Dubai Islamic Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dubai Islamic Bank Bundle

Discover the strategic framework behind Dubai Islamic Bank's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance.

Unlock the full strategic blueprint behind Dubai Islamic Bank's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Dubai Islamic Bank (DIB) strategically partners with top-tier technology providers such as HPE GreenLake and IBM Consulting. These collaborations are crucial for modernizing DIB's core banking infrastructure and significantly improving its digital customer offerings.

The primary objective of these partnerships is to accelerate data transformation initiatives, ensuring DIB can leverage advanced technologies. This focus on cutting-edge solutions is designed to deliver innovative and seamless Sharia-compliant financial products and services to its clientele.

By integrating these technological advancements, DIB aims to create an intuitive and user-friendly cloud experience. This secure and compliant environment directly supports DIB's overarching ambition to be recognized as the most progressive Islamic financial institution globally.

Dubai Islamic Bank's Sharia Advisory Boards and Scholars are cornerstones of its business model, ensuring every product and service aligns with Islamic finance principles. These esteemed bodies offer critical guidance on product innovation, transaction structuring, and ethical conduct, safeguarding the bank's distinct identity.

This rigorous oversight is vital for cultivating and maintaining the confidence of its Sharia-compliant customer base, setting DIB apart from conventional financial institutions. For instance, in 2023, DIB reported a net profit of AED 4.0 billion, underscoring the success of its Sharia-compliant approach.

Dubai Islamic Bank (DIB) actively collaborates with Takaful providers, notably Salaam Family Takaful, to broaden its Sharia-compliant product suite. These partnerships are crucial for offering customers integrated insurance and protection plans that align with Islamic financial principles.

Through these alliances, DIB extends its value proposition beyond core banking services. Customers gain access to comprehensive financial solutions encompassing savings, investments, and life protection, ensuring ethical financial security and a holistic approach to wealth management.

Real Estate Developers and Property Management Companies

Dubai Islamic Bank (DIB) actively collaborates with real estate developers, such as Deyaar Development, an entity within the DIB Group. These alliances are fundamental to DIB's strategy, enabling the bank to provide Sharia-compliant financing for property acquisition and investment. This synergy is vital for bolstering asset-backed financing, a core principle of Islamic banking, and for broadening DIB's real estate market presence.

These partnerships are instrumental in meeting the increasing investor appetite for ethical and compliant property ventures. For instance, DIB's involvement in projects like the AED 1.7 billion Deyaar HQ tower demonstrates the tangible benefits of these collaborations, directly supporting the bank's asset growth and market share in the lucrative real estate sector.

- Developer Collaboration: DIB partners with leading real estate developers to co-create Sharia-compliant financing solutions for buyers.

- Asset-Backed Financing: These relationships are key to structuring asset-backed deals, a cornerstone of Islamic finance.

- Portfolio Expansion: Partnerships allow DIB to gain access to and finance a wider range of real estate projects, diversifying its portfolio.

- Market Demand: DIB leverages these alliances to cater to the growing demand for ethical and compliant property investments.

Government Entities and Regulatory Bodies

Dubai Islamic Bank (DIB) actively cultivates strategic alliances with governmental bodies and regulatory authorities, including the Central Bank of the UAE. These partnerships are fundamental for ensuring DIB's operations align with the stringent legal and regulatory requirements governing Islamic finance. For instance, DIB's commitment to Sharia compliance is overseen by these entities, fostering trust and stability within the Islamic banking sector.

These collaborations are not merely about compliance; they actively contribute to shaping and advancing Islamic finance policies within the UAE. By working closely with regulators, DIB plays a role in the nation's ambition to position itself as a leading global hub for the Islamic economy. This synergy supports the development of innovative Islamic financial products and services.

The UAE government's strategic focus on expanding Islamic banking assets and increasing sukuk issuances creates a highly conducive environment for DIB's expansion. In 2023, the UAE's Islamic banking sector continued its robust growth, with total assets reaching significant figures, underscoring the supportive ecosystem DIB benefits from.

- Regulatory Alignment: DIB's partnerships ensure adherence to Sharia principles and UAE financial regulations, critical for maintaining operational integrity and customer confidence.

- Policy Development: Collaboration with government entities influences the creation of favorable policies that promote the growth and innovation of the Islamic finance industry.

- Economic Hub Vision: DIB's engagement supports the UAE's broader strategy to enhance its global standing in the Islamic economy, attracting international investment and expertise.

- Market Growth Support: Government initiatives aimed at increasing Islamic banking assets and sukuk issuances directly benefit DIB by fostering a dynamic and expanding market.

Dubai Islamic Bank (DIB) collaborates with fintech companies to enhance its digital offerings and operational efficiency. These partnerships are vital for integrating cutting-edge technologies, ensuring DIB remains competitive in the rapidly evolving financial landscape.

By teaming up with these innovators, DIB can offer more sophisticated digital banking solutions, improving customer experience and streamlining internal processes. This focus on technological advancement is key to DIB's strategy of providing seamless, Sharia-compliant financial services.

For example, DIB's investment in digital transformation initiatives, often facilitated by fintech partnerships, aims to create a more agile and customer-centric banking environment. This proactive approach ensures DIB can adapt to new market demands and maintain its leadership position.

What is included in the product

A comprehensive, pre-written business model tailored to Dubai Islamic Bank’s strategy, reflecting its real-world operations and plans for Islamic finance.

Covers customer segments, channels, and value propositions in full detail, designed to help analysts make informed decisions.

Dubai Islamic Bank's Business Model Canvas offers a structured approach to identify and address the complex financial needs of businesses, acting as a pain point reliever by clearly outlining value propositions and customer segments.

This visual tool simplifies the understanding of how Dubai Islamic Bank delivers Sharia-compliant financial solutions, alleviating the pain of navigating complex Islamic finance regulations and product offerings.

Activities

Dubai Islamic Bank (DIB) actively pursues the development of new banking products and services that strictly adhere to Islamic finance principles, such as avoiding interest and engaging in profit-sharing models. This commitment to Sharia-compliant innovation spans personal, corporate, and investment banking sectors.

DIB's focus on innovation is evident in its recent activities, including the issuance of sustainable sukuk, which garnered significant investor interest. For instance, in 2024, DIB successfully launched a AED 1 billion sustainability sukuk, aligning with global ESG trends and demonstrating its capacity for Sharia-compliant structured finance.

