Diodes Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diodes Bundle

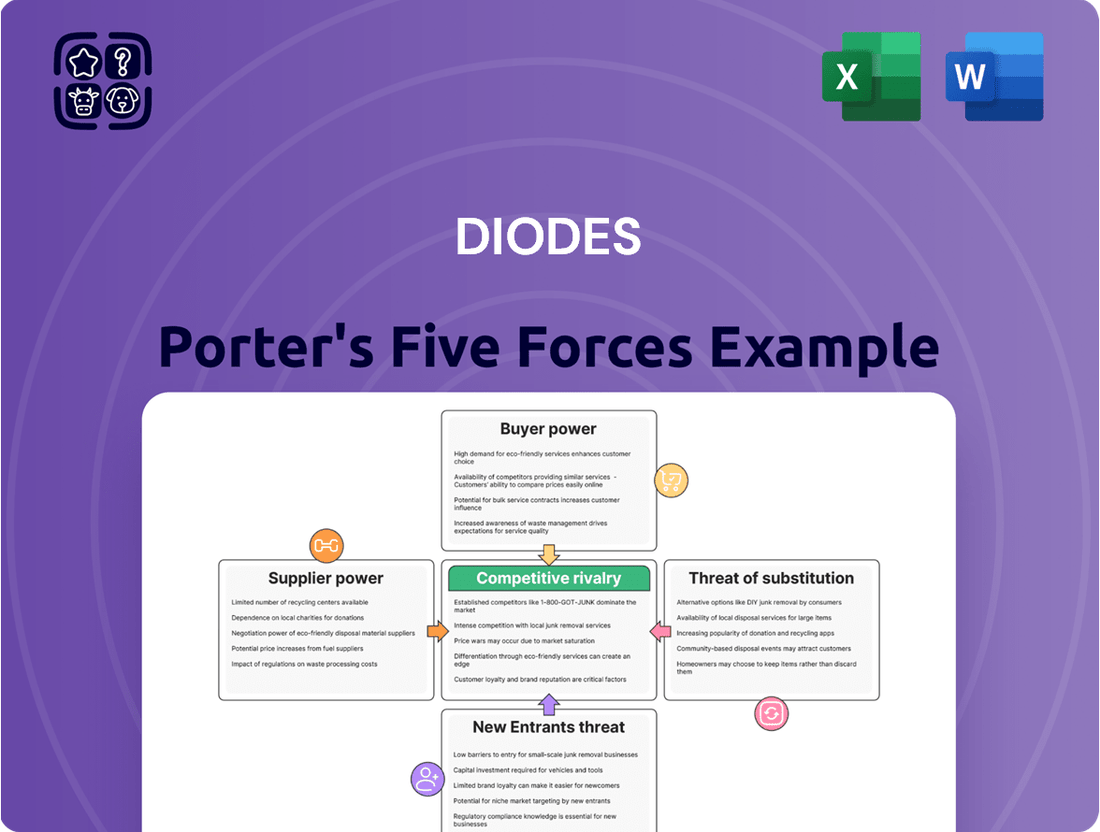

Diodes Incorporated operates within a dynamic semiconductor landscape, where understanding the interplay of competitive forces is paramount. Our Porter's Five Forces analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Diodes’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The semiconductor industry, including companies like Diodes Incorporated, faces a significant challenge due to the concentration of its suppliers. A few highly specialized companies control essential components and materials needed for chip manufacturing.

For instance, ASML Holding is a near-monopoly in the advanced lithography equipment market, crucial for producing cutting-edge semiconductors. Similarly, the supply of high-purity silicon wafers, the foundational material for all chips, is dominated by a limited number of global producers. This limited supplier base grants them considerable bargaining power.

This supplier concentration means Diodes Incorporated, and others in the sector, have less leverage to negotiate prices or secure favorable terms. Consequently, these key suppliers can dictate higher costs or impose supply limitations, directly impacting Diodes' production efficiency and profitability. In 2024, the ongoing demand for advanced semiconductors further amplified this supplier leverage.

