Diodes Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diodes Bundle

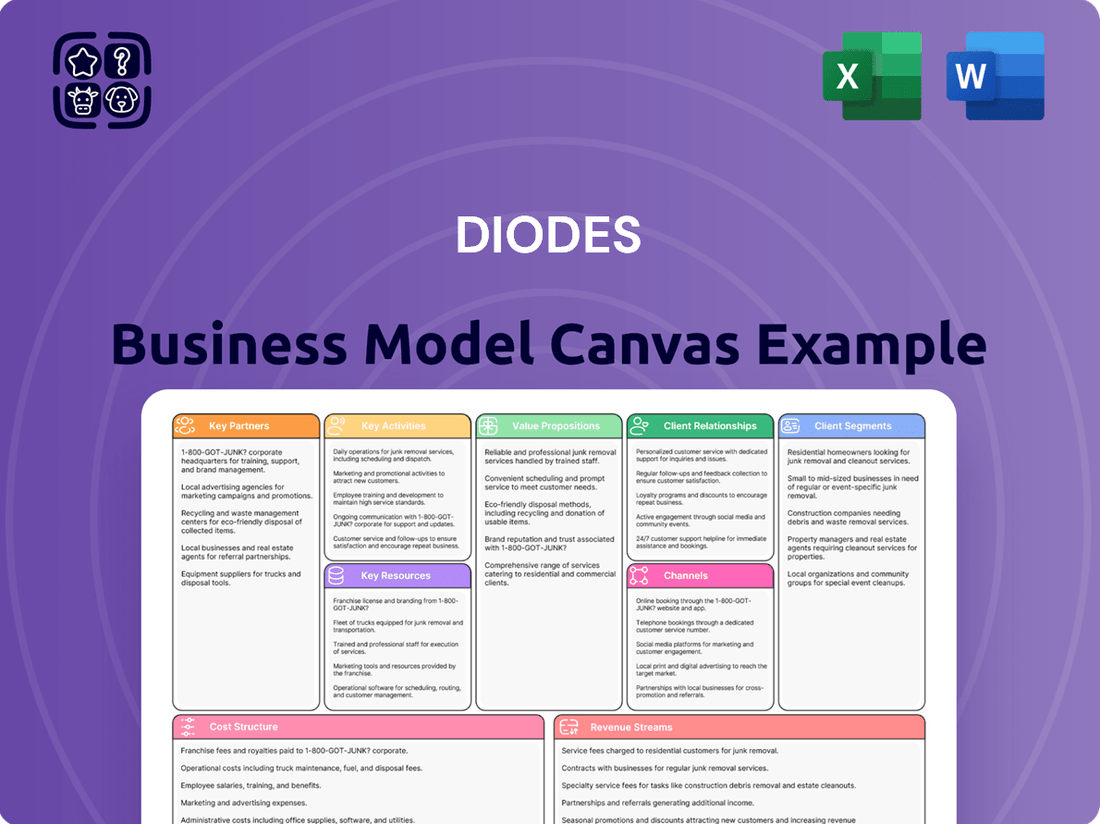

Unlock the strategic blueprint of Diodes's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, key resources, and revenue streams, offering a clear picture of their operational genius. Discover how Diodes effectively delivers value and captures market share.

Partnerships

Diodes Incorporated cultivates strategic alliances with industry giants like NVIDIA and AMD. These collaborations are fundamental for securing early design wins, embedding Diodes' semiconductor solutions into cutting-edge systems before market launch.

This deep integration ensures Diodes' products precisely align with evolving application needs and market trends. Such partnerships are pivotal for accelerating product adoption and expanding market presence in rapidly expanding sectors.

Diodes Incorporated actively pursues technology and intellectual property (IP) licensing agreements to bolster its product range and technical expertise. This strategic approach enables Diodes to integrate advanced technologies, such as novel semiconductor processes or specialized circuit designs, into its offerings, broadening its market reach beyond what internal R&D alone could achieve.

These partnerships are crucial for accelerating the introduction of new products. For instance, by licensing specific IP, Diodes can bypass lengthy development cycles, bringing innovative solutions to market faster and gaining a competitive edge. This was evident in their strategy to expand into higher-performance analog and mixed-signal segments, often leveraging licensed technologies to complement their existing strengths.

Diodes Incorporated strategically utilizes a hybrid manufacturing approach, integrating its internal wafer fabrication capabilities with external production from third-party foundries and assembly/test partners. This dual strategy is crucial for maintaining manufacturing agility and cost-effectiveness.

These vital partnerships offer Diodes significant flexibility in scaling production volumes and optimizing the utilization of its manufacturing capacity. For instance, in 2023, Diodes reported that its outsourced manufacturing represented a substantial portion of its production, enabling it to meet diverse customer demands without being solely reliant on its internal facilities.

By outsourcing a portion of its manufacturing, Diodes can efficiently manage production costs and respond adeptly to the dynamic fluctuations characteristic of the semiconductor market. This adaptability is fundamental to its ability to maintain competitiveness and capture growth opportunities.

Key Supplier Relationships

Diodes Incorporated places significant emphasis on its key supplier relationships, recognizing their direct impact on production continuity and product quality. These partnerships are foundational for securing a stable supply of essential raw materials, specialized components, and advanced manufacturing equipment. In 2023, Diodes continued to foster these vital connections, understanding that supplier reliability is paramount to meeting market demand.

Responsible supply chain management is a core commitment for Diodes, extending beyond mere transactional interactions. The company actively collaborates with its suppliers to promote environmental sustainability and uphold social responsibility standards throughout the value chain. This collaborative approach ensures that Diodes’ operations are not only efficient but also ethically sound.

These supplier relationships are critical for several reasons:

- Supply Chain Stability: Ensuring consistent availability of raw materials and components is vital for uninterrupted manufacturing operations.

