Diodes Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diodes Bundle

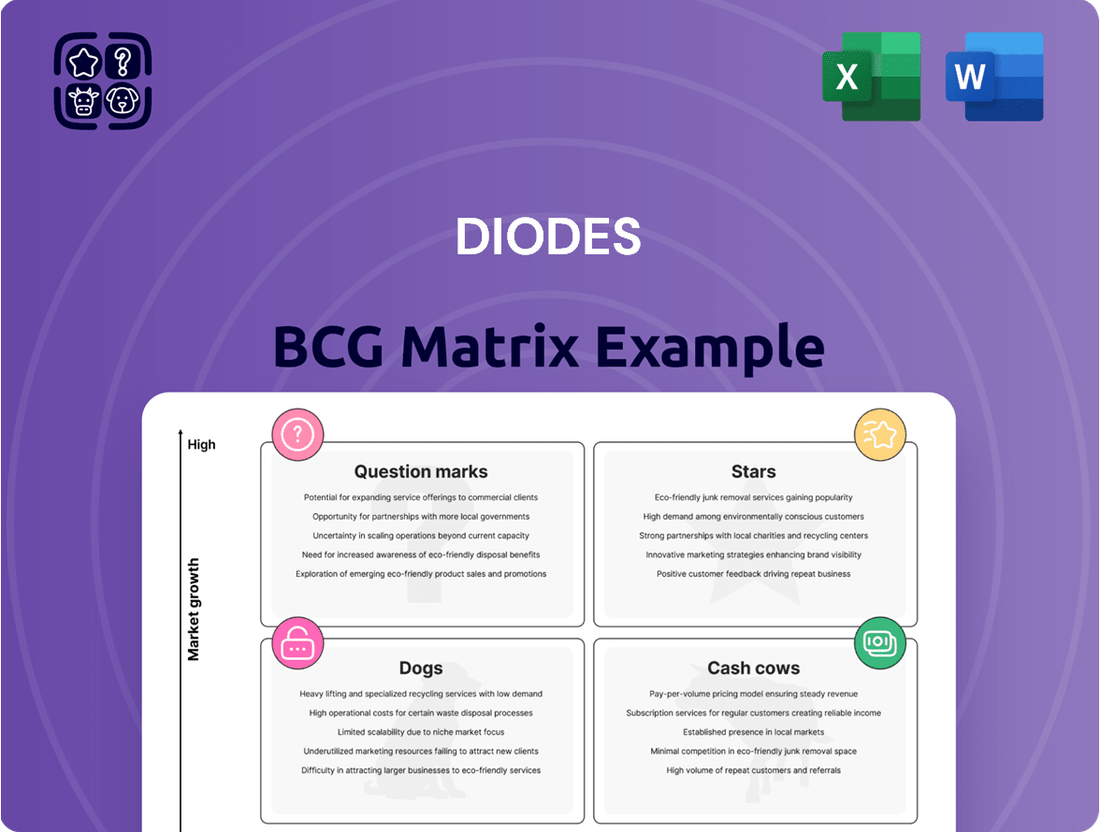

Ready to unlock the strategic potential of your product portfolio? The BCG Matrix is your essential guide to understanding market share and growth potential, categorizing products into Stars, Cash Cows, Dogs, and Question Marks. This preview offers a glimpse into the power of this analytical tool, but the real insights lie within the full report.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Diodes Incorporated is heavily investing in the automotive sector, specifically targeting growth areas like advanced driver-assistance systems (ADAS) and electric vehicle (EV) components. This strategic pivot aligns with the global trend towards more electrified and technologically advanced vehicles, a market poised for significant expansion.

The company's commitment is underscored by its introduction of innovative products, such as 80V ideal diode controllers designed for the demanding automotive environment. This focus on specialized automotive solutions positions Diodes as a key player in a segment projected to see substantial growth in the coming years.

The AI-related applications market is a rapidly expanding sector, offering substantial growth potential for Diodes. This area inherently requires advanced, high-performance semiconductor solutions that Diodes is well-positioned to provide.

