Dubai Islamic Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dubai Islamic Bank Bundle

Dubai Islamic Bank operates within a dynamic environment shaped by evolving political stability, economic growth, and technological advancements in the UAE. Understanding these external forces is crucial for strategic planning and risk mitigation. Download our comprehensive PESTLE analysis to gain actionable insights into these critical factors and position yourself for success.

Political factors

The UAE government's unwavering commitment to Islamic finance, recognizing it as a cornerstone of economic diversification and global financial standing, provides a robust foundation for Dubai Islamic Bank. This strategic imperative is further underscored by recent UAE Cabinet approvals targeting a substantial expansion of Islamic bank assets and sukuk values by 2031, signaling a proactive and supportive policy environment.

The Central Bank of the UAE (CBUAE) is instrumental in shaping a stable regulatory environment for Islamic banking. Its directives on Sharia governance and compliance are vital for maintaining sector integrity. This robust oversight, a cornerstone of the UAE's financial landscape, underpins the trust placed in institutions like Dubai Islamic Bank (DIB).

The UAE's commitment to becoming a global hub for Islamic finance is a significant political driver. This national ambition is backed by concrete policy actions and infrastructure development aimed at fostering Islamic banking and Takaful sectors.

Dubai Islamic Bank is strategically positioned to capitalize on these government-led initiatives, which are designed to attract international investment and talent. The bank's growth is intrinsically linked to the success of the UAE's vision for Islamic economic leadership.

For instance, the Dubai Centre for Islamic Banking and Finance aims to boost the sector's contribution to the UAE's GDP, with Islamic finance assets in the UAE projected to grow substantially in the coming years, reaching potentially hundreds of billions of dollars by 2025-2026.

Geopolitical Stability in the UAE

Despite broader regional geopolitical tensions, the UAE banking sector, including Dubai Islamic Bank, is expected to maintain stability. The nation’s proactive foreign policy and strong diplomatic ties contribute to this secure operating environment. For instance, the UAE's role in fostering regional economic cooperation and its participation in international security initiatives bolster investor confidence.

Business-friendly regulations, a low corporate tax regime, and successful long-term residency visas continue to attract businesses and population to the UAE. This influx of talent and capital directly benefits the financial sector by increasing the customer base and transaction volumes. As of early 2024, the UAE continues to implement policies aimed at further enhancing its attractiveness as a global business hub.

- Stable Operating Environment: The UAE's commitment to regional peace and its strong international relationships foster a secure climate for financial institutions.

- Economic Diversification Initiatives: Government efforts to broaden the economy beyond oil reduce reliance on volatile commodity markets, enhancing overall stability.

- Attraction of Foreign Investment: Favorable business regulations and tax policies, including a corporate tax rate of 9% introduced in 2023, continue to draw significant foreign direct investment.

- Population Growth: The UAE's initiatives, such as the Golden Visa program, are driving population growth, which in turn fuels demand for banking services.

National Economic Diversification Agenda

The UAE's commitment to diversifying its economy beyond oil, a strategy actively pursued through initiatives like the Dubai Economic Agenda (D33), directly benefits the banking sector. This focus on sectors such as finance, tourism, technology, and real estate is creating new avenues for growth and investment. For Dubai Islamic Bank (DIB), this translates into increased opportunities for project financing, corporate banking services, and wealth management as these non-oil sectors expand.

The national diversification agenda is a significant driver for economic expansion. For instance, the UAE's non-oil GDP growth was projected to reach 4.5% in 2024, according to the Ministry of Economy. This sustained growth in key sectors directly translates into a larger pipeline of business for financial institutions like DIB. The bank's strategic alignment with these national goals positions it to benefit from increased lending, advisory services, and investment opportunities.

Dubai Islamic Bank is strategically positioned to leverage these government-led economic diversification efforts. The bank's strong presence in key growth sectors, coupled with its Islamic finance expertise, allows it to cater to the evolving needs of businesses and individuals driving this diversification. This includes supporting new ventures in technology hubs, financing hospitality projects, and facilitating cross-border trade in non-oil commodities.

- Economic Diversification: UAE's non-oil GDP growth projected at 4.5% for 2024, signaling a robust shift away from oil dependency.

- Sectoral Growth: Focus on finance, tourism, technology, and real estate creates new business pipelines for banks.

- Strategic Alignment: DIB's expertise in Islamic finance supports businesses in emerging and diversified sectors.

- Opportunity Creation: Diversification fuels demand for project finance, corporate banking, and investment services.

The UAE's proactive stance on becoming a global Islamic finance hub, backed by supportive policies and infrastructure development, creates a fertile ground for Dubai Islamic Bank. Government initiatives, such as the Dubai Centre for Islamic Banking and Finance, aim to significantly boost the sector's contribution to the national GDP, with Islamic finance assets in the UAE anticipated to reach hundreds of billions of dollars by 2025-2026.