- Quality Assurance: Strong supplier partnerships facilitate rigorous quality control measures, directly impacting the performance and reliability of Diodes’ products.

- Innovation and Cost Efficiency: Collaborative efforts with suppliers can lead to the development of new materials or processes, driving innovation and optimizing costs.

- Risk Mitigation: Diversifying the supplier base and building robust relationships helps mitigate risks associated with supply disruptions or quality issues.

Acquisition Targets and Integration

Diodes Incorporated actively seeks strategic acquisitions to bolster its product lines, acquire cutting-edge technologies, and penetrate new market segments. A prime example is the 2023 acquisition of Fortemedia, Inc., which significantly expanded Diodes' capabilities in advanced voice processing for automotive and computing applications. This move underscores Diodes' commitment to inorganic growth as a critical component of its overall strategy.

The company's growth trajectory is heavily reliant on its ability to identify suitable acquisition targets and then effectively integrate them into its existing operations. This process is crucial for realizing synergies and maximizing the value derived from these strategic investments. Diodes' approach focuses on acquiring businesses that complement its core competencies and offer clear pathways to market expansion and technological advancement.

- Acquisition Strategy: Diodes pursues acquisitions to enhance product portfolios, acquire new technologies, and enter new markets.

- Recent Acquisition: The 2023 acquisition of Fortemedia, Inc. strengthened Diodes' position in advanced voice processing for automotive and computer sectors.

- Integration Focus: Successful identification and integration of acquired companies are paramount to Diodes' sustained growth and market competitiveness.

Diodes Incorporated's Key Partnerships are multifaceted, encompassing collaborations with leading technology firms, strategic IP licensing, and robust supplier relationships. These alliances are critical for innovation, market access, and operational efficiency.

The company also leverages acquisitions as a key partnership strategy, as seen with the 2023 Fortemedia acquisition, to expand its product offerings and technological capabilities, particularly in high-growth areas like automotive and computing.

These partnerships collectively enable Diodes to accelerate product development, ensure supply chain stability, and maintain a competitive edge in the dynamic semiconductor industry.

| Partnership Type | Key Partners/Examples | Strategic Benefit | 2023 Impact/Focus |

|---|---|---|---|

| Technology Collaborations | NVIDIA, AMD | Early design wins, product integration | Securing design wins in next-gen platforms |

| IP Licensing | Various technology providers | Broaden product range, accelerate development | Expanding analog and mixed-signal portfolio |

| Manufacturing & Supply Chain | Third-party foundries, assembly/test partners, raw material suppliers | Production agility, cost efficiency, supply stability, quality assurance | Optimizing outsourced manufacturing, ensuring material availability |

| Acquisitions | Fortemedia, Inc. (2023) | Technology acquisition, market expansion | Strengthening voice processing for automotive/computing |

What is included in the product

A detailed breakdown of Diodes Incorporated's strategic approach, mapping out its core customer segments, value propositions, and key revenue streams.

This model offers a clear view of Diodes' operational framework, including its channels, partnerships, and cost structure, ideal for strategic planning.

The Diodes Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of how the company addresses customer needs, effectively streamlining the identification of value propositions and customer segments.

Activities

Diodes Incorporated prioritizes research and development, dedicating substantial resources to foster innovation and launch novel semiconductor products. This focus is crucial for staying ahead in the fast-paced technology landscape.

In 2024, Diodes continued its commitment to R&D, particularly in areas like advanced analog and discrete power solutions. They are also actively developing products tailored for burgeoning fields such as AI applications, ensuring their offerings remain relevant and cutting-edge.

This ongoing investment in R&D is the bedrock of Diodes’ strategy to maintain a competitive advantage and effectively address the ever-changing demands of the global market.

Diodes' core business revolves around the manufacturing of discrete, logic, analog, and mixed-signal semiconductor products. This intricate process includes wafer fabrication, assembly, and rigorous testing, all managed across their strategically located global facilities in the U.S., China, Taiwan, and the UK. For 2024, Diodes has been focused on optimizing these operations to ensure both cost-effectiveness and timely product delivery to their diverse customer base.

Diodes Incorporated's global sales and marketing activities are central to its business, aiming to promote and sell its wide array of semiconductor products to customers worldwide. This involves a dual approach: direct sales to major clients and utilizing an extensive network of distributors to reach a broader market. For instance, in 2023, the company reported net sales of $1.86 billion, highlighting the scale of its global commercial operations.

Effective engagement with target customer segments and driving revenue growth are critically dependent on these sales and marketing strategies. The company's ability to connect with diverse industries, from automotive to consumer electronics, relies on robust marketing campaigns and a well-supported sales force. This is reflected in their ongoing investment in sales infrastructure and channel partnerships to ensure market penetration and customer satisfaction.

Supply Chain Management and Logistics

Diodes' key activities heavily rely on expertly managing its intricate global supply chain. This spans the entire process, from procuring essential raw materials to ensuring the timely delivery of finished semiconductor products to customers worldwide. A significant focus is placed on optimizing logistics and meticulously managing inventory levels to meet demand efficiently.

Ensuring responsible sourcing practices is also a cornerstone of Diodes' operations, reflecting a commitment to ethical and sustainable procurement. The company's ability to maintain operational resilience and achieve high levels of customer satisfaction is directly tied to the effectiveness and robustness of its supply chain management.

- Supply Chain Optimization: Diodes actively works to streamline its global logistics and inventory management to reduce lead times and costs. For instance, in 2023, the company reported efforts to improve inventory turnover ratios, aiming for greater efficiency.

- Supplier Relationships: Building and maintaining strong relationships with a diverse base of reliable suppliers is crucial for securing critical components and raw materials.