Diodes is actively seeking to leverage emerging opportunities within AI, a field that consistently demands cutting-edge silicon. The company's focus on power management and analog components, crucial for AI hardware efficiency and performance, aligns perfectly with market needs.

Strategic investments in developing specialized semiconductor products for AI could secure Diodes a leading position in niche markets. For instance, the global AI chip market was valued at approximately $22.1 billion in 2023 and is projected to reach over $100 billion by 2030, highlighting the immense scale of this opportunity.

Diodes Incorporated is making significant strides in the high-speed data communication market with its introduction of 64GT/s PAM4 Linear ReDrivers for the PCIe® 6.0 interface. This is a crucial move as the demand for faster data transfer rates continues to surge across computing and communication infrastructure. The company's early entry into this rapidly expanding segment positions it to capture substantial market share.

The PCIe® 6.0 interface represents a significant leap in data transfer speeds, with its 64GT/s PAM4 signaling doubling the bandwidth of PCIe® 5.0. This acceleration is essential for next-generation data centers, AI accelerators, and high-performance computing, areas experiencing exponential growth. For instance, the global data center market was valued at approximately $226 billion in 2023 and is projected to grow considerably, underscoring the immense opportunity for companies providing enabling technologies like Diodes.

High-Performance Analog and Mixed-Signal Products

Diodes Incorporated is strategically positioning its high-performance analog and mixed-signal products as Stars in the BCG matrix. These products are essential for sophisticated electronic systems, driving higher profitability due to increasing demand and complexity in sectors like automotive and consumer electronics.

The company's expanded portfolio in this area reflects a commitment to capturing value in a high-growth market. This focus on solutions rather than just individual components allows Diodes to command better margins and solidify its market position.

- High-Performance Analog and Mixed-Signal Products: Diodes is investing heavily in these areas, recognizing their critical role in modern electronic designs.

- Growing Demand and Profitability: These products often feature higher profit margins and are experiencing robust demand as electronic systems become more intricate and integrated.

- Solutions-Oriented Approach: The company's strategy emphasizes providing comprehensive solutions, which is key to unlocking greater value and market share in this segment.

- Market Expansion: Diodes' expanded portfolio targets burgeoning markets such as advanced driver-assistance systems (ADAS) and high-speed data communication, which are projected for significant growth through 2025 and beyond.

Specific Discrete Semiconductor Innovations (e.g., SiC)

While the broader discrete semiconductor market is established, Diodes Incorporated is strategically targeting innovation in areas like Silicon Carbide (SiC) Schottky Diodes. This focus places them in high-growth niches, particularly within power electronics.

SiC technology is a key driver for advancements in electric vehicles (EVs) and renewable energy systems, offering significant improvements in efficiency and performance over traditional silicon. For instance, the global SiC power semiconductor market was valued at approximately $2.5 billion in 2023 and is projected to reach over $15 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 25%.

- Targeted Innovation: Diodes' investment in SiC Schottky Diodes addresses the increasing demand for high-efficiency power components.

- Market Growth Drivers: The adoption of SiC is accelerating in sectors like electric vehicles and renewable energy infrastructure.

- Competitive Advantage: By specializing in these advanced materials, Diodes aims to capture market share in rapidly expanding sub-segments of the discrete semiconductor market.

- Performance Benefits: SiC devices offer higher voltage handling, faster switching speeds, and lower power loss compared to silicon counterparts.

Diodes' high-performance analog and mixed-signal products are positioned as Stars due to their strong market growth and the company's significant investments. These products are crucial for advanced applications, leading to higher profitability as electronic systems become more complex and integrated. The company's strategy focuses on delivering comprehensive solutions, which is key to capturing greater value and market share in these expanding segments.

What is included in the product

The BCG Matrix categorizes business units by market share and growth rate to guide strategic decisions.

A visual, one-page BCG Matrix quickly identifies underperforming "Dogs" and resource-draining "Cash Cows," freeing up management bandwidth.

Cash Cows

Diodes Incorporated holds a dominant position in the market for standard discrete products, including diodes, rectifiers, and transistors. These essential components are integral to a wide spectrum of electronic devices, particularly within mature sectors like consumer electronics and general industrial applications.