Furthermore, DIB is enhancing its digital banking solutions to offer seamless and Sharia-compliant services to its customers. This includes advancements in mobile banking platforms and digital payment gateways, catering to the evolving needs of a digitally-savvy clientele while maintaining strict adherence to Islamic principles.

Dubai Islamic Bank's retail banking operations are central to its business, focusing on managing customer deposits and providing Sharia-compliant financing for personal needs like auto and home loans. They also offer essential services such as current and savings accounts, alongside credit cards, all designed for individual customers.

The bank prioritizes simplifying financial management through efficient online platforms and a strong customer-centric philosophy. This approach has contributed to notable growth in consumer products, with areas like credit cards and auto financing showing positive performance.

Dubai Islamic Bank's Corporate and Investment Banking division is central to its operations, offering Sharia-compliant financial solutions. This includes vital services like cash and risk management, specifically tailored for corporate and institutional clients, alongside comprehensive investment banking activities. The bank actively supports business expansion through customized financing and specialized business accounts, all while adhering strictly to Islamic principles.

In fiscal year 2024, this segment demonstrated significant strength, with the corporate banking portfolio alone reaching an impressive AED 149 billion. This substantial figure underscores the bank's robust engagement with the corporate sector and its capacity to facilitate substantial financial transactions in line with Islamic finance.

Treasury and Sukuk Management

Dubai Islamic Bank's treasury and Sukuk management is a core function, focusing on maintaining robust liquidity, strategic investments, and efficient capital allocation. This is all conducted through Sharia-compliant financial instruments, with Sukuk playing a central role.

The bank actively participates in the issuance of sustainable Sukuk, demonstrating a commitment to environmentally and socially responsible finance. As of September 2024, Dubai Islamic Bank had outstanding sustainable Sukuk valued at USD 2.75 billion, highlighting its significant presence in this growing market segment. This activity also encompasses the gross new underwriting of Sukuk investments, further solidifying its position.

- Liquidity and Capital Management: Overseeing the bank's financial resources and capital structure in adherence to Sharia principles.

- Sukuk Issuance and Investment: Actively managing the issuance and underwriting of Sukuk, including a focus on sustainable instruments.

- Sustainable Finance Growth: Contributing to the expansion of sustainable finance with USD 2.75 billion in outstanding sustainable Sukuk as of September 2024.

Ensuring Sharia Compliance and Governance

Dubai Islamic Bank's core operations revolve around ensuring strict adherence to Sharia principles. This is a continuous and critical activity, permeating every aspect of their business. The bank actively manages its operations and transactions to align with Islamic finance guidelines.

A key element of this is the robust governance structure. DIB relies on its internal Sharia Supervisory Committees and also engages external Sharia scholars. These committees provide essential oversight, confirming that all financial services offered are ethical and responsible, in line with Islamic law.

This unwavering commitment to Sharia compliance serves as a fundamental differentiator for Dubai Islamic Bank. It's not just a regulatory requirement but a core tenet of their identity and value proposition in the market. For instance, in 2023, DIB reported a significant increase in its Sharia-compliant financing, reflecting the growing demand for such products.

- Sharia Supervisory Committee Oversight

- External Sharia Scholar Consultation

- Transaction and Operational Alignment with Islamic Principles

- Ethical and Responsible Financial Service Delivery

Dubai Islamic Bank's key activities center on developing and offering Sharia-compliant banking products and services across retail, corporate, and investment banking. This includes managing customer deposits, providing various financing solutions, and facilitating complex corporate transactions, all while maintaining strict adherence to Islamic principles.

The bank also actively engages in treasury functions, focusing on liquidity management, strategic investments, and capital allocation through Sharia-compliant instruments, notably Sukuk. A significant aspect of this is their commitment to sustainable finance, evidenced by substantial issuances of sustainable Sukuk.

Crucially, DIB ensures all its operations and offerings are governed by a robust Sharia compliance framework, involving internal committees and external scholars. This commitment is a core differentiator, driving customer trust and market positioning.

| Key Activity Area | Description | 2024/2025 Data Point |

|---|---|---|

| Product & Service Development | Creating Sharia-compliant banking solutions | Issued AED 1 billion sustainability sukuk (2024) |

| Corporate & Investment Banking | Facilitating corporate finance and investment | Corporate banking portfolio reached AED 149 billion (FY 2024) |

| Treasury & Sukuk Management | Managing liquidity and issuing Sukuk | USD 2.75 billion in outstanding sustainable Sukuk (Sept 2024) |

| Sharia Compliance | Ensuring all operations align with Islamic principles | Significant increase in Sharia-compliant financing (2023) |