- Risk Mitigation: Implementing strategies to mitigate potential disruptions, such as geopolitical events or natural disasters, is a continuous effort to ensure supply continuity.

- Quality Assurance: Maintaining rigorous quality control throughout the supply chain, from raw material inspection to final product testing, is paramount to product reliability.

Customer Support and Application Engineering

Diodes Incorporated's commitment to customer support and application engineering is a cornerstone of its business model. This involves offering extensive technical assistance and specialized engineering help tailored to specific customer needs. For instance, in 2023, Diodes reported significant investment in R&D to enhance these support capabilities, aiming to solidify its position in dynamic markets.

The company actively engages in design-in support, guiding customers through product integration and optimization. This collaborative approach extends to developing customized solutions, ensuring Diodes’ products seamlessly fit into diverse applications. This dedication to service underpins their status as a preferred supplier in high-volume, rapidly expanding sectors.

- Technical Support: Providing expert guidance on product selection and troubleshooting.

- Design-In Assistance: Helping customers integrate Diodes' components into their designs.

- Application-Specific Engineering: Collaborating on tailored solutions for unique customer requirements.

- Market Focus: Enabling Diodes to excel in high-volume, high-growth markets through superior service.

Diodes' key activities are deeply rooted in its manufacturing prowess, encompassing the production of discrete, logic, analog, and mixed-signal semiconductor devices. This intricate process involves wafer fabrication, assembly, and rigorous testing across its global facilities. In 2024, the company has been focused on enhancing operational efficiency within these manufacturing hubs to ensure cost-effectiveness and timely delivery.

The company's sales and marketing efforts are vital for promoting its broad range of semiconductor products to a global clientele. This strategy employs both direct sales to major clients and leverages a wide network of distributors to broaden market reach. In 2023, Diodes reported net sales of $1.86 billion, underscoring the significant scale of its commercial operations and market penetration.

Diodes places a strong emphasis on customer support and application engineering, providing extensive technical assistance and specialized engineering help. This includes design-in support to aid customers in integrating Diodes' components, as well as developing customized solutions. Their investment in these support capabilities in 2023 aims to solidify their market position in dynamic sectors.

| Key Activity | Description | 2023 Data/Focus |

|---|---|---|

| Manufacturing | Wafer fabrication, assembly, and testing of semiconductor products. | Focus on operational efficiency in global facilities. |

| Sales & Marketing | Direct sales and distributor network to reach global customers. | Net sales of $1.86 billion in 2023. |

| Customer Support & Engineering | Technical assistance and design-in support for product integration. | Investment in R&D to enhance support capabilities. |

Delivered as Displayed

Business Model Canvas

The Diodes Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, ready-to-use canvas exactly as it will be delivered. Once your order is processed, you'll gain full access to this comprehensive business planning tool, allowing you to immediately start strategizing and refining your business model.

Resources

Diodes Incorporated's intellectual property, particularly its patents and proprietary designs, forms a cornerstone of its competitive edge in the semiconductor market. This IP safeguards its unique technological innovations, allowing the company to differentiate its products and maintain market share.

In 2023, Diodes continued its commitment to innovation, filing a significant number of new patents to protect its advancements. This ongoing investment ensures a pipeline of novel products and reinforces its position against competitors by securing exclusive rights to key technologies.

Diodes Incorporated's global manufacturing facilities are the backbone of its hybrid production strategy. These sites, including wafer fabrication plants in the U.S., China, Taiwan, and the UK, are crucial for producing their diverse range of semiconductor products.

These advanced facilities are key to managing production capacity and ensuring the high quality of their offerings. For instance, in 2023, Diodes continued to invest in expanding its manufacturing capabilities, particularly in Asia, to meet growing demand.

Strategic investments in these global operations are fundamental to Diodes' growth initiatives, allowing them to scale production efficiently and maintain a competitive edge in the semiconductor market.

Diodes Incorporated relies heavily on its highly skilled human capital, especially in engineering and research and development. This expertise is crucial for their innovation and the creation of advanced semiconductor solutions. Their technical sales teams also play a key role in understanding and meeting complex customer needs.

The company's leadership, including its CEO and CFO, represents a significant human resource. Their strategic direction and financial acumen are vital for navigating the competitive semiconductor market. In 2024, Diodes continued to invest in talent development, recognizing that skilled employees are central to their competitive advantage and ability to deliver specialized products.

Extensive Product Portfolio

Diodes Incorporated boasts an extensive product portfolio, a cornerstone of its business model. This vast offering includes over 28,000 distinct semiconductor devices, spanning discrete, logic, analog, and mixed-signal categories. This breadth allows Diodes to cater to a multitude of industries and applications, from automotive and industrial to consumer electronics and computing.

The company's strategic focus on continuously expanding and diversifying this product line is evident. For instance, in 2023, Diodes continued to introduce new products across its key segments, reinforcing its market presence. This commitment to a wide and evolving product range is crucial for meeting diverse customer needs and capturing new market opportunities.

Key aspects of Diodes' extensive product portfolio include:

- Diversified Product Categories: Covering discrete, logic, analog, and mixed-signal semiconductors.

- Vast Product Count: Exceeding 28,000 individual products available.

- Broad Market Reach: Serving critical sectors like automotive, industrial, computing, and consumer electronics.

- Strategic Expansion: Ongoing development and introduction of new semiconductor solutions.

Strong Financial Capital

Diodes Incorporated's strong financial capital is a cornerstone of its business model, providing the necessary resources for sustained growth and operational resilience. This robust financial footing allows the company to proactively invest in research and development, expand manufacturing capacity to meet growing demand, and pursue strategic acquisitions that enhance its product portfolio and market reach.