The consistent demand for these foundational parts, coupled with Diodes Incorporated's efficient manufacturing capabilities, suggests these product lines are significant cash cows. For instance, in the first quarter of 2024, revenue from their Analog segment, which includes many discrete products, reached $239.7 million, demonstrating continued market strength.

General-purpose analog products like voltage regulators and amplifiers form a significant part of many semiconductor companies' portfolios. These are foundational components found in virtually every electronic device, from smartphones to industrial machinery. Their widespread application ensures a consistent demand.

These product lines are typically considered Cash Cows within the BCG Matrix. They operate in mature markets with strong brand recognition and established customer relationships, leading to predictable and stable revenue. For instance, in 2024, the global market for voltage regulators was estimated to be around $5 billion, with a projected compound annual growth rate of approximately 4.5%.

The maturity of these markets means that significant investment in research and development or aggressive marketing is often not required. Instead, the focus is on efficient manufacturing and supply chain management to maintain profitability. This allows companies to generate substantial cash flow from these products, which can then be reinvested in other areas of the business, such as high-growth potential Stars or Question Marks.

Diodes Incorporated's established power management IC (PMIC) product lines, such as certain LED drivers and battery management solutions, are strong contenders for cash cow status within their BCG matrix. These mature offerings likely hold significant market share in various stable, high-volume applications, providing a consistent and reliable source of revenue for the company.

The broader power management IC market is experiencing steady growth, projected to reach approximately $30 billion by 2024. Within this landscape, Diodes' established product families benefit from their widespread adoption and proven reliability, enabling them to generate substantial cash flow without requiring significant reinvestment.

Legacy Computing and Communications Components

Diodes Incorporated's legacy computing and communications components fit squarely into the cash cow quadrant of the BCG matrix. These are products that have established a strong, dominant market share within their mature segments. Think of foundational semiconductor parts that are essential but no longer experiencing rapid growth. Their sales are consistent, providing a reliable stream of income for Diodes without demanding significant new capital investment for innovation or market expansion.

These cash cow products are crucial for Diodes' overall financial health. They generate substantial profits that can then be reinvested into other areas of the business, such as research and development for new, high-growth products or to support the company's operations. For instance, in 2024, Diodes reported that its computing and communications segments continued to be significant revenue drivers, with established product lines contributing a substantial portion of their profitability.

- Dominant Market Share: Legacy components in computing and communications have secured a leading position in their respective, mature market niches.

- Stable Revenue Generation: These products consistently deliver reliable sales and contribute significantly to Diodes' overall financial stability.

- Low Investment Needs: Unlike growth products, cash cows require minimal new capital expenditure to maintain their market position and sales volume.

- Profitability Driver: The profits generated by these components are vital for funding other strategic initiatives within Diodes, such as R&D for emerging technologies.

Asia-Pacific Market Presence

Diodes Incorporated's established market presence in Asia, particularly in China and Southeast Asia, represents a significant cash cow. The company has observed improving sales momentum in these regions, driven by its core product offerings. This strong regional footprint translates into consistent sales and substantial revenue contributions, likely benefiting from lower cost of sales and marketing due to well-established distribution channels.

In 2024, Diodes continued to leverage its robust Asia-Pacific network. For instance, the company reported that its Asia-Pacific segment accounted for a substantial portion of its net sales, with growth driven by demand in key markets like China. This regional strength allows Diodes to generate predictable cash flows, essential for funding investments in other areas of its business.

- Asia-Pacific Dominance: Diodes holds a strong market position across Asia, especially in China and Southeast Asia.

- Improving Momentum: The company has experienced increasing sales performance in these key Asian markets.

- Revenue Contribution: This established presence acts as a cash cow, providing consistent revenue streams.

- Cost Efficiencies: Existing distribution channels likely lead to lower operational costs for sales and marketing in the region.

Cash Cows within Diodes Incorporated's portfolio are product lines that have achieved a dominant market share in mature industries. These products, like standard discrete components and established power management ICs, generate consistent and predictable revenue with minimal need for further investment. For example, Diodes' Analog segment, which includes many discrete products, generated $239.7 million in Q1 2024, highlighting their stable performance.