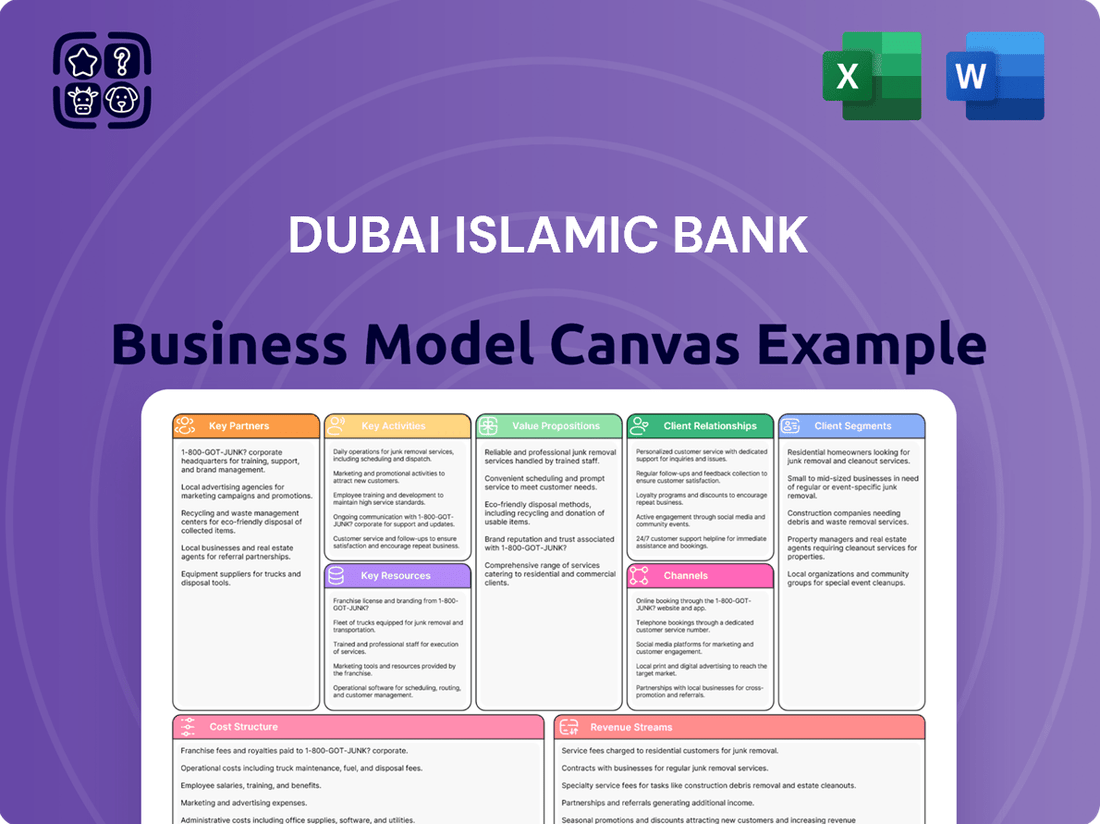

Preview Before You Purchase

Business Model Canvas

The Dubai Islamic Bank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you'll gain immediate access to the complete, professionally structured analysis, identical to this preview. You can be assured that what you see is precisely what you will get, ready for your immediate use and application.

Resources

Dubai Islamic Bank's (DIB) strong Sharia compliance framework is built upon a dedicated internal Sharia Supervisory Committee and a network of renowned Sharia scholars. This intellectual capital ensures every product, service, and operation strictly adheres to Islamic principles, forming the bedrock of customer trust and DIB's identity.

DIB's commitment to Islamic finance is further solidified by its rigorous adherence to standards set by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and robust Sharia governance practices. This meticulous approach, evidenced by DIB's consistent financial performance and market position, underscores its dedication to ethical and compliant banking.

Dubai Islamic Bank leverages significant financial capital, primarily sourced from customer deposits, to fuel its operations. These deposits, totaling AED 249 billion as of December 31, 2024, represent a core funding base. This robust deposit base is essential for the bank's ability to provide financing and engage in sukuk investments.

The bank's substantial asset base, amounting to AED 345 billion at the close of 2024, underscores its financial strength. A significant portion of these assets, specifically AED 295 billion, is comprised of net financing and sukuk investments. This highlights DIB's core business of deploying capital to generate returns through Sharia-compliant financing and investment instruments.

Dubai Islamic Bank (DIB) relies on a robust human capital base, boasting over 10,000 employees. This diverse team includes seasoned banking professionals, specialized Sharia scholars, and cutting-edge technology experts, all critical for offering a full spectrum of Sharia-compliant financial services.

DIB actively invests in its workforce through comprehensive learning and development programs. These initiatives are designed to foster career advancement and ensure continuous skill enhancement, keeping employees at the forefront of the evolving financial landscape.

Advanced Technology Infrastructure and Digital Platforms

Dubai Islamic Bank (DIB) leverages advanced technology infrastructure and digital platforms as a cornerstone of its business model. This includes modern core banking systems that ensure operational efficiency and the backbone for all digital services. DIB's commitment to technological advancement is evident in its continuous investment in upgrading these systems to meet the demands of a rapidly evolving digital economy.

The bank’s digital banking platforms and mobile applications are crucial for delivering a seamless and enhanced customer experience. These digital touchpoints allow customers to access a wide range of banking services conveniently, fostering greater engagement and satisfaction. DIB’s focus on digital innovation aims to provide intuitive and user-friendly interfaces for all its customers.

Furthermore, DIB utilizes sophisticated data analytics capabilities to gain insights into customer behavior and market trends. This data-driven approach informs the development of new digital products and personalized services, ensuring DIB remains competitive. By harnessing the power of data, DIB can anticipate customer needs and proactively offer relevant solutions.

Key technological resources include:

- Modern Core Banking Systems: Enabling robust and scalable financial operations.

- Digital Banking Platforms: Offering comprehensive online and mobile banking services.

- Advanced Data Analytics: Driving personalized customer experiences and product development.

- Mobile Applications: Providing convenient access to banking services on the go.

Extensive Branch Network and International Presence

Dubai Islamic Bank (DIB) leverages its extensive branch network within the UAE, complemented by a significant international presence. This global footprint includes subsidiaries and associates in key markets such as Pakistan, Indonesia, Kenya, and Bosnia, enabling DIB to serve a diverse and widespread customer base.

This physical and global reach is a critical component of DIB's business model, facilitating the expansion of its Sharia-compliant financial services. By establishing a presence in these international markets, DIB can tap into new customer segments and geographical areas, reinforcing its position as a leading Islamic bank.

- Branch Network: DIB operates a substantial number of branches across the United Arab Emirates, providing convenient access to its services for local customers.

- International Footprint: The bank has a presence in Pakistan (through MCB Islamic Bank), Indonesia (through Bank Panin Dubai Syariah), Kenya, and Bosnia, extending its reach beyond the UAE.

- Customer Reach: This dual focus on domestic and international operations allows DIB to cater to a broad spectrum of individual and corporate clients, both within its home market and abroad.

- Service Expansion: DIB's physical presence in these regions is instrumental in promoting and delivering its comprehensive suite of Sharia-compliant banking and financial solutions globally.