The company's financial flexibility is a significant competitive advantage, enabling it to weather economic fluctuations and capitalize on emerging opportunities. This is evidenced by its substantial cash reserves, which provide a buffer against market volatility and support long-term strategic initiatives. As of the first quarter of 2025, Diodes reported approximately $322 million in cash and cash equivalents, underscoring its healthy liquidity position.

- Robust Cash Position: Approximately $322 million in cash and cash equivalents as of Q1 2025.

- Financial Flexibility: Enables funding of organic growth, R&D, and strategic acquisitions.

- Market Navigation: Allows investment in high-demand capacity and resilience during market cycles.

Diodes' intellectual property, including over 2,000 patents, is a critical resource that protects its innovative semiconductor designs. This IP portfolio is vital for maintaining its competitive edge and securing exclusive rights to its technology.

The company's global manufacturing footprint, with facilities in the US, Asia, and Europe, is another key resource. These sites are essential for producing its extensive range of over 28,000 semiconductor products, ensuring quality and scalability.

Diodes' human capital, particularly its skilled engineering and R&D teams, is paramount. Their expertise drives product development and innovation, enabling the company to meet complex customer demands in sectors like automotive and industrial.

Financially, Diodes possesses strong capital, with approximately $322 million in cash and cash equivalents as of Q1 2025. This financial strength allows for strategic investments in R&D, manufacturing expansion, and potential acquisitions.

| Key Resource | Description | 2024/2025 Data Point |

|---|---|---|

| Intellectual Property | Patents and proprietary designs | Over 2,000 patents |

| Manufacturing Facilities | Global production sites | Facilities in US, Asia, Europe |

| Human Capital | Skilled workforce, R&D expertise | Investment in talent development |

| Financial Capital | Cash reserves and financial flexibility | ~$322 million cash (Q1 2025) |

| Product Portfolio | Breadth and diversity of semiconductor offerings | Over 28,000 distinct products |

Value Propositions

Diodes Incorporated is dedicated to providing semiconductor products that consistently meet rigorous industry benchmarks, ensuring dependable performance in demanding applications. This unwavering commitment to quality fosters deep trust and cultivates enduring partnerships with their clientele.

In 2024, Diodes Incorporated continued to emphasize product reliability, a cornerstone of their value proposition. This focus is critical as their components are integral to sectors like automotive and industrial, where failure is not an option. For instance, their automotive-qualified products adhere to stringent AEC-Q100 standards, a testament to their dedication to superior quality and dependability.

Diodes Incorporated excels by offering application-specific solutions, not just off-the-shelf components. This means they develop products precisely engineered for the demands of sectors like automotive, industrial, computing, and communications. For instance, their automotive-grade components meet stringent reliability and performance standards crucial for vehicle safety and advanced driver-assistance systems.

This tailored approach allows customers to integrate Diodes' products seamlessly into their designs, optimizing performance and reducing development time. By understanding the unique challenges within each industry, Diodes acts as a valuable design partner, contributing to their customers' success and solidifying their position as a solution provider rather than a mere component supplier.

Diodes consistently introduces new product lines, leveraging cutting-edge technology to meet evolving market demands, especially in high-growth sectors like automotive and AI. In 2024 alone, Diodes launched 15 new product lines, directly contributing to a significant 15% increase in revenue from these newer offerings. This dedication to continuous innovation not only drives operational efficiency but also empowers the development of next-generation electronic designs.

Expanded Portfolio of Analog and Discrete Power Solutions

Diodes leverages its significantly expanded portfolio of analog and discrete power solutions, enhanced by cutting-edge packaging technology, to address a wide array of customer requirements. This broad product range enables clients to consolidate their component sourcing from a single, reliable supplier, streamlining procurement processes.

The company's commitment to innovation is particularly evident in its focus on high-performance silicon carbide (SiC) diodes. These advanced components are crucial for applications demanding greater efficiency and power handling capabilities, such as electric vehicles and renewable energy systems.

- Expanded Product Range: Diodes offers a comprehensive suite of analog and discrete power components, simplifying supply chains for customers.

- Technological Advancement: The integration of leading-edge packaging technology ensures that these solutions meet demanding performance criteria.

- Key Growth Area: A strategic emphasis on high-performance silicon carbide (SiC) diodes positions Diodes to capitalize on the growing demand for efficient power electronics.

- Customer Value: By providing a wider selection from one source, Diodes enhances convenience and reliability for its diverse customer base.

Efficiency and Sustainability Enablement

Diodes Incorporated's product portfolio is a key enabler of efficiency and sustainability across a wide array of industries. By focusing on energy conservation, Diodes helps its customers create end applications that are both environmentally responsible and economically advantageous. This commitment to sustainability is increasingly important as global demand for eco-friendly technology continues to grow.

The company's solutions are designed to reduce power consumption and improve the overall energy footprint of electronic devices. For instance, their advanced power management ICs and discrete components are crucial for optimizing energy usage in everything from consumer electronics to automotive systems. This focus on efficiency directly supports customers in meeting stringent environmental regulations and consumer expectations for greener products.

- Enabling Energy-Efficient Designs: Diodes' components are integral to creating devices that consume less power, contributing to a lower carbon footprint for end products.

- Supporting Sustainable Innovation: The company actively helps customers develop applications that align with global sustainability goals, offering a competitive edge in the market.

- Reducing Operational Costs: By improving energy efficiency, Diodes' solutions can lead to significant cost savings for both manufacturers and end-users over the product lifecycle.

Diodes Incorporated's value proposition centers on delivering high-quality, reliable semiconductor products tailored for specific applications, particularly in demanding sectors like automotive and industrial. Their commitment to innovation is demonstrated through continuous product line expansion, with a notable 15% revenue increase from new offerings in 2024, driven by advancements in areas like silicon carbide diodes.