The uniqueness of inputs significantly bolsters supplier bargaining power for companies like Diodes Incorporated. Many critical components and specialized equipment essential for semiconductor manufacturing are highly proprietary, meaning there are limited or no alternative suppliers available. This scarcity directly translates to greater leverage for these suppliers, as Diodes has fewer options to turn to if prices rise or terms become unfavorable.

For instance, advanced lithography machines from companies like ASML are indispensable for producing cutting-edge semiconductors. ASML holds a near-monopoly in EUV lithography, a technology crucial for manufacturing the most advanced chips. This technological dominance gives ASML immense bargaining power. The escalating demand for chips used in artificial intelligence (AI) applications further amplifies this, as manufacturers are in a race to secure the latest, most efficient equipment and materials, making them more reliant on the few suppliers that can provide them.

Switching suppliers in the semiconductor industry, particularly for specialized components like diodes, involves significant hurdles. The intricate nature of semiconductor manufacturing means that integrating a new supplier's products requires extensive re-qualification of processes, materials, and even existing equipment. This can translate into substantial costs and extended timelines, often running into months or even years for full integration and validation.

These high switching costs directly empower Diodes Incorporated's suppliers. When it's difficult and expensive for Diodes to change who they buy from, their current suppliers have more leverage to negotiate terms, pricing, and supply agreements. This can limit Diodes' ability to seek more favorable conditions or alternative sourcing options, impacting their cost structure and operational flexibility.

Threat of Forward Integration by Suppliers

While direct forward integration into chip manufacturing by raw material suppliers is rare due to the substantial capital and technical know-how required, specialized equipment makers or intellectual property licensors could pose this threat. This could manifest as them choosing to serve other chip manufacturers or restricting Diodes' access to cutting-edge technology, thereby leveraging their supplier power.

For instance, a key supplier of advanced lithography equipment, critical for producing the latest semiconductor nodes, might leverage its position. If Diodes were heavily reliant on this supplier for its most advanced product lines, the supplier could, in theory, prioritize other clients or even explore partnerships that could lead to their own manufacturing capabilities, impacting Diodes' competitive edge. In 2023, the global semiconductor manufacturing equipment market was valued at approximately $100 billion, highlighting the significant investment needed for such a move.

- Specialized Equipment Suppliers: Can influence Diodes by controlling access to essential, high-tech manufacturing machinery.

- Intellectual Property Providers: May leverage their patents or designs to gain an advantage, potentially limiting Diodes' product development.

- Capital Intensity: The immense cost of establishing chip fabrication facilities, often billions of dollars, acts as a significant barrier to supplier forward integration.

- Market Dynamics: Suppliers might opt to focus on their core competencies rather than entering the highly competitive and complex semiconductor manufacturing sector.

Importance of Diodes as a Customer

Diodes Incorporated, a key player in discrete, analog, and mixed-signal semiconductors, may not represent a substantial portion of revenue for major suppliers of essential fab equipment. This means Diodes' individual leverage with these large suppliers is somewhat limited compared to larger semiconductor manufacturers who can command greater attention and potentially better terms.

However, Diodes' importance as a customer can be amplified through strategic sourcing and building strong relationships. For specialized component suppliers or those catering to niche markets where Diodes holds a dominant position, the bargaining power shifts more favorably towards Diodes.

- Diodes Incorporated's revenue contribution to large, diversified suppliers of essential fab equipment is likely a smaller percentage, thus reducing its individual bargaining power in those relationships.

- For suppliers of specialized components or those serving niche markets where Diodes is a dominant customer, the company's bargaining power is enhanced.

- In 2023, Diodes Incorporated reported revenues of $1.95 billion, indicating a significant but not overwhelming scale in the broader semiconductor supply chain.