Dubai Islamic Bank's key resources include its intellectual capital, financial capital, human capital, and technological infrastructure. The bank's Sharia compliance framework, supported by a dedicated committee and scholars, ensures adherence to Islamic principles. Financially, DIB relies on a substantial deposit base, which stood at AED 249 billion by the end of 2024, and a significant asset base of AED 345 billion, with AED 295 billion in net financing and sukuk investments. Its human capital comprises over 10,000 employees, including banking professionals and technology experts, all trained through continuous development programs. Advanced technology, including core banking systems and digital platforms, underpins efficient operations and customer service.

| Key Resource | Description | 2024 Data Point |

| Intellectual Capital | Sharia compliance framework, Sharia Supervisory Committee, Sharia scholars | Ensures adherence to Islamic principles |

| Financial Capital | Customer deposits, Net financing and sukuk investments | Deposits: AED 249 billion; Net financing/sukuk: AED 295 billion |

| Human Capital | Number of employees, Expertise in banking, Sharia, and technology | Over 10,000 employees |

| Technological Infrastructure | Core banking systems, Digital platforms, Data analytics | Supports efficient operations and digital services |

Value Propositions

Dubai Islamic Bank (DIB) offers a full spectrum of banking services that strictly follow Islamic finance guidelines, excluding interest and embracing profit-sharing arrangements. This commitment to ethical finance ensures customers can engage in transactions with confidence, knowing their financial activities align with their moral and religious beliefs.

The bank's focus on asset-backed investments underscores its dedication to fairness and mutual benefit. For instance, DIB reported a net profit of AED 5.1 billion for the first nine months of 2023, demonstrating the success of its Sharia-compliant model in generating value for stakeholders while upholding ethical principles.

Dubai Islamic Bank (DIB) offers a broad spectrum of financial solutions, encompassing personal, corporate, and investment banking. This includes essential services like home and auto financing, alongside robust business financing options. In 2024, DIB continued to expand its retail lending, with personal finance and mortgage portfolios showing steady growth, reflecting strong customer demand for tailored financing solutions.

The bank's commitment extends to a diverse array of deposit accounts and investment products, designed to meet varied financial objectives and security requirements. DIB's wealth management segment, for instance, saw a significant increase in assets under management in the first half of 2024, driven by demand for Sharia-compliant investment vehicles.

This comprehensive and diversified product portfolio ensures DIB can address the complete financial lifecycle of its customers, from everyday banking needs to long-term wealth creation and protection strategies. The bank's focus on innovation in digital banking services further enhances accessibility to this wide range of offerings, making it a one-stop financial partner.

Dubai Islamic Bank (DIB) is dedicated to crafting a banking journey that feels personal and intuitive for every customer. They achieve this by constantly enhancing existing services and innovating with new solutions, ensuring a progressive approach to financial needs. This focus on customer-centricity means DIB is always looking for ways to make banking simpler and more convenient.

Leveraging digital transformation is key to DIB's strategy for delivering an improved banking experience. By embracing technology, they aim to streamline processes and offer services that are not only efficient but also easily accessible. This commitment to digital advancement underscores their drive to provide a seamless and engaging banking environment for all their clients.

In 2024, DIB reported a net profit of AED 7.4 billion, reflecting strong operational performance and customer trust. This financial growth is a testament to their successful implementation of customer-centric strategies and digital enhancements, which continue to drive engagement and satisfaction across their diverse customer base.

Financial Stability and Trust

Dubai Islamic Bank's position as the largest Islamic bank in the UAE and a notable global entity provides customers with confidence in its strength and stability. This assurance is further solidified by its consistent financial performance. For instance, in the fiscal year 2024, DIB demonstrated robust growth, reporting a significant increase in its total income and net profit, underscoring its reliability as a financial partner.

This strong financial footing translates directly into enhanced trust for its customers. The bank's commitment to sound financial practices and its ability to generate positive results year after year build a foundation of dependability. This is crucial for any financial institution, especially one operating in a dynamic global market.

- Largest Islamic Bank in UAE: This scale offers inherent stability and market influence.

- Global Player: International presence diversifies risk and broadens reach.

- FY 2024 Performance: Significant increases in total income and net profit signal resilience.

- Customer Assurance: Strong financials build trust and confidence in the institution.

Contribution to Sustainable and Responsible Economic Growth

Dubai Islamic Bank (DIB) is a key player in fostering sustainable and responsible economic growth within the UAE and beyond. Their commitment is evident through active participation in sustainable finance initiatives.

A significant aspect of this is DIB's issuance of sustainable sukuk, which directly channels capital towards environmentally and socially beneficial projects. This aligns with the growing global demand for Sharia-compliant and ESG-focused investments, attracting a segment of customers and stakeholders who prioritize ethical and impactful financial solutions.

DIB has set ambitious targets, aiming for a substantial portion of its portfolio to be dedicated to sustainable finance by 2030. For instance, by the end of 2023, DIB reported its green financing portfolio had grown significantly, demonstrating tangible progress toward these goals.

- Sustainable Sukuk Issuance: DIB has actively participated in issuing green and sustainability-linked sukuk, raising capital for projects with positive environmental and social impact.

- ESG Integration: The bank is increasingly embedding Environmental, Social, and Governance (ESG) criteria into its lending and investment decisions.

- Portfolio Targets: DIB has publicly committed to increasing its sustainable finance portfolio, with a notable target for significant growth by 2030, reflecting a long-term strategic vision.

- Stakeholder Appeal: This focus on sustainability attracts customers and investors who are increasingly prioritizing ethical and responsible financial practices, enhancing DIB's reputation and market position.

Dubai Islamic Bank (DIB) offers a comprehensive suite of Sharia-compliant banking products and services, catering to both individual and corporate clients. This includes everything from personal finance and mortgages to business solutions and investment opportunities, all designed to align with Islamic principles. For example, DIB's retail financing options saw robust demand throughout 2024, contributing to its overall growth.

The bank's value proposition is significantly enhanced by its strong digital banking capabilities, offering a seamless and convenient customer experience. This focus on innovation ensures accessibility and efficiency for all users. DIB's investment in digital platforms paid dividends in 2024, with a notable increase in digital transaction volumes and customer adoption rates.

As the UAE's largest Islamic bank and a significant global player, DIB provides a high degree of trust and stability. Its consistent financial performance, including a reported net profit of AED 7.4 billion for 2024, reinforces customer confidence. This financial strength underpins its ability to offer reliable and secure financial solutions.

