Diebold Nixdorf Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diebold Nixdorf Bundle

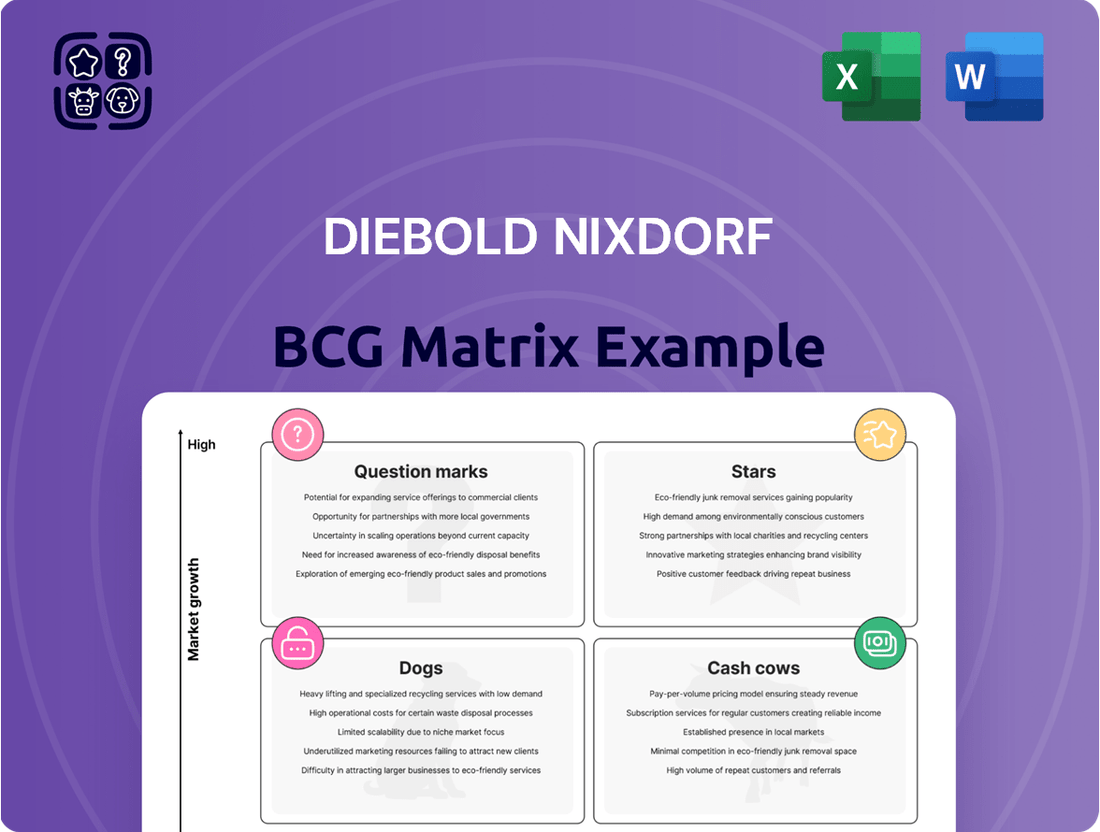

Curious about Diebold Nixdorf's product portfolio? Our BCG Matrix analysis offers a glimpse into their Stars, Cash Cows, Dogs, and Question Marks. To truly understand their strategic positioning and unlock actionable insights for your own business, you need the full picture.

Don't settle for a partial view. Purchase the complete Diebold Nixdorf BCG Matrix report for a detailed quadrant breakdown, expert commentary, and strategic recommendations designed to guide your investment and product development decisions. Secure your competitive edge today!

Stars

Diebold Nixdorf has solidified its position as a major player in self-service checkout solutions, achieving the second-largest global market share. This impressive growth is fueled by significant retailer investment in advanced self-service technologies, especially across Europe and North America.

In 2023, Diebold Nixdorf captured a commanding 40% market share in the EMEA region, underscoring its leadership. The company’s forward-thinking product line, featuring AI and computer vision for enhanced shrink reduction and age verification, directly addresses critical retailer demands.