These cash cows are vital for funding Diodes' growth initiatives. Their strong market position, often built on years of reliable performance and established customer relationships, ensures a steady cash inflow. The company's legacy computing and communications components, for instance, continue to be significant revenue drivers, contributing substantially to profitability without requiring aggressive R&D or marketing spend.

The Asia-Pacific region, particularly China and Southeast Asia, represents a significant cash cow for Diodes. The company's strong presence and improving sales momentum in these markets, driven by core product offerings, translate into consistent revenue. In 2024, the Asia-Pacific segment remained a substantial contributor to net sales, underscoring the region's role as a reliable cash generator.

| Product Category | Market Maturity | Market Share | Revenue Contribution (2024 Est.) | Investment Needs |

| Standard Discrete Products | Mature | Dominant | Significant | Low |

| Established Power Management ICs | Mature | High | Substantial | Low |

| Legacy Computing & Communications | Mature | Leading | Significant | Minimal |

| Asia-Pacific Sales Channels | Mature Market Presence | Strong | Consistent | Low (Leveraging existing infrastructure) |

Full Transparency, Always

Diodes BCG Matrix

The Diodes BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report ready for your strategic planning. You can confidently use this preview to understand the depth and quality of the insights provided, knowing the purchased version is exactly the same, enabling you to seamlessly integrate it into your business operations. This ensures you get precisely what you need to make informed decisions and drive your business forward.

Dogs

Diodes Incorporated, with its extensive history, likely possesses legacy products that have become obsolete or cater to niche markets. These products, often characterized by declining sales and minimal market share, represent the 'dogs' in the BCG matrix. For instance, older analog components that have been superseded by more advanced digital solutions would fall into this category.

These legacy items typically demand continued investment in maintenance and support, even as their revenue generation dwindles. In 2023, Diodes reported a net revenue of $1.73 billion, and while specific figures for legacy product performance aren't publicly itemized, any product segment consistently underperforming or requiring disproportionate resources would be a candidate for review.

The strategic consideration for these 'dog' products is often divestiture or discontinuation. By phasing out or selling off these low-growth, low-share assets, Diodes can reallocate capital and resources towards more promising growth areas, thereby improving overall portfolio efficiency and profitability.

Certain components designed for highly saturated consumer electronics, like older generations of smartphone processors or basic feature phone components, are likely dogs in the Diodes BCG Matrix. Demand for these items is shrinking as consumers upgrade to newer technologies, leading to fierce price competition and minimal growth opportunities. For instance, the global market for feature phones, while still present, saw a decline in shipments by approximately 10% in 2023 compared to 2022, indicating a shrinking user base for these components.

Following its acquisition strategy, Diodes Incorporated may find certain inherited product lines struggling. These could be products that didn't integrate smoothly into Diodes' existing portfolio or failed to capture the anticipated market share. If these underperforming acquired products operate in slow-growing market segments and hold a low market share, they would be classified as Dogs.

Such "Dog" products typically consume resources without generating substantial returns, acting as cash traps for the company. For instance, if an acquired semiconductor line, like a legacy analog chip family, now faces intense competition from newer, more efficient technologies and operates in a mature, low-growth automotive segment, it would fit this category. In 2023, Diodes’ revenue from its Analog segment was $1.15 billion, a slight decrease from 2022, indicating potential pressure in some of its product areas.

Commoditized Discrete Components with Intense Competition

Certain highly commoditized discrete components, like basic diodes and rectifiers, can be considered dogs within Diodes Incorporated's portfolio. These product categories often face intense global price competition from a vast number of manufacturers, leaving little room for differentiation and resulting in razor-thin profit margins. For instance, in 2024, the market for standard rectifier diodes saw average selling prices decline by an estimated 5-7% year-over-year due to oversupply and aggressive pricing strategies from Asian competitors.

These products typically exhibit low growth potential and a small market share for Diodes, making them less attractive from a strategic standpoint. The lack of proprietary technology or unique features means that price becomes the primary competitive factor, eroding profitability. Companies in this segment often struggle to maintain significant market share without engaging in price wars, which further depresses margins.