DIB is also committed to sustainable and responsible finance, actively channeling capital into projects with positive environmental and social impact. The bank’s issuance of sustainable sukuk and its growing green financing portfolio demonstrate this dedication. By the close of 2023, DIB reported substantial growth in its green finance portfolio, reflecting a clear commitment to ESG principles.

| Value Proposition | Description | Supporting Data/Facts (2023-2024) |

|---|---|---|

| Sharia-Compliant Financial Solutions | Offers a full range of banking products adhering strictly to Islamic finance principles, excluding interest and promoting profit-sharing. | Net profit of AED 5.1 billion for the first nine months of 2023. Strong growth in personal finance and mortgage portfolios in 2024. |

| Digital Convenience and Innovation | Provides an intuitive and accessible banking experience through advanced digital platforms and services. | Significant increase in digital transaction volumes and customer adoption rates in 2024. |

| Trust, Stability, and Global Reach | Leverages its position as the largest Islamic bank in the UAE and a global entity to ensure customer confidence and security. | Reported net profit of AED 7.4 billion for fiscal year 2024. Consistent year-on-year growth in total income and net profit. |

| Commitment to Sustainable Finance | Actively participates in sustainable finance initiatives, including green sukuk issuance and ESG-integrated investments. | Notable growth in green financing portfolio by the end of 2023. Setting ambitious targets for sustainable finance portfolio growth by 2030. |

Customer Relationships

Dubai Islamic Bank (DIB) cultivates personalized relationships by assigning dedicated relationship managers, particularly for its high-net-worth and corporate clientele. This ensures clients receive tailored advice and solutions that deeply align with their unique financial needs and objectives.

This personalized approach fosters a strong sense of trust and loyalty, making banking feel more intuitive and responsive. For instance, DIB's commitment to personalized service is a cornerstone of its strategy to retain and grow its customer base, especially within the competitive UAE banking sector.

Dubai Islamic Bank (DIB) enhances customer relationships through advanced digital self-service, offering comprehensive online banking and mobile applications. These platforms allow customers to effortlessly manage accounts, execute transactions, and access a wide array of banking services anytime, anywhere.

This digital-first approach ensures 24/7 accessibility, empowering customers with the convenience of self-service options and reducing reliance on traditional branch interactions. In 2024, DIB reported a significant increase in digital transaction volumes, with over 80% of retail transactions conducted through digital channels, underscoring the success of their self-service strategy.

Dubai Islamic Bank (DIB) actively fosters community engagement through extensive Sharia education programs, aiming to boost financial literacy in Islamic principles. This commitment extends to significant corporate social responsibility (CSR) efforts, reinforcing its identity as a values-driven institution.

In 2024, DIB continued its focus on community impact, with initiatives that reached thousands of individuals across various educational platforms. These programs are designed to build deep trust and demonstrate that the bank's purpose goes beyond mere financial services, embedding its dedication to Islamic values into its core operations and growth strategy.

Proactive Customer Feedback and Service Improvement

Dubai Islamic Bank (DIB) prioritizes understanding its customers through proactive feedback mechanisms. This allows them to continuously enhance existing services and create innovative solutions tailored to changing market demands.

This customer-centric approach ensures DIB remains adaptive and responsive. For instance, DIB's digital transformation efforts, which often stem from customer feedback, saw a significant increase in digital transactions. In 2023, over 80% of customer transactions were conducted through digital channels, highlighting the success of their service refinement.

- Customer Feedback Integration: DIB actively solicits feedback via surveys, social media, and direct customer interactions to identify areas for improvement.

- Service Enhancement: Insights gathered are used to refine product features, streamline processes, and personalize customer experiences.

- New Product Development: Feedback also fuels the creation of new banking solutions designed to address emerging customer needs and preferences.

- Digital Channel Adoption: In 2023, DIB reported that digital channels handled over 80% of customer transactions, a testament to their responsive service improvements.

Loyalty Programs and Rewards

Dubai Islamic Bank (DIB) actively cultivates customer loyalty through well-structured programs. These initiatives aim to deepen engagement by rewarding customers for their continued patronage and specific banking activities.

DIB has implemented campaigns, such as those rewarding salary transfers, to incentivize new customer acquisition and encourage existing customers to consolidate their banking relationships. For instance, in 2024, DIB continued its focus on enhancing customer value through targeted promotions and exclusive offers, aiming to solidify its position as a preferred banking partner.

- Salary Transfer Campaigns: DIB offers incentives for customers to transfer their salaries to the bank, often including cash bonuses or preferential rates on other banking products.

- Rewards for Product Usage: Loyalty may be enhanced by offering points or discounts on services when customers utilize a range of DIB products, such as credit cards, loans, or investment accounts.

- Exclusive Benefits: High-value customers or those participating in loyalty programs might receive access to exclusive benefits like priority service, special event invitations, or personalized financial advice.

Dubai Islamic Bank (DIB) fosters strong customer relationships through a blend of personalized service and robust digital platforms. Dedicated relationship managers cater to high-net-worth and corporate clients, ensuring tailored financial advice. Simultaneously, advanced self-service options via online and mobile banking provide 24/7 accessibility and convenience for all customers.

Community engagement and Sharia education programs further solidify DIB's customer connections, reinforcing its values-driven approach. Proactive feedback mechanisms are crucial for service enhancement and new product development, ensuring DIB remains responsive to evolving customer needs.

DIB actively cultivates loyalty through targeted campaigns and rewards, incentivizing product usage and customer retention. In 2024, the bank continued to focus on enhancing customer value through promotions, solidifying its position as a preferred banking partner.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Personalized Service | Dedicated Relationship Managers | Tailored advice for high-net-worth and corporate clients |

| Digital Self-Service | Online & Mobile Banking Platforms | 24/7 access, effortless transaction management |

| Community Engagement | Sharia Education, CSR | Building trust, reinforcing values |

| Customer Feedback | Surveys, Direct Interaction | Service enhancement, new product development |

| Loyalty Programs | Salary Transfer Campaigns, Rewards | Customer retention, increased product usage |

Channels

Dubai Islamic Bank leverages its extensive branch network, boasting over 90 branches within the UAE and a presence in seven international markets, as a cornerstone of its customer engagement strategy. This physical footprint allows DIB to offer traditional in-person banking services, personalized consultations, and direct customer support, catering to a significant portion of its client base.

Dubai Islamic Bank (DIB) leverages robust digital banking platforms, including comprehensive online portals and intuitive mobile applications, to provide customers with seamless access to a full spectrum of banking services anytime, anywhere. These digital channels are central to DIB's strategy for engaging with an increasingly tech-savvy customer base.