The DN Series® ATMs are a standout performer for Diebold Nixdorf. As of early 2024, the company had shipped over 200,000 units worldwide, a significant increase that effectively doubled their shipments compared to Q1 2023. This robust sales trajectory positions the DN Series® squarely in the Stars category of the BCG Matrix.

These ATMs represent the next generation of self-service banking, engineered for exceptional availability and the delivery of advanced, personalized customer experiences. Their success is fueled by features like widespread cash recycler adoption and a commitment to digital inclusion, making them highly competitive across diverse global markets.

Diebold Nixdorf is heavily investing in cloud-based banking solutions, recognizing their importance in competing with tech giants and nimble fintech startups. These solutions are designed to allow for remote management and the easy introduction of new software features for their extensive network of installed banking machines.

This strategic shift towards an agile, cloud-native core infrastructure aims to make Diebold Nixdorf's services more adaptable and readily deployable across various customer interaction points.

AI and Computer Vision for Retail

The integration of AI and computer vision into Diebold Nixdorf's self-service solutions is a significant driver of growth, particularly in areas like shrink reduction, produce recognition, and age verification. These advanced technologies are crucial for elevating the retail customer experience and providing tangible value to businesses.

The market for AI and computer vision solutions is experiencing robust expansion, with a projected compound annual growth rate (CAGR) of 8.7%. This strong adoption rate underscores the increasing reliance on these capabilities within the retail sector.

- Shrink Reduction: AI-powered video analytics can identify suspicious activities, reducing inventory loss.

- Produce Recognition: Computer vision enables self-checkout systems to accurately identify and price fresh produce, improving efficiency.

- Age Verification: AI can automate and streamline age verification processes for restricted items, enhancing compliance and customer convenience.

- Enhanced Customer Experience: These technologies contribute to faster, more intuitive, and personalized shopping journeys.

Digital Banking Platforms & Integrated Channels

Diebold Nixdorf is at the forefront of merging digital and physical banking experiences, a critical move in today's market. Their platforms are designed to bridge the gap, offering financial institutions the tools to create seamless, efficient, and personalized customer journeys across all touchpoints.

This integration is crucial as the banking sector increasingly embraces omnichannel strategies. For instance, Diebold Nixdorf's solutions enable advanced functionalities within ATMs, such as contactless payments and personalized offers, reflecting a broader industry trend. By 2024, it's estimated that over 70% of all bank transactions will involve some form of digital interaction, highlighting the importance of these integrated channels.

Key aspects of their digital banking platforms and integrated channels include:

- Omnichannel Experience: Connecting ATMs, mobile banking, and online platforms for a unified customer view.

- Contactless Technology: Facilitating secure and convenient transactions through NFC and other contactless methods.

- Personalization: Leveraging data to offer tailored services and promotions at the point of interaction.

- Digital Transformation: Supporting banks in their move towards more agile and customer-centric operations.

Diebold Nixdorf's DN Series ATMs are strong performers, fitting the Stars category due to their high growth and market share. With over 200,000 units shipped by early 2024, representing a doubling of shipments from Q1 2023, these ATMs are leading the way in self-service banking innovation.

Their success is driven by advanced features like widespread cash recycling and a focus on digital inclusion, making them highly competitive globally. This positions them as a key growth driver for Diebold Nixdorf, benefiting from significant retailer investment in advanced self-service technologies.

The company's strategic investment in cloud-based solutions and AI integration further bolsters the appeal and functionality of these ATMs, ensuring their continued relevance and market leadership.

| Product/Segment | Market Share (EMEA 2023) | Growth Trajectory | BCG Category |

|---|---|---|---|

| DN Series ATMs | N/A (High adoption) | Doubled shipments Q1 2023 vs. Early 2024 | Stars |

| Self-Service Checkout | 2nd Largest Global Share | Fueled by retailer investment | Stars |

| AI/Computer Vision Solutions | N/A (Growing market) | 8.7% CAGR projected | Stars |

What is included in the product

This overview positions Diebold Nixdorf's product portfolio within the BCG Matrix, guiding strategic decisions for growth and resource allocation.

