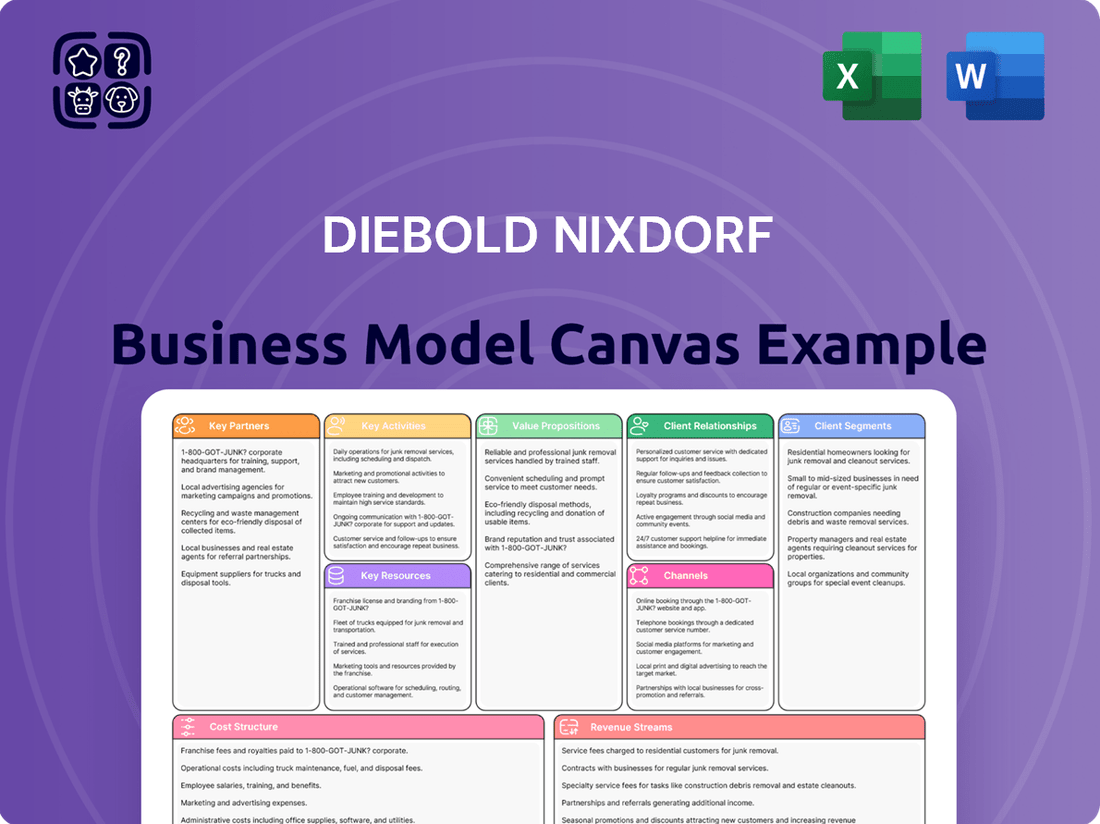

Diebold Nixdorf Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diebold Nixdorf Bundle

Unlock the strategic blueprint behind Diebold Nixdorf's business model with our comprehensive Business Model Canvas. Discover how they connect with customers, deliver value, and generate revenue in the dynamic financial and retail technology sectors. This detailed canvas is your key to understanding their operational success.

Want to dissect Diebold Nixdorf's winning strategy? Our full Business Model Canvas breaks down their customer relationships, key resources, and cost structure, offering invaluable insights for any business professional. Download it now to gain a competitive edge.

Partnerships

Diebold Nixdorf collaborates with key technology firms, notably Microsoft, to guarantee that its comprehensive suite of financial and retail solutions remains compatible and benefits from sustained, long-term support. This strategic alignment ensures Diebold Nixdorf's offerings are at the forefront of technological advancements.

A prime example of this partnership's success is Diebold Nixdorf's achievement as the first ATM solution provider fully prepared to support the Windows 11 IoT Enterprise LTSC 2024 operating system, a platform slated for support until October 2034. This forward-thinking integration underscores their commitment to future-proofing client investments.

These alliances are fundamental to Diebold Nixdorf’s ability to seamlessly integrate cutting-edge features. Such innovations are vital for significantly enhancing the security protocols, operational speed, and overall user-friendliness of their systems for financial institutions and retailers worldwide.

Diebold Nixdorf's key partnerships with financial institutions and payment processors are crucial for driving innovation in the financial services sector. Collaborations with entities like Bankart in Southeast Europe exemplify this, focusing on modernizing payment platforms and facilitating advanced payment services.

These partnerships are instrumental in migrating complex legacy systems to agile, cloud-native solutions. This modernization effort supports a wide range of critical banking infrastructure, including ATMs, point-of-sale (POS) terminals, and the expanding e-commerce landscape, ensuring seamless and secure transactions for consumers and businesses alike.

For instance, in 2024, Diebold Nixdorf continued to expand its cloud-based payment solutions, aiming to help financial institutions reduce operational costs by an estimated 20-30% through enhanced efficiency and scalability.

Diebold Nixdorf relies heavily on key partnerships with logistics and service providers to maintain its global operational efficiency. For instance, collaborations with companies like Arvato are crucial for managing the intricate supply chain of spare parts across its vast network of ATMs and retail systems. This ensures that replacement components reach service technicians promptly, minimizing downtime for customers.

These partnerships are fundamental to Diebold Nixdorf's ability to operate global distribution centers and effectively manage the reverse logistics of returned parts. In 2024, the company continued to optimize these relationships to achieve high availability of critical components and reduce lead times, directly impacting customer satisfaction and the overall reliability of its deployed solutions.

Retail Solution Integrators

Diebold Nixdorf collaborates with a network of retail solution integrators and value-added resellers (VARs). These partners are crucial for deploying Diebold Nixdorf's self-service kiosks and point-of-sale (POS) systems across diverse retail settings.