The bargaining power of suppliers is a significant factor for Diodes Incorporated, primarily due to the specialized nature of inputs and high switching costs. Key suppliers of advanced equipment, like ASML for lithography, hold near-monopolies, allowing them to dictate terms. This situation was particularly pronounced in 2024, with high demand for AI chips intensifying supplier leverage.

Diodes' limited individual revenue contribution to major fab equipment suppliers can reduce its direct bargaining power. However, for niche component suppliers where Diodes is a dominant customer, its leverage increases. In 2023, Diodes reported $1.95 billion in revenue, illustrating its scale within the supply chain.

| Factor | Impact on Diodes | Example/Data Point |

| Supplier Concentration | High leverage for suppliers | ASML's near-monopoly in EUV lithography |

| Uniqueness of Inputs | Limited alternatives for Diodes | Proprietary materials and specialized equipment |

| Switching Costs | High costs and time for Diodes to change suppliers | Months to years for process re-qualification |

| Diodes' Revenue Contribution | Reduced leverage with large suppliers | $1.95 billion revenue in 2023 |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Diodes, evaluating supplier/buyer power and the threat of substitutes.

Effortlessly identify and mitigate competitive threats by visually mapping the intensity of each Porter's Five Forces, providing actionable insights to protect your market position.

Customers Bargaining Power

Diodes Incorporated’s broad market reach, spanning automotive, industrial, computing, communications, and consumer electronics, means no single customer segment dominates. This diversification inherently limits the bargaining power of any individual customer.

With over 375 direct customers and an additional tens of thousands reached indirectly via distributors, Diodes benefits from a wide customer base. This broad distribution network dilutes the influence any one customer can exert.

Customer switching costs are a crucial factor in the semiconductor industry, directly impacting Diodes' bargaining power. For customers, moving from one semiconductor supplier to another isn't a simple plug-and-play operation. It often entails substantial expenses related to redesigning their products, undergoing rigorous requalification processes, and managing the potential for production line disruptions. These hurdles are particularly pronounced when dealing with application-specific integrated circuits or highly specialized components, areas where Diodes has a strong presence.

The financial implications of these switching costs can be significant. For instance, a customer needing to replace a custom-designed microcontroller might face redesign costs ranging from tens of thousands to hundreds of thousands of dollars, depending on the complexity and the time to market pressures. Furthermore, the requalification process alone can take several months, during which the customer might need to invest in new testing equipment and personnel. This inherent stickiness in customer relationships provides Diodes with a degree of leverage, allowing them to maintain pricing and service levels more effectively.

In 2023, the global semiconductor market experienced a slowdown, with revenue declining by approximately 11% compared to 2022, according to the Semiconductor Industry Association (SIA). Despite this challenging environment, companies like Diodes, which offer specialized and often integrated solutions, benefit from the high switching costs associated with their products. This stability in their customer base, even amidst broader market fluctuations, underscores the importance of these costs in shaping competitive dynamics.

Customer price sensitivity is a significant factor for Diodes, particularly in sectors like automotive, industrial, and consumer electronics where high-volume, standard components are common. Even though Diodes aims for quality and specialized solutions, broader market trends and competitive pressures can still lead to price negotiations.

For instance, in 2024, the semiconductor industry experienced fluctuations in demand across different segments. While some areas saw robust growth, the consumer electronics market, a key sector for Diodes, faced headwinds, potentially increasing customer pressure on pricing for more commoditized products.

Threat of Backward Integration by Customers

The threat of backward integration by customers is a significant factor influencing Diodes' bargaining power. Large Original Equipment Manufacturers (OEMs) in sectors like computing and communications often possess the substantial financial resources and advanced technical expertise necessary to develop and even produce their own semiconductor components. This capability creates a credible threat, as these customers could potentially bring chip design or manufacturing in-house, thereby reducing their reliance on suppliers like Diodes and limiting Diodes' ability to dictate pricing.