A clear BCG Matrix overview visually categorizes Diebold Nixdorf's business units, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Diebold Nixdorf's global ATM hardware and traditional services segment is a classic Cash Cow. The company commands a significant 32% of the worldwide ATM market, underscoring its established presence and market leadership.

Despite a slight downturn in the U.S. ATM sector, Diebold Nixdorf is strategically capitalizing on international growth, particularly in Europe and the U.K. Favorable regulatory environments and collaborative pooling efforts in these regions are sustaining demand for their ATM solutions.

With an impressive global installed base exceeding 800,000 ATMs, Diebold Nixdorf benefits from a consistent and predictable revenue stream. This large installed base ensures ongoing income from hardware maintenance, software updates, and other essential services.

Managed Services Agreements represent Diebold Nixdorf's Cash Cows. A substantial 70% of their service revenue is recurring, highlighting their strong cash generation.

The company consistently inks multi-year managed service deals with major financial players. For example, a recent five-year contract was secured with a leading Western European bank.

These agreements are crucial for Diebold Nixdorf, as they guarantee steady revenue streams and ensure high system availability for their clients, leading to predictable and stable profits.

Diebold Nixdorf's traditional point-of-sale (POS) hardware holds a strong position as a cash cow. The company is a significant player in the global POS hardware arena, competing with giants like NCR and Toshiba. This mature market still sees consistent demand for both new installations and hardware upgrades, ensuring a steady revenue stream.

Physical Security Products and Installation Services

Diebold Nixdorf's physical security products and installation services represent a classic Cash Cow. This segment caters to the ongoing, steady demand from financial institutions for essential security infrastructure, ensuring a reliable revenue stream. The consistent need for maintenance and upgrades means this business line offers stability within the company's portfolio.

The market for physical security in financial services, while not experiencing explosive growth, is characterized by persistent demand. This is driven by regulatory requirements and the perpetual need for robust protection against theft and fraud. In 2024, the global physical security market was projected to reach over $100 billion, with financial institutions being significant contributors to this spending.

- Stable Revenue: Provides a consistent income due to the essential nature of security for banks.

- Low Growth, High Share: Operates in a mature market with established demand, maintaining a strong market position.

- Investment Focus: Generates cash that can be reinvested into higher-growth areas of the business.

- Client Retention: High switching costs for security systems often lead to long-term customer relationships.

Lean Operational Principles and Cost Management

Diebold Nixdorf's commitment to lean operational principles has been a cornerstone in its journey toward enhanced profitability and robust free cash flow generation. This disciplined approach to efficiency has directly translated into tangible financial benefits.

The company's focus on streamlining operations has not only expanded its gross margins but has also been instrumental in generating strong free cash flow. For instance, in 2024, Diebold Nixdorf reported significant improvements in its operational efficiency, contributing to a notable increase in its cash from operations.

These internal efficiencies are crucial for maximizing the cash generated from existing operations, a key characteristic of a cash cow. By minimizing waste and optimizing processes, Diebold Nixdorf ensures that its established business segments continue to be strong contributors to overall cash flow.

- Gross Margin Expansion: Disciplined execution of lean principles directly fuels gross margin growth.

- Robust Free Cash Flow: Operational efficiencies are a primary driver for strong free cash flow generation.

- Maximizing Existing Operations: Internal efficiencies ensure that established segments generate substantial cash.

- 2024 Performance: The company demonstrated notable improvements in operational efficiency during 2024, boosting cash from operations.

Diebold Nixdorf's ATM hardware and traditional services are prime examples of Cash Cows within the BCG Matrix. These segments benefit from a significant global market share, approximately 32% of the worldwide ATM market, and a substantial installed base of over 800,000 ATMs. This installed base ensures a predictable and consistent revenue stream through ongoing maintenance, software updates, and managed services, with 70% of their service revenue being recurring.