These strategic alliances significantly broaden Diebold Nixdorf's market penetration. They also enable the delivery of customized solutions that precisely address the unique operational requirements of individual retailers.

- Expanded Market Access: Retail solution integrators and VARs provide access to new customer segments and geographic regions, amplifying Diebold Nixdorf's reach.

- Tailored Implementation: Partners offer specialized expertise to integrate Diebold Nixdorf hardware and software into existing retail infrastructures, ensuring seamless deployment.

- Value-Added Services: These collaborations often include installation, maintenance, and support services, enhancing the overall customer experience and product value.

Strategic Alliances for Market Expansion

Diebold Nixdorf cultivates strategic alliances, notably with fintech innovators, to bolster its market reach. These collaborations are crucial for penetrating new markets, particularly in rapidly developing economies.

These vital partnerships were a significant revenue driver, accounting for roughly 20% of Diebold Nixdorf's total sales in 2024. This demonstrates their critical role in the company's ongoing global growth strategy.

- Fintech Partnerships: Alliances with fintech firms enhance Diebold Nixdorf's product offerings and market access.

- Emerging Market Focus: Strategic alliances are key to expanding presence in high-growth emerging economies.

- Sales Contribution: Partnerships contributed approximately 20% to total sales in 2024, underscoring their financial impact.

Diebold Nixdorf's key partnerships extend to financial institutions and payment processors, vital for modernizing payment platforms and facilitating advanced services. Collaborations with entities like Bankart in Southeast Europe exemplify this focus.

These alliances are instrumental in migrating complex legacy systems to agile, cloud-native solutions, supporting critical banking infrastructure like ATMs and POS terminals. In 2024, Diebold Nixdorf aimed to help financial institutions reduce operational costs by 20-30% through these cloud-based payment solutions.

Strategic alliances with fintech innovators are crucial for penetrating new markets, particularly in rapidly developing economies. These partnerships were a significant revenue driver, accounting for roughly 20% of Diebold Nixdorf's total sales in 2024.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Impact |

|---|---|---|---|

| Technology | Microsoft | Ensuring compatibility and long-term support for financial and retail solutions; future-proofing client investments. | First ATM solution provider supporting Windows 11 IoT Enterprise LTSC 2024. |

| Financial Institutions & Payment Processors | Bankart (example) | Modernizing payment platforms, facilitating advanced payment services, migrating legacy systems. | Targeted 20-30% operational cost reduction for financial institutions via cloud solutions. |

| Fintech Innovators | Various | Expanding market reach, penetrating new markets, especially in emerging economies. | Contributed ~20% to total sales. |

What is included in the product

A detailed Business Model Canvas for Diebold Nixdorf, outlining its approach to serving financial and retail customers through integrated hardware, software, and services.

It covers key customer segments like banks and retailers, their channels of engagement, and the value proposition of secure, efficient transaction solutions.

The Diebold Nixdorf Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying strategic understanding and alignment for stakeholders.

It addresses the pain of information overload by condensing Diebold Nixdorf's intricate strategy into a digestible format, enabling faster decision-making and problem-solving.

Activities

Diebold Nixdorf's commitment to Research and Development is central to its strategy, focusing on creating cutting-edge hardware and software for the retail and banking sectors. This includes pioneering AI-driven fraud detection for self-checkout terminals and developing next-generation ATM functionalities.

A significant portion of their R&D efforts is dedicated to advancing software platforms. For instance, the development of Vynamic Connection Points 7 and Vynamic Transaction Middleware aims to streamline and secure payment processing and customer interactions across various touchpoints.

In 2023, Diebold Nixdorf reported $237 million in R&D expenses, underscoring their substantial investment in innovation to maintain a competitive edge and anticipate future market demands.

Diebold Nixdorf's manufacturing and assembly operations are central to its business, focusing on producing self-service transaction systems like ATMs and point-of-sale terminals. The company has strategically brought back U.S.-based production for self-service checkouts and kiosk systems, enhancing its domestic supply chain capabilities.

These activities are underpinned by a commitment to lean manufacturing principles, a methodology aimed at maximizing efficiency and consistently delivering high-quality products. This approach helps to streamline production processes and reduce waste.

Diebold Nixdorf's software development and integration activities are central to its strategy, focusing on creating cloud-native solutions like Vynamic Transaction Middleware. These platforms are designed to facilitate modern payment processing and deliver seamless omnichannel customer experiences, connecting both digital and physical touchpoints for retailers and financial institutions.

The company's commitment to flexible and scalable software development ensures its offerings can adapt to evolving market demands. For instance, in 2024, Diebold Nixdorf continued to invest in enhancing its Vynamic suite, aiming to provide clients with the agility needed to manage complex transaction flows and deploy new services rapidly across their entire ecosystem.

Installation and Maintenance Services

Diebold Nixdorf's installation and maintenance services are fundamental to their business model, ensuring clients' critical systems operate smoothly. They offer global support for hardware and software, covering everything from initial setup to ongoing upkeep. This comprehensive approach is vital for maintaining high availability and operational efficiency for their customers' diverse needs.

These services are designed to support a wide array of solutions, including those for managed stores, self-service kiosks, mobile payment systems, and checkout technologies. By providing these essential support functions, Diebold Nixdorf helps businesses minimize downtime and maximize the performance of their technology investments, which is especially critical in fast-paced retail and banking environments.

- Global Reach: Diebold Nixdorf's service network spans numerous countries, enabling them to provide consistent support regardless of a client's geographic location.

- Comprehensive Support: Services include installation, preventative maintenance, break-fix repairs, and remote monitoring to ensure optimal system performance.

- Managed Services: They offer end-to-end management of IT infrastructure, allowing clients to focus on their core business operations.

- Efficiency Focus: The primary goal is to enhance operational efficiency and availability for clients' self-service, retail, and banking technology.