For instance, major tech companies like Apple have already demonstrated this by designing their own custom processors, such as the A-series and M-series chips. This strategic move not only gives them greater control over their product's performance and cost but also serves as a powerful negotiating tactic against existing chip suppliers. Such actions highlight the inherent risk for semiconductor manufacturers like Diodes, as their most influential customers could choose to become competitors.

- Customer Capability: Major OEMs often have the financial muscle and technical know-how to design and manufacture their own chips.

- Example: Apple's in-house processor design for its devices showcases this trend.

- Impact on Diodes: This threat can constrain Diodes' pricing power and necessitate competitive offerings.

- Strategic Consideration: Diodes must continuously innovate and offer compelling value to deter customers from vertical integration.

Customers' Information Availability

Customers in the semiconductor industry, particularly major players, frequently possess a wealth of market intelligence, including details on competing products and precise technical specifications. This readily available information empowers them to make well-informed purchasing choices and engage in robust negotiations.

The increased transparency in the semiconductor market directly translates to enhanced bargaining power for customers. For instance, in 2024, major automotive manufacturers, a significant customer segment for semiconductor companies, actively leveraged price comparisons and performance data to secure more favorable terms. This trend was evident as lead times for certain automotive-grade chips remained extended, prompting buyers to seek better deals from multiple suppliers.

- Informed Decision-Making: Access to detailed product specifications and pricing from various suppliers allows customers to pinpoint the best value.

- Negotiating Leverage: Knowledge of market alternatives and competitive pricing gives customers a stronger position to negotiate lower prices or better terms.

- Supplier Comparison: Customers can easily compare the offerings of different semiconductor manufacturers, driving competition among suppliers.

- Impact on Profitability: For large buyers, even small price concessions can significantly impact their overall costs and profitability, making information availability crucial.

The bargaining power of Diodes' customers is moderate, influenced by factors like customer concentration, switching costs, and the threat of backward integration. While Diodes serves a vast number of customers, limiting individual power, the significant costs associated with switching semiconductor suppliers provide a degree of insulation. However, large Original Equipment Manufacturers (OEMs) can exert considerable influence due to their technical capabilities and market knowledge.

In 2024, the semiconductor industry saw continued demand for specialized automotive and industrial chips, where Diodes has a strong footing. This demand, coupled with existing supply chain complexities, generally kept switching costs high for these segments. Yet, the consumer electronics sector, a more price-sensitive market, presented opportunities for customers to negotiate more aggressively, especially for higher-volume, less differentiated components.

The threat of backward integration remains a key consideration. For instance, major players in the computing and communications sectors, like those developing advanced AI hardware, possess the resources to design their own custom silicon. This potential for in-house production limits Diodes' pricing flexibility in these high-stakes markets, necessitating continuous innovation and value-added services to retain these crucial relationships.

Customer price sensitivity is a dynamic factor; while Diodes offers specialized solutions, broad market trends and competitive pressures can still lead to price negotiations. For example, in 2024, the automotive sector, a significant market for Diodes, experienced fluctuations in vehicle production, which in turn influenced demand for automotive-grade semiconductors and customer price expectations.

Preview Before You Purchase

Diodes Porter's Five Forces Analysis

This preview showcases the complete Diodes Porter's Five Forces Analysis, providing a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises. You are looking at the actual analysis; once you complete your purchase, you’ll get instant access to this comprehensive, ready-to-use file.

Rivalry Among Competitors

The semiconductor landscape is intensely crowded, featuring a vast array of both broad-spectrum manufacturers and niche specialists. Diodes Incorporated finds itself in direct competition with formidable entities such as Texas Instruments, a giant in analog and embedded processing, and Vishay Intertechnology, known for its discrete semiconductors and passive components.

Further competition comes from Microchip Technology, a leader in microcontroller, analog, and mixed-signal products, as well as NXP Semiconductors, a major player in automotive and industrial solutions, and ON Semiconductor, which offers a wide range of power and sensing technologies. This diverse competitive set underscores the dynamic and challenging nature of the market.