Managed Services Agreements are a critical Cash Cow, generating substantial recurring revenue and guaranteeing stable profits through long-term contracts with major financial institutions. The company's traditional POS hardware also represents a strong Cash Cow, maintaining a solid position in a mature market with consistent demand for installations and upgrades.

Physical security products and installation services for financial institutions are also identified as Cash Cows. This segment taps into the steady demand driven by regulatory requirements and the continuous need for robust security infrastructure. In 2024, the global physical security market was projected to exceed $100 billion, with financial services being a key contributor.

The company's focus on lean operational principles in 2024 significantly boosted profitability and free cash flow. These efficiencies directly contribute to expanding gross margins and maximizing cash generation from established business segments, ensuring these Cash Cows continue to be strong financial contributors.

| Segment | BCG Classification | Key Characteristics | 2024 Data/Context |

| ATM Hardware & Traditional Services | Cash Cow | High market share (32%), large installed base (>800k ATMs), predictable revenue from maintenance and services. | Strong international growth sustaining demand, particularly in Europe and UK. |

| Managed Services Agreements | Cash Cow | High recurring revenue (70% of service revenue), long-term contracts with financial institutions, stable profit generation. | Secured multi-year deals with major banks, ensuring steady income. |

| Traditional POS Hardware | Cash Cow | Strong market position, consistent demand for new installations and upgrades. | Competes with major players like NCR and Toshiba in a mature market. |

| Physical Security Products & Installation | Cash Cow | Steady demand from financial institutions, driven by regulatory needs and security requirements. | Global physical security market projected over $100 billion in 2024, with financial services a significant spender. |

What You’re Viewing Is Included

Diebold Nixdorf BCG Matrix

The Diebold Nixdorf BCG Matrix preview you are viewing is the complete, final document you will receive upon purchase. This means you're getting the exact same professionally formatted and analysis-ready report, free from any demo content or watermarks, allowing for immediate strategic application.

Dogs

Legacy hardware, such as older ATM and POS systems that cannot support modern operating systems like Windows 11 IoT Enterprise LTSC 2024, are prime candidates for the Dogs quadrant in the BCG Matrix. These systems often come with escalating maintenance expenses and a restricted feature set, diminishing their appeal to customers demanding contemporary solutions. For instance, a significant portion of the installed base of ATMs globally still operates on outdated Windows versions, posing security risks and limiting the integration of new digital services.

Diebold Nixdorf divested low-margin third-party hardware sales, especially within the European retail sector. This move signals that these particular product lines were not significantly boosting profitability and were instead consuming valuable resources.

This strategic exit from certain hardware sales is a key component of Diebold Nixdorf's broader plan to enhance its gross margins. The company is shifting its focus towards offering higher-value solutions that better align with its profitability goals.

In 2023, Diebold Nixdorf reported a gross margin of 31.3%, up from 29.8% in 2022, reflecting the positive impact of such strategic divestitures and a sharpened focus on core, profitable offerings.

Proprietary software solutions from Diebold Nixdorf that aren't integrated into the Vynamic platform or lack a clear upgrade to cloud or AI capabilities would likely fall into the Dogs category. These systems face significant challenges in a market that prioritizes connected and intelligent solutions.

For instance, older ATM software that requires extensive custom maintenance and cannot easily adopt new features like contactless payments or personalized offers would be a prime example. In 2023, Diebold Nixdorf reported that its ongoing efforts to modernize its software portfolio were crucial for future growth, implying that legacy systems are a drag on resources.

The cost of supporting these outdated systems often outweighs the revenue they generate, making them inefficient. Companies are increasingly demanding seamless integration and advanced functionalities, leaving these standalone solutions behind.

Non-Integrated, Standalone Physical Security Products

Non-integrated, standalone physical security products within Diebold Nixdorf's portfolio might be facing a decline. As the market increasingly favors connected commerce ecosystems, these isolated offerings provide less comprehensive value to customers seeking seamless digital and physical integration.

These products could represent potential divestiture candidates if they don't align with Diebold Nixdorf's strategic pivot towards integrated solutions. For instance, while Diebold Nixdorf aims to bolster its retail technology solutions, standalone security hardware might not contribute to this core objective.