Sales and Customer Support

Diebold Nixdorf's sales and customer support are crucial for maintaining its global presence. They directly engage with a vast client base, which includes major financial institutions and retailers worldwide. This direct interaction is often facilitated through specialized sales teams and a network of strategic partnerships, ensuring broad market coverage.

The company emphasizes providing continuous customer support, positioning itself as a trusted advisor. This advisory role is vital for helping clients adapt to evolving technological landscapes and optimize their operations. In 2024, Diebold Nixdorf continued to invest in its customer-facing infrastructure to enhance these relationships.

- Global Reach: Serving financial institutions and retailers across numerous countries.

- Dedicated Teams: Employing specialized sales and support personnel.

- Strategic Alliances: Leveraging partnerships to expand market access and service capabilities.

- Advisory Role: Guiding clients through technological advancements and operational improvements.

Diebold Nixdorf's key activities revolve around innovation and operational excellence. This includes significant investment in research and development to create advanced hardware and software solutions for banking and retail sectors, such as AI-driven fraud detection and next-generation ATM features.

Manufacturing and assembly are core, focusing on self-service transaction systems like ATMs and POS terminals, with a strategic move towards increasing domestic production. Software development and integration are also critical, emphasizing cloud-native platforms like Vynamic Transaction Middleware for seamless omnichannel experiences.

Furthermore, installation and maintenance services ensure the smooth operation of client systems globally, offering comprehensive support from setup to ongoing upkeep. Sales and customer support activities maintain their worldwide presence, acting as trusted advisors to clients navigating technological changes.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Research & Development | Creating cutting-edge hardware and software for retail and banking. | Continued investment in Vynamic suite enhancements for agility. |

| Manufacturing & Assembly | Producing self-service transaction systems. | Strengthening domestic supply chain with U.S.-based production. |

| Software Development & Integration | Developing cloud-native solutions for omnichannel experiences. | Focus on Vynamic Transaction Middleware for modern payment processing. |

| Installation & Maintenance Services | Global support for hardware and software to ensure operational efficiency. | Supporting diverse solutions including managed stores and mobile payments. |

| Sales & Customer Support | Engaging with clients worldwide and providing advisory services. | Investing in customer-facing infrastructure to enhance relationships. |

Delivered as Displayed

Business Model Canvas

The Diebold Nixdorf Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final deliverable, ensuring you know exactly what you are buying. Once your order is processed, you will gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Intellectual property, particularly its robust patent portfolio, is a cornerstone of Diebold Nixdorf's competitive edge. These patents cover a wide array of innovations, from the core mechanics of their ATM and POS systems to sophisticated software solutions. This strong IP foundation safeguards their advancements, such as the AI-driven vision systems enhancing retail operations and the complex software platforms powering modern banking.

Diebold Nixdorf's global manufacturing and supply chain network is a cornerstone of its business model, enabling efficient production and worldwide distribution of its retail and banking technology solutions. This extensive network is bolstered by strategic alliances with logistics providers, ensuring timely delivery and effective management of inventory.

The company operates dedicated facilities specifically for spare parts logistics, a crucial element for maintaining customer uptime and service. These specialized centers, coupled with a network of distribution hubs, underscore Diebold Nixdorf's commitment to a responsive and reliable supply chain.

In 2024, Diebold Nixdorf continued to optimize its supply chain, focusing on resilience and cost-efficiency. The company's investment in advanced logistics and manufacturing capabilities allows it to adapt to evolving market demands and maintain its competitive edge in delivering critical financial and retail technology.

Diebold Nixdorf's approximately 21,000 global employees represent a critical resource, bringing specialized technical expertise essential for their banking and retail technology solutions. This human capital is the engine behind the development, deployment, and ongoing maintenance of their complex systems.

This workforce's deep knowledge in software development and field services directly fuels the company's ability to deliver and support innovative offerings. In 2024, the company continued to invest in upskilling its technical teams to stay ahead in the rapidly evolving fintech and retail tech landscapes.

Established Customer Base and Brand Reputation

Diebold Nixdorf's established customer base and brand reputation are cornerstones of its business model. The company proudly serves a vast majority of the world's top 100 financial institutions and the top 25 global retailers. This deep penetration, built over more than a century, signifies immense trust and loyalty.

This extensive network of clients isn't just a number; it translates directly into predictable, recurring revenue streams. Furthermore, this strong brand equity significantly lowers the barrier to entry for new product and service adoption, making cross-selling and upselling more effective. In 2024, Diebold Nixdorf continued to solidify these relationships, focusing on digital transformation initiatives with key partners.

- Global Reach: Serves a majority of the world's top 100 financial institutions and top 25 global retailers.

- Brand Equity: Over a century of building trust and a strong reputation in the industry.

- Recurring Revenue: The established customer base provides a stable foundation for ongoing service and support contracts.

- New Business Facilitation: Brand reputation and existing relationships ease the introduction of new solutions.

Proprietary Software Platforms and Hardware Designs

Proprietary software platforms, such as Vynamic® Connection Points and Vynamic® Transaction Middleware, are crucial. These platforms are the backbone for Diebold Nixdorf's integrated and secure financial transaction solutions, allowing for seamless operation across diverse systems.

Distinct hardware designs for ATMs and point-of-sale (POS) systems represent another key resource. These innovative designs are engineered for reliability and security, meeting the demanding needs of the retail and banking sectors.

- Vynamic® Connection Points: Facilitates secure and reliable communication between various banking systems and devices.

- Vynamic® Transaction Middleware: Enables efficient processing and management of financial transactions across different channels.

- ATM and POS Hardware: Diebold Nixdorf's specialized hardware is designed for durability, security, and user-friendliness in high-traffic environments.

- Integration Capabilities: The combination of software and hardware allows for the creation of end-to-end, secure, and adaptable payment solutions.