This focus on both quality and innovation allows Diodes to act as a strategic partner, enabling customers to optimize performance, reduce development time, and meet evolving market needs. Furthermore, their emphasis on energy-efficient solutions supports customers in achieving sustainability goals and reducing operational costs.

| Value Proposition Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Product Quality & Reliability | Dependable performance in demanding applications, fostering trust. | Automotive-qualified products meet AEC-Q100 standards. |

| Application-Specific Solutions | Tailored products for automotive, industrial, computing, and communications sectors. | Components critical for vehicle safety and advanced driver-assistance systems. |

| Continuous Innovation | Introduction of new product lines leveraging cutting-edge technology. | Launched 15 new product lines, contributing to a 15% revenue increase from new offerings. |

| Expanded Portfolio & Packaging | Broad range of analog and discrete power solutions with advanced packaging. | Enables customers to consolidate sourcing from a single supplier. |

| Energy Efficiency & Sustainability | Components designed to reduce power consumption and support eco-friendly designs. | Supports customers in meeting environmental regulations and consumer expectations for greener products. |

Customer Relationships

Diodes cultivates deep customer loyalty by prioritizing a solution-focused sales strategy. Their sales teams collaborate intimately with clients, dissecting unique application needs to craft tailored solutions. This proactive engagement, supported by extensive technical and application engineering resources, ensures seamless design and integration, a key driver for securing design wins.

Diodes Incorporated actively cultivates long-term strategic partnerships with key players across its target sectors, including automotive and industrial markets. This approach goes beyond simple supplier-customer dynamics, focusing on deep collaboration and understanding future technological needs.

By engaging continuously and aligning with partners' technology roadmaps, Diodes aims to co-develop innovative solutions. For instance, in 2023, approximately 30% of Diodes' revenue was derived from its top ten customers, highlighting the significance of these strong relationships for sustained business growth.

Diodes Incorporated excels in global customer service, bolstered by a robust regional footprint. This is particularly crucial in Asia, the origin of a substantial portion of their sales, where localized support fosters responsiveness and cultural alignment, ensuring efficient handling of diverse customer needs.

This strong regional presence allows Diodes to effectively serve its multinational clientele by providing tailored support and understanding the nuances of different markets. For example, in 2023, Diodes reported that approximately 55% of its net sales were generated in Asia, highlighting the importance of its regional customer service infrastructure.

Transparent Investor and Stakeholder Engagement

Diodes, while primarily a business-to-business entity, actively cultivates strong relationships with its investors and stakeholders. This is achieved through a commitment to transparent financial reporting, regular earnings calls, and informative investor presentations. For instance, in their Q1 2024 earnings report, Diodes highlighted a revenue of $531.1 million, demonstrating their ongoing operational performance.

This consistent communication strategy ensures that stakeholders have a clear understanding of the company's performance, its strategic trajectory, and its dedication to sustainability. Such open dialogue is crucial for building and maintaining trust, fostering confidence in Diodes' long-term prospects and its ability to navigate the evolving semiconductor market.

- Transparent Financial Reporting: Diodes provides detailed financial statements, allowing investors to assess performance and financial health.

- Regular Earnings Calls: These sessions offer direct updates on company results and future outlook, with Q1 2024 revenue reaching $531.1 million.

- Investor Presentations: These events outline strategic initiatives and sustainability efforts, reinforcing stakeholder confidence.

- Building Trust: Open engagement fosters a reliable perception of the company's stability and growth potential.

Quality and Reliability Assurance

Customer relationships at Diodes Incorporated are significantly strengthened by a steadfast commitment to quality and reliability. This assurance is paramount, as clients depend on consistent performance for their own product integrity.

Diodes implements stringent quality control measures throughout its manufacturing processes. These include rigorous testing and adherence to international standards, often backed by certifications that validate product performance and safety. For instance, in 2023, Diodes reported a significant reduction in product defect rates, a testament to these robust quality assurance programs.

- Rigorous Quality Control: Diodes maintains comprehensive testing protocols at multiple stages of production to ensure every component meets exacting specifications.

- Certifications and Compliance: The company actively pursues and maintains industry-specific certifications, such as ISO 9001, demonstrating its adherence to global quality management benchmarks.

- Risk Mitigation: By delivering highly reliable products, Diodes helps its customers avoid costly recalls, production downtime, and reputational damage, thereby reinforcing its value proposition.

- Customer Trust: This consistent delivery of high-quality, dependable components fosters deep trust, leading to long-term partnerships and repeat business across various demanding sectors like automotive and industrial electronics.

Diodes fosters deep customer loyalty through a solution-oriented sales approach, collaborating closely with clients to understand and address specific application needs. This partnership model, supported by extensive technical expertise, secures design wins and drives long-term engagement.

The company cultivates strategic, long-term partnerships, particularly in automotive and industrial sectors, by aligning with customers' technology roadmaps and co-developing solutions. This collaborative spirit is evident as approximately 30% of Diodes' revenue in 2023 came from its top ten customers, underscoring the value of these key relationships.

Diodes' global customer service is enhanced by a strong regional presence, especially in Asia where over 55% of its 2023 net sales originated. This localized support ensures responsiveness and cultural alignment, crucial for managing diverse customer needs effectively.

Beyond product delivery, Diodes maintains robust investor relations through transparent financial reporting, regular earnings calls, and informative presentations. For example, their Q1 2024 revenue of $531.1 million demonstrates ongoing operational strength and commitment to stakeholder confidence.

| Customer Relationship Aspect | Description | Supporting Data/Example |

|---|---|---|

| Solution-Focused Sales | Intimate collaboration with clients to craft tailored solutions for unique application needs. | Securing design wins through proactive engagement and technical support. |

| Strategic Partnerships | Long-term collaboration, aligning with technology roadmaps for co-development. | Top 10 customers contributed ~30% of 2023 revenue. |

| Global & Regional Support | Robust regional footprint for localized, responsive customer service. | ~55% of 2023 net sales generated in Asia, requiring strong regional presence. |

| Investor Relations | Transparent communication and engagement with stakeholders. | Q1 2024 revenue of $531.1 million reported, with consistent investor updates. |

Channels

Diodes Incorporated leverages a direct sales force to cultivate deep relationships with major Original Equipment Manufacturers (OEMs) and other strategic clients. This approach facilitates direct dialogue, enabling tailored solutions and efficient negotiation processes.

