Dubai Islamic Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dubai Islamic Bank Bundle

Uncover the strategic positioning of Dubai Islamic Bank's product portfolio with a glimpse into its BCG Matrix. See where its offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth. Purchase the full version for a comprehensive breakdown and actionable insights to optimize your investment strategy.

Stars

Dubai Islamic Bank (DIB) shines brightly in the sustainable finance arena, demonstrating significant leadership. Its successful issuance of three sustainable sukuk, notably a $1 billion offering in March 2024, underscores its commitment and market traction in this growing sector.

This strategic focus positions DIB as a star within the BCG matrix. The bank has a clear target: to allocate 15% of its portfolio to sustainable finance by 2030, reflecting a forward-thinking approach to ethical and environmentally conscious investing.

Dubai Islamic Bank's significant investment in digital transformation, highlighted by the launch of DIB 'alt', positions it as a high-growth star. This comprehensive digital banking solution is designed to elevate customer experience and operational efficiency, meeting the surging demand for digital financial services across the UAE and beyond.

The bank's commitment is evident in its continuous upgrades and strategic focus on digital capabilities, aiming for market leadership in this rapidly evolving sector. For instance, in 2023, DIB reported a substantial increase in digital transactions, reflecting the growing adoption of its online platforms.

Dubai Islamic Bank's consumer banking portfolio is a significant growth engine, demonstrating impressive year-on-year increases, especially in areas like credit cards and auto loans. This expansion is fueled by strategic new underwriting, highlighting the bank's success in capturing new market share and adapting its product offerings to meet evolving customer demands. For instance, in 2024, DIB reported substantial growth in its consumer finance division, with a notable uptick in card spending and new auto financing agreements.

Strategic Digital Bank Stake in Turkey

Dubai Islamic Bank's (DIB) increased 25% stake in a Turkish digital bank signifies a strategic push into rapidly expanding international digital banking arenas. This move is geared towards accessing new customer segments and utilizing digital channels to grow market share beyond its established domestic presence.

The investment is particularly timely given the burgeoning adoption of digital financial services in emerging economies, positioning DIB to benefit from this trend. For instance, Turkey's digital banking sector has seen significant growth, with projections indicating continued expansion in the coming years. As of early 2024, the number of digital-only banks and fintech solutions in Turkey has surged, catering to a younger, tech-savvy population increasingly comfortable with online transactions and services.

- Market Expansion: DIB's enhanced stake allows it to tap into Turkey's growing digital banking market, a key emerging economy.

- Digital Leverage: The investment enables DIB to utilize advanced digital platforms to reach new customers and increase its market share.

- Growth Potential: This strategic move capitalizes on the increasing global trend of digital financial service adoption, especially in developing regions.

Corporate Deposits and CASA Growth

Dubai Islamic Bank (DIB) has seen a significant uptick in its corporate deposits and Current Account Savings Accounts (CASA). This robust growth highlights DIB's success in attracting and holding onto a substantial corporate customer base, signaling an expanding market share within this critical funding area.

This expansion in CASA and corporate deposits establishes a stable and cost-effective foundation for the bank's funding, which in turn empowers further growth in its lending operations. The considerable year-over-year increase points to a distinct competitive edge in capturing corporate liquidity.

- Corporate Deposits and CASA Growth: DIB's ability to attract and retain corporate clients is evident in the strong increase in these deposit categories.

- Stable Funding Base: This growth provides a low-cost and reliable source of funds, essential for expanding the bank's financing activities.

- Market Share Expansion: The substantial year-on-year growth indicates an increasing market presence in securing corporate liquidity.

- Competitive Advantage: DIB demonstrates a competitive edge in attracting and managing corporate funds, a key indicator of its financial health and strategic positioning.

