Diebold Nixdorf PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diebold Nixdorf Bundle

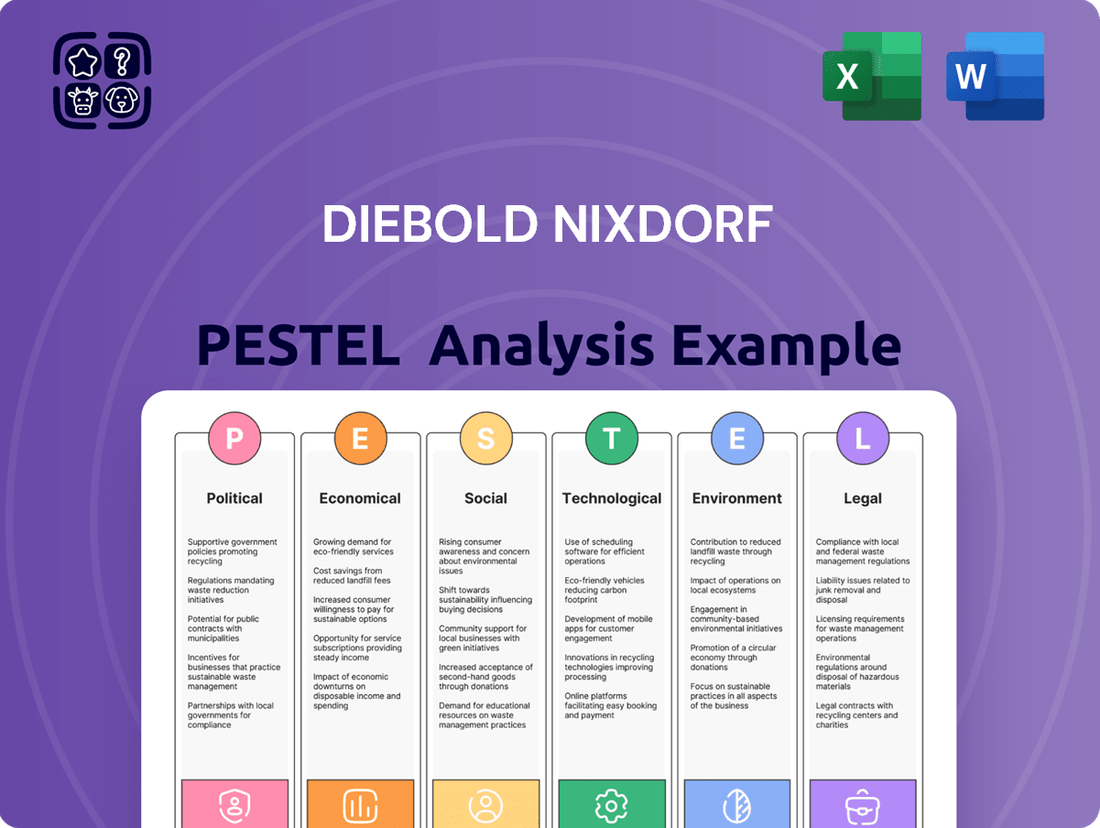

Navigate the complex external forces shaping Diebold Nixdorf's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategies and gain a competitive edge. Download the full PESTLE analysis now and unlock critical insights for informed decision-making.

Political factors

Governments and international bodies are continuously evolving cybersecurity and financial regulations, directly impacting Diebold Nixdorf's operations and product development for financial institutions and retailers.

Compliance with stringent mandates like the NYDFS Cybersecurity Regulation, with critical deadlines in April and May 2025, and the EU's Digital Operational Resilience Act (DORA) effective January 2025, is crucial for Diebold Nixdorf and its clients.

These regulations necessitate robust measures in data protection, incident reporting, and operational resilience, with DORA, for instance, requiring financial entities to report significant ICT-related incidents within strict timeframes.

International trade policies and geopolitical tensions directly impact Diebold Nixdorf's global operations, affecting everything from component sourcing to market entry. For instance, the ongoing trade friction between major economic blocs could lead to increased tariffs on imported goods, raising production costs for Diebold Nixdorf's ATMs and retail solutions. The company's presence in over 100 countries means it's particularly exposed to these shifts, as demonstrated by past supply chain disruptions experienced by many global manufacturers during periods of heightened international trade disputes.

Government initiatives promoting digital transformation, like the UK's Open Banking regulations, directly benefit Diebold Nixdorf by encouraging banks to modernize their infrastructure. This creates a demand for the company's advanced self-service solutions and software. For example, the UK government's push for financial inclusion and digital banking services, supported by initiatives like the Access to Cash Action Group's recommendations, can lead to increased deployment of sophisticated ATMs and related technologies.

Data Privacy and Security Legislation

The global data privacy and security landscape, marked by regulations like GDPR and CCPA, directly impacts Diebold Nixdorf's software and services. Compliance with these evolving laws is crucial for protecting sensitive data handled by financial institutions and retailers using their solutions.