The nation's commitment to economic diversification, evidenced by a projected non-oil GDP growth of 4.5% for 2024, directly benefits the banking sector by expanding opportunities in finance, tourism, technology, and real estate. This strategic focus creates a larger business pipeline for institutions like DIB, supporting new ventures and facilitating growth in non-oil sectors.

Furthermore, the UAE's business-friendly environment, including a 9% corporate tax rate introduced in 2023 and programs like the Golden Visa, continues to attract foreign investment and population growth. This influx enhances the banking sector's customer base and transaction volumes, solidifying a stable operating environment for financial institutions.

| Political Factor | Description | Impact on DIB | Supporting Data/Initiatives |

|---|---|---|---|

| Government Support for Islamic Finance | UAE's commitment to Islamic finance as an economic diversification strategy. | Provides a strong foundation and favorable regulatory environment. | Targeted expansion of Islamic bank assets and sukuk values by 2031; Dubai Centre for Islamic Banking and Finance. |

| Economic Diversification Agenda | Focus on non-oil sectors like finance, tourism, and technology. | Creates new avenues for growth, lending, and investment services. | Projected non-oil GDP growth of 4.5% in 2024; Dubai Economic Agenda (D33). |

| Business-Friendly Regulations | Low corporate tax and attractive residency programs. | Attracts foreign investment and population, increasing customer base and transaction volumes. | 9% corporate tax rate (introduced 2023); Golden Visa program. |

What is included in the product

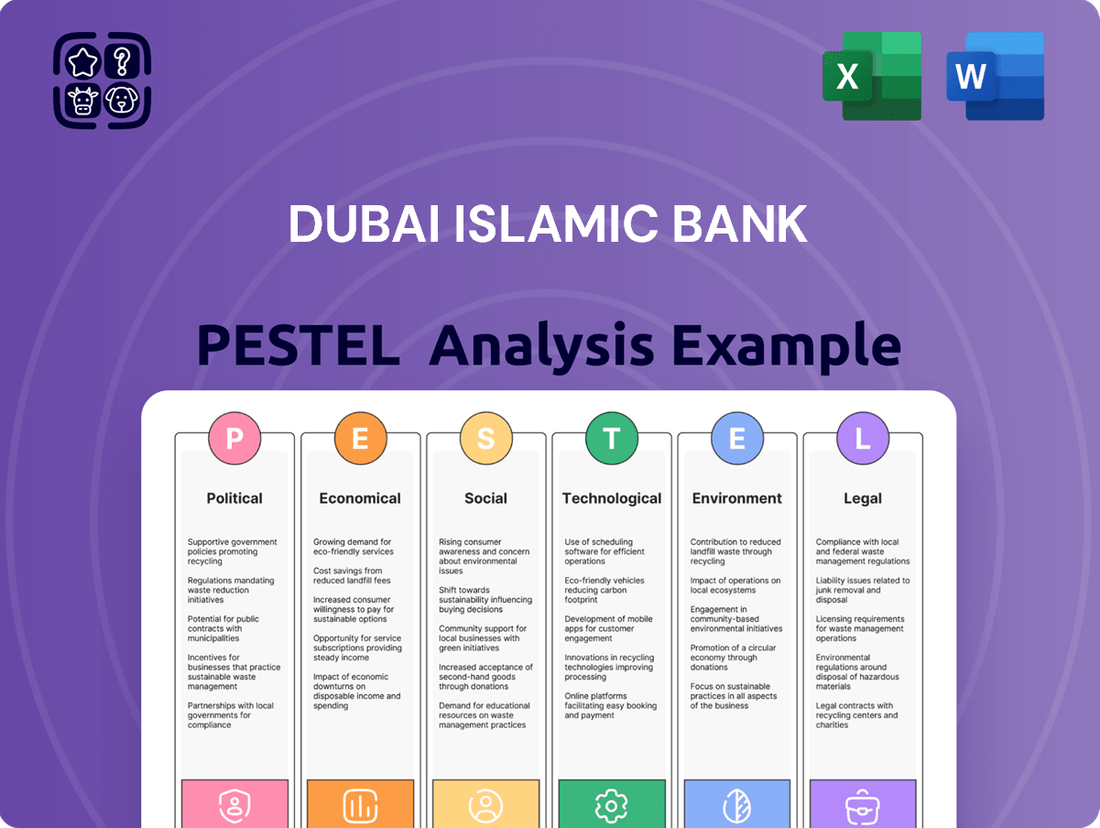

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Dubai Islamic Bank, providing a comprehensive understanding of its operating landscape.

It offers actionable insights into how these external forces create both challenges and strategic advantages for the bank within its specific market context.