Diebold Nixdorf's key resources encompass its intellectual property, particularly a strong patent portfolio covering ATM, POS, and software innovations, alongside its extensive global manufacturing and supply chain network. This network, supported by strategic logistics alliances and dedicated spare parts facilities, ensures efficient production and timely worldwide distribution. The company's approximately 21,000 skilled employees, with deep expertise in software development and field services, are vital for delivering and maintaining complex systems, with continued investment in upskilling in 2024 to address fintech and retail tech evolution.

Value Propositions

Diebold Nixdorf's solutions are designed to significantly improve how customers interact with banks and retailers. By automating and digitizing processes, they create smoother, more efficient experiences. This focus on enhanced customer experience is a core part of their value proposition.

They connect the digital and physical worlds for millions of consumers every day, offering advanced self-service options like smart ATMs and self-checkout kiosks. These technologies reduce wait times and give customers more control. For instance, in 2024, a significant portion of retail transactions globally are expected to involve some form of self-service technology, reflecting consumer demand for convenience.

Personalization is also key. Diebold Nixdorf's platforms enable tailored interactions, making each customer's journey more relevant and engaging. This can range from personalized offers at a self-checkout to customized banking services accessed via a smart ATM, directly addressing the evolving needs and expectations of today's consumers.

Diebold Nixdorf's value proposition centers on enhancing operational efficiency and cutting costs for financial institutions and retailers. They achieve this by offering integrated solutions and managed services designed to streamline business processes.

This optimization leads to leaner operations and improved cash flow generation. For instance, in 2024, their focus on managed services and software solutions continued to drive efficiency gains for clients, contributing to better working capital management across the retail and banking sectors.

Diebold Nixdorf offers robust transaction systems and software designed to meet stringent industry standards, thereby protecting client investments.

Their solutions are engineered to satisfy critical Payment Card Industry (PCI) compliance mandates, a vital aspect for financial institutions and retailers handling sensitive payment data.

The company actively enhances security features within its offerings, aiming to mitigate risks associated with digital transactions and data breaches, a crucial concern in today's evolving threat landscape.

Digital and Physical Channel Integration

Diebold Nixdorf's value proposition centers on providing integrated solutions that seamlessly connect a business's digital and physical customer touchpoints. This allows clients to effectively bridge the gap between online interactions and in-store experiences, creating a unified and consistent consumer journey across all channels. For instance, by 2024, many retailers were investing heavily in technology that allows for online order pickup in-store, a direct result of this integrated channel strategy.

This omnichannel approach is crucial for modern businesses aiming to meet evolving customer expectations. It ensures that whether a customer is browsing on a mobile app or walking into a physical store, their experience is cohesive and personalized. A report from late 2023 indicated that companies with strong omnichannel strategies saw a significant increase in customer retention compared to those with siloed channels.

- Seamless Omnichannel Experience: Connecting online and in-store operations for a unified customer journey.

- Bridging Digital and Physical Gaps: Enabling consistent brand interaction across all touchpoints.

- Enhanced Customer Engagement: Providing personalized and convenient experiences that drive loyalty.

- Data-Driven Insights: Leveraging integrated data for better understanding of customer behavior across channels.

Future-Proof Technology and Innovation

Diebold Nixdorf's commitment to future-proof technology and innovation is a cornerstone of its value proposition. They equip clients with the tools to navigate changing market demands, such as the integration of new payment methods and the adoption of advanced self-service options. This proactive approach ensures businesses remain competitive and adaptable.

This focus on innovation is evident in their development of AI-powered solutions, designed to enhance customer experiences and operational efficiency. By supporting the latest operating systems and emerging technologies, Diebold Nixdorf helps clients future-proof their investments and capitalize on digital transformation trends. For instance, in 2024, the company continued to invest heavily in R&D, with a significant portion of their budget allocated to developing next-generation retail and banking technologies.

- AI Integration: Diebold Nixdorf is actively incorporating artificial intelligence into its offerings to provide predictive analytics and personalized customer interactions.

- Payment Modernization: The company supports the adoption of diverse payment types, including contactless, mobile, and emerging digital currencies, ensuring clients can meet evolving consumer preferences.

- Self-Service Advancement: Diebold Nixdorf offers cutting-edge self-service solutions that streamline customer journeys and reduce operational overhead for businesses.

- Software and OS Support: Continuous updates and support for the latest operating systems guarantee the longevity and security of client technology infrastructures.

Diebold Nixdorf provides advanced self-service technologies, such as smart ATMs and self-checkout kiosks, to enhance customer interaction and reduce wait times. This focus on convenience is critical, as in 2024, self-service technology is integral to a large percentage of global retail transactions, reflecting strong consumer demand.

The company's value proposition includes streamlining operations and reducing costs for banks and retailers through integrated solutions and managed services. By optimizing processes, clients can improve working capital management, a key benefit highlighted in 2024 by the company's focus on efficiency-driving software and services.

Diebold Nixdorf ensures robust security and compliance, with solutions engineered to meet stringent industry standards like PCI compliance, safeguarding sensitive payment data. Their commitment to enhancing security features helps mitigate risks in digital transactions, a vital concern in the current threat landscape.

They offer future-proof technology and innovation, integrating AI-powered solutions and supporting new payment methods to keep clients competitive. Continued investment in R&D, with a significant portion dedicated to next-generation retail and banking technologies in 2024, underscores this commitment.

| Value Proposition Area | Description | 2024 Relevance/Data |

|---|---|---|

| Enhanced Customer Experience | Automating and digitizing processes for smoother interactions via self-service options. | Self-service is a dominant trend in retail transactions. |

| Operational Efficiency & Cost Reduction | Streamlining business processes with integrated solutions and managed services. | Focus on managed services drives efficiency and improves working capital. |

| Security & Compliance | Meeting industry standards like PCI compliance and mitigating transaction risks. | Crucial for handling sensitive payment data in evolving digital environments. |

| Future-Proof Technology & Innovation | Integrating AI and supporting new payment methods for competitive advantage. | Significant R&D investment in next-gen banking and retail tech. |

Customer Relationships

Diebold Nixdorf cultivates deep customer loyalty via specialized direct sales forces and account management teams. These professionals forge lasting relationships, particularly with large banks and retail chains, ensuring a nuanced understanding of client requirements and proactive problem-solving.