The increasing complexity and stringency of these regulations necessitate ongoing adaptation and investment in robust security measures. For instance, the enforcement of GDPR has led to significant fines for non-compliance, with over €1.5 billion in fines issued across the EU as of late 2023, underscoring the financial imperative for companies like Diebold Nixdorf to maintain strict data protection protocols.

- GDPR (General Data Protection Regulation): Continues to set a high bar for data protection in the EU, impacting how Diebold Nixdorf processes and secures personal data.

- CCPA/CPRA (California Consumer Privacy Act/California Privacy Rights Act): Provides consumers in California with significant control over their personal information, requiring businesses to be transparent and offer opt-out options.

- Emerging AI Regulations: New legislation focused on artificial intelligence, such as the EU AI Act, will likely introduce specific data governance and transparency requirements for AI-driven solutions, which Diebold Nixdorf may offer.

- Cybersecurity Investment: Companies are projected to increase cybersecurity spending, with global spending expected to reach over $200 billion in 2024, reflecting the critical need for advanced security infrastructure.

Political Stability in Key Markets

Diebold Nixdorf's operational success hinges on political stability in its key markets. Countries with stable political landscapes offer predictable regulatory environments, crucial for long-term investment and business continuity. For instance, in 2024, regions experiencing political transitions or unrest may present increased operational risks and hinder market penetration efforts.

Geopolitical tensions can directly impact supply chains and consumer confidence, affecting demand for Diebold Nixdorf's financial self-service and retail solutions. The company's presence in diverse global markets means it must navigate varying levels of political risk, from established economies to emerging markets undergoing development.

- Political Stability Index: Countries with higher political stability scores, generally above 70 on a 100-point scale, are preferred for significant capital investment and expansion.

- Regulatory Predictability: Consistent and transparent regulatory frameworks, particularly concerning financial technology and data privacy, are vital for Diebold Nixdorf's compliance and operational efficiency.

- Geopolitical Risk Assessment: Diebold Nixdorf actively monitors geopolitical risk indicators, such as the Global Peace Index, to identify and mitigate potential disruptions in its operating regions.

Evolving cybersecurity and data privacy regulations, such as the EU's DORA effective January 2025 and ongoing GDPR compliance, directly shape Diebold Nixdorf's product development and operational strategies.

Government initiatives promoting digital transformation and financial inclusion, like the UK's Open Banking, create opportunities for Diebold Nixdorf's advanced self-service solutions and software.

Political stability in key markets is crucial for Diebold Nixdorf, as unstable regions can present operational risks and hinder market penetration, impacting their global presence across over 100 countries.

Geopolitical tensions and trade policies can affect component sourcing and market access, potentially increasing production costs, as seen with general supply chain disruptions experienced by global manufacturers.

| Regulation/Factor | Effective Date/Status | Impact on Diebold Nixdorf |

|---|---|---|

| DORA (EU) | January 2025 | Mandates ICT incident reporting and operational resilience for financial entities. |

| GDPR/CCPA | Ongoing | Requires robust data protection and transparency for sensitive data handled by clients. |

| UK Open Banking | Ongoing | Drives demand for modernized financial infrastructure and Diebold Nixdorf's solutions. |

| Geopolitical Tensions | Ongoing | Affects supply chains, market access, and operational costs globally. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Diebold Nixdorf, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market trends and regulatory landscapes, empowering strategic decision-making for stakeholders.

A clear, actionable PESTLE analysis for Diebold Nixdorf, presented in an easily digestible format, alleviates the pain of sifting through complex data, enabling swift strategic decision-making.

Economic factors

Global economic growth, projected at 2.7% for both 2025 and 2026, directly impacts the demand for Diebold Nixdorf's financial and retail technology. A robust global economy typically translates to increased consumer spending and business investment, benefiting companies like Diebold Nixdorf.

Consumer spending patterns are crucial. The ongoing shift towards digital payments and self-service technologies, such as contactless payments and automated checkouts, is a key driver for Diebold Nixdorf's product innovation and sales. For instance, in 2024, global e-commerce sales are expected to reach $6.3 trillion, highlighting this digital trend.

Diebold Nixdorf's success is intrinsically linked to the financial health of the banking and retail sectors worldwide. As these sectors invest in modernizing their operations to meet evolving consumer demands, Diebold Nixdorf is positioned to supply the necessary technology solutions.

Persistent inflation directly impacts Diebold Nixdorf's operational costs. For instance, the Consumer Price Index (CPI) in the US saw a notable increase, with a year-over-year change of 3.3% as of May 2024, impacting raw material and component prices. This rise in input costs can squeeze gross margins if not effectively passed on to customers or offset by internal efficiencies.

In response to inflationary pressures, many businesses, including those in Diebold Nixdorf's sector, are prioritizing supply chain optimization, focusing on reducing inventory levels and streamlining logistics. This strategy aims to mitigate the impact of rising holding costs and potential price volatility for components used in their self-service and retail solutions.