DIB has demonstrably invested heavily in technological upgrades to bolster its digital infrastructure, a move crucial for supporting the burgeoning digital economy. For instance, by the end of 2024, DIB reported a significant increase in digital transaction volumes, with mobile banking transactions alone growing by over 25% year-on-year, highlighting the effectiveness of their digital push.

Dubai Islamic Bank's extensive network of ATMs and Cash Deposit Machines (CDMs) serves as a vital touchpoint for customers, offering convenient access to essential banking services. In 2024, the bank continued to leverage these self-service channels to enhance customer accessibility and streamline operational efficiency, allowing for quick cash withdrawals and deposits across numerous locations.

These machines are critical for providing 24/7 banking convenience, supporting a significant volume of transactions that contribute to the bank's overall service delivery. The widespread presence of ATMs and CDMs directly supports the bank's strategy of broad customer reach and operational cost management.

Contact Centers and Customer Service Hotlines

Dubai Islamic Bank leverages dedicated contact centers as a crucial channel for direct customer engagement. These hubs are designed to efficiently handle inquiries, resolve issues, and provide comprehensive guidance on the bank's diverse range of Sharia-compliant products and services. This direct line of communication ensures customers receive timely and effective support whenever they need it, enhancing overall satisfaction and trust. In 2024, the bank reported a significant increase in digital service adoption, with contact centers playing a key role in assisting customers with these transitions.

These contact centers are instrumental in fostering strong customer relationships by offering personalized assistance. They act as a primary touchpoint for resolving complex queries and facilitating smoother transactions, thereby reinforcing the bank's commitment to customer-centricity. The efficiency of these operations is vital for maintaining a competitive edge in the financial services sector.

- Customer Support: Dedicated teams offer direct assistance for inquiries and issue resolution.

- Product Guidance: Customers receive expert advice on Islamic banking products and services.

- Accessibility: Provides a reliable channel for customers to seek help when needed.

- Efficiency: Focus on timely and effective resolution of customer concerns.

Strategic Partnerships and Affiliates

Dubai Islamic Bank (DIB) actively cultivates strategic partnerships and affiliate relationships to broaden its market reach and product offerings. These collaborations are crucial for accessing new customer segments and distributing specialized financial solutions. For instance, DIB leverages its network of subsidiaries and associates across various international markets to enhance its global footprint and service capabilities.

These strategic alliances enable DIB to tap into diverse customer bases and offer tailored products. By partnering with other financial institutions, fintech innovators, and prominent real estate developers, DIB can effectively expand its distribution channels and introduce specialized financial instruments. This approach is vital for staying competitive in the dynamic financial landscape.

- Partnerships with Fintech Companies: DIB collaborates with fintech firms to integrate innovative digital solutions, enhancing customer experience and operational efficiency.

- Real Estate Developer Alliances: Joint ventures and partnerships with leading real estate developers allow DIB to offer integrated financing solutions for property buyers, driving mortgage growth.

- International Subsidiaries and Associates: DIB's presence through subsidiaries and associates in countries like Pakistan and Kenya, for example, significantly expands its geographical reach and ability to serve a wider client base.

Dubai Islamic Bank utilizes a multi-channel approach, blending its extensive physical branch network with advanced digital platforms and convenient ATM/CDM access to serve its diverse customer base. Strategic partnerships further expand its reach and product offerings, ensuring comprehensive service delivery and market penetration.

| Channel | Description | 2024 Key Metric/Focus |

|---|---|---|

| Branches | Over 90 branches in UAE, presence in 7 international markets for in-person services and consultations. | Continued personalized customer support and direct engagement. |

| Digital Platforms (Online & Mobile) | Comprehensive online portals and intuitive mobile apps for anytime, anywhere banking. | Mobile banking transactions grew over 25% year-on-year, supporting digital economy growth. |

| ATMs & CDMs | Extensive network for 24/7 self-service transactions like withdrawals and deposits. | Enhanced customer accessibility and operational efficiency through self-service points. |

| Contact Centers | Dedicated centers for inquiries, issue resolution, and product guidance via phone and digital means. | Assisted customers with digital service adoption, enhancing overall satisfaction. |

| Strategic Partnerships | Collaborations with fintech, real estate developers, and international subsidiaries/associates. | Expanded market reach and diversified product distribution through alliances. |

Customer Segments

Dubai Islamic Bank (DIB) serves a broad customer base, including individuals, both Muslim and non-Muslim, who are drawn to Sharia-compliant banking. This segment values ethical finance, specifically avoiding interest (riba) and preferring profit-and-loss sharing arrangements. DIB's unwavering commitment to Sharia principles is a key draw for these customers.

DIB's strategy extends to attracting a universal audience, promoting Islamic banking as a viable and ethical option for everyone, regardless of their religious background. This inclusive approach aims to broaden the appeal of Islamic finance beyond its traditional base.

In 2024, the global Islamic finance industry continued its robust growth, with assets projected to reach over $4.9 trillion by 2025, according to industry reports. DIB, as a pioneer, is well-positioned to capture a significant share of this expanding market by catering to the growing demand for Sharia-compliant financial solutions.

Small and Medium-sized Enterprises (SMEs) are a crucial segment for Dubai Islamic Bank (DIB), requiring Sharia-compliant financing, business accounts, and robust cash management services to fuel their expansion and daily operations. DIB's commitment to this sector is evident in its provision of specialized banking solutions tailored to the varied requirements of businesses, from startups to established larger enterprises.

In 2024, the UAE government continued its strong focus on supporting SMEs, recognizing their vital role in economic diversification. For instance, the Dubai SME agency reported that SMEs contribute significantly to the emirate's GDP, with DIB actively participating in initiatives designed to bolster their access to capital and financial tools. DIB's offerings in this space include murabaha and ijara financing, alongside digital banking platforms that streamline transactions and improve efficiency for business owners.

Large corporations, government entities, and institutional clients form a critical customer segment for Dubai Islamic Bank (DIB). These clients require sophisticated, Sharia-compliant financial solutions tailored to their extensive operational needs.

DIB caters to this segment by offering a comprehensive suite of corporate financing, including large-scale project finance and trade finance, alongside robust treasury services. For instance, in 2023, DIB's corporate banking segment continued to demonstrate strong growth, contributing significantly to the bank's overall profitability.