- Low Market Growth: The overall market for very basic discrete components, such as standard silicon diodes, is often characterized by single-digit annual growth, typically in the 2-4% range, as demand is largely tied to mature industries.

- Intense Price Competition: In 2024, the average selling price for a standard 1N4007 rectifier diode from various manufacturers hovered around $0.01 to $0.02, reflecting the highly competitive and commoditized nature of this segment.

- Limited Differentiation: Products like general-purpose diodes offer minimal unique selling propositions, with performance metrics often meeting industry standards rather than exceeding them significantly, making it difficult to command premium pricing.

- Low Profit Margins: Due to the combination of low growth and intense price pressure, the gross profit margins for these commoditized discrete components typically fall in the 10-15% range, significantly lower than more specialized semiconductor products.

Products Impacted by Rapid Technological Obsolescence

In the dynamic semiconductor sector, rapid technological shifts can render products obsolete swiftly. If Diodes Incorporated (DIOD) has offerings that are no longer competitive due to advancements or new industry benchmarks, and these haven't been effectively updated or replaced, they would be categorized as Dogs in the BCG matrix. This signifies low market share and low growth potential.

For instance, older generations of microcontrollers or power management ICs might face this challenge if newer, more efficient, or feature-rich alternatives emerge. In 2024, the semiconductor industry continued to see intense competition, with companies investing heavily in R&D for next-generation technologies like AI-accelerated chips and advanced connectivity solutions. Products not keeping pace with these trends are prime candidates for the Dog quadrant.

- Technological Obsolescence Risk: Products facing rapid obsolescence due to new innovations or evolving industry standards.

- Low Market Share and Growth: Diodes' products superseded by advanced solutions without successful transition.

- Example: Older microcontroller or power management ICs that haven't been updated to meet current performance or efficiency demands.

- Industry Context (2024): Continued heavy R&D investment in AI, advanced connectivity, and next-generation semiconductor technologies impacting product lifecycles.

Products classified as Dogs in Diodes Incorporated's BCG matrix are those with low market share and low growth potential. These often include legacy components that have been superseded by newer technologies or highly commoditized products facing intense price competition. For Diodes, these could be older analog chips or basic discrete components where differentiation is minimal and profit margins are thin. In 2024, the market for standard rectifier diodes saw an estimated 5-7% decline in average selling prices year-over-year, highlighting the pressure on such products.

The strategic approach for Dog products typically involves divestiture or discontinuation to free up resources. By shedding these underperforming assets, Diodes can reallocate capital towards more promising growth areas, enhancing overall portfolio efficiency. For example, if an acquired product line, like a legacy analog chip family, operates in a mature, low-growth segment and faces stiff competition, it would likely be a candidate for this strategy.

These products are often cash traps, consuming resources without generating substantial returns. The lack of innovation or unique features makes them vulnerable to price wars, further eroding profitability. Companies must carefully evaluate which Dog products to phase out to optimize their business strategy and resource allocation.

The semiconductor industry's rapid pace of technological advancement means that products not keeping up with trends, such as older microcontrollers or power management ICs, are prime candidates for the Dog quadrant. In 2024, the industry's focus on AI and advanced connectivity underscores the risk of obsolescence for products that fail to adapt. Diodes' 2023 net revenue of $1.73 billion means any segment consistently underperforming would warrant review.

| Product Category | Market Growth | Market Share | Profitability | Strategic Action |

| Legacy Analog Chips | Low | Low | Low | Divest/Discontinue |

| Commoditized Discrete Components | Low (2-4%) | Low | Very Low (10-15% gross margin) | Divest/Discontinue |

| Outdated Microcontrollers | Low | Low | Low | Divest/Discontinue |

| Feature Phone Components | Declining | Low | Low | Divest/Discontinue |

Question Marks

Emerging automotive technologies, beyond Diodes current strongholds, present significant opportunities. Areas like advanced power modules for the rapidly evolving electric vehicle (EV) market, which saw global EV sales surpass 13 million units in 2023, and highly specialized sensors crucial for autonomous driving systems, represent high-growth potential. These segments, while demanding substantial investment, could redefine Diodes market position.