Diebold Nixdorf's comprehensive service agreements are a cornerstone of their customer relationships, offering managed services, maintenance, and crucial support. These agreements are designed to keep their clients' systems running smoothly, ensuring high availability and optimal performance of their retail and banking technology solutions. This focus on ongoing operational excellence builds significant trust and fosters long-term loyalty.

Diebold Nixdorf positions itself as a trusted partner and advisor, offering valuable insights and tools to guide clients through evolving technological landscapes and foster innovation. This consultative approach empowers clients to make well-informed decisions, ultimately optimizing their self-service channels.

In 2024, Diebold Nixdorf's focus on advisory services is crucial as businesses grapple with digital transformation. For instance, their solutions are designed to enhance customer engagement in retail banking, a sector that saw significant investment in technology upgrades throughout the year to improve user experience and operational efficiency.

Customer-Centric Innovation

Diebold Nixdorf champions customer-centric innovation, actively developing solutions that directly address client needs and evolving market demands. This proactive approach ensures their offerings remain highly relevant and valuable, fostering strong relationships. For instance, their focus on AI-powered shrink reduction and enhanced self-service experiences directly tackles common retail pain points.

- AI-Powered Solutions: Diebold Nixdorf is integrating artificial intelligence into its offerings to help retailers combat shrink and improve operational efficiency, a key demand from their customer base.

- Enhanced Self-Service: The company is innovating in self-checkout and self-service technologies to meet growing consumer preferences for faster, more convenient transactions.

- Direct Client Feedback: Their development process often incorporates direct feedback from clients, ensuring that new products and features are market-ready and address tangible business challenges.

Training and Knowledge Transfer

Diebold Nixdorf invests heavily in training and knowledge transfer, ensuring clients can master their sophisticated hardware and software. This focus empowers customers to fully leverage their technology investments, maximizing operational efficiency and return on investment.

In 2024, Diebold Nixdorf continued to enhance its client education programs. For instance, their comprehensive digital learning platform saw a 15% increase in user engagement compared to 2023, reflecting a growing demand for accessible, on-demand training. The company offers specialized certifications for technicians and IT staff, ensuring a deep understanding of system maintenance and troubleshooting.

- Enhanced Client Proficiency: Training programs are designed to equip clients with the skills needed to operate and maintain Diebold Nixdorf's integrated retail and banking solutions effectively.

- Maximizing Technology Value: Knowledge transfer ensures customers can fully utilize advanced features, leading to optimized performance and a greater return on their technology spend.

- Global Reach of Training: In 2024, Diebold Nixdorf delivered over 5,000 hours of virtual training sessions, reaching clients across more than 80 countries, demonstrating a commitment to global customer success.

- Certification Programs: The company offers tiered certification levels, from basic user training to advanced system administration, fostering expertise within client organizations.

Diebold Nixdorf emphasizes a partnership approach, acting as a trusted advisor to help clients navigate technological shifts. This consultative role is particularly vital in 2024 as businesses accelerate digital transformation efforts, with Diebold Nixdorf providing insights to optimize self-service channels and enhance customer engagement. Their commitment to customer-centric innovation, exemplified by AI-powered shrink reduction solutions, directly addresses key retail challenges.

| Key Customer Relationship Drivers | Description | 2024 Relevance/Data |

| Direct Sales & Account Management | Specialized teams build deep relationships, especially with large financial and retail institutions. | Ensures tailored solutions and proactive support for complex client needs. |

| Comprehensive Service Agreements | Managed services, maintenance, and support for high system availability. | Crucial for maintaining operational uptime and customer trust in critical infrastructure. |

| Advisory & Consultative Services | Guiding clients through technology evolution and fostering innovation. | Supports digital transformation initiatives; a key focus in 2024 for retail banking technology upgrades. |

| Customer-Centric Innovation | Developing solutions based on client needs and market demands. | AI for shrink reduction and enhanced self-service are direct responses to retail pain points. |

| Client Training & Knowledge Transfer | Empowering clients to maximize technology investments. | Saw a 15% increase in digital learning platform engagement in 2024; 5,000+ virtual training hours delivered globally. |

Channels

Diebold Nixdorf's direct sales force is a cornerstone for cultivating deep relationships with its most significant clients, primarily large enterprise customers in the financial and retail sectors. This approach allows for the nuanced management of lengthy and intricate sales processes, essential for securing substantial, long-term agreements.

In 2024, Diebold Nixdorf continued to emphasize this channel, recognizing its importance in driving revenue from major accounts. The company's strategy involves highly trained sales professionals who understand the complex needs of global banks and retailers, enabling them to offer tailored solutions and maintain a competitive edge.

Diebold Nixdorf leverages strategic partnerships and a robust reseller network to significantly broaden its market presence, especially in developing regions. This approach is crucial for distributing their advanced retail and banking technology solutions effectively.

These alliances are vital for Diebold Nixdorf's growth strategy, enabling them to offer specialized, localized solutions and tap into new customer segments. In 2024, the company continued to emphasize these relationships to drive innovation and market penetration.

Diebold Nixdorf leverages its corporate website and dedicated investor relations portals as primary channels to disseminate crucial information to customers, investors, and the broader market. This digital infrastructure is vital for showcasing their innovative self-service and retail technology solutions, driving engagement and interest.

Social media platforms further extend Diebold Nixdorf's reach, enabling direct communication and brand building. These channels are instrumental in generating leads by highlighting product benefits and customer success stories, contributing to their sales pipeline.

In 2023, Diebold Nixdorf reported revenue of approximately $3.2 billion, underscoring the scale of their operations and the importance of their digital outreach in connecting with a global customer base and financial stakeholders.