The global semiconductor market's strong growth, projected to reach $697 billion in 2025 from $627.6 billion in 2024, fueled by AI and high-performance computing, can temper direct price wars. This expansion creates room for various companies to thrive, potentially reducing the pressure for aggressive pricing strategies as demand outpaces supply.

Diodes Incorporated distinguishes itself by offering high-quality discrete, logic, analog, and mixed-signal semiconductor products, often tailored for specific applications. This focus on application-specific solutions, rather than just commodity components, allows them to carve out a niche. For example, their integrated power management solutions can offer significant advantages over standard discrete parts, providing a clear point of differentiation in a competitive market.

High Fixed Costs and Exit Barriers

The semiconductor industry, including players like Diodes Incorporated, operates with exceptionally high fixed costs. These are driven by substantial investments in research and development, the construction and maintenance of advanced manufacturing facilities, and the purchase of sophisticated production equipment. For instance, building a new leading-edge semiconductor fabrication plant can cost tens of billions of dollars.

These immense capital outlays and the specialized nature of semiconductor assets create formidable exit barriers. Companies are often compelled to continue operating and competing aggressively, even when market demand softens or profitability declines, simply to spread these fixed costs over a larger production volume and avoid substantial losses from shutting down operations. This dynamic intensifies competitive rivalry.

- High R&D Spending: Companies like Diodes invest heavily in developing new chip designs and manufacturing processes, often billions annually.

- Fab Costs: Building and equipping a modern semiconductor fab can exceed $20 billion.

- Equipment Investment: Advanced manufacturing machinery is incredibly expensive, with individual tools costing millions.

- Capacity Utilization: Firms strive for high capacity utilization to amortize these fixed costs, leading to price pressure during low demand periods.

Strategic Stakes and Aggressiveness

Companies within the semiconductor sector are engaged in a fierce battle for market share and technological supremacy. This is evident in their substantial investments in research and development, as well as in expanding manufacturing capacity. For instance, many are pouring billions into developing next-generation AI chips and advanced packaging solutions, crucial for staying ahead in this rapidly evolving industry.

This intense focus on innovation and expansion directly fuels aggressive competitive rivalry. Companies are not just aiming to keep pace; they are striving to lead, which often involves price competition and rapid product cycles. The pursuit of technological leadership means that a misstep in R&D or capacity planning can have significant repercussions on a company's market position.

- Aggressive R&D Investment: Leading semiconductor firms are allocating significant portions of their revenue to R&D, with many exceeding 20% in 2024, to develop cutting-edge technologies.

- Capacity Expansion Efforts: Global semiconductor capital expenditure is projected to reach over $150 billion in 2024, reflecting a strong drive to increase production capabilities.

- Focus on High-Growth Segments: Investments are heavily concentrated in areas like AI, automotive, and high-performance computing, where market share gains are most critical.

- Technological Leadership Race: The race to achieve smaller process nodes and more efficient chip designs intensifies rivalry, as leadership here translates to premium pricing and greater demand.

The competitive landscape for Diodes Incorporated is defined by intense rivalry, driven by a mix of large, diversified players and specialized firms. Companies like Texas Instruments, Vishay Intertechnology, Microchip Technology, NXP Semiconductors, and ON Semiconductor represent significant competitive threats due to their broad product portfolios and established market presence. This crowded field necessitates continuous innovation and strategic positioning for Diodes to maintain and grow its market share.

Despite the intense competition, the robust growth of the global semiconductor market, projected to hit $697 billion in 2025, offers some buffer against outright price wars. This expansion, particularly fueled by AI and high-performance computing, allows multiple companies to capture growth. Diodes' strategy of focusing on application-specific, high-quality discrete, logic, analog, and mixed-signal products helps it differentiate from competitors who may focus on broader, more commoditized segments.