A PESTLE analysis for Dubai Islamic Bank offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during meetings.

This analysis, delivered in a concise format, can be dropped into PowerPoints or used in group planning sessions, effectively relieving the pain of time-consuming data compilation for strategy development.

Economic factors

The UAE banking sector demonstrated remarkable resilience and expansion in 2024, with total assets reaching an impressive $1.24 trillion. This growth solidifies the UAE's status as a premier financial center in the Middle East.

Looking ahead, forecasts suggest sustained strong performance for UAE banks through 2024 and 2025, anticipating annual net income growth in the range of 7-8%. This positive outlook provides a favorable environment for institutions like Dubai Islamic Bank.

Dubai Islamic Bank's own financial performance in 2024 mirrors this sector-wide strength, reporting substantial increases in both total income and net profit, underscoring its successful navigation of the thriving economic landscape.

The demand for Islamic finance continues to surge across the Gulf and Arab markets, with customer deposits at Sharia-compliant banks showing a notable increase in the first quarter of 2025. This robust growth underscores the increasing preference for ethical and faith-based financial products.

Globally, Islamic finance assets experienced a significant expansion, growing by almost 15% in 2024. Banking assets represented a substantial part of this growth, highlighting the sector's increasing maturity and appeal.

This sustained and growing demand directly benefits institutions like Dubai Islamic Bank, which is well-positioned as a premier Islamic financial institution to capitalize on this expanding market. The bank's strong presence and comprehensive offerings align perfectly with these favorable market trends.

UAE banks are anticipated to sustain vigorous lending, with loan growth projected at 11% for 2024 and a minimum of 9% for 2025. This expansion is fueled by substantial business borrowing needs and ongoing project development.

Dubai Islamic Bank experienced a notable increase in customer deposits, rising by almost 12% year-on-year in 2024. This robust growth in both lending and deposits underpins the bank's strong financial standing and operational capacity.

Favorable Economic Outlook and Diversification

The United Arab Emirates (UAE) is experiencing robust economic growth, with its economy expanding by 3.9% in 2024. This expansion is driven by strong performance in both oil and non-oil sectors. Projections indicate an even faster growth rate of 4.7% for 2025, signaling sustained economic momentum.

This positive macroeconomic environment, bolstered by strategic reforms and initiatives, significantly strengthens the financial fundamentals of the UAE's banking sector. Dubai Islamic Bank is well-positioned to capitalize on this favorable economic outlook.

- UAE Economic Growth: 3.9% expansion in 2024, with a projected 4.7% for 2025.

- Growth Drivers: Fueled by both oil and non-oil sector contributions.

- Impact on Banking: Strengthens financial fundamentals and creates opportunities.

- Dubai Islamic Bank Advantage: Benefits directly from the positive macroeconomic trends.

Healthy Asset Quality and Profitability

Dubai Islamic Bank benefits from a robust UAE banking sector where asset quality has notably improved. As of September 2024, the non-performing loan (NPL) ratio for the ten largest banks in the UAE stood at a healthy 4%, a significant decrease that reflects a stronger financial landscape. This trend provides a stable environment for banks like Dubai Islamic Bank.

Banks have leveraged their strong profitability to proactively manage and provision for older, riskier loans. This strategic approach strengthens their balance sheets and enhances overall financial resilience. Dubai Islamic Bank, for instance, reported a commendable NPF ratio of 4.0% in fiscal year 2024, underscoring its commitment to maintaining high asset quality.

- Strengthened Asset Quality: UAE banking sector NPLs decreased to 4% for the 10 largest banks by September 2024.

- Proactive Provisioning: Banks are using strong profits to provision against legacy loans, bolstering balance sheets.

- Dubai Islamic Bank's Performance: The bank's NPF ratio improved to 4.0% in FY 2024, demonstrating sustained asset quality enhancement.

The UAE's economy is projected for robust growth, with a 3.9% expansion in 2024 and an anticipated 4.7% in 2025, driven by both oil and non-oil sectors. This positive economic climate directly benefits Dubai Islamic Bank by strengthening the overall financial landscape and creating new opportunities for lending and investment.

The banking sector is experiencing strong lending growth, with projections of 11% for 2024 and at least 9% for 2025, fueled by business needs and project development. Dubai Islamic Bank's own customer deposits saw a nearly 12% year-on-year increase in 2024, highlighting its strong position within this expanding market.