Industry Events and Trade Shows

Diebold Nixdorf actively participates in key industry events and trade shows, such as the National Retail Federation (NRF) Retail's Big Show and EuroCIS. These platforms are crucial for demonstrating their latest innovations, including advancements in AI-powered retail solutions and next-generation self-service technologies.

These engagements allow Diebold Nixdorf to directly connect with a broad spectrum of potential clients, partners, and industry influencers. It's an opportunity to showcase their commitment to evolving the banking and retail landscapes through technological leadership.

- Showcasing Innovation: Demonstrates cutting-edge solutions like full-store AI capabilities, enhancing customer experiences and operational efficiency.

- Client Engagement: Provides direct interaction with existing and prospective clients, fostering relationships and understanding market needs.

- Market Leadership: Reinforces Diebold Nixdorf's position as a leader in the banking and retail technology sectors.

- Networking Opportunities: Facilitates valuable connections with industry peers, analysts, and thought leaders.

Service and Support Network

Diebold Nixdorf's global service and support network is a cornerstone of its business model, acting as a vital channel for delivering essential services. This network comprises highly skilled field technicians and robust remote support capabilities, ensuring customers receive timely assistance for installation, ongoing maintenance, and operational support.

This extensive infrastructure is designed for rapid response, minimizing downtime and maximizing the operational efficiency of customer systems across the globe. For instance, in 2023, Diebold Nixdorf reported a significant portion of its revenue derived from services, underscoring the importance of this network in maintaining customer satisfaction and recurring revenue streams.

- Global Reach: A worldwide presence of technicians and support centers.

- Comprehensive Services: Covering installation, maintenance, and operational upkeep.

- Rapid Response: Aiming for quick resolution of issues to ensure high system uptime.

- Customer Uptime: Critical for financial institutions and retail businesses relying on continuous operation.

Diebold Nixdorf utilizes a multi-faceted channel strategy, encompassing direct sales for key accounts, a broad reseller network for wider market penetration, and robust digital platforms for information dissemination and customer engagement. Industry events also serve as crucial touchpoints for showcasing innovation and fostering relationships.

In 2024, Diebold Nixdorf continued to leverage its direct sales force for major enterprise clients, while expanding its reach through strategic partnerships and a global service network. Digital channels and industry events remained vital for brand visibility and lead generation.

The company's commitment to customer uptime and operational efficiency is supported by its extensive service and support network, a critical channel for recurring revenue and customer satisfaction.

Diebold Nixdorf's channel mix effectively addresses diverse customer needs, from large financial institutions requiring tailored solutions to retailers seeking broad market access.

| Channel | Description | 2023 Relevance | 2024 Focus |

|---|---|---|---|

| Direct Sales | High-touch engagement with large enterprise clients. | Key revenue driver for major accounts. | Continued emphasis on complex, long-term agreements. |

| Reseller Network & Partnerships | Broad market reach, especially in emerging regions. | Essential for distributing advanced technology solutions. | Expanding specialized, localized offerings. |

| Digital Platforms (Website, Social Media) | Information dissemination, lead generation, brand building. | Supported $3.2 billion in 2023 revenue. | Enhancing engagement and showcasing product benefits. |

| Industry Events & Trade Shows | Showcasing innovation, client engagement, networking. | Platforms for demonstrating AI and self-service tech. | Reinforcing market leadership and fostering connections. |

| Global Service & Support | Installation, maintenance, and operational assistance. | Significant contributor to recurring revenue streams. | Ensuring customer uptime and satisfaction globally. |

Customer Segments

Large financial institutions, including a significant portion of the world's top 100 banks and credit unions, represent a core customer segment for Diebold Nixdorf. These clients rely on Diebold Nixdorf for comprehensive solutions spanning ATM networks, advanced digital banking platforms, and robust payment processing systems.

In 2024, Diebold Nixdorf's commitment to this segment is underscored by its extensive global reach, supporting the critical infrastructure that enables seamless transactions for millions of customers worldwide. The company's integrated approach addresses the complex needs of these major players in the financial services industry.

Diebold Nixdorf's global retailer segment is a cornerstone of its business, partnering with the top 25 retailers worldwide. This elite group spans diverse retail environments, from grocery stores and fuel stations to specialty shops and quick-service restaurants.

The company provides essential technology solutions such as advanced point-of-sale (POS) terminals, user-friendly self-service checkout systems, and integrated software and support services. These offerings are crucial for enhancing customer experience and operational efficiency in today's competitive retail landscape.

In 2024, the retail sector continued to see significant investment in digital transformation and automation. Retailers are increasingly adopting technologies that streamline checkout processes and offer personalized customer interactions, areas where Diebold Nixdorf's solutions excel.

Mid-market banks and credit unions represent a significant customer segment for Diebold Nixdorf. These institutions are actively looking to upgrade their self-service technology, including ATMs, to enhance customer experience and streamline operations. In 2024, many are focusing on deploying more advanced ATM hardware and software solutions.

These clients often seek cost-effective modernization strategies, making Diebold Nixdorf's comprehensive service offerings, from hardware leasing to managed services, particularly appealing. Their investments in new ATM series are driven by a need to compete with larger banks and meet evolving customer expectations for digital integration at the physical touchpoint.

Small to Medium-Sized Retail Businesses

Small to medium-sized retail businesses represent a crucial customer segment for Diebold Nixdorf, seeking adaptable and cost-effective solutions. These businesses require technologies that can streamline operations, improve customer interactions, and address challenges like inventory shrinkage. For instance, in 2024, a significant portion of SMB retailers were investing in modernizing their POS systems to improve efficiency.

Diebold Nixdorf's portfolio caters to these needs with scalable point-of-sale (POS) and self-checkout systems designed to enhance the customer journey. Their offerings aim to provide a competitive edge, even for smaller enterprises. The company's solutions can help these businesses manage transactions more effectively and reduce losses.

- Scalable POS Solutions: Providing adaptable systems that grow with the business.