Dubai Islamic Bank's (DIB) strategic investments and market performance position several of its business units as Stars in the BCG matrix. The bank's strong performance in sustainable finance, marked by a $1 billion sukuk issuance in March 2024, and its ambitious target of 15% portfolio allocation by 2030, clearly identifies this segment as a Star. Furthermore, DIB's aggressive digital transformation, exemplified by the launch of DIB 'alt' and a significant increase in digital transactions in 2023, also firmly places its digital banking offerings in the Star category. The robust growth in its consumer banking, particularly credit cards and auto loans, with substantial increases reported in 2024, further solidifies this segment's Star status.

| Business Unit | BCG Category | Key Growth Drivers | Supporting Data (as of early 2024/latest available) |

|---|---|---|---|

| Sustainable Finance | Star | Market leadership, growing investor demand, strategic allocation targets | $1 billion sukuk issuance (March 2024); Target of 15% portfolio allocation by 2030 |

| Digital Banking (DIB 'alt') | Star | Digital transformation, enhanced customer experience, increasing digital transactions | Significant increase in digital transactions (2023); Focus on elevating customer experience |

| Consumer Banking (Credit Cards, Auto Loans) | Star | Strategic underwriting, product adaptation, market share capture | Substantial growth in consumer finance division (2024); Notable uptick in card spending and auto financing agreements |

What is included in the product

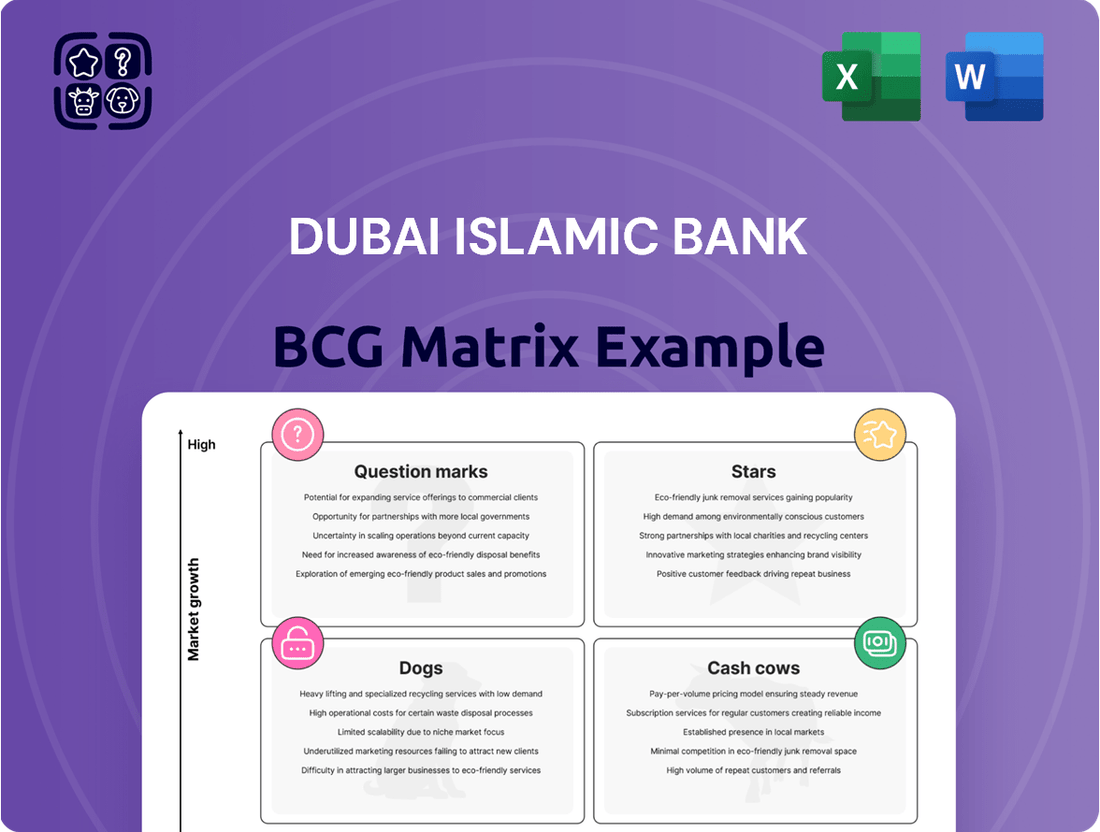

This analysis highlights Dubai Islamic Bank's product portfolio within the BCG Matrix, identifying units for investment, holding, or divestment.

A clear BCG Matrix visualizes Dubai Islamic Bank's portfolio, easing the pain of strategic resource allocation by highlighting high-growth, high-share opportunities.

Cash Cows

Dubai Islamic Bank's core Islamic retail banking services, including current and savings accounts, personal financing, and basic payment solutions, are its established cash cows. As the largest Islamic bank in the UAE, DIB commands a dominant market share in these traditional offerings.