This direct engagement is vital for navigating the complexities inherent in serving large accounts and securing significant design wins, which are foundational to Diodes' revenue growth.

In 2024, Diodes reported that its direct sales channel remained a primary driver for high-volume business, contributing to a significant portion of its overall revenue, particularly in the automotive and industrial sectors where customized support is paramount.

Diodes Incorporated effectively utilizes a vast global distribution network to connect with a broad customer base, from large enterprises to smaller businesses needing readily available components. This network is crucial for ensuring Diodes' products reach diverse markets efficiently.

Distributors are instrumental in managing inventory and logistics, offering localized access to Diodes' semiconductor solutions worldwide. Their role is pivotal in facilitating high-volume sales and providing essential support to a wide array of clients.

In 2023, Diodes reported that its distribution channel represented a significant portion of its revenue, underscoring the network's importance. The company's strategy relies on these partners to extend its market reach and serve a dispersed customer base, particularly for its standard product offerings.

Diodes Incorporated's official website is a crucial hub, offering customers and stakeholders extensive product information, detailed technical documentation, and timely press releases. In 2024, the company continued to leverage this digital platform for investor relations, providing easy access to financial reports and performance updates. This online presence ensures comprehensive support and transparency for all interested parties.

Industry Trade Shows and Conferences

Diodes Incorporated actively participates in key industry trade shows and technical conferences, such as the Consumer Electronics Show (CES) and embedded world, to highlight its latest semiconductor solutions. These events are crucial for direct engagement with customers, fostering relationships, and demonstrating product innovation to a broad audience. For example, in 2024, Diodes continued its presence at major electronics exhibitions, showcasing advancements in areas like automotive and industrial applications.

Beyond technical showcases, Diodes also engages with the financial community at investor conferences. This interaction is vital for communicating the company's strategic direction, financial performance, and market outlook to analysts and investors. Such participation helps maintain market visibility and allows for valuable feedback from stakeholders. In the first half of 2024, Diodes management presented at several prominent investor events, providing updates on their growth strategies and market positioning.

- Showcasing Innovation: Diodes uses trade shows to unveil new product lines and technologies, driving market awareness.

- Customer Engagement: Direct interaction at conferences allows for feedback and strengthens relationships with existing and potential clients.

- Investor Relations: Participation in financial conferences ensures clear communication of the company's performance and strategy to the investment community.

- Market Intelligence: These events provide valuable insights into industry trends, competitor activities, and emerging market needs.

Strategic Design-In Partnerships

Working directly with leading companies at the design-in stage allows Diodes Incorporated to embed its products into new technologies and platforms from their inception. This strategic approach ensures Diodes' components are integral to upcoming innovations, establishing a strong market presence early on.

This channel is crucial for capturing early adoption in high-growth sectors. For instance, in 2024, the automotive sector continued its robust expansion, with global vehicle production expected to reach over 90 million units, and the automotive semiconductor market projected for significant growth, driven by electrification and advanced driver-assistance systems (ADAS).

- Design-In Advantage: Secures Diodes' components in next-generation products by integrating them from the initial design phase.

- Early Market Entry: Establishes a strong foothold in emerging technologies and platforms before competitors.

- High-Growth Sector Focus: Particularly vital for automotive and AI markets, which are experiencing rapid technological advancements and increased semiconductor demand.

- Strategic Collaboration: Fosters deep relationships with key industry players, leading to co-innovation and market leadership.

Diodes' channels include a direct sales force for major OEMs, a global distribution network for broader market reach, and digital platforms like its website for information dissemination. The company also actively engages through industry trade shows, technical conferences, and investor events to showcase innovation and communicate its strategy. These varied channels ensure Diodes effectively connects with its diverse customer base and the financial community.

Customer Segments

The automotive industry represents a significant customer segment for Diodes, demanding semiconductor solutions that meet stringent reliability standards and specific application needs. Diodes is actively growing its footprint in this expanding market, driven by the surge in electric vehicles and sophisticated automotive designs.

In the fourth quarter of 2024, revenue from the automotive sector demonstrated robust performance, consistently accounting for over 40% of Diodes' total product revenue, highlighting its critical importance to the company's financial success.

The industrial sector is a key customer base for Diodes, requiring resilient and high-performance semiconductor components for applications like factory automation, advanced power management, and sophisticated control systems. Diodes is actively enhancing its product portfolio to meet these demanding industrial needs.

This sector, alongside the automotive market, forms a substantial revenue driver for Diodes, underscoring the company's strategic focus on these growth areas. In 2023, industrial and automotive segments together represented a significant portion of Diodes' overall sales, demonstrating their critical importance to the company's financial performance.

Diodes serves the dynamic computing market, providing essential semiconductor components for a wide range of devices. This includes everything from personal computers and robust server infrastructure to the rapidly expanding field of artificial intelligence.

The company's discrete, logic, and mixed-signal product portfolios are crucial for managing power efficiently, ensuring seamless connectivity, and maintaining signal integrity within these computing systems.

In 2024, the computing segment represented a significant portion of Diodes' business, contributing 25% to its total product revenue, underscoring its importance in the company's overall financial performance.