Asset quality in the UAE banking sector has improved significantly, with non-performing loans (NPLs) for the top ten banks falling to 4% by September 2024. Dubai Islamic Bank mirrored this trend, reporting a non-performing financing ratio of 4.0% in fiscal year 2024, underscoring its sound financial management.

| Economic Indicator | 2024 Projection/Actual | 2025 Projection |

|---|---|---|

| UAE GDP Growth | 3.9% | 4.7% |

| UAE Banking Sector Loan Growth | 11% | 9% (minimum) |

| Dubai Islamic Bank Customer Deposits Growth (YoY) | ~12% (2024 Actual) | N/A |

| UAE Top 10 Banks NPL Ratio | 4.0% (Sept 2024) | N/A |

| Dubai Islamic Bank NPF Ratio | 4.0% (FY 2024) | N/A |

Preview the Actual Deliverable

Dubai Islamic Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Dubai Islamic Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain immediate access to this detailed report upon purchase.

Sociological factors

The UAE's financial landscape is witnessing a significant surge in demand for Sharia-compliant products, reflecting a growing preference for ethical and interest-free banking. This trend is not confined to the UAE but is a strong movement across many Muslim-majority nations.

Dubai Islamic Bank is strategically positioned to capitalize on this expanding market. Its adherence to Sharia principles directly addresses the values and financial needs of a substantial and increasingly aware consumer base seeking faith-aligned financial solutions.

The global Islamic finance market is experiencing significant growth, with assets projected to reach $4.9 trillion by 2025, up from $3.7 trillion in 2020. This expansion is fueled by increasing financial literacy and a growing awareness of Sharia-compliant products, particularly in regions like the UAE. As more individuals understand the principles of Islamic finance, trust in these services deepens, leading to higher adoption rates.

Dubai Islamic Bank can capitalize on this societal shift by enhancing its educational outreach. By offering clear, accessible information about its Sharia-compliant products and services, the bank can further build confidence and attract a broader customer base. This proactive approach aligns with the increasing demand for ethical and faith-aligned financial solutions.

The UAE's population is notably young, with a significant portion under 40 years old. This demographic is highly receptive to digital technologies, with over 70% of customers in this age bracket expressing openness to digital-only banking solutions as of early 2024. This trend directly fuels the demand for innovative financial services.

Dubai Islamic Bank's strategic focus on digital transformation, including enhancements to its mobile app and online platforms, directly addresses this growing preference among younger, tech-savvy customers. This proactive approach ensures the bank remains relevant and competitive in a rapidly evolving digital landscape.

Emphasis on Ethical and Responsible Finance

The growing global emphasis on ethical and responsible finance directly aligns with Sharia principles, which prioritize the societal and environmental impact of financial transactions. This societal shift is increasingly influencing consumer and investor behavior, making Sharia-compliant banking models, like that of Dubai Islamic Bank, more attractive. For instance, the global Islamic finance market was estimated to be worth over $3.6 trillion in 2023, with a projected growth to $4.9 trillion by 2025, indicating a strong demand for ethically aligned financial services.

Dubai Islamic Bank's commitment to these principles positions it favorably within this evolving financial landscape. The bank's operations are inherently designed to consider the welfare of individuals, the community, and the environment, mirroring a broader societal demand for sustainability and corporate social responsibility. This focus not only caters to a specific customer base but also resonates with a wider audience increasingly concerned about the ethical implications of their financial choices.

- Growing Demand for Ethical Investments: Global sustainable investment assets reached $37.8 trillion in 2024, demonstrating a significant market shift.

- Sharia Compliance as a Value Proposition: Dubai Islamic Bank leverages its adherence to Sharia principles as a key differentiator in attracting ethically conscious customers.

- Societal Impact Focus: The bank's business model inherently considers community well-being and environmental stewardship, aligning with global ESG (Environmental, Social, and Governance) trends.

- Market Growth in Islamic Finance: Projections indicate continued expansion of the Islamic finance sector, underscoring the relevance of Dubai Islamic Bank's offerings.

Community Engagement and Social Responsibility

Islamic banks, by their nature, place a significant emphasis on community welfare and social responsibility, which are core tenets of their Sharia-compliant operations. This commitment often manifests through initiatives like Zakat distribution and various charitable endeavors, fostering a sense of shared prosperity. Dubai Islamic Bank's dedication to these principles is a key differentiator, directly impacting its brand image and strengthening its connection with the community it serves.

For instance, Dubai Islamic Bank actively participates in philanthropic activities, aligning with the broader UAE's vision for social impact. In 2023, the bank continued its support for various social causes, reflecting a deep-seated commitment to giving back. This focus on community engagement not only adheres to Islamic financial principles but also builds trust and loyalty among customers and stakeholders, reinforcing its position as a responsible corporate citizen.

- Community Welfare Focus: Islamic banking principles mandate a focus on community well-being, often through Zakat and charitable giving.

- Brand Reputation Enhancement: Strong social responsibility initiatives by Dubai Islamic Bank can significantly boost its public image and customer loyalty.

- Strengthened Community Ties: Active involvement in social causes fosters deeper relationships and trust between the bank and the communities in which it operates.