Diebold Nixdorf's commitment to lean operations and enhancing service gross margins is therefore crucial. By improving operational efficiency and the profitability of its service offerings, the company can better absorb increased costs and maintain its financial resilience in this challenging economic environment. For example, in Q1 2024, Diebold Nixdorf reported a gross profit margin of 28.1%, demonstrating ongoing efforts in this area.

Digital payment adoption varies significantly worldwide, impacting cash usage. For instance, in 2024, while countries like Sweden are nearing a cashless society, others still maintain a strong reliance on physical currency. This disparity creates a complex landscape for companies like Diebold Nixdorf.

Diebold Nixdorf navigates this by evolving its ATM offerings. Instead of just dispensing cash, their machines are increasingly incorporating advanced functionalities, acting as self-service hubs for digital transactions and banking services. This strategic shift addresses the decline in traditional ATM usage in markets like the U.S., where ATM withdrawals fell by an estimated 5% in 2023 compared to the previous year.

However, cash remains relevant, especially in emerging markets and for specific demographics. Diebold Nixdorf's approach acknowledges this by ensuring their solutions can still support cash-heavy environments while simultaneously facilitating the integration of digital payment methods. This dual focus is crucial for maintaining relevance and capturing market share across diverse economic conditions.

Competitive Landscape and Market Share

The ATM and retail technology sectors are intensely competitive, with key players constantly innovating and expanding to capture market share. Diebold Nixdorf, a major force, aims to solidify its position by emphasizing its unique banking and retail solutions to boost revenue and profitability.

This competitive environment fuels a relentless drive for innovation and operational efficiency across the industry. For instance, in 2023, Diebold Nixdorf reported revenues of $3.3 billion, underscoring its substantial presence in these markets.

- Market Share Focus: Diebold Nixdorf is actively working to maintain and grow its significant share in the global ATM market.

- Competitive Differentiation: The company leverages its specialized banking and retail solutions as key competitive advantages.

- Revenue and Margin Goals: Strategic efforts are directed towards securing revenue streams and improving profit margins amidst intense competition.

- Innovation Driver: Competitive pressures are a primary catalyst for continuous product development and efficiency enhancements within the company.

Investment in Strategic Growth Initiatives

Diebold Nixdorf's financial projections for 2025 and beyond signal a strong focus on strategic growth. The company has set ambitious targets, aiming for significant increases in revenue, adjusted EBITDA, and free cash flow. This forward-looking strategy is underpinned by a substantial $100 million share repurchase program, demonstrating confidence in future performance and a commitment to shareholder value.

These investments are strategically directed towards key growth areas. A significant portion is allocated to expanding AI-powered retail solutions, recognizing the increasing demand for intelligent and personalized customer experiences in the retail sector. Furthermore, Diebold Nixdorf is enhancing its ATM recycling technology, a move that aligns with global trends towards more efficient and sustainable cash management solutions.

- Revenue Growth Targets: Diebold Nixdorf has outlined ambitious revenue growth objectives for the period leading up to and including 2025.

- Adjusted EBITDA and Free Cash Flow: The company anticipates substantial improvements in both adjusted EBITDA and free cash flow, indicating operational efficiency and strong cash generation.

- Share Repurchase Program: A $100 million share repurchase program is in place, signaling management's belief in the company's undervaluation and commitment to returning capital to shareholders.

- Strategic Investment Areas: Key investments are being channeled into AI-powered retail solutions and advanced ATM recycling technology to drive innovation and market leadership.

Global economic growth, projected at 2.7% for both 2025 and 2026, directly impacts the demand for Diebold Nixdorf's financial and retail technology. A robust global economy typically translates to increased consumer spending and business investment, benefiting companies like Diebold Nixdorf.

Consumer spending patterns are crucial. The ongoing shift towards digital payments and self-service technologies, such as contactless payments and automated checkouts, is a key driver for Diebold Nixdorf's product innovation and sales. For instance, in 2024, global e-commerce sales are expected to reach $6.3 trillion, highlighting this digital trend.

Diebold Nixdorf's success is intrinsically linked to the financial health of the banking and retail sectors worldwide. As these sectors invest in modernizing their operations to meet evolving consumer demands, Diebold Nixdorf is positioned to supply the necessary technology solutions.

Persistent inflation directly impacts Diebold Nixdorf's operational costs. For instance, the Consumer Price Index (CPI) in the US saw a notable increase, with a year-over-year change of 3.3% as of May 2024, impacting raw material and component prices. This rise in input costs can squeeze gross margins if not effectively passed on to customers or offset by internal efficiencies.

In response to inflationary pressures, many businesses, including those in Diebold Nixdorf's sector, are prioritizing supply chain optimization, focusing on reducing inventory levels and streamlining logistics. This strategy aims to mitigate the impact of rising holding costs and potential price volatility for components used in their self-service and retail solutions.