The industry's high fixed costs, with fab construction alone costing tens of billions, create significant exit barriers. This means companies are often compelled to operate at high capacity utilization to spread these costs, leading to intensified competition, especially during periods of softer demand. The pursuit of technological leadership, with firms investing billions in R&D and capacity expansion, further fuels this rivalry.

| Competitor | Key Product Areas | Market Focus |

|---|---|---|

| Texas Instruments | Analog, Embedded Processing | Industrial, Automotive, Personal Electronics |

| Vishay Intertechnology | Discrete Semiconductors, Passive Components | Industrial, Automotive, Consumer, Computing |

| Microchip Technology | Microcontrollers, Analog, Mixed-Signal | Automotive, Industrial, Consumer, Communications |

| NXP Semiconductors | Automotive, Industrial, IoT | Automotive, Industrial, Secure Connectivity |

| ON Semiconductor | Power Management, Sensing, Connectivity | Automotive, Industrial, Cloud Power, IoT |

SSubstitutes Threaten

The threat of substitutes is intensifying for Diodes Incorporated, primarily driven by advancements in alternative semiconductor materials. While silicon has long been the industry standard, materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) are rapidly emerging as viable, and often superior, alternatives in key growth sectors.

These next-generation materials offer significant performance advantages, such as higher efficiency, greater power handling capabilities, and improved thermal performance. This makes them particularly attractive for high-growth markets like electric vehicles (EVs), renewable energy systems, and advanced data centers, where energy efficiency and robust performance are paramount. For instance, the global SiC market was valued at approximately $1.2 billion in 2023 and is projected to reach over $6 billion by 2028, indicating a strong demand shift.

This shift directly challenges Diodes' established silicon-based product portfolio. As industries increasingly adopt SiC and GaN for their power management needs, the demand for traditional silicon components in these applications could decline, forcing Diodes to adapt its product strategy or risk losing market share to these more advanced substitute technologies.

The performance-price trade-off of substitutes like Silicon Carbide (SiC) and Gallium Nitride (GaN) presents a significant threat to traditional silicon-based semiconductor providers like Diodes. While SiC and GaN offer superior efficiency and higher operating temperatures, their current higher cost can limit adoption in price-sensitive markets. For instance, in 2024, SiC MOSFETs can still be 2-3 times more expensive than comparable silicon counterparts, although this premium is decreasing.

As the manufacturing scale for SiC and GaN increases, their production costs are expected to decline further, making them more viable alternatives across a broader range of applications. This trend directly impacts Diodes' strategic planning, compelling them to continuously evaluate their product roadmaps and pricing models to remain competitive. The ongoing reduction in the cost premium for these advanced materials, projected to narrow by an estimated 15-20% annually through 2025, will intensify this competitive pressure.

Customer willingness to switch to alternative solutions hinges on performance gains, cost benefits, and how easily new options can be adopted. For instance, if a competitor's product offers significant energy savings or a much lower price point, customers are more likely to consider switching.

As advanced applications like electric vehicles (EVs) and AI data centers continue to push performance boundaries, the appeal of silicon carbide (SiC) and gallium nitride (GaN) technologies grows. These materials offer superior efficiency and power handling compared to traditional silicon, making them attractive substitutes in high-demand sectors.

The market for SiC power devices, for example, was projected to reach approximately $7.3 billion in 2023 and is expected to see robust growth, indicating a clear customer shift towards these higher-performing materials where the benefits outweigh integration costs.

Emergence of Software-Defined Solutions

The rise of software-defined solutions, particularly in computing and communication sectors, presents a significant threat of substitution for traditional semiconductor components. These advancements allow for greater functionality to be handled by software and cloud-based services, diminishing the need for specialized, discrete hardware. For instance, the increasing adoption of Network Functions Virtualization (NFV) in telecommunications, which replaces dedicated network appliances with software running on general-purpose servers, directly impacts the demand for certain types of network interface controllers and processors that were previously essential.

This shift can fundamentally alter the value proposition, moving it away from the physical chip itself towards the integrated software ecosystem. Companies heavily reliant on selling specific hardware components may see their market share erode as customers opt for more flexible, software-centric architectures. In 2024, the global cloud computing market was valued at over $600 billion, a figure expected to continue its rapid ascent, underscoring the growing influence of software-defined infrastructure and its potential to substitute hardware dependencies.