Communications Market

The communications sector is a vital customer segment for Diodes, with its products integral to telecommunications infrastructure, networking equipment, and the ever-evolving mobile device market. The relentless push for faster connectivity, exemplified by the ongoing 5G rollout and the development of new communication standards, directly fuels the demand for Diodes' high-performance components. In 2024, this crucial segment accounted for 14% of Diodes' total product revenue, underscoring its significant contribution.

Key aspects of the communications market as a customer segment include:

- Telecommunications Infrastructure: Diodes' components are essential for building the backbone of modern communication networks, supporting everything from base stations to core network equipment.

- Networking Equipment: Routers, switches, and other data networking devices rely on Diodes' semiconductors to ensure efficient and reliable data transmission.

- Mobile Devices: The increasing complexity and performance demands of smartphones and other mobile devices necessitate advanced semiconductor solutions, a need Diodes addresses.

- 5G Rollout and Advancements: The global deployment of 5G technology and the continuous evolution of communication standards create a sustained demand for the specialized, high-frequency components Diodes offers.

Consumer Electronics Market

Diodes plays a crucial role in the consumer electronics market, supplying essential components for everything from smart home devices and televisions to portable music players and gaming consoles. This broad reach makes it a vital supplier for manufacturers across the diverse consumer electronics landscape.

Despite some market headwinds and inventory recalibrations experienced in late 2023 and into 2024, the consumer electronics sector continues to represent a substantial revenue stream for Diodes. The segment's inherent high-volume nature ensures consistent demand for its semiconductor solutions.

- Market Reach: Diodes' components are found in a vast range of consumer electronic devices, from kitchen appliances to personal computing and entertainment systems.

- Demand Dynamics: While facing some softness and inventory adjustments in 2023-2024, the segment remains a key driver for high-volume product sales.

- Revenue Contribution: In 2024, consumer electronics accounted for a significant 19% of Diodes' total product revenue, underscoring its importance to the company's financial performance.

Diodes' customer segments are diverse, spanning critical industries that rely heavily on semiconductor technology. The company strategically targets sectors with high growth potential and consistent demand for its specialized components.

The automotive and industrial sectors represent the largest customer bases, with automotive revenue consistently exceeding 40% of total product revenue in Q4 2024. The computing segment is also a significant contributor, accounting for 25% of total product revenue in 2024. These segments underscore Diodes' focus on markets demanding reliability and advanced performance.

| Customer Segment | 2024 Revenue Contribution (Approximate) | Key Applications |

|---|---|---|

| Automotive | Over 40% | Electric vehicles, advanced driver-assistance systems, infotainment |

| Industrial | Significant portion (combined with Automotive) | Factory automation, power management, control systems |

| Computing | 25% | Personal computers, servers, AI infrastructure |

| Communications | 14% | 5G infrastructure, networking equipment, mobile devices |

| Consumer Electronics | 19% | Smart home devices, televisions, gaming consoles |

Cost Structure

Manufacturing and production expenses represent a substantial component of Diodes' cost structure. This includes the outlay for essential raw materials, the intricate processes of wafer fabrication, and the subsequent steps of assembly and rigorous testing. For instance, in the first quarter of 2024, Diodes reported a cost of goods sold of $375.7 million, highlighting the significant investment in these operational areas.

Diodes actively pursues cost discipline by focusing on optimizing the capacity utilization across its worldwide manufacturing facilities. This strategic approach, coupled with the advantages of its hybrid manufacturing model, allows for greater efficiency and cost control. The company's gross profit margins, which stood at 34.5% in Q1 2024, are a direct reflection of these ongoing manufacturing efficiencies.

Research and Development (R&D) is a significant ongoing investment for Diodes, crucial for creating innovative products and staying ahead in the competitive semiconductor market. These costs encompass everything from the salaries of talented engineers and scientists to the acquisition and upkeep of advanced laboratory equipment and the creation of prototypes. For instance, in fiscal year 2024, Diodes reported R&D expenses of $277.4 million, underscoring the substantial commitment to technological advancement. This continuous focus on R&D is the engine that drives future revenue streams and ensures a healthy pipeline of next-generation solutions.

Sales, General, and Administrative (SG&A) expenses are a crucial component of Diodes' cost structure, encompassing all operating costs not directly tied to manufacturing. These include significant outlays for sales and marketing efforts to reach global customers, as well as the salaries of administrative staff, corporate overhead, and essential professional services like legal and accounting. For instance, in the first quarter of 2024, Diodes reported SG&A expenses of $101.2 million, a slight increase from the previous year, highlighting the ongoing investment in these areas.

Efficient management of SG&A is paramount for Diodes to maintain healthy profit margins. The company actively seeks ways to optimize these expenditures without compromising its ability to generate sales or maintain effective corporate operations. This focus on cost control directly influences the company's overall profitability and its capacity to reinvest in growth initiatives.

Amortization of Acquisition-Related Intangible Assets

Diodes, as a company that actively pursues strategic acquisitions, faces costs associated with the amortization of intangible assets acquired. These are non-cash expenses that stem from valuing things like patents, brand names, and customer lists from purchased companies. These costs are typically categorized within operating expenses.

For instance, in their fiscal year 2023, Diodes Incorporated reported amortization of acquisition-related intangible assets as a significant operating expense. This figure reflects the systematic expensing of the value attributed to these acquired intangibles over their useful lives.

- Amortization of Acquisition-Related Intangible Assets: This represents the non-cash expense recognized from the valuation of intellectual property, customer relationships, and other identifiable intangible assets acquired through business combinations.

- Impact on Operating Expenses: These costs are included in Diodes' overall operating expenses, directly affecting profitability metrics like operating income.

- 2023 Financial Data: Diodes Incorporated’s financial reports for the fiscal year ending December 31, 2023, detail these amortization expenses as part of their cost structure, highlighting the financial impact of past acquisitions.