Key offerings for these entities include current accounts, diverse deposit products, advanced cash management solutions, and strategic risk management tools. These services are designed to optimize liquidity, facilitate seamless transactions, and mitigate financial exposures in complex global markets.

The bank’s investment banking arm also provides advisory services for mergers and acquisitions, capital markets access, and sukuk issuance, further solidifying its role as a trusted financial partner for major economic players. DIB's commitment to Islamic finance principles ensures these services align with ethical and religious requirements, a crucial factor for many clients in this segment.

High-Net-Worth Individuals and Investors

Dubai Islamic Bank (DIB) targets high-net-worth individuals and investors seeking Sharia-compliant wealth management. These affluent clients are drawn to exclusive investment options and tailored structured financing solutions, reflecting a growing demand for ethical financial products.

DIB provides these discerning clients with access to specialized offerings, including Sukuk, which are Islamic bonds, and a curated selection of ethical investment opportunities. This focus caters to a segment increasingly prioritizing values-aligned financial growth.

- Wealth Management: DIB offers bespoke wealth management services designed for affluent clients, ensuring Sharia compliance.

- Exclusive Investments: Access to specialized investment products like Sukuk and other Sharia-compliant opportunities is a key draw.

- Structured Financing: Tailored financing solutions are provided to meet the complex needs of high-net-worth individuals.

- Ethical Opportunities: DIB emphasizes ethical investment avenues, aligning with the values of its target clientele.

International Customers and Expats

Dubai Islamic Bank (DIB) serves a significant segment of international customers and expatriates. This includes individuals and businesses that operate or reside in countries where DIB has an established presence, such as Pakistan, Indonesia, Kenya, and Bosnia. These customers specifically seek Sharia-compliant banking solutions tailored to their needs.

DIB's extensive global network is crucial for meeting the increasing demand for Islamic finance worldwide. For instance, in 2023, DIB Pakistan reported a net profit after tax of PKR 35.2 billion, demonstrating its operational strength in a key international market. This expansion allows DIB to offer a consistent banking experience to its international clientele.

- Global Reach: DIB's presence in multiple countries facilitates seamless banking for expatriates and international businesses.

- Sharia Compliance: A core offering that attracts customers seeking ethical and faith-aligned financial services.

- Market Growth: Catering to the expanding global market for Islamic finance, particularly in emerging economies.

- Operational Strength: Demonstrated by strong financial performance in key international subsidiaries, such as DIB Pakistan's 2023 profits.

Dubai Islamic Bank (DIB) caters to a diverse customer base, encompassing individuals seeking Sharia-compliant banking, SMEs requiring tailored financial solutions, and large corporations and government entities needing sophisticated services. The bank also targets high-net-worth individuals for wealth management and international customers and expatriates across its global network.

Cost Structure

Operating expenses and administrative costs form a significant part of Dubai Islamic Bank's (DIB) business model, covering everything from staff salaries and branch rent to utilities and general overheads. These are the essential costs of running the day-to-day banking operations.

In fiscal year 2024, DIB saw its operating expenses increase by 8.3%, reaching AED 3.43 billion. Despite this rise, the bank actively worked on improving its cost-to-income ratio, a key efficiency metric, through strategic investments in automation and digitalization initiatives.

Dubai Islamic Bank (DIB) allocates significant capital towards technology and digital transformation, recognizing its crucial role in the modern financial landscape. These investments are essential for maintaining a competitive edge and meeting evolving customer expectations.

In 2024, DIB continued its substantial spending on upgrading core banking systems and developing robust digital platforms. This includes enhancing mobile banking applications and online portals to provide seamless customer experiences. For instance, DIB has been actively investing in AI and machine learning capabilities to personalize services, improve fraud detection, and streamline internal operations.

Cybersecurity remains a top priority, with considerable expenditure dedicated to protecting customer data and ensuring the integrity of digital transactions. These measures are vital in an increasingly interconnected world, safeguarding against sophisticated cyber threats and maintaining customer trust. DIB’s commitment to technological advancement reflects its strategy to thrive in the growing digital economy.

Dubai Islamic Bank invests significantly in marketing and customer acquisition to attract and retain a diverse customer base. These expenses cover advertising across digital and traditional media, targeted promotional campaigns, and brand-building initiatives aimed at enhancing its Islamic finance proposition.

In 2024, the bank likely continued its strategic focus on expanding its digital channels and offering competitive products, which would necessitate robust spending on customer acquisition. While specific figures for 2024 marketing budgets aren't yet public, similar banks in the region have reported substantial allocations to digital marketing and customer onboarding programs to drive growth in a competitive market.

Sharia Compliance and Governance Costs

Dubai Islamic Bank incurs significant costs to uphold its Sharia compliance. These include remunerating Sharia scholars for their oversight and advisory roles, essential for validating all financial products and operations. For instance, in 2023, the bank allocated a substantial portion of its operational budget to these governance functions, reflecting the critical nature of adhering to Islamic principles.

Furthermore, the cost structure incorporates expenses for Sharia auditing and certification, ensuring that all transactions and internal processes strictly adhere to Islamic finance guidelines. This meticulous attention to detail is a hallmark of Islamic banking and differentiates it from conventional financial institutions.

- Sharia Scholar Fees: Direct payments to scholars for ongoing consultation and product approval.

- Sharia Auditing: Costs associated with independent audits verifying compliance with Islamic principles.

- Compliance Training: Investment in educating staff on Sharia requirements and best practices.

- Certification Costs: Fees for obtaining and maintaining Sharia certification for products and the bank itself.

Regulatory and Compliance Costs

Dubai Islamic Bank incurs significant expenses to adhere to the stringent regulatory landscape. These costs are essential for maintaining its banking license and operating legally within the UAE. For instance, in 2024, the banking sector globally saw increased investment in compliance technology and personnel, a trend mirrored in Dubai.

These expenses cover a broad spectrum, including:

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Implementing robust systems and processes to detect and prevent financial crime, which often involves significant technology investments and ongoing training.

- Central Bank of the UAE (CBUAE) Regulations: Meeting capital adequacy ratios, liquidity requirements, and reporting obligations mandated by the local regulator.

- International Standards: Aligning with global financial regulations and best practices, such as those set by the Basel Committee on Banking Supervision, to ensure international operability and trust.