- Software-Defined Networking (SDN) reduces reliance on proprietary network hardware.

- Cloud-based services increasingly handle processing and storage, lessening the need for on-premise specialized hardware.

- Virtualization technologies allow for software to emulate hardware functions, impacting demand for certain chipsets.

Integration of Functions and System-on-Chip (SoC) Designs

The increasing integration of multiple functionalities into single System-on-Chip (SoC) designs presents a significant threat of substitution for discrete component manufacturers like Diodes. As more processing, memory, and peripheral functions are consolidated onto a single chip, the demand for individual logic and analog components diminishes. This trend directly impacts Diodes' core business by reducing the need for the separate chips they produce.

For instance, the automotive sector, a key market for Diodes, is rapidly adopting SoCs for advanced driver-assistance systems (ADAS) and infotainment. By 2024, the global automotive SoC market was projected to reach over $40 billion, with significant growth driven by the need for higher levels of integration. This consolidation means fewer discrete components are required for these complex systems, directly substituting the need for Diodes' standalone products.

- SoC Integration: Consolidating multiple functions onto a single chip reduces the need for individual discrete components.

- Market Impact: This trend directly substitutes the demand for Diodes' discrete logic and analog products.

- Automotive Example: The automotive sector's shift to SoCs for ADAS and infotainment exemplifies this substitution threat.

- Market Size: The global automotive SoC market's substantial growth underscores the increasing prevalence of integrated solutions.

The threat of substitutes for Diodes is amplified by the increasing performance and decreasing cost of advanced materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials offer superior efficiency and power handling, making them attractive for high-growth sectors such as electric vehicles and renewable energy.

While SiC and GaN components were historically more expensive, their price premium is narrowing. For example, the cost difference between SiC MOSFETs and silicon equivalents, which was substantial in previous years, is projected to decrease by approximately 15-20% annually through 2025, making them more competitive.

This trend directly challenges Diodes' silicon-based product lines as customers in performance-critical applications increasingly adopt these next-generation materials, impacting Diodes' market share in these segments.

| Substitute Technology | Key Advantages | Market Adoption Trend (2023-2024) | Impact on Diodes |

|---|---|---|---|

| Silicon Carbide (SiC) | Higher efficiency, greater power handling, improved thermal performance | Strong growth in EVs, renewable energy; market projected to exceed $6 billion by 2028 | Direct competition for power management solutions |

| Gallium Nitride (GaN) | Higher switching frequencies, smaller form factors, increased efficiency | Increasing adoption in power adapters, data centers, and RF applications | Substitution for high-frequency silicon components |

| System-on-Chip (SoC) Integration | Consolidation of multiple functions, reduced component count | Rapid adoption in automotive (ADAS, infotainment); automotive SoC market exceeding $40 billion in 2024 | Reduces demand for discrete logic and analog components |

| Software-Defined Solutions | Flexibility, reduced hardware dependency | Growth in cloud computing (>$600 billion market in 2024), Network Functions Virtualization (NFV) | Diminishes need for certain specialized network and processing chips |

Entrants Threaten

The semiconductor industry presents a significant threat of new entrants due to its exceptionally high capital requirements. Establishing a new, cutting-edge fabrication facility, or fab, necessitates an investment that can easily reach tens of billions of dollars.

This immense financial hurdle, covering specialized equipment, advanced materials, and ongoing research and development, acts as a powerful deterrent for any aspiring new companies seeking to enter the market and compete with established players.

The semiconductor industry, including companies like Diodes Incorporated, presents a formidable barrier to new entrants due to the incredibly steep learning curve and the necessity for profound technical expertise. Developing and manufacturing high-quality semiconductors demands extensive research and development capabilities, coupled with a highly skilled engineering and scientific workforce. This complexity, along with the relentless pace of innovation, makes it exceptionally challenging for newcomers to gain a foothold.

