fabrication plants, a trend Diodes must navigate.

Compliance with evolving environmental standards, including those pertaining to substances like PFAS (per- and polyfluoroalkyl substances) and the imperative for robust water recycling systems, is critical. These regulations are not uniform, often differing significantly from one region to another, requiring Diodes to maintain a flexible and adaptive approach to its manufacturing footprint.

The semiconductor industry, including Diodes Incorporated, faces growing demands for sustainability. Consumers, investors, and governments are pushing for greener operations. For instance, by 2024, the global semiconductor market's focus on environmental, social, and governance (ESG) factors is projected to significantly influence investment decisions.

Diodes is likely to implement strategies such as adopting renewable energy sources for its manufacturing facilities and improving water usage efficiency. These efforts aim to reduce the company's environmental impact and bolster its reputation. Analysts anticipate that companies demonstrating strong ESG performance, like Diodes, will see enhanced brand loyalty and investor confidence in the coming years.

Semiconductor manufacturing, the core of Diodes' operations, is heavily reliant on a range of critical raw materials. Some of these materials face increasing scarcity or are concentrated in regions with significant geopolitical risks, directly impacting production stability. For instance, the global supply of rare earth elements, crucial for various electronic components, is dominated by a few countries, creating potential vulnerabilities.

Diodes must proactively address the environmental footprint associated with resource extraction for these materials. Simultaneously, building robust and resilient supply chains is paramount. This resilience needs to account for disruptions stemming from environmental factors, such as the increasing frequency of extreme weather events linked to climate change, which can directly affect the availability of raw material sources.

Waste Management and Recycling

The increasing global focus on electronic waste (e-waste) presents a significant environmental challenge for companies like Diodes. Proper management of manufacturing byproducts and end-of-life products is crucial. For instance, in 2023, the global e-waste generated reached an estimated 62 million tonnes, highlighting the scale of the issue.

Diodes must prioritize robust waste management strategies and actively pursue recycling initiatives. Embracing circular economy principles can help mitigate environmental impact and ensure compliance with evolving waste disposal regulations worldwide. For example, the EU's Ecodesign directive is pushing for greater product longevity and repairability, influencing how electronics are managed throughout their lifecycle.

- E-waste Generation: Global e-waste is projected to grow, demanding proactive management.

- Regulatory Compliance: Strict waste disposal regulations necessitate effective strategies.

- Circular Economy: Opportunities exist in recycling and product lifecycle extension.

- Environmental Impact: Minimizing waste is key to reducing Diodes' ecological footprint.

Climate Change and Carbon Footprint

The semiconductor industry, including Diodes Incorporated, is under growing scrutiny for its environmental impact, particularly concerning greenhouse gas emissions. As global awareness of climate change intensifies, chip manufacturers are facing increasing pressure to actively reduce their carbon footprint and commit to net-zero emission targets. This necessitates significant investments in sustainable practices.

Diodes is expected to continue investing in renewable energy sources to power its manufacturing facilities and optimize energy efficiency throughout its operations. For instance, the semiconductor industry's energy consumption is substantial, with some estimates suggesting it accounts for a significant portion of global electricity use. Lifecycle assessments (LCAs) are also becoming a critical tool, offering greater transparency regarding the environmental impact of semiconductor products from raw material extraction to end-of-life disposal.

- Industry Emissions: The manufacturing of semiconductors is an energy-intensive process, contributing to global greenhouse gas emissions.

- Net-Zero Pressure: Diodes, like its peers, faces mounting pressure from regulators, investors, and consumers to set and achieve net-zero emission goals.

- Sustainability Investments: Key strategies include transitioning to renewable energy sources and enhancing operational energy efficiency.

- Lifecycle Transparency: Lifecycle assessments (LCAs) are increasingly used to provide a comprehensive view of environmental impact, fostering accountability.

Diodes Incorporated, like all semiconductor manufacturers, operates within an environment increasingly focused on sustainability and resource management. The energy and water demands of fabrication processes are significant, placing the company under scrutiny regarding emissions, waste, and water usage. For example, the global push for water conservation in industrial processes, particularly in water-scarce regions, directly impacts semiconductor operations.

The industry faces stringent regulations concerning hazardous substances and a growing demand for circular economy principles, which includes robust e-waste management and product lifecycle extension. By 2024, the emphasis on ESG factors in the semiconductor market is expected to heavily influence investment strategies, pushing companies like Diodes towards greener operational models.

In response, Diodes is likely to prioritize renewable energy adoption and water efficiency improvements. These strategic shifts are not only about environmental compliance but also about enhancing brand reputation and investor confidence, as companies demonstrating strong ESG performance are predicted to see increased loyalty and trust in the coming years.

| Environmental Factor | Diodes' Relevance | Industry Trend/Data (2024/2025) |

|---|---|---|

| Water Consumption | High demand in semiconductor fabrication | Increased regulatory focus on water recycling and usage limits in manufacturing hubs. |

| Energy Consumption & Emissions | Significant energy use in chip production | Growing pressure for net-zero targets; renewable energy adoption is a key strategy. Global semiconductor industry energy consumption is a substantial portion of global electricity use. |

| E-Waste | Management of manufacturing byproducts and end-of-life products | Global e-waste generated reached an estimated 62 million tonnes in 2023, with continued growth projected. |

| Resource Scarcity | Reliance on critical raw materials | Geopolitical risks and scarcity of certain elements impacting supply chains; focus on supply chain resilience. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Diodes is built on a robust foundation of data from leading market research firms, industry-specific publications, and official government reports. We analyze economic indicators, technological advancements, and regulatory changes to provide comprehensive insights.