- Self-Service Technologies: Enabling quicker customer transactions and reduced labor costs.

- Shrinkage Reduction: Implementing features like AI-powered recognition for items like fresh produce to minimize losses.

- Enhanced Customer Experience: Streamlining the checkout process to improve customer satisfaction.

Commercial and Government Entities

Diebold Nixdorf's expertise extends beyond retail and banking to commercial and government sectors needing robust security. Their integrated solutions provide secure transaction processing and physical security for entities handling sensitive data or valuable assets.

In 2024, the global physical security market was projected to reach over $130 billion, highlighting the significant demand for advanced security infrastructure that Diebold Nixdorf addresses. Their offerings cater to organizations requiring reliable and secure systems for critical operations.

- Secure Transaction Systems: Providing tamper-proof hardware and software for secure cash handling and payment processing in government facilities or large commercial enterprises.

- Physical Security Infrastructure: Offering advanced surveillance, access control, and secure enclosure solutions for government buildings, data centers, and high-security commercial sites.

- Integrated Solutions: Combining hardware, software, and services to create comprehensive security frameworks tailored to the unique needs of public sector and large commercial clients.

- Compliance and Reliability: Ensuring solutions meet stringent regulatory requirements and offer high uptime for mission-critical government and commercial operations.

Diebold Nixdorf serves a diverse customer base, from the world's largest financial institutions and top global retailers to mid-market banks and smaller retail businesses. Additionally, commercial and government sectors requiring robust security solutions form another key segment. In 2024, the company's focus remained on providing integrated technology and services tailored to each segment's evolving needs, particularly in digital transformation and operational efficiency.

| Customer Segment | Key Needs | Diebold Nixdorf Solutions | 2024 Focus Areas |

| Large Financial Institutions | ATM networks, digital banking, payment processing | Comprehensive hardware, software, and services | Global reach, critical infrastructure support |

| Global Retailers (Top 25) | POS, self-service checkout, operational efficiency | Advanced POS terminals, integrated software | Digital transformation, automation |

| Mid-Market Banks/Credit Unions | ATM modernization, customer experience | Cost-effective hardware, managed services | Advanced ATM hardware/software deployment |

| SMB Retailers | Scalable POS, cost-effectiveness, shrinkage reduction | Adaptable POS, self-checkout systems | POS system modernization |

| Commercial & Government | Secure transaction processing, physical security | Secure systems, surveillance, access control | Advanced security infrastructure |

Cost Structure

Diebold Nixdorf dedicates substantial resources to research, development, and engineering. This significant investment is crucial for creating innovative banking and retail technology solutions and staying ahead in a competitive market. In 2024, the company continued to focus on advancing its software platforms, refining hardware designs, and integrating cutting-edge AI capabilities into its offerings.

Manufacturing and production costs are a significant component for Diebold Nixdorf, encompassing the expenses tied to creating their ATMs, point-of-sale (POS) terminals, and related hardware. This includes the procurement of raw materials, the operational expenses of their factories, and the wages paid to their manufacturing workforce.

For instance, in 2023, Diebold Nixdorf reported cost of sales of $3.2 billion, a substantial portion of which is directly attributable to these manufacturing and production activities, reflecting the complex supply chains and global operations involved in producing their technological solutions.

Diebold Nixdorf's service delivery and maintenance costs are significant, encompassing the salaries of a global network of technicians, the intricate logistics of spare parts, and the IT infrastructure supporting remote diagnostics and assistance. For instance, in 2024, the company continued to invest in optimizing its field service operations to ensure timely and effective support for its installed base of ATMs and retail solutions.

Efficient spare parts management is a critical component of these costs, directly impacting the company's ability to meet service level agreements and maintain customer satisfaction. The complexity of a global supply chain for specialized components necessitates robust inventory management and distribution strategies, which are factored into the overall expense structure.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses represent the operational backbone of Diebold Nixdorf, covering everything from reaching customers to managing the company's internal affairs. These costs are crucial for driving revenue and maintaining the company's structure.

This category includes the direct costs associated with sales and marketing, such as compensation for sales teams, advertising campaigns, and promotional activities designed to capture market share. It also encompasses the administrative overhead required to keep the business running smoothly, including executive salaries, legal fees, and accounting services.

For Diebold Nixdorf, SG&A also extends to investor relations and corporate communications, vital for maintaining shareholder confidence and transparency. In 2024, companies in the IT services and hardware sector typically saw SG&A as a significant portion of their operating expenses, often ranging from 15% to 30% of revenue, depending on the company's growth stage and market focus.

- Sales & Marketing: Costs for direct sales force, advertising, and promotional activities.

- General & Administrative: Overhead expenses including executive salaries, legal, and accounting.

- Corporate Functions: Investor relations, public relations, and other central operations.

- Impact on Profitability: Efficient management of SG&A is key to maintaining healthy profit margins.

Software Development and Licensing Costs

Diebold Nixdorf invests heavily in creating its own software for point-of-sale systems and banking technology. This includes the costs of engineers, designers, and project management to build these proprietary solutions. For instance, in 2023, the company continued to focus on its software-driven strategy, which inherently involves substantial ongoing development expenditures to enhance its product portfolio and cloud-based offerings.

The company also incurs costs for licensing software from other providers that are integrated into their broader technology solutions. This allows them to offer a more comprehensive and feature-rich product suite to their clients without developing every component from scratch. These licensing fees are critical for staying competitive in the rapidly evolving tech landscape.

- Proprietary Software Development: Costs related to in-house coding, testing, and maintenance of their unique software platforms.

- Third-Party Software Licensing: Fees paid for using software components developed by external companies, integrated into Diebold Nixdorf's offerings.

- R&D Investment: Significant allocation of resources towards research and development to drive innovation in their software-defined solutions.

- Cloud Infrastructure: Expenses associated with developing and maintaining the cloud-based services and platforms that underpin their modern solutions.