- Alignment with National Vision: Dubai Islamic Bank's social responsibility efforts often align with the UAE's broader national agenda for social development and humanitarian aid.

Societal trends show a growing preference for ethical and faith-aligned financial products, with the global Islamic finance market expected to reach $4.9 trillion by 2025. This surge in demand for Sharia-compliant services directly benefits Dubai Islamic Bank, as its core operations align with these evolving consumer values. The bank's commitment to community welfare and social responsibility further strengthens its appeal, resonating with a broader audience increasingly focused on ESG principles.

| Sociological Factor | Description | Relevance to Dubai Islamic Bank | Data Point (2024/2025) |

|---|---|---|---|

| Demand for Ethical Finance | Increasing consumer preference for financial products that adhere to ethical and moral principles. | Dubai Islamic Bank's Sharia-compliant model inherently meets this demand. | Global Islamic finance assets projected to reach $4.9 trillion by 2025. |

| Demographic Shifts (Youth) | A significant portion of the UAE population is young and digitally native. | The bank's focus on digital transformation caters to this tech-savvy demographic. | Over 70% of customers under 40 are open to digital-only banking (early 2024). |

| Community Welfare & CSR | Growing societal expectation for businesses to contribute positively to their communities. | The bank's commitment to Zakat, charitable giving, and social impact initiatives enhances its reputation. | Continued support for social causes in 2023, aligning with national social impact goals. |

Technological factors

The UAE banking sector is experiencing a rapid digital overhaul, with institutions channeling significant investments into cutting-edge technologies such as artificial intelligence, machine learning, and blockchain. This strategic pivot is designed to enhance customer experiences by offering more personalized and streamlined services. Projections indicate a robust growth rate of 4.77% for the UAE's digital banking sector from 2024 to 2029, underscoring the immense potential and ongoing evolution in this space.

Dubai Islamic Bank is at the forefront of this digital wave, demonstrating a clear commitment to technological advancement and digitalization. This focus is evident in the bank's ongoing initiatives to build operational efficiencies and improve its service delivery mechanisms through innovative tech solutions.

UAE banks are heavily investing in AI and data analytics to understand customers better. This technology allows them to predict preferences and financial needs, leading to highly personalized services like smart savings plans and custom credit offers. For instance, a significant portion of UAE banks are exploring or have already implemented AI for fraud detection and customer service chatbots, with projections indicating substantial growth in AI adoption within the financial sector in the coming years.

The surge in digital banking necessitates a strong emphasis on cybersecurity. UAE banks, including Dubai Islamic Bank, are adopting advanced biometric authentication and AI-powered fraud detection to secure transactions and safeguard customer information. For instance, in 2023, the UAE's financial sector saw a significant increase in cyberattack attempts, highlighting the critical need for enhanced defenses.

Adoption of Blockchain Technology

Blockchain technology is increasingly being woven into the fabric of banking in the UAE, with a significant focus on enhancing the security of transactions, especially for remittances and cross-border transfers. This integration aims to drastically reduce instances of fraud. For example, in 2024, the UAE's financial sector continued to explore pilot programs for blockchain-based trade finance solutions, aiming to streamline processes and reduce settlement times by up to 40% compared to traditional methods.

The Central Bank of the UAE's commitment to a digital currency initiative, coupled with ongoing advancements in blockchain integration, is actively reshaping the nation's status as a global financial hub. This digital push is creating new opportunities for innovation and efficiency within the banking sector. By the end of 2024, the UAE had launched several cross-border payment systems leveraging distributed ledger technology, processing billions of dollars in transactions with enhanced transparency.

Dubai Islamic Bank can strategically leverage blockchain applications to achieve notable improvements in operational efficiency and bolster its security protocols. Exploring areas such as smart contracts for loan processing or secure digital identity management could unlock significant benefits.

- Enhanced Transaction Security: Blockchain's inherent immutability can prevent fraudulent alterations in remittances and cross-border transfers.

- Digital Currency Initiatives: The Central Bank's exploration of a digital currency signals a broader adoption of DLT, creating a fertile ground for innovation.

- Efficiency Gains: Smart contracts can automate processes like loan origination and settlement, reducing manual intervention and processing times.

- Fraud Reduction: By providing a transparent and verifiable ledger, blockchain can significantly deter and detect fraudulent activities in financial operations.

Development of Digital-Only Banking Platforms

The burgeoning success of digital-only banking platforms across the UAE, including the introduction of services like Liv. by Emirates NBD and YAP, underscores a significant shift in consumer preference. These platforms resonate with customers seeking convenient, cost-effective, and technologically advanced banking experiences without the need for physical branches. This evolving landscape compels established institutions like Dubai Islamic Bank to bolster their digital capabilities and consider innovative, digital-first banking models to remain competitive.