These services operate in a mature market segment characterized by consistent demand, ensuring stable and predictable cash flows for the bank. For instance, DIB reported a net profit of AED 7.7 billion for 2023, with retail banking forming a significant portion of this success.

Given their established brand loyalty and strong market presence, these cash cow services require minimal investment in promotion and placement. This allows DIB to leverage these offerings for sustained profitability and to fund investments in other business areas.

Dubai Islamic Bank's (DIB) established corporate financing portfolio is a prime example of a cash cow within its business operations. This segment consistently fuels the bank's balance sheet growth by providing stable financing solutions to large, established corporations. In 2023, DIB reported a net profit of AED 6.5 billion, with its corporate banking division playing a significant role in this strong performance, demonstrating its reliable revenue-generating capabilities.

Dubai Islamic Bank’s diversified sukuk investments are a cornerstone of its financial stability, fitting the description of Cash Cows in the BCG Matrix. These holdings generate consistent, predictable income streams, bolstering the bank's profitability.

The bank’s substantial portfolio of long-term sukuk represents a mature asset class within Islamic finance. These investments offer reliable returns with lower growth potential, but excel in their ability to generate significant cash flow, supporting other strategic initiatives.

As of the first quarter of 2024, Dubai Islamic Bank reported a net profit of AED 1.2 billion, a significant portion of which is underpinned by its stable income-generating assets like sukuk. This highlights the Cash Cow status of these investments in providing consistent financial strength.

Traditional Trade Finance Services

Dubai Islamic Bank's traditional trade finance services, a cornerstone of its operations, consistently generate fee-based income by facilitating import and export activities in compliance with Sharia principles. This mature service segment holds a significant market share among Islamic businesses, underscoring its vital role in supporting international commerce and bolstering the bank's non-funded income streams.

These services are crucial for businesses engaged in global trade, providing essential financial instruments like letters of credit and guarantees. For instance, in 2023, the UAE’s non-oil exports reached AED 467.5 billion, a testament to the robust trade ecosystem that DIB actively supports.

- Established Offerings: DIB's expertise in Sharia-compliant trade finance, including import and export letters of credit, guarantees, and documentary collections, provides a stable revenue base.

- Market Position: The bank enjoys a high market share within the Islamic business community for these essential trade facilitation services.

- Revenue Generation: These activities are a significant contributor to DIB's fee and commission income, enhancing its profitability.

- Economic Impact: By supporting international trade, DIB plays a vital role in the economic growth and connectivity of the regions it serves.

Real Estate and Home Financing

Dubai Islamic Bank's traditional Sharia-compliant home financing products are firmly positioned as Cash Cows within its BCG Matrix. This segment benefits from a mature market in the UAE's stable real estate sector, where the bank holds a significant market share. These offerings consistently generate substantial returns over extended periods, necessitating minimal aggressive marketing efforts compared to emerging products.

These established home finance solutions are a cornerstone of the bank's financial strength, contributing considerably to its overall asset base and profitability. For instance, in 2023, the UAE real estate market saw a robust performance, with transaction values reaching billions of dirhams, underscoring the demand for home financing. Dubai Islamic Bank's deep penetration in this sector means these products are reliable revenue generators.

- Mature Market Dominance: High market share in the stable UAE real estate sector.

- Consistent Profitability: Generates steady, long-term returns with lower marketing costs.

- Asset Base Contribution: Significantly bolsters the bank's overall asset value and financial stability.

Dubai Islamic Bank's established Sharia-compliant corporate financing portfolio is a prime example of a cash cow. This segment consistently fuels the bank's balance sheet growth by providing stable financing solutions to large, established corporations.