Diebold Nixdorf's commitment to lean operations and enhancing service gross margins is therefore crucial. By improving operational efficiency and the profitability of its service offerings, the company can better absorb increased costs and maintain its financial resilience in this challenging economic environment. For example, in Q1 2024, Diebold Nixdorf reported a gross profit margin of 28.1%, demonstrating ongoing efforts in this area.

Digital payment adoption varies significantly worldwide, impacting cash usage. For instance, in 2024, while countries like Sweden are nearing a cashless society, others still maintain a strong reliance on physical currency. This disparity creates a complex landscape for companies like Diebold Nixdorf.

Diebold Nixdorf navigates this by evolving its ATM offerings. Instead of just dispensing cash, their machines are increasingly incorporating advanced functionalities, acting as self-service hubs for digital transactions and banking services. This strategic shift addresses the decline in traditional ATM usage in markets like the U.S., where ATM withdrawals fell by an estimated 5% in 2023 compared to the previous year.

However, cash remains relevant, especially in emerging markets and for specific demographics. Diebold Nixdorf's approach acknowledges this by ensuring their solutions can still support cash-heavy environments while simultaneously facilitating the integration of digital payment methods. This dual focus is crucial for maintaining relevance and capturing market share across diverse economic conditions.

The ATM and retail technology sectors are intensely competitive, with key players constantly innovating and expanding to capture market share. Diebold Nixdorf, a major force, aims to solidify its position by emphasizing its unique banking and retail solutions to boost revenue and profitability.

This competitive environment fuels a relentless drive for innovation and operational efficiency across the industry. For instance, in 2023, Diebold Nixdorf reported revenues of $3.3 billion, underscoring its substantial presence in these markets.

- Market Share Focus: Diebold Nixdorf is actively working to maintain and grow its significant share in the global ATM market.

- Competitive Differentiation: The company leverages its specialized banking and retail solutions as key competitive advantages.

- Revenue and Margin Goals: Strategic efforts are directed towards securing revenue streams and improving profit margins amidst intense competition.

- Innovation Driver: Competitive pressures are a primary catalyst for continuous product development and efficiency enhancements within the company.

Diebold Nixdorf's financial projections for 2025 and beyond signal a strong focus on strategic growth. The company has set ambitious targets, aiming for significant increases in revenue, adjusted EBITDA, and free cash flow. This forward-looking strategy is underpinned by a substantial $100 million share repurchase program, demonstrating confidence in future performance and a commitment to shareholder value.

These investments are strategically directed towards key growth areas. A significant portion is allocated to expanding AI-powered retail solutions, recognizing the increasing demand for intelligent and personalized customer experiences in the retail sector. Furthermore, Diebold Nixdorf is enhancing its ATM recycling technology, a move that aligns with global trends towards more efficient and sustainable cash management solutions.

- Revenue Growth Targets: Diebold Nixdorf has outlined ambitious revenue growth objectives for the period leading up to and including 2025.

- Adjusted EBITDA and Free Cash Flow: The company anticipates substantial improvements in both adjusted EBITDA and free cash flow, indicating operational efficiency and strong cash generation.

- Share Repurchase Program: A $100 million share repurchase program is in place, signaling management's belief in the company's undervaluation and commitment to returning capital to shareholders.

- Strategic Investment Areas: Key investments are being channeled into AI-powered retail solutions and advanced ATM recycling technology to drive innovation and market leadership.

| Economic Factor | 2023 (Actual) | 2024 (Projected) | 2025 (Projected) |

|---|---|---|---|

| Global GDP Growth | ~3.0% | ~2.7% | ~2.7% |

| US CPI (YoY) | ~4.1% | ~3.3% (May 2024) | (Continued monitoring) |

| Global E-commerce Sales | $5.7 Trillion | $6.3 Trillion | (Continued growth expected) |

| ATM Withdrawals (US YoY) | ~-5% | (Continued trend) | (Continued trend) |

What You See Is What You Get

Diebold Nixdorf PESTLE Analysis

The preview shown here is the exact Diebold Nixdorf PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Diebold Nixdorf's operations and strategic positioning. You'll gain a clear understanding of the external forces shaping the company's landscape.

Sociological factors

Consumer preferences are rapidly shifting towards more convenient, digital-first banking experiences. This includes a strong preference for mobile banking, enhanced ATM functionality, and the widespread adoption of contactless transactions, with studies in late 2024 indicating over 70% of retail transactions globally utilizing contactless methods.

Diebold Nixdorf is actively responding to these evolving demands by repositioning ATMs as crucial digital touchpoints. Their solutions integrate advanced features such as seamless mobile app connectivity and sophisticated cash recycling technology, aiming to provide a more personalized and efficient self-service banking environment.

The persistent growth in demand for seamless and efficient self-service solutions underscores a fundamental change in how consumers interact with financial institutions. This trend is driven by a desire for immediate access and reduced friction in everyday banking tasks, a sentiment strongly supported by a 2024 survey showing a 25% year-over-year increase in self-service banking channel usage.