- Strategic Significance: The amortization reflects the ongoing cost of integrating and realizing the value from strategic acquisitions, a key element of Diodes' growth strategy.

Capital Expenditures

Diodes Incorporated makes substantial capital expenditures to enhance and expand its manufacturing operations, particularly in wafer fabrication facilities and advanced equipment. These investments are vital for fueling future growth and preserving its competitive edge in technology. The company projects its capital expenditures to remain between 5% and 9% of its net sales.

- Manufacturing Expansion: Investments in wafer fabrication plants and machinery are key to Diodes' strategy.

- Technological Advancement: Capital spending supports the acquisition of cutting-edge equipment to maintain market leadership.

- Financial Guidance: Diodes anticipates capital expenditures to be in the range of 5% to 9% of net sales.

Diodes' cost structure is heavily influenced by its manufacturing and production expenses, including raw materials, wafer fabrication, assembly, and testing. For Q1 2024, the cost of goods sold was $375.7 million. The company also invests significantly in R&D, with $277.4 million spent in fiscal year 2024, to drive innovation and maintain a competitive edge.

Sales, General, and Administrative (SG&A) expenses are also a key part of the cost structure, covering sales, marketing, and corporate overhead. In Q1 2024, SG&A expenses were $101.2 million. Additionally, Diodes incurs costs related to the amortization of intangible assets from strategic acquisitions, impacting operating expenses.

Capital expenditures are crucial for Diodes, with projections indicating spending between 5% and 9% of net sales to enhance manufacturing capabilities and technological advancement.

| Cost Component | Q1 2024 Data | FY 2024 Data |

|---|---|---|

| Cost of Goods Sold | $375.7 million | N/A |

| R&D Expenses | N/A | $277.4 million |

| SG&A Expenses | $101.2 million | N/A |

| Capital Expenditures (Projected % of Net Sales) | N/A | 5% - 9% |

Revenue Streams

Diodes generates significant revenue from selling discrete semiconductor products like diodes, rectifiers, and transistors. These essential components are vital for electronics across all of Diodes' key markets, demonstrating their broad applicability and consistent demand.

The company's commitment to innovation is evident in its ongoing launch of new discrete products, such as advanced Silicon Carbide (SiC) Schottky Diodes. This focus on next-generation technology helps Diodes maintain its competitive edge and capture emerging market opportunities.

Diodes generates revenue by selling logic semiconductor products, crucial for digital circuits and signal processing. These components are vital across computing, communications, and consumer electronics sectors. In 2023, Diodes' logic products contributed significantly to their overall sales, reflecting strong demand in these key markets.

Diodes' revenue is significantly boosted by the sales of analog semiconductor products. These components are essential for managing and processing continuous signals, finding critical applications in power management, sensing, and signal conditioning across various industries.

The automotive and industrial sectors are particularly reliant on Diodes' analog solutions. For instance, in 2023, Diodes reported that its automotive segment revenue grew by 13.5% year-over-year, highlighting the strong demand for its analog products in this area.

Diodes continues to strengthen its market position by expanding its portfolio of analog solutions. This strategic move allows the company to cater to a broader range of customer needs and emerging technological trends, further solidifying its revenue streams.

Sales of Mixed-Signal Semiconductor Products

Diodes generates revenue by selling mixed-signal semiconductor products. These are chips that integrate both analog and digital functions, making them essential for sophisticated electronic devices.

These integrated solutions are vital for modern electronics, enabling complex operations across various industries Diodes serves. The company sees this segment as a key area for generating higher value.

- Mixed-Signal Products: Combines analog and digital capabilities on a single chip.

- High Integration: Crucial for complex, modern electronic systems.

- Value Proposition: Offers higher-value revenue opportunities for Diodes.

Revenue from High-Growth and Application-Specific Solutions

Diodes is strategically targeting high-growth markets and application-specific solutions to boost revenue. Key areas include the automotive and industrial sectors, alongside emerging AI applications. This focus is evident in their new product introductions, which are designed to capture significant revenue from these expanding markets.

In 2024, Diodes saw a substantial contribution to revenue from its new product introductions. Specifically, 15 new product lines were launched, resulting in a 15% increase in revenue generated from these newer offerings. This demonstrates a successful execution of their strategy to capitalize on evolving technological demands.

- Targeting High-Growth Markets: Diodes prioritizes revenue generation from sectors like automotive, industrial, and AI-related applications.

- New Product Introduction Strategy: A significant portion of new revenue is directly linked to the introduction of products specifically designed for these high-growth areas.

- 2024 Performance: In 2024, 15 new product lines contributed to a 15% revenue increase from new products.

Diodes' revenue is diversified across several key semiconductor product categories. These include discrete components, logic products, analog products, and mixed-signal products, each serving critical functions in a wide array of electronic devices.

The company's strategic focus on high-growth markets, particularly automotive and industrial sectors, is a significant driver of its revenue. This is supported by a robust new product introduction strategy, which aims to capture emerging technological demands.

In 2024, Diodes experienced a notable uptick in revenue from new product lines. The introduction of 15 new product lines contributed to a 15% increase in revenue specifically from these newer offerings, underscoring the success of their market-focused innovation.

| Product Category | Key Applications | 2023 Revenue Contribution (Illustrative) |

|---|---|---|

| Discrete Semiconductor Products | Power management, signal control | Significant |

| Logic Semiconductor Products | Digital circuits, signal processing | Strong |

| Analog Semiconductor Products | Power management, sensing, signal conditioning | Growing (Automotive segment up 13.5% YoY in 2023) |

| Mixed-Signal Semiconductor Products | Integrated analog and digital functions | Higher Value Opportunities |

Business Model Canvas Data Sources

The Diodes Business Model Canvas is built using comprehensive market analysis, financial performance data, and internal operational insights. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to the semiconductor industry.