In 2023, DIB reported a net profit of AED 6.5 billion, with its corporate banking division playing a significant role in this strong performance, demonstrating its reliable revenue-generating capabilities. These established offerings require minimal aggressive marketing, allowing DIB to leverage them for sustained profitability.

| Business Segment | BCG Matrix Category | Key Characteristics | 2023 Performance Indicator |

|---|---|---|---|

| Retail Banking Services | Cash Cow | Mature market, consistent demand, stable cash flows, high market share | Net Profit Contribution Significant |

| Corporate Financing | Cash Cow | Stable revenue, established client base, supports balance sheet growth | Net Profit of AED 6.5 billion (overall bank net profit AED 7.7 billion) |

| Sukuk Investments | Cash Cow | Predictable income, mature asset class, supports strategic initiatives | Net Profit of AED 1.2 billion (Q1 2024) underpinned by stable assets |

| Trade Finance Services | Cash Cow | Fee-based income, Sharia-compliant, high market share among Islamic businesses | Contributes significantly to fee and commission income |

| Home Financing | Cash Cow | Mature market, stable real estate sector, consistent long-term returns | Bolsters overall asset value and financial stability |

What You See Is What You Get

Dubai Islamic Bank BCG Matrix

The Dubai Islamic Bank BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional-grade report ready for immediate use. You are seeing the final version, meticulously crafted to provide actionable insights into Dubai Islamic Bank's product portfolio, allowing for informed decision-making and effective business planning.

Dogs

Legacy IT systems and infrastructure at Dubai Islamic Bank (DIB) would likely fall into the 'Dog' category of the BCG Matrix. These are systems that are no longer efficient and require significant investment for maintenance, such as the bank's core banking system upgrades, which saw capital expenditure of AED 100 million in 2023. While essential for ongoing operations, they do not contribute to significant market share growth or offer a competitive advantage in the rapidly evolving digital banking landscape.

These outdated systems can also stifle innovation and slow down the implementation of new digital products and services, impacting DIB's ability to compete with more agile fintech players. For instance, the cost of maintaining these legacy systems can represent a substantial portion of the IT budget, diverting resources that could be used for growth-oriented projects. DIB's 2024 IT budget allocated AED 250 million towards modernization efforts, highlighting the ongoing challenge of managing these underperforming assets.

Underperforming niche products in stagnant markets within Dubai Islamic Bank's portfolio could include highly specialized Sharia-compliant investment funds targeting a very narrow segment of the market, such as niche agricultural commodities or specific ethical sectors with limited investor interest. These products might have seen a decline in adoption, with their assets under management (AUM) shrinking or remaining flat. For instance, a fund focused on a particular type of Islamic finance instrument that has not gained traction might represent this category.

These offerings often consume valuable resources, including marketing and operational expenses, without delivering commensurate returns. In 2024, many financial institutions are reviewing portfolios to divest or restructure such products. If a niche product's AUM has fallen below a certain threshold, say AED 50 million, and its revenue generation is minimal, it could be a prime candidate for re-evaluation. The lack of significant new customer acquisition for these products further solidifies their position as potential Dogs.

Dubai Islamic Bank (DIB) may categorize certain minor or non-strategic international operations as 'Dogs' within its BCG Matrix. These are ventures that consistently underperform and don't fit with the bank's main growth plans.

These operations often have a small market share and poor growth potential, essentially consuming resources without significant returns. For instance, if a DIB subsidiary in a less developed market, such as a small branch in a country with a struggling economy, shows consistent losses, it might fall into this category. In 2023, DIB's international operations contributed to its overall performance, but specific underperforming units would be assessed against strategic objectives.

Manual, Paper-Based Processes

Dubai Islamic Bank, like many traditional financial institutions, still grapples with certain manual, paper-based processes that hinder efficiency. These legacy workflows are significant drains on operational resources, increasing costs and slowing down service delivery. For instance, manual account opening or loan processing can take days, a stark contrast to the instant digital alternatives offered by competitors.

These inefficiencies directly impact customer satisfaction and fail to provide any discernible competitive edge. In 2024, the global banking sector continued its aggressive push towards digital transformation, with many banks reporting substantial cost savings and improved customer engagement through automation. Banks that lag in digitizing these paper-heavy operations risk falling behind.

- High Operational Costs: Manual processing incurs higher labor and material expenses compared to automated systems.

- Slow Service Delivery: Paper-based workflows create bottlenecks, leading to longer wait times for customers.

- Increased Error Potential: Human handling of paper documents is more prone to errors than automated data entry.

- Lack of Competitive Advantage: Outdated processes do not offer the speed and convenience expected in today's digital banking landscape.