Dubai Islamic Bank can strategically leverage this trend by further investing in its existing digital channels, such as its mobile app and online banking portal, to offer seamless and intuitive user experiences. Furthermore, exploring the potential launch of a dedicated digital banking subsidiary or a specialized digital product suite could attract a new segment of digitally native customers and cater to the growing demand for branchless financial services.

The digital banking sector in the UAE has seen substantial growth, with projections indicating continued expansion. For instance, the UAE's fintech market is expected to reach significant valuations by 2025, driven by digital banking adoption. This presents an opportunity for Dubai Islamic Bank to capture market share by offering competitive digital products and services that align with these evolving consumer expectations.

- Digital Adoption: Over 80% of UAE consumers have used digital banking services at least once in the past year, highlighting a strong preference for online and mobile channels.

- Fintech Growth: The UAE fintech sector is projected to experience a compound annual growth rate of over 20% in the coming years, fueled by digital banking innovation.

- Customer Expectations: Consumers increasingly expect personalized digital experiences, instant transactions, and lower fees, all of which are hallmarks of digital-only banks.

Technological advancements are fundamentally reshaping the UAE banking landscape, with Dubai Islamic Bank actively embracing digital transformation. Investments in AI, machine learning, and blockchain are enhancing customer experiences and operational efficiency, with the UAE digital banking sector projected to grow by 4.77% from 2024 to 2029. This digital shift necessitates robust cybersecurity measures, with banks like DIB implementing advanced biometric authentication and AI-driven fraud detection to combat rising cyber threats, a critical concern given the significant increase in cyberattack attempts observed in 2023.

| Technology Area | Impact on Dubai Islamic Bank | Supporting Data/Projections |

|---|---|---|

| Digital Banking Growth | Increased customer engagement and service delivery | UAE digital banking sector growth: 4.77% (2024-2029) |

| AI & Data Analytics | Personalized services, improved risk management | Significant AI adoption in UAE financial sector expected |

| Blockchain | Enhanced transaction security, efficiency in cross-border payments | Potential to reduce settlement times by up to 40% |

| Cybersecurity | Protection of customer data and transactions | Increased cyberattack attempts in UAE financial sector (2023) |

Legal factors

The Central Bank of the UAE (CBUAE) is the key regulator for Islamic finance in the Emirates, ensuring adherence to Sharia principles. It sets crucial standards for capital adequacy, liquidity, and risk management, providing a stable operational environment for institutions like Dubai Islamic Bank. The CBUAE's recent focus has been on strengthening Sharia governance frameworks, a critical element for Islamic financial institutions.

The Central Bank of the UAE (CBUAE) issued the Sharia Compliance Function (SCF) Standard and Guidance Note in April 2024, setting a firm deadline of April 2025 for all Islamic financial institutions operating in the UAE to achieve full compliance. This pivotal regulation is designed to bolster governance frameworks and internal control mechanisms, ensuring that all banking operations rigorously adhere to Sharia principles.

Dubai Islamic Bank, as a leading Islamic financial institution, is therefore mandated to integrate these new requirements into its operational fabric. The SCF Standard aims to enhance transparency and accountability, crucial for maintaining the integrity of Islamic finance and building trust with a growing base of ethically-minded customers. By April 2025, the bank will need to demonstrate robust systems and processes that guarantee Sharia compliance across its entire product and service portfolio.

The legal framework surrounding Sukuk issuance is crucial for the growth of Islamic finance in the UAE. These laws ensure Sharia compliance and investor protection, fostering confidence in the market. For instance, the UAE Central Bank's regulations provide a clear structure for Sukuk transactions, supporting market stability.

The UAE's commitment to developing its Islamic capital markets is evident in initiatives like the introduction of dirham-denominated Islamic Treasury Sukuk. This move, alongside the increasing issuance of green Sukuk, signals a supportive regulatory environment that encourages diverse and sustainable Islamic financial products.

Dubai Islamic Bank, a key player in the region, leverages this well-defined legal landscape to its advantage. The bank's active participation in the Sukuk market, including its role in recent issuances, highlights the beneficial impact of these laws on its operations and the broader Islamic finance sector.

Financial Free Zones Law

The Financial Free Zones Law is a significant legal factor for Dubai Islamic Bank, fostering the growth of Islamic finance within specialized economic zones in the UAE. This legislation offers attractive tax exemptions and streamlined operational regulations, enhancing the UAE's position as a global hub for Islamic finance. For instance, by the end of 2023, Dubai's financial free zones continued to attract significant foreign investment, with the Dubai International Financial Centre (DIFC) reporting a 26% increase in registered companies in the first half of 2024 compared to the same period in 2023, underscoring the effectiveness of these legal frameworks.