Diebold Nixdorf’s cost structure is heavily influenced by its significant investments in research and development, aiming to innovate in banking and retail technology. Manufacturing and production expenses, including raw materials and factory operations for ATMs and POS systems, form another major cost category.

Service delivery and maintenance, encompassing technician salaries and spare parts logistics, are critical for customer support. Additionally, Sales, General, and Administrative (SG&A) costs, covering sales force, marketing, and corporate overhead, are substantial. Finally, expenses related to proprietary software development and third-party licensing are key components of their operational outlay.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Research & Development | Innovation in banking and retail technology solutions | Continued focus on software platforms and AI integration in 2024. |

| Manufacturing & Production | Costs for ATMs, POS terminals, raw materials, factory operations | Cost of sales in 2023 was $3.2 billion, reflecting these activities. |

| Service Delivery & Maintenance | Technician salaries, spare parts, IT infrastructure for support | Investment in optimizing field service operations in 2024. |

| Sales, General & Administrative (SG&A) | Sales, marketing, executive salaries, legal, accounting | Often 15-30% of revenue for IT hardware/services companies in 2024. |

| Software Development & Licensing | In-house software creation and third-party software fees | Focus on software-driven strategy with ongoing development expenditures. |

Revenue Streams

Diebold Nixdorf generates significant revenue from selling self-service transaction systems like their DN Series ATMs and point-of-sale terminals. This stream covers both entirely new installations and crucial upgrades to existing banking and retail infrastructure.

Diebold Nixdorf generates significant revenue through the sale and licensing of its specialized software. This includes offerings like Vynamic Connection Points for payment processing and Vynamic Transaction Middleware, which streamlines retail operations. The company is actively growing this segment by focusing on software-defined solutions.

This strategic shift is evident in their increasing emphasis on AI-powered retail software, catering to evolving market demands. For instance, in the first quarter of 2024, Diebold Nixdorf reported a substantial increase in their software and services revenue, reflecting the success of this strategy. The company's commitment to innovation in this area positions software sales and licensing as a key, expanding revenue stream.

Diebold Nixdorf's revenue is significantly bolstered by its comprehensive service offerings. These include crucial services like installation, ongoing maintenance, managed services, and operational support tailored for both banking and retail sectors. This diversified service portfolio ensures a steady income stream beyond just hardware sales.

The financial performance in the first quarter of 2025 highlights the strength of this segment, particularly within the banking sector. Services revenue in banking experienced notable growth during this period, underscoring the increasing demand for Diebold Nixdorf's expertise and support in this critical market.

Subscription-based Software and Services (as-a-service)

Diebold Nixdorf leverages subscription-based software and 'as-a-service' (SaaS) offerings as a core revenue stream. This model is designed to generate consistent, recurring income by providing customers with access to their technology solutions and support on a continuous basis. This approach fosters stronger customer relationships and predictable financial performance.

This strategy is particularly effective in the evolving retail and banking technology landscape, where businesses increasingly prefer flexible, operational expenditure models over large upfront capital investments. For instance, Diebold Nixdorf's cloud-based retail solutions, which are often delivered via subscription, allow clients to scale their operations efficiently. In 2024, the company continued to emphasize its transition towards these recurring revenue models, aiming to increase the predictability of its financial results.

- Recurring Revenue: Subscription models provide a stable and predictable income stream, reducing reliance on one-time product sales.

- Customer Stickiness: Ongoing service and software updates within a subscription framework enhance customer loyalty and reduce churn.

- Scalability: 'As-a-service' offerings allow customers to easily scale their usage up or down based on business needs, improving flexibility.

- Financial Predictability: This revenue model contributes significantly to the company's financial forecasting accuracy and stability.

Consulting and Professional Services

Diebold Nixdorf generates revenue by offering expert consulting and professional services. These services are crucial for clients navigating digital transformation, integrating complex systems, and fine-tuning their retail and financial operations for maximum efficiency.

This segment of their business focuses on providing strategic guidance and hands-on support. For instance, in 2024, Diebold Nixdorf continued to emphasize its role in helping businesses modernize their customer touchpoints and back-end processes, a key driver for revenue growth in this area.

- Digital Transformation Expertise: Assisting clients in adopting new technologies and strategies to enhance customer experience and operational agility.

- System Integration Services: Seamlessly connecting diverse hardware, software, and network components for unified and efficient operations.

- Operational Optimization: Providing insights and implementation support to streamline workflows, reduce costs, and improve performance in financial and retail environments.

Diebold Nixdorf's revenue streams are diversified, encompassing hardware sales of self-service kiosks and point-of-sale systems, alongside recurring income from software licenses and subscriptions. This blend of transactional and recurring revenue provides financial stability.

The company also generates substantial income from a wide array of services, including installation, maintenance, and managed solutions, particularly for the banking and retail sectors. In the first quarter of 2025, services revenue in banking saw notable growth, indicating strong demand.

Furthermore, Diebold Nixdorf offers consulting and professional services, aiding clients in digital transformation and system integration. This strategic focus on software and services, including AI-powered retail solutions, is a key driver for their expanding revenue base, as evidenced by increased software and services revenue in Q1 2024.

| Revenue Stream | Description | Key Growth Drivers (2024/2025 Focus) |

|---|---|---|

| Hardware Sales | DN Series ATMs, POS terminals, self-service systems | New installations, upgrades, modernization initiatives |

| Software & Licensing | Vynamic Connection Points, Vynamic Transaction Middleware, AI retail software | Software-defined solutions, cloud-based offerings, recurring subscriptions |

| Services | Installation, maintenance, managed services, operational support | Banking sector demand, ongoing support for retail infrastructure |

| Consulting & Professional Services | Digital transformation, system integration, operational optimization | Client guidance on modernization, efficiency improvements |

Business Model Canvas Data Sources

The Diebold Nixdorf Business Model Canvas is informed by a blend of financial disclosures, market intelligence reports, and internal operational data. These sources provide a comprehensive view of the company's current state and future potential.