Retail shoppers in 2024 and 2025 are placing a premium on value, transparency, and eco-friendly practices. They also demand seamless self-service and tailored interactions, pushing retailers to innovate. This shift means businesses must adapt to meet these heightened expectations to remain competitive.

Diebold Nixdorf's product suite, featuring advanced self-checkout stations and AI-driven engagement tools, directly addresses these evolving consumer desires. These technologies are designed to cut down on friction points, like long queues, and elevate the overall shopping journey, aiming for increased customer loyalty.

Demographic shifts are profoundly reshaping markets, and Diebold Nixdorf must navigate these changes. An aging global population, for instance, means more seniors requiring accessible and user-friendly technology for banking and retail. Simultaneously, Gen Z, now entering the workforce and as consumers, demands seamless digital experiences. By 2024, it's projected that Gen Z will represent a significant portion of the consumer base, influencing how businesses must innovate.

Financial Inclusion and Access to Services

The global drive for financial inclusion, especially in regions with limited banking access, offers substantial growth avenues for Diebold Nixdorf. By providing secure and user-friendly self-service terminals, such as ATMs, in these underserved communities, the company plays a crucial role in broadening financial access. This directly supports Diebold Nixdorf's mission to reshape global banking and retail experiences.

Consider these points:

- Expanding Reach: In 2024, over 1.4 billion adults globally remained unbanked, with a significant portion in emerging economies. Diebold Nixdorf's self-service solutions are key to reaching these populations.

- Digital Transformation: Initiatives like India's Jan Dhan Yojana have dramatically increased banking penetration, with over 500 million accounts opened by early 2024, highlighting the demand for accessible financial touchpoints.

- Market Opportunity: The ATM market in Africa and Southeast Asia is projected to grow by over 8% annually through 2027, driven by the need for basic financial services and government-backed inclusion programs.

- Technological Integration: Diebold Nixdorf's ability to integrate advanced features like biometric authentication and mobile banking into their ATMs further enhances their value proposition in diverse markets.

Public Perception of Automated Services

Public perception of automated services is a significant factor for Diebold Nixdorf. Consumer trust and comfort with self-service technologies like ATMs and self-checkout systems directly influence the adoption rates of Diebold Nixdorf's offerings. For instance, a 2023 survey indicated that while 75% of consumers find self-checkout convenient, only 55% fully trust the technology's accuracy and security.

Ensuring user-friendly design and strong security measures are paramount to building and maintaining this trust. Diebold Nixdorf's success hinges on its ability to create automated solutions that are not only efficient but also perceived as reliable and safe by a broad demographic, including those less familiar with advanced technology. This is particularly relevant as the company expands its presence in diverse global markets.

The ongoing evolution of consumer expectations also plays a role. As more people become accustomed to digital interactions, the acceptance of automated services is likely to grow. However, Diebold Nixdorf must remain attuned to potential hesitations, such as concerns about job displacement or data privacy, and address them through transparent communication and robust product development.

Societal trends highlight a growing demand for personalized and convenient digital experiences across banking and retail sectors. Consumer preferences are shifting towards self-service options, with a notable increase in mobile banking adoption and contactless payments, which accounted for over 70% of global retail transactions by late 2024.

Demographic changes, including an aging population and the increasing influence of Gen Z consumers, necessitate accessible and user-friendly technology. Furthermore, the push for financial inclusion, particularly in emerging markets, presents significant opportunities for companies like Diebold Nixdorf to expand their reach through accessible self-service solutions.

Public trust in automated services, while growing, remains a critical factor, with a 2023 survey showing that while 75% of consumers find self-checkout convenient, only 55% fully trust its accuracy and security. Addressing concerns about data privacy and job displacement through transparent communication and robust product development is crucial for Diebold Nixdorf's sustained success.

| Sociological Factor | Trend/Impact | Diebold Nixdorf Relevance |

|---|---|---|

| Digitalization of Services | Increased preference for mobile banking and contactless payments (over 70% of global retail transactions in late 2024). | Repositioning ATMs as digital touchpoints with mobile app connectivity and advanced features. |

| Demographic Shifts | Aging population requires user-friendly tech; Gen Z demands seamless digital experiences. | Developing accessible and intuitive self-service solutions for diverse age groups. |

| Financial Inclusion | Over 1.4 billion adults unbanked globally in 2024; significant growth in ATM markets in Africa and Southeast Asia. | Providing self-service terminals to underserved communities, expanding financial access. |

| Consumer Trust in Automation | While convenience is high (75% for self-checkout), trust in accuracy and security is lower (55% in 2023). | Focusing on user-friendly design, strong security measures, and transparent communication to build confidence. |

Technological factors

Advancements in Artificial Intelligence (AI) are increasingly central to Diebold Nixdorf's innovation strategy, impacting both their banking and retail sectors. In banking, AI is being deployed to bolster fraud detection capabilities, enable predictive maintenance for ATMs and other hardware, and deliver more personalized customer experiences through data analysis. This focus on AI aims to enhance operational efficiency and customer satisfaction.