The bank's commitment to these regulatory and compliance costs, estimated to be a substantial portion of its operational budget, ensures it operates with integrity and avoids penalties, thereby safeguarding its reputation and long-term viability.

Dubai Islamic Bank's cost structure is heavily influenced by its operational expenses, technology investments, and adherence to Sharia principles and regulatory requirements. In 2024, operating expenses rose by 8.3% to AED 3.43 billion, reflecting ongoing investments in digitalization and automation to improve efficiency. Significant capital is also allocated to cybersecurity and customer acquisition, crucial for maintaining a competitive digital presence and expanding its customer base.

The bank also incurs substantial costs related to Sharia compliance, including fees for scholars and auditing, as well as significant expenditure on regulatory adherence, such as AML/KYC measures and meeting CBUAE mandates. These investments are fundamental to DIB's operational integrity and market positioning as a leading Islamic bank.

| Cost Category | 2024 Impact/Focus | Key Components |

|---|---|---|

| Operating Expenses | Increased by 8.3% to AED 3.43 billion in 2024. | Staff salaries, branch rent, utilities, general overheads. |

| Technology & Digitalization | Ongoing substantial spending. | Core banking systems, mobile apps, AI/ML, cybersecurity. |

| Sharia Compliance | Significant budget allocation. | Sharia scholar fees, auditing, training, certification. |

| Regulatory Compliance | Essential for operations and reputation. | AML/KYC, CBUAE regulations, international standards. |

Revenue Streams

Dubai Islamic Bank (DIB) generates significant revenue through profit-sharing from its financing and investment activities. This includes returns from Sharia-compliant products like Murabaha, Ijarah, and Musharaka. These arrangements are fundamental to DIB's business model, aligning with Islamic finance principles.

Furthermore, DIB earns income from its investments in permissible assets, notably Sukuk. The bank's strategic focus on these areas is evident in its financial performance. In fiscal year 2024, DIB reported a substantial increase in net financing and Sukuk investments, reaching AED 295 billion, a clear indicator of this revenue stream's importance.

Dubai Islamic Bank generates significant revenue through fees and commissions derived from its diverse banking services. This includes income from account maintenance charges, processing fees for transactions like fund transfers and cheque processing, and charges for advisory services. These non-funded income streams are crucial for the bank's overall profitability.

In fiscal year 2024, Dubai Islamic Bank saw a notable 33% year-on-year increase in its non-funded income. This robust growth highlights the effectiveness of the bank's strategy in diversifying its revenue sources beyond traditional interest income, contributing substantially to its financial performance.

Dubai Islamic Bank generates significant income from its treasury operations and Sukuk investments. These activities involve trading in Sharia-compliant financial instruments and earning returns from the bank's holdings in Sukuk, which are Islamic bonds. This segment is a crucial contributor to the bank's overall profitability.

In fiscal year 2024, the bank's treasury operations demonstrated exceptional performance, achieving a growth rate exceeding 20% compared to the previous year. This robust expansion highlights the effectiveness of the bank's treasury strategies and its successful management of its Sharia-compliant investment portfolio.

Rental Income from Leased Assets (Ijarah)

Dubai Islamic Bank earns significant revenue through rental income derived from its Ijarah contracts. This Sharia-compliant financing method involves the bank owning an asset and leasing it to customers for a fee, providing a stable income stream.

This revenue is a core component of the bank's operations, reflecting its role in facilitating asset acquisition for clients through Islamic finance principles. For instance, in 2023, the bank reported strong performance across its various business segments, with Ijarah contributing to overall profitability.

Furthermore, subsidiaries like Tamweel play a role in generating leasing income, particularly from investment properties. This diversification within the leasing segment enhances the bank's revenue base and resilience.

- Ijarah contracts provide a consistent revenue stream for Dubai Islamic Bank.

- The bank acts as an owner and lessor of assets under these Sharia-compliant agreements.

- Subsidiaries like Tamweel contribute to leasing income, including from investment properties.

- Leasing revenue is a key element supporting the bank's financial performance.

Returns from Strategic Equity Investments and Subsidiaries

Dubai Islamic Bank (DIB) generates significant returns from its strategic equity investments and subsidiaries, bolstering group profitability. These investments, including stakes in entities like Dubai Islamic Bank Pakistan and Panin Dubai Syariah Bank, provide a steady stream of income through profits and dividends.

The bank's enhanced stake in a digital bank in Türkiye further diversifies its revenue base and taps into the growing digital finance sector. For example, DIB's 2023 financial results showed robust contributions from its international operations, underscoring the value of these strategic holdings.

- Profits and dividends from subsidiaries like Dubai Islamic Bank Pakistan.

- Income generated from investments in associates, such as Panin Dubai Syariah Bank.

- Returns from an increased stake in a digital bank operating in Türkiye.

- These diverse investments contribute directly to DIB's consolidated financial performance.

Dubai Islamic Bank (DIB) derives substantial revenue from its core financing activities, which are structured around Sharia-compliant principles. This includes profit-sharing arrangements from products like Murabaha, Ijarah, and Musharaka, forming the bedrock of its income generation.

The bank also generates significant income from its treasury operations and investments in Sukuk, which are Islamic bonds. In fiscal year 2024, DIB's net financing and Sukuk investments reached AED 295 billion, demonstrating the scale of these revenue-generating assets.

Furthermore, DIB earns substantial fees and commissions from a wide array of banking services, contributing to its non-funded income. This diversification strategy proved successful in 2024, with a notable 33% year-on-year increase in non-funded income.

| Revenue Stream | Description | 2024 Data/Impact |

| Financing & Investments | Profit-sharing from Sharia-compliant products (Murabaha, Ijarah, Musharaka) and Sukuk investments. | Net financing and Sukuk investments: AED 295 billion. |

| Fees & Commissions | Income from banking services like account maintenance, transaction processing, and advisory. | 33% year-on-year increase in non-funded income. |

| Treasury Operations | Trading in Sharia-compliant instruments and managing investment portfolios. | Growth rate exceeding 20% compared to the previous year. |

Business Model Canvas Data Sources

The Dubai Islamic Bank Business Model Canvas is informed by a blend of internal financial reports, customer transaction data, and regulatory filings. This ensures a robust understanding of the bank's operational performance and financial health.