Very Low-Margin, High-Volume Basic Services

These are the fundamental, high-volume transactional services that Dubai Islamic Bank offers. Think of basic account management or simple fund transfers. While they are crucial for customer convenience and maintaining a broad customer base, the profit margins on these services are quite slim. For instance, in 2024, the average transaction fee for a basic domestic wire transfer across the UAE banking sector hovered around AED 20-30, a minimal amount considering the operational costs.

Dubai Islamic Bank, like many financial institutions, views these as necessary utilities rather than profit drivers. The challenge lies in managing the significant operational overhead associated with processing a high volume of these transactions efficiently. Without a clear path to upselling or cross-selling other profitable products, these services can become a cost center.

- Low Profitability: Transactional services often yield very low profit margins per transaction.

- High Operational Costs: Managing a large volume of basic transactions requires substantial infrastructure and staffing.

- Digitalization Focus: The bank is actively investing in digital solutions to streamline these processes and reduce costs.

- Customer Convenience: Despite low margins, these services are essential for customer satisfaction and retention.

Dubai Islamic Bank's 'Dog' category likely includes legacy IT systems and manual, paper-based processes. These areas are characterized by high operational costs, slow service delivery, and a lack of competitive advantage in the digital age. For example, the bank's 2024 IT budget included AED 250 million for modernization, indicating the significant investment needed to address these underperforming assets.

Underperforming niche products, such as specialized Sharia-compliant investment funds with limited investor interest, also fit the 'Dog' profile. These offerings consume resources without generating substantial returns, potentially having assets under management below AED 50 million and minimal new customer acquisition. Similarly, minor international operations in struggling economies that consistently incur losses without aligning with growth plans would be considered Dogs.

| Category | Description | Example at DIB | Key Challenges | 2024 Data/Trend |

|---|---|---|---|---|

| Legacy IT Systems | Outdated and inefficient technology infrastructure. | Core banking system upgrades. | High maintenance costs, slow innovation, security risks. | AED 250 million allocated for modernization in 2024 IT budget. |

| Manual Processes | Paper-based workflows hindering efficiency. | Manual account opening, loan processing. | Increased error potential, slow service, higher labor costs. | Global banking sector aggressively pursuing automation for cost savings. |

| Underperforming Products | Niche offerings with low adoption and stagnant markets. | Specialized Sharia-compliant funds with shrinking AUM. | Low revenue generation, resource drain, lack of investor interest. | Products with AUM below AED 50 million and minimal new customers are candidates for re-evaluation. |

| Non-Strategic Operations | Minor international ventures with consistent losses. | Subsidiaries in less developed markets with struggling economies. | Small market share, poor growth potential, resource consumption. | Assessment against strategic objectives for international units. |

Question Marks

Dubai Islamic Bank's (DIB) collaboration with Crypto.com to explore tokenized Islamic Sukuks and real-world asset tokenization positions them in a rapidly expanding, yet still emerging, market. This initiative is a clear 'Question Mark' in the BCG matrix, reflecting the substantial potential rewards alongside significant uncertainties in market acceptance and evolving regulatory landscapes.

The global digital asset market is projected for robust growth, with some estimates suggesting it could reach trillions of dollars by the end of the decade. DIB's foray into tokenization, particularly for Sharia-compliant instruments like Sukuks, taps into this burgeoning sector. For instance, the Islamic finance market itself is valued in the trillions, and integrating it with blockchain technology offers a novel avenue for financial innovation and accessibility.

Dubai Islamic Bank (DIB) has signaled a strong inclination towards acquiring fintech firms and forging new partnerships, a move that clearly aligns with its strategic objective to penetrate high-growth financial technology sectors where its current market presence might be limited. This proactive approach is a testament to DIB's ambition to bolster its digital capabilities and expand its reach within the rapidly evolving fintech landscape.

These strategic ventures, while carrying inherent risks associated with new market entries and integration challenges, present a significant upside potential for substantial future growth. For instance, DIB's reported digital transformation investments in 2024 are substantial, aiming to enhance customer experience and operational efficiency, with fintech acquisitions being a key component of this strategy.

The bank is actively scouting for complementary assets and innovative technologies that can enhance its existing digital product suite. This pursuit of synergistic acquisitions underscores DIB's commitment to staying ahead of the curve and leveraging external innovation to accelerate its digital transformation journey and solidify its competitive position in the market.