Within the retail space, Diebold Nixdorf leverages AI through platforms like Vynamic® Smart Vision. This technology is designed to address critical retail challenges, including reducing shrinkage by identifying suspicious activity, accelerating checkout processes with advanced multi-item recognition, and streamlining age verification for restricted purchases. These AI-driven solutions are crucial for modernizing the retail environment and improving the customer journey.

The payment landscape is rapidly changing, with contactless and mobile payments becoming the norm. By 2024, it's estimated that over 80% of all point-of-sale transactions in developed markets will be contactless, a significant jump from just a few years prior. Diebold Nixdorf must integrate these capabilities, alongside biometric authentication, into their ATMs and POS systems to stay competitive.

Cybersecurity threats continue to escalate, demanding constant vigilance and investment from companies like Diebold Nixdorf. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, a stark reminder of the risks involved. Diebold Nixdorf actively addresses this by implementing advanced security measures across its hardware and software offerings.

The company prioritizes robust security protocols, including enhanced encryption for sensitive financial data and sophisticated fraud detection systems. This proactive approach is crucial for maintaining customer trust and ensuring compliance with increasingly stringent global security standards, which are constantly being updated to counter new attack vectors.

Cloud Computing and Digital Infrastructure

Diebold Nixdorf's embrace of cloud computing is a significant technological driver. The adoption of cloud-based solutions directly enhances their data management capabilities, boosts operational efficiency, and provides crucial scalability for their integrated banking and retail systems. This shift is vital as financial institutions increasingly demand agile and secure service delivery to meet the evolving needs of a digital-first customer base.

Modern digital infrastructure is increasingly built around resilience and the advantages of microservices architecture. This technological approach allows Diebold Nixdorf to offer solutions that help banks adapt more readily to a world that expects instant transactions and seamless digital experiences. For instance, by leveraging cloud infrastructure, Diebold Nixdorf can facilitate faster deployment of new features and updates, ensuring their clients remain competitive.

The market trend towards cloud adoption is substantial. In 2024, global cloud spending was projected to reach over $600 billion, with financial services being a major contributor. This indicates a strong demand for the very services Diebold Nixdorf is enhancing through its technological investments. The company’s focus on microservices also aligns with industry efforts to create more flexible and robust IT environments, which is critical for maintaining uptime and security in the financial sector.

- Enhanced Scalability: Cloud solutions allow Diebold Nixdorf to scale its offerings up or down rapidly based on client demand, a key advantage in the fluctuating financial market.

- Improved Efficiency: Cloud-based platforms streamline operations, reducing latency and improving the speed at which financial transactions and services can be processed.

- Digital Resilience: Modern infrastructure, including microservices, bolsters the ability of Diebold Nixdorf's systems to withstand disruptions and maintain continuous service availability.

- Agile Service Delivery: The cloud and microservices architecture enable quicker development and deployment cycles, allowing banks to introduce new digital products and services more rapidly.

Innovation in Self-Service and Automation

Diebold Nixdorf is at the forefront of technological advancement, driving transformation in banking and retail through its leadership in self-service and automation. Their innovative solutions, encompassing advanced ATMs and sophisticated point-of-sale terminals, are designed to reshape customer interactions and operational efficiency. For instance, the company's focus on cash recycling technology not only reduces manual cash handling but also enhances security and availability in banking environments.

The company is continuously pushing the boundaries of what's possible with technologies like video banking, which allows for more personalized and secure customer service remotely. Furthermore, their development of self-checkout systems integrated with AI-powered features aims to significantly speed up transactions and reduce friction for shoppers. In 2024, Diebold Nixdorf reported a strong pipeline for its self-service solutions, indicating continued market demand for these efficiency-boosting technologies.

Key technological innovations include:

- Cash Recycling ATMs: These machines significantly reduce the need for manual cash replenishment and processing, improving operational efficiency for financial institutions.

- AI-Powered Self-Checkout: Enhancing the retail experience by offering faster, more intuitive, and secure self-service payment options.

- Video Banking Solutions: Extending personalized banking services beyond branch hours and locations through secure, interactive video communication.

- Smart Store Solutions: Integrating various self-service and automation technologies to create more seamless and efficient shopping environments.

Diebold Nixdorf's technological strategy is deeply intertwined with advancements in AI and automation, aiming to enhance both banking and retail operations. Their Vynamic® Smart Vision platform, for example, uses AI to reduce retail shrinkage and speed up checkouts, reflecting the growing demand for intelligent automation in customer-facing environments.

The company is also adapting to the rapid shift towards contactless and mobile payments, with over 80% of point-of-sale transactions in developed markets expected to be contactless by 2024. Cybersecurity remains a paramount concern, with global cybercrime costs projected to reach $10.5 trillion annually in 2024, necessitating robust security measures in all their offerings.