- Diminishing Market Relevance: Standalone physical security products may struggle to compete in a market prioritizing integrated digital and physical customer journeys.

- Reduced Value Proposition: Without integration into a broader ecosystem, these products offer limited added value compared to comprehensive, connected solutions.

- Strategic Alignment Concerns: Products not contributing to the company's core strategy of connected commerce may be considered for divestiture to streamline operations and focus resources.

Underperforming Regional Operations or Niche Offerings

Underperforming regional operations or niche offerings are those segments of Diebold Nixdorf that exhibit both low market share and low growth. These areas often fall outside the company's primary strategic focus and, while they might not be losing money, they can tie up valuable capital without offering substantial future expansion potential. For instance, a specific, less profitable product line in a declining market segment could be a prime example.

These segments may require careful consideration. A review could highlight opportunities for streamlining processes, reducing operational costs, or even exploring divestment if they no longer align with Diebold Nixdorf's long-term vision. In 2024, companies across various sectors have been actively pruning non-core assets to boost efficiency and focus on high-growth areas.

- Low Market Share: These segments struggle to capture a significant portion of their respective markets.

- Low Growth Prospects: The markets these segments operate in are not expected to expand significantly in the future.

- Capital Tie-up: Resources invested in these areas could potentially be redeployed to more promising ventures.

- Strategic Misalignment: They may not contribute to the company's core competencies or long-term strategic objectives.

Legacy hardware and software solutions that are not integrated into modern platforms like Diebold Nixdorf's Vynamic ecosystem are considered Dogs. These offerings often have high support costs and limited market appeal due to their inability to support new features like contactless payments or advanced analytics.

Diebold Nixdorf’s divestiture of low-margin third-party hardware in Europe in 2023, which saw a gross margin improvement to 31.3% from 29.8% in 2022, exemplifies the strategic decision to shed such underperforming assets.

Standalone physical security products that lack integration into broader connected commerce ecosystems also fall into this category, as they offer a reduced value proposition in a market prioritizing seamless digital and physical integration.

Underperforming regional operations or niche product lines with low market share and low growth prospects, which tie up capital without significant future potential, are also classified as Dogs, prompting companies in 2024 to prune non-core assets.

| Category | Description | Example | Strategic Implication |

|---|---|---|---|

| Dogs | Low market share, low growth, high cost to maintain. | Outdated ATM software not supporting contactless payments. | Divestment or significant investment to modernize. |

| Dogs | Products with diminishing market relevance and reduced value proposition. | Standalone physical security hardware without digital integration. | Focus on integration or potential divestiture. |

| Dogs | Legacy systems unable to support current operating systems. | POS systems running on unsupported Windows versions. | High security risk and limited functionality. |

Question Marks

Interactive Teller Machines (ITMs) are a burgeoning area in emerging markets, blending ATM convenience with live video assistance from remote tellers. This innovation promises a richer customer experience and boosts operational efficiency for financial institutions. For Diebold Nixdorf, this represents a high-growth opportunity, especially in regions like the Middle East where adoption is accelerating.

However, the ITM segment is still maturing, and Diebold Nixdorf's current market share in this specific, fast-paced niche might be in its formative stages. Capturing a significant portion of this expanding market will necessitate substantial investment in technology and market penetration strategies. For instance, by the end of 2023, ITM deployments in Southeast Asia saw a notable uptick, indicating strong potential for further growth.

Diebold Nixdorf is actively embedding artificial intelligence into its security and fraud prevention offerings, notably enhancing protection on platforms like Windows 11 IoT Enterprise LTSC 2024 with advanced fraud scoring capabilities. This strategic move targets a burgeoning market driven by escalating cybersecurity concerns, with global cybersecurity spending projected to reach $300 billion in 2024.

While the demand for robust security is high, the market penetration and established share of these specific AI-powered solutions are likely in their nascent phases, positioning them as potential Question Marks within the BCG framework. Continued, significant investment in research and development, coupled with aggressive market penetration strategies, will be essential for these innovative security features to transition into market Stars.