Dubai Islamic Bank can strategically utilize these free zones for specific business functions or to forge new partnerships, capitalizing on the regulatory advantages. The law's provisions are designed to create a competitive yet supportive environment for Islamic financial institutions, driving innovation and expansion. The UAE's commitment to developing its Islamic finance sector is further evidenced by the ongoing efforts to harmonize regulations across different free zones, aiming for greater efficiency and investor confidence.

- Legal Framework: The Financial Free Zones Law specifically encourages and regulates Islamic finance entities.

- Incentives: It provides tax and operational benefits, making the UAE more appealing for Islamic financial institutions.

- Strategic Advantage: Dubai Islamic Bank can leverage these zones for operational efficiency and strategic alliances.

- Market Growth: The law supports the competitive expansion of the Islamic finance sector within the UAE.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Regulations

The Central Bank of the UAE (CBUAE) has significantly bolstered its regulatory landscape, emphasizing cybersecurity, data protection, and robust Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) measures to safeguard financial system stability. The UAE's successful exit from the Financial Action Task Force's (FATF) 'enhanced monitoring' list in February 2024 underscores the nation's commitment to combating financial crime and adhering to international standards.

Dubai Islamic Bank, like all financial institutions in the UAE, must maintain stringent compliance with these evolving AML/CTF regulations. This adherence is crucial for preserving operational integrity, avoiding potential penalties, and upholding its reputation within the global financial community.

- Enhanced Regulatory Oversight: CBUAE's focus on AML/CTF is a continuous process, requiring ongoing vigilance and adaptation from banks.

- International Compliance: The UAE's FATF delisting in 2024 signifies a strong commitment to global best practices in financial crime prevention.

- Reputational Risk: Strict adherence to AML/CTF rules is paramount for Dubai Islamic Bank to maintain trust and avoid reputational damage.

- Operational Integrity: Compliance ensures the bank's systems and processes are robust against illicit financial activities.

The legal environment for Dubai Islamic Bank is shaped by the Central Bank of the UAE's (CBUAE) evolving regulations, particularly concerning Sharia compliance. The CBUAE's issuance of the Sharia Compliance Function (SCF) Standard in April 2024, with full compliance mandated by April 2025, directly impacts the bank's operational framework and governance. Furthermore, the UAE's robust legal framework for Sukuk issuance, including dirham-denominated Islamic Treasury Sukuk and green Sukuk, supports market stability and product diversification, benefiting institutions like Dubai Islamic Bank.

The Financial Free Zones Law significantly benefits Dubai Islamic Bank by creating specialized economic zones with tax exemptions and streamlined regulations, enhancing the UAE's position as an Islamic finance hub. The Dubai International Financial Centre (DIFC), for instance, saw a 26% increase in registered companies in H1 2024 compared to H1 2023, demonstrating the attractiveness of these zones. The bank can strategically leverage these zones for operational efficiency and partnerships.

Stringent adherence to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations is paramount, especially following the UAE's successful exit from the FATF's 'enhanced monitoring' list in February 2024. Dubai Islamic Bank must maintain robust compliance to preserve operational integrity, avoid penalties, and uphold its global reputation.

| Regulatory Area | Key Development | Impact on Dubai Islamic Bank | Compliance Deadline |

|---|---|---|---|

| Sharia Compliance | CBUAE SCF Standard issued | Mandatory integration into operations and governance | April 2025 |

| Capital Markets | Growth in Sukuk issuance (incl. green Sukuk) | Supports product diversification and market stability | Ongoing |

| Financial Free Zones | DIFC company growth (26% in H1 2024) | Opportunities for operational efficiency and strategic alliances | N/A |

| Financial Crime Prevention | UAE exits FATF 'enhanced monitoring' list | Reinforces need for stringent AML/CTF compliance | Ongoing |

Environmental factors

The UAE's banking sector, including institutions like Dubai Islamic Bank, is increasingly prioritizing sustainable finance, viewing it not just as a compliance issue but as a significant profit driver. This shift is underscored by a national commitment from banks to mobilize a substantial AED 1 trillion in sustainable finance by 2030.

Many Islamic banks operating within the UAE have proactively developed and implemented comprehensive sustainability strategies, with a notable trend of these strategies receiving formal approval at the board of directors' level, signaling strong institutional commitment.

As an Islamic financial institution, Dubai Islamic Bank is inherently aligned with the core principles of ESG (Environmental, Social, and Governance) investing, which emphasize ethical conduct and responsible resource management, making it naturally positioned to capitalize on the growing demand for sustainable financial products.

The UAE's Sukuk market has seen robust expansion, with a notable surge in Green Sukuk issuances since 2019, accelerating the adoption of sustainable finance. This growth is underscored by the UAE's regional leadership and second-place global ranking in outstanding sustainability Sukuk, highlighting a strong commitment to eco-friendly financial instruments.