Cloud computing and microservices architecture are central to Diebold Nixdorf's service delivery, enabling scalability and efficiency. Global cloud spending in 2024 was anticipated to exceed $600 billion, highlighting the market's strong embrace of cloud-based solutions, a trend Diebold Nixdorf is actively leveraging.

Legal factors

Diebold Nixdorf operates under a complex web of global data protection and privacy regulations, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These laws dictate the collection, storage, and utilization of personal data, a critical aspect for a company handling sensitive financial information. Failure to comply can result in significant penalties, as seen with GDPR fines which can reach up to 4% of global annual turnover.

Diebold Nixdorf and its financial institution clients must navigate a complex web of compliance standards. For instance, the PCI DSS mandates are evolving, with new requirements like TR-31 key blocks becoming compulsory from January 2025, and 'best practice' guidelines transitioning to mandatory status by March 2025. These changes directly impact the security and management of payment card data processed through Diebold Nixdorf's solutions.

Furthermore, regulations such as the EU's Digital Operational Resilience Act (DORA) and the New York Department of Financial Services (NYDFS) Cybersecurity Regulation place stringent demands on operational resilience and cybersecurity. DORA, for example, aims to bolster the digital security of financial entities across the EU, requiring robust risk management frameworks and incident reporting, which Diebold Nixdorf's systems must support.

Diebold Nixdorf's payment and retail solutions are designed to help financial institutions and businesses comply with evolving anti-money laundering (AML) and fraud prevention regulations. These systems are crucial for detecting and mitigating illicit financial activities, ensuring secure transactions.

The increasing regulatory focus on transaction security, such as the Eurozone's push for instant payment capabilities and Verification of Payee (VoP) services, directly impacts the demand for Diebold Nixdorf's technology. For instance, the Payment Services Directive 3 (PSD3) in Europe, expected to be finalized in 2024/2025, will likely introduce stricter requirements for fraud prevention and consumer protection in payment systems, necessitating advanced solutions like those offered by Diebold Nixdorf.

Accessibility Standards for Self-Service Terminals

Diebold Nixdorf must ensure its self-service terminals, like ATMs and point-of-sale systems, comply with accessibility laws. This means designing for users with disabilities, a growing focus globally. For instance, the Americans with Disabilities Act (ADA) in the U.S. mandates specific physical and functional requirements for accessible technology.

These legal mandates are crucial for Diebold Nixdorf's product development. Failure to comply can result in significant fines and reputational damage. The company's commitment to inclusive design supports regulatory adherence and responsible business practices across its global operations.

- ADA Compliance: U.S. regulations require accessible design for ATMs, impacting features like screen height, reach ranges, and audio output.

- Global Standards: Diebold Nixdorf navigates varying accessibility laws in Europe and Asia, such as EN 301 549 in the EU, which sets technical standards for ICT products and services.

- User Inclusivity: Legal frameworks push for solutions that accommodate a wider range of users, including those with visual, auditory, or motor impairments.

Intellectual Property Laws and Patent Protection

Intellectual property laws are critical for Diebold Nixdorf, safeguarding its innovations in areas like self-service kiosks, financial software, and physical security systems. Strong patent protection is key to maintaining its edge in a competitive market. For instance, as of early 2024, the company actively manages a portfolio of patents covering various aspects of its technology, ensuring its unique solutions are shielded from imitation.

Navigating the complex global intellectual property landscape is also paramount. Diebold Nixdorf must ensure its products and services do not infringe on existing patents in different jurisdictions to facilitate seamless international deployment. This diligence supports its continuous investment in research and development, reinforcing its market leadership and ability to bring new technologies to customers worldwide.

- Patent Portfolio Strength: Diebold Nixdorf's commitment to innovation is reflected in its active patent portfolio, crucial for protecting its advanced self-service and security technologies.

- Global IP Compliance: The company prioritizes adherence to international intellectual property laws to prevent infringement and ensure smooth global market entry for its solutions.

- R&D Investment Protection: Robust IP strategies are vital for securing the returns on Diebold Nixdorf's significant investments in research and development, fostering continued technological advancement.

Diebold Nixdorf operates within a stringent regulatory environment, particularly concerning data privacy and financial transactions. Compliance with evolving standards like GDPR and CCPA is critical, with potential fines for non-adherence reaching up to 4% of global annual turnover. The company must also adhere to evolving payment security mandates, such as PCI DSS, with new requirements impacting key management and data protection becoming mandatory in 2025.

Furthermore, regulations like the EU's Digital Operational Resilience Act (DORA) and various national cybersecurity laws impose significant demands on operational resilience and data security. Diebold Nixdorf's solutions are designed to assist clients in meeting these requirements, including those related to anti-money laundering and fraud prevention. The company's commitment to intellectual property protection, evidenced by its active patent portfolio, is also vital for safeguarding its technological innovations in a competitive global market.

Environmental factors

Environmental, Social, and Governance (ESG) reporting is increasingly vital for companies like Diebold Nixdorf. Investors and customers are demanding greater transparency, pushing for accountability in environmental impact and ethical practices. By 2025, expect stricter ESG disclosure mandates, especially for publicly traded firms and financial service providers.