Emerging Sharia-compliant digital wealth and equity trading platforms represent a 'Question Mark' for Dubai Islamic Bank (DIB) within the BCG Matrix framework. While the global Islamic finance market is projected to reach $3.6 trillion by 2026, the specific niche of digital Sharia-compliant wealth management is still in its nascent stages of development and adoption.

DIB's market share in this innovative segment is likely still growing, necessitating substantial investment to cultivate user bases and solidify its position. For instance, the broader digital wealth management market saw significant growth in 2023, with assets under management increasing by an estimated 15%, but the Sharia-compliant segment's penetration is less defined, indicating high potential but also high risk.

Expansion into Untapped High-Growth Islamic Finance Markets

Dubai Islamic Bank (DIB) could strategically expand into burgeoning Islamic finance markets like Southeast Asia, particularly Indonesia and Malaysia, and potentially parts of Sub-Saharan Africa, such as Nigeria. These regions exhibit strong demographic growth and increasing demand for Sharia-compliant financial products, representing significant untapped potential.

These expansion efforts, while promising high growth, present considerable hurdles. DIB would face intense competition from established local and international players, navigate diverse regulatory landscapes, and require substantial capital for market entry, including building brand awareness and distribution networks. For instance, the global Islamic finance market was projected to reach $4.9 trillion by 2025, with emerging markets playing a crucial role in this growth.

- Indonesia: A large Muslim population and a growing economy make it a prime target, though regulatory frameworks are still evolving.

- Malaysia: Already a mature Islamic finance hub, offering a stable environment but with higher competition.

- Nigeria: Demonstrates increasing interest in Islamic finance, presenting a frontier market opportunity with high risk and reward.

Specialized Solutions for Freelance Economy

Dubai Islamic Bank's (DIB) strategic consideration of specialized solutions for the freelance economy, exemplified by its partnership with JazzCash in Pakistan, positions it to tap into a burgeoning, high-growth segment. While this initiative is in its nascent stages for DIB, the potential for financial inclusion and market penetration within Pakistan's substantial freelance community is considerable.

This niche market, characterized by its increasing reliance on digital platforms and cross-border transactions, presents a unique opportunity for DIB to innovate. The focus is on developing tailored digital financial tools that cater specifically to the needs of freelancers, addressing challenges such as irregular income streams and international payment processing. For instance, Pakistan's digital payments market saw significant growth in 2023, with mobile banking transactions reaching PKR 13.7 trillion, indicating a strong user base for such specialized solutions.

- High-Growth Potential: The freelance sector is a rapidly expanding segment globally and within emerging markets like Pakistan, offering significant untapped customer bases.

- Digital Reach and Financial Inclusion: Leveraging digital platforms allows DIB to reach a geographically dispersed and often underserved freelance population, promoting financial inclusion.

- Niche Market Focus: Developing specialized solutions requires targeted investment to build market share and achieve profitability in a segment with unique financial requirements.

- Early Stage Development: The partnership with JazzCash signifies an initial exploration into this market, with future success dependent on continued strategic investment and product refinement.

Dubai Islamic Bank's (DIB) exploration into tokenized Islamic Sukuks and emerging Sharia-compliant digital wealth platforms firmly places these initiatives in the 'Question Mark' category of the BCG matrix. These ventures represent high-growth potential markets, yet they are characterized by significant market uncertainties and require substantial investment to establish a strong foothold. For example, the global Islamic finance market is projected to reach $4.9 trillion by 2025, highlighting the scale of opportunity in Sharia-compliant finance, while the digital asset market's trajectory suggests similar growth for tokenized products.

| Initiative | Market Potential | Current Position | Strategic Focus | BCG Category |

|---|---|---|---|---|

| Tokenized Islamic Sukuks | High (Trillions globally) | Emerging, low market share | Explore new asset classes, digital innovation | Question Mark |

| Sharia-compliant Digital Wealth Platforms | High (Growing niche within $3.6T Islamic finance market by 2026) | Nascent, requires significant investment | Digital transformation, fintech penetration | Question Mark |

| Freelance Economy Solutions (e.g., Pakistan) | High (Growing segment) | Early stage, initial exploration | Financial inclusion, niche market development | Question Mark |

BCG Matrix Data Sources

Our Dubai Islamic Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.