This burgeoning Green Sukuk market presents a significant opportunity for Dubai Islamic Bank. The bank can actively engage in this expanding sector by participating in existing green issuances and by taking a leading role in structuring and issuing its own green financial instruments, aligning with global sustainability trends and investor demand.

Financial institutions in the UAE, including Dubai Islamic Bank, are increasingly incorporating climate-related risk assessments into their operations. This involves strengthening stress testing capabilities to better understand the potential impact of climate change on their portfolios. For instance, the UAE Central Bank has been actively promoting enhanced risk management practices for its regulated entities.

Dubai Islamic Bank will likely need to conduct physical stress testing to gauge the direct impacts of climate events, such as extreme weather, on its assets and operations. This proactive approach is crucial for developing robust strategies to adapt to and mitigate climate change risks, ensuring the bank's long-term financial stability and resilience in a changing environmental landscape.

Commitment to Reducing Carbon Emissions

Banks in the UAE, including Dubai Islamic Bank, are increasingly focused on reducing their carbon footprint. This commitment is evident through initiatives like the purchase of renewable energy certificates and the installation of solar panels on their premises, showcasing a growing dedication to environmental sustainability within the financial sector.

Dubai Islamic Bank is anticipated to play a role in these broader environmental efforts as part of its overarching Environmental, Social, and Governance (ESG) strategy. This aligns with the UAE's national sustainability goals and the global push towards decarbonization.

- Renewable Energy Adoption: UAE banks are investing in solar power and renewable energy certificates to power their operations.

- ESG Strategy Integration: Dubai Islamic Bank's ESG framework likely includes specific targets for carbon emission reduction.

- Industry Trend: The financial sector's commitment to sustainability is a growing global and regional imperative.

Sharia Principles and Environmental Stewardship

A fundamental tenet of Sharia principles is the consideration of outcomes and environmental impact, rendering transactions detrimental to the environment invalid. This intrinsic alignment positions Islamic finance, and by extension institutions like Dubai Islamic Bank (DIB), as natural proponents of environmental stewardship.

DIB's operational framework inherently supports sustainable practices and actively steers clear of investments that could harm the environment. This commitment is not merely a compliance issue but a core ethical imperative derived from Islamic jurisprudence.

- Environmental Impact Assessment: Sharia scholars scrutinize the environmental consequences of financial activities, ensuring alignment with ecological preservation.

- Prohibition of Harmful Investments: Transactions contributing to pollution, resource depletion, or ecological damage are considered impermissible under Sharia.

- Sustainable Finance Growth: The global Islamic finance market, valued at over $3.7 trillion in 2023 according to Refinitiv, demonstrates a growing demand for ethically and environmentally sound financial products.

- DIB's Sustainability Initiatives: Dubai Islamic Bank actively engages in initiatives promoting green finance and sustainable development, reflecting its adherence to these principles.

Environmental factors significantly shape Dubai Islamic Bank's operations and strategy, driven by the UAE's strong push towards sustainability. The nation's commitment to mobilizing AED 1 trillion in sustainable finance by 2030 directly influences how banks like DIB approach their investments and product development, emphasizing green finance and ethical considerations.

DIB, as an Islamic financial institution, naturally aligns with environmental stewardship due to Sharia principles that prohibit environmentally harmful transactions. This inherent compatibility positions the bank to capitalize on the growing global demand for sustainable financial products, further supported by the UAE's leading role in the Green Sukuk market.

The bank is also actively integrating climate-related risk assessments and reducing its carbon footprint through initiatives like renewable energy adoption, reflecting a broader industry trend and a commitment to long-term resilience.

| Environmental Factor | Impact on Dubai Islamic Bank | Supporting Data/Initiatives |

|---|---|---|

| UAE's Sustainable Finance Goal | Drives product development and investment strategy towards green finance. | AED 1 trillion sustainable finance mobilization by 2030. |

| Sharia Principles | Prohibits environmentally damaging transactions, fostering ethical investment. | Prohibition of pollution and resource depletion investments. |

| Green Sukuk Market Growth | Creates opportunities for DIB to participate and issue green financial instruments. | UAE's second-place global ranking in outstanding sustainability Sukuk. |

| Climate Risk Management | Requires enhanced stress testing and adaptation strategies for portfolio resilience. | UAE Central Bank promotion of enhanced risk management practices. |

| Carbon Footprint Reduction | Encourages adoption of renewable energy and energy efficiency measures. | Investment in solar panels and renewable energy certificates by UAE banks. |

PESTLE Analysis Data Sources

Our Dubai Islamic Bank PESTLE analysis is grounded in data from official UAE government sources, the Dubai Financial Services Authority, and reputable economic forecasting agencies. We also incorporate insights from international financial institutions and industry-specific reports to ensure comprehensive coverage.