The financial and retail industries are increasingly prioritizing energy-efficient hardware and eco-friendly business operations. This shift is driven by both consumer preference and regulatory pressures, creating a significant market opportunity for companies like Diebold Nixdorf that can offer sustainable solutions.

Diebold Nixdorf is expected to enhance its environmental stewardship by focusing on energy efficiency in its data centers and embedding sustainable design principles into its product development. For example, the company's ATM solutions are being engineered for lower power consumption, contributing to reduced operational costs for financial institutions.

Diebold Nixdorf faces growing pressure to manage electronic waste (e-waste) responsibly, a trend amplified by evolving environmental regulations and consumer expectations throughout 2024 and into 2025. The company's commitment to circular economy principles, particularly in the recycling of components from ATMs and POS terminals, directly addresses this challenge.

Implementing circularity means designing products for extended lifespans and facilitating easier disassembly for reuse or recycling. This approach is crucial as the global e-waste generation continues its upward trajectory; projections indicate it could reach 74 million metric tons annually by 2030, highlighting the urgency for manufacturers like Diebold Nixdorf to innovate in product design and end-of-life management.

Carbon Footprint Reduction Initiatives

Diebold Nixdorf is actively addressing the increasing global pressure to reduce its carbon footprint across all operational areas. This includes a focus on manufacturing processes and the energy consumption of its data centers.

The company's dedication to environmental responsibility is demonstrated through ongoing initiatives aimed at meticulously tracking and lowering its carbon emissions. Diebold Nixdorf is exploring certifications such as ISO 14064, which provides a framework for quantifying and reporting greenhouse gas emissions, thereby aligning its efforts with international climate objectives.

- Carbon Emission Tracking: Diebold Nixdorf implements systems to monitor greenhouse gas emissions from its global operations.

- Energy Efficiency Programs: Initiatives focus on reducing energy consumption in manufacturing plants and data centers.

- ISO 14064 Alignment: The company is working towards standards for carbon footprint verification to ensure credible reporting.

- Sustainability Goals: These efforts are part of Diebold Nixdorf's broader commitment to contributing to global climate change mitigation.

Supply Chain Sustainability and Ethical Sourcing

Diebold Nixdorf's commitment to supply chain sustainability and ethical sourcing is a critical environmental consideration. Ensuring transparency and adherence to social and environmental standards throughout their operations is paramount. This involves actively working with suppliers to guarantee the ethical sourcing of all materials and promoting sustainable practices across the entire value chain. Meeting increasing stakeholder expectations and avoiding accusations of greenwashing necessitates robust oversight and collaboration. For instance, in 2023, many technology companies faced scrutiny over their reliance on conflict minerals, highlighting the importance of rigorous supplier audits and responsible procurement policies to mitigate these environmental risks.

Diebold Nixdorf must ensure its supply chain is resilient and environmentally responsible. This includes:

- Supplier Audits: Regularly assessing suppliers for compliance with environmental regulations and ethical labor practices.

- Material Traceability: Implementing systems to track the origin of raw materials, particularly those with potential environmental impacts.

- Waste Reduction Programs: Collaborating with suppliers to minimize waste generation and promote recycling initiatives within the supply chain.

- Carbon Footprint Monitoring: Working with partners to understand and reduce the carbon emissions associated with logistics and manufacturing processes.

Environmental regulations and consumer demand for sustainability are shaping the market for Diebold Nixdorf's products. The company is focusing on energy efficiency in its hardware, like ATMs, to reduce operational costs for clients and meet eco-friendly preferences. This aligns with broader industry trends where greener operations are becoming a competitive advantage.

Diebold Nixdorf is actively working to minimize its environmental footprint, particularly concerning electronic waste (e-waste). As global e-waste is projected to hit 74 million metric tons annually by 2030, the company's commitment to circular economy principles, including product design for longevity and easier recycling of components from ATMs and POS terminals, is crucial for responsible end-of-life management.

Tracking and reducing carbon emissions is a key environmental focus for Diebold Nixdorf. The company is implementing systems to monitor greenhouse gas output from its operations and is exploring certifications like ISO 14064 to ensure credible reporting of its climate impact. These efforts underscore a commitment to global climate change mitigation.

Supply chain sustainability is a critical environmental factor for Diebold Nixdorf. The company emphasizes ethical sourcing and requires suppliers to adhere to environmental standards, conducting regular audits to ensure compliance. This focus on material traceability and waste reduction within the supply chain helps mitigate environmental risks and meet stakeholder expectations for responsible procurement.

PESTLE Analysis Data Sources

Our Diebold Nixdorf PESTLE analysis is meticulously constructed using data from leading financial institutions like the IMF and World Bank, alongside industry-specific reports and government regulatory databases. This ensures a comprehensive understanding of economic trends, political landscapes, and technological advancements impacting the company.