Diodes Incorporated could explore emerging AI hardware architectures, such as neuromorphic computing or specialized AI accelerators for edge devices, which represent question mark segments. These areas, while currently small in market share, are poised for significant growth as AI adoption expands beyond data centers. For instance, the global edge AI hardware market was projected to reach approximately $20 billion by 2024, with a compound annual growth rate expected to exceed 20% in the coming years.

The ongoing expansion of 5G infrastructure and the anticipation of future connectivity standards like 6G signal a robust, high-growth market. Diodes' newer, more advanced connectivity solutions, or those still in their nascent stages of development for these evolving standards, likely occupy a low current market share. However, these products possess substantial potential for significant growth if they successfully capture market traction.

In 2024, the global 5G infrastructure market was valued at approximately $25.5 billion, with projections indicating a compound annual growth rate (CAGR) of around 25% through 2030. Diodes' investment in technologies supporting these advanced networks, even with a small initial footprint, positions them to capitalize on this expansion. For instance, their portfolio of high-frequency analog and mixed-signal semiconductors are critical components for base stations and user equipment, areas experiencing rapid innovation and demand.

Highly Integrated Mixed-Signal ICs for Niche Markets

Diodes is strategically broadening its mixed-signal integrated circuit (IC) offerings. Some of these new, highly integrated, and complex mixed-signal ICs are specifically designed for emerging niche markets. These products represent potential question marks within the BCG matrix, as they are in their early stages of market penetration.

These advanced mixed-signal ICs demand significant effort in market development and require substantial customer adoption to transition from a low market share to a more influential position. For instance, Diodes' recent expansion into automotive applications, which often require highly specialized and integrated mixed-signal solutions, exemplifies this strategy. The automotive sector, projected to grow significantly, presents a prime example of a niche market where these complex ICs could become stars if successful.

The success of these question mark products hinges on their ability to gain traction in these specialized sectors. For example, Diodes' introduction of new mixed-signal ICs for industrial IoT applications, which are characterized by unique performance and integration requirements, fits this category. The company's investment in R&D for these areas, aiming for higher value-added solutions, underscores the potential for these question marks to evolve.

- Market Development Focus: Diodes is investing in creating demand for its highly integrated mixed-signal ICs in nascent, specialized markets.

- Customer Adoption is Key: The success of these products depends heavily on their acceptance and integration by customers in these niche sectors.

- Potential for Growth: While currently having low market share, these offerings have the potential to become market leaders if they capture significant customer interest and adoption.

- Example Niche Markets: Emerging areas like advanced automotive systems and specialized industrial IoT solutions are prime examples where these complex ICs are being introduced.

New Geographic Market Expansions

When Diodes Incorporated ventures into new geographic markets where its presence is minimal, the products launched in these territories are classified as question marks within the BCG matrix. These markets represent potential high growth, but also carry significant risk and require substantial investment to build brand awareness and distribution networks.

For instance, if Diodes is targeting emerging economies in Southeast Asia or Africa, where its brand recognition is nascent and established competitors may already hold strong positions, its semiconductor solutions in these regions would be considered question marks. The company must invest heavily in marketing and sales infrastructure to penetrate these markets effectively.

- High Growth Potential: Emerging markets often exhibit faster economic growth rates, translating to increased demand for electronic components.

- Market Penetration Challenges: Building brand loyalty and distribution channels from scratch in unfamiliar territories demands considerable resources and time.

- Investment Required: Significant capital outlay is typically needed for market research, establishing sales offices, and developing local partnerships.

- Uncertain Future Returns: The success of products in these new markets is not guaranteed, making them a gamble with potentially high rewards or losses.

Question Marks represent products or business units with low market share in high-growth industries. Diodes is strategically targeting these areas, such as advanced automotive electronics and emerging AI hardware, to foster future growth. The success of these ventures hinges on significant investment in research, development, and market penetration, as their future market position is uncertain.

BCG Matrix Data Sources

Our Diodes BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis, to accurately position each product.