Diebold Nixdorf's strategic push into untapped digital banking segments, driven by its digital transformation initiatives and agile core infrastructure, presents a significant opportunity. The company is eyeing areas like specialized digital services for niche markets and forging new partnerships with fintech companies, where its current footprint is minimal.

These emerging digital banking spaces are characterized by high growth potential, but successfully penetrating them will necessitate considerable investment. For instance, the global digital banking market was valued at approximately $25.5 billion in 2023 and is projected to reach over $70 billion by 2030, indicating substantial room for expansion.

Strategic Partnerships for Software Integration (e.g., LOC Software)

Diebold Nixdorf's strategic partnership with LOC Software to integrate retail management software onto its self-service terminals signifies a significant push towards deeper software integration. This move directly addresses the escalating demand for all-encompassing retail management solutions, aiming to offer more value beyond hardware.

This collaboration positions Diebold Nixdorf to capture a larger share of the retail technology market, which is experiencing robust growth. For instance, the global retail management software market was valued at approximately $10.5 billion in 2023 and is projected to reach over $21 billion by 2028, demonstrating substantial potential.

While this represents a high-growth opportunity, the market share derived from these newly integrated software offerings is still in its early stages. Expanding this segment necessitates considerable investment in research and development, alongside robust marketing efforts to establish a strong foothold against established software providers.

- Deepening Software Integration: Partnership with LOC Software for retail management software on self-service solutions.

- Market Demand: Addresses the increasing need for comprehensive retail management tools.

- Growth Potential: Operates in a high-growth software market, with global retail management software market projected for significant expansion.

- Market Share: Current market share from these integrated offerings is nascent, requiring further development and collaboration.

DN Series® EASY ONE Modular Retail Solutions

The DN Series® EASY ONE Modular Retail Solutions are positioned as a potential star within the BCG framework. Its modular design offers significant flexibility for retailers, catering to diverse checkout needs and payment options, a key driver in the rapidly expanding self-service retail market.

The growth in retail self-service is substantial, with global spending on retail self-checkout systems projected to reach over $20 billion by 2027, indicating a strong market opportunity. The EASY ONE's adaptability directly addresses evolving consumer preferences for faster, more convenient shopping experiences.

As a newer product, the EASY ONE is still building its market presence. Diebold Nixdorf's strategy likely involves aggressive marketing and partnerships to increase adoption rates and solidify its market share in this competitive segment.

- Modular Design: Adaptable for various retail checkout scenarios.

- Target Market: High-growth retail self-service sector.

- Market Position: Emerging product requiring market share development.

- Growth Drivers: Changing consumer behavior and demand for flexible systems.

Emerging digital banking solutions and AI-driven security features represent areas where Diebold Nixdorf is investing heavily, aiming to capture future market share. These initiatives are in their early stages, requiring substantial capital to foster growth and establish a competitive edge. The company's focus on these nascent markets positions them as potential Question Marks in the BCG matrix.

Diebold Nixdorf's strategic expansion into new digital banking segments, coupled with its AI-powered security enhancements, highlights a forward-looking approach. While these ventures offer significant growth potential, their current market penetration is limited, demanding ongoing investment to mature into market Stars. The global digital banking market's projected growth, from an estimated $25.5 billion in 2023 to over $70 billion by 2030, underscores the opportunity.

The company's investment in advanced security features, such as AI-enhanced fraud prevention on platforms like Windows 11 IoT Enterprise LTSC 2024, addresses a critical market need. With global cybersecurity spending anticipated to reach $300 billion in 2024, these offerings are strategically aligned with market trends, though their market share is still developing.

| BCG Category | Diebold Nixdorf Focus Area | Market Characteristic | Growth Potential | Investment Need |

|---|---|---|---|---|

| Question Marks | Emerging Digital Banking Segments | High growth, low market share | High | Substantial |

| Question Marks | AI-Powered Security Solutions | Growing demand, nascent adoption | High | Significant R&D and market penetration |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.