The semiconductor industry, including companies like Diodes, is a fortress of intellectual property. Patents on chip designs, intricate manufacturing methods, and fundamental device structures create substantial barriers. For instance, in 2023, the global semiconductor industry spent an estimated $100 billion on research and development, a significant portion of which is dedicated to securing and expanding IP portfolios.

Newcomers must navigate this complex IP landscape, either by licensing existing technologies, which can be costly, or by developing entirely novel approaches. Failure to do so risks infringement lawsuits, which can derail even promising ventures. This heavy reliance on patents means that truly disruptive innovation is often required to overcome existing protections, a feat that demands immense capital and expertise.

Established Distribution Channels and Customer Relationships

Diodes Incorporated benefits from deeply entrenched relationships with a broad spectrum of customers and has meticulously cultivated extensive global distribution networks. New competitors face a significant hurdle in replicating this established infrastructure and trust.

New entrants would find it exceedingly difficult to gain traction, as securing critical design wins with key customers requires a proven track record and existing partnerships that Diodes already possesses. Building comparable sales channels and achieving the same market penetration would be a monumental and costly undertaking.

- Established Customer Loyalty: Diodes has nurtured long-term partnerships, making it challenging for newcomers to displace existing suppliers.

- Global Reach: Their extensive distribution network provides a competitive advantage that new entrants would struggle to match quickly.

- Design Win Barrier: Securing initial product designs with major manufacturers is a critical step that favors established, trusted vendors.

- Brand Reputation: Diodes' reputation for reliability and service further solidifies its position against potential new market participants.

Government Regulations and Trade Policies

Government regulations and trade policies present a substantial barrier to entry in the semiconductor sector. The recent CHIPS and Science Act of 2022, for instance, allocated over $52 billion in subsidies to boost domestic semiconductor manufacturing and research. This significant government investment, alongside evolving trade restrictions and export controls, particularly concerning advanced technologies and geopolitical sensitivities, creates a complex and costly environment for newcomers. Navigating these intricate and frequently changing rules requires substantial legal and lobbying resources, making it difficult for new players to establish a foothold.

The landscape for new semiconductor entrants is further shaped by:

- Subsidies and Incentives: Government programs like the CHIPS Act offer substantial financial support, potentially favoring established players or those with strong government relations.

- Trade Restrictions: Export controls and tariffs imposed by various nations can disrupt supply chains and limit market access for new companies.

- Compliance Costs: Adhering to diverse and evolving regulatory frameworks across different jurisdictions demands significant investment in expertise and infrastructure.

The threat of new entrants in the semiconductor industry, impacting companies like Diodes Incorporated, is significantly mitigated by the immense capital required for advanced manufacturing facilities, often exceeding tens of billions of dollars. This financial barrier, coupled with complex intellectual property landscapes and deeply entrenched customer relationships, makes it exceptionally difficult for newcomers to gain a competitive edge. Furthermore, government incentives and evolving trade policies, like the CHIPS Act's $52 billion allocation, create a challenging regulatory environment that favors established players with the resources to navigate it.

| Factor | Impact on New Entrants | Example/Data Point |

| Capital Requirements | Extremely High Barrier | Semiconductor fab construction costs can reach $10-20 billion+ (as of 2024 projections). |

| Intellectual Property | Significant Hurdle | Global R&D spending in semiconductors was ~$100 billion in 2023, much focused on IP protection. |

| Customer Relationships & Distribution | Challenging to Replicate | Established players like Diodes have years of cultivated trust and extensive global sales networks. |

| Government Regulations & Subsidies | Complex & Costly Navigation | CHIPS Act (2022) provides $52 billion in US subsidies, influencing competitive dynamics. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Diodes is built upon a foundation of comprehensive data, including annual reports, investor presentations, and market research reports from leading firms. We also leverage industry-specific trade publications and government economic data to capture a holistic view